A tariff is a tax on imports or exports between sovereign states. It is a form of regulation of foreign trade and a policy that taxes foreign products to encourage or safeguard domestic industry. Traditionally, states have used them as a source of income. Now, they are among the most widely used instruments of protectionism, along with import and export quotas.

Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Taxing items coming into the country means people are less likely to buy them as they become more expensive. The intention is that they buy local products instead – boosting the country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products. Tariffs are meant to reduce pressure from foreign competition and reduce the trade deficit. They have historically been justified as a means to protect infant industries and to allow import substitution industrialization. Tariffs may also be used to rectify artificially low prices for certain imported goods, due to 'dumping', export subsidies or currency manipulation.

There is near unanimous consensus among economists that tariffs have a negative effect on economic growth and economic welfare while free trade and the reduction of trade barriers has a positive effect on economic growth. However, liberalization of trade can cause significant and unequally distributed losses, and the economic dislocation of workers in import-competing sectors.

Etymology

The origin of tariff is the Italian word tariffa translated as "list of prices, book of rates", which is likely derived from the Arabic ta'rif تعريف meaning "notification" or "inventory of fees to be paid".

History

Average tariff rates for selected countries (1913–2007)

Tariff rates in Japan (1870–1960)

Average tariff rates in Spain and Italy (1860–1910)

Average Levels of Duties (1875 and 1913)

Great Britain

At

the beginning of the 19th century, Britain's average tariff on

manufactured goods was roughly 51 percent, the highest of any major

nation in Europe. And even after Britain embraced free trade in most

goods, it continued to tightly regulate trade in strategic capital

goods, such as the machinery for the mass production of textiles.

In 1800, Great Britain with about 10% of the European population,

provided 29% of all pig iron produced in Europe, a proportion that

reached 45% in 1830; industrial production per capita was even more

significant: in 1830 it was 250% higher than in the rest of Europe

compared to 110% in 1800.

Tariffs were reduced in 1833 and the Corn Laws were repealed

in 1846, which amounted to free trade in food. (The Corn Laws were

passed in 1815 to restrict wheat imports and guarantee British farmers'

incomes ). This devastated Britain's old rural economy but began to

mitigate the effects of Great Famine in Ireland.

On 15 June 1903, the Secretary of State for Foreign Affairs, the Marquess of Lansdowne

made a speech in the House of Lords defending fiscal retaliation

against countries with high tariffs and whose governments subsidised

products for sale in Britain (known as 'bounty-fed products', also

called dumping).

The retaliation was to be done by threatening to impose tariffs in

response against that country's goods. His Liberal Unionists had split

from the Liberals, who promoted Free Trade, and the speech was a landmark in the group's slide towards Protectionism.

Landsdowne argued that threatening retaliatory tariffs was similar to

getting respect in a room of armed men by showing a big revolver (his

exact words were "a rather larger revolver than everybody else's"). The

"Big Revolver" became a catchphrase of the day, often used in speeches

and cartoons

United States

Average tariff rates (France, UK, US)

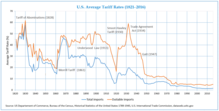

Average tariff rates in US (1821–2016)

US Trade Balance and Trade Policy (1895–2015)

Before the new Constitution took effect in 1788, the Congress could

not levy taxes—it sold land or begged money from the states. The new

national government needed revenue and decided to depend upon a tax on

imports with the Tariff of 1789. The policy of the U.S. before 1860 was low tariffs "for revenue only" (since duties continued to fund the national government). A high tariff was attempted in 1828 but the South denounced it as a "Tariff of Abominations" and it almost caused a rebellion in South Carolina until it was lowered.

The policy from 1860 to 1933 was usually high protective tariffs

(apart from 1913–21) After 1890, the tariff on wool did affect an

important industry, but otherwise the tariffs were designed to keep

American wages high. The conservative Republican tradition, typified by William McKinley was a high tariff, while the Democrats typically called for a lower tariff to help consumers.

Protectionism was an American tradition: according to Paul

Bairoch, the United States was "the homeland and bastion of modern

protectionism" since the end of the 18th century and until after World

War II.

From 1846 to 1861, during which American tariffs were lowered but this

was followed by a series of recessions and the 1857 panic, which

eventually led to higher demands for tariffs than President James

Buchanan, signed in 1861 (Morrill Tariff).

Between 1816 and the end of the Second World War, the United States had

one of the highest average tariff rates on manufactured imports in the

world. According to economic historian Douglas Irwin, a common myth

about United States trade policy is that low tariffs harmed American

manufacturers in the early 19th century and then that high tariffs made

the United States into a great industrial power in the late 19th

century. A review by the Economist of Irwin's 2017 book Clashing over Commerce: A History of US Trade Policy notes:

Political dynamics would lead people to see a link between tariffs and the economic cycle that was not there. A boom would generate enough revenue for tariffs to fall, and when the bust came pressure would build to raise them again. By the time that happened, the economy would be recovering, giving the impression that tariff cuts caused the crash and the reverse generated the recovery. Mr Irwin also methodically debunks the idea that protectionism made America a great industrial power, a notion believed by some to offer lessons for developing countries today. As its share of global manufacturing powered from 23% in 1870 to 36% in 1913, the admittedly high tariffs of the time came with a cost, estimated at around 0.5% of GDP in the mid-1870s. In some industries, they might have sped up development by a few years. But American growth during its protectionist period was more to do with its abundant resources and openness to people and ideas.

In the 19th century, statesmen such as Senator Henry Clay continued Hamilton's themes within the Whig Party under the name "American System.[17][full citation needed] Before 1860 they were always defeated by the low-tariff Democrats.

During the American Civil War (1861-1865), agrarian interests in

the South were opposed to any protection, while manufacturing interests

in the North wanted to maintain it. The war marked the triumph of the

protectionists of the industrial states of the North over the free

traders of the South. Abraham Lincoln was a protectionist like Henry

Clay of the Whig Party, who advocated the "American system" based on

infrastructure development and protectionism. In 1847, he declared:

"Give us a protective tariff, and we will have the greatest nation on

earth". Once elected, Lincoln raised industrial tariffs and after the

war, tariffs remained at or above wartime levels. High tariffs were a

policy designed to encourage rapid industrialisation and protect the

high American wage rates.

The Democrats called for low tariffs help poor consumers, but

they always failed until 1913. The Republican Party, which is heir to

the Whigs, makes protectionism a central theme in its electoral

platforms. According to the party, it is right to favour domestic

producers and tax foreigners and consumers of imported luxury products.

Republicans prioritize the protection function, while the need to

provide revenue to the federal budget is only a secondary objective.

In the early 1860s, Europe and the United States pursued

completely different trade policies. The 1860s were a period of growing

protectionism in the United States, while the European free trade phase

lasted from 1860 to 1892. The tariff average rate on imports of

manufactured goods was in 1875 from 40% to 50% in the United States

against 9% to 12% in continental Europe at the height of free trade.

Milton Friedman

held the opinion that the Smoot–Hawley tariff of 1930 did not cause the

Great Depression, instead he blamed the lack of sufficient action on

the part of the Federal Reserve. Douglas A. Irwin wrote: "most

economists, both liberal and conservative, doubt that Smoot–Hawley

played much of a role in the subsequent contraction".

Tariffs and the Great Depression

Most economists hold the opinion that the US Tariff Act did not greatly worsen the great depression:

Peter Temin,

an economist at the Massachusetts Institute of Technology, explained

that a tariff is an expansionary policy, like a devaluation as it

diverts demand from foreign to home producers. He noted that exports

were 7 percent of GNP in 1929, they fell by 1.5 percent of 1929 GNP in

the next two years and the fall was offset by the increase in domestic

demand from tariff. He concluded that contrary the popular argument,

contractionary effect of the tariff was small.

William Bernstein wrote: "Between 1929 and 1932, real GDP fell 17

percent worldwide, and by 26 percent in the United States, but most

economic historians now believe that only a miniscule part of that huge

loss of both world GDP and the United States’ GDP can be ascribed to the

tariff wars. .. At the time of Smoot-Hawley’s passage, trade volume

accounted for only about 9 percent of world economic output. Had all

international trade been eliminated, and had no domestic use for the

previously exported goods been found, world GDP would have fallen by the

same amount — 9 percent. Between 1930 and 1933, worldwide trade volume

fell off by one-third to one-half. Depending on how the falloff is

measured, this computes to 3 to 5 percent of world GDP, and these losses

were partially made up by more expensive domestic goods. Thus, the

damage done could not possibly have exceeded 1 or 2 percent of world GDP

— nowhere near the 17 percent falloff seen during the Great

Depression... The inescapable conclusion: contrary to public perception,

Smoot-Hawley did not cause, or even significantly deepen, the Great

Depression,"

Nobel laureate Maurice Allais

argued: 'First, most of the trade contraction occurred between January

1930 and July 1932, before most protectionist measures were introduced,

except for the limited measures applied by the United States in the

summer of 1930. It was therefore the collapse of international liquidity

that caused the contraction of trade[8], not customs tariffs'.

Russia

Russia

adopted more protectionist trade measures in 2013 than any other

country, making it the world leader in protectionism. It alone

introduced 20% of protectionist measures worldwide and one-third of

measures in the G20 countries. Russia's protectionist policies include

tariff measures, import restrictions, sanitary measures, and direct

subsidies to local companies. For example, the state supported several

economic sectors such as agriculture, space, automotive, electronics,

chemistry, and energy.

In recent years, the policy of import substitution due to

tariffs, i.e. the replacement of imported products by domestic products,

has been considered a success because it has enabled Russia to increase

its domestic production and save several billion dollars. Russia has

been able to reduce its imports and launch an emerging and increasingly

successful domestic production in almost all industrial sectors. The

most important results have been achieved in the agriculture and food

processing, automotive, chemical, pharmaceutical, aviation and naval

sectors.

From 2014, customs duties were applied on imported products in

the food sector. Russia has reduced its food imports while domestic

production has increased considerably. The cost of food imports has

dropped from $60 billion in 2014 to $20 billion in 2017 and the country

enjoys record cereal production. Russia has strengthened its position on

the world food market and the country has become food self-sufficient.

In the fisheries, fruit and vegetable sector, domestic production has

increased sharply, imports have declined significantly and the trade

balance (difference between exports and imports) has improved. In the

second quarter of 2017, agricultural exports are expected to exceed

imports, making Russia a net exporter for the first time.

India

From 2017, as part of the promotion of its "Make in India" programme

to stimulate and protect domestic manufacturing industry and to combat

current account deficits, India has introduced tariffs on several

electronic products and "non-essential items". This concerns items

imported from countries such as China and South Korea. For example,

India's national solar energy programme favours domestic producers by

requiring the use of Indian-made solar cells.

Armenia

The

Republic of Armenia, a country located in Western Asia, established its

custom service on January 4, 1992, as directed by the Armenian

President. On January 2, 2015, Armenia was given access to the Eurasian

Customs Union, which is led by the Russian Federation and the EAEU; this

resulted in an increased number of import tariffs. Armenia does not

currently have export taxes; in addition, it does not declare temporary

imports duties and credit on government imports or pursuant to other

international assistance imports.

Customs duty

A customs duty or due is the indirect tax levied on the import or export of goods in international trade. In economic sense, a duty is also a kind of consumption tax. A duty levied on goods being imported is referred to as an import duty. Similarly, a duty levied on exports is called an export duty. A tariff, which is actually a list of commodities along with the leviable rate (amount) of customs duty, is popularly referred to as a customs duty.

Calculation of customs duty

Customs duty is calculated on the determination of the assessable value in case of those items for which the duty is levied ad valorem. This is often the transaction value unless a customs officer determines assessable value in accordance with the Harmonized System. For certain items like petroleum and alcohol, customs duty is realized at a specific rate applied to the volume of the import or export consignments.

Harmonized System of Nomenclature

For the purpose of assessment of customs duty, products are given an identification code that has come to be known as the Harmonized System code. This code was developed by the World Customs Organization based in Brussels. A Harmonized System code may be from four to ten digits. For example, 17.03 is the HS code for molasses from the extraction or refining of sugar. However, within 17.03, the number 17.03.90 stands for "Molasses (Excluding Cane Molasses)".

Introduction of Harmonized System code in 1990s has largely replaced the Standard International Trade Classification

(SITC), though SITC remains in use for statistical purposes. In drawing

up the national tariff, the revenue departments often specifies the

rate of customs duty with reference to the HS code of the product. In

some countries and customs unions, 6-digit HS codes are locally extended

to 8 digits or 10 digits for further tariff discrimination: for example

the European Union uses its 8-digit CN (Combined Nomenclature) and 10-digit TARIC codes.

Customs authority

A customs

authority in each country is responsible for collecting taxes on the

import into or export of goods out of the country. Normally the customs

authority, operating under national law, is authorized to examine cargo

in order to ascertain actual description, specification volume or

quantity, so that the assessable value and the rate of duty may be

correctly determined and applied.

Evasion

Evasion of customs duties takes place mainly in two ways. In one, the

trader under-declares the value so that the assessable value is lower

than actual. In a similar vein, a trader can evade customs duty by

understatement of quantity or volume of the product of trade. A trader

may also evade duty by misrepresenting traded goods, categorizing goods

as items which attract lower customs duties. The evasion of customs duty

may take place with or without the collaboration of customs officials. Evasion of customs duty does not necessarily constitute smuggling.

Duty-free goods

Many countries allow a traveler to bring goods into the country duty-free. These goods may be bought at ports and airports

or sometimes within one country without attracting the usual government

taxes and then brought into another country duty-free. Some countries

impose allowances

which limit the number or value of duty-free items that one person can

bring into the country. These restrictions often apply to tobacco, wine, spirits, cosmetics, gifts and souvenirs. Often foreign diplomats and UN officials are entitled to duty-free goods. Duty-free goods are imported and stocked in what is called a bonded warehouse.

Duty calculation for companies in real life

With

many methods and regulations, businesses at times struggle to manage

the duties. In addition to difficulties in calculations, there are

challenges in analyzing duties; and to opt for duty free options like

using a bonded warehouse.

Companies use Enterprise Resource Planning

(ERP) software to calculate duties automatically to, on the one hand,

avoid error-prone manual work on duty regulations and formulas and, on

the other hand, manage and analyze historically paid duties. Moreover,

ERP software offers an option for customs warehouses to save duty and

VAT payments. In addition, duty deferment and suspension can also be

taken into consideration.

Economic analysis

Effects

of import tariff, which hurts domestic consumers more than domestic

producers are helped. Higher prices and lower quantities reduce consumer surplus by areas A+B+C+D, while expanding producer surplus by A and government revenue by C. Areas B and D are dead-weight losses, surplus lost by consumers and overall.

Shows the consumer surplus, producer surplus, government revenue, and deadweight losses after tariff imposition.

General government revenue, in % of GDP, from import taxes. For this data, the variance of GDP per capita with purchasing power parity (PPP) is explained in 38 % by tax revenue.

Neoclassical economic theorists tend to view tariffs as distortions to the free market.

Typical analyses find that tariffs tend to benefit domestic producers

and government at the expense of consumers, and that the net welfare

effects of a tariff on the importing country are negative. Normative

judgments often follow from these findings, namely that it may be

disadvantageous for a country to artificially shield an industry from

world markets and that it might be better to allow a collapse to take

place. Opposition to all tariff aims to reduce tariffs and to avoid

countries discriminating between differing countries when applying

tariffs. The diagrams at right show the costs and benefits of imposing a

tariff on a good in the domestic economy.

Imposing an import tariff has the following effects, shown in the

first diagram in a hypothetical domestic market for televisions:

- Price rises from world price Pw to higher tariff price Pt.

- Quantity demanded by domestic consumers falls from C1 to C2, a movement along the demand curve due to higher price.

- Domestic suppliers are willing to supply Q2 rather than Q1, a movement along the supply curve due to the higher price, so the quantity imported falls from C1-Q1 to C2-Q2.

- Consumer surplus (the area under the demand curve but above price) shrinks by areas A+B+C+D, as domestic consumers face higher prices and consume lower quantities.

- Producer surplus (the area above the supply curve but below price) increases by area A, as domestic producers shielded from international competition can sell more of their product at a higher price.

- Government tax revenue is the import quantity (C2-Q2) times the tariff price (Pw - Pt), shown as area C.

- Areas B and D are deadweight losses, surplus formerly captured by consumers that now is lost to all parties.

The overall change in welfare = Change in Consumer Surplus + Change

in Producer Surplus + Change in Government Revenue = (-A-B-C-D) + A + C =

-B-D. The final state after imposition of the tariff is indicated in

the second diagram, with overall welfare reduced by the areas labeled

"societal losses", which correspond to areas B and D in the first

diagram. The losses to domestic consumers are greater than the combined

benefits to domestic producers and government.

That tariffs overall reduce welfare is not a controversial topic

among economists. For example, the University of Chicago surveyed about

40 leading economists in March 2018 asking whether "Imposing new U.S.

tariffs on steel and aluminum will improve Americans'welfare." About

two-thirds strongly disagreed with the statement, while one third

disagreed. None agreed or strongly agreed. Several commented that such

tariffs would help a few Americans at the expense of many.

This is consistent with the explanation provided above, which is that

losses to domestic consumers outweigh gains to domestic producers and

government, by the amount of deadweight losses.

Tariffs are more inefficient than consumption taxes.

Optimal tariff

For economic efficiency, free trade is often the best policy, however levying a tariff is sometimes second best.

A tariff is called an optimal tariff if it is set to maximize the welfare of the country imposing the tariff. It is a tariff derived by the intersection between the trade indifference curve of that country and the offer curve of another country. In this case, the welfare of the other country grows worse simultaneously, thus the policy is a kind of beggar thy neighbor policy. If the offer curve of the other country is a line through the origin point, the original country is in the condition of a small country, so any tariff worsens the welfare of the original country.

It is possible to levy a tariff as a political policy choice, and to consider a theoretical optimum tariff rate.

However, imposing an optimal tariff will often lead to the foreign

country increasing their tariffs as well, leading to a loss of welfare

in both countries. When countries impose tariffs on each other, they

will reach a position off the contract curve, meaning that both countries' welfare could be increased by reducing tariffs.

Political analysis

The tariff has been used as a political tool to establish an independent nation; for example, the United States Tariff Act of 1789,

signed specifically on July 4, was called the "Second Declaration of

Independence" by newspapers because it was intended to be the economic

means to achieve the political goal of a sovereign and independent

United States.

The political impact of tariffs is judged depending on the political perspective; for example the 2002 United States steel tariff

imposed a 30% tariff on a variety of imported steel products for a

period of three years and American steel producers supported the tariff.

Tariffs can emerge as a political issue prior to an election. In the leadup to the 2007 Australian Federal election, the Australian Labor Party announced it would undertake a review of Australian car tariffs if elected. The Liberal Party made a similar commitment, while independent candidate Nick Xenophon announced his intention to introduce tariff-based legislation as "a matter of urgency".

Unpopular tariffs are known to have ignited social unrest, for example the 1905 meat riots in Chile that developed in protest against tariffs applied to the cattle imports from Argentina.

Arguments in favor of tariffs

Protection of infant industry

In the 19th century, Alexander Hamilton and the economist Friedrich List defended the benefits of "educator protectionism" as a necessary means of protecting infant industries.

Protectionism would be necessary in the short term for a country to

start industrialization away from competition from more advanced foreign

industries, under which pressure it could succumb at the first stage of

the process. As a result, they benefit from greater freedom of

manoeuvre and greater certainty regarding their profitability and future

development. The protectionist phase is therefore a learning period

that would allow the least developed countries to acquire general and

technical know-how in the fields of industrial production in order to

become competitive on international markets.

Protection against dumping

States resorting to protectionism invoke unfair competition or dumping practices:

- Monetary dumping: a currency undergoes a devaluation when monetary authorities decide to intervene in the foreign exchange market to lower the value of the currency against other currencies. This makes local products more competitive and imported products more expensive (Marshall Lerner Condition), increasing exports and decreasing imports, and thus improving the trade balance. Countries with a weak currency cause trade imbalances: they have large external surpluses while their competitors have large deficits.

- Tax dumping: some tax haven states have lower corporate and personal tax rates.

- Social dumping: when a state reduces social contributions or maintains very low social standards (for example, in China, labour regulations are less restrictive for employers than elsewhere).

- Environmental dumping: when environmental regulations are less stringent than elsewhere.

Free trade and poverty

Sub-Saharan African countries have a lower income per capita in 2003 than 40 years earlier (Ndulu, World Bank, 2007, p. 33).[47]

Per capita income increased by 37% between 1960 and 1980 and fell by 9%

between 1980 and 2000. Africa's manufacturing sector's share of GDP

decreased from 12% in 1980 to 11% in 2013. In the 1970s, Africa

accounted for more than 3% of world manufacturing output, and now

accounts for 1.5%. Ha-Joon Chang claims that these downturns are the result of free trade policies, and attributes successes in some African countries such as Ethiopia and Rwanda to their abandonment of free trade and adoption of a "developmental state model".

The poor countries that have succeeded in achieving strong and sustainable growth are those that have become mercantilists, not free traders: China, South Korea, Japan, Taiwan.

Thus, whereas in the 1990s, China and India had the same GDP per

capita, China followed a much more mercantilist policy and now has a GDP

per capita three times higher than India's.

Indeed, a significant part of China's rise on the international trade

scene does not come from the supposed benefits of international

competition but from the relocations practiced by companies from

developed countries. Dani Rodrik

points out that it is the countries that have systematically violated

the rules of globalisation that have experienced the strongest growth.

For developed countries that have implemented free trade, the work of E.F. Denison

on growth factors in the United States and Western Europe between 1950

and 1962 shows that the positive effects on growth of trade

liberalization have been negligible in the United States, while in

Western Europe it contributed to a weighted average of only 2% of total

economic growth.

The 'dumping' policies of some countries have also largely

affected developing countries. Studies on the effects of free trade show

that the gains induced by WTO rules for developing countries are very

small.

This has reduced the gain for these countries from an estimated $539

billion in the 2003 LINKAGE model to $22 billion in the 2005 GTAP model.

The 2005 LINKAGE version also reduced gains to 90 billion. As for the "Doha Round", it would have brought in only $4 billion to developing countries (including China...) according to the GTAP model.

However, the models used are actually designed to maximize the positive

effects of trade liberalization. They are characterized by the absence

of taking into account the loss of income caused by the end of tariff

barriers.

Criticism of the theory of comparative advantage

Free trade is based on the theory of comparative advantage.

The classical and neoclassical formulations of comparative advantage

theory differ in the tools they use but share the same basis and logic.

Comparative advantage theory says that market forces lead all factors of

production to their best use in the economy. It indicates that

international free trade would be beneficial for all participating

countries as well as for the world as a whole because they could

increase their overall production and consume more by specializing

according to their comparative advantages. Goods would become cheaper

and available in larger quantities. Moreover, this specialization would

not be the result of chance or political intent, but would be

automatic. However according to some commentators, the theory is based

on assumptions that are neither theoretically nor empirically valid.

International mobility of capital and labour

The

international immobility of labour and capital is essential to the

theory of comparative advantage. Without this, there would be no reason

for international free trade to be regulated by comparative advantages.

Classical and neoclassical economists all assume that labour and capital

do not circulate between nations. At the international level, only the

goods produced can move freely, with capital and labour trapped in

countries. David Ricardo was aware that the international immobility of

labour and capital is an indispensable hypothesis. He devoted half of

his explanation of the theory to it in his book. He even explained that

if labour and capital could move internationally, then comparative

advantages could not determine international trade. Ricardo assumed that

the reasons for the immobility of the capital would be:

the fancied or real insecurity of capital, when not under the immediate control of its owner, together with the natural disinclination which every man has to quit the country of his birth and connexions, and intrust himself with all his habits fixed, to a strange government and new laws

Neoclassical economists, for their part, argue that the scale of

these movements of workers and capital is negligible. They developed the

theory of price compensation by factor that makes these movements

superfluous.

In practice, however, workers move in large numbers from one country to

another. Today, labour migration is truly a global phenomenon. And, with

the reduction in transport and communication costs, capital has become

increasingly mobile and frequently moves from one country to another.

Moreover, the neoclassical assumption that factors are trapped at the

national level has no theoretical basis and the assumption of factor

price equalisation cannot justify international immobility. Moreover,

there is no evidence that factor prices are equal worldwide. Comparative

advantages cannot therefore determine the structure of international

trade.

If they are internationally mobile and the most productive use of

factors is in another country, then free trade will lead them to

migrate to that country. This will benefit the nation to which they

emigrate, but not necessarily the others.

Externalities

An

externality is the term used when the price of a product does not

reflect its cost or real economic value. The classic negative

externality is environmental degradation, which reduces the value of

natural resources without increasing the price of the product that has

caused them harm. The classic positive externality is technological

encroachment, where one company's invention of a product allows others

to copy or build on it, generating wealth that the original company

cannot capture. If prices are wrong due to positive or negative

externalities, free trade will produce sub-optimal results.

For example, goods from a country with lax pollution standards

will be too cheap. As a result, its trading partners will import too

much. And the exporting country will export too much, concentrating its

economy too much in industries that are not as profitable as they seem,

ignoring the damage caused by pollution.

On the positive externalities, if an industry generates

technological spinoffs for the rest of the economy, then free trade can

let that industry be destroyed by foreign competition because the

economy ignores its hidden value. Some industries generate new

technologies, allow improvements in other industries and stimulate

technological advances throughout the economy; losing these industries

means losing all industries that would have resulted in the future.

Cross-industrial movement of productive resources

Comparative

advantage theory deals with the best use of resources and how to put

the economy to its best use. But this implies that the resources used to

manufacture one product can be used to produce another object. If they

cannot, imports will not push the economy into industries better suited

to its comparative advantage and will only destroy existing industries.

For example, when workers cannot move from one industry to

another—usually because they do not have the right skills or do not live

in the right place—changes in the economy's comparative advantage will

not shift them to a more appropriate industry, but rather to

unemployment or precarious and unproductive jobs.

Static vs. dynamic gains via international trade

Comparative

advantage theory allows for a "static" and not a "dynamic" analysis of

the economy. That is, it examines the facts at a single point in time

and determines the best response to those facts at that point in time,

given our productivity in various industries. But when it comes to

long-term growth, it says nothing about how the facts can change

tomorrow and how they can be changed in someone's favour. It does not

indicate how best to transform factors of production into more

productive factors in the future.

According to theory, the only advantage of international trade is

that goods become cheaper and available in larger quantities. Improving

the static efficiency of existing resources would therefore be the only

advantage of international trade. And the neoclassical formulation

assumes that the factors of production are given only exogenously.

Exogenous changes can come from population growth, industrial policies,

the rate of capital accumulation (propensity for security) and

technological inventions, among others. Dynamic developments endogenous

to trade such as economic growth are not integrated into Ricardo's

theory. And this is not affected by what is called "dynamic comparative

advantage". In these models, comparative advantages develop and change

over time, but this change is not the result of trade itself, but of a

change in exogenous factors.

However, the world, and in particular the industrialized

countries, are characterized by dynamic gains endogenous to trade, such

as technological growth that has led to an increase in the standard of

living and wealth of the industrialized world. In addition, dynamic

gains are more important than static gains.

Balanced trade and adjustment mechanisms

A

crucial assumption in both the classical and neoclassical formulation

of comparative advantage theory is that trade is balanced, which means

that the value of imports is equal to the value of each country's

exports. The volume of trade may change, but international trade will

always be balanced at least after a certain adjustment period. The

balance of trade is essential for theory because the resulting

adjustment mechanism is responsible for transforming the comparative

advantages of production costs into absolute price advantages. And this

is necessary because it is the absolute price differences that determine

the international flow of goods. Since consumers buy a good from the

one who sells it cheapest, comparative advantages in terms of production

costs must be transformed into absolute price advantages. In the case

of floating exchange rates, it is the exchange rate adjustment mechanism

that is responsible for this transformation of comparative advantages

into absolute price advantages. In the case of fixed exchange rates,

neoclassical theory suggests that trade is balanced by changes in wage

rates.

So if trade were not balanced in itself and if there were no

adjustment mechanism, there would be no reason to achieve a comparative

advantage. However, trade imbalances are the norm and balanced trade is

in practice only an exception. In addition, financial crises such as the

Asian crisis of the 1990s show that balance of payments imbalances are

rarely benign and do not self-regulate. There is no adjustment mechanism

in practice. Comparative advantages do not turn into price differences

and therefore cannot explain international trade flows.

Thus, theory can very easily recommend a trade policy that gives

us the highest possible standard of living in the short term but none in

the long term. This is what happens when a nation runs a trade deficit,

which necessarily means that it goes into debt with foreigners or sells

its existing assets to them. Thus, the nation applies a frenzy of

consumption in the short term followed by a long-term decline.

International trade as bartering

The

assumption that trade will always be balanced is a corollary of the

fact that trade is understood as barter. The definition of international

trade as barter trade is the basis for the assumption of balanced

trade. Ricardo insists that international trade takes place as if it

were purely a barter trade, a presumption that is maintained by

subsequent classical and neoclassical economists. The quantity of money

theory, which Ricardo uses, assumes that money is neutral and neglects

the velocity of a currency. Money has only one function in

international trade, namely as a means of exchange to facilitate trade.

In practice, however, the velocity of circulation is not

constant and the quantity of money is not neutral for the real economy. A

capitalist world is not characterized by a barter economy but by a

market economy. The main difference in the context of international

trade is that sales and purchases no longer necessarily have to

coincide. The seller is not necessarily obliged to buy immediately.

Thus, money is not only a means of exchange. It is above all a means of

payment and is also used to store value, settle debts and transfer

wealth. Thus, unlike the barter hypothesis of the comparative advantage

theory, money is not a commodity like any other. Rather, it is of

practical importance to specifically own money rather than any

commodity. And money as a store of value in a world of uncertainty has a

significant influence on the motives and decisions of wealth holders

and producers.

Using labour and capital to their full potential

Ricardo

and later classical economists assume that labour tends towards full

employment and that capital is always fully used in a liberalized

economy, because no capital owner will leave its capital unused but will

always seek to make a profit from it. That there is no limit to the use

of capital is a consequence of Jean-Baptiste Say's law, which presumes

that production is limited only by resources and is also adopted by

neoclassical economists.

From a theoretical point of view, comparative advantage theory

must assume that labour or capital is used to its full potential and

that resources limit production. There are two reasons for this: the

realization of gains through international trade and the adjustment

mechanism. In addition, this assumption is necessary for the concept of

opportunity costs. If unemployment (or underutilized resources) exists,

there are no opportunity costs, because the production of one good can

be increased without reducing the production of another good. Since

comparative advantages are determined by opportunity costs in the

neoclassical formulation, these cannot be calculated and this

formulation would lose its logical basis.

If a country's resources were not fully utilized, production and

consumption could be increased at the national level without

participating in international trade. The whole raison d'être of

international trade would disappear, as would the possible gains. In

this case, a State could even earn more by refraining from participating

in international trade and stimulating domestic production, as this

would allow it to employ more labour and capital and increase national

income. Moreover, any adjustment mechanism underlying the theory no

longer works if unemployment exists.

In practice, however, the world is characterised by unemployment.

Unemployment and underemployment of capital and labour are not a

short-term phenomenon, but it is common and widespread. Unemployment and

untapped resources are more the rule than the exception.