Combined oral contraceptives. Introduced in 1960, "the Pill" has played an instrumental role in family planning for decades.

Family planning services are defined as "educational,

comprehensive medical or social activities which enable individuals,

including minors, to determine freely the number and spacing of their

children and to select the means by which this may be achieved".

Family planning may involve consideration of the number of children a

woman wishes to have, including the choice to have no children, as well

as the age at which she wishes to have them. These matters are

influenced by external factors such as marital situation, career

considerations, financial position, and any disabilities that may affect

their ability to have children and raise them. If sexually active,

family planning may involve the use of contraception and other techniques to control the timing of reproduction.

Other aspects of family planning include sex education, prevention and management of sexually transmitted infections, pre-conception counseling and management, and infertility management.

Family planning, as defined by the United Nations and the World Health

Organization, encompasses services leading up to conception. Abortion is not considered a component of family planning, although access to contraception and family planning reduces the need for abortion.

Family planning is sometimes used as a synonym or euphemism for access to and the use of contraception.

However, it often involves methods and practices in addition to

contraception. Additionally, there are many who might wish to use

contraception but are not, necessarily, planning a family (e.g.,

unmarried adolescents, young married couples delaying childbearing while

building a career); family planning has become a catch-all phrase for

much of the work undertaken in this realm. Contemporary notions of

family planning, however, tend to place a woman and her childbearing

decisions at the center of the discussion, as notions of women's

empowerment and reproductive autonomy have gained traction in many parts

of the world. It is most usually applied to a female-male couple who wish to limit the number of children they have and/or to control the timing of pregnancy (also known as spacing children).

Purposes

In 2006, the US Centers for Disease Control (CDC) issued a recommendation, encouraging men and women to formulate a reproductive life plan, to help them in avoiding unintended pregnancies and to improve the health of women and reduce adverse pregnancy outcomes.

Raising a child requires significant amounts of resources: time, social, financial, and environmental.

Planning can help assure that resources are available. The purpose of

family planning is to make sure that any couple, man, or woman who has a

child has the resources that are needed in order to complete this goal. With these resources a couple, man or woman can explore the options of natural birth, surrogacy, artificial insemination, or adoption.

In the other case, if the person does not wish to have a child at the

specific time, they can investigate the resources that are needed to

prevent pregnancy, such as birth control, contraceptives, or physical

protection and prevention.

There is no clear social impact case for or against conceiving a child. Individually, for most people,

bearing a child or not has no measurable impact on person well-being. A

review of the economic literature on life satisfaction shows that

certain groups of people are much happier without children:

- Single parents

- Fathers who both work and raise the children equally.

- Singles

- The divorced

- The poor

- Those whose children are older than 3

- Those whose children are sick

However, both adoptees and the adopters report that they are happier after adoption.

Adoption may also insure against costs of prenatal or childhood

disability which can be anticipated with prenatal screening or with

reference to parental risk factors. For instance, older fathers and/or Advanced maternal age increase the risk of numerous health issues in their offspring, including autism and schizophrenia.

Resources

When

women can pursue additional education and paid employment, families can

invest more in each child. Children with fewer siblings tend to stay in

school longer than those with many siblings. Leaving school in order to

have children has long-term implications for the future of these girls,

as well as the human capital of their families and communities. Family

planning slows unsustainable population growth which drains resources

from the environment, and national and regional development efforts.

Health

The WHO states about maternal health that:

- "Maternal health refers to the health of women during pregnancy, childbirth and the postpartum period. While motherhood is often a positive and fulfilling experience, for too many women it is associated with suffering, ill-health and even death."

About 99% of maternal deaths occur in less developed countries; less than one half occur in sub-Saharan Africa and almost a third in South Asia.

Both early and late motherhood have increased risks. Young

teenagers face a higher risk of complications and death as a result of

pregnancy. Waiting until the mother is at least 18 years old before trying to have children improves maternal and child health.

Also, if additional children are desired after a child is born,

it is healthier for the mother and the child to wait at least 2 years

after the previous birth before attempting to conceive (but not more

than 5 years). After a miscarriage or abortion, it is healthier to wait at least 6 months.

Joselyne When planning a family, women should be aware that

reproductive risks increase with the age of the woman. Like older men,

older women have a higher chance of having a child with autism or Down syndrome, the chances of having multiple births increases, which cause further late-pregnancy risks, they have an increased chance of developing gestational diabetes, the need for a Caesarian section

is greater, older women's bodies are not as well-suited for delivering a

baby. The risk of prolonged labor is higher. Older mothers have a

higher risk of a long labor, putting the baby in distress.

Modern methods

Modern methods of family planning include birth control, assisted reproductive technology and family planning programs.

In regard to the use of modern methods of contraception, The United Nations Population Fund

(UNFPA) says that, “Contraceptives prevent unintended pregnancies,

reduce the number of abortions, and lower the incidence of death and

disability related to complications of pregnancy and childbirth.”

UNFPA states that, “If all women with an unmet need for contraceptives

were able to use modern methods, an additional 24 million abortions (14

million of which would be unsafe), 6 million miscarriages, 70,000

maternal deaths and 500,000 infant deaths would be prevented.”

In cases where couples may not want to have children just yet,

family planning programs help a lot. Federal family planning programs

reduced childbearing among poor women by as much as 29 percent,

according to a University of Michigan study.

Adoption

is another option used to build a family. There are seven steps that

one must make towards adoption. You must decide to pursue an adoption,

apply to adopt, complete an adoption home study, get approved to adopt,

be matched with a child, receive an adoptive placement, and then

legalize the adoption.

Contraception

Placard showing positive effects of family planning (Ethiopia)

A number of contraceptive methods are available to prevent unwanted pregnancy. There are natural methods and various chemical-based methods, each with particular advantages and disadvantages. Behavioral methods to avoid pregnancy that involve vaginal intercourse include the withdrawal and calendar-based methods, which have little upfront cost and are readily available. Long-acting reversible contraceptive methods, such as intrauterine device

(IUD) and implant are highly effective and convenient, requiring little

user action, but do come with risks. When cost of failure is included,

IUDs and vasectomy are much less costly than other methods. In addition to providing birth control, male and/or female condoms protect against sexually transmitted diseases (STD). Condoms may be used alone, or in addition to other methods, as backup or to prevent STD. Surgical methods (tubal ligation, vasectomy) provide long-term contraception for those who have completed their families.

Assisted reproductive technology

When, for any reason, a woman is unable to conceive by natural means,

she may seek assisted conception. For example, some families or women

seek assistance through surrogacy, in which a woman agrees to become pregnant and deliver a child for another couple or person.

There are two types of surrogacy: traditional and gestational. In traditional surrogacy, the surrogate uses her own eggs and

carries the child for her intended parents. This procedure is done in a

doctor's office through IUI. This type of surrogacy obviously includes a

genetic connection between the surrogate and the child. Legally, the

surrogate will have to disclaim any interest in the child to complete

the transfer to the intended parents. A gestational surrogacy occurs

when the intended mother's or a donor egg is fertilized outside the body

and then the embryos are transferred into the uterus. The woman who

carries the child is often referred to as a gestational carrier. The

legal steps to confirm parentage with the intended parents are generally

easier than in a traditional because there is no genetic connection

between child and carrier.

Sperm donation is another form of assisted conception. It involves donated sperm being used to fertilise a woman's ova by artificial insemination (either by intracervical insemination or intrauterine insemination) and less commonly by invitro fertilization (IVF), but insemination may also be achieved by a donor having sexual intercourse with a woman for the purpose of achieving conception. This method is known as natural insemination (NI).

Mapping of a woman's ovarian reserve, follicular dynamics and associated biomarkers can give an individual prognosis about future chances of pregnancy, facilitating an informed choice of when to have children.

Finances

Family planning is among the most cost-effective of all health interventions.

"The cost savings stem from a reduction in unintended pregnancy, as

well as a reduction in transmission of sexually transmitted infections,

including HIV".

Childbirth and prenatal health care cost averaged $7,090 for normal delivery in the United States in 1996. U.S. Department of Agriculture

estimates that for a child born in 2007, a U.S. family will spend an

average of $11,000 to $23,000 per year for the first 17 years of child's

life. (Total inflation-adjusted estimated expenditure: $196,000 to $393,000, depending on household income.)

Breaks down cost by age, type of expense, region of country.

Adjustments for number of children (one child — spend 24% more, 3 or

more spend less on each child.)

Investing in family planning has clear economic benefits and can

also help countries to achieve their “demographic dividend,” which means

that countries productivity is able to increase when there are more

people in the workforce and less dependents. UNFPA says that, “For every dollar invested in contraception, the cost of pregnancy-related care is reduced by $1.47.”

UNFPA states that,

The lifetime opportunity cost related to adolescent pregnancy – a measure of the annual income a young mother misses out on over her lifetime – ranges from 1 per cent of annual gross domestic product in a large country such as China to 30 per cent of annual GDP in a small economy such as Uganda. If adolescent girls in Brazil and India were able to wait until their early twenties to have children, the increased economic productivity would equal more than $3.5 billion and $7.7 billion, respectively.

In the Copenhagen Consensus produced by Nobel laureates in

collaboration with the UN, universal access to contraception ranks as

the third highest policy initiative in social, economic, and

environmental benefits for every dollar spent.

Providing universal access to sexual and reproductive health services

and eliminating the unmet need for contraception will result in 640,000

fewer newborn deaths, 150,000 fewer maternal deaths and 600,000 fewer

children who lose their mother. At the same time, societies will

experience fewer dependents and more women in the workforce, driving

faster economic growth. The costs of universal access to contraceptives

will be about $3.6 billion/year, but the benefits will be more than $400

billion annually and cut maternal deaths by 150,000.

Fertility Awareness

Fertility awareness refers to a set of practices used to determine the fertile and infertile phases of a woman's menstrual cycle. Fertility awareness methods may be used to avoid pregnancy, to achieve pregnancy, or as a way to monitor gynecological

health. Methods of identifying infertile days have been known since

antiquity, but scientific knowledge gained during the past century has

increased the number and variety of methods. Various methods can be used

and the Symptothermal method has achieved a success rates over 99% if

used properly.

These methods are used for various reasons: There are no drug-related side effects, it is free to use and only has a small upfront cost, it works both ways, or for religious reasons (the Catholic Church promotes this as the only acceptable form of family planning calling it Natural Family Planning).

Its disadvantages are that either abstinence or backup method is

required on fertile days, typical use is often less effective than other

methods, and it does not protect against sexually transmitted disease.

Media campaign

Recent

research based on nationally representative surveys supports a strong

association between family planning mass media campaigns and

contraceptive use, even after social and demographic variables are

controlled for. The 1989 Kenya Demographic and Health Survey found half

of the women who recalled hearing or seeing family planning messages in

radio, print, and television consequently used contraception, compared

with 14% who did not recall family planning messages in the media, even

after age, residence and socioeconomic status were taken into account.

The Health Education Division of the Ministry of Health conducted

the Tanzanian Family Planning Communication Project from January 1991

through December 1994, a project funded by the U.S. Agency for

International Development (USAID).

The program intended to educate both men and men of reproductive age

about modern contraception methods. The major media channels and

products included radio spots, radio series drama, Green Star logo

promotional activities (identifies sites where family planning services

are available), posters, leaflets, newspapers, and audio cassettes. In

conjunction with other non-project interventions sponsored by other

Tanzanian and international agencies from 1992–1994, contraception use

among women ages 15–49 increased from 5.9% to 11.3%. The total fertility

rate dropped from 6.3 lifetime births per individual in 1991–1992 to

5.8 in 1994.

Providers

Direct government support

Direct

government support for family planning includes providing family

planning education and supplies through government-run facilities such

as hospitals, clinics, health posts and health centers and through

government fieldworkers.

In 2013, 160 out of 197 governments provided direct support for

family planning. Twenty countries only provided indirect support through

private sector or NGOs. Seventeen governments did not support family

planning. Direct government support has continued to increase in

developing countries from 82% in 1996 to 93% in 2013, but is declining

in developed countries from 58% in 1976 to 45% in 2013. Ninety-seven

percent of Latin America and the Caribbean, 96% of Africa, and 94% of

Oceania governments provided direct support for family planning. In

Europe, only 45% of governments directly support family planning. Out of

172 countries with available data in 2012, 152 countries had

implemented realistic measures to increase women's access to family

planning methods from 2009–2014. This included 95% of developing nations

and 65% of developed nations.

Private sector

The

private sector includes nongovernmental and faith-based organizations

who typically provide free or subsidized services to for-profit medical

providers, pharmacies and drug shops. The private sector accounts for

approximately two-fifths of contraceptive suppliers worldwide. Private

organizations are able to provide sustainable markets for contraceptive

services through social marketing, social franchising, and pharmacies.

Social marketing employs marketing techniques to achieve

behavioral change while making contraceptives available. By utilizing

private providers, social marketing reduces geographic and socioeconomic

disparities and reaches men and boys.

Social franchising designs a brand for contraceptives in order to expand the market for contraceptives.

Drug shops and pharmacies provide health care in rural areas and

urban slums where there are few public clinics. They account for most of

the private sector provided contraception in sub-Saharan Africa,

especially for condoms, pills, injectables and emergency contraception.

Pharmacy supply and low-cost emergency contraception in South Africa and

many low-income countries increased access to contraception.

Workplace policies and programs help expand access to family

planning information. The Family Guidance Association of Ethiopia, which

works with more than 150 enterprises to improve health services,

analyzed health outcomes in one factory over 10 years and found

reductions in unintended pregnancies and STIs as well as sick leave.

Contraception use rose from 11% to 90% between 1997 and 2000. In 2016,

the Bangladesh Garment Manufacturers Export Association partnered with

family planning organizations to provide training and free

contraceptives to factory clinics, creating the potential to reach

thousands of factory employees.

Non-governmental organizations (NGOs)

NGOs

may meet the needs of local poor by encouraging self-help and

participation, understanding social and cultural subtleties, and working

around red tape when governments do not adequately meet the needs of

their constituents. A successful NGO can uphold family planning services

even when a national program is threatened by political forces. NGOs

can contribute to informing government policy, developing programs, or

carry out programs that the government will not or can not implement.

International oversight

Family planning programs are now considered a key part of a

comprehensive development strategy. The United Nations Millennium

Development Goals (now superseded by the Sustainable Development Goals)

reflects this international consensus. The 2012 London Summit on Family

Planning, hosted by the UK government and the Bill and Melinda Gates

Foundation, affirmed political commitments and increased funds for the

project, strengthening the role of family planning in global

development.

Family Planning 2020 is the result of the 2012 London Summit on Family

Planning where more than 20 governments made commitments to address the

policy, financing, delivery, and socio-cultural barriers to women

accessing contraception formation and services. FP2020 is a global

movement that supports the rights of women to decide for themselves

whether, when and how many children they want to have.

The commitments of the program are specific to each country, as

compared to the generalized main goals of the 1995 conference program of

action. FP2020 is hosted by the United Nations Foundation and operates

in support of the UN Secretary-General's Global Strategy for Women's,

Children's and Adolescent's Health.

The world's largest international source of funding for population and reproductive health programs is the United Nations Population Fund (UNFPA). In 1994, the International Conference on Population and Development set the main goals of its Program of Action as:

- Universal access to reproductive health services by 2015

- Universal primary education and ending the gender gap in education by 2015

- Reducing maternal mortality by 75% by 2015

- Reducing infant mortality

- Increasing life expectancy at birth

- Reducing HIV infection rates in persons aged 15–24 years by 25% in the most-affected countries by 2005, and by 25% globally by 2010

The World Health Organization (WHO) and World Bank

estimate that $3 per person per year would provide basic family

planning, maternal and neonatal health care to women in developing

countries. This would include contraception, prenatal, delivery, and post-natal care in addition to postpartum family planning and the promotion of condoms to prevent sexually transmitted infections.

Coercive interference with family planning

Forced sterilization

Compulsory or forced sterilization programs or government policy

attempt to force people to undergo surgical sterilization without their

freely given consent. People from marginalized communities are at most

risk of forced sterilization. Forced sterilization has occurred in recent years in Eastern Europe (against Roma women), and in Peru (during the 1990s against indigenous women). China's one-child policy was intended to limit the rise in population numbers, but in some situations involved forced sterilisation.

Sexual violence

Rape can result in a pregnancy. Rape can occur in a variety of situations, including war rape, forced prostitution and marital rape.

In Rwanda,

the National Population Office has estimated that between 2,000 and

5,000 children were born as a result of sexual violence perpetrated

during the genocide, but victims' groups gave a higher estimated number of over 10,000 children.

Human rights, development and climate

Access

to safe, voluntary family planning is a human right and is central to

gender equality, women's empowerment and poverty reduction. The United Nations Population Fund

(UNFPA) says that, “Some 225 million women who want to avoid pregnancy

are not using safe and effective family planning methods, for reasons

ranging from lack access to information or services to lack of support

from their partners or communities.” UNFPA says that, “Most of these women with an unmet need for contraceptives live in 69 of the poorest countries on earth.”

Over the past 50 years, right-based family planning has enabled

the cycle of poverty to be broken resulting in millions of women and

children's lives being saved.

UNFPA says that,

Global consensus that family planning is a human right was secured at the 1994 International Conference on Population and Development, in Principle 8 of the Programme of Action: All couples and individuals have the basic right to decide freely and responsibly the number and spacing of their children and to have the information, education, and means to do so.

As part of the United Nations Millennium Development Goals

(MDGs) universal access to family planning is one of the key factors

contributing to development and reducing poverty. Family planning

creates benefits in areas such as, gender quality and women's health,

access to sexual education and higher education, and improvements in

maternal and child health. Note that the Millennium Development Goals have been superseded by the Sustainable Development Goals.

UNFPA and the Guttmacher Institute say that,

Serving all women in developing countries that currently have an unmet need for modern contraceptives would prevent an additional 54 million unintended pregnancies, including 21 million unplanned births, 26 million abortions and seven million miscarriages; this would also prevent 79,000 maternal deaths and 1.1 million infant deaths.

Since climate change is directly proportional to the number of

humans, family planning has a significant impact on climate change. The research project Drawdown estimates that family planning is the seventh most efficient action against climate change (ahead of solar farms, nuclear power, afforestation and many other actions).

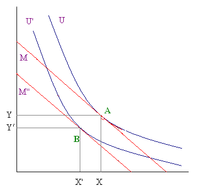

Quality-quantity trade-off

Having

children produces a quality-quantity trade-off: parents need to decide

how many children to have and how much to invest in the future of each

child.

The increasing marginal cost of quality (child outcome) with respect to

quantity (number of children) creates a trade-off between quantity and

quality.

The quantity-quality trade-off means that policies that raise benefits

of investing in child quality will generate higher levels of human

capital, and policies that lower the costs of having children may have

unintended adverse consequences on long-run economic growth. When

deciding how many children, parents are influenced by their income

level, perceived return to human capital investment, and cultural norms

related to gender equality. Controlling birth rates allows families to

raise the future earnings power of the next generation.

Many empirical studies have tested the quantity-quality trade-off

and either observed a negative correlation between family size and

child quality or did not find a correlation.

Most studies treat family size as an exogenous variable because parents

choose childbearing and child outcome and therefore cannot establish

causality. They are both influenced by typically non-observable parental

preferences and household characteristics, but some studies observe

proxy variables such as investment in education.

Developing countries

High fertility countries have 18% of the world's population but contribute 38% of the population growth.

In order to become rich, resources must be re-appropriated to increase

income per person rather than supporting larger populations. As

populations increase, governments must accommodate increasing

investments in health and human capital and institutional reforms to

address demographic divides. Reducing the cost of human capital can be

implemented by subsidizing education, which raises the earning power of

women and the opportunity cost of having children, consequently lowering

fertility.

Access to contraceptives may also yield lower fertility rates: having

more children than expected constrains the individual from attaining

their desired level of investment in child quantity and quality.

In high fertility contexts, reduced fertility may contribute to

economic development by improving child outcomes, reducing maternal

mortality and increasing female human capital.

Dang and Rogers (2015) show that in Vietnam, family planning

services increased investment in education by lowering the relative cost

of child quality and encouraging families to invest in quality.

By observing the distance to the nearest family planning center and the

general education expenditure on each child, Dang and Rogers provide

evidence that parents in Vietnam are making a child quality-quantity

trade-off.

Demand for Private Tutoring with and without access to family planning

Developed countries

Currently,

developed countries have experienced rising economic growth and falling

fertility. As a result of the demographic transition that takes place

when countries become rich, developed countries have an increasing

proportion of retired people which raises the burden on the workforce

population to support pensions and social programs. Encouraging higher

fertility as a solution may risk reversing the benefits for increased

child investment and female labor force participation have had on

economic growth. Increasing high skill migration may be an effective way

to increase the return to education leading to lower fertility and a

greater supply of highly skilled individuals.

Demand for family planning

214

million women of reproductive age in developing countries who do not

want to become pregnant are not using a modern contraceptive method.

This could be a result of a limited choice of methods, limited access

to contraception, fear of side-effects, cultural or religious

opposition, poor quality of available services, user or provider bias,

or gender-based barriers. In Africa, 24.2% of women of reproductive age

do not have access to modern contraction. In Asia, Latin America, and

the Caribbean, the unmet need is 10–11%. Meeting the unmet need for

contraception could prevent 104,000 maternal deaths per year, a 29%

reduction of women dying from postpartum hemorrhage or unsafe abortions.

According to the United Nations Department of Economic and Social

Affairs: Population Division, 64% of the world uses contraceptives, 12%

of the world population's need for contraceptives is unmet. In the

least developed countries, 22% of the population do not have access to

contraceptives, and 40% use contraceptives.

The unmet need for modern contraceptives is very high in sub-Saharan

Africa, south Asia, and western Asia. Africa has the lowest rate of

contraceptive use (33%) and highest rate of unmet need (22%). Northern

America has the highest rate of contraceptive use (73%) and the lowest

unmet need (7%). Latin America and the Caribbean follows closely behind

with 73% contraceptive use and 11% unmet need. Europe and Asia are on

par: Europe has a 69% contraceptive use rate and 10% unmet need, Asia

has a 68% contraceptive use and 10% unmet need. Although unmet need is

lower in Asia because of the large population in this region, the number

of women with unmet need is 443 million, compared to 74 million in

Europe Oceania has a 59% contraceptive use rate and 15% unmet need.

When comparing the regions within these continents, Eastern Asia ranks

the highest rate of contraceptive use (82%) and lowest unmet need (5%).

Western Africa ranks the lowest rate of contraceptive use (17%). Middle

Africa ranks the highest unmet need (26%). Unmet need is higher among

poorer women; in Bolivia and Ethiopa unmet need is tripled and doubled

among poor populations. However, in the Democratic Republic of Congo and Liberia the rates of unmet need are different by 1–2 percentage points. This suggests that as wealthier women begin to want smaller families, they will increasingly seek out family planning methods.

United

Nations Department of Economic and Social Affairs, Population Division,

"Trends in Contraceptive Use Worldwide 2015" New York: United Nations,

2015.

Substantial unmet need has provoked family planning programs by

governments and donors, but the impact of family planning programs on

fertility and contraceptive use remains somewhat unsettled. "Demand

theory" argues that in traditional agricultural societies, fertility

rates are driven by the desire to offset high mortality, thus as society

modernizes, the costs of raising children increases, reducing their

economic value, and resulting in a decline in desired number of

children. Under this theory, family planning programs will have a

marginal impact. Bongaarts (2014) shows that using a country case study

approach, both stronger and weaker family programs reduce the unmet need

for contraceptives and increases use by making modern contraceptives

more widely available and removing obstacles to use.

Also, the demand that is satisfied and the proportion of women using

modern methods increased. The programs may have an additional effect of

diffusing the ideas related to family planning and thus raising the

demand for contraception. As a result, a small decrease in unmet need

may be offset by a rise in demand. Nonetheless, even in countries where

it is assumed that family programs will make a marginal impact,

Bongaarts shows that family planning programs can potentially increase

contraceptive use and increase/decrease demand depending on the

preexisting attitudes of the community.

Regional variations

A family planning facility in Kuala Terengganu, Malaysia

Africa

Most of the countries with lowest rates of contraceptive use, highest

maternal, infant, and child mortality rates, and highest fertility

rates are in Africa.

Only about 30% of all women use birth control, although over half of

all African women would like to use birth control if it was available to

them.

The main problems that preventing access to and use of birth control

are unavailability, poor health care services, spousal disapproval,

religious concerns, and misinformation about the effects of birth

control. The most available type of birth control is condoms.

A rapidly growing population coupled with an increase in preventable

diseases means countries in Sub-Saharan Africa face an increasingly

younger population.

China

China's Family planning policy forced couples to have no more than one child. Beginning in 1979 and being officially phased out in 2015,

the policy was instated to control the rapid population growth that was

occurring in the nation at that time. With the rapid change in

population, China was facing many impacts, including poverty and

homelessness. As a developing nation, the Chinese government was

concerned that a continuation of the rapid population growth that had

been occurring would hinder their development as a nation. The process

of family planning varied throughout China, as people differed in their

responsiveness to the one-child policy, based on location and

socioeconomic status. For example, many families in the cities accepted

the policy more readily based on the lack of space, money, and resources

that often occurs in the cities. Another example can be found in the

enforcement of this rule; people living in rural areas of China were, in

some cases, permitted to have more than one child, but had to wait

several years after the birth of the first one.

However, the people in rural areas of China were more hesitant in

accepting this policy. China's population policy has been credited with a

very significant slowing of China's population growth which had been

higher before the policy was implemented. However, the policy has come

under criticism that it has resulted in the abuse of women. Often

implementation of the policy has involved forced abortions, forced sterilization,

and infanticides. That families desired a male child had a part to play

in the number of infanticides. The number of girls that die within

their first year of birth is twice that of boys. Another drawback of the policy is that China's elderly population is now increasing rapidly.

However, while the punishment of "unplanned" pregnancy is a large fine,

both forced abortion and forced sterilization can be charged with

intentional assault, which is punished with up to ten years'

imprisonment.

Another issue that is raised in the one-child policy in China is the

information in regards to naturally giving birth to twins or triplets.

If this situation arises, the family is allowed to keep the children

because of the natural causes of this impregnation.

Family planning in China had its benefits, and its drawbacks. For

example, it helped reduce the population by about 300 million people in

its first 20 years.

A drawback is that there are now millions of sibling-less people, and

in China siblings are very important. Once the parent generation gets

older, the children help take care of them, and the work is usually

equally split among the siblings.

Another benefit of the implementation of the one-child law is that it

reduced the fertility rate from about 2.75 children born per woman, to

about 1.8 children born per woman in the 1979.

Hong Kong

In Hong Kong, the Eugenics League was found in 1936, which became The Family Planning Association of Hong Kong in 1950. The organisation provides family planning advice, sex education, birth control services to the general public of Hong Kong.

In the 1970s, due to the rapidly rising population, it launched the

"Two Is Enough" campaign, which reduced the general birth rate through

educational means.

The Family Planning Association of Hong Kong, Hong Kong's national family planning association, founded the International Planned Parenthood Federation with its counterparts in seven other countries.

India

Family planning in India is based on efforts largely sponsored by the Indian government.

In the 1965–2009 period, contraceptive usage has more than tripled

(from 13% of married women in 1970 to 48% in 2009) and the fertility

rate has more than halved (from 5.7 in 1966 to 2.6 in 2009), but the

national fertility rate is still high enough to cause long-term

population growth. India adds up to 1,000,000 people to its population

every 15 days.

Iran

While Iran's population grew at a rate of more than 3% per year

between 1956 and 1986, the growth rate began to decline in the late

1980s and early 1990s after the government initiated a major population

control program. By 2007 the growth rate had declined to 0.7 percent per

year, with a birth rate of 17 per 1,000 persons and a death rate of 6

per 1,000.

Reports by the UN show birth control policies in Iran to be effective

with the country topping the list of greatest fertility decreases. UN's

Population Division of the Department of Economic and Social Affairs

says that between 1975 and 1980, the total fertility number was 6.5. The

projected level for Iran's 2005 to 2010 birth rate is fewer than two.

In late July 2012, Supreme Leader Ali Khamenei

described Iran's contraceptive services as "wrong," and Iranian

authorities are slashing birth-control programs in what one Western

newspaper (USA Today)

describes as a "major reversal" of its long standing policy. Whether

program cuts and high-level appeals for bigger families will be

successful is still unclear.

Ireland

The sale of contraceptives was illegal in Ireland from 1935 until

1980, when it was legalized with strong restrictions, later loosened. It

has been argued that the resulting demographic dividend played a role in the economic boom in Ireland that began in the 1990s and ended abruptly in 2008 (the Celtic tiger) was in part due to the legalisation of contraception in 1979 and subsequent decline in the fertility rate. In Ireland the ratio of workers to dependents increased due to lower fertility — the reality of which has been questioned — but was raised further by increased female labor market participation.

Pakistan

In agreement with the 1994 International Conference on Population and Development in Cairo, Pakistan

pledged that by 2010 it would provide universal access to family

planning. Additionally, Pakistan's Poverty Reduction Strategy Paper has

set specific national goals for increases in family planning and contraceptive use. In 2011 just one in five Pakistani women ages 15 to 49 uses modern birth control. Contraception is shunned under traditional social mores that are fiercely defended as fundamentalist Islam gains strength.

Russia

According to a 2004 study, current pregnancies were termed "desired

and timely" by 58% of respondents, while 23% described them as "desired,

but untimely", and 19% said they were "undesired". As of 2004, the

share of women of reproductive age using hormonal or intrauterine birth

control methods was about 46% (29% intrauterine, 17% hormonal).

During the soviet era high quality contraceptives were difficult to

obtain, and abortion became the most common way of preventing unwanted

births. Since the dissolution of the Soviet Union abortion rates have

fallen considerably, but they are still higher than rates in many

developed countries.

Philippines

In the Philippines, the Responsible Parenthood and Reproductive Health Act of 2012 guarantees universal access to methods on contraception, fertility control, sexual education,

and maternal care. While there is general agreement about its

provisions on maternal and child health, there is great debate on its

mandate that the Philippine government and the private sector will fund

and undertake widespread distribution of family planning devices such as

condoms, birth control pills, and IUDs, as the government continues to disseminate information on their use through all health care centers.

Thailand

In

1970, Thailand's government declared a population policy that would

battle the country's rapid population growth rate. This policy set a

5-year goal to reduce Thailand's population growth rate from 3 percent

to 2.5 percent through methods such as spreading family planning

awareness to rural families, or integrating family planning activities

into maternal and child healthcare education.[82] Public figures such as Mechai Viravaidya helped spread family planning awareness through public speakings and charitable activities.

Singapore

Population control in Singapore spans two distinct phases: first to slow and reverse the boom in births that started after World War II; and then, from the 1980s onwards, to encourage parents to have more children because birth numbers had fallen below replacement levels.

United Kingdom

Contraception has been available for free under the National Health Service since 1974, and 74% of reproductive-age women use some form of contraception. The levonorgestrel intrauterine system has been massively popular. Sterilization is popular in older age groups, among those 45–49, 29% of men and 21% of women have been sterilized. Female sterilization has been declining since 1996, when the intrauterine system was introduced. Emergency contraception

has been available since the 1970s, a product was specifically licensed

for emergency contraception in 1984, and emergency contraceptives

became available over the counter in 2001.

Since becoming available over the counter it has not reduced the use of

other forms of contraception, as some moralists feared it might. In any year only 5% of women of childbearing age use emergency hormonal contraception.

Despite widespread availability of contraceptives, almost half of pregnancies were unintended in 2005. Abortion was legalized in 1967.

United States

Despite the availability of highly effective contraceptives, about half of U.S. pregnancies are unintended. Highly effective contraceptives, such as IUD, are underused in the United States. Increasing use of highly effective contraceptives could help meet the goal set forward in Healthy People 2020 to decrease unintended pregnancy by 10%. Cost to the user is one factor preventing many American women from using more effective contraceptives.

Making contraceptives available without a copay increases use of

highly effective methods, reduces unintended pregnancies, and may be

instrumental in achieving the Healthy People 2020 goal.

In the United States, contraceptive use saves about $19 billion in direct medical costs each year. Title X of the Public Health Service Act,

is a U.S. government program dedicated to providing family planning

services for those in need. But funding for Title X as a percentage of

total public funding to family planning client services has steadily

declined from 44% of total expenditures in 1980 to 12% in 2006. Current

funding for Title X is less than 40% of what is needed to meet the need

for publicly funded family planning. Title X would need $737 million annually to meet the need for family planning services.

Only 6.2 million women accessed publicly funded services from 10,700

clinics in 2015, despite an estimated 20 million women who could

benefit.

Clinics funded by Title X served 3.8 million of these women with

access to services.In 2015, publicly funded contraceptive services

helped women prevent 1.9 million unintended pregnancies; 876,100 of

these would have resulted in unplanned births and 628,000 abortions.

Without publicly funded contraceptive services, the rates of unintended

pregnancies, unplanned births and abortions would have been 67% higher. The rates for teens would have been 102% higher. Title X funded programs saw 1.2 million fewer patients in 2015 compared to 2010 as funding decreased by $31 million. In 2015, an estimated 2.4 million additional women received Medicaid-funded contraceptive services from private doctors.

Medicaid has increased from 20% to 71% from 1980 to 2006. In 2006, Medicaid contributed $1.3 billion to public family planning. The $1.9 billion spent on publicly funded family planning in 2008 saved an estimated $7 billion in short-term Medicaid costs. Such services helped women prevent an estimated 1.94 million unintended pregnancies and 810,000 abortions.

About 3 out of 10 women in the United States have an abortion by the time they are 45 years old.

A 2017 paper found that parents' access to family planning

programs had a positive economic impact on their subsequent children: "

Using the county-level introduction of U.S. family planning programs

between 1964 and 1973, we find that children born after programs began

had 2.8% higher household incomes. They were also 7% less likely to live

in poverty and 12% less likely to live in households receiving public

assistance. After accounting for selection, the direct effects of family

planning programs on parents’ incomes account for roughly two thirds of

these gains."

Uzbekistan

In Uzbekistan the government has pushed for uteruses to be removed from women in order to forcibly sterilize them.

Obstacles to family planning

There

are many reasons as to why women do not use contraceptives. These

reasons include logistical problems, scientific and religious concerns,

limited access to transportation in order to access health clinics, lack

of education and knowledge and opposition by partners, families or

communities plus the fact that no one is able to control their fertility

beyond basic behavior involving conception.

UNFPA says that “efforts to increase access must be sensitive to

cultural and national contexts, and must consider economic, geographic

and age disparities within countries.”

UNFPA states that, “Poorer women and those in rural areas often

have less access to family planning services. Certain groups — including

adolescents, unmarried people, the urban poor, rural populations, sex

workers and people living with HIV also face a variety of barriers to

family planning. This can lead to higher rates of unintended pregnancy,

increased risk of HIV and other STIs, limited choice of contraceptive

methods, and higher levels of unmet need for family planning.”

For national, international, or local health programs involved in family planning, the use of standard indicators

is increasingly encouraged, to track barriers to effective family

planning along with the efficacy, uptake, and provision of family

planning services.

World Contraception Day

September

26 is designated as World Contraception Day, devoted to raising

awareness of contraception and improving education about sexual and

reproductive health, with a vision of "a world where every pregnancy is

wanted". It is supported by a group of international NGOs, including:

Asian Pacific Council on Contraception, Centro Latinamericano

Salud y Mujer, European Society of Contraception and Reproductive

Health, German Foundation for World Population, International Federation of Pediatric and Adolescent Gynecology, International Planned Parenthood Federation, Marie Stopes International, Population Services International, The Population Council, The USAID, Women Deliver.

Abortion

Some pro-life groups claim that the United Nations and World Health Organization advocate abortion as a form of family planning. In fact, the United Nations Population Fund explicitly states it “never promotes abortion as a form of family planning.”

The World Health Organization states that "Family

planning/contraception reduces the need for abortion, especially unsafe

abortion."

The campaign to conflate contraception and abortion is rooted on

the assertion that contraception ends, rather than prevents, pregnancy.

According to an amicus brief submitted to the U.S. Supreme Court in

October 2013 led by Physicians for Reproductive Health and the American

College of Obstetricians and Gynecologists, a contraceptive method

prevents pregnancy by interfering with fertilization, or implantation.

Abortion, separate from contraceptives, ends an established pregnancy.