Social media are interactive computer-mediated technologies that facilitate the creation or sharing of information, ideas, career interests and other forms of expression via virtual communities and networks.

The variety of stand-alone and built-in social media services currently

available introduces challenges of definition; however, there are some

common features:

Networks formed through social media change the way groups of people interact and communicate or stand with the votes. They "introduce substantial and pervasive changes to communication between organizations, communities, and individuals." These changes are the focus of the emerging fields of technoself studies. Social media differ from paper-based media (e.g., magazines and newspapers) and traditional electronic media such as TV broadcasting, Radio broadcasting in many ways, including quality, reach, frequency, interactivity, usability, immediacy, and performance. Social media outlets operate in a dialogic transmission system (many sources to many receivers). This is in contrast to traditional media which operates under a mono-logic transmission model (one source to many receivers), such as a newspaper which is delivered to many subscribers, or a radio station which broadcasts the same programs to an entire city. Some of the most popular social media websites, with over 100 million registered users, include Facebook (and its associated Facebook Messenger), TikTok, WeChat, Instagram, QZone, Weibo, Twitter, Tumblr, Baidu Tieba, LinkedIn and VK. Other popular platforms that are sometimes referred to as social media services (differing on interpretation) include YouTube, QQ, Quora, Telegram, WhatsApp, LINE, Snapchat, Pinterest, Viber, Reddit, Discord and more.

Observers have noted a wide range of positive and negative impacts of social media use. Social media can help to improve an individual's sense of connectedness with real or online communities and can be an effective communication (or marketing) tool for corporations, entrepreneurs, non-profit organizations, advocacy groups, political parties, and governments.

- Social media are interactive Web 2.0 Internet-based applications.

- User-generated content such as text posts or comments, digital photos or videos, and data generated through all online interactions, is the lifeblood of social media.

- Users create service-specific profiles and identities for the website or app that are designed and maintained by the social media organization.

- Social media facilitate the development of online social networks by connecting a user's profile with those of other individuals or groups.

Networks formed through social media change the way groups of people interact and communicate or stand with the votes. They "introduce substantial and pervasive changes to communication between organizations, communities, and individuals." These changes are the focus of the emerging fields of technoself studies. Social media differ from paper-based media (e.g., magazines and newspapers) and traditional electronic media such as TV broadcasting, Radio broadcasting in many ways, including quality, reach, frequency, interactivity, usability, immediacy, and performance. Social media outlets operate in a dialogic transmission system (many sources to many receivers). This is in contrast to traditional media which operates under a mono-logic transmission model (one source to many receivers), such as a newspaper which is delivered to many subscribers, or a radio station which broadcasts the same programs to an entire city. Some of the most popular social media websites, with over 100 million registered users, include Facebook (and its associated Facebook Messenger), TikTok, WeChat, Instagram, QZone, Weibo, Twitter, Tumblr, Baidu Tieba, LinkedIn and VK. Other popular platforms that are sometimes referred to as social media services (differing on interpretation) include YouTube, QQ, Quora, Telegram, WhatsApp, LINE, Snapchat, Pinterest, Viber, Reddit, Discord and more.

Observers have noted a wide range of positive and negative impacts of social media use. Social media can help to improve an individual's sense of connectedness with real or online communities and can be an effective communication (or marketing) tool for corporations, entrepreneurs, non-profit organizations, advocacy groups, political parties, and governments.

History

Social media may have roots in the 1840s introduction of the telegraph, which connected the United States.

The PLATO system launched in 1960, which was developed at the University of Illinois and subsequently commercially marketed by Control Data Corporation,

offered early forms of social media features with 1973-era innovations

such as Notes, PLATO's message-forum application; TERM-talk, its

instant-messaging feature; Talkomatic,

perhaps the first online chat room; News Report, a crowd-sourced online

newspaper and blog; and Access Lists, enabling the owner of a note file

or other application to limit access to a certain set of users, for

example, only friends, classmates, or co-workers.

ARPANET,

which first came online in 1967, had by the late 1970s developed a rich

cultural exchange of non-government/business ideas and communication,

as evidenced by the network etiquette (or "netiquette") described in a 1982 handbook on computing at MIT's Artificial Intelligence Laboratory. ARPANET evolved into the Internet following the publication of the first Transmission Control Protocol (TCP) specification, RFC 675 (Specification of Internet Transmission Control Program), written by Vint Cerf, Yogen Dalal and Carl Sunshine in 1974. This became the foundation of Usenet, conceived by Tom Truscott and Jim Ellis in 1979 at the University of North Carolina at Chapel Hill and Duke University, and established in 1980.

A precursor of the electronic bulletin board system (BBS), known as Community Memory,

had already appeared by 1973. True electronic bulletin board systems

arrived with the Computer Bulletin Board System in Chicago, which first

came online on February 16, 1978. Before long, most major cities had

more than one BBS running on TRS-80, Apple II, Atari, IBM PC, Commodore 64, Sinclair, and similar personal computers.

The IBM PC was introduced in 1981, and subsequent models of both Mac

computers and PCs were used throughout the 1980s. Multiple modems,

followed by specialized telecommunication hardware, allowed many users

to be online simultaneously. Compuserve, Prodigy and AOL

were three of the largest BBS companies and were the first to migrate

to the Internet in the 1990s. Between the mid-1980s and the mid-1990s,

BBSes numbered in the tens of thousands in North America alone.

Message forums (a specific structure of social media) arose with the

BBS phenomenon throughout the 1980s and early 1990s. When the World Wide Web (WWW, or "the web") was added to the Internet in the mid-1990s, message forums migrated to the web, becoming Internet forums,

primarily due to cheaper per-person access as well as the ability to

handle far more people simultaneously than telco modem banks.

Digital imaging and semiconductor image sensor technology facilitated the development and rise of social media. Advances in metal-oxide-semiconductor (MOS) semiconductor device fabrication, reaching smaller micron and then sub-micron levels during the 1980s–1990s, led to the development of the NMOS (n-type MOS) active-pixel sensor (APS) at Olympus in 1985, and then the complementary MOS (CMOS) active-pixel sensor (CMOS sensor) at NASA's Jet Propulsion Laboratory (JPL) in 1993. CMOS sensors enabled the mass proliferation of digital cameras and camera phones, which bolstered the rise of social media.

An important feature of social media is digital media data compression, due to the impractically high memory and bandwidth requirements of uncompressed media. The most important compression algorithm is the discrete cosine transform (DCT), a lossy compression technique that was first proposed by Nasir Ahmed in 1972. DCT-based compression standards include the H.26x and MPEG video coding standards introduced from 1988 onwards, and the JPEG image compression standard introduced in 1992. JPEG was largely responsible for the proliferation of digital images and digital photos which lie at the heart of social media, and the MPEG standards did the same for digital video content on social media. The JPEG image format is used more than a billion times on social networks every day, as of 2014.

SixDegrees, launched in 1997, is often regarded as the first social media site.

GeoCities was one of the World Wide Web's earliest social networking websites, appearing in November 1994, followed by Classmates in December 1995 and SixDegrees

in May 1997. According to CBS news, SixDegrees is "widely considered to

be the very first social networking site", as it included "profiles,

friends lists and school affiliations" that could be used by registered

users. Open Diary was launched in October 1998; LiveJournal in April 1999; Ryze in October 2001; Friendster in March 2003; the corporate and job-oriented site LinkedIn in May 2003; hi5 in June 2003; MySpace in August 2003; Orkut in January 2004; Facebook in February 2004; YouTube in February 2005; Yahoo! 360° in March 2005; Bebo in July 2005; the text-based service Twitter, in which posts, called "tweets", were limited to 140 characters, in July 2006; Tumblr in February 2007; and Google+ in July 2011.

Definition and classification

The variety of evolving stand-alone and built-in social media services makes it challenging to define them. However, marketing and social media experts broadly agree that social media includes the following 13 types of social media:

- blogs,

- business networks,

- collaborative projects,

- enterprise social networks,

- forums,

- microblogs,

- photo sharing,

- products/services review,

- social bookmarking,

- social gaming,

- social networks,

- video sharing, and

- virtual worlds.

The idea that social media are defined simply by their ability to

bring people together has been seen as too broad, as this would suggest

that fundamentally different technologies like the telegraph and telephone are also social media. The terminology is unclear, with some early researchers referring to social media as social networks or social networking services in the mid 2000s. A more recent paper from 2015 reviewed the prominent literature in the area and identified four common features unique to then-current social media services:

- Social media are Web 2.0 Internet-based applications.

- User-generated content (UGC) is the lifeblood of the social media organism.

- Users create service-specific profiles for the site or app that are designed and maintained by the social media organization.

- Social media facilitate the development of online social networks by connecting a user's profile with those of other individuals or groups.

In 2019, Merriam-Webster

defined "social media" as "forms of electronic communication (such as

websites for social networking and microblogging) through which users

create online communities to share information, ideas, personal

messages, and other content (such as videos)"

The development of social media started off with simple platforms such as sixdegrees.com.

Unlike instant messaging clients, such as ICQ and AOL's AIM, or chat

clients like IRC, iChat or Chat Television, sixdegrees.com was the first

online business that was created for real people, using their real

names. The first social networks were short-lived, however, because

their users lost interest. The Social Network Revolution has led to the

rise of networking sites. Research

shows that the audience spends 22% of their time on social networks,

thus proving how popular social media platforms have become. This

increase is because of the widespread daily use of smartphones.

Social media are used to document memories, learn about and explore

things, advertise oneself and form friendships as well as the growth of

ideas from the creation of blogs, podcasts, videos, and gaming sites.

Networked individuals create, edit, and manage content in collaboration

with other networked individuals. This way they contribute to expanding

knowledge. Wikis are examples of collaborative content creation.

Mobile social media

The

heavy usage of smartphones among young people relates to the

significant percentage of social media users who are from this

demographic.

Mobile social media refer to the use of social media on mobile devices such as smartphones and tablet computers. Mobile social media are a useful application of mobile marketing

because the creation, exchange, and circulation of user-generated

content can assist companies with marketing research, communication, and

relationship development.

Mobile social media differ from others because they incorporate the

current location of the user (location-sensitivity) or the time delay

between sending and receiving messages (time-sensitivity). According to Andreas Kaplan, mobile social media applications can be differentiated among four types:

- Space-timers (location and time sensitive): Exchange of messages with relevance mostly for one specific location at one specific point in time (e.g. Facebook Places WhatsApp; Foursquare)

- Space-locators (only location sensitive): Exchange of messages, with relevance for one specific location, which is tagged to a certain place and read later by others (e.g. Yelp; Qype, Tumblr, Fishbrain)

- Quick-timers (only time sensitive): Transfer of traditional social media mobile apps to increase immediacy (e.g. posting Twitter messages or Facebook status updates)

- Slow-timers (neither location nor time sensitive): Transfer of traditional social media applications to mobile devices (e.g. watching a YouTube video or reading/editing a Wikipedia article)

Elements and function

Viral content

Some social media sites have potential for content posted there to spread virally over social networks. The term is an analogy to the concept of viral infections,

which can spread rapidly from person to person. In a social media

context, content or websites that are "viral" (or which "go viral") are

those with a greater likelihood that users will reshare content posted

(by another user) to their social network, leading to further sharing.

In some cases, posts containing popular content or fast-breaking news

have been rapidly shared and reshared by a huge number of users. Many

social media sites provide specific functionality to help users reshare

content, such as Twitter's retweet button, Pinterest's pin function, Facebook's share option or Tumblr's reblog function. Businesses have a particular interest in viral marketing

tactics because a viral campaign can achieve widespread advertising

coverage (particularly if the viral reposting itself makes the news) for

a fraction of the cost of a traditional marketing campaign, which

typically uses printed materials, like newspapers, magazines, mailings, and billboards, and television and radio commercials. Nonprofit organizations and activists

may have similar interests in posting content on social media sites

with the aim of it going viral. A popular component and feature of

Twitter is retweeting. Twitter allows other people to keep up with

important events, stay connected with their peers, and can contribute in

various ways throughout social media. When certain posts become popular, they start to get retweeted

over and over again, becoming viral. Hashtags can be used in tweets,

and can also be used to take count of how many people have used that

hashtag.

Bots

Social media can enable companies to get in the form of greater market share and increased audiences. Internet bots have been developed which facilitate social media marketing. Bots are automated programs that run over the Internet.

Chatbots and social bots are programmed to mimic natural human

interactions such as liking, commenting, following, and unfollowing on

social media platforms. A new industry of bot providers has been created. Social bots and chatbots have created an analytical crisis in the marketing industry as they make it difficult to differentiate between human interactions and automated bot interactions.

Some bots are negatively affecting their marketing data causing a

"digital cannibalism" in social media marketing. Additionally, some bots

violate the terms of use on many social mediums such as Instagram, which can result in profiles being taken down and banned.

"Cyborgs", a combination of a human and a bot, are used to spread fake news or create a marketing "buzz". Cyborgs can be bot-assisted humans or human-assisted bots.

An example is a human who registers an account for which they set

automated programs to post, for instance, tweets, during their absence.

From time to time, the human participates to tweet and interact with

friends. Cyborgs make it easier to spread fake news, as it blends

automated activity with human input.

When the automated accounts are publicly identified, the human part of

the cyborg is able to take over and could protest that the account has

been used manually all along. Such accounts try to pose as real people;

in particular, the number of their friends or followers should be

resembling that of a real person.

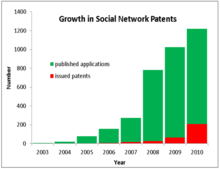

Patents of social media technology

Number

of U.S. social network patent applications published and patents issued

per year since 2003. The chart shows that the number of software applications published (the green bars) increased steadily from 2003 to 2007, and then shot up from 2008 to 2010.

There has been rapid growth in the number of U.S. patent applications

that cover new technologies related to social media, and the number of

them that are published has been growing rapidly over the past five

years. There are now over 2000 published patent applications.

As many as 7000 applications may be currently on file including those

that haven't been published yet. Only slightly over 100 of these

applications have issued as patents, however, largely due to the

multi-year backlog in examination of business method patents, patents which outline and claim new methods of doing business.

Statistics on usage and membership

Social media websites are popular on mobile devices such as smartphones.

According to Statista,

in 2019, it is estimated that there will be around 2.77 billion social

media users around the globe, up from 2.46 billion in 2017.

In 2020, there were 3.8 billion social media users.

Most popular social networks

The

following list of the leading social networks shows the number of

active users as of April 2020 (figures for Baidu Tieba, LinkedIn, Viber

and Discord are from October 2019).

Usage

| # | Network Name | Number of Users

(in millions)

|

Country of Origin |

|---|---|---|---|

| 1 | 2,498 | ||

| 2 | YouTube | 2,000 | |

| 3 | 2,000 | ||

| 4 | Facebook Messenger | 1,300 | |

| 5 | 1,165 | ||

| 6 | 1,000 | ||

| 7 | TikTok | 800 | |

| 8 | 731 | ||

| 9 | Qzone | 517 | |

| 10 | Sina Weibo | 516 | |

| 11 | 430 | ||

| 12 | Kuaishou | 400 | |

| 13 | Snapchat | 398 | |

| 14 | 386 | ||

| 15 | 366 | ||

| 16 | Baidu Tieba | 320 | |

| 17 | 310 | ||

| 18 | Viber | 260 | |

| 19 | Discord | 250 |

According

to a survey conducted by Pew Research in 2018, Facebook and YouTube

dominate the social media landscape, as notable majorities of U.S.

adults use each of these sites. At the same time, younger Americans

(especially those ages 18 to 24) stand out for embracing a variety of

platforms and using them frequently. Some 78% of 18 - 24-year-old

youngsters use Snapchat, and a sizeable majority of these users (71%)

visit the platform multiple times per day. Similarly, 71% of Americans

in this age group now use Instagram and close to half (45%) are Twitter

users. However, Facebook remains the primary platform for most

Americans. Roughly two-thirds of U.S. adults (68%) now report that they

are Facebook users, and roughly three-quarters of those users access

Facebook on a daily basis. With the exception of those 65 and older, a

majority of Americans across a wide range of demographic groups now use

Facebook.

After this rapid growth, the number of new U.S. Facebook accounts

created has plateaued, with not much observable growth in the 2016-18

period.

Use by organizations

Use by governments

Governments may use social media to (for example):

- interact with citizens

- foster citizen participation

- further open government

- analyze/monitor public opinion and activities

Use by businesses

The high distribution of social media in the private environment

drives companies to deal with the application possibilities of social

media on

- customer-organizational level

- and on intra-organizational level.

Marketplace actors can use social-media tools for marketing research, communication, sales promotions/discounts, informal employee-learning/organizational development, relationship development/loyalty programs, and e-Commerce. Often social media can become a good source of information and/or explanation of industry trends for a business

to embrace change. Trends in social-media technology and usage change

rapidly, making it crucial for businesses to have a set of guidelines

that can apply to many social media platforms.

Companies are increasingly using social-media monitoring

tools to monitor, track, and analyze online conversations on the Web

about their brand or products or about related topics of interest. This

can prove useful in public relations management and advertising-campaign tracking, allowing analysts to measure return on investment for their social media ad spending, competitor-auditing, and for public engagement. Tools range from free, basic applications to subscription-based, more in-depth tools.

Financial industries utilize the power of social media as a tool

for analysing sentiment of financial markets. These range from the

marketing of financial products, gaining insights into market sentiment,

future market predictions, and as a tool to identify insider trading.

Social media becomes effective through a process called "building social authority". One of the foundation concepts in social media has become

that one cannot completely control one's message through social media

but rather one can simply begin to participate in the "conversation"

expecting that one can achieve a significant influence in that

conversation.

Social media mining

Social media "mining" is a type of data mining, a technique of analyzing data

to detect patterns. Social media mining is a process of representing,

analyzing, and extracting actionable patterns from data collected from

people's activities on social media. Google mines data in many ways

including using an algorithm in Gmail

to analyze information in emails. This use of the information will then

affect the type of advertisements shown to the user when they use

Gmail. Facebook has partnered with many data mining companies such as Datalogix and BlueKai to use customer information for targeted advertising. Ethical questions of the extent to which a company should be able to utilize a user's information have been called "big data".

Users tend to click through Terms of Use agreements when signing up on

social media platforms, and they do not know how their information will

be used by companies. This leads to questions of privacy and

surveillance when user data is recorded. Some social media outlets have

added capture time and Geotagging that helps provide information about the context of the data as well as making their data more accurate.

In politics

Social media has a range of uses in political processes and

activities. Social media have been championed as allowing anyone with an

Internet connection to become a content creator and empowering their users. The role of social media in democratizing media participation, which proponents herald as ushering in a new era of participatory democracy,

with all users able to contribute news and comments, may fall short of

the ideals, given that many often follow like-minded individuals, as

noted by Philip Pond and Jeff Lewis.

Online media audience members are largely passive consumers, while

content creation is dominated by a small number of users who post

comments and write new content.

Younger generations are becoming more involved in politics due to

the increase of political news posted on social media. Political

campaigns are targeting Millennials online via social media posts in

hope that they will increase their political engagement. Social media was influential in the widespread attention given to the revolutionary outbreaks in the Middle East and North Africa during 2011. During the Tunisian revolution in 2011, people used Facebook to organize meetings and protests. However, there is debate about the extent to which social media facilitated this kind of political change.

Social Media footprints of candidates have grown during the last

decade and the 2016 United States Presidential election provides a good

example. Dounoucos et al. noted that Twitter use by the candidates was

unprecedented during that election cycle. Most candidates in the United States have a Twitter account. The public has also increased their reliance on social media sites for political information. In the European Union, social media has amplified political messages.

One challenge is that militant groups have begun to see social media as a major organizing and recruiting tool. The Islamic State of Iraq and the Levant,

also known as ISIL, ISIS, and Daesh, has used social media to promote

its cause. In 2014, #AllEyesonISIS went viral on Arabic Twitter. ISIS produces an online magazine named the Islamic State Report to recruit more fighters. Social media platforms have been weaponized by state-sponsored cyber groups to attack governments in the United States, European Union, and Middle East. Although phishing attacks via email are the most commonly used tactic to breach government networks, phishing attacks on social media rose 500% in 2016.

Use in hiring

Photos

of college applicants engaging in activities contrary to a school's

rules or values can adversely affect admission, as evident from this

photo of a 40-year-old crack addict.

Some employers examine job applicants' social media profiles as part

of the hiring assessment. This issue raises many ethical questions that

some consider an employer's right and others consider discrimination.

Many Western European countries have already implemented laws that

restrict the regulation of social media in the workplace. States

including Arkansas, California, Colorado, Illinois, Maryland, Michigan,

Nevada, New Jersey, New Mexico, Utah, Washington, and Wisconsin have

passed legislation that protects potential employees and current

employees from employers that demand that they provide their usernames

and/or passwords for any social media accounts.

Use of social media by young people has caused significant problems for

some applicants who are active on social media when they try to enter

the job market. A survey of 17,000 young people in six countries in 2013

found that 1 in 10 people aged 16 to 34 have been rejected for a job

because of online comments they made on social media websites.

Use in school admissions

It

is not only an issue in the workplace but an issue in post-secondary

school admissions as well. There have been situations where students

have been forced to give up their social media passwords to school

administrators.

There are inadequate laws to protect a student's social media privacy,

and organizations such as the ACLU are pushing for more privacy

protection, as it is an invasion. They urge students who are pressured

to give up their account information to tell the administrators to

contact a parent or lawyer before they take the matter any further.

Although they are students, they still have the right to keep their

password-protected information private.

Before social media, admissions officials in the United States used SAT and other standardized test scores, extra-curricular activities, letters of recommendation, and high school report cards

to determine whether to accept or deny an applicant. In the 2010s,

while colleges and universities still use these traditional methods to

evaluate applicants, these institutions are increasingly accessing

applicants' social media profiles to learn about their character and

activities. According to Kaplan, Inc, a corporation that provides higher education preparation, in 2012 27% of admissions officers used Google to learn more about an applicant, with 26% checking Facebook.

Students whose social media pages include offensive jokes or photos,

racist or homophobic comments, photos depicting the applicant engaging

in illegal drug use or drunkenness, and so on, may be screened out from

admission processes.

Use in law enforcement and investigations

Social media has been used extensively in civil and criminal investigations. It has also been used to assist in searches for missing persons.

Police departments often make use of official social media accounts to

engage with the public, publicize police activity, and burnish law

enforcement's image; conversely, video footage of citizen-documented police brutality and other misconduct has sometimes been posted to social media.

In the United States U.S. Immigration and Customs Enforcement

identifies and track individuals via social media, and also has

apprehended some people via social media based sting operations. U.S. Customs and Border Protection (also known as CPB) and the United States Department of Homeland Security use social media data as influencing factors during the visa process, and continue to monitor individuals after they have entered the country.

CPB officers have also been documented performing searches of

electronics and social media behavior at the border, searching both

citizens and non-citizens without first obtaining a warrant.

Use in court cases

Social

media comments and images are being used in a range of court cases

including employment law, child custody/child support and insurance

disability claims. After an Apple employee criticized his employer on

Facebook, he was fired. When the former employee sued Apple for unfair

dismissal, the court, after seeing the man's Facebook posts, found in

favor of Apple, as the man's social media comments breached Apple's

policies.

After a heterosexual couple broke up, the man posted "violent rap

lyrics from a song that talked about fantasies of killing the rapper's

ex-wife" and made threats against him. The court found him guilty and he

was sentenced to jail.

In a disability claims case, a woman who fell at work claimed that she

was permanently injured; the employer used her social media posts of her

travels and activities to counter her claims.

Courts do not always admit social media evidence, in part because screenshots can be faked or tampered with. Judges are taking emojis

into account to assess statements made on social media; in one Michigan

case where a person alleged that another person had defamed them in an

online comment, the judge disagreed, noting that there was an emoji

after the comment which indicated that it was a joke.

In a 2014 case in Ontario against a police officer regarding alleged

assault of a protester during the G20 summit, the court rejected the

Crown's application to use a digital photo of the protest that was

anonymously posted online, because there was no metadata proving when the photo was taken and it could have been digitally altered.

Social media marketing

Social media websites can also use "traditional" marketing approaches, as seen in these LinkedIn-branded chocolates.

Social media marketing has increased due to the growing active user rates on social media sites. For example, Facebook currently has 2.2 billion users, Twitter has 330 million active users and Instagram has 800 million users.

One of the main uses is to interact with audiences to create awareness

of their brand or service, with the main idea of creating a two-way

communication system where the audience and/or customers can interact

back; providing feedback as just one example.

Social media can be used to advertise; placing an advert on Facebook's

Newsfeed, for example, can allow a vast number of people to see it or

targeting specific audiences from their usage to encourage awareness of

the product or brand. Users of social media are then able to like, share

and comment on the advert, becoming message senders as they can keep

passing the advert's message on to their friends and onwards.

The use of new media put consumers on the position of spreading

opinions, sharing experience, and has shift power from organization to

consumers for it allows transparency and different opinions to be heard.

media marketing has to keep up with all the different platforms. They

also have to keep up with the ongoing trends that are set by big

influencers and draw many peoples attention. The type of audience a

business is going for will determine the social media site they use.

Social media personalities have been employed by marketers to promote products online. Research shows that digital endorsements seem to be successfully targeting social media users, especially younger consumers who have grown up in the digital age. Celebrities with large social media followings, such as Kylie Jenner, regularly endorse products to their followers on their social media pages. In 2013, the United Kingdom Advertising Standards Authority (ASA)

began to advise celebrities and sports stars to make it clear if they

had been paid to tweet about a product or service by using the hashtag

#spon or #ad within tweets containing endorsements. The practice of

harnessing social media personalities to market or promote a product or

service to their following is commonly referred to as Influencer Marketing.

The Cambridge Dictionary defines an "influencer" as any person

(personality, blogger, journalist, celebrity) who has the ability to

affect the opinions, behaviors, or purchases of others through the use

of social media.

Companies such as fast food franchise Wendy's have used humor to advertise their products by poking fun at competitors such as McDonald's and Burger King. Other companies such as Juul have used hashtags to promote themselves and their products.

On social media, consumers are exposed to the purchasing

practices of peers through messages from a peer's account, which may be

peer-written. Such messages may be part of an interactive marketing

strategy involving modeling, reinforcement, and social interaction

mechanisms.

A 2011 study focusing on peer communication through social media

described how communication between peers through social media can

affect purchase intentions: a direct impact through conformity, and an

indirect impact by stressing product engagement.

The study indicated that social media communication between peers about

a product had a positive relationship with product engagement.

Use in science

Signals from social media are used to assess academic publications, as well as for evaluation of the quality of the Wikipedia articles and their sources.

Data from social media can be also used for different scientific

approaches. One of the studies examined how millions of users interact

with socially shared news and show that individuals’ choices played a

stronger role in limiting exposure to cross-cutting content. Another study found that most of the health science students acquiring academic materials from others through social media. Massive amounts of data from social platforms allows scientists and machine learning researchers to extract insights and build product features. Using social media can help to shape patterns of deception in resumes.

Use by individuals

As a news source

In the United States, 81% of users look online for news of the

weather, first and foremost, with the percentage seeking national news

at 73%, 52% for sports news, and 41% for entertainment or celebrity

news. According to CNN, in 2010 75% of people got their news forwarded

through e-mail or social media posts, whereas 37% of people shared a

news item via Facebook or Twitter. Facebook and Twitter

make news a more participatory experience than before as people share

news articles and comment on other people's posts. Rainie and Wellman

have argued that media making now has become a participation work, which changes communication systems. However, 27% of respondents worry about the accuracy of a story on a blog.

From a 2019 poll, Pew Research Center found that Americans are wary

about the ways that social media sites share news and certain content.

This wariness of accuracy is on the rise as social media sites are

increasingly exploited by aggregated new sources which stitch together

multiple feeds to develop plausible correlations. Hemsley, Jacobson et

al. refer to this phenomenon as "pseudoknowledge" which develop false

narratives and fake news that are supported through general analysis and

ideology rather than facts.

Social media as a news source is further questioned as spikes in

evidence surround major news events such as was captured in the United

States 2016 presidential election.

Effects on individual and collective memory

News

media and television journalism have been a key feature in the shaping

of American collective memory for much of the twentieth century.

Indeed, since the United States' colonial era, news media has

influenced collective memory and discourse about national development

and trauma. In many ways, mainstream journalists

have maintained an authoritative voice as the storytellers of the

American past. Their documentary style narratives, detailed exposes, and

their positions in the present make them prime sources for public

memory. Specifically, news media journalists have shaped collective

memory on nearly every major national event – from the deaths of social

and political figures to the progression of political hopefuls.

Journalists provide elaborate descriptions of commemorative events in

U.S. history and contemporary popular cultural sensations. Many

Americans learn the significance of historical events and political

issues through news media, as they are presented on popular news

stations. However, journalistic influence is growing less important, whereas social networking sites such as Facebook, YouTube and Twitter, provide a constant supply of alternative news sources for users.

As social networking

becomes more popular among older and younger generations, sites such as

Facebook and YouTube, gradually undermine the traditionally

authoritative voices of news media. For example, American citizens

contest media coverage of various social and political events as they

see fit, inserting their voices into the narratives about America's past

and present and shaping their own collective memories. An example of this is the public explosion of the Trayvon Martin

shooting in Sanford, Florida. News media coverage of the incident was

minimal until social media users made the story recognizable through

their constant discussion of the case. Approximately one month after the

fatal shooting of Trayvon Martin, its online coverage by everyday Americans garnered national attention from mainstream media journalists, in turn exemplifying media activism. In some ways, the spread of this tragic event through alternative news sources parallels that of Emmitt Till

– whose murder by lynching in 1955 became a national story after it was

circulated in African-American and Communist newspapers.

Interpersonal relationships

Modern day teenagers interacting

Social media is used to fulfill perceived social needs, but not all needs can be fulfilled by social media. For example, lonely individuals are more likely to use the Internet for emotional support than those who are not lonely. Sherry Turkle explores these issues in her book Alone Together

as she discusses how people confuse social media usage with authentic

communication. She posits that people tend to act differently online and

are less afraid to hurt each other's feelings. Additionally, studies on

who interacts on the internet have shown that extraversion and openness

have a positive relationship with social media, while emotional

stability has a negative sloping relationship with social media.

Some online behaviors can cause stress and anxiety, due to the

permanence of online posts, the fear of being hacked, or of universities

and employers exploring social media pages. Turkle also speculates that

people are beginning to prefer texting to face-to-face communication,

which can contribute to feelings of loneliness.

Some researchers have also found that exchanges that involved direct

communication and reciprocation of messages correlated with less

feelings of loneliness. However, passively using social media without

sending or receiving messages does not make people feel less lonely

unless they were lonely to begin with.

Checking updates on friends' activities on social media is associated with the "fear of missing out" (FOMO), the "pervasive apprehension that others might be having rewarding experiences from which one is absent". FOMO is a social anxiety characterized by "a desire to stay continually connected with what others are doing".

It has negative influences on people's psychological health and

well-being because it could contribute to negative mood and depressed

feelings.

Concerns have been raised

about online "stalking" or "creeping" of people on social media, which

means looking at the person's "timeline, status updates, tweets, and

online bios" to find information about them and their activities.

While social media creeping is common, it is considered to be poor form

to admit to a new acquaintance or new date that you have looked through

his or her social media posts, particularly older posts, as this will

indicate that you were going through their old history.

A sub-category of creeping is creeping ex-partners' social media posts

after a breakup to investigate if there is a new partner or new dating;

this can lead to preoccupation with the ex, rumination and negative

feelings, all of which postpone recovery and increase feelings of loss. Catfishing

has become more prevalent since the advent of social media.

Relationships formed with catfish can lead to actions such as supporting

them with money and catfish will typically make excuses as to why they

cannot meet up or be viewed on camera.

According to research from UCLA, teenage brains' reward circuits

were more active when teenager's photos were liked by more peers. This

has both positive and negative features. Teenagers and young adults

befriend people online whom they do not know well. This opens the

possibility of a child being influenced by people who engage in

risk-taking behavior. When children have several hundred online

connections there is no way for parents to know who they are.

Self-presentation

The more time people spend on Facebook, the less satisfied they feel about their life.

Self-presentational theory explains that people will consciously manage

their self-image or identity related information in social contexts.

When people are not accepted or are criticized online they feel

emotional pain. This may lead to some form of online retaliation such as online bullying.

Trudy Hui Hui Chua and Leanne Chang's article, "Follow Me and Like My

Beautiful Selfies: Singapore Teenage Girls' Engagement in

Self-Presentation and Peer Comparison on Social Media"

states that teenage girls manipulate their self-presentation on social

media to achieve a sense of beauty that is projected by their peers.

These authors also discovered that teenage girls compare themselves to

their peers on social media and present themselves in certain ways in

effort to earn regard and acceptance, which can actually lead to

problems with self-confidence and self-satisfaction.

Users also tend to segment their audiences based on the image

they want to present, pseudonymity and use of multiple accounts across

the same platform remain popular ways to negotiate platform expectations

and segment audiences.

Health improvement and behavior reinforcement

Social

media can also function as a supportive system for adolescents' health,

because by using social media, adolescents are able to mobilize around

health issues that they themselves deem relevant. For example, in a clinical study among adolescent patients undergoing treatment for obesity, the participants' expressed that through social media, they could find personalized weight-loss content as well as social support among other adolescents with obesity

The same authors also found that as with other types of online

information, the adolescents need to possess necessary skills to

evaluate and identify reliable health information, competencies commonly

known as health literacy.

Other social media, such as pro-anorexia

sites, have been found in studies to cause significant risk of harm by

reinforcing negative health-related behaviors through social networking,

especially in adolescents.

Social impacts

Disparity

People who live in poverty, such as homeless people,

have low levels of access to computers and Internet or a lack of

familiarity with these technologies. This means that these marginalized

people are not able to use social media tools to find information, jobs,

housing, and other necessities.

The digital divide

is a measure of disparity in the level of access to technology between

households, socioeconomic levels or other demographic categories. People who are homeless,

living in poverty, elderly people and those living in rural or remote

communities may have little or no access to computers and the Internet;

in contrast, middle class and upper-class people in urban areas have

very high rates of computer and Internet access. Other models argue that

within a modern information society, some individuals produce Internet content while others only consume it,

which could be a result of disparities in the education system where

only some teachers integrate technology into the classroom and teach

critical thinking. While social media has differences among age groups, a 2010 study in the United States found no racial divide. Some zero-rating

programs offer subsidized data access to certain websites on low-cost

plans. Critics say that this is an anti-competitive program that

undermines net neutrality and creates a "walled garden" for platforms like Facebook Zero.

A 2015 study found that 65% of Nigerians, 61% of Indonesians, and 58%

of Indians agree with the statement that "Facebook is the Internet"

compared with only 5% in the US.

Eric Ehrmann contends that social media in the form of public diplomacy create a patina of inclusiveness that covers

traditional economic interests that are structured to ensure that

wealth is pumped up to the top of the economic pyramid, perpetuating the

digital divide and post Marxian class conflict. He also voices concern

over the trend that finds social utilities operating in a quasi-libertarian

global environment of oligopoly that requires users in economically

challenged nations to spend high percentages of annual income to pay for

devices and services to participate in the social media lifestyle. Neil Postman

also contends that social media will increase an information disparity

between "winners" – who are able to use the social media actively – and

"losers" – who are not familiar with modern technologies or who do not

have access to them. People with high social media skills may have

better access to information about job opportunities, potential new

friends, and social activities in their area, which may enable them to

improve their standard of living and their quality of life.

Political polarization

According to the Pew Research Center, a majority of Americans at least occasionally receive news from social media. Because of algorithms

on social media which filter and display news content which are likely

to match their users’ political preferences, a potential impact of

receiving news from social media includes an increase in political polarization due to selective exposure.

Political polarization refers to when an individual's stance on a topic

is more likely to be strictly defined by their identification with a

specific political party or ideology than on other factors. Selective

exposure occurs when an individual favors information which supports

their beliefs and avoids information which conflicts with their beliefs.

A study by Hayat and Samuel-Azran conducted during the 2016 U.S. presidential election observed an “echo chamber” effect of selective exposure among 27,811 Twitter users following the content of cable news shows.

The Twitter users observed in the study were found to have little

interaction with users and content whose beliefs were different from

their own, possibly heightening polarization effects.

Efforts to combat selective exposure in social media may also cause an increase in political polarization.

A study examining Twitter activity conducted by Bail et al. paid

Democrat and Republican participants to follow Twitter handles whose

content was different from their political beliefs (Republicans received

liberal content and Democrats received conservative content) over a

six-week period.

At the end of the study, both Democrat and Republican participants were

found to have increased political polarization in favor of their own

parties, though only Republican participants had an increase that was

statistically significant.

Though research has shown evidence that social media plays a role

in increasing political polarization, it has also shown evidence that

social media use leads to a persuasion of political beliefs.

An online survey consisting of 1,024 U.S. participants was conducted by

Diehl, Weeks, and Gil de Zuñiga, which found that individuals who use

social media were more likely to have their political beliefs persuaded

than those who did not.

In particular, those using social media as a means to receive their

news were the most likely to have their political beliefs changed.

Diehl et al. found that the persuasion reported by participants was

influenced by the exposure to diverse viewpoints they experienced, both

in the content they saw as well as the political discussions they

participated in.

Similarly, a study by Hardy and colleagues conducted with 189 students

from a Midwestern state university examined the persuasive effect of

watching a political comedy video on Facebook. Hardy et al. found that after watching a Facebook video of the comedian/political commentator John Oliver

performing a segment on his show, participants were likely to be

persuaded to change their viewpoint on the topic they watched (either payday lending or the Ferguson protests) to one that was closer to the opinion expressed by Oliver.

Furthermore, the persuasion experienced by the participants was found

to be reduced if they viewed comments by Facebook users which

contradicted the arguments made by Oliver.

Research has also shown that social media use may not have an effect on polarization at all.

A U.S. national survey of 1,032 participants conducted by Lee et al.

found that participants who used social media were more likely to be

exposed to a diverse number of people and amount of opinion than those

who did not, although using social media was not correlated with a

change in political polarization for these participants.

In a study examining the potential polarizing effects of social

media on the political views of its users, Mihailidis and Viotty suggest

that a new way of engaging with social media must occur to avoid

polarization. The authors note that media literacies

(described as methods which give people skills to critique and create

media) are important to using social media in a responsible and

productive way, and state that these literacies must be changed further

in order to have the most effectiveness.

In order to decrease polarization and encourage cooperation among

social media users, Mihailidis and Viotty suggest that media literacies

must focus on teaching individuals how to connect with other people in a

caring way, embrace differences, and understand the ways in which

social media has a realistic impact on the political, social, and

cultural issues of the society they are a part of.

Stereotyping

Recent

research has demonstrated that social media, and media in general, have

the power to increase the scope of stereotypes not only in children but

people all ages.

Three researchers at Blanquerna University, Spain, examined how

adolescents interact with social media and specifically Facebook. They

suggest that interactions on the website encourage representing oneself

in the traditional gender constructs, which helps maintain gender

stereotypes.

The authors noted that girls generally show more emotion in their posts

and more frequently change their profile pictures, which according to

some psychologists can lead to self-objectification. On the other hand, the researchers found that boys prefer to portray themselves as strong, independent, and powerful.

For example, men often post pictures of objects and not themselves, and

rarely change their profile pictures; using the pages more for

entertainment and pragmatic reasons. In contrast girls generally post

more images that include themselves, friends and things they have

emotional ties to, which the researchers attributed that to the higher

emotional intelligence of girls at a younger age. The authors sampled

over 632 girls and boys from the ages of 12–16 from Spain in an effort

to confirm their beliefs. The researchers concluded that masculinity is

more commonly associated with a positive psychological well-being, while

femininity displays less psychological well-being.

Furthermore, the researchers discovered that people tend not to

completely conform to either stereotype, and encompass desirable parts

of both. Users of Facebook generally use their profile to reflect that

they are a "normal" person. Social media was found to uphold gender

stereotypes both feminine and masculine. The researchers also noted that

the traditional stereotypes are often upheld by boys more so than

girls. The authors described how neither stereotype was entirely

positive, but most people viewed masculine values as more positive.

Cognition and memory

According

to writer Christine Rosen in "Virtual Friendship, and the New

Narcissism," many social media sites encourage status-seeking.

According to Rosen, the practice and definition of "friendship" changes

in virtuality. Friendship in these virtual spaces is thoroughly

different from real-world friendship. In its traditional sense,

friendship is a relationship which, broadly speaking, involves the

sharing of mutual interests, reciprocity, trust, and the revelation of

intimate details over time and within specific social (and cultural)

contexts. Because friendship depends on mutual revelations that are

concealed from the rest of the world, it can only flourish within the

boundaries of privacy; the idea of public friendship is an oxymoron."

Rosen also cites Brigham Young University researchers who "recently

surveyed 184 users of social networking sites and found that heavy users

'feel less socially involved with the community around them.'"

Critic Nicholas G. Carr in "Is Google Making Us Stupid?" questions how

technology affects cognition and memory.

"The kind of deep reading that a sequence of printed pages promotes is

valuable not just for the knowledge we acquire from the author's words

but for the intellectual

vibrations those words set off within our own minds. In the quiet

spaces opened up by the sustained, undistracted reading of a book, or by

any other act of contemplation, for that matter, we make our own

associations, draw our own inferences and analogies, foster our own

ideas... If we lose those quiet spaces, or fill them up with "content,"

we will sacrifice something important not only in ourselves but in our

culture."

Physical and mental health

There are several negative effects to social media which receive criticism, for example regarding privacy issues, information overload and Internet fraud. Social media can also have negative social effects on users.

Angry or emotional conversations can lead to real-world interactions

outside of the Internet, which can get users into dangerous situations.

Some users have experienced threats of violence online and have feared

these threats manifesting themselves offline. At the same time, concerns

have been raised about possible links between heavy social media use

and depression, and even the issues of cyberbullying, online harassment and "trolling".

According to cyber bullying statistics from the i-Safe Foundation, over

half of adolescents and teens have been bullied online, and about the

same number have engaged in cyber bullying.

Both the bully and the victim are negatively affected, and the

intensity, duration, and frequency of bullying are the three aspects

that increase the negative effects on both of them.

Studies also show that social media have negative effects on peoples'

self-esteem and self-worth. The authors of "Who Compares and Despairs?

The Effect of Social Comparison Orientation on Social Media Use and its

Outcomes"

found that people with a higher social comparison orientation appear to

use social media more heavily than people with low social comparison

orientation. This finding was consistent with other studies that found

people with high social comparison orientation make more social

comparisons once on social media.

People compare their own lives to the lives of their friends

through their friends' posts. People are motivated to portray themselves

in a way that is appropriate to the situation and serves their best

interest. Often the things posted online are the positive aspects of

people's lives, making other people question why their own lives are not

as exciting or fulfilling. This can lead to depression and other

self-esteem issues as well as decrease their satisfaction of life as

they feel if their life is not exciting enough to put online it is not

as good as their friends or family.

Studies have shown that self comparison on social media can have

dire effects on physical and mental health because they give us the

ability to seek approval and compare ourselves. Social media has both a practical usage- to connect us with others, but also can lead to fulfillment of gratification.

In fact, one study suggests that because a critical aspect of social

networking sites involve spending hours, if not months customizing a

personal profile, and encourage a sort of social currency based on

likes, followers and comments- they provide a forum for persistent

"appearance conversations".

These appearance centered conversations that forums like Facebook,

Instagram among others provide can lead to feelings of disappointment in

looks and personality when not enough likes or comments are achieved.

In addition, social media use can lead to detrimental physical health

effects. A large body of literature associates body image and disordered

eating with social networking platforms. Specifically, literature

suggests that social media can breed a negative feedback loop of viewing

and uploading photos, self comparison, feelings of disappointment when

perceived social success is not achieved, and disordered body

perception.

In fact, one study shows that the microblogging platform, Pinterest is

directly associated with disordered dieting behavior, indicating that

for those who frequently look at exercise or dieting "pins" there is a

greater chance that they will engage in extreme weight-loss and dieting

behavior.

Bo Han, a social media researcher at Texas A&M

University-Commerce, finds that users are likely to experience the

"social media burnout" issue.

Ambivalence, emotional exhaustion, and depersonalization are usually

the main symptoms if a user experiences social media burnout.

Ambivalence refers to a user's confusion about the benefits she can get

from using a social media site. Emotional exhaustion refers to the

stress a user has when using a social media site. Depersonalization

refers to the emotional detachment from a social media site a user

experiences. The three burnout factors can all negatively influence the

user's social media continuance. This study provides an instrument to

measure the burnout a user can experience, when his or her social media

"friends" are generating an overwhelming amount of useless information

(e.g., "what I had for dinner", "where I am now").

Adolescents

Excessive

use of digital technology, like social media, by adolescents can cause

disruptions in their physical and mental health, in sleeping patterns,

their weight and levels of exercise and notably in their academic

performance. Research has continued to demonstrate that long hours spent

on mobile devices have shown a positive relationship with an increase

in teenagers' BMI and a lack of physical activity. Moreover, excessive

internet usage has been linked to lower grades compared to users who do

not spend an excessive amount of time online, even with a control over

age, gender, race, parent education and personal contentment factors

that may affect the study. In a recent study, it was found that time spent on Facebook has a strong negative relationship with overall GPA.

The use of multiple social media platforms is more strongly associated

with depression and anxiety among young adults than time spent online.

The analysis showed that people who reported using the most platforms (7

to 11) had more than three times the risk of depression and anxiety

than people who used the fewest (0 to 2). Social media addiction

and its sub-dimensions have a high positive correlation. The more the

participants are addicted to social media, the less satisfied they are

with life. Some parents restrict their children's access to social media for these reasons.

There are many ways to combat the negative effects of social media, one

being increasing the education teachers and parents of the real harms

of social media, as most grew up without the access to social media that

adolescents have in 2020.

Sleep disturbances

According to a study released in 2017 by researchers from the University of Pittsburgh,

the link between sleep disturbance and the use of social media was

clear. It concluded that blue light had a part to play—and how often

they logged on, rather than time spent on social media sites, was a

higher predictor of disturbed sleep, suggesting "an obsessive

'checking'".

The strong relationship of social media use and sleep disturbance has

significant clinical ramifications for a young adults health and

well-being. In a recent study, we have learned that people in the

highest quartile for social media use per week report the most sleep

disturbance. The median number of minutes of social media use per day is

61 minutes. Lastly, we have learned that females are more inclined to

experience high levels of sleep disturbance than males.

Changes in mood

Many

teenagers suffer from sleep deprivation as they spend long hours at

night on their phones, and this, in turn, could affect grades as they

will be tired and unfocused in school. Social media has generated a

phenomenon known as " Facebook depression", which is a type of

depression that affects adolescents who spend too much of their free

time engaging with social media sites. "Facebook depression" leads to

problems such as reclusiveness which can negatively damage ones health

by creating feelings of loneliness and low self-esteem among young

people.

At the same time, a 2017 shown that there is a link between social

media addiction and negative mental health effects. In this study,

almost 6,000 adolescent students were examined using the Bergen Social

Media Addiction Scale. 4.5% of these students were found to be "at risk"

of social media addiction. Furthermore, this same 4.5% reported low

self-esteem and high levels of depressive symptoms.

UK researchers used a data set of more than 800 million Twitter

messages to evaluate how collective mood changes over the course of 24

hours and across the seasons. The research team collected 800 million

anonymous Tweets from 33,576 time points over four years, to examine

anger and sadness and compare them with fatigue. The "research revealed

strong circadian patterns for both positive and negative moods. The

profiles of anger and fatigue were found remarkably stable across the

seasons or between the weekdays/weekend." The "positive emotions and

sadness showed more variability in response to these changing conditions

and higher levels of interaction with the onset of sunlight exposure."

Effects on youth communication

Social media has allowed for mass cultural exchange and intercultural communication. As different cultures have different value systems, cultural themes, grammar, and world views, they also communicate differently.

The emergence of social media platforms fused together different

cultures and their communication methods, blending together various

cultural thinking patterns and expression styles.

Social media has affected the way youth communicate, by

introducing new forms of language. Abbreviations have been introduced to

cut down on the time it takes to respond online. The commonly known "LOL" has become globally recognized as the abbreviation for "laugh out loud" thanks to social media.

Another trend that influences the way youth communicates is

(through) the use of hashtags. With the introduction of social media

platforms such as Twitter, Facebook and Instagram,

the hashtag was created to easily organize and search for information.

Hashtags can be used when people want to advocate for a movement, store

content or tweets from a movement for future use, and allow other social

media users to contribute to a discussion about a certain movement by

using existing hashtags. Using hashtags as a way to advocate for

something online makes it easier and more accessible for more people to

acknowledge it around the world. As hashtags such as #tbt ("throwback Thursday")

become a part of online communication, it influenced the way in which

youth share and communicate in their daily lives. Because of these

changes in linguistics and communication etiquette, researchers of media

semiotics have found that this has altered youth's communications habits and more.[vague]

Social media has offered a new platform for peer pressure

with both positive and negative communication. From Facebook comments

to likes on Instagram, how the youth communicate and what is socially

acceptable is now heavily based on social media.

Social media does make kids and young adults more susceptible to peer

pressure. The American Academy of Pediatrics has also shown that

bullying, the making of non-inclusive friend groups, and sexual

experimentation have increased situations related to cyberbullying,

issues with privacy, and the act of sending sexual images or messages to

someone's mobile device. On the other hand, social media also benefits

the youth and how they communicate. Adolescents can learn basic social and technical skills that are essential in society.

Through the use of social media, kids and young adults are able to

strengthen relationships by keeping in touch with friends and family,

make more friends, and participate in community engagement activities

and services.

Criticism, debate and controversy

Criticisms

of social media range from criticisms of the ease of use of specific

platforms and their capabilities, disparity of information available,

issues with trustworthiness and reliability of information presented, the impact of social media use on an individual's concentration,

ownership of media content, and the meaning of interactions created by

social media. Although some social media platforms offer users the

opportunity to cross-post simultaneously, some social network platforms

have been criticized for poor interoperability between platforms, which

leads to the creation of information silos, viz. isolated pockets of

data contained in one social media platform. However, it is also argued that social media has positive effects, such as allowing the democratization of the Internet while also allowing individuals to advertise themselves and form friendships. Others

have noted that the term "social" cannot account for technological

features of a platform alone, hence the level of sociability should be

determined by the actual performances of its users. There has been a

dramatic decrease in face-to-face interactions as more and more social

media platforms have been introduced with the threat of cyber-bullying

and online sexual predators being more prevalent. Social media may expose children to images of alcohol, tobacco, and sexual behaviors.

In regards to cyber-bullying, it has been proven that individuals who

have no experience with cyber-bullying often have a better well-being

than individuals who have been bullied online.

Twitter is increasingly a target of heavy activity of marketers.

Their actions, focused on gaining massive numbers of followers, include

use of advanced scripts and manipulation techniques that distort the

prime idea of social media by abusing human trustfulness. British-American entrepreneur and author Andrew Keen criticizes social media in his book The Cult of the Amateur,

writing, "Out of this anarchy, it suddenly became clear that what was

governing the infinite monkeys now inputting away on the Internet was

the law of digital Darwinism, the survival of the loudest and most

opinionated. Under these rules, the only way to intellectually prevail

is by infinite filibustering."

This is also relative to the issue "justice" in the social network. For example, the phenomenon "Human flesh search engine" in Asia raised the discussion of "private-law" brought by social network platform. Comparative media professor José van Dijck contends in her book "The Culture of Connectivity"

(2013) that to understand the full weight of social media, their

technological dimensions should be connected to the social and the

cultural. She critically describes six social media platforms. One of

her findings is the way Facebook had been successful in framing the term

'sharing' in such a way that third party use of user data is neglected

in favor of intra-user connectedness.

Essena O'Neill attracted international coverage when she explicitly left social media.

Trustworthiness and reliability

There has been speculation that social media has become perceived as a trustworthy source of information by a large number of people.

The continuous interpersonal connectivity on social media, for example,

may lead to people regarding peer recommendations as indicators of the

reliability of information sources. This trust can be exploited by

marketers, who can utilize consumer-created content about brands and

products to influence public perceptions.

Trustworthiness of information can be improved by fact-checking. Some social media has started to employ this.

Evgeny Morozov, a 2009–2010 Yahoo fellow at Georgetown University,

contended that information uploaded to Twitter may have little

relevance to the masses of people who do not use Twitter. In an article

for the magazine Dissent titled "Iran: Downside to the 'Twitter Revolution'", Morozov wrote:

[B]y its very design Twitter only adds to the noise: it's simply impossible to pack much context into its 140 characters. All other biases are present as well: in a country like Iran it's mostly pro-Western, technology-friendly and iPod-carrying young people who are the natural and most frequent users of Twitter. They are a tiny and, most important, extremely untypical segment of the Iranian population (the number of Twitter users in Iran — a country of more than seventy million people — was estimated at less than twenty thousand before the protests).

In contrast, in the United States (where Twitter originated), the social network had 306 million accounts as of 2012. The number of accounts, though sizable in proportion to the U.S. population of 314.7 million in 2012, may not be fairly comparable, since an undisclosed number of Twitter users operate multiple accounts.

Professor Matthew Auer of Bates College

casts doubt on the conventional wisdom that social media are open and

participatory. He also speculates on the emergence of "anti-social

media" used as "instruments of pure control."

Criticism of data harvesting on Facebook

On April 10, 2018, in a hearing held in response to revelations of data harvesting by Cambridge Analytica, Mark Zuckerberg, the Facebook

chief executive, faced questions from senators on a variety of issues,

from privacy to the company's business model and the company's

mishandling of data. This was Mr. Zuckerberg's first appearance before

Congress, prompted by the revelation that Cambridge Analytica, a

political consulting firm linked to the Trump campaign, harvested the

data of an estimated 87 million Facebook users to psychologically

profile voters during the 2016 election. Zuckerburg was pressed to

account for how third-party partners could take data without users’

knowledge. Lawmakers grilled the 33-year-old executive on the

proliferation of so-called fake news on Facebook, Russian interference

during the 2016 presidential election and censorship of conservative media.

Critique of activism

For Malcolm Gladwell, the role of social media, such as Twitter and Facebook, in revolutions and protests is overstated.

On one hand, social media make it easier for individuals, and in this

case activists, to express themselves. On the other hand, it is harder

for that expression to have an impact.

Gladwell distinguishes between social media activism and high risk

activism, which brings real changes. Activism and especially high-risk

activism involves strong-tie relationships, hierarchies, coordination,

motivation, exposing oneself to high risks, making sacrifices.

Gladwell discusses that social media are built around weak ties and he

argues that "social networks are effective at increasing participation —

by lessening the level of motivation that participation requires".