| Part of the Interwar period | |

Josephine Baker performing the Charleston

| |

| Date | 1920s |

|---|---|

| Location | Mainly the United States (Equivalents and effects in the greater Western world) |

| Also known as | Années folles in France Golden Twenties in Germany |

| Participants | Social movements First-wave feminism Harlem Renaissance Jazz Age Progressive Era |

| Outcome | Ending events Wall Street Crash of 1929 Repeal of Prohibition in the United States |

The Roaring Twenties (sometimes stylized as the Roarin’ Twenties) refers to the decade of the 1920s in Western society and Western culture. It was a period of economic prosperity with a distinctive cultural edge in the United States and Europe, particularly in major cities such as Berlin, Chicago, London, Los Angeles, New York City, Paris, and Sydney. In France, the decade was known as the "années folles" ('crazy years'), emphasizing the era's social, artistic and cultural dynamism. Jazz blossomed, the flapper redefined the modern look for British and American women, and Art Deco peaked. In the wake of the patriotism of World War I, President Warren G. Harding "brought back normalcy" to the politics of the United States. This period saw the large-scale development and use of automobiles, telephones, movies, radio, and electrical appliances being installed in the lives of millions of Westerners. Aviation soon became a business. Nations saw rapid industrial and economic growth, accelerated consumer demand, and introduced significantly new changes in lifestyle and culture. The media, funded by the new industry of mass-market advertising driving consumer demand, focused on celebrities, especially sports heroes and movie stars, as cities rooted for their home teams and filled the new palatial cinemas and gigantic sports stadiums. In many major democratic states, women won the right to vote. The right to vote had a huge impact on society.

The social and cultural features known as the Roaring Twenties began in leading metropolitan centers and spread widely in the aftermath of World War I. The United States gained dominance in world finance. Thus, when Germany could no longer afford to pay World War I reparations to the United Kingdom, France, and the other Allied powers, the United States came up with the Dawes Plan, named after banker and later 30th Vice President Charles G. Dawes. Wall Street invested heavily in Germany, which paid its reparations to countries that, in turn, used the dollars to pay off their war debts to Washington. By the middle of the decade, prosperity was widespread, with the second half of the decade known, especially in Germany, as the "Golden Twenties".

The spirit of the Roaring Twenties was marked by a general feeling of novelty associated with modernity and a break with tradition. Everything seemed to be feasible through modern technology. New technologies, especially automobiles, moving pictures, and radio, brought "modernity" to a large part of the population. Formal decorative frills were shed in favor of practicality in both daily life and architecture. At the same time, jazz and dancing rose in popularity, in opposition to the mood of World War I. As such, the period often is referred to as the Jazz Age.

The Wall Street Crash of 1929 ended the era, as the Great Depression brought years of hardship worldwide.

Economy

Chart 1: USA GDP annual pattern and long-term trend, 1920–1940, in billions of constant dollars

The Roaring Twenties was a decade of economic growth and widespread

prosperity, driven by recovery from wartime devastation and deferred

spending, a boom in construction, and the rapid growth of consumer goods such as automobiles and electricity in North America and Europe and a few other developed countries such as Australia. The economy of the United States, which had successfully transitioned from a wartime economy to a peacetime economy, boomed and provided loans for a European boom as well. Some sectors stagnated, especially farming and coal mining. The US became the richest country in the world per capita and since the late-19th century had been the largest in total GDP. Its industry was based on mass production, and its society acculturated into consumerism. European economies, by contrast, had a more difficult postwar readjustment and did not begin to flourish until about 1924.

At first, the end of wartime production caused a brief but deep recession, the post–World War I recession

of 1919–20. Quickly, however, the economies of the U.S. and Canada

rebounded as returning soldiers re-entered the labor force and munitions

factories were retooled to produce consumer goods.

New products and technologies

Mass production made technology affordable to the middle class. The automotive industry, the film industry, the radio industry, and the chemical industry took off during the 1920s.

Automobiles

Before World War I, cars were a luxury good. In the 1920s, mass-produced vehicles became commonplace in the US and Canada. By 1927, the Ford Motor Company discontinued the Ford Model T after selling 15 million units of that model. It had been in continuous production from October 1908 to May 1927. The company planned to replace the old model with a newer one, the Ford Model A.

The decision was a reaction to competition. Due to the commercial

success of the Model T, Ford had dominated the automotive market from

the mid-1910s to the early-1920s. In the mid-1920s, Ford's dominance

eroded as its competitors had caught up with Ford's mass production

system. They began to surpass Ford in some areas, offering models with

more powerful engines, new convenience features, and styling.

Only about 300,000 vehicles were registered in 1918 in all of

Canada, but by 1929, there were 1.9 million. By 1929, the United States

had just under 27,000,000

motor vehicles registered. Automobile parts were being manufactured in

Ontario, near Detroit, Michigan. The automotive industry's influence on

other segments of the economy were widespread, jump starting industries

such as steel production, highway building, motels, service stations,

car dealerships, and new housing outside the urban core.

Ford opened factories around the world and proved a strong

competitor in most markets for its low-cost, easy-maintenance vehicles. General Motors,

to a lesser degree, followed. European competitors avoided the

low-price market and concentrated on more expensive vehicles for upscale

consumers.

Radio

Radio became the first mass broadcasting medium. Radios were expensive, but their mode of entertainment proved revolutionary. Radio advertising became a platform for mass marketing. Its economic importance led to the mass culture that has dominated society since this period. During the "Golden Age of Radio", radio programming was as varied as the television programming of the 21st century. The 1927 establishment of the Federal Radio Commission introduced a new era of regulation.

In 1925, electrical recording, one of the greater advances in sound recording, became available with commercially issued gramophone records.

Cinema

The cinema boomed, producing a new form of entertainment that virtually ended the old vaudeville theatrical genre. Watching a film was cheap and accessible; crowds surged into new downtown movie palaces

and neighborhood theaters. Since the early 1910s, lower-priced cinema

successfully competed with vaudeville. Many vaudeville performers and

other theatrical personalities were recruited by the film industry,

lured by greater salaries and less arduous working conditions. The

introduction of the sound film

at the end of the decade of the 1920s eliminated vaudeville's last

major advantage. Vaudeville was in sharp financial decline. The

prestigious Orpheum Circuit, a chain of vaudeville and movie theaters, was absorbed by a new film studio.

Sound movies

In 1923, inventor Lee de Forest at Phonofilm released a number of short films with sound. Meanwhile, inventor Theodore Case developed the Movietone sound system and sold the rights to the film studio, Fox Film. In 1926, the Vitaphone sound system was introduced. The feature film Don Juan

(1926) was the first feature-length film to use the Vitaphone sound

system with a synchronized musical score and sound effects, though it

had no spoken dialogue. The film was released by the film studio Warner Bros. In October 1927, the sound film The Jazz Singer

(1927) turned out to be a smash box-office success. It was innovative

for its use of sound. Produced with the Vitaphone system, most of the

film does not contain live-recorded audio, relying on a score and

effects. When the movie's star, Al Jolson,

sings, however, the film shifts to sound recorded on the set, including

both his musical performances and two scenes with ad-libbed speech—one

of Jolson's character, Jakie Rabinowitz (Jack Robin), addressing a

cabaret audience; the other an exchange between him and his mother. The

"natural" sounds of the settings were also audible. The film's profits were proof enough to the film industry that the technology was worth investing in.

In 1928, the film studios Famous Players-Lasky (later known as Paramount Pictures), First National Pictures, Metro-Goldwyn-Mayer, and Universal Studios

signed an agreement with Electrical Research Products Inc. (ERPI) for

the conversion of production facilities and theaters for sound film.

Initially, all ERPI-wired theaters were made Vitaphone-compatible; most

were equipped to project Movietone reels as well. Also in 1928, Radio Corporation of America (RCA) marketed a new sound system, the RCA Photophone system. RCA offered the rights to its system to the subsidiary RKO Pictures. Warner Bros. continued releasing a few films with live dialogue, though only in a few scenes. It finally released Lights of New York (1928), the first all-talking full-length feature film. The animated short film Dinner Time (1928) by the Van Beuren Studios was among the first animated sound films. It was followed a few months later by the animated short film Steamboat Willie (1928), the first sound film by the Walt Disney Animation Studios. It was the first commercially successful animated short film and introduced the character Mickey Mouse. Steamboat Willie

was the first cartoon to feature a fully post-produced soundtrack,

which distinguished it from earlier sound cartoons. It became the most

popular cartoon of its day.

For much of 1928, Warner Bros. was the only studio to release talking features.

It profited from its innovative films at the box office. Other studios

quickened the pace of their conversion to the new technology and started

producing their own sound films and talking films. In February 1929,

sixteen months after The Jazz Singer, Columbia Pictures became the eighth and last major studio to release a talking feature. In May 1929, Warner Bros. released On with the Show! (1929), the first all-color, all-talking feature film. Soon silent film production ceased. The last totally silent feature produced in the US for general distribution was The Poor Millionaire, released by Biltmore Pictures in April 1930. Four other silent features, all low-budget Westerns, were also released in early 1930.

Aviation

The 1920s saw milestones in aviation that seized the world's attention. In 1927, Charles Lindbergh rose to fame with the first solo nonstop transatlantic flight. He took off from Roosevelt Field in New York and landed at Paris–Le Bourget Airport. It took Lindbergh 33.5 hours to cross the Atlantic Ocean. His aircraft, the Spirit of St. Louis, was a custom-built, single engine, single-seat monoplane. It was designed by aeronautical engineer Donald A. Hall. In Britain, Amy Johnson

(1903–1941) was the first woman to fly alone from Britain to Australia.

Flying solo or with her husband, Jim Mollison, she set numerous

long-distance records during the 1930s.

Television

The

1920s saw several inventors advance work on television, but programs

did not reach the public until the eve of World War II, and few people

saw any television before the late-1940s.

In July 1928, John Logie Baird

demonstrated the world's first color transmission, using scanning discs

at the transmitting and receiving ends with three spirals of apertures,

each spiral with a filter of a different primary color; and three light

sources at the receiving end, with a commutator to alternate their

illumination. That same year he also demonstrated stereoscopic television.

In 1927, Baird transmitted a long-distance television signal over

438 miles (705 km) of telephone line between London and Glasgow; Baird

transmitted the world's first long-distance television pictures to the

Central Hotel at Glasgow Central Station. Baird then set up the Baird Television Development Company Ltd,

which in 1928 made the first transatlantic television transmission,

from London to Hartsdale, New York and the first television programme

for the BBC.

Medicine

For decades biologists had been at work on the medicine that became penicillin. In 1928, Scottish biologist Alexander Fleming discovered a substance that killed a number of disease-causing bacteria. In 1929, he named the new substance penicillin. His publications were largely ignored at first, but it became a significant antibiotic in the 1930s. In 1930, Cecil George Paine, a pathologist at Sheffield Royal Infirmary, used penicillin to treat sycosis barbae, eruptions in beard follicles, but was unsuccessful. Moving to ophthalmia neonatorum,

a gonococcal infection in infants, he achieved the first recorded cure

with penicillin, on November 25, 1930. He then cured four additional

patients (one adult and three infants) of eye infections, but failed to

cure a fifth.

New infrastructure

The automobile's dominance led to a new psychology celebrating mobility.

Cars and trucks needed road construction, new bridges, and regular

highway maintenance, largely funded by local and state government

through taxes on gasoline. Farmers were early adopters as they used

their pickups to haul people, supplies and animals. New industries were

spun off—to make tires and glass and refine fuel, and to service and

repair cars and trucks by the millions. New car dealers were franchised

by the car makers and became prime movers in the local business

community. Tourism gained an enormous boost, with hotels, restaurants

and curio shops proliferating.

Electrification, having slowed during the war, progressed greatly as more of the US and Canada was added to the electrical grid. Industries switched from coal power to electricity. At the same time, new power plants were constructed. In America, electricity production almost quadrupled.

Telephone lines also were being strung across the continent. Indoor plumbing and modern sewer systems were installed for the first time in many houses.

Urbanization

reached a milestone in the 1920 census, that showed slightly more

Americans lived in urban areas towns and cities of 2,500 or more people

than in small towns or rural areas. However, the nation was fascinated

with its great metropolitan centers that contained about 15% of the

population. New York and Chicago vied in building skyscrapers, and New

York pulled ahead with the Empire State Building. The basic pattern of the modern white-collar

job was set during the late-19th century, but it now became the norm

for life in large and medium cities. Typewriters, filing cabinets, and

telephones brought unmarried women into clerical jobs. In Canada, by the

end of the decade one in five workers was a woman. Interest in finding

jobs in the now ever-growing manufacturing sector in U.S. cities became

widespread among rural Americans.

Society

Suffrage

With some exceptions,

many countries expanded women's voting rights in representative and

direct democracies across the world such as the United States, Canada,

Great Britain and most major European countries in 1917–1921, as well as

India. This influenced many governments and elections by increasing the

number of voters. Politicians responded by focusing more on issues of

concern to women, especially peace, public health, education, and the

status of children. On the whole, women voted much like men, except they

were more interested in peace.

Lost Generation

The Lost Generation was composed of young people who came out of

World War I disillusioned and cynical about the world. The term usually

refers to American literary notables who lived in Paris at the time.

Famous members included Ernest Hemingway, F. Scott Fitzgerald, and Gertrude Stein. These authors, some of them expatriates, wrote novels and short stories expressing their resentment towards the materialism and individualism rampant during this era.

In the United Kingdom, the bright young things

were young aristocrats and socialites who threw fancy dress parties,

went on elaborate treasure hunts, were seen in all the trendy venues,

and were well covered by the gossip columns of the London tabloids.

Social criticism

Climax of the new architectural style: the Chrysler Building in New York City was built after the European wave of Art Deco reached the United States.

As the average American in the 1920s became more enamored of wealth

and everyday luxuries, some began satirizing the hypocrisy and greed

they observed. Of these social critics, Sinclair Lewis was the most popular. His popular 1920 novel Main Street satirized the dull and ignorant lives of the residents of a Midwestern town. He followed with Babbitt, about a middle-aged

businessman who rebels against his dull life and family, only to

realize that the younger generation is as hypocritical as his own. Lewis

satirized religion with Elmer Gantry, which followed a con man who teams with an evangelist to sell religion to a small town.

Other social critics included Sherwood Anderson, Edith Wharton, and H.L. Mencken. Anderson published a collection of short stories titled Winesburg, Ohio, which studied the dynamics of a small town. Wharton mocked the fads of the new era through her novels, such as Twilight Sleep (1927). Mencken criticized narrow American tastes and culture in essays and articles.

Art Deco

Art Deco was the style of design and architecture that marked the

era. Originating in Europe, it spread to the rest of western Europe and

North America towards the mid-1920s.

In the U.S., one of the more remarkable buildings featuring this style was constructed as the tallest building of the time: the Chrysler Building.

The forms of art deco were pure and geometric, though the artists often

drew inspiration from nature. In the beginning, lines were curved,

though rectilinear designs would later become more and more popular.

Expressionism and surrealism

Painting in North America during the 1920s developed in a different

direction from that of Europe. In Europe, the 1920s were the era of expressionism and later surrealism. As Man Ray stated in 1920 after the publication of a unique issue of New York Dada: "Dada cannot live in New York".

Cinema

Felix the Cat, a popular cartoon character of the decade, exhibits his famous pace.

At the beginning of the decade, films were silent and colorless. In 1922, the first all-color feature, The Toll of the Sea, was released. In 1926, Warner Bros. released Don Juan, the first feature with sound effects and music. In 1927, Warner released The Jazz Singer, the first sound feature to include limited talking sequences.

The public went wild for sound films, and movie studios converted to sound almost overnight. In 1928, Warner released Lights of New York, the first all-talking feature film. In the same year, the first sound cartoon, Dinner Time, was released. Warner ended the decade by unveiling On with the Show in 1929, the first all-color, all-talking feature film.

Cartoon shorts were popular in movie theaters during this time. In the late 1920s, Walt Disney emerged. Mickey Mouse made his debut in Steamboat Willie on November 18, 1928, at the Colony Theater in New York City. Mickey was featured in more than 120 cartoon shorts, the Mickey Mouse Club, and other specials. This started Disney and led to creation of other characters going into the 1930s.

Oswald, a character created by Disney, before Mickey, in 1927, was contracted by Universal

for distribution purposes, and starred in a series of shorts between

1927 and 1928. Disney lost the rights to the character, but in 2006,

regained the rights to Oswald. He was the first Disney character to be

merchandised.

The period had the emergence of box-office draws such as Mae Murray, Ramón Novarro, Rudolph Valentino, Charlie Chaplin, Buster Keaton, Harold Lloyd, Warner Baxter, Clara Bow, Louise Brooks, Bebe Daniels, Billie Dove, Dorothy Mackaill, Mary Astor, Nancy Carroll, Janet Gaynor, Charles Farrell, William Haines, Conrad Nagel, John Gilbert, Greta Garbo, Dolores del Río, Norma Talmadge, Colleen Moore, Nita Naldi, John Barrymore, Norma Shearer, Joan Crawford, Mary Pickford, Douglas Fairbanks, Anna May Wong, and Al Jolson.

Harlem

African-American literary and artistic culture developed rapidly during the 1920s under the banner of the "Harlem Renaissance". In 1921, the Black Swan Corporation

was founded. At its height, it issued 10 recordings per month.

All-African American musicals also started in 1921. In 1923, the Harlem Renaissance Basketball Club was founded by Bob Douglas. During the late-1920s, and especially in the 1930s, the basketball team became known as the best in the world.

The first issue of Opportunity was published. The African American playwright Willis Richardson debuted his play The Chip Woman's Fortune at the Frazee Theatre (also known as the Wallacks theatre). Notable African American authors such as Langston Hughes and Zora Neale Hurston began to achieve a level of national public recognition during the 1920s.

Jazz Age

The 1920s brought new styles of music into the mainstream of culture in avant-garde cities. Jazz became the most popular form of music for youth.

Historian Kathy J. Ogren wrote that, by the 1920s, jazz had become the

"dominant influence on America's popular music generally"

Scott DeVeaux argues that a standard history of jazz has emerged such

that: "After an obligatory nod to African origins and ragtime

antecedents, the music is shown to move through a succession of styles

or periods: New Orleans jazz up through the 1920s, swing in the 1930s,

bebop in the 1940s, cool jazz and hard bop in the 1950s, free jazz and

fusion in the 1960s.... There is substantial agreement on the defining

features of each style, the pantheon of great innovators, and the canon

of recorded masterpieces."

The pantheon of performers and singers from the 1920s include Louis Armstrong, Duke Ellington, Sidney Bechet, Jelly Roll Morton, Joe "King" Oliver, James P. Johnson, Fletcher Henderson, Frankie Trumbauer, Paul Whiteman, Bix Beiderbecke, Adelaide Hall and Bing Crosby. The development of urban and city blues also began in the 1920s with performers such as Bessie Smith and Ma Rainey. In the latter part of the decade, early forms of country music were pioneered by Jimmie Rodgers, The Carter Family, Uncle Dave Macon, Vernon Dalhart, and Charlie Poole.

Dance

Dance clubs

became enormously popular in the 1920s. Their popularity peaked in the

late 1920s and reached into the early 1930s. Dance music came to

dominate all forms of popular music by the late 1920s. Classical pieces,

operettas, folk music, etc., were all transformed into popular dancing

melodies to satiate the public craze for dancing. For example, many of

the songs from the 1929 Technicolor musical operetta "The Rogue Song" (starring the Metropolitan Opera star Lawrence Tibbett) were rearranged and released as dancing music and became popular dance club hits in 1929.

Dance clubs across the U.S.-sponsored dancing contests, where

dancers invented, tried and competed with new moves. Professionals began

to hone their skills in tap dance and other dances of the era

throughout the stage circuit across the United States. With the advent

of talking pictures (sound film), musicals became all the rage and film

studios flooded the box office with extravagant and lavish musical

films. The representative was the musical Gold Diggers of Broadway,

which became the highest-grossing film of the decade. Harlem played a

key role in the development of dance styles. Several entertainment

venues attracted people of all races. The Cotton Club featured black performers and catered to a white clientele, while the Savoy Ballroom catered to a mostly black clientele. Some religious moralists preached against "Satan in the dance hall" but had little impact.

The most popular dances throughout the decade were the foxtrot, waltz, and American tango. From the early 1920s, however, a variety of eccentric novelty dances were developed. The first of these were the Breakaway and Charleston. Both were based on African American musical styles and beats, including the widely popular blues. The Charleston's popularity exploded after its feature in two 1922 Broadway shows. A brief Black Bottom craze, originating from the Apollo Theater, swept dance halls from 1926 to 1927, replacing the Charleston in popularity. By 1927, the Lindy Hop, a dance based on Breakaway and Charleston and integrating elements of tap, became the dominant social dance. Developed in the Savoy Ballroom, it was set to stride piano ragtime jazz. The Lindy Hop later evolved into other Swing dances.

These dances, nonetheless, never became mainstream, and the

overwhelming majority of people in Western Europe and the U.S. continued

to dance the foxtrot, waltz, and tango throughout the decade.

The dance craze had a large influence on popular music. Large

numbers of recordings labeled as foxtrot, tango, and waltz were produced

and gave rise to a generation of performers who became famous as

recording artists or radio artists. Top vocalists included Nick Lucas, Adelaide Hall, Scrappy Lambert, Frank Munn, Lewis James, Chester Gaylord, Gene Austin, James Melton, Franklyn Baur, Johnny Marvin, Annette Hanshaw, Helen Kane, Vaughn De Leath, and Ruth Etting. Leading dance orchestra leaders included Bob Haring, Harry Horlick, Louis Katzman, Leo Reisman, Victor Arden, Phil Ohman, George Olsen, Ted Lewis, Abe Lyman, Ben Selvin, Nat Shilkret, Fred Waring, and Paul Whiteman.

Attire

Paris set the fashion trends for Europe and North America.

The fashion for women was all about getting loose. Women wore dresses

all day, everyday. Day dresses had a drop waist, which was a sash or

belt around the low waist or hip and a skirt that hung anywhere from the

ankle on up to the knee, never above. Daywear had sleeves (long to

mid-bicep) and a skirt that was straight, pleaded, hank hem, or tired.

Jewelry was less conspicuous. Hair was often bobbed, giving a boyish look.

For men in white collar jobs, business suits were the day to day

attire. Striped, plaid, or windowpane suits came in dark gray, blue, and

brown in the winter and ivory, white, tan, and pastels in the summer.

Shirts were white and neckties were essential.

Actress Norma Talmadge

Immortalized in movies and magazine covers, young women's fashions of

the 1920s set both a trend and social statement, a breaking-off from

the rigid Victorian

way of life. These young, rebellious, middle-class women, labeled

'flappers' by older generations, did away with the corset and donned

slinky knee-length dresses, which exposed their legs and arms. The

hairstyle of the decade was a chin-length bob, which had several popular

variations. Cosmetics, which until the 1920s were not typically

accepted in American society because of their association with prostitution, became extremely popular.

In the 1920s, new magazines appealed to young German women with a

sensuous image and advertisements for the appropriate clothes and

accessories they would want to purchase. The glossy pages of Die Dame and Das Blatt der Hausfrau displayed the "Neue Frauen," "New Girl" – what Americans called the flapper.

She was young and fashionable, financially independent, and was an

eager consumer of the latest fashions. The magazines kept her up to date

on styles, clothes, designers, arts, sports, and modern technology such

as automobiles and telephones.

Sexuality of women during the 1920s

The

1920s was a period of social revolution, coming out of World War I,

society changed as inhibitions faded and youth demanded new experiences

and more freedom from old controls. Chaperones faded in importance as

"anything goes" became a slogan for youth taking control of their

subculture.

A new woman was born—a "flapper" who danced, drank, smoked and voted.

This new woman cut her hair, wore make-up, and partied. She was known

for being giddy and taking risks.

Women gained the right to vote in most countries. New careers opened

for single women in offices and schools, with salaries that helped them

to be more independent. With their desire for freedom and independence came change in fashion.

One of the more dramatic post-war changes in fashion was the woman's

silhouette; the dress length went from floor length to ankle and knee

length, becoming more bold and seductive. The new dress code emphasized

youth: Corsets were left behind and clothing was looser, with more

natural lines. The hourglass figure

was not popular anymore, whereas a slimmer, boyish body type was

considered appealing. The flappers were known for this and for their

high spirits, flirtation, and recklessness when it came to the search

for fun and thrills.

Coco Chanel

was one of the more enigmatic fashion figures of the 1920s. She was

recognized for her avant-garde designs; her clothing was a mixture of

wearable, comfortable, and elegant. She was the one to introduce a

different aesthetic into fashion, especially a different sense for what

was feminine, and based her design on new ethics; she designed for an

active woman, one that could feel at ease in her dress. Chanel's primary goal was to empower freedom. She was the pioneer for women wearing pants and for the little black dress, which were signs of a more independent lifestyle.

The changing role of women

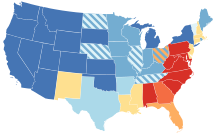

Map of local U.S. suffrage laws just prior to passing of the 19th Amendment

Dark blue = full women's suffrage

Bright red = no women's suffrage

Dark blue = full women's suffrage

Bright red = no women's suffrage

Most British historians depict the 1920s as an era of domesticity for

women with little feminist progress, apart from full suffrage which

came in 1928. On the contrary, argues Alison Light, literary sources reveal that many British women enjoyed:

... the buoyant sense of excitement and release which animates so many of the more broadly cultural activities which different groups of women enjoyed in this period. What new kinds of social and personal opportunity, for example, were offered by the changing cultures of sport and entertainment ... by new patterns of domestic life ... new forms of a household appliance, new attitudes to housework?

With the passage of the 19th Amendment in 1920, that gave women the right to vote, American feminists attained the political equality

they had been waiting for. A generational gap began to form between the

"new" women of the 1920s and the previous generation. Prior to the 19th

Amendment, feminists commonly thought women could not pursue both a

career and a family successfully, believing one would inherently inhibit

the development of the other. This mentality began to change in the

1920s, as more women began to desire not only successful careers of

their own, but also families. The "new" woman was less invested in social service than the Progressive generations, and in tune with the consumerist spirit of the era, she was eager to compete and to find personal fulfillment.

Higher education was rapidly expanding for women. Linda Eisenmann

claims, "New collegiate opportunities for women profoundly redefined

womanhood by challenging the Victorian belief that men's and women's

social roles were rooted in biology."

Advertising agencies exploited the new status of women, for

example in publishing automobile ads in women's magazines, at a time

when the vast majority of purchasers and drivers were men. The new ads

promoted new freedoms for affluent women while also suggesting the outer

limits of the new freedoms. Automobiles were more than practical

devices. They were also highly visible symbols of affluence, mobility,

and modernity. The ads, wrote Einav Rabinovitch-Fox, "offered women a

visual vocabulary to imagine their new social and political roles as

citizens and to play an active role in shaping their identity as modern

women".

Significant changes in the lives of working women occurred in the 1920s. World War I

had temporarily allowed women to enter into industries such as

chemical, automobile, and iron and steel manufacturing, which were once

deemed inappropriate work for women.

Black women, who had been historically closed out of factory jobs,

began to find a place in industry during World War I by accepting lower

wages and replacing the lost immigrant labor and in heavy work. Yet,

like other women during World War I, their success was only temporary;

most black women were also pushed out of their factory jobs after the

war. In 1920, 75% of the black female labor force consisted of

agricultural laborers, domestic servants, and laundry workers.

Equal Rights envoys of the National Woman's Party, 1927

Legislation passed at the beginning of the 20th century mandated a minimum wage

and forced many factories to shorten their workdays. This shifted the

focus in the 1920s to job performance to meet demand. Factories

encouraged workers to produce more quickly and efficiently with speedups

and bonus systems, increasing the pressure on factory workers. Despite

the strain on women in the factories, the booming economy of the 1920s

meant more opportunities even for the lower classes. Many young girls

from working-class backgrounds did not need to help support their

families as prior generations did and were often encouraged to seek work

or receive vocational training which would result in social mobility.

The achievement of suffrage led to feminists refocusing their efforts towards other goals. Groups such as the National Women's Party continued the political fight, proposing the Equal Rights Amendment in 1923 and working to remove laws that used sex to discriminate against women, but many women shifted their focus from politics to challenge traditional definitions of womanhood.

Young women, especially, began staking claim to their own bodies and took part in a sexual liberation

of their generation. Many of the ideas that fueled this change in

sexual thought were already floating around New York intellectual

circles prior to World War I, with the writings of Sigmund Freud, Havelock Ellis and Ellen Key.

There, thinkers claimed that sex was not only central to the human

experience, but also that women were sexual beings with human impulses

and desires, and restraining these impulses was self-destructive. By the

1920s, these ideas had permeated the mainstream.

In the 1920s, the co-ed emerged, as women began attending large state colleges and universities. Women entered into the mainstream middle class

experience but took on a gendered role within society. Women typically

took classes such as home economics, "Husband and Wife", "Motherhood"

and "The Family as an Economic Unit". In an increasingly conservative

postwar era, a young woman commonly would attend college with the

intention of finding a suitable husband. Fueled by ideas of sexual

liberation, dating underwent major changes on college campuses. With the

advent of the automobile, courtship occurred in a much more private

setting. "Petting", sexual relations without intercourse, became the social norm for a portion of college students.

Despite women's increased knowledge of pleasure and sex, the

decade of unfettered capitalism that was the 1920s gave birth to the

"feminine mystique". With this formulation, all women wanted to marry,

all good women stayed at home with their children, cooking and cleaning,

and the best women did the aforementioned and in addition, exercised

their purchasing power freely and as frequently as possible to better

their families and their homes.

Liberalism in Europe

The Allied victory in the First World War seems to mark the triumph of liberalism,

not just in the Allied countries themselves, but also in Germany and in

the new states of Eastern Europe, as well as Japan. Authoritarian

militarism as typified by Germany had been defeated and discredited.

Historian Martin Blinkhorn argues that the liberal themes were ascendant

in terms of "cultural pluralism, religious and ethnic toleration,

national self-determination, free-market economics, representative and

responsible government, free trade, unionism, and the peaceful

settlement of international disputes through a new body, the League of

Nations". However, as early as 1917, the emerging liberal order was being challenged by the new communist movement

taking inspiration from the Russian Revolution. Communist revolts were

beaten back everywhere else, but they did succeed in Russia.

Homosexuality

Speed Langworthy's sheet music poking fun at the masculine traits many women adopted during the 1920s

Homosexuality became much more visible and somewhat more acceptable. London, New York, Paris, Rome, and Berlin were important centers of the new ethic.

Historian Jason Crouthamel argues that in Germany, the First World War

promoted homosexual emancipation because it provided an ideal of

comradeship which redefined homosexuality and masculinity. The many gay

rights groups in Weimar Germany favored a militarised rhetoric with a

vision of a spiritually and politically emancipated hypermasculine gay

man who fought to legitimize "friendship" and secure civil rights. Ramsey explores several variations. On the left, the Wissenschaftlich-humanitäres Komitee (Scientific-Humanitarian Committee;

WhK) reasserted the traditional view that homosexuals were an

effeminate "third sex" whose sexual ambiguity and nonconformity was

biologically determined. The radical nationalist Gemeinschaft der Eigenen

(Community of the Self-Owned) proudly proclaimed homosexuality as heir

to the manly German and classical Greek traditions of homoerotic male

bonding, which enhanced the arts and glorified relationships with young

men. The politically centrist Bund für Menschenrecht (League for

Human Rights) engaged in a struggle for human rights, advising gays to

live in accordance with the mores of middle-class German respectability.

Humor was used to assist in acceptability. One popular American song, "Masculine Women, Feminine Men", was released in 1926 and recorded by numerous artists of the day; it included these lyrics:

Masculine women, Feminine men

Which is the rooster, which is the hen?

It's hard to tell 'em apart today! And, say!

Sister is busy learning to shave,

Brother just loves his permanent wave,

It's hard to tell 'em apart today! Hey, hey!

Girls were girls and boys were boys when I was a tot,

Now we don't know who is who, or even what's what!

Knickers and trousers, baggy and wide,

Nobody knows who's walking inside,

Those masculine women and feminine men!

The relative liberalism of the decade is demonstrated by the fact that the actor William Haines,

regularly named in newspapers and magazines as the #1 male box-office

draw, openly lived in a gay relationship with his partner, Jimmie Shields. Other popular gay actors/actresses of the decade included Alla Nazimova and Ramón Novarro. In 1927, Mae West wrote a play about homosexuality called The Drag, and alluded to the work of Karl Heinrich Ulrichs. It was a box-office success. West regarded talking about sex as a basic human rights issue, and was also an early advocate of gay rights.

Profound hostility did not abate in more remote areas such as western Canada. With the return of a conservative mood in the 1930s, the public grew intolerant of homosexuality, and gay actors were forced to choose between retiring or agreeing to hide their sexuality even in Hollywood.

Psychoanalysis

Vienna psychiatrist Sigmund Freud (1856–1939) played a major role in Psychoanalysis, which impacted avant-garde thinking, especially in the humanities and artistic fields. Historian Roy Porter wrote:

- He advanced challenging theoretical concepts such as unconscious mental states and their repression, infantile sexuality and the symbolic meaning of dreams and hysterical symptoms, and he prized the investigative techniques of free association and dream interpretation, to methods for overcoming resistance and uncovering hidden unconscious wishes.

Other influential proponents of psychoanalysis included Alfred Adler (1870–1937), Karen Horney (1885–1952), and Helene Deutsch

(1884–1982). Adler argued that a neurotic individual would

overcompensate by manifesting aggression. Porter notes that Adler's

views became part of "an American commitment to social stability based

on individual adjustment and adaptation to healthy, social forms".

Culture

Immigration restrictions

The United States became more anti-immigration in policy. The Immigration Act of 1924

limited immigration to a fraction proportionate to that ethnic group in

the United States in 1890. The goal was to freeze the pattern of

European ethnic composition, and to exclude almost all Asians. Hispanics

were not restricted.

Australia, New Zealand and Canada also sharply restricted or ended Asian immigration.

In Canada, the Chinese Immigration Act of 1923 prevented almost all immigration from Asia. Other laws curbed immigration from Southern and Eastern Europe.

Prohibition

During the late 19th and early 20th centuries the Progressive movement

gradually caused local communities in many parts of Western Europe and

North America to tighten restrictions of vice activities, particularly

gambling, alcohol, and narcotics (though splinters of this same movement

were also involved in racial segregation in the U.S.). This movement

gained its strongest traction in the U.S. and its crowning achievement

was the passage of the Eighteenth Amendment to the U.S. Constitution and the associated Volstead Act

which made illegal the manufacture, import and sale of beer, wine and

hard liquor (though drinking was technically not illegal). The laws were

specifically promoted by evangelical Protestant churches and the Anti-Saloon League to reduce drunkenness, petty crime, wife abuse, corrupt saloon-politics, and (in 1918), Germanic influences. The KKK

was an active supporter in rural areas, but cities generally left

enforcement to a small number of federal officials. The various

restrictions on alcohol and gambling were widely unpopular leading to

rampant and flagrant violations of the law, and consequently to a rapid

rise of organized crime around the nation (as typified by Chicago's Al Capone). In Canada, prohibition

ended much earlier than in the U.S., and barely took effect at all in

the province of Quebec, which led to Montreal's becoming a tourist

destination for legal alcohol consumption. The continuation of legal

alcohol production in Canada soon led to a new industry in smuggling

liquor into the U.S.

Rise of the speakeasy

Speakeasies

were illegal bars selling beer and liquor after paying off local police

and government officials. They became popular in major cities and

helped fund large-scale gangsters operations such as those of Lucky Luciano, Al Capone, Meyer Lansky, Bugs Moran, Moe Dalitz, Joseph Ardizzone, and Sam Maceo.

They operated with connections to organized crime and liquor smuggling.

While the U.S. Federal Government agents raided such establishments and

arrested many of the small figures and smugglers, they rarely managed

to get the big bosses; the business of running speakeasies was so

lucrative that such establishments continued to flourish throughout the

nation. In major cities, speakeasies could often be elaborate, offering

food, live bands, and floor shows. Police were notoriously bribed by

speakeasy operators to either leave them alone or at least give them

advance notice of any planned raid.

Literature

The Roaring Twenties was a period of literary creativity, and works of several notable authors appeared during the period. D. H. Lawrence's novel Lady Chatterley's Lover was a scandal at the time because of its explicit descriptions of sex.

Books that take the 1920s as their subject include:

- The Great Gatsby by F. Scott Fitzgerald, set in 1922 in the vicinity of New York City, is often described as the symbolic meditation on the "Jazz Age" in American literature.

- All Quiet on the Western Front by Erich Maria Remarque recounts the horrors of World War I and also the deep detachment from German civilian life felt by many men returning from the front.

- This Side of Paradise by F. Scott Fitzgerald, primarily set up in post-World War I Princeton University, portrays the lives and morality of youth.

- The Sun Also Rises by Ernest Hemingway is about a group of expatriate Americans in Europe during the 1920s.

The 1920s also saw the widespread popularity of the pulp magazine. Printed on cheap pulp paper,

these magazines provided affordable entertainment to the masses and

quickly became one of the most popular forms of media during the decade.

Many prominent writers of the 20th century would get their start

writing for pulps, including F. Scott Fitzgerald, Dashiell Hammett and H.P. Lovecraft. Pulp fiction magazines would last in popularity until the 1950s.

Solo flight across the Atlantic

Charles Lindbergh gained sudden great international fame as the first pilot to fly solo and non-stop across the Atlantic Ocean, flying from Roosevelt Airfield (Nassau County, Long Island), New York to Paris on May 20–21, 1927. He had a single-engine airplane, the "Spirit of St. Louis", which had been designed by Donald Hall and custom built by Ryan Airlines of San Diego, California. His flight took 33.5 hours. The president of France bestowed on him the French Legion of Honor

and, on his arrival back in the United States, a fleet of warships and

aircraft escorted him to Washington, D.C., where President Calvin Coolidge awarded him the Distinguished Flying Cross.

Sports

The

Roaring Twenties was the breakout decade for sports across the modern

world. Citizens from all parts of the country flocked to see the top

athletes of the day compete in arenas and stadia. Their exploits were

loudly and highly praised in the new "gee whiz" style of sports

journalism that was emerging; champions of this style of writing

included the legendary writers Grantland Rice and Damon Runyon in the U.S. Sports literature presented a new form of heroism departing from the traditional models of masculinity.

High school and junior high school students were offered to play

sports that they hadn't been able to play in the past. Several sports,

such as golf,

that had previously been unavailable to the middle-class finally became

available. Also, a notable motorsports feat was accomplished in Roaring

Twenties as driver Henry Seagrave, driving his car the Golden Arrow, reaches at the time in 1929 a record speed of 231.44 mph.

Olympics

Following the 1922 Latin American Games in Rio de Janeiro, IOC

officials toured the region, helping countries establish national

Olympic committees and prepare for future competition. In some

countries, such as Brazil, sporting and political rivalries hindered

progress as opposing factions battled for control of the international

sport. The 1924 Olympic Games in Paris and the 1928 games in Amsterdam

saw greatly increased participation from Latin American athletes.

Sports journalism, modernity, and nationalism excited Egypt.

Egyptians of all classes were captivated by news of the Egyptian

national soccer team's performance in international competitions.

Success or failure in the Olympics of 1924 and 1928 was more than a

betting opportunity but became an index of Egyptian independence and a

desire to be seen as modern by Europe. Egyptians also saw these

competitions as a way to distinguish themselves from the traditionalism

of the rest of Africa.

Balkans

The Greek government of Eleftherios Venizelos

initiated a number of programs involving physical education in the

public schools and raised the profile of sports competition. Other

Balkan nations also became more involved in sports and participated in

several precursors of the Balkan Games, competing sometimes with Western

European teams. The Balkan Games, first held in Athens in 1929 as an

experiment, proved a sporting and a diplomatic success. From the

beginning, the games, held in Greece through 1933, sought to improve

relations among Greece, Turkey, Bulgaria, Yugoslavia, Romania, and

Albania. As a political and diplomatic event, the games worked in

conjunction with an annual Balkan Conference, which resolved issues

between these often-feuding nations. The results were quite successful;

officials from all countries routinely praised the games' athletes and

organizers. During a period of persistent and systematic efforts to

create rapprochement and unity in the region, this series of athletic

meetings played a key role.

United States

The most popular American athlete of the 1920s was baseball player Babe Ruth. His characteristic home-run hitting heralded a new epoch in the history of the sport (the "Live-ball era"),

and his high style of living fascinated the nation and made him one of

the highest-profile figures of the decade. Fans were enthralled in 1927

when Ruth hit 60 home runs, setting a new single-season home run record

that was not broken until 1961. Together with another up-and-coming star

named Lou Gehrig, Ruth laid the foundation of future New York Yankees dynasties.

A former bar room brawler named Jack Dempsey, also known as The Manassa Mauler, won the world heavyweight boxing title and became the most celebrated pugilist of his time. Enrique Chaffardet the Venezuelan Featherweight World Champion was the most sought-after boxer in 1920s Brooklyn, New York City. College football captivated fans, with notables such as Red Grange, running back of the University of Illinois, and Knute Rockne

who coached Notre Dame's football program to great success on the field

and nationwide notoriety. Grange also played a role in the development

of professional football in the mid-1920s by signing on with the NFL's Chicago Bears. Bill Tilden

thoroughly dominated his competition in tennis, cementing his

reputation as one of the greatest tennis players of all time. And Bobby Jones

popularized golf with his spectacular successes on the links. Ruth,

Dempsey, Grange, Tilden, and Jones are collectively referred to as the

"Big Five" sporting icons of the Roaring Twenties.

Organized crime

The Balinese Room, famed Galveston, Texas, casino/nightclub opened in the 1920s by the Maceo crime syndicate

During the 19th century vices such as gambling, alcohol, and

narcotics had been popular throughout the United States in spite of not

always being technically legal. Enforcement against these vices had

always been spotty. Indeed, most major cities established red-light districts to regulate gambling and prostitution despite the fact that these vices were typically illegal. However, with the rise of the Progressive Movement

in the early 20th century, laws gradually became tighter with most

gambling, alcohol, and narcotics outlawed by the 1920s. Because of

widespread public opposition to these prohibitions, especially alcohol, a

great economic opportunity was created for criminal enterprises.

Organized crime blossomed during this era, particularly the American Mafia.

So lucrative were these vices that some entire cities in the U.S.

became illegal gaming centers with vice actually supported by the local

governments. Notable examples include Miami, Florida, and Galveston, Texas.

Many of these criminal enterprises would long outlast the roaring

twenties and ultimately were instrumental in establishing Las Vegas as a

gambling center.

Culture of Weimar Germany

Bauhaus Dessau, built from 1925 to 1926 to a design by Walter Gropius

The Europahaus, one of the hundreds of cabarets in Weimar Berlin, 1931

Weimar culture was the flourishing of the arts and sciences that flourished in Germany during the Weimar Republic, from 1918 until Adolf Hitler's rise to power in 1933. 1920s Berlin

was at the hectic center of the Weimar culture. Although not part of

Germany, German-speaking Austria, and particularly Vienna, is often

included as part of Weimar culture. Bauhaus

was a German art school operational from 1919 to 1933 that combined

crafts and the fine arts. Its goal of unifying art, craft, and

technology became influential worldwide, especially in architecture.

Germany, and Berlin in particular, was fertile ground for

intellectuals, artists, and innovators from many fields. The social

environment was chaotic, and politics were passionate. German university

faculties became universally open to Jewish scholars in 1918. Leading

Jewish intellectuals on university faculties included physicist Albert Einstein; sociologists Karl Mannheim, Erich Fromm, Theodor Adorno, Max Horkheimer, and Herbert Marcuse; philosophers Ernst Cassirer and Edmund Husserl; sexologist Magnus Hirschfeld; political theorists Arthur Rosenberg and Gustav Meyer;

and many others. Nine German citizens were awarded Nobel prizes during

the Weimar Republic, five of whom were Jewish scientists, including two

in medicine.

Sport took on a new importance as the human body became a focus

that pointed away from the heated rhetoric of standard politics. The new

emphasis reflected the search for freedom by young Germans alienated

from rationalized work routines.

American politics

The 1920s saw dramatic innovations in American political campaign

techniques, based especially on new advertising methods that had worked

so well selling war bonds during the First World War. Governor James M. Cox

of Ohio, the Democratic Party candidate, made a whirlwind campaign that

took him to rallies, train station speeches, and formal addresses,

reaching audiences totaling perhaps 2,000,000 people. It resembled the William Jennings Bryan campaign of 1896. By contrast, the Republican Party candidate Senator Warren G. Harding of Ohio relied upon a "Front Porch Campaign". It brought 600,000 voters to Marion, Ohio, where Harding spoke from his home. Republican campaign manager Will Hays

spent some $8,100,000; nearly four times the money Cox's campaign

spent. Hays used national advertising in a major way (with advice from

adman Albert Lasker). The theme was Harding's own slogan "America First". Thus the Republican advertisement in Collier's Magazine

for October 30, 1920, demanded, "Let's be done with wiggle and wobble."

The image presented in the ads was nationalistic, using catchphrases

like "absolute control of the United States by the United States,"

"Independence means independence, now as in 1776," "This country will

remain American. Its next President will remain in our own country," and

"We decided long ago that we objected to a foreign government of our

people."

1920 was the first presidential campaign to be heavily covered by

the press and to receive widespread newsreel coverage, and it was also

the first modern campaign to use the power of Hollywood and Broadway

stars who traveled to Marion for photo opportunities with Harding and

his wife. Al Jolson, Lillian Russell, Douglas Fairbanks and Mary Pickford, were among the celebrities to make the pilgrimage. Business icons Thomas Edison, Henry Ford and Harvey Firestone also lent their cachet to the Front Porch Campaign. On election night, November 2, 1920, commercial radio broadcast coverage of election returns for the first time. Announcers at KDKA-AM

in Pittsburgh, PA read telegraph ticker results over the air as they

came in. This single station could be heard over most of the Eastern

United States by the small percentage of the population that had radio

receivers.

Calvin Coolidge

was inaugurated as president after the sudden death of President Warren

G. Harding in 1923; he was re-elected in 1924 in a landslide against a

divided opposition. Coolidge made use of the new medium of radio and

made radio history several times while president: his inauguration was the first presidential inauguration broadcast on radio; on 12 February 1924, he became the first American president to deliver a political speech on radio. Herbert Hoover was elected president in 1928.

Decline of labor unions

Unions grew very rapidly during the war but after a series of failed

major strikes in steel, meatpacking and other industries, a long decade

of decline weakened most unions and membership fell even as employment

grew rapidly. Radical unionism virtually collapsed, in large part

because of Federal repression during World War I by means of the Espionage Act of 1917 and the Sedition Act of 1918. The major unions supported the third party candidacy of Robert La Follette in 1924.

The 1920s marked a period of sharp decline for the labor

movement. Union membership and activities fell sharply in the face of

economic prosperity, a lack of leadership within the movement, and

anti-union sentiments from both employers and the government. The unions

were much less able to organize strikes. In 1919, more than 4,000,000

workers (or 21% of the labor force) participated in about 3,600 strikes.

In contrast, 1929 witnessed about 289,000 workers (or 1.2% of the

workforce) stage only 900 strikes. Unemployment rarely dipped below 5%

in the 1920s and few workers faced real wage losses.

Progressivism in 1920s

The Progressive Era in the United States was a period of social

activism and political reform that flourished from the 1890s to the

1920s. The politics of the 1920s was unfriendly toward the labor unions

and liberal crusaders against business, so many if not all historians

who emphasize those themes write off the decade. Urban cosmopolitan

scholars recoiled at the moralism of prohibition and the intolerance of

the nativists of the Ku Klux Klan (KKK), and denounced the era. Historian Richard Hofstadter,

for example, in 1955 wrote that prohibition, "was a pseudo-reform, a

pinched, parochial substitute for reform" that "was carried about

America by the rural-evangelical virus". However, as Arthur S. Link emphasized, the progressives did not simply roll over and play dead.

Link's argument for continuity through the 1920s stimulated a

historiography that found Progressivism to be a potent force. Palmer,

pointing to people like George Norris, say, "It is worth noting that

progressivism, whilst temporarily losing the political initiative,

remained popular in many western states and made its presence felt in

Washington during both the Harding and Coolidge presidencies."

Gerster and Cords argue that "Since progressivism was a 'spirit' or an

'enthusiasm' rather than an easily definable force with common goals, it

seems more accurate to argue that it produced a climate for reform

which lasted well into the 1920s, if not beyond."

Even the Klan has been seen in a new light as numerous social

historians reported that Klansmen were "ordinary white Protestants"

primarily interested in purification of the system, which had long been a

core progressive goal.

Business progressivism

What historians have identified as "business progressivism", with its emphasis on efficiency and typified by Henry Ford and Herbert Hoover

reached an apogee in the 1920s. Reynold M. Wik, for example, argues

that Ford's "views on technology and the mechanization of rural America

were generally enlightened, progressive, and often far ahead of his

times."

Tindall stresses the continuing importance of the Progressive

movement in the South in the 1920s involving increased democracy,

efficient government, corporate regulation, social justice, and

governmental public service. William Link finds political progressivism dominant in most of the South in the 1920s. Likewise it was influential in Midwest.

Historians of women and of youth emphasize the strength of the progressive impulse in the 1920s. Women consolidated their gains after the success of the suffrage movement, and moved into causes such as world peace, good government, maternal care (the Sheppard–Towner Act of 1921), and local support for education and public health. The work was not nearly as dramatic as the suffrage crusade, but women voted

and operated quietly and effectively. Paul Fass, speaking of youth,

wrote "Progressivism as an angle of vision, as an optimistic approach to

social problems, was very much alive."

The international influences which had sparked a great many reform

ideas likewise continued into the 1920s, as American ideas of modernity

began to influence Europe.

There is general agreement that the Progressive era was over by

1932, especially since a majority of the remaining progressives opposed

the New Deal.

Canadian politics

Canadian politics were dominated federally by the Liberal Party of Canada under William Lyon Mackenzie King.

The federal government spent most of the decade disengaged from the

economy and focused on paying off the large debts amassed during the war

and during the era of railway over expansion. After the booming wheat

economy of the early part of the century, the prairie provinces

were troubled by low wheat prices. This played an important role in the

development of Canada's first highly successful third political party,

the Progressive Party of Canada that won the second most seats in the 1921 national election. As well with the creation of the Balfour Declaration of 1926, Canada achieved with other British former colonies autonomy, forming the British Commonwealth.

End of the Roaring Twenties

Black Tuesday

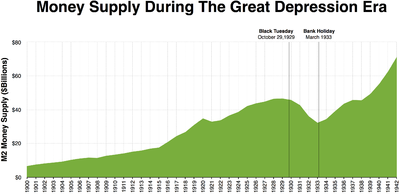

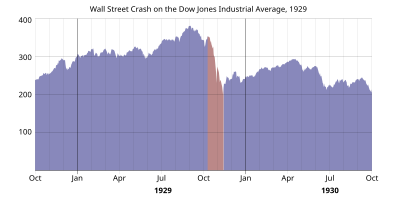

The Dow Jones Industrial Stock Index had continued its upward move for weeks, and coupled with heightened speculative activities, it gave an illusion that the bull market of 1928 to 1929 would last forever. On October 29, 1929, also known as Black Tuesday, stock prices on Wall Street collapsed. The events in the United States added to a worldwide depression, later called the Great Depression, that put millions of people out of work around the world throughout the 1930s.

Repeal of Prohibition

The 21st Amendment, which repealed the 18th Amendment,

was proposed on February 20, 1933. The choice to legalize alcohol was

left up to the states, and many states quickly took this opportunity to

allow alcohol. Prohibition was officially ended with the ratification of

the Amendment on December 5, 1933.