Energy subsidies are measures that keep prices for customers below market levels, or for suppliers above market levels, or reduce costs for customers and suppliers. Energy subsidies may be direct cash transfers to suppliers, customers, or related bodies, as well as indirect support mechanisms, such as tax exemptions and rebates, price controls, trade restrictions, and limits on market access.

Eliminating fossil fuel subsidies would greatly reduce global carbon emissions and would reduce the health risks of air pollution.

Overview

Main arguments for energy subsidies are:

- Security of supply – subsidies are used to ensure adequate domestic supply by supporting indigenous fuel production in order to reduce import dependency, or supporting overseas activities of national energy companies.

- Environmental improvement – subsidies are used to reduce pollution, including different emissions, and to fulfill international obligations (e.g. Kyoto Protocol).

- Economic benefits – subsidies in the form of reduced prices are used to stimulate particular economic sectors or segments of the population, e.g. alleviating poverty and increasing access to energy in developing countries.

- Employment and social benefits – subsidies are used to maintain employment, especially in periods of economic transition.

Main arguments against energy subsidies are:

- Some energy subsidies counter the goal of sustainable development, as they may lead to higher consumption and waste, exacerbating the harmful effects of energy use on the environment, create a heavy burden on government finances and weaken the potential for economies to grow, undermine private and public investment in the energy sector. Also, most benefits from fossil fuel subsidies in developing countries go to the richest 20% of households.

- Impede the expansion of distribution networks and the development of more environmentally benign energy technologies, and do not always help the people that need them most.

- The study conducted by the World Bank finds that subsidies to the large commercial businesses that dominate the energy sector are not justified. However, under some circumstances it is reasonable to use subsidies to promote access to energy for the poorest households in developing countries. Energy subsidies should encourage access to the modern energy sources, not to cover operating costs of companies. The study conducted by the World Resources Institute finds that energy subsidies often go to capital intensive projects at the expense of smaller or distributed alternatives.

Types of energy subsidies are:

- Direct financial transfers – grants to suppliers; grants to customers; low-interest or preferential loans to suppliers.

- Preferential tax treatments – rebates or exemption on royalties, duties, supplier levies and tariffs; tax credit; accelerated depreciation allowances on energy supply equipment.

- Trade restrictions – quota, technical restrictions and trade embargoes.

- Energy-related services provided by government at less than full cost – direct investment in energy infrastructure; public research and development.

- Regulation of the energy sector – demand guarantees and mandated deployment rates; price controls; market-access restrictions; preferential planning consent and controls over access to resources.

- Failure to impose external costs – environmental externality costs; energy security risks and price volatility costs.

- Depletion Allowance – allows a deduction from gross income of up to ~27% for the depletion of exhaustible resources (oil, gas, minerals).

Overall, energy subsidies require coordination and integrated implementation, especially in light of globalization and increased interconnectedness of energy policies, thus their regulation at the World Trade Organization is often seen as necessary.

Impact of fossil fuel subsidies

The degree and impact of fossil fuel subsidies is extensively studied. Because fossil fuels are a leading contributor to climate change through greenhouse gases, fossil fuel subsidies increase emissions and exacerbate climate change. The OECD created an inventory in 2015 of subsidies for the extraction, refining, or combustion of fossil fuels among the OECD and large emerging economies. This inventory identified an overall value of $160 to $200 billion per year between 2010 and 2014. Meanwhile, the International Energy Agency has estimated global fossil fuel subsidies as ranging from $300 to $600 billion per year between 2008 and 2015.

According to the International Energy Agency, the elimination of fossil fuel subsidies worldwide would be one of the most effective ways of reducing greenhouse gases and battling global warming. Along with this, elimination of these subsidies was welcomed by the G20 nations as a way reduce expenditures during the recession during the 2009 Pittsburgh Summit. In May 2016, the G7 nations set for the first time a deadline for ending most fossil fuel subsidies; saying government support for coal, oil and gas should end by 2025. According to a 2019 report by the Overseas Development Institute, the G20 governments still provide billions of dollars of support for the production and consumption of fossil fuels, spending at least $63.9 billion per year on coal alone.

According to the OECD, subsidies supporting fossil fuels, particularly coal and oil, represent greater threats to the environment than subsidies to renewable energy. Subsidies to nuclear power contribute to unique environmental and safety issues, related mostly to the risk of high-level environmental damage, although nuclear power contributes positively to the environment in the areas of air pollution and climate change. According to Fatih Birol, Chief Economist at the International Energy Agency, without a phasing out of fossil fuel subsidies, countries will not reach their climate targets.

In 2011, IEA chief economist Fatih Birol said the current $409 billion equivalent of fossil fuel subsidies (in non-OECD countries) are encouraging a wasteful use of energy, and that the cuts in subsidies is the biggest policy item that would help renewable energies get more market share and reduce CO2 emissions.

Environmental cost

Global fossil fuel subsidies reached $319 billion in 2017, although this number rises to $5.2 trillion (equivalent to 6.3% of world economy), when the economic value of environmental externalities such as air pollution are priced in. When measured this way, ending these subsidies can cause a 28% reduction in global carbon emissions and a 46% reduction in deaths due to fossil fuel air pollution. Total global air pollution deaths reach 7 million annually. Using this definition, "China was the biggest subsidizer in 2013 ($1.8 trillion), followed by the United States ($0.6 trillion), and Russia, the European Union, and India (each with about $0.3 trillion)."

IEA position on subsidies

According to International Energy Agency (IEA) (2011) energy subsidies artificially lower the price of energy paid by customers, raise the price received by suppliers or lower the cost of production. "Fossil fuels subsidies costs generally outweigh the benefits. Subsidies to renewables and low-carbon energy technologies can bring long-term economic and environmental benefits". In November 2011, an IEA report entitled Deploying Renewables 2011 said "subsidies in green energy technologies that were not yet competitive are justified in order to give an incentive to investing into technologies with clear environmental and energy security benefits". The IEA's report disagreed with claims that renewable energy technologies are only viable through costly subsidies and not able to produce energy reliably to meet demand. "A portfolio of renewable energy technologies is becoming cost-competitive in an increasingly broad range of circumstances, in some cases providing investment opportunities without the need for specific economic support," the IEA said, and added that "cost reductions in critical technologies, such as wind and solar, are set to continue."

Fossil-fuel consumption subsidies in non-OECD countries were $409 billion in 2010, oil products being half of it. In OECD countries, fossil fuel consumption subsidies have largely been phased out. Global fossil fuel taxes, mostly in OECD countries and on oil products, yield around $800 billion in revenues annually. Renewable energy is subsidized in order to compete in the market, increase their volume and develop the technology so that the subsidies become unnecessary with the development. Eliminating fossil-fuel subsidies could bring economic and environmental benefits. Phasing out fossil-fuel subsidies by 2020 would cut primary energy demand 5%. Since the start of 2010, at least 15 countries have taken steps to phase out fossil-fuel subsidies.

According to the IEA the phase-out of fossil fuel subsidies, over $500 billion annually, will reduce 10% greenhouse gas emissions by 2050.

Subsidies by country

The International Energy Agency estimates that governments subsidised fossil fuels by US $548 billion in 2013. Ten countries accounted for almost three-quarters of this figure. At their meeting in September 2009 the G-20 countries committed to "rationalize and phase out over the medium term inefficient fossil fuel subsidies that encourage wasteful consumption". The 2010s have seen many countries reducing energy subsidies, for instance in July 2014 Ghana abolished all diesel and gasoline subsidies, whilst in the same month Egypt raised diesel prices 63% as part of a raft of reforms intended to remove subsidies within 5 years.

The public energy subsidies for energy in Finland in 2013 were €700 million for fossil energy and €60 million for renewable energy (mainly wood and wind).

Canada

Fossil fuel subsidies

The Canadian federal government offers subsidies for fossil fuel exploration and production and Export Development Canada regularly provides financing to oil and gas companies. A 2018 report from the Overseas Development Institute, a UK-based think tank, found that Canada spent a greater proportion of its GDP on fiscal support to oil and gas production in 2015 and 2016 than any other G7 country.

In 2015 and 2016, the largest federal subsidies for fossil fuel exploration and production were the Canadian Exploration Expense (CEE), the Canadian Development Expense (CDE), and the Atlantic Investment Tax Credit (AITC). In these years Canada paid a yearly average of $1.018 billion CAD to oil and gas companies through the CDE, $148 million CAD through the CEE, and $127 million through the AITC. In 2017, subsidies to oil and gas through the AITC were phased out. Also in 2017, the federal government reformed the CEE so that exploration expenses may only be deducted through it if the exploration is unsuccessful. Otherwise, these expenses must be deducted through the CDE, which is deductible at 30% rather than 100%.

In December 2018, in response to low Canadian oil prices, the federal government announced $1.6 billion in financial support for the oil and gas sector: $1 billion in loans to oil and gas exporters from Export Development Canada, $500 million in financing for “higher risk” oil and gas companies from the Business Development Bank of Canada, $50 million through Natural Resources Canada’s Clean Growth Program, and $100 million through Innovation, Science and Economic Development Canada’s Strategic Innovation Fund. Minister of Natural Resources Amarjeet Sohi said that this financing is “not a subsidy for fossil fuels”, adding that “These are commercial loans, made available on commercial terms. We have committed to phasing out inefficient fossil fuel subsidies by 2025, and we stand by that commitment". In 2016, Canada committed to “phase out inefficient fossil fuel subsidies by 2025” in line with commitments made with G20 and G7 countries, although a 2017 report from the Office of the Auditor-General found that little work had been done to define this goal and establish a timeline for achieving it. Reducing subsidies to fossil fuels was an explicit part of the Liberal Party's platform in the 2015 federal election.

The largest provincial fossil fuel subsidies are paid by Alberta and British Columbia. Alberta spent a yearly average of $1.161 billion CAD on Crown Royalty Reductions for oil and gas from 2013 to 2015. And British Columbia paid a yearly average of $271 million CAD to gas companies through the Deep Drilling Credit.

Canadian provincial governments also offer subsidies for the consumption of fossil fuels. For example, Saskatchewan offers a fuel tax exemption for farmers and a sales tax exemption for natural gas used for heating.

A 2018 report from the Overseas Development Institute was critical of Canada's reporting and transparency practices around its fossil fuel subsidies. Canada does not publish specific reports on its fiscal support for fossil fuels, and when Canada’s Office of the Auditor-General attempted an audit of Canadian fossil fuel subsidies in 2017, they found much of the data they needed was not provided by Finance Canada. Export Development Canada reports on their transactions related to fossil fuel projects, but do not provide data on exact amounts or the stage of project development.

Iran

Contrary to the subsidy reform plan's objectives, under president Rouhani the volume of Iranian subsidies given to its citizens on fossil fuel increased 42.2% in 2019 and equals 15.3% of Iran’s GDP and 16% of total global energy subsidies. This has made Iran the world's largest subsidizer of energy prices. This situation is leading to highly wasteful consumption patterns, large budget deficits, price distortions in its entire economy, pollution and very lucrative (multi-billion dollars) contraband (because of price differentials) with neighbouring countries each year by rogue elements within the Iranian government supporting the status-quo.

Russia

Russia is one of the world’s energy powerhouses. It holds the world’s largest natural gas reserves (27% of total), the second-largest coal reserves, and the eighth-largest oil reserves. Russia is the world's third-largest energy subsidizer as of 2015. The country subsidizes electricity and natural gas as well as oil extraction. Approximately 60% of the subsidies go to natural gas, with the remainder spent on electricity (including under-pricing of gas delivered to power stations). For oil extraction the government gives tax exemptions and duty reductions amounting to about 22 billion dollars a year. Some of the tax exemptions and duty reductions also apply to natural gas extraction, though the majority is allocated for oil. In 2013 Russia offered the first subsidies to renewable power generators. The large subsidies of Russia are costly and it is recommended in order to help the economy that Russia lowers its domestic subsidies. However, the potential elimination of energy subsidies in Russia carries the risk of social unrest that makes Russian authorities reluctant to remove them.

Turkey

The energy policy of Turkey subsidizes fossil fuels US$1.6 billion annually including heavily subsidizing coal in Turkey.

United Kingdom

The government says that the 5% value added tax (VAT) rate on natural gas for home heating is not a subsidy, but some environmental groups disagree and say that it should be increased to the standard 20% with the extra revenue ringfenced for poor people.

United States

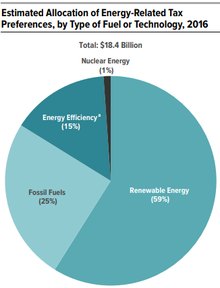

According to Congressional Budget Office testimony in 2016, an estimated $10.9 billion in tax preferences was directed toward renewable energy, $4.6 billion went to fossil fuels, and $2.7 billion went to energy efficiency or electricity transmission.

According to a 2015 estimate by the Obama administration, the US oil industry benefited from subsidies of about $4.6 billion per year. A 2017 study by researchers at Stockholm Environment Institute published in the journal Nature Energy estimated that nearly half of U.S. oil production would be unprofitable without subsidies.

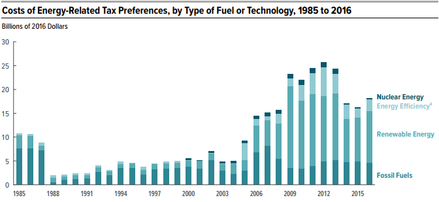

Allocation of subsidies in the United States

A 2017 study by the consulting firm Management Information Services, Inc. (MISI) estimated the total historical federal subsidies for various energy sources over the years 1950–2016. The study found that oil, natural gas, and coal received $414 billion, $140 billion, and $112 billion (2015 dollars), respectively, or 65% of total energy subsidies over that period. Oil, natural gas, and coal benefited most from percentage depletion allowances and other tax-based subsidies, but oil also benefited heavily from regulatory subsidies such as exemptions from price controls and higher-than-average rates of return allowed on oil pipelines. The MISI report found that non-hydro renewable energy (primarily wind and solar) benefited from $158 billion in federal subsidies, or 16% of the total, largely in the form of tax policy and direct federal expenditures on research and development (R&D). Nuclear power benefited from $73 billion in federal subsidies, 8% of the total and less than half of the total applied to renewables, while hydro power received $105 billion in federal subsidies, 10% of the total. Notable was MISI's finding that between 2011 through 2016, renewable energy received more than three times as much help in federal incentives as oil, natural gas, coal, and nuclear combined, and 27 times as much as nuclear energy.

In the United States, the federal government has paid US$145 billion for energy subsidies to support R&D for nuclear power ($85 billion) and fossil fuels ($60 billion) from 1950 to 2016. During this same timeframe, renewable energy technologies received a total of US $34 billion. Though in 2007 some suggested that a subsidy shift would help to level the playing field and support growing energy sectors, namely solar power, wind power, and bio-fuels., by 2017 those sources combined had yet to provide 10% of U.S. electricity, and intermittency forced utilities to remain reliant on oil, natural gas, and coal to meet baseload demand. Many of the "subsidies" available to the oil and gas industries are general business opportunity credits, available to all US businesses (particularly, the foreign tax credit mentioned above). The value of industry-specific (oil, gas, and coal) subsidies in 2006 was estimated by the Texas State Comptroller to be $6.25 billion - about 60% of the amount calculated by the Environmental Law Institute. The balance of federal subsidies, which the comptroller valued at $7.4 billion, came from shared credits and deductions, and oil defense (spending on the Strategic Petroleum Reserve, energy infrastructure security, etc.).

Critics allege that the most important subsidies to the nuclear industry have not involved cash payments, but rather the shifting of construction costs and operating risks from investors to taxpayers and ratepayers, burdening them with an array of risks including cost overruns, defaults to accidents, and nuclear waste management. Critics claim that this approach distorts market choices, which they believe would otherwise favor less risky energy investments.

Many energy analysts, such as Clint Wilder, Ron Pernick and Lester Brown, have suggested that energy subsidies need to be shifted away from mature and established industries and towards high growth clean energy (excluding nuclear). They also suggest that such subsidies need to be reliable, long-term and consistent, to avoid the periodic difficulties that the wind industry has had in the United States.

United States government role in the development of new energy industries

From civilian nuclear power to hydro, wind, solar, and shale gas, the United States federal government has played a central role in the development of new energy industries.

America's nuclear power industry, which currently supplies about 20% of the country's electricity, has its origins in the Manhattan Project to develop atomic weapons during World War II. From 1942 to 1945, the United States invested $20 billion (2003 dollars) into a massive nuclear research and deployment initiative. But the achievement of the first nuclear weapon test in 1945 marked the beginning, not the end, of federal involvement in nuclear technologies. President Dwight D. Eisenhower's “Atoms for Peace” address in 1953 and the 1954 Atomic Energy Act committed the United States to develop peaceful uses for nuclear technology, including commercial energy generation.

Commercial wind power was also enabled through government support. In the 1980s, the federal government pursued two different R&D efforts for wind turbine development. The first was a “big science” effort by NASA and the Department of Energy (DOE) to use U.S. expertise in high-technology research and products to develop new large-scale wind turbines for electricity generation, largely from scratch. A second, more successful R&D effort, sponsored by the DOE, focused on component innovations for smaller turbines that used the operational experience of existing turbines to inform future research agendas. Joint research projects between the government and private firms produced a number of innovations that helped increase the efficiency of wind turbines, including twisted blades and special-purpose airfoils. Publicly funded R&D was coupled with efforts to build a domestic market for new turbines. At the federal level, this included tax credits and the passage of the Public Utilities Regulatory Policy Act (PURPA), which required that utilities purchase power from some small renewable energy generators at avoided cost. Both federal and state support for wind turbine development helped drive costs down considerably, but policy incentives at both the federal and state level were discontinued at the end of the decade. However, after a nearly five-year federal policy hiatus in the late 1980s, the U.S. government enacted new policies to support the industry in the early 1990s. The National Renewable Energy Laboratory (NREL) continued its support for wind turbine R&D, and also launched the Advanced Wind Turbine Program (AWTP). The goal of the AWTP was to reduce the cost of wind power to rates that would be competitive in the U.S. market. Policymakers also introduced new mechanisms to spur the demand of new wind turbines and boost the domestic market, including a 1.5 cents per kilowatt-hour tax credit (adjusted over time for inflation) included in the 1992 Energy Policy Act. Today the wind industry's main subsidy support comes from the federal production tax credit.

The development of commercial solar power was also dependent on government support. Solar PV technology was born in the United States, when Daryl Chapin, Calvin Fuller, and Gerald Pearson at Bell Labs first demonstrated the silicon solar photovoltaic cell in 1954. The first cells recorded efficiencies of four percent, far lower than the 25 percent efficiencies typical of some silicon crystalline cells today. With the cost out of reach for most applications, developers of the new technology had to look elsewhere for an early market. As it turned out, solar PV did make economic sense in one market segment: aerospace. The United States Army and Air Force viewed the technology as an ideal power source for a top-secret project on earth-orbiting satellites. The government contracted with Hoffman Electronics to provide solar cells for its new space exploration program. The first commercial satellite, the Vanguard I, launched in 1958, was equipped with both silicon solar cells and chemical batteries. By 1965, NASA was using almost a million solar PV cells. Strong government demand and early research support for solar cells paid off in the form of dramatic declines in the cost of the technology and improvements in its performance. From 1956 to 1973, the price of PV cells declined from $300 to $20 per watt. Beginning in the 1970s, as costs were declining, manufacturers began producing solar PV cells for terrestrial applications. Solar PV found a new niche in areas distant from power lines where electricity was needed, such as oil rigs and Coast Guard lighthouses. The government continued to support the industry through the 1970s and early 1980s with new R&D efforts under Presidents Richard Nixon and Gerald Ford, both Republicans, and President Jimmy Carter, a Democrat. As a direct result of government involvement in solar PV development, 13 of the 14 top innovations in PV over the past three decades were developed with the help of federal dollars, nine of which were fully funded by the public sector.

More recently than nuclear, wind, or solar, the development of the shale gas industry and subsequent boom in shale gas development in the United States was enabled through government support. The history of shale gas fracking in the United States was punctuated by the successive developments of massive hydraulic fracturing (MHF), microseismic imaging, horizontal drilling, and other key innovations that when combined made the once unreachable energy resource technically recoverable. Along each stage of the innovation pipeline – from basic research to applied R&D to cost-sharing on demonstration projects to tax policy support for deployment – public-private partnerships and federal investments helped push hydraulic fracturing in shale into full commercial competitiveness. Through a combination of federally funded geologic research beginning in the 1970s, public-private collaboration on demonstration project and R&D priorities, and tax policy support for unconventional technologies, the federal government played a key role in the development of shale gas in the United States.

Investigations have uncovered the crucial role of the government in the development of other energy technologies and industries, including aviation and jet engines, synthetic fuels, advanced natural gas turbines, and advanced diesel internal combustion engines.

Venezuela

In Venezuela, energy subsidies were equivalent to about 8.9 percent of the country's GDP in 2012. Fuel subsidies were 7.1 percent while electricity subsidies were 1.8 percent. In order to fund this the government used about 85 percent of its tax revenue on these subsidies. It is estimated the subsidies have caused Venezuela to consume 20 percent more energy than without them. The fuel subsidies are given more heavily to the richest part of the population who are consuming the most energy. The fuel subsidies maintained a cost of about $0.01 US for a liter of gasoline at the pump since 1996 until president Nicolas Maduro reduced the national subsidy in 2016 to make it roughly $0.60 US per liter (The local currency is Bolivar and the price per liter of gas is 6 Bolivars). Fuel consumption has increased overall since the 1996 policy began even though the production of oil has fallen more than 350,000 barrels a day since 2008 under that policy. PDVSA, the Venezuelan state oil company, has been losing money on these domestic transactions since the enactment of these policies. These losses can also be attributed to the 2005 Petrocaribe agreement, under which Venezuela sells many surrounding countries petroleum at a reduced or preferable price; essentially a subsidy by Venezuela for countries that are a part of the agreement. The subsidizing of fossil fuels and consequent low cost of fuel at the pump has caused the creation of a large black market. Criminal groups smuggle fuel out of Venezuela to adjacent nations (mainly Colombia). This is due to the large profits that can be gained by this act, as fuel is much more expensive in Colombia than in Venezuela. Despite the fact that this issue is already well known in Venezuela, and insecurity in the region continues to rise, the state has not yet lowered or eliminated these fossil fuel subsidies.

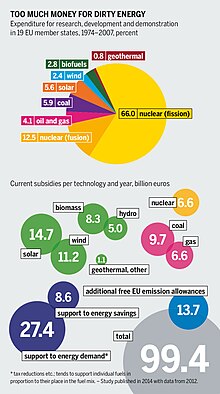

European Union

In February 2011 and January 2012 the UK Energy Fair group, supported by other organisations and environmentalists, lodged formal complaints with the European Union's Directorate General for Competition, alleging that the Government was providing unlawful state aid in the form of subsidies for nuclear power industry, in breach of European Union competition law.

One of the largest subsidies is the cap on liabilities for nuclear accidents which the nuclear power industry has negotiated with governments. “Like car drivers, the operators of nuclear plants should be properly insured,” said Gerry Wolff, coordinator of the Energy Fair group. The group calculates that, "if nuclear operators were fully insured against the cost of nuclear disasters like those at Chernobyl and Fukushima, the price of nuclear electricity would rise by at least €0.14 per kWh and perhaps as much as €2.36, depending on assumptions made". According to the most recent statistics, subsidies for fossil fuels in Europe are exclusively allocated to coal (€10 billion) and natural gas (€6 billion). Oil products do not receive any subsidies.