The New Deal was a series of programs, public work projects, financial reforms, and regulations enacted by President Franklin D. Roosevelt in the United States between 1933 and 1938 to rescue the U.S. from the Great Depression. It was widely believed that the depression was caused by the inherent market instability and that government intervention was necessary to rationalize and stabilize the economy.

Major federal programs and agencies, including the Civilian Conservation Corps (CCC), the Works Progress Administration (WPA), the Civil Works Administration (CWA), the Farm Security Administration (FSA), the National Industrial Recovery Act of 1933 (NIRA) and the Social Security Administration (SSA), provided support for farmers, the unemployed, youth, and the elderly. The New Deal included new constraints and safeguards on the banking industry and efforts to re-inflate the economy after prices had fallen sharply. New Deal programs included both laws passed by Congress as well as presidential executive orders during the first term of the presidency of Franklin D. Roosevelt.

The programs focused on what historians refer to as the "3 R's": relief for the unemployed and for the poor, recovery of the economy back to normal levels, and reform of the financial system to prevent a repeat depression. The New Deal produced a political realignment, making the Democratic Party the majority (as well as the party that held the White House for seven out of the nine presidential terms from 1933 to 1969) with its base in progressive ideas, the South, big city machines and the newly empowered labour unions, and various ethnic groups. The Republicans were split, with progressive Republicans in support but conservatives opposing the entire New Deal as hostile to business and economic growth. The realignment crystallized into the New Deal coalition that dominated presidential elections into the 1960s and the opposing conservative coalition largely controlled Congress in domestic affairs from 1937 to 1964.

Summary of First and Second New Deal programs

The First New Deal (1933–1934) dealt with the pressing banking crisis through the Emergency Banking Act and the 1933 Banking Act. The Federal Emergency Relief Administration (FERA) provided US$500 million (equivalent to $11.8 billion in 2023) for relief operations by states and cities, and the short-lived CWA gave locals money to operate make-work projects from 1933 to 1934. The Securities Act of 1933 was enacted to prevent a repeated stock market crash. The controversial work of the National Recovery Administration (NRA) was also part of the First New Deal.

The Second New Deal in 1935–1936 included the National Labor Relations Act to protect labor organizing, the Works Progress Administration (WPA) relief program (which made the federal government the largest employer in the nation), the Social Security Act and new programs to aid tenant farmers and migrant workers. The final major items of New Deal legislation were the creation of the United States Housing Authority and the FSA, which both occurred in 1937; and the Fair Labor Standards Act of 1938, which set maximum hours and minimum wages for most categories of workers. The FSA was also one of the oversight authorities of the Puerto Rico Reconstruction Administration, which administered relief efforts to Puerto Rican citizens affected by the Great Depression.

Roosevelt had built a New Deal coalition, but the economic downturn of 1937–1938 and the bitter split between the American Federation of Labor (AFL) and Congress of Industrial Organizations (CIO) labor unions led to major Republican gains in Congress in 1938. Conservative Republicans and Democrats in Congress joined the informal conservative coalition. By 1942–1943, they shut down relief programs such as the WPA and the CCC and blocked major progressive proposals. Noting the composition of the new Congress, one study argued

The Congress that assembled in January 1939 was quite unlike any with which Roosevelt had to contend before.

Since all Democratic losses took place in the North and the West, and particularly in states like Ohio and Pennsylvania, southerners held a much stronger position. The House contained 169 non-southern Democrats, 93 southern Democrats, 169 Republicans, and 4 third-party representatives. For the first time, Roosevelt could not form a majority without the help of some southerners or Republicans. In addition, the president had to contend with several senators who, having successfully resisted the purge, no longer owed him anything. Most observers agreed, therefore, that the president could at best hope to consolidate, but certainly not to extend, the New Deal. James Farley thought that Roosevelt's wisest course would be "to clean up odds and ends, tighten up and improve things [he] already has but not try [to] start anything new."

In any event, Farley predicted that Congress would discard much of Roosevelt's program.

As noted by another study, "the 1938 elections proved a decisive point in the consolidation of the conservative coalition in Congress. The liberal bloc in the House had been halved, and conservative Democrats had escaped 'relatively untouched'". In the House elected in 1938 there were at least 30 anti-New Deal Democrats and another 50 who were "not at all enthusiastic". In addition, "The new Senate was split about evenly between pro- and anti-New Deal factions." The Fair Labor Standards Act of 1938 was the last major New Deal legislation that Roosevelt succeeded in enacting into law before the conservative coalition won control of Congress. Though he could usually use the veto to restrain Congress, Congress could block any Roosevelt legislation it disliked.

Nonetheless, Roosevelt turned his attention to the war effort and won reelection in 1940–1944. Furthermore, the Supreme Court declared the NRA and the first version of the Agricultural Adjustment Act (AAA) unconstitutional, but the AAA was rewritten and then upheld. Republican President Dwight D. Eisenhower (1953–1961) left the New Deal largely intact, even expanding it in some areas. In the 1960s, Lyndon B. Johnson's Great Society used the New Deal as inspiration for a dramatic expansion of progressive programs, which Republican Richard Nixon generally retained. However, after 1974 the call for deregulation of the economy gained bipartisan support. The New Deal regulation of banking (Glass–Steagall Act) lasted until it was suspended in the 1990s.

Several organizations created by New Deal programs remain active and those operating under the original names include the Federal Deposit Insurance Corporation (FDIC), the Federal Crop Insurance Corporation (FCIC), the Federal Housing Administration (FHA), and the Tennessee Valley Authority (TVA). The largest programs still in existence are the Social Security System and the Securities and Exchange Commission (SEC).

Origins

Economic collapse (1929–1933)

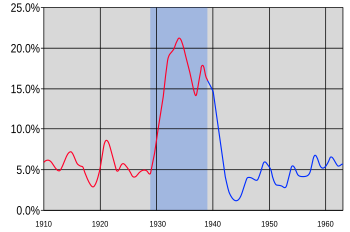

From 1929 to 1933 manufacturing output decreased by one third, which economist Milton Friedman later called the Great Contraction. Prices fell by 20%, causing deflation that made repaying debts much harder. Unemployment in the United States increased from 4% to 25%. Additionally, one-third of all employed persons were downgraded to working part-time on much smaller paychecks. In the aggregate, almost 50% of the nation's human work-power was going unused.

Before the New Deal, USA bank deposits were not "guaranteed" by government. When thousands of banks closed, depositors temporarily lost access to their money; most of the funds were eventually restored but there was gloom and panic. The United States had no national safety net, no public unemployment insurance and no Social Security. Relief for the poor was the responsibility of families, private charity and local governments, but as conditions worsened year by year demand skyrocketed and their combined resources increasingly fell far short of demand.

The depression had psychologically devastated the nation. As Roosevelt took the oath of office at noon on March 4, 1933, all state governors had authorized bank holidays or restricted withdrawals—many Americans had little or no access to their bank accounts. Farm income had fallen by over 50% since 1929. Between 1930 and 1933, an estimated 844,000 non-farm mortgages were foreclosed on, out of a total of five million. Political and business leaders feared revolution and anarchy. Joseph P. Kennedy Sr., who remained wealthy during the Depression, recalled that "in those days I felt and said I would be willing to part with half of what I had if I could be sure of keeping, under law and order, the other half."

Campaign

Throughout the nation men and women, forgotten in the political philosophy of the Government, look to us here for guidance and for more equitable opportunity to share in the distribution of national wealth... I pledge myself to a new deal for the American people. This is more than a political campaign. It is a call to arms.

Franklin D. Roosevelt, 1932

The phrase "New Deal" was coined by an adviser to Roosevelt, Stuart Chase, who used A New Deal as the title for an article published in the progressive magazine The New Republic a few days before Roosevelt's speech. Speechwriter Rosenman added it to his draft of FDR's presidential nomination acceptance speech at the last minute. Upon accepting the 1932 Democratic nomination for president, Roosevelt promised "a new deal for the American people". In campaign speeches, Roosevelt committed to carrying out, if elected, several elements of what would become the New Deal, such as unemployment relief and public works programs.

First New Deal (1933–1934)

Roosevelt entered office with clear ideas for policies to address the Great Depression, though he remained open to experimentation as his presidency began implementing these. Among Roosevelt's more famous advisers was an informal "Brain Trust", a group that tended to view pragmatic government intervention in the economy positively. His choice for Secretary of Labor, Frances Perkins, greatly influenced his initiatives. Her list of what her priorities would be if she took the job illustrates: "a forty-hour workweek, a minimum wage, worker's compensation, unemployment compensation, a federal law banning child labor, direct federal aid for unemployment relief, Social Security, a revitalized public employment service and health insurance".

The New Deal policies drew from many different ideas proposed earlier in the 20th century. Assistant Attorney General Thurman Arnold led efforts that hearkened back to an anti-monopoly tradition rooted in American politics by figures such as Andrew Jackson and Thomas Jefferson. Supreme Court Justice Louis Brandeis, an influential adviser to many New Dealers, argued that "bigness" (referring, presumably, to corporations) was a negative economic force, producing waste and inefficiency. However, the anti-monopoly group never had a major impact on New Deal policy. Other leaders such as Hugh S. Johnson of the NRA took ideas from the Woodrow Wilson Administration, advocating techniques used to mobilize the economy for World War I. They brought ideas and experience from the government controls and spending of 1917–1918. Other New Deal planners revived experiments suggested in the 1920s, such as the TVA. The "First New Deal" (1933–1934) encompassed the proposals offered by a wide spectrum of groups (not included was the Socialist Party, whose influence was all but destroyed). This first phase of the New Deal was also characterized by fiscal conservatism (see Economy Act, below) and experimentation with several different, sometimes contradictory, cures for economic ills.

Roosevelt created dozens of new agencies. They are traditionally and typically known to Americans by their alphabetical initials.

The First 100 Days (1933)

The American people were generally extremely dissatisfied with the crumbling economy, mass unemployment, declining wages, and profits, and especially Herbert Hoover's policies such as the Smoot–Hawley Tariff Act and the Revenue Act of 1932. Roosevelt entered office with enormous political capital. Americans of all political persuasions were demanding immediate action and Roosevelt responded with a remarkable series of new programs in the "first hundred days" of the administration, in which he met with Congress for 100 days. During those 100 days of lawmaking, Congress granted every request Roosevelt asked and passed a few programs (such as the Federal Deposit Insurance Corporation to insure bank accounts) that he opposed. Ever since, presidents have been judged against Roosevelt for what they accomplished in their first 100 days. Walter Lippmann famously noted:

At the end of February we were a congeries of disorderly panic-stricken mobs and factions. In the hundred days from March to June, we became again an organized nation confident of our power to provide for our own security and to control our own destiny.

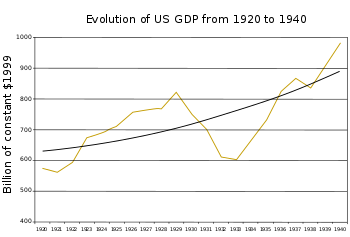

The economy had hit bottom in March 1933 and then started to expand. Economic indicators show the economy reached its lowest point in the first days of March, then began a steady, sharp upward recovery. Thus the Federal Reserve Index of Industrial Production sank to its lowest point of 52.8 in July 1932 (with 1935–1939 = 100) and was practically unchanged at 54.3 in March 1933. However, by July 1933 it reached 85.5, a dramatic rebound of 57% in four months. Recovery was steady and strong until 1937. Except for employment, the economy by 1937 surpassed the levels of the late 1920s. The Recession of 1937 was a temporary downturn. Private sector employment, especially in manufacturing, recovered to the level of the 1920s but failed to advance further until the war. The U.S. population was 124,840,471 in 1932 and 128,824,829 in 1937, an increase of 3,984,468. The ratio of these numbers, times the number of jobs in 1932, means there was a need for 938,000 more jobs in 1937, to maintain the same employment level.

Fiscal policy

The Economy Act, drafted by Budget Director Lewis Williams Douglas, was passed on March 15, 1933. The act proposed to balance the "regular" (non-emergency) federal budget by cutting the salaries of government employees and cutting pensions to veterans by fifteen percent. It saved $500 million per year and reassured deficit hawks, such as Douglas, that the new president was fiscally conservative. Roosevelt argued there were two budgets: the "regular" federal budget, which he balanced; and the emergency budget, which was needed to defeat the depression. It was imbalanced on a temporary basis.

Roosevelt initially favored balancing the budget, but soon found himself running spending deficits to fund his numerous programs. However, Douglas—rejecting the distinction between a regular and emergency budget—resigned in 1934 and became an outspoken critic of the New Deal. Roosevelt strenuously opposed the Bonus Bill that would give World War I veterans a cash bonus. Congress finally passed it over his veto in 1936 and the Treasury distributed $1.5 billion in cash as bonus welfare benefits to 4 million veterans just before the 1936 election.

New Dealers never accepted the Keynesian argument for government spending as a vehicle for recovery. Most economists of the era, along with Henry Morgenthau of the Treasury Department, rejected Keynesian solutions and favored balanced budgets.

Banking reform

At the beginning of the Great Depression, the economy was destabilized by bank failures followed by credit crunches. The initial reasons were substantial losses in investment banking, followed by bank runs. Bank runs occur when a large number of customers withdraw their deposits because they believe the bank might become insolvent. As the bank run progressed, it generated a self-fulfilling prophecy: as more people withdrew their deposits, the likelihood of default increased and this encouraged further withdrawals.

Milton Friedman and Anna Schwartz have argued that the drain of money out of the banking system caused the monetary supply to shrink, forcing the economy to likewise shrink. As credit and economic activity diminished, price deflation followed, causing further economic contraction with disastrous impact on banks. Between 1929 and 1933, 40% of all banks (9,490 out of 23,697 banks) failed. Much of the Great Depression's economic damage was caused directly by bank runs.

Herbert Hoover had already considered a bank holiday to prevent further bank runs but rejected the idea because he was afraid to incite a panic. However, Roosevelt gave a radio address, held in the atmosphere of a Fireside Chat. He explained to the public in simple terms the causes of the banking crisis, what the government would do, and how the population could help. He closed all the banks in the country and kept them all closed until new legislation could be passed.

On March 9, 1933, Roosevelt sent to Congress the Emergency Banking Act, drafted in large part by Hoover's top advisors. The act was passed and signed into law the same day. It provided for a system of reopening sound banks under Treasury supervision, with federal loans available if needed. Three-quarters of the banks in the Federal Reserve System reopened within the next three days. Billions of dollars in hoarded currency and gold flowed back into them within a month, thus stabilizing the banking system. By the end of 1933, 4,004 small local banks were permanently closed and merged into larger banks. Their deposits totaled $3.6 billion. Depositors lost $540 million (equivalent to $12,710,128,535 in 2023) and eventually received on average 85 cents on the dollar of their deposits.

The Glass–Steagall Act limited commercial bank securities activities and affiliations between commercial banks and securities firms to regulate speculations. It also established the Federal Deposit Insurance Corporation (FDIC), which insured deposits for up to $2,500, ending the risk of runs on banks. This banking reform offered unprecedented stability because throughout the 1920s more than five hundred banks failed per year, and then it was less than ten banks per year after 1933.

Monetary reform

Under the gold standard, the United States kept the dollar convertible to gold. The Federal Reserve would have had to execute an expansionary monetary policy to fight the deflation and to inject liquidity into the banking system to prevent it from crumbling—but lower interest rates would have led to a gold outflow. Under the gold standards, price–specie flow mechanism countries that lost gold, but nevertheless wanted to maintain the gold standard, had to permit their money supply to decrease and the domestic price level to decline (deflation). As long as the Federal Reserve had to defend the gold parity of the dollar it had to sit idle while the banking system crumbled.

In March and April in a series of laws and executive orders, the government suspended the gold standard. Roosevelt stopped the outflow of gold by forbidding the export of gold except under license from the Treasury. Anyone holding significant amounts of gold coinage was mandated to exchange it for the existing fixed price of U.S. dollars. The Treasury no longer paid out gold for dollars and gold would no longer be considered valid legal tender for debts in private and public contracts.

The dollar was allowed to float freely on foreign exchange markets with no guaranteed price in gold. With the passage of the Gold Reserve Act in 1934, the nominal price of gold was changed from $20.67 per troy ounce to $35. These measures enabled the Federal Reserve to increase the amount of money in circulation to the level the economy needed. Markets immediately responded well to the suspension in the hope that the decline in prices would finally end. In her essay "What ended the Great Depression?" (1992), Christina Romer argued that this policy raised industrial production by 25% until 1937 and by 50% until 1942.

Securities Act of 1933

Before the Wall Street Crash of 1929, securities were unregulated at the federal level. Even firms whose securities were publicly traded published no regular reports, or even worse, rather misleading reports based on arbitrarily selected data. To avoid another crash, the Securities Act of 1933 was passed. It required the disclosure of the balance sheet, profit and loss statement, and the names and compensations of corporate officers for firms whose securities were traded. Additionally, the reports had to be verified by independent auditors. In 1934, the U.S. Securities and Exchange Commission was established to regulate the stock market and prevent corporate abuses relating to corporate reporting and the sale of securities.

Repeal of Prohibition

In a measure that garnered substantial popular support for his New Deal, Roosevelt moved to put to rest one of the most divisive cultural issues of the 1920s. He signed the bill to legalize the manufacture and sale of alcohol, an interim measure pending the repeal of prohibition, for which a constitutional amendment of repeal (the 21st) was already in process. The repeal amendment was ratified later in 1933. States and cities gained additional new revenue and Roosevelt secured his popularity especially in the cities and ethnic areas by legalizing alcohol.

Relief

Relief was the immediate effort to help the one-third of the population that was hardest hit by the depression. Relief was also aimed at providing temporary help to suffering and unemployed Americans. Local and state budgets were sharply reduced because of falling tax revenue, but New Deal relief programs were used not just to hire the unemployed but also to build needed schools, municipal buildings, waterworks, sewers, streets, and parks according to local specifications. While the regular Army and Navy budgets were reduced, Roosevelt juggled relief funds to provide for their claimed needs. All of the CCC camps were directed by army officers, whose salaries came from the relief budget. The PWA built numerous warships, including two aircraft carriers; the money came from the PWA agency. PWA also built warplanes, and the WPA built military bases and airfields.

Public works

To prime the pump and cut unemployment, the NIRA created the Public Works Administration (PWA), a major program of public works, which organized and provided funds for the building of useful works such as government buildings, airports, hospitals, schools, roads, bridges, and dams. From 1933 to 1935, PWA spent $3.3 billion with private companies to build 34,599 projects, many of them quite large. The NIRA also contained a provision for the "construction, reconstruction, alteration, or repair under public regulation or control of low-cost housing and slum-clearance projects".

Many unemployed people were put to work under Roosevelt on a variety of government-financed public works projects, including the construction of bridges, airports, dams, post offices, hospitals, and hundreds of thousands of miles of road. Through reforestation and flood control, they reclaimed millions of hectares of soil from erosion and devastation. As noted by one authority, Roosevelt's New Deal "was literally stamped on the American landscape".

Farm and rural programs

The rural U.S. was a high priority for Roosevelt and his energetic Secretary of Agriculture, Henry A. Wallace. Roosevelt believed that full economic recovery depended upon the recovery of agriculture and raising farm prices was a major tool, even though it meant higher food prices for the poor living in cities.

Many rural people lived in severe poverty, especially in the South. Major programs addressed to their needs included the Resettlement Administration (RA), the Rural Electrification Administration (REA), rural welfare projects sponsored by the WPA, National Youth Administration (NYA), Forest Service and Civilian Conservation Corps (CCC), including school lunches, building new schools, opening roads in remote areas, reforestation and purchase of marginal lands to enlarge national forests.

In 1933, the Roosevelt administration launched the Tennessee Valley Authority, a project involving dam construction planning on an unprecedented scale to curb flooding, generate electricity, and modernize poor farms in the Tennessee Valley region of the Southern United States. Under the Farmers' Relief Act of 1933, the government paid compensation to farmers who reduced output, thereby raising prices. Because of this legislation, the average income of farmers almost doubled by 1937.

In the 1920s, farm production had increased dramatically thanks to mechanization, more potent insecticides, and increased use of fertilizer. Due to an overproduction of agricultural products, farmers faced severe and chronic agricultural depression throughout the 1920s. The Great Depression even worsened the agricultural crises and, at the beginning of 1933, agricultural markets nearly faced collapse. Farm prices were so low that in Montana wheat was rotting in the fields because it could not be profitably harvested. In Oregon, sheep were slaughtered and left to rot because meat prices were not sufficient to warrant transportation to markets.

Roosevelt was keenly interested in farm issues and believed that true prosperity would not return until farming was prosperous. Many different programs were directed at farmers. The first 100 days produced the Farm Security Act to raise farm incomes by raising the prices farmers received, which was achieved by reducing total farm output. The Agricultural Adjustment Act created the Agricultural Adjustment Administration (AAA) in May 1933. The act reflected the demands of leaders of major farm organizations (especially the Farm Bureau) and reflected debates among Roosevelt's farm advisers such as Secretary of Agriculture Henry A. Wallace, M.L. Wilson, Rexford Tugwell and George Peek.

The AAA aimed to raise prices for commodities through artificial scarcity. The AAA used a system of domestic allotments, setting total output of corn, cotton, dairy products, hogs, rice, tobacco, and wheat. The farmers themselves had a voice in the process of using the government to benefit their incomes. The AAA paid land owners subsidies for leaving some of their land idle with funds provided by a new tax on food processing. To force up farm prices to the point of "parity", 10 million acres (40,000 km2) of growing cotton was plowed up, bountiful crops were left to rot and six million piglets were killed and discarded.

The idea was to give farmers a "fair exchange value" for their products in relation to the general economy ("parity level"). Farm incomes and the income for the general population recovered fast since the beginning of 1933. Food prices remained still well below the 1929 peak. The AAA established an important and long-lasting federal role in the planning of the entire agricultural sector of the economy and was the first program on such a scale for the troubled agricultural economy. The original AAA targeted landowners, and therefore did not provide for any sharecroppers or tenants or farm laborers who might become unemployed.

A Gallup poll printed in The Washington Post revealed that a majority of the American public opposed the AAA. In 1936, the Supreme Court declared the AAA to be unconstitutional, stating, "a statutory plan to regulate and control agricultural production, [is] a matter beyond the powers delegated to the federal government". The AAA was replaced by a similar program that did win Court approval. Instead of paying farmers for letting fields lie barren, this program subsidized them for planting soil-enriching crops such as alfalfa that would not be sold on the market. Federal regulation of agricultural production has been modified many times since then, but together with large subsidies is still in effect.

A number of other measures affecting rural areas were introduced under Roosevelt. The Farm Credit Act of 1933 authorized farmers "to organize a nationwide system of local credit cooperatives -- production credit associations -- to make operating credit readily accessible to farmers throughout the country." The Farm Mortgage Foreclosure Act of 1934 provided for debt reduction and the redemption of foreclosed farms, and the Homestead Settler's Act of 1934 liberalized homestead residence requirements. The Farm Research Act of 1935 included various provisions such as the development of cooperative agricultural extension, and the Commodity Exchange Act of 1936 enabled "the Commodity Credit Corporation to better serve the needs of farmers in orderly marketing, and provided credit and facilities for carrying surpluses from season to season". The Farmers Mortgage Amendatory Act of 1936 authorized the Reconstruction Finance Corporation to make loans to drainage, levee, and irrigation districts, while under the Soil Conservation and Domestic Allotment Act of 1936 payments to farmers to encourage conservation were authorized. In 1937, the Water Facilities Act was enacted "to provide loans for individuals and association farm water systems in 17 Western states where drought and water shortage were familiar hardships."

The Bankhead–Jones Farm Tenant Act of 1937 was the last major New Deal legislation that concerned farming. It created the Farm Security Administration (FSA), which replaced the Resettlement Administration.

The Food Stamp Plan, a major new welfare program for urban poor, was established in 1939 to provide stamps to poor people who could use them to purchase food at retail outlets. The program ended during wartime prosperity in 1943 but was restored in 1961. It survived into the 21st century with little controversy because it was seen to benefit the urban poor, food producers, grocers, wholesalers, and farmers, so it gained support from both progressive and conservative Congressmen. In 2013, Tea Party activists in the House nonetheless tried to end the program, now known as the Supplemental Nutrition Assistance Program, while the Senate fought to preserve it.

Recovery

Recovery was the effort in numerous programs to restore the economy to normal levels. By most economic indicators, this was achieved by 1937—except for unemployment, which remained stubbornly high until World War II began. Recovery was designed to help the economy bounce back from depression. Economic historians led by Price Fishback have examined the impact of New Deal spending on improving health conditions in the 114 largest cities, 1929–1937. They estimated that every additional $153,000 in relief spending (in 1935 dollars, or $1.95 million in the year 2000 dollars) was associated with a reduction of one infant death, one suicide, and 2.4 deaths from infectious diseases.

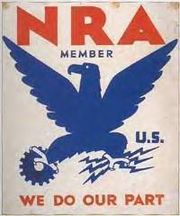

NRA "Blue Eagle" campaign

From 1929 to 1933, the industrial economy suffered from a vicious cycle of deflation. Since 1931, the U.S. Chamber of Commerce, the voice of the nation's organized business, promoted an anti-deflationary scheme that would permit trade associations to cooperate in government-instigated cartels to stabilize prices within their industries. Though existing antitrust laws clearly forbade such practices, the organized business were entertained by the Roosevelt Administration.

Roosevelt's advisors believed that excessive competition and technical progress had led to overproduction and lowered wages and prices, which they believed lowered demand and employment (deflation). He argued that government economic planning was necessary to remedy this. New Deal economists argued that cut-throat competition had hurt many businesses and that with prices having fallen 20% and more, "deflation" exacerbated the burden of debt and would delay recovery. They rejected a strong move in Congress to limit the workweek to 30 hours. Instead, their remedy, designed in cooperation with big business, was the National Industrial Recovery Act (NIRA). It included stimulus funds for the WPA to spend and sought to raise prices, give more bargaining power for unions (so the workers could purchase more), and reduce harmful competition.

At the center of the NIRA was the National Recovery Administration (NRA), headed by former General Hugh S. Johnson, who had been a senior economic official in World War I. Johnson called on every business establishment in the nation to accept a stopgap "blanket code": a minimum wage of between 20 and 45 cents per hour, a maximum workweek of 35–45 hours and the abolition of child labor. Johnson and Roosevelt contended that the "blanket code" would raise consumer purchasing power and increase employment. To mobilize political support for the NRA, Johnson launched the "NRA Blue Eagle" publicity campaign to boost what he called "industrial self-government". The NRA brought together leaders in each industry to design specific sets of codes for that industry—the most important provisions were anti-deflationary floors below which no company would lower prices or wages and agreements on maintaining employment and production. In a remarkably short time, the NRA announced agreements from almost every major industry in the nation. By March 1934, industrial production was 45% higher than in March 1933.

NRA Administrator Hugh Johnson was showing signs of a mental breakdown due to the extreme pressure and workload of running the National Recovery Administration. Johnson lost power in September 1934, but kept his title. Roosevelt replaced his position with a new National Industrial Recovery Board, of which Donald Richberg was named Executive Director.

On May 27, 1935, the NRA was found to be unconstitutional by a unanimous decision of the U.S. Supreme Court in the case of A.L.A. Schechter Poultry Corp. v. United States. After the end of the NRA, quotas in the oil industry were fixed by the Railroad Commission of Texas with Tom Connally's federal Hot Oil Act of 1935, which guaranteed that illegal "hot oil" would not be sold. By the time NRA ended in May 1935, well over 2 million employers accepted the new standards laid down by the NRA, which had introduced a minimum wage and an eight-hour workday, together with abolishing child labor. These standards were reintroduced by the Fair Labor Standards Act of 1938.

Historian William E. Leuchtenburg argued in 1963:

The NRA could boast some considerable achievements: it gave jobs to some two million workers; it helped stop a renewal of the deflationary spiral that had almost wrecked the nation; it did something to improve business ethics and civilize competition; it established a national pattern of maximum hours and minimum wages; and it all but wiped out child labor and the sweatshop. But this was all it did. It prevented things from getting worse, but it did little to speed recovery, and probably actually hindered it by its support of restrictionism and price raising. The NRA could maintain a sense of national interest against private interests only so long as the spirit of national crisis prevailed. As it faded, restriction-minded businessmen moved into a decisive position of authority. By delegating power over price and production to trade associations, the NRA created a series of private economic governments.

Other labor measures were carried out under the First New Deal. The Wagner-Peyser Act of 1933 established a national system of public employment offices, and the Anti-Kickback Act of 1934 "established penalties for employers on Government contracts who induce employees to return any part of pay to which they are entitled". That same year, the Railway Labor Act of 1926 was amended "to outlaw company unions and yellow dog contracts, and to provide that the majority of any craft or class of employees shall determine who shall represent them in collective bargaining". In July 1933, Secretary of Labor Frances Perkins held at the Department of Labor what was described as "a very successful conference of 16 state minimum wage boards (some of the states had minimum wage laws long before the Federal Government)". The following year she held a two-day conference on state labor legislation in which 39 states were represented. According to one study, "State officials in attendance were gratified that the U.S. Department of Labor was showing interest in their problems. They called on Perkins to make the labor legislation conferences an annual event. She did so and participated actively in them every year until she left office. The conferences continued under Labor Department auspices for another ten years, by which time they had largely accomplished their goal of improving and standardizing state labor laws and administration." As a means of institutionalizing the work she tried to achieve with these conferences, Perkins established the Division of Labor Standards (which was later redesignated a bureau) in 1934 as a service agency and informational clearinghouse for state governments and other federal agencies. Its goal was to promote (through voluntary means) improved conditions of work, and the Division "offered many services in addition to helping the states deal with administrative problems". It offered, for instance, training for factory inspectors, and drew national attention "to the area of workers' health with a series of conferences on silicosis. This wide-spread lung disease had been dramatized by the 'Gauley Bridge Disaster' in which hundreds of tunnel workers died from breathing silica-filled air. The Division also worked with unions, whose support was needed in passing labor legislation in the States."

The Muscle Shoals Act contained various provisions of interest to labor, including prevailing wage rate and workmen's compensation. A resolution approved by the Senate, June 13, authorized the President to accept membership for the Government of the United States in the International Labor Organization, without assuming any obligation under the covenant of the League of Nations. The resolution was approved by the House, June 16, by a vote of 232 to 109. Public Act 448 amended the Federal Employees' Civil Service Retirement Act of 1930 by, as noted by one study, "giving to the employee the right to name a beneficiary irrespective of the amount to his credit without the need of an appointment of an administrator". Public Act No. 245 "provided for the development of vocational education in the States by appropriating funds for the fiscal years 1935, 1936 and 1937, and Public Act 296 amended the United States Bankruptcy Act with safeguards for labor. Public Act No. 349 provided for hourly rates of pay for substitute laborers in the mail service and time credits when appointed as regular laborers, and Public Act No. 461 authorized the President to create a "federal prison industries", in which inmates hereafter "receiving injuries while in the course of their employment will receive the benefits of compensation, limited however to that amount prescribed in the Federal Employees' Compensation Act". Public Act No. 467 created a Federal Credit Union Law, one of the main purposes of which was to make a system of credit for provident purposes available to people of small means. For those in the District of Columbia, an Act concerning fire escapes on certain buildings was amended by Public Act No. 284."

Housing sector

The New Deal had an important impact on the housing field. The New Deal followed and increased President Hoover's lead-and-seek measures. The New Deal sought to stimulate the private home building industry and increase the number of individuals who owned homes. The Public Works Administration of the Interior Department planned to construct public housing across the country, providing low-rent apartments for low-income families. However resistance from the private housing sector was strong except in New York city, which welcomed the program. Furthermore, the White House reallocated most of the funding into relief projects, where each million federal dollars would create more jobs for the unemployed. As a result by 1937 there were only 49 projects nationwide, containing about 21,800 apartments. It was taken over in 1938 by the Federal Housing Administration (FHA). Starting in 1933 the New Deal operated the new Home Owners' Loan Corporation (HOLC) that helped finance mortgages on private houses.

Programs

HOLC set uniform national appraisal methods and simplified the mortgage process. The Federal Housing Administration (FHA) created national standards for home construction. In 1934 the Alley Dwelling Authority was established by Congress "to provide for the discontinuation of the use as dwellings of the buildings situated in alleys in the District of Columbia". That year, a National Housing Act was approved which was aimed at improving employment while making private credit available for repairing and homebuilding. In 1938 this act was amended and as noted by one study "provision was made renewing the insurance on repair loans, for insuring mortgages up to 90 percent of the value of small-owner –occupied homes, and for insuring mortgages on rental property".

Redlining

This also marked the beginning of discriminatory redlining within the United states under the HOLC. Their maps broadly determined what housing loans would be backed by the federal government. Though other criteria existed, the most major criterion was race. Any neighborhood with "inharmonious racial groups" would either be marked red or yellow, depending on the proportion of black residents. This was explicitly stated within the FHA underwriting manual that the HOLC used as a guideline for its maps.

Alongside other discriminatory housing policy, this meant in practice is that Black Americans were denied federally backed mortgages locking most out of the housing market and all Americans were denied backing for any loans within black neighborhood. Lastly, for the other policies in place meant for neighborhood building projects, the federal government required they be explicitly segregated to be backed. The federal government's financial backing also required the use of racially restrictive covenants, that banned white homeowners from reselling their house to any black buyers.

Reform

Reform was based on the assumption that the depression was caused by the inherent instability of the market and that government intervention was necessary to rationalize and stabilize the economy and to balance the interests of farmers, business, and labor. Reforms targeted the causes of the depression and sought to prevent a crisis like it from happening again. In other words, this sought to financially rebuild the U.S. while ensuring not to repeat history.

Trade liberalization

Most economic historians assert that protectionist policies, culminating in the Smoot-Hawley Act of 1930, worsened the Depression. Roosevelt already spoke against the act while campaigning for president during 1932. In 1934, the Reciprocal Tariff Act was drafted by Cordell Hull. It gave the president power to negotiate bilateral, reciprocal trade agreements with other countries. The act enabled Roosevelt to liberalize American trade policy around the globe and it is widely credited with ushering in the era of liberal trade policy that persists to this day.

Puerto Rico

The Puerto Rico Reconstruction Administration oversaw a separate set of programs in Puerto Rico. It promoted land reform and helped small farms, it set up farm cooperatives, promoted crop diversification, and helped the local industry.

Second New Deal (1935–1936)

In the spring of 1935, responding to the setbacks in the Court, a new skepticism in Congress, and the growing popular clamor for more dramatic action, New Dealers passed important new initiatives. Historians refer to them as the "Second New Deal" and note that it was more progressive and more controversial than the "First New Deal" of 1933–1934.

Social Security Act

Until 1935, only a dozen states had implemented old-age insurance, and these programs were woefully underfunded. Just one state (Wisconsin) had an insurance program. The United States was the only modern industrial country where people faced the Depression without any national system of social security. The work programs of the "First New Deal" such as CWA and FERA were designed for immediate relief, for a year or two.

The most important program of 1935, and perhaps of the New Deal itself, was the Social Security Act. It established a permanent system of universal retirement pensions (Social Security), unemployment insurance and welfare benefits for the handicapped and needy children in families without a father present. It established the framework for the U.S. welfare system. Roosevelt insisted that it should be funded by payroll taxes rather than from the general fund—he said: "We put those payroll contributions there so as to give the contributors a legal, moral, and political right to collect their pensions and unemployment benefits. With those taxes in there, no damn politician can ever scrap my social security program".

Labor relations

The National Labor Relations Act of 1935, also known as the Wagner Act, finally guaranteed workers the rights to collective bargaining through unions of their own choice. The Act also established the National Labor Relations Board (NLRB) to facilitate wage agreements and to suppress the repeated labor disturbances. The Wagner Act did not compel employers to reach agreement with their employees, but it opened possibilities for American labor. The result was a tremendous growth of membership in the labor unions, especially in the mass-production sector, led by the older and larger American Federation of Labor and the new, more radical Congress of Industrial Organizations. Labor thus became a major component of the New Deal political coalition. However, the intense battle for members between the AFL and the CIO coalitions weakened labor's power.

To help agricultural labor, the 1934 Jones-Costigan Act included provisions such as the prohibition of child labor under the age of 14, limited the working hours of children aged 14–16, and the granting to the USDA "the authority to fix minimum wages, but only after holding public hearings 'at a place accessible to producers and workers'". In addition, the Act called for farmers "to pay their workers 'promptly' and 'in full' before collecting their benefit payments as a way to deal with the historic inequalities embedded in staggered payments and hold-back clauses". This Act was replaced by the 1937 Sugar Act after the Supreme Court ruled the AAA unconstitutional. In passing the Act, Congress not only followed Roosevelt's advice by continuing the previous Act's labor provisions but strengthened them. As noted by one study, the Act "once again prohibited child labor and made the 'fair, reasonable and equitable' minimum wage determinations mandatory". The Public Contracts (Walsh-Healey) Act of 1936 established labor standards on government contracts, "including minimum wages, overtime compensation for hours in excess of 8 a day or 40 a week, child and convict labor provisions, and health and safety requirements". The Anti-Strikebreaker (Byrnes) Act from that same year declared it unlawful "to transport or aid in transporting strikebreakers in interstate or foreign commerce".

The Davis-Bacon Act Amendment (Public Act 403) was approved in August 1935, "Establishing prevailing wages for mechanics and laborers employed on public buildings and public works". Under the Miller Act of 1935, as noted by one study, "every construction worker or person who furnished material on a covered contract has the right to sue the contractor or surety if not fully paid within 90 days after performing labor or furnishing such material". The Motor Carrier Act of 1935, as noted by one study, "authorized the Interstate Commerce Commission to limit the hours of service and to prescribe other measures to safeguard motor carrier employees and passengers, as well as the users of highways generally". The Merchant Marine Act of 1936 directed the Maritime Commission "to investigate and specify suitable wage and manning scales and working conditions with respect to subsidized ships". Public Act 783 of March 1936 sought to extend "the facilities of the Public Health Service to seamen on Government vessels not in the military or Naval establishments". The Railway Labor Act Amendment (Public Act 487) was approved in April 1936, "Extending protection of Railway Labor Act to employees of air transportation companies engaged in interstate and foreign commerce".

The Bituminous Coal Act of 1937 contained various labor provisions such as prohibiting "requiring an employee or applicant for employment to join a company union". A national Railroad Retirement program was introduced that year, which in 1938 also introduced unemployment benefits. The Randolph-Sheppard Act provided for "licensing of blind persons to operate vending stands in Federal buildings". Public Law No. 814 of the 74th Congress, as noted by one study, conferred jurisdiction "upon each of the several states to extend the provisions of their State workmen's compensation laws to employments on Federal property and premises located within the respective States". The National Apprenticeship Act of 1937 established standards for apprenticeship programs. The Chandler Act of 1938 allowed wage earners "to extend debt payments over longer periods of time." That same year the Interstate Commerce Commission "issued an order regulating the hours of drivers of motor vehicles engaged in interstate commerce". The Wagner-O'Day Act in 1938 set up a program "designed to increase employment opportunities for persons who are blind so they could manufacture and sell their goods to the federal government".

Public Act No. 702 provided an 8-hour day for officers and seamen on certain vessels that navigated the Great Lakes and adjacent waters, and the Second Deficiency Appropriation Act (Public, No. 723) contained an appropriation for investigating labor conditions in Hawaii. Public Act No. 706 provided for the preservation of the right of air carrier employees "to obtain higher compensation and better working conditions so as to conform to a decision of the National Labor Board of May 10, 1934 (No. 83). Under Public Act No. 486 the provisions of section 13 of the air-mail act of 1934 "relating to pay, working conditions, and relations of pilots and other employees shall apply to all contracts awarded under the act". A number of laws affecting federal employees were also enacted. An act of 1936, for instance, provided vacations and accumulated leaves for Government employees, and another 1936 act provided for accumulated sick leave with pay for Government employees.

The Fair Labor Standards Act of 1938 set maximum hours (44 per week) and minimum wages (25 cents per hour) for most categories of workers. Child labor of children under the age of 16 was forbidden and children under 18 years were forbidden to work in hazardous employment. As a result, the wages of 300,000 workers, especially in the South, were increased and the hours of 1.3 million were reduced.

Consumer rights

Various laws were also passed to advance consumer rights. In 1935 the Public Utility Holding Company Act of 1935 was passed "to protect consumers and investors from abuses by holding companies with interests in gas and electric utilities". The Federal Power Act of 1935 sought "to protect customers and to assure reasonableness in the provision of a service essential to life in modern society". The Natural Gas Act of 1938 sought protect consumers "against exploitation at the hands of natural gas companies". The Food, Drug and Cosmetic Act of 1938 granted to the Food and Drug Administration "the power to test and license drugs and to test the safety of cosmetics, and to the Department of Agriculture the authority to set food quality standards." In addition, the Wheeler-Lea Act "gave the Free Trade Commission, an old Progressive agency, the power to prohibit unfair and deceptive business acts or practices."

Works Progress Administration

Roosevelt nationalized unemployment relief through the Works Progress Administration (WPA), headed by close friend Harry Hopkins. Roosevelt had insisted that the projects had to be costly in terms of labor, beneficial in the long term and the WPA was forbidden to compete with private enterprises—therefore the workers had to be paid smaller wages. The Works Progress Administration (WPA) was created to return the unemployed to the workforce. The WPA financed a variety of projects such as hospitals, schools, and roads, and employed more than 8.5 million workers who built 650,000 miles of highways and roads, 125,000 public buildings as well as bridges, reservoirs, irrigation systems, parks, playgrounds and so on.

Prominent projects were the Lincoln Tunnel, the Triborough Bridge, the LaGuardia Airport, the Overseas Highway and the San Francisco–Oakland Bay Bridge. The Rural Electrification Administration used cooperatives to bring electricity to rural areas, many of which still operate. Between 1935 and 1940, the percentage of rural homes lacking electricity fell from 90% to 40.% The National Youth Administration was another semi-autonomous WPA program for youth. Its Texas director, Lyndon B. Johnson, later used the NYA as a model for some of his Great Society programs in the 1960s.[140] The WPA was organized by states, but New York City had its own branch Federal One, which created jobs for writers, musicians, artists and theater personnel. It became a hunting ground for conservatives searching for communist employees.

The Federal Writers' Project operated in every state, where it created a famous guide book—it also catalogued local archives and hired many writers, including Margaret Walker, Zora Neale Hurston and Anzia Yezierska, to document folklore. Other writers interviewed elderly ex-slaves and recorded their stories.

Under the Federal Theater Project, headed by charismatic Hallie Flanagan, actresses and actors, technicians, writers and directors put on stage productions. The tickets were inexpensive or sometimes free, making theater available to audiences unaccustomed to attending plays.

One Federal Art Project paid 162 trained woman artists on relief to paint murals or create statues for newly built post offices and courthouses. Many of these works of art can still be seen in public buildings around the country, along with murals sponsored by the Treasury Relief Art Project of the Treasury Department. During its existence, the Federal Theatre Project provided jobs for circus people, musicians, actors, artists, and playwrights, together with increasing public appreciation of the arts.

Tax policy

In 1935, Roosevelt called for a tax program called the Wealth Tax Act (Revenue Act of 1935) to redistribute wealth. The bill imposed an income tax of 79% on incomes over $5 million. Since that was an extraordinarily high income in the 1930s, the highest tax rate actually covered just one individual—John D. Rockefeller. The bill was expected to raise only about $250 million in additional funds, so revenue was not the primary goal. Morgenthau called it "more or less a campaign document". In a private conversation with Raymond Moley, Roosevelt admitted that the purpose of the bill was "stealing Huey Long's thunder" by making Long's supporters of his own. At the same time, it raised the bitterness of the rich who called Roosevelt "a traitor to his class" and the wealth tax act a "soak the rich tax".

A tax called the undistributed profits tax was enacted in 1936. This time the primary purpose was revenue, since Congress had enacted the Adjusted Compensation Payment Act, calling for payments of $2 billion to World War I veterans. The bill established the persisting principle that retained corporate earnings could be taxed. Paid dividends were tax deductible by corporations. Its proponents intended the bill to replace all other corporation taxes—believing this would stimulate corporations to distribute earnings and thus put more cash and spending power in the hands of individuals. In the end, Congress watered down the bill, setting the tax rates at 7 to 27% and largely exempting small enterprises. Facing widespread and fierce criticism, the tax deduction of paid dividends was repealed in 1938.

Housing Act of 1937

The United States Housing Act of 1937 created the United States Housing Authority within the U.S. Department of the Interior. It was one of the last New Deal agencies created. The bill passed in 1937 with some Republican support to abolish slums.

Political alignment

By 1936, the term "progressive" was typically used for supporters of the New Deal and "conservative" for its opponents. Roosevelt was assisted in his endeavors by the election of a liberal Congress in 1932. According to one source "We recognize that the best liberal legislation in American history was enacted following the election of President Roosevelt and a liberal Congress in 1932. After the midterm congressional election setbacks in 1938, labor was faced with a hostile congress until 1946. Only the presidential veto prevented the enactment of reactionary anti-labor laws." In noting the composition of the Seventy-Third Congress, one study has stated: "Though much of the Democratic congressional leadership remained old-guard, southern, agrarian, and conservative, the rank-and-file Democratic majorities in both houses were largely made up of fresh, northern, urban-industrial representatives of at least potentially liberal bent. At a minimum they were impatient with inaction, and not likely to be silenced by appeals to tradition. They were, as yet, an unformed and reckoned force, one that Roosevelt might mould to his purposes of remaking his party – or one whose very strength and impetuosity might force the president's hand." As stated by another study, in regards to the gains the Democrats made in the 1932 midterm elections, "The party gained ninety seats in the house and thirteen in the Senate. Even more significant, from the standpoint of potential support for urban programs, was that non-Southern Democrats represented a working majority in the House for the first of what would be only a few times in the twentieth century. Roosevelt's political instincts mood paralleled the mood of Congress, and he sought policies to tie the party's new urban supporters into a permanent majority coalition behind the Democratic Party." As noted by another study, "President Roosevelt's extraordinary legislative accomplishments between 1933 and 1938 owed much to his personal political qualities, but ideologically favourable large partisan majorities in the House and the Senate were a prerequisite of success."

As one journal reflected in 1950: "Look back to the 1930's and you can see how winning in mid-terms years affects the kind of laws that are passed. A tremendous liberal majority was swept in with Franklin Roosevelt in 1932. In the 1934 mid-term races that liberal majority was increased. After 1936 it went even higher."

From 1934 to 1938, there existed a "pro-spender" majority in Congress (drawn from two-party, competitive, non-machine, progressive and left party districts). In the 1938 midterm election, Roosevelt and his progressive supporters lost control of Congress to the bipartisan conservative coalition. Many historians distinguish between the First New Deal (1933–1934) and a Second New Deal (1935–1936), with the second one more progressive and more controversial.

Court-packing plan and jurisprudential shift

When the Supreme Court started abolishing New Deal programs as unconstitutional, Roosevelt launched a surprise counter-attack in early 1937. He proposed adding five new justices, but conservative Democrats revolted, led by the Vice President. The Judiciary Reorganization Bill of 1937 failed—it never reached a vote. Momentum in Congress and public opinion shifted to the right and very little new legislation was passed expanding the New Deal. However, retirements allowed Roosevelt to put supporters on the Court and it stopped killing New Deal programs.

Recession of 1937 and recovery

The Roosevelt administration was under assault during Roosevelt's second term, which presided over a new dip in the Great Depression in the fall of 1937 that continued through most of 1938. Production and profits declined sharply. Unemployment jumped from 14.3% in May 1937 to 19.0% in June 1938. The downturn could have been explained by the familiar rhythms of the business cycle, but until 1937 Roosevelt had claimed responsibility for the excellent economic performance. That backfired in the recession and the heated political atmosphere of 1937.

John Maynard Keynes did not think that the New Deal under Roosevelt single-handedly ended the Great Depression: "It is, it seems, politically impossible for a capitalistic democracy to organize expenditure on the scale necessary to make the grand experiments which would prove my case—except in war conditions."

World War II and full employment

The U.S. reached full employment after entering World War II in December 1941. Under the special circumstances of war mobilization, massive war spending doubled the gross national product (GNP). Military Keynesianism brought full employment and federal contracts were cost-plus. Instead of competitive bidding to get lower prices, the government gave out contracts that promised to pay all the expenses plus a modest profit. Factories hired everyone they could find regardless of their lack of skills—they simplified work tasks and trained the workers, with the federal government paying all the costs. Millions of farmers left marginal operations, students quit school and housewives joined the labor force.

The emphasis was for war supplies as soon as possible, regardless of cost and inefficiencies. Industry quickly absorbed the slack in the labor force and the tables turned such that employers needed to actively and aggressively recruit workers. As the military grew, new labor sources were needed to replace the 12 million men serving in the military. Propaganda campaigns started pleading for people to work in the war factories. The barriers for married women, the old, the unskilled—and (in the North and West) the barriers for racial minorities—were lowered.

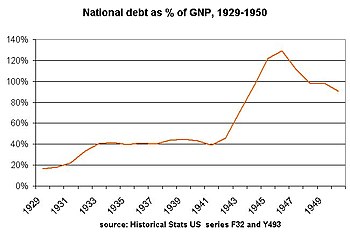

Federal budget soars

In 1929, federal expenditures accounted for only 3% of GNP. Between 1933 and 1939, federal expenditures tripled, but the national debt as a percent of GNP showed little change. Spending on the war effort quickly eclipsed spending on New Deal programs. In 1944, government spending on the war effort exceeded 40% of GNP. These controls shared broad support among labor and business, resulting in cooperation between the two groups and the U.S. government. This cooperation resulted in the government subsidizing business and labor through both direct and indirect methods.

Wartime welfare projects

Conservative domination of Congress during the war meant that all welfare projects and reforms had to have their approval, which was given when business supported the project. For example, the Coal Mines Inspection and Investigation Act of 1941 significantly reduced fatality rates in the coal-mining industry, saving workers' lives and company money. In terms of welfare, the New Dealers wanted benefits for everyone according to need. However, conservatives proposed benefits based on national service—especially tied to military service or working in war industries—and their approach won out.

The Community Facilities Act of 1940 (the Lanham Act) provided federal funds to defense-impacted communities where the population had soared and local facilities were overwhelmed. It provided money for the building of segregated housing for war workers as well as recreational facilities, water, and sanitation plants, hospitals, day care centers, and schools.

The Servicemen's Dependents Allowance Act of 1942 provided family allowances for dependents of enlisted men. Emergency grants to states were authorized in 1942 for programs for day care for children of working mothers. In 1944, pensions were authorized for all physically or mentally helpless children of deceased veterans regardless of the age of the child at the date the claim was filed or at the time of the veteran's death, provided the child was disabled at the age of sixteen and that the disability continued to the date of the claim. The Public Health Service Act, which was passed that same year, expanded federal-state public health programs and increased the annual amount for grants for public health services.

The Emergency Maternity and Infant Care Program (EMIC), introduced in March 1943 by the Children's Bureau, provided free maternity care and medical treatment during an infant's first year for the wives and children of military personnel in the four lowest enlisted pay grades. One out of seven births was covered during its operation. EMIC paid $127 million to state health departments to cover the care of 1.2 million new mothers and their babies. The average cost of EMIC maternity cases completed was $92.49 for medical and hospital care. A striking effect was the sudden rapid decline in home births as most mothers now had paid hospital maternity care.

Under the 1943 Disabled Veterans Rehabilitation Act, vocational rehabilitation services were offered to wounded World War II veterans and some 621,000 veterans would go on to receive assistance under this program. The G.I. Bill (Servicemen's Readjustment Act of 1944) was a landmark piece of legislation, providing 16 million returning veterans with benefits such as housing, educational and unemployment assistance and played a major role in the postwar expansion of the American middle class.

Fair Employment Practices

In response to the March on Washington Movement led by A. Philip Randolph, Roosevelt promulgated Executive Order 8802 in June 1941, which established the President's Committee on Fair Employment Practices (FEPC) "to receive and investigate complaints of discrimination" so that "there shall be no discrimination in the employment of workers in defense industries or government because of race, creed, color, or national origin".

Growing equality of income

A major result of the full employment at high wages was a sharp, long-lasting decrease in the level of income inequality (Great Compression). The gap between rich and poor narrowed dramatically in the area of nutrition because food rationing and price controls provided a reasonably priced diet to everyone. White collar workers did not typically receive overtime and therefore the gap between white collar and blue collar income narrowed. Large families that had been poor during the 1930s had four or more wage earners and these families shot to the top one-third income bracket. Overtime provided large paychecks in war industries and average living standards rose steadily, with real wages rising by 44% in the four years of war, while the percentage of families with an annual income of less than $2,000 fell from 75% to 25% of the population.

In 1941, 40% of all American families lived on less than the $1,500 per year defined as necessary by the Works Progress Administration for a modest standard of living. The median income stood at $2,000 per year, and 8 million workers earned below the legal minimum. From 1939 to 1944, wages and salaries more than doubled, with overtime pay and the expansion of jobs leading to a 70% rise in average weekly earnings during the course of the war. Membership in organized labor increased by 50% between 1941 and 1945 and because the War Labor Board sought labor-management peace, new workers were encouraged to participate in the existing labor organizations, thereby receiving all the benefits of union membership such as improved working conditions, better fringe benefits, and higher wages. As noted by William H. Chafe, "with full employment, higher wages and social welfare benefits provided under government regulations, American workers experienced a level of well-being that, for many, had never occurred before". According to one study over 60% of Americans lived in poverty in 1933, and under 40% did so by 1945.

As a result of the new prosperity, consumer expenditures rose by nearly 50%, from $61.7 billion at the start of the war to $98.5 billion by 1944. Individual savings accounts climbed almost sevenfold during the course of the war. The share of total income held by the top 5% of wage earners fell from 22% to 17% while the bottom 40% increased their share of the economic pie. In addition, during the course of the war, the proportion of the American population earning less than $3,000 (in 1968 dollars) fell by half.

Legacy

According to the Encyclopædia Britannica, "perhaps the greatest achievement of the New Deal was to restore faith in American democracy at a time when many people believed that the only choice left was between communism and fascism".

Analysts agree the New Deal produced a new political coalition that sustained the Democratic Party as the majority party in national politics into the 1960s. A 2013 study found, "an average increase in New Deal relief and public works spending resulted in a 5.4 percentage point increase in the 1936 Democratic voting share and a smaller amount in 1940. The estimated persistence of this shift suggests that New Deal spending increased long-term Democratic support by 2 to 2.5 percentage points. Thus, it appears that Roosevelt's early, decisive actions created long-lasting positive benefits for the Democratic party... The New Deal did play an important role in consolidating Democratic gains for at least two decades".

However, there is disagreement about whether it marked a permanent change in values. Cowie and Salvatore in 2008 argued that it was a response to Depression and did not mark a commitment to a welfare state because the U.S. has always been too individualistic. MacLean rejected the idea of a definitive political culture. She says they overemphasized individualism and ignored the enormous power that big capital wields, the Constitutional restraints on radicalism and the role of racism, antifeminism and homophobia. She warns that accepting Cowie and Salvatore's argument that conservatism's ascendancy is inevitable would dismay and discourage activists on the left. Klein responds that the New Deal did not die a natural death—it was killed off in the 1970s by a business coalition mobilized by such groups as the Business Roundtable, the Chamber of Commerce, trade organizations, conservative think tanks and decades of sustained legal and political attacks.

Historians generally agree that during Roosevelt's 12 years in office there was a dramatic increase in the power of the federal government as a whole. Roosevelt also established the presidency as the prominent center of authority within the federal government. Roosevelt created a large array of agencies protecting various groups of citizens—workers, farmers, and others—who suffered from the crisis and thus enabled them to challenge the powers of the corporations. In this way, the Roosevelt administration generated a set of political ideas—known as New Deal Progressivism—that remained a source of inspiration and controversy for decades. New Deal liberalism lay the foundation of a new consensus. Between 1940 and 1980, there was the progressive consensus about the prospects for the widespread distribution of prosperity within an expanding capitalist economy. Especially Harry S. Truman's Fair Deal and in the 1960s Lyndon B. Johnson's Great Society used the New Deal as inspiration for a dramatic expansion of progressive programs.

The New Deal's enduring appeal on voters fostered its acceptance by moderate and progressive Republicans.

As the first Republican president elected after Roosevelt, Dwight D. Eisenhower (1953–1961) built on the New Deal in a manner that embodied his thoughts on efficiency and cost-effectiveness. He sanctioned a major expansion of Social Security by a self-financed program. He supported such New Deal programs as the minimum wage and public housing—he greatly expanded federal aid to education and built the Interstate Highway system primarily as defense programs (rather than jobs program). In a private letter, Eisenhower wrote:

Should any party attempt to abolish social security and eliminate labor laws and farm programs, you would not hear of that party again in our political history. There is a tiny splinter group of course, that believes you can do these things [...] Their number is negligible and they are stupid.

In 1964, Barry Goldwater, an unreconstructed anti–New Dealer, was the Republican presidential candidate on a platform that attacked the New Deal. The Democrats under Lyndon B. Johnson won a massive landslide and Johnson's Great Society programs extended the New Deal. However, the supporters of Goldwater formed the New Right which helped to bring Ronald Reagan into the White House in the 1980 presidential election. Once an ardent supporter of the New Deal, Reagan turned against it, now viewing government as the problem rather than solution and, as president, moved the nation away from the New Deal model of government activism, shifting greater emphasis to the private sector.

A 2016 review study of the existing literature in the Journal of Economic Literature summarized the findings of the research as follows:

The studies find that public works and relief spending had state income multipliers of around one, increased consumption activity, attracted internal migration, reduced crime rates, and lowered several types of mortality. The farm programs typically aided large farm owners but eliminated opportunities for share croppers, tenants, and farm workers. The Home Owners' Loan Corporation's purchases and refinancing of troubled mortgages staved off drops in housing prices and home ownership rates at relatively low ex-post cost to taxpayers. The Reconstruction Finance Corporation's loans to banks and railroads appear to have had little positive impact, although the banks were aided when the RFC took ownership stakes.

Historiography and evaluation of New Deal policies

Historians debating the New Deal have generally been divided between progressives who support it, conservatives who oppose it, and some New Left historians who complain it was too favorable to capitalism and did too little for minorities. There is consensus on only a few points, with most commentators favorable toward the CCC and hostile toward the NRA.

Consensus historians of the 1950s, such as Richard Hofstadter, according to Lary May:

- [B]elieved that the prosperity and apparent class harmony of the post-World War II era reflected a return to the true Americanism rooted in liberal capitalism and the pursuit of individual opportunity that had made fundamental conflicts over resources a thing of the past. They argued that the New Deal was a conservative movement that built a welfare state, guided by experts, that saved rather than transformed liberal capitalism.

Progressive historians argue that Roosevelt restored hope and self-respect to tens of millions of desperate people, built labor unions, upgraded the national infrastructure, and saved capitalism in his first term when he could have destroyed it and easily nationalized the banks and the railroads. Historians generally agree that apart from building up labor unions, the New Deal did not substantially alter the distribution of power within American capitalism. "The New Deal brought about limited change in the nation's power structure". The New Deal preserved democracy in the United States in a historic period of uncertainty and crises when in many other countries democracy failed.

The most common arguments can be summarized as follows:

- Harmful

- The New Deal vastly increased the federal debt (Billington and Ridge). However, Keynesians argue that the federal deficit between 1933 and 1939 averaged only 3.7% which was not enough to offset the reduction in private sector spending during the Great Depression

- Fostered bureaucracy and administrative inefficiency (Billington and Ridge) and enlarged the powers of the federal government

- Slowed the growth of civil service reform by multiplying offices outside the merit system (Billington and Ridge)

- Infringed upon free business enterprise (Billington and Ridge)

- Prolonged the Great Depression (revisionist economists)

- Rescued capitalism when the opportunity was at hand to nationalize banking, railroads, and other industries (New Left critique)

- Neutral

- Stimulated the growth of class consciousness among farmers and workers (Billington and Ridge)

- Raised the issue of how far economic regulation could be extended without sacrificing the liberties of the people (Billington and Ridge)

- Beneficial

- Allowed the nation to come through its greatest depression without undermining the capitalist system (Billington and Ridge)

- Made the capitalist system more beneficial by enacting banking and stock market regulations to avoid abuses and providing greater financial security, through, for example, the introduction of Social Security or the Federal Deposit Insurance Corporation (David M. Kennedy)

- Created a better balance among labor, agriculture, and industry (Billington and Ridge)

- Produced a more equal distribution of wealth (Billington and Ridge)

- Help conserve natural resources (Billington and Ridge)

- Permanently established the principle that the national government should take action to rehabilitate and preserve America's human resources (Billington and Ridge)

Fiscal policy