Development economics involves the creation of theories and

methods that aid in the determination of policies and practices and can

be implemented at either the domestic or international level. This may involve restructuring market incentives or using mathematical methods such as intertemporal optimization for project analysis, or it may involve a mixture of quantitative and qualitative methods.

Unlike in many other fields of economics, approaches in development economics may incorporate social and political factors to devise particular plans. Also unlike many other fields of economics, there is no consensus on what students should know. Different approaches may consider the factors that contribute to economic convergence or non-convergence across households, regions, and countries.

Unlike in many other fields of economics, approaches in development economics may incorporate social and political factors to devise particular plans. Also unlike many other fields of economics, there is no consensus on what students should know. Different approaches may consider the factors that contribute to economic convergence or non-convergence across households, regions, and countries.

Theories of development economics

Mercantilism and physiocracy

World GDP per capita, from 1400 to 2003 CE

The earliest Western theory of development economics was mercantilism, which developed in the 17th century, paralleling the rise of the nation state. Earlier theories had given little attention to development. For example, scholasticism,

the dominant school of thought during medieval feudalism, emphasized

reconciliation with Christian theology and ethics, rather than

development. The 16th- and 17th-century School of Salamanca, credited as the earliest modern school of economics, likewise did not address development specifically.

Major European nations in the 17th and 18th century all adopted

mercantilist ideals to varying degrees, the influence only ebbing with

the 18th-century development of physiocrats in France and classical economics

in Britain. Mercantilism held that a nation's prosperity depended on

its supply of capital, represented by bullion (gold, silver, and trade

value) held by the state. It emphasised the maintenance of a high

positive trade balance (maximising exports and minimising imports) as a

means of accumulating this bullion. To achieve a positive trade balance,

protectionist measures such as tariffs and subsidies to home industries

were advocated. Mercantilist development theory also advocated colonialism.

Theorists most associated with mercantilism include Philipp von Hörnigk, who in his Austria Over All, If She Only Will of 1684 gave the only comprehensive statement of mercantilist theory, emphasizing production and an export-led economy. In France, mercantilist policy is most associated with 17th-century finance minister Jean-Baptiste Colbert, whose policies proved influential in later American development.

Mercantilist ideas continue in the theories of economic nationalism and neomercantilism.

Economic nationalism

Alexander Hamilton, credited as Father of the National System

Following mercantilism was the related theory of economic nationalism,

promulgated in the 19th century related to the development and

industrialization of the United States and Germany, notably in the

policies of the American System in America and the Zollverein

(customs union) in Germany. A significant difference from mercantilism

was the de-emphasis on colonies, in favor of a focus on domestic

production.

The names most associated with 19th-century economic nationalism are the American Alexander Hamilton, the German-American Friedrich List, and the American Henry Clay. Hamilton's 1791 Report on Manufactures,

his magnum opus, is the founding text of the American System, and drew

from the mercantilist economies of Britain under Elizabeth I and France

under Colbert. List's 1841 Das Nationale System der Politischen Ökonomie

(translated into English as The National System of Political Economy),

which emphasized stages of growth, proved influential in the US and

Germany, and nationalist policies were pursued by politician Henry Clay,

and later by Abraham Lincoln, under the influence of economist Henry Charles Carey.

Forms of economic nationalism and neomercantilism have also been

key in Japan's development in the 19th and 20th centuries, and the more

recent development of the Four Asian Tigers (Hong Kong, South Korea, Taiwan, and Singapore), and, most significantly, China.

Following Brexit and the United States presidential election, 2016, some experts have argued a new kind of "self-seeking capitalism" popularly known as Trumponomics could have a considerable impact on cross-border investment flows and long-term capital allocation.

Post-WWII theories

The origins of modern development economics are often traced to the

need for, and likely problems with the industrialization of eastern

Europe in the aftermath of World War II. The key authors are Paul Rosenstein-Rodan, Kurt Mandelbaum, Ragnar Nurkse, and Sir Hans Wolfgang Singer.

Only after the war did economists turn their concerns towards Asia,

Africa and Latin America. At the heart of these studies, by authors such

as Simon Kuznets and W. Arthur Lewis was an analysis of not only economic growth but also structural transformation.

Linear-stages-of-growth model

An early theory of development economics, the linear-stages-of-growth model was first formulated in the 1950s by W. W. Rostow in The Stages of Growth: A Non-Communist Manifesto,

following work of Marx and List. This theory modifies Marx's stages

theory of development and focuses on the accelerated accumulation of

capital, through the utilization of both domestic and international

savings as a means of spurring investment, as the primary means of

promoting economic growth and, thus, development.

The linear-stages-of-growth model posits that there are a series of

five consecutive stages of development which all countries must go

through during the process of development. These stages are "the

traditional society, the pre-conditions for take-off, the take-off, the

drive to maturity, and the age of high mass-consumption" Simple versions of the Harrod–Domar model provide a mathematical illustration of the argument that improved capital investment leads to greater economic growth.

Such theories have been criticized for not recognizing that, while necessary, capital accumulation

is not a sufficient condition for development. That is to say that this

early and simplistic theory failed to account for political, social and

institutional obstacles to development. Furthermore, this theory was

developed in the early years of the Cold War and was largely derived from the successes of the Marshall Plan.

This has led to the major criticism that the theory assumes that the

conditions found in developing countries are the same as those found in

post-WWII Europe.

Structural-change theory

Structural-change

theory deals with policies focused on changing the economic structures

of developing countries from being composed primarily of subsistence

agricultural practices to being a "more modern, more urbanized, and more

industrially diverse manufacturing and service economy." There are two

major forms of structural-change theory: W. Lewis' two-sector surplus model,

which views agrarian societies as consisting of large amounts of

surplus labor which can be utilized to spur the development of an

urbanized industrial sector, and Hollis Chenery's patterns of development approach, which holds that different countries become wealthy via different trajectories. The pattern

that a particular country will follow, in this framework, depends on

its size and resources, and potentially other factors including its

current income level and comparative advantages relative to other

nations.

Empirical analysis in this framework studies the "sequential process

through which the economic, industrial and institutional structure of an

underdeveloped economy is transformed over time to permit new

industries to replace traditional agriculture as the engine of economic

growth."

Structural-change approaches to development economics have faced

criticism for their emphasis on urban development at the expense of

rural development which can lead to a substantial rise in inequality

between internal regions of a country. The two-sector surplus model,

which was developed in the 1950s, has been further criticized for its

underlying assumption that predominantly agrarian societies suffer from a

surplus of labor. Actual empirical studies have shown that such labor

surpluses are only seasonal and drawing such labor to urban areas can

result in a collapse of the agricultural sector. The patterns of

development approach has been criticized for lacking a theoretical

framework.

International dependence theory

International dependence theories gained prominence in the 1970s as a reaction to the failure of earlier theories to lead to widespread successes in international development.

Unlike earlier theories, international dependence theories have their

origins in developing countries and view obstacles to development as

being primarily external in nature, rather than internal. These

theories view developing countries as being economically and politically

dependent on more powerful, developed countries which have an interest

in maintaining their dominant position. There are three different,

major formulations of international dependence theory: neocolonial dependence theory, the false-paradigm model, and the dualistic-dependence model.

The first formulation of international dependence theory, neocolonial dependence theory, has its origins in Marxism

and views the failure of many developing nations to undergo successful

development as being the result of the historical development of the

international capitalist system.

Neoclassical theory

First

gaining prominence with the rise of several conservative governments in

the developed world during the 1980s, neoclassical theories represent a

radical shift away from International Dependence Theories.

Neoclassical theories argue that governments should not intervene in the

economy; in other words, these theories are claiming that an

unobstructed free market is the best means of inducing rapid and

successful development. Competitive free markets

unrestrained by excessive government regulation are seen as being able

to naturally ensure that the allocation of resources occurs with the

greatest efficiency possible and the economic growth is raised and

stabilized.

It is important to note that there are several different

approaches within the realm of neoclassical theory, each with subtle,

but important, differences in their views regarding the extent to which

the market should be left unregulated. These different takes on

neoclassical theory are the free market approach, public-choice theory, and the market-friendly approach.

Of the three, both the free-market approach and public-choice theory

contend that the market should be totally free, meaning that any

intervention by the government is necessarily bad. Public-choice theory

is arguably the more radical of the two with its view, closely

associated with libertarianism, that governments themselves are rarely good and therefore should be as minimal as possible.

Academic economists have given varied policy advice to governments of developing countries. See for example, Economy of Chile (Arnold Harberger), Economic history of Taiwan (Sho-Chieh Tsiang). Anne Krueger

noted in 1996 that success and failure of policy recommendations

worldwide had not consistently been incorporated into prevailing

academic writings on trade and development.

The market-friendly approach, unlike the other two, is a more recent development and is often associated with the World Bank.

This approach still advocates free markets but recognizes that there

are many imperfections in the markets of many developing nations and

thus argues that some government intervention is an effective means of

fixing such imperfections.

Topics of research

Development economics also includes topics such as third world debt, and the functions of such organisations as the International Monetary Fund and World Bank.

In fact, the majority of development economists are employed by, do

consulting with, or receive funding from institutions like the IMF and

the World Bank.

Many such economists are interested in ways of promoting stable and

sustainable growth in poor countries and areas, by promoting domestic

self-reliance and education in some of the lowest income countries in

the world. Where economic issues merge with social and political ones,

it is referred to as development studies.

Economic development and ethnicity

A

growing body of research has been emerging among development economists

since the very late 20th century focusing on interactions between ethnic diversity and economic development, particularly at the level of the nation-state.

While most research looks at empirical economics at both the macro and

the micro level, this field of study has a particularly heavy

sociological approach. The more conservative branch of research focuses

on tests for causality in the relationship between different levels of

ethnic diversity and economic performance, while a smaller and more

radical branch argues for the role of neoliberal economics in enhancing or causing ethnic conflict. Moreover, comparing these two theoretical approaches brings the issue of endogeneity

(endogenicity) into questions. This remains a highly contested and

uncertain field of research, as well as politically sensitive, largely

due to its possible policy implications.

The role of ethnicity in economic development

Much discussion among researchers centers around defining and measuring two key but related variables: ethnicity and diversity. It is debated whether ethnicity should be defined by culture, language, or religion. While conflicts in Rwanda were largely along tribal lines, Nigeria's string of conflicts is thought to be – at least to some degree – religiously based. Some have proposed that, as the saliency

of these different ethnic variables tends to vary over time and across

geography, research methodologies should vary according to the context. Somalia provides an interesting example. Due to the fact that about 85% of its population defined themselves as Somali, Somalia was considered to be a rather ethnically-homogeneous nation. However, civil war caused ethnicity (or ethnic affiliation) to be redefined according to clan groups.

There is also much discussion in academia concerning the creation of an index

for "ethnic heterogeneity". Several indices have been proposed in order

to model ethnic diversity (with regards to conflict). Easterly and

Levine have proposed an ethno-linguistic fractionalization index defined

as FRAC or ELF defined by:

where si is size of group i as a percentage of total population. The ELF index is a measure of the probability that two randomly chosen individuals belong to different ethno-linguistic groups. Other researchers have also applied this index to religious rather than ethno-linguistic groups.

Though commonly used, Alesina and La Ferrara point out that the ELF

index fails to account for the possibility that fewer large ethnic

groups may result in greater inter-ethnic conflict than many small

ethnic groups. More recently, researchers such as Montalvo and Reynal-Querol, have put forward the Q polarization index as a more appropriate measure of ethnic division. Based on a simplified adaptation of a polarization index developed by Esteban and Ray, the Q index is defined as

where si once again represents the size of group i

as a percentage of total population, and is intended to capture the

social distance between existing ethnic groups within an area.

Early researchers, such as Jonathan Pool, considered a concept dating back to the account of the Tower of Babel: that linguistic unity may allow for higher levels of development.

While pointing out obvious oversimplifications and the subjectivity of

definitions and data collection, Pool suggested that we had yet to see a

robust economy emerge from a nation with a high degree of linguistic

diversity.

In his research Pool used the "size of the largest native-language

community as a percentage of the population" as his measure of

linguistic diversity.

Not much later, however, Horowitz pointed out that both highly diverse

and highly homogeneous societies exhibit less conflict than those in

between.

Similarly, Collier and Hoeffler provided evidence that both highly

homogenous and highly heterogeneous societies exhibit lower risk of

civil war, while societies that are more polarized are at greater risk.

As a matter of fact, their research suggests that a society with only

two ethnic groups is about 50% more likely to experience civil war than

either of the two extremes.

Nonetheless, Mauro points out that ethno-linguistic fractionalization

is positively correlated with corruption, which in turn is negatively

correlated with economic growth.

Moreover, in a study on economic growth in African countries, Easterly

and Levine find that linguistic fractionalization plays a significant

role in reducing national income growth and in explaining poor policies. In addition, empirical research in the U.S., at the municipal level, has revealed that ethnic fractionalization (based on race) may be correlated with poor fiscal management and lower investments in public goods.

Finally, more recent research would propose that ethno-linguistic

fractionalization is indeed negatively correlated with economic growth

while more polarized societies exhibit greater public consumption, lower

levels of investment and more frequent civil wars.

Economic development and its impact on ethnic conflict

Increasingly, attention is being drawn to the role of economics in spawning or cultivating ethnic conflict.

Critics of earlier development theories, mentioned above, point out

that “ethnicity” and ethnic conflict cannot be treated as exogenous

variables. There is a body of literature which discusses how economic growth and development, particularly in the context of a globalizing world characterized by free trade, appears to be leading to the extinction and homogenization of languages.

Manuel Castells asserts that the "widespread destructuring of

organizations, delegitimation of institutions, fading away of major

social movements, and ephemeral cultural expressions" which characterize

globalization lead to a renewed search for meaning; one that is based

on identity rather than on practices. Barber and Lewis argue that culturally-based movements of resistance have emerged as a reaction to the threat of modernization (perceived or actual) and neoliberal development.

On a different note, Chua suggests that ethnic conflict often

results from the envy of the majority toward a wealthy minority which

has benefited from trade in a neoliberal world. She argues that conflict is likely to erupt through political manipulation and the vilification of the minority. Prasch points out that, as economic growth often occurs in tandem with increased inequality, ethnic or religious organizations may be seen as both assistance and an outlet for the disadvantaged. However, empirical research by Piazza argues that economics and unequal development have little to do with social unrest in the form of terrorism. Rather, "more diverse societies, in terms of ethnic and religious demography,

and political systems with large, complex, multiparty systems were more

likely to experience terrorism than were more homogeneous states with

few or no parties at the national level".

Recovery from conflict (civil war)

Violent conflict and economic development are deeply intertwined. Paul Collier

describes how poor countries are more prone to civil conflict. The

conflict lowers incomes catching countries in a "conflict trap." Violent

conflict destroys physical capital (equipment and infrastructure),

diverts valuable resources to military spending, discourages investment

and disrupts exchange.

Recovery from civil conflict is very uncertain. Countries that

maintain stability can experience a "peace dividend," through the rapid

re-accumulation of physical capital (investment flows back to the

recovering country because of the high return). However, successful recovery depends on the quality of legal system and the protection of private property.

Investment is more productive in countries with higher quality

institutions. Firms that experienced a civil war were more sensitive to

the quality of the legal system that firm similar firms that had never

been exposed to conflict.

Growth indicator controversy

Per

capita Gross Domestic Product (GDP per head) is used by many

developmental economists as an approximation of general national

well-being. However, these measures are criticized as not measuring

economic growth well enough, especially in countries where there is much

economic activity that is not part of measured financial transactions

(such as housekeeping and self-homebuilding), or where funding is not

available for accurate measurements to be made publicly available for

other economists to use in their studies (including private and

institutional fraud, in some countries).

Even though per-capita GDP as measured can make economic

well-being appear smaller than it really is in some developing

countries, the discrepancy could be still bigger in a developed country

where people may perform outside of financial transactions an even

higher-value service than housekeeping or homebuilding as gifts or in

their own households, such as counseling, lifestyle coaching,

a more valuable home décor service, and time management. Even free

choice can be considered to add value to lifestyles without necessarily

increasing the financial transaction amounts.

More recent theories of Human Development have begun to see

beyond purely financial measures of development, for example with

measures such as medical care available, education, equality, and

political freedom. One measure used is the Genuine Progress Indicator, which relates strongly to theories of distributive justice. Actual knowledge about what creates growth is largely unproven; however recent advances in econometrics

and more accurate measurements in many countries is creating new

knowledge by compensating for the effects of variables to determine

probable causes out of merely correlational statistics.

Recent developments

Recent theories revolve around questions about what variables or

inputs correlate or affect economic growth the most: elementary,

secondary, or higher education, government policy stability, tariffs and

subsidies, fair court systems, available infrastructure, availability

of medical care, prenatal care and clean water, ease of entry and exit

into trade, and equality of income distribution (for example, as

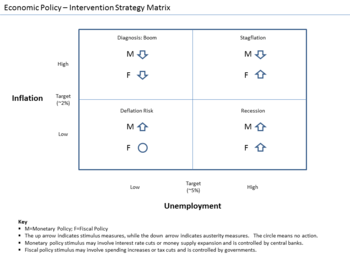

indicated by the Gini coefficient), and how to advise governments about macroeconomic policies, which include all policies that affect the economy.

Education enables countries to adapt the latest technology and creates an environment for new innovations.

The cause of limited growth and divergence in economic growth

lies in the high rate of acceleration of technological change by a small

number of developed countries. These countries' acceleration of

technology was due to increased incentive structures for mass education

which in turn created a framework for the population to create and adapt

new innovations and methods. Furthermore, the content of their

education was composed of secular schooling that resulted in higher

productivity levels and modern economic growth.

Researchers at the Overseas Development Institute

also highlight the importance of using economic growth to improve the

human condition, raising people out of poverty and achieving the Millennium Development Goals.

Despite research showing almost no relation between growth and the

achievement of the goals 2 to 7 and statistics showing that during

periods of growth poverty levels in some cases have actually risen (e.g.

Uganda grew by 2.5% annually between 2000–2003, yet poverty levels rose

by 3.8%), researchers at the ODI suggest growth is necessary, but that

it must be equitable. This concept of inclusive growth is shared even by key world leaders such as former Secretary General Ban Ki-moon, who emphasises that:

- "Sustained and equitable growth based on dynamic structural economic change is necessary for making substantial progress in reducing poverty. It also enables faster progress towards the other Millennium Development Goals. While economic growth is necessary, it is not sufficient for progress on reducing poverty."

Researchers at the ODI thus emphasise the need to ensure social protection

is extended to allow universal access and that active policy measures

are introduced to encourage the private sector to create new jobs as the

economy grows (as opposed to jobless growth) and seek to employ people from disadvantaged groups.

Notable development economists

- Daron Acemoglu, professor of economics at the Massachusetts Institute of Technology, and 2005 Clark Medal winner.

- Philippe Aghion, professor of economics at Harvard University, co-authored textbook in economic growth, forwarded Schumpeterian growth, and established creative destruction theories mathematically with Peter Howitt.

- Bina Agarwal is a prize-winning development economist and Professor of Development Economics and Environment at the Global Development Institute at The University of Manchester.

- Abhijit Banerjee, professor of economics at the Massachusetts Institute of Technology and Director of Abdul Latif Jameel Poverty Action Lab.

- Pranab Bardhan, professor of economics at the University of California, Berkeley, author of texts in both trade and development economics, and editor of the Journal of Development Economics from 1985–2003.

- Kaushik Basu, professor of economics at Cornell University and author of Analytical Development Economics.

- Peter Thomas Bauer, professor of economics at the London School of Economics, author of Dissent on Development.

- Jagdish Bhagwati, a frequent commentator on international trade and noted supporter of free trade

- Nancy Birdsall is the founding president of the Center for Global Development (CGD) in Washington, DC, USA, and former executive vice-president of the Inter-American Development Bank.

- David E. Bloom, professor of economics and demography at the Harvard School of Public Health.

- Ha-Joon Chang, author of Kicking Away the Ladder and Bad Samaritans; Rich Nations, Poor Policies and the Threat to the Developing World which use historical evidence to critique neoliberal development economics.

- Paul Collier, author of The Bottom Billion which attempts to tie together a series of traps to explain the self-fulfilling nature of poverty at the lower end of the development scale.

- Esther Duflo, Director of Abdul Latif Jameel Poverty Action Lab, professor of Economics at the Massachusetts Institute of Technology, 2009 MacArthur Fellow, 2010 Clark Medal winner, advocate for field experiments.

- William Easterly, author of The Elusive Quest for Growth: Economists' Adventures and Misadventures in the Tropics[43][44] and White Man's Burden: How the West's Efforts to Aid the Rest Have Done So Much Ill and So Little Good.[45]

- Diane Rosemary Elson is a British economist, sociologist and gender and development social scientist.

- Sakiko Fukuda-Parr (サキコ・フクダ・パー、福田 咲子) is a development economist who has gained recognition for her work with the United Nations Development Programme (UNDP).

- Celso Furtado, Brazilian structuralist economist.

- Oded Galor, Israeli-American economist at Brown University; editor-in-chief of the Journal of Economic Growth, the principal journal in economic growth. Developer of the unified growth theory, the newest alternative to theories of endogenous growth.

- Jayati Ghosh is a development economist and Professor of Economics at the Centre for Economic Studies and Planning, School of Social Sciences, at the Jawaharlal Nehru University, in New Delhi, India.

- Stephany Griffith-Jones is an economist specialising in international finance and development. She is currently financial markets director at the Initiative for Policy Dialogue, based at Columbia University in New York and associate fellow at the Overseas Development Institute.

- Barbara Harriss-White is an English economist and emeritus professor of development studies.

- Peter Howitt, Canadian economist at Brown University; past president of the Canadian Economics Association, introduced the concept of Schumpeterian growth and established creative destruction theory mathematically with Philippe Aghion.

- Dean Karlan, American economist at Northwestern University; co-director of the Global Poverty Research Lab at the Buffett Institute for Global Studies; founded Innovations for Poverty Action (IPA), a New Haven, Connecticut, based research outfit dedicated to creating and evaluating solutions to social and international development problems.

- Naila Kabeer (Bengali: নায়লা কবির) is an Indian-born British Bangladeshi social economist, research fellow and writer.

- Justin Yifu Lin, Chinese economist at Peking University; former chief economist of World Bank, one of the most important Chinese economists.

- W. Arthur Lewis, with T. W. Schultz, winner of the 1979 Nobel Prize in Economics for work in development economics.

- Utsa Patnaik is an Indian Marxist economist.

- Raúl Prebisch, founding Secretary General of the United Nations Conference on Trade and Development and influential dependency theorist.

- Lant Pritchett, professor at Harvard University's Kennedy School of Government, and has held several prominent research positions at the World Bank.

- Dani Rodrik, professor at Harvard University's Kennedy School of Government, has written extensively on globalization.

- Mark Rosenzweig, a professor at Yale University and director of Economic Growth Center at Yale

- Walt Whitman Rostow, modernization theorist, author of The Stages of Economic Growth: A Non-communist Manifesto.

- Jeffrey Sachs, author of The End of Poverty: Economic Possibilities of Our Time (preview) and Common Wealth: Economics for a Crowded Planet.

- Amartya Sen, Indian economist, Nobel Prize winner, author of Development as Freedom.

- Hans Singer, who dealt with how unequal terms of trade disproportionately affect producers of primary products. His thesis, combined with the work of Raúl Prebisch, form the basis for dependency theory.

- Hernando de Soto Polar, proponent of property rights in the developing world, author of The Mystery of Capital: Why Capitalism Triumphs in the West and Fails Everywhere Else.

- Frances Stewart, current president of the Human Development and Capability Association.

- Joseph Stiglitz, Nobel Prize winner and former chief economist at the World Bank.

- Finn Tarp, Danish Professor of Development Economics at the University of Copenhagen and Director of UNU-WIDER, Helsinki, Finland.

- Erik Thorbecke, a co-originator of Foster–Greer–Thorbecke poverty measure who also played a significant role in the development and popularization of social accounting matrix.

- Michael Todaro, known for the Todaro and Harris–Todaro models of migration and urbanization; Economic Development.

- Robert M. Townsend, professor at the Massachusetts Institute of Technology known for his Thai Project, a model for many other applied and theoretical projects in economic development.

- Mahbub ul Haq, Pakistani economist, creator of the Human Development Report.

- Muhammad Yunus, Nobel Prize winner and founder of the Grameen Bank.