Functional genomics is a field of molecular biology that attempts to describe gene (and protein) functions and interactions. Functional genomics make use of the vast data generated by genomic and transcriptomic projects (such as genome sequencing projects and RNA sequencing). Functional genomics focuses on the dynamic aspects such as gene transcription, translation, regulation of gene expression and protein–protein interactions, as opposed to the static aspects of the genomic information such as DNA sequence

or structures. A key characteristic of functional genomics studies is

their genome-wide approach to these questions, generally involving

high-throughput methods rather than a more traditional “gene-by-gene”

approach.

Deep mutational scan of the RNA recognition motif(RRM2) of a yeast PolyA binding protein (Pab1)

Definition and goals of functional genomics

In order to understand functional genomics it is important to first define function. In their paper

Graur et al. define function in two possible ways. These are "Selected

effect" and "Causal Role". The "Selected Effect" function refers to the

function for which a trait(DNA, RNA, protein etc.) is selected for. The

"Causal role" function refers to the function that a trait is sufficient

and necessary for. Functional genomics usually tests the "Causal role"

definition of function.

The goal of functional genomics is to understand the function of

genes or proteins, eventually all components of a genome. The term

functional genomics is often used to refer to the many technical approaches to study an organism's genes and proteins, including the "biochemical, cellular, and/or physiological properties of each and every gene product" while some authors include the study of nongenic elements in their definition. Functional genomics may also include studies of natural genetic variation over time (such as an organism's development) or space (such as its body regions), as well as functional disruptions such as mutations.

The promise of functional genomics is to generate and synthesize

genomic and proteomic knowledge into an understanding of the dynamic

properties of an organism. This could potentially provide a more

complete picture of how the genome specifies function compared to

studies of single genes. Integration of functional genomics data is

often a part of systems biology approaches.

Techniques and applications

Functional genomics includes function-related aspects of the genome itself such as mutation and polymorphism (such as single nucleotide polymorphism (SNP) analysis), as well as the measurement of molecular activities. The latter comprise a number of "-omics" such as transcriptomics (gene expression), proteomics (protein production), and metabolomics. Functional genomics uses mostly multiplex techniques to measure the abundance of many or all gene products such as mRNAs or proteins within a biological sample.

A more focused functional genomics approach might test the function of

all variants of one gene and quantify the effects of mutants by using

sequencing as a readout of activity. Together these measurement

modalities endeavor to quantitate the various biological processes and

improve our understanding of gene and protein functions and

interactions.

At the DNA level

Genetic interaction mapping

Systematic pairwise deletion of genes or inhibition of gene

expression can be used to identify genes with related function, even if

they do not interact physically. Epistasis refers to the fact that

effects for two different gene knockouts may not be additive; that is,

the phenotype that results when two genes are inhibited may be different

from the sum of the effects of single knockouts.

DNA/Protein interactions

Proteins

formed by the translation of the mRNA (messenger RNA, a coded

information from DNA for protein synthesis) play a major role in

regulating gene expression. To understand how they regulate gene

expression it is necessary to identify DNA sequences that they interact

with. Techniques have been developed to identify sites of DNA-protein

interactions. These include Chip-sequencing, CUT&RUN sequencing and Calling Cards.

DNA accessibility assays

Assays

have been developed to identify regions of the genome that are

accessible. These regions of open chromatin are candidate regulatory

regions. These

assays include ATAC-seq, DNase-Seq and FAIRE-Seq.

At the RNA level

Microarrays

Microarrays measure the amount of mRNA in a sample that corresponds

to a given gene or probe DNA sequence. Probe sequences are immobilized

on a solid surface and allowed to hybridize

with fluorescently labeled “target” mRNA. The intensity of fluorescence

of a spot is proportional to the amount of target sequence that has

hybridized to that spot, and therefore to the abundance of that mRNA

sequence in the sample. Microarrays allow for identification of

candidate genes involved in a given process based on variation between

transcript levels for different conditions and shared expression

patterns with genes of known function.

SAGE

Serial analysis of gene expression

(SAGE) is an alternate method of analysis based on RNA sequencing

rather than hybridization. SAGE relies on the sequencing of 10–17 base

pair tags which are unique to each gene. These tags are produced from poly-A mRNA

and ligated end-to-end before sequencing. SAGE gives an unbiased

measurement of the number of transcripts per cell, since it does not

depend on prior knowledge of what transcripts to study (as microarrays

do).

RNA sequencing

RNA sequencing has taken over microarray and SAGE technology in

recent years, as noted in 2016, and has become the most efficient way to

study transcription and gene expression. This is typically done by next-generation sequencing.

A subset of sequenced RNAs are small RNAs, a class of non-coding

RNA molecules that are key regulators of transcriptional and

post-transcriptional gene silencing, or RNA silencing. Next generation sequencing is the gold standard tool for non-coding RNA discovery, profiling and expression analysis.

Massively Parallel Reporter Assays (MPRAs)

Massively parallel reporter assays is a technology to test the cis-regulatory activity of DNA sequences.

MPRAs use a plasmid with a synthetic cis-regulatory element upstream of

a promoter driving a synthetic gene such as Green Fluorescent Protein. A

library of cis-regulatory elements is usually tested using MPRAs, a

library can contain from hundreds to thousands of cis-regulatory

elements. The cis-regulatory activity of the elements is assayed by

using the downstream reporter activity. The activity of all the library

members is assayed in parallel using barcodes for each cis-regulatory

element. One limitation of MPRAs is that the activity is assayed on a

plasmid and may not capture all aspects of gene regulation observed in

the genome.

STARR-seq

STARR-seq is a technique similar to MPRAs to assay enhancer activity

of randomly sheared genomic fragments. In the original publication,

randomly sheared fragments of the Drosophila genome were placed

downstream of a minimal promoter. Candidate enhancers amongst the

randomly sheared fragments will transcribe themselves using the minimal

promoter. By using sequencing as a readout and controlling for input

amounts of each sequence the strength of putative enhancers are assayed

by this method.

Perturb-seq

Overview of Perturb-seq workflow

Perturb-seq couples CRISPR mediated gene knockdowns with single-cell

gene expression. Linear models are used to calculate the effect of the

knockdown of a single gene on the expression of multiple genes.

At the protein level

Yeast two-hybrid system

A yeast two-hybrid screening

(Y2H) tests a "bait" protein against many potential interacting

proteins ("prey") to identify physical protein–protein interactions.

This system is based on a transcription factor, originally GAL4,

whose separate DNA-binding and transcription activation domains are

both required in order for the protein to cause transcription of a

reporter gene. In a Y2H screen, the "bait" protein is fused to the

binding domain of GAL4, and a library of potential "prey" (interacting)

proteins is recombinantly expressed in a vector with the activation

domain. In vivo interaction of bait and prey proteins in a yeast cell

brings the activation and binding domains of GAL4 close enough together

to result in expression of a reporter gene.

It is also possible to systematically test a library of bait proteins

against a library of prey proteins to identify all possible interactions

in a cell.

AP/MS

Affinity purification and mass spectrometry

(AP/MS) is able to identify proteins that interact with one another in

complexes. Complexes of proteins are allowed to form around a particular

“bait” protein. The bait protein is identified using an antibody or a

recombinant tag which allows it to be extracted along with any proteins

that have formed a complex with it. The proteins are then digested into

short peptide fragments and mass spectrometry is used to identify the proteins based on the mass-to-charge ratios of those fragments.

Deep Mutational Scanning

In

Deep mutational scanning every possible amino acid change in a given

protein is first synthesized. The activity of each of these protein

variants is assayed in parallel using barcodes for each variant. By

comparing the activity to the wild-type protein, the effect of each

mutation is identified. While it is possible to assay every possible

single amino-acid change due to combinatorics two or more concurrent

mutations are hard to test. Deep Mutational scanning experiments have

also been used to infer protein structure and protein-protein

interactions.

Loss-of-function techniques

Mutagenesis

Gene function can be investigated by systematically “knocking out” genes one by one. This is done by either deletion or disruption of function (such as by insertional mutagenesis) and the resulting organisms are screened for phenotypes that provide clues to the function of the disrupted gene.

RNAi

RNA interference (RNAi) methods can be used to transiently silence or

knock down gene expression using ~20 base-pair double-stranded RNA

typically delivered by transfection of synthetic ~20-mer

short-interfering RNA molecules (siRNAs) or by virally encoded

short-hairpin RNAs (shRNAs). RNAi screens, typically performed in cell

culture-based assays or experimental organisms (such as C. elegans)

can be used to systematically disrupt nearly every gene in a genome or

subsets of genes (sub-genomes); possible functions of disrupted genes

can be assigned based on observed phenotypes.

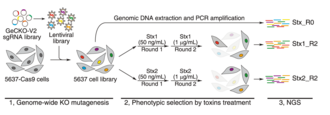

CRISPR screens

An example of a CRISPR loss-of-function screen.

CRISPR-Cas9 has been used to delete genes in a multiplexed manner in

cell-lines. Quantifying the amount of guide-RNAs for each gene before

and after the experiment can point towards essential genes. If a

guide-RNA disrupts an essential gene it will lead to the loss of that

cell and hence there will be a depletion of that particular guide-RNA

after the screen. In a recent CRISPR-cas9 experiment in mammalian

cell-lines, around 2000 genes were found to be essential in multiple

cell-lines.

Some of these genes were essential in only one cell-line. Most of genes

are part of multi-protein complexes. This approach can be used to

identify synthetic lethality by using the appropriate genetic

background. CRISPRi and CRISPRa enable loss-of-function and

gain-of-function screens in a similar manner. CRISPRi identified ~2100

essential genes in the K562 cell-line.

CRISPR deletion screens have also been used to identify potential

regulatory elements of a gene. For example, a technique called ScanDel

was published which attempted this approach. The authors deleted regions

outside a gene of interest(HPRT1 involved in a Mendelian disorder) in

an attempt to identify regulatory elements of this gene.

Gassperini et al. did not identify any distal regulatory elements for

HPRT1 using this approach, however such approaches can be extended to

other genes of interest.

Functional annotations for genes

Genome annotation

Putative genes can be identified by scanning a genome for regions

likely to encode proteins, based on characteristics such as long open reading frames, transcriptional initiation sequences, and polyadenylation

sites. A sequence identified as a putative gene must be confirmed by

further evidence, such as similarity to cDNA or EST sequences from the

same organism, similarity of the predicted protein sequence to known

proteins, association with promoter sequences, or evidence that mutating

the sequence produces an observable phenotype.

Rosetta stone approach

The

Rosetta stone approach is a computational method for de-novo protein

function prediction. It is based on the hypothesis that some proteins

involved in a given physiological process may exist as two separate

genes in one organism and as a single gene in another. Genomes are

scanned for sequences that are independent in one organism and in a

single open reading frame in another. If two genes have fused, it is

predicted that they have similar biological functions that make such

co-regulation advantageous.

Bioinformatics methods for Functional genomics

Because of the large quantity of data produced by these techniques and the desire to find biologically meaningful patterns, bioinformatics is crucial to analysis of functional genomics data. Examples of techniques in this class are data clustering or principal component analysis for unsupervised machine learning (class detection) as well as artificial neural networks or support vector machines for supervised machine learning (class prediction, classification).

Functional enrichment analysis is used to determine the extent of over-

or under-expression (positive- or negative- regulators in case of RNAi

screens) of functional categories relative to a background sets. Gene ontology based enrichment analysis are provided by DAVID and gene set enrichment analysis (GSEA), pathway based analysis by Ingenuity and Pathway studio and protein complex based analysis by COMPLEAT.

An overview of a phydms workflow

New computational methods have been developed for understanding the

results of a deep mutational scanning experiment. 'phydms' compares the

result of a deep mutational scanning experiment to a phylogenetic tree.

This allows the user to infer if the selection process in nature

applies similar constraints on a protein as the results of the deep

mutational scan indicate. This may allow an experimenter to choose

between different experimental conditions based on how well they reflect

nature. Deep mutational scanning has also been used to infer

protein-protein interactions.

The authors used a thermodynamic model to predict the effects of

mutations in different parts of a dimer. Deep mutational structure can

also be used to infer protein structure. Strong positive epistasis

between two mutations in a deep mutational scan can be indicative of two

parts of the protein that are close to each other in 3-D space. This

information can then be used to infer protein structure. A proof of

principle of this approach was shown by two groups using the protein

GB1.

Results from MPRA experiments have required machine learning

approaches to interpret the data. A gapped k-mer SVM model has been used

to infer the kmers that are enriched within cis-regulatory sequences

with high activity compared to sequences with lower activity.

These models provide high predictive power. Deep learning and random

forest approaches have also been used to interpret the results of these

high-dimensional experiments. These models are beginning to help develop a better understanding of non-coding DNA function towards gene-regulation.

Consortium projects focused on Functional Genomics

The ENCODE project

The ENCODE (Encyclopedia of DNA elements) project is an in-depth

analysis of the human genome whose goal is to identify all the

functional elements of genomic DNA, in both coding and noncoding

regions. Important results include evidence from genomic tiling arrays

that most nucleotides are transcribed as coding transcripts, noncoding

RNAs, or random transcripts, the discovery of additional transcriptional

regulatory sites, further elucidation of chromatin-modifying

mechanisms.

The Genotype-Tissue Expression (GTEx) project

Samples used and eQTLs discovered in GTEx v6

The GTEx project is a human genetics project aimed at understanding

the role of genetic variation in shaping variation in the transcriptome

across tissues. The project has collected a variety of tissue samples

(> 50 different tissues) from more than 700 post-mortem donors. This

has resulted in the collection of >11,000 samples. GTEx has helped

understand the tissue-sharing and tissue-specificity of EQTLs.