| Congo River | |

|---|---|

| |

| |

| Location | |

| Physical characteristics | |

| Source | Lualaba River |

| - location | Boyoma Falls |

| Mouth | Atlantic Ocean |

| Length | 4,700 km (2,900 mi) |

| Basin size | 4,014,500 km2 (1,550,000 sq mi) |

| Discharge | |

| - average | 41,200 m3/s (1,450,000 cu ft/s) |

| - minimum | 23,000 m3/s (810,000 cu ft/s) |

| - maximum | 75,000 m3/s (2,600,000 cu ft/s) |

The great Congo River is the second longest river in Africa, shorter only than the Nile, as well as the second largest river in the world by discharge volume, following only the Amazon. It is also the world's deepest recorded river, with measured depths in excess of 220 m (720 ft). The Congo-Lualaba-Chambeshi River system has an overall length of 4,700 km (2,920 mi), which makes it the world's ninth-longest river. The Chambeshi is a tributary of the Lualaba River, and Lualaba is the name of the Congo River upstream of Boyoma Falls, extending for 1,800 km (1,120 mi).

Measured along with the Lualaba, the main tributary, the Congo River has a total length of 4,370 km (2,715 mi). It is the only river to cross the equator twice. The Congo Basin has a total area of about 4,000,000 km2 (1,500,000 sq mi), or 13% of the entire African landmass.

Name

The name Congo/Kongo river originates from the Kingdom of Kongo once located on the southern bank of the river. The kingdom in turn was named for the indigenous Bantu Kongo people, known in the 17th century as "Esikongo". South of the Kingdom of Kongo proper lay the similarly named Kakongo kingdom, mentioned in 1535. Abraham Ortelius in his world map of 1564 labeled as "Manicongo" the city at the mouth of the river.

The tribal names in Kongo possibly derive from a word for a public gathering or tribal assembly. The modern name of the Kongo people or Bakongo was introduced in the early 20th century.

The name Zaire is from a Portuguese adaptation of a Kikongo word, nzere ("river"), a truncation of nzadi o nzere ("river swallowing rivers"). The river was known as Zaire during the 16th and 17th centuries; Congo seems to have replaced Zaire gradually in English usage during the 18th century, and Congo is the preferred English name in 19th-century literature, although references to Zahir or Zaire as the name used by the inhabitants remained common.

The Democratic Republic of the Congo and the Republic of the Congo are named after it, as was the previous Republic of the Congo which had gained independence in 1960 from the Belgian Congo.

The Republic of Zaire during 1971–1997 was also named after the river, after its name in French and Portuguese.

Basin and course

The Congo's drainage basin covers 4,014,500 square kilometres (1,550,000 sq mi), an area larger than India. The Congo's discharge

at its mouth ranges from 23,000 to 75,000 cubic metres per second

(810,000 to 2,650,000 cu ft/s), with an average of 41,000 cubic metres

per second (1,400,000 cu ft/s).

The river and its tributaries flow through the Congo Rainforest, the second largest rain forest area in the world, second only to the Amazon Rainforest in South America. The river also has the second-largest flow in the world, behind the Amazon; the third-largest drainage basin of any river, behind the Amazon and Plate rivers; and is one of the deepest rivers in the world, at depths greater than 220 m (720 ft). Because its drainage basin includes areas both north and south of the equator, its flow is stable, as there is always at least one part of the river experiencing a rainy season.

The sources of the Congo are in the highlands and mountains of the East African Rift, as well as Lake Tanganyika and Lake Mweru, which feed the Lualaba River, which then becomes the Congo below Boyoma Falls. The Chambeshi River

in Zambia is generally taken as the source of the Congo in line with

the accepted practice worldwide of using the longest tributary, as with

the Nile River.

The Congo flows generally toward the northwest from Kisangani just below the Boyoma falls, then gradually bends southwestwards, passing by Mbandaka, joining with the Ubangi River, and running into the Pool Malebo (Stanley Pool). Kinshasa (formerly Léopoldville) and Brazzaville are on opposite sides of the river at the Pool, where the river narrows and falls through a number of cataracts in deep canyons (collectively known as the Livingstone Falls), running by Matadi and Boma, and into the sea at the small town of Muanda.

The Congo River Basin is one of the distinct physiographic

sections of the larger Mid-African province, which in turn is part of

the larger African massive physiographic division.

Tributaries to the great Congo river

Course and Drainage basin of the Congo River with countries marked

Course and Drainage basin of the Congo River with topography shading.

The drainage basin of the Congo River includes most of Central Africa. The main river and tributaries are:

Sorted in order from the mouth heading upstream.

Downstream of Kinshasa, from the river mouth at Banana, there are a few major tributaries, all on the left side.

- Middle Congo (Kinshasa to the Boyoma Falls)

- Kwa-Kassai (left) – 2150 km – 881,900 km2, 9,900 m3/s

- Lefini (right)

- Sangha (right) – 1,400 km, 213,400 km2, 750 m3/s

- Ubangi/ (right) – 2,270 km, 772,800 km2, 4,000 m3/s

- Tshuapa or Ruki River (left) – 1,000 km

- Lomami River (left) – 1,400 km

- Upper Congo (Upstream from the Boyoma Falls)

Economic importance

The town of Mbandaka is a busy port on the banks of the Congo River.

The Congo River at Maluku.

Although the Livingstone Falls prevent access from the sea, nearly the entire Congo above them is readily navigable in sections, especially between Kinshasa and Kisangani. Large river steamers worked the river until quite recently. The Congo River still is a lifeline in a land with few roads or railways.

Railways now bypass the three major falls, and much of the trade of Central Africa passes along the river, including copper, palm oil (as kernels), sugar, coffee, and cotton. The river is also potentially valuable for hydroelectric power, and the Inga Dams below Pool Malebo are first to exploit the Congo river.

Hydro-electric power

The Congo River is the most powerful river in Africa. During the

rainy season over 50,000 cubic metres (1,800,000 cu ft) of water per

second flow into the Atlantic Ocean. Opportunities for the Congo River

and its tributaries to generate hydropower are therefore enormous. Scientists have calculated that the entire Congo Basin accounts for 13 percent of global hydropower potential. This would provide sufficient power for all of sub-Saharan Africa's electricity needs.

Currently there are about forty hydropower plants in the Congo Basin. The largest are the Inga dams, about 200 kilometres (120 mi) southwest of Kinshasa. The project was launched in the early 1970s, when the first dam was completed.

The plan as originally conceived called for the construction of five

dams that would have had a total generating capacity of 34,500

megawatts. To date only the Inga I and Inga II dams have been built,

generating 1,776 MW.

In February 2005, South Africa's state-owned power company, Eskom, announced a proposal to expand generation through improvements and the construction of a new hydroelectric dam. The project would bring the maximum output of the facility to 40 gigawatts (54,000,000 hp), twice that of China's Three Gorges Dam.

It is feared that these new hydroelectric dams could lead to the extinction of many of the fish species that are native to the river.

Natural history

The beginning of the Livingstone Falls (Lower Congo Rapids) near Kinshasa

The current course of the Congo River formed 1.5–2 million years BP, during the Pleistocene.

The Congo's formation may have led to the allopatric speciation of the bonobo and the common chimpanzee from their most recent common ancestor. The bonobo is endemic to the humid forests in the region, as are other iconic species like the Allen's swamp monkey, dryas monkey, aquatic genet, okapi, and Congo peafowl.

In terms of aquatic life, the Congo River Basin has a very high species richness, and among the highest known concentrations of endemics.

Until now, almost 700 fish species have been recorded from the Congo

River Basin, and large sections remain virtually unstudied. This is by far the highest diversity of any African river system (in comparison, the next richest are the Niger, Volta and Nile with about 210, 140 and 130 fish species, respectively). Due to this and the great ecological differences between the regions in the Congo basin, it is often divided into multiple ecoregions (instead of treating it as a single ecoregion). Among these ecoregions, the Lower Congo Rapids alone has more than 300 fish species, including approximately 80 endemics while the southwestern part (Kasai Basin) alone has more than 200 fish species, of which about a quarter are endemic. The dominant fish families – at least in parts of the river – are Cyprinidae (carp/cyprinids, such as Labeo simpsoni), Mormyridae (elephantfishes), Alestidae (African tetras), Mochokidae (squeaker catfishes), and Cichlidae (cichlids). Among the natives in the river is the huge, highly carnivorous giant tigerfish. Three of the more unusual endemics are the whitish (non-pigmented) and blind Lamprologus lethops, which is believed to live as deep as 160 metres (520 ft) below the surface, Heterochromis multidens, which appears to be more closely related to cichlids of the Americas than other African cichlids, and Caecobarbus geertsii, the only known cavefish in Central Africa. There are also numerous endemic frogs and snails. Several hydroelectric dams are planned on the river, and these may lead to the extinction of many of the endemics.

Several species of turtles, and the slender-snouted, Nile and dwarf crocodile are native to the Congo River Basin. African manatees inhabit the lower parts of the river.

History

European Exploration

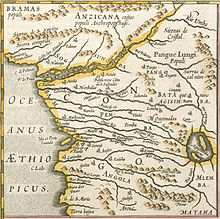

17th-century map of the Congo estuary

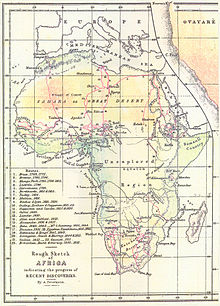

In this 1853 map of Africa, the remaining Unexplored Region essentially corresponds to the Congo basin

The entire Congo basin is populated by Bantu peoples, divided into several hundred ethnic or tribal groups. Bantu expansion

is estimated to have reached the Middle Congo by about 500 BC, and the

Upper Congo by the first century AD. Remnants of the aboriginal

population displaced by the Bantu migration, Pygmies/Abatwa of the Ubangian phylum, remain in the remote forest areas of the Congo basin.

The Kingdom of Kongo

was formed around 1400 on the left banks of the lower Congo River. Its

territorial control along the river remained limited to what corresponds

to the modern Bas-Congo province. European exploration of the Congo begins in 1482, when Portuguese explorer Diogo Cão discovered the river estuary (likely in August 1482), which he marked by a Padrão,

or stone pillar (still existing, but only in fragments) erected on

Shark Point. Cão also sailed up the river for a short distance,

establishing contact with the Kingdom of Congo. The full course of the

river remained unknown throughout the early modern period.

The upper Congo basin runs west of the Albertine Rift. Its connection to the Congo was unknown until 1877.

The extreme northeast of the Congo basin was reached by the Nilotic expansion at some point between the 15th and 18th centuries, by the ancestors of the Southern Luo speaking Alur people.

Francisco de Lacerda following the Zambezi reached the uppermost part of the Congo basin (the Kazembe in the upper Luapula basin) in 1796.

The upper Congo River, known as the Lualaba was first reached by the Arab slave trade by the 19th century. Nyangwe was founded as a slavers' outpost around 1860.

David Livingstone was the first European to reach Nyangwe in March 1871. Livingstone proposed to prove that the Lualaba connected to the Nile,

but on 15 July, he witnessed a massacre of about 400 Africans by Arab

slavers in Nyangwe, which experience left him too horrified and

shattered to continue his mission to find the sources of the Nile, so he

turned back to Lake Tanganyika.

Henry M Stanley with the officers of the Advance Column, Cairo, 1890. From the left: Dr. Thomas Heazle Parke, Robert H. Nelson, Henry M. Stanley, William G. Stairs, and Arthur J. M. Jephson

The middle reaches of the Congo remained unexplored from either the east or west, until Henry Morton Stanley's expedition of 1876–77.

At the time one of the last open questions of the exploration of Africa (or indeed of the world)

whether the Lualaba River fed the Nile (Livingstone's theory), the Congo or even the Niger.

Financed in 1874, Stanley's first trans-Africa exploration

started in Zanzibar, and reached the Lualaba on October 17, 1876.

Overland he reached Nyangwe, the centre of a lawless area containing cannibal tribes at which Tippu Tip

based his trade in slaves. Stanley managed to hire a force from Tippu

Tip, to guard him for the next 150 kilometres (90 mi) or so, for 90

days. The party left Nyangwe overland through the dense Matimba forest.

On November 19 they reached the Lualaba again. Since the going through

the forest was so heavy, Tippu Tip turned around with his party on

December 28, leaving Stanley on his own, with 143 people, including 8

children and 16 women. They had 23 canoes. His first encounter with a

local tribe was with the cannibal Wenya. In total Stanley would report

32 unfriendly meetings on the river, some violent, even though he

attempted to negotiate a peaceful thoroughfare. But the tribes were wary

as their only experience of outsiders was of slave traders.

On January 6, 1877, after 640 kilometres (400 mi), they reached Boyoma Falls

(called Stanley Falls for some time after), consisting of seven

cataracts spanning 100 kilometres (60 mi) which they had to bypass

overland. It took them to February 7 to reach the end of the falls. Here

Stanley learned that the river was called Ikuta Yacongo, proving to him that he had reached the Congo, and that the Lualaba did not feed the Nile.

From this point, the tribes were no longer cannibals, but

possessed firearms, apparently as a result of Portuguese influence. Some

four weeks and 1,900 kilometres (1,200 mi) later he reached Stanley

Pool (now Pool Malebo), the site of the present day cities Kinshasa and Brazzaville. Further downstream were the Livingstone Falls,

misnamed as Livingstone had never been on the Congo: a series of 32

falls and rapids with a fall of 270 metres (900 ft) over 350 kilometres

(220 mi).

On 15 March they started the descent of the falls, which took five

months and cost numerous lives. From the Isangile Falls, five falls from

the foot, they beached the canoes and Lady Alice and left the river, aiming for the Portuguese outpost of Boma

via land. On August 3 they reached the hamlet Nsada. From there Stanley

sent four men with letters forward to Boma, asking for food for his

starving people. On August 7 relief came, being sent by representatives

from the Liverpool

trading firm Hatton & Cookson. On August 9 they reached Boma, 1,001

days since leaving Zanzibar on November 12, 1874. The party then

consisted of 108 people, including three children born during the trip.

Most probably (Stanley's own publications give inconsistent figures), he

lost 132 people through disease, hunger, drowning, killing and

desertion.

Kinshasa was founded as a trading post by Stanley in 1881 and named Léopoldville in honour of Leopold II of Belgium. The Congo basin was claimed by Leopold II as Congo Free State in 1885.

Congo River Allegory by Thomas Vinçotte.

Bridges in the Congo Basin

The Congo river basin is notable for the lack of bridges crossing the main rivers, although there are a number of ferries available for crossing the great Congo river and the major tributaries.

The main reasoning is the mere width of the Congo river and main

rivers, and the second is the lack of funds to set up permanent river

crossings, this is however slowly changing to the better.

Bridges on the Congo proper and Lualaba

There are only two bridges on the Congo river proper and main tributaries, which both are found in the DR Congo:

- The Matadi Bridge, 148 km from the rivermouth, at the port of Matadi in the Kongo Central province.

- The Kongolo Bridge on the Lualaba River, some 3,900 km along the tributary from the rivermouth, near the town Kongolo, in the eastern province Katanga.

Bridges on the Uele and Kibali rivers

There is one bridge on the Uele River, and two on the Kibali River, which all lies in the northern province Haut-Uele of DR Congo:

- The Niangara Bridge on the Uele, some 2,000 km along the tributary from the rivermouth, near the town Niangara.

- The Dungu Bridge on the Kibali, some 2,050 km along the tributary from the rivermouth, near the town Dungu, at the confluence of Dungu and Kibali rivers, where the Uele river is formed.

- The Kalimva Bridge on the Kibali, some 2,250 km along the tributary from the rivermouth, near the town Kalimva.

Bridges on the Lulua river

- Between the towns of Luebo and Tshimpumpu.

- Near the town of Kananga.

- At the town of Sanduwa.

- West of the town of Diongo (also the location of a railway bridge on the Benguela Railway).

Ferries in the Congo Basin

Ferries on the Congo proper

DR Congo - Congo Republic border:

- Kinshasa - Brazzaville, the ferry between the twin capitals - the most busy international ferry connection within Africa.

- Near Isangi, some 1250 km from the mouth.

- At Kisangani, some 1500 km from the mouth.

- At Ubundu, some 1700 km from the mouth

Ferries on the Kasai River and tributaries

- Near Bandundu on the Kasai River.

- At Bandundu on the Kwango River.

- Near Bandundu on the Bunzili River.

- At Loange on the Loange River.

Ferry on the Ubangi river

- DR Congo - Central African Republic border:

Ferry on the Mbomou river

- DR Congo - Central African Republic border:

Ferries on the Lulua river

- Near the township of Tshinkenke, in the province of Kasai in DR Congo.

- Near the township of Mpungu, in the province of Kasai in DR Congo.

Ferries on the Uele river

On the minor tributaries of the great Congo there are numerous river crossings, which cannot be included here.