The Hypercar Lives: Meet VW’s XL1

RMI

followers and auto buffs often ask, ‘What happened to the hypercar?’

With the release of VW’s impressively fuel-efficient and strikingly

similiar XL1, the world now has an answer.

Original link: https://medium.com/solutions-journal-summer-2014/the-hypercar-lives-meet-vws-xl1-97603e97612f

When

VW released the European fuel economy ratings for its new,

limited-production XL1 passenger car last summer, you could almost hear

the automotive world’s collective jaw drop. The XL1 came in at a

staggering 313 miles per Imperial gallon of diesel. That’s the

efficiency equivalent of more than 230 miles per U.S. gallon of

gasoline. At a time when the 2014 model of the best-selling vehicle in

the United States for more than three decades — Ford’s F-150 pickup

truck — gets an EPA-rated 23 mpg highway, and the average for all model

year 2013 light-duty vehicles sold in the U.S. was just 24.6 mpg, VW had

moved the decimal point an entire place to the right.

Engineering leadership and platform fitness

The

XL1 is named for its engineering goal: develop a production car that

can drive 100 kilometers on 1 liter of fuel (235 miles per U.S. gallon).

That was the charge in 1999 to VW engineers by the company’s visionary

then-chairman, Ferdinand Piëch, who is Ferdinand Porsche’s grandson and

chair of VW’s supervisory board today. “We built the Bugatti and now the

XL1,” says Mark Gillies, manager of product and technology

communications for VW of America. “Both use extreme technology to

achieve almost opposite ends of the [performance] spectrum.”

The

XL1’s tiny 2.6-gallon diesel-fuel tank can fuel average driving for

more than 310 miles, thanks to a combination of strategies that RMI

collectively calls platform fitness. That’s the key to the Hypercar

concept developed by RMI chief scientist Amory Lovins in 1991 and

evolved by RMI’s Hypercar Center through the 1990s. Hypercars integrate

ultralight weight, superior aerodynamics, low-rolling-resistance tires,

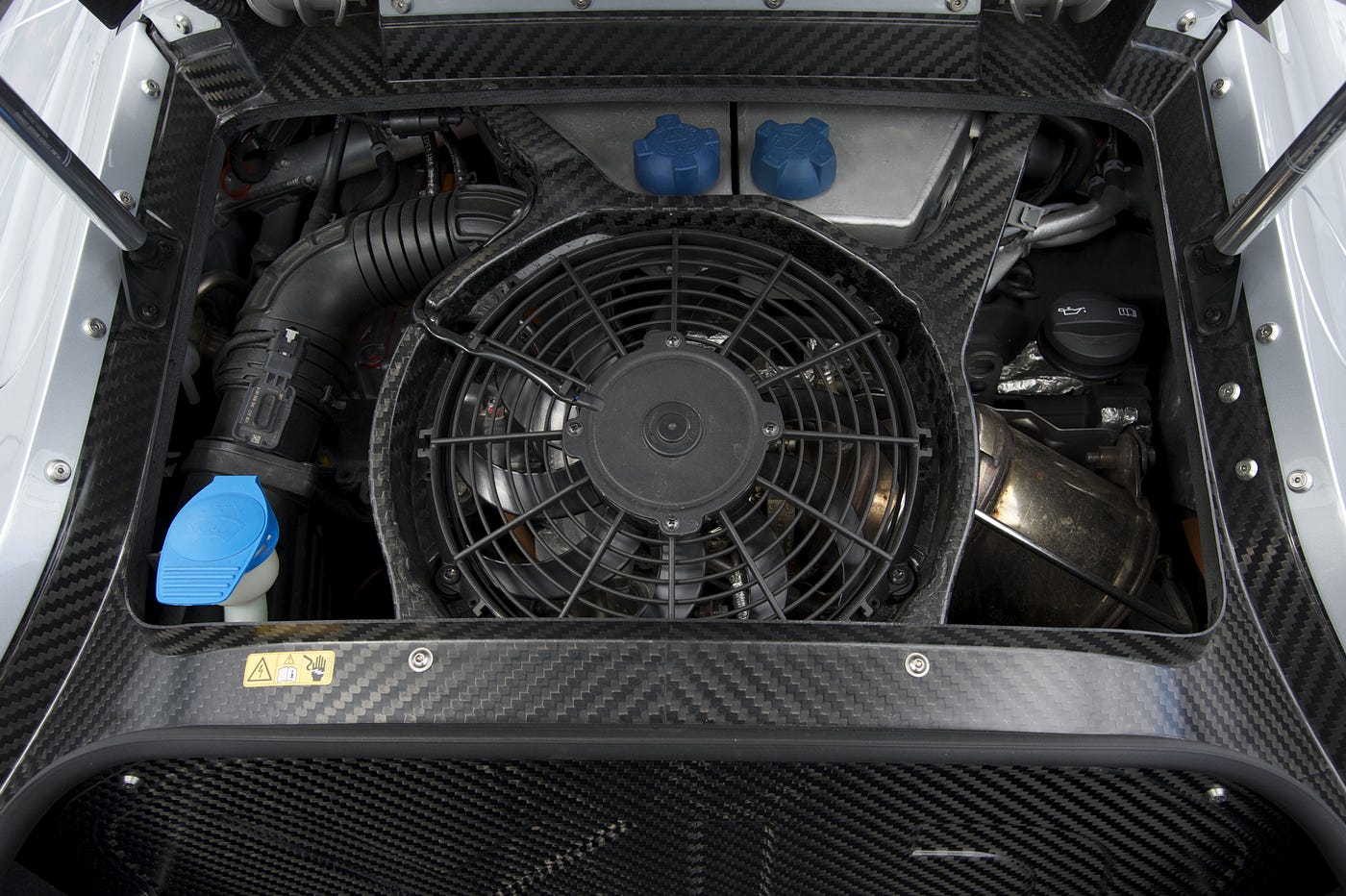

and a downsized and superefficient electrified powertrain. For example,

VW’s XL1 weighs just 1,753 pounds. How? “We used mixed lightweight

materials to bring out their best performance in their respective places

in the vehicle,” explains Dr. Volker Kaese, VW’s project manager for

the XL1. High-temperature-tolerant steel is used in the powertrain.

Lighter, more flexible aluminum forms the chassis and crush zones.

Polycarbonate side panels save weight and allow sleeker shapes. And the

passenger cell is a carbon-fiber monocoque.

Then

there’s the XL1’s astonishing aerodynamic drag coefficient. Lower is

better, and the XL1’s 0.189 is the best ever in a production car. By

comparison, a sleek and streamlined 2014 Corvette Stingray has a drag

coefficient of 0.29 and Ford’s popular F-150 is around 0.40. The XL1

shaves drag everywhere it can, covering the rear wheels and replacing

protruding side-view mirrors with low-profile, rear-facing cameras

displayed on a dashboard screen.

Even

before the first XL1 rolled off the production line, some were quick to

point out the striking parallels between the Hypercar concept specs of

the early 1990s and the real-world specs of today’s production XL1. “The

XL1 is a hypercar in the way that might make Amory Lovins smile,” wrote

High Gear Media’s Bengt Halvorson, in a piece that ran in the Washington Post. “That’s

a nod to one of the creators of the original 1990s Hypercar project

from Rocky Mountain Institute.” Similarly, automotive writer David

Herron in Torque News noted, “the VW XL1 is the embodiment of the hypercar concept developed by Amory Lovins years ago.”

Besides

Lovins himself, no one knows this better than Michael Brylawski.

Currently the founder and CEO of Vision Fleet Capital, which works on

clean vehicle adoption, he cofounded RMI’s sustainable transportation

practice and later led strategy for RMI spinoffs Hypercar, Inc., its

successor Fiberforge Corporation, and Bright Automotive. “When I saw the

XL1 from VW, the specs looked quite similar to where Amory was

predicting well over 20 years ago that vehicle design could go,” he

explains. “The XL1 is the purest form of the Hypercar [on the market

today]. The similarities are exceptional.”

From Hypercar concept to VW reality

RMI’s

Hypercar started in 1990 with a $50,000 seed grant from the Nathan

Cummings Foundation to “get Amory to think about cars.” The resulting

paper, “Advanced Light Vehicle Concepts,” shocked the National Research

Council’s auto-efficiency symposium, says Lovins. Don Runkle, then GM’s

head of advanced engineering, took Lovins to lunch, and on a handshake,

launched a fruitful two-year process of mutual education.

To say that Lovins, RMI, and Hypercar made a splash in the auto world would be an understatement. The British magazine Car named

Lovins the 22nd most powerful person in the global automotive industry

(and the only outsider). The Hypercar concept won the ISATA Nissan Prize

and a World Technology Award — followed by another to Hypercar, Inc. In

1993, after two years’ validation with the industry, RMI put the

Hypercar concept into the public domain so nobody could patent it and to

encourage competition leveraging its ideas, while RMI’s for-profit

spinoffs sought to commercialize technologies outside automakers’

comfort zone and raise the competitive pressure.

By the first half of the 2000s, you could read about the Hypercar everywhere from Automobile magazine to the Wall Street Journal to Environmental Health Perspectives. But

a true Hypercar had yet to leap from the drawing board to the streets.

“The roadmap was right, but the distance underestimated,” Brylawski says

today.

Indeed,

many of Lovins’s predictions have come to pass. Two decades ago he

claimed regenerative braking could yield 70 percent efficiency when

automakers balked at the idea of exceeding 30.

Today’s electric vehicles, including the Chevy Volt and Tesla Model S, respectively get 70+ and 80 percent. Meanwhile, the XL1’s specs are an eerily close match with Lovins’s early Hypercar predictions for achievable rolling resistance, aerodynamic drag, and more. (Unfortunately, estimates of fuel economy can’t be directly compared between the Hypercar and XL1 due to differences in their number of seats, U.S. vs. European test cycles, and changes in modeling and test cycle protocols, but both are far into triple digits.)

So

if the Hypercar concept is now emergent reality, why aren’t more

Hypercars on the road? “There’s a lot of hard work that goes between the

idea and the execution,” says Brylawski. And that’s where

VW’s XL1 is really notable. It combines an electrified hybrid

powertrain, lightweight carbon fiber and other materials, and low

aerodynamic drag and rolling resistance, bringing the Hypercar and other

1990s concepts like it — such as GM’s 1991 Ultralite — from drawing

board to driver’s seat. Lovins, for his part, is thrilled — he would

love to be VW’s first U.S. XL1 customer, he says.

The fuel-efficient road ahead

For

all the similarities between Hypercar and XL1, there is at least one

major point of departure: cost. The Hypercar was always meant to be

competitively priced, but with a sticker price of $150,000, VW’s XL1

certainly is not. Its production run is just 250 copies — a niche,

novelty vehicle for aficionados. “It’s something of a one-off,” says

VW’s Gillies. “The market is effectively limited for [such an expensive]

small economy car.”

But

a high-volume car was never VW’s goal. The XL1 was a proof of concept,

says Gillies, to “show the production feasibility; that VW has the

vision and drive to get it through to production. It’s one thing to do a

concept, but another to show you could actually build the thing.” Its

innovations will doubtless inform other models.

Despite

XL1’s eye-popping mpg rating, VW might have left some efficiency on the

table. Lovins notes that Toyota’s 2007 1/X concept car, also a plug-in

hybrid, had four seats and the interior volume of a Prius, but weighed

only 926 pounds, so even a production-ready version would probably weigh

less than the two-seat XL1. “We’re seeing a lot of partially executed

solutions,” says Jerry Weiland, the GM veteran who leads RMI’s

transportation practice. “Different automakers have done bits and pieces

[of the Hypercar concept], but no one has put the whole thing

together.”

Equally surprisingly, the XL1 may actually take efficiency further than

needed. RMI senior associate Jonathan Walker explains: “VW had a

different goal than we do. Their goal was to make a 235-mpg car. In my

opinion, you don’t need that,” he says. “RMI’s goal is get off carbon

and oil. A 100 mpg car gets you there.” RMI’s Reinventing Fire analysis,

he notes, can fuel its efficient vehicles, some at just half XL1’s

efficiency, with any mixture of electricity, hydrogen, and advanced

biofuels but no oil. “The added capital and cost of going for XL1 levels

of efficiency is not worth it,” Walker says. “You start getting

diminishing returns.” In other words, more modest but still radically

improved fuel efficiency can yield an affordable Hypercar that doesn’t

carry an XL1 price tag.

Runkle’s theory of economic gravity

“Amory

gets full credit for putting these concepts on the table more than 20

years ago,” says Weiland. “But by now, the automakers have developed and

productionized what they saw fit. If they’re not doing something,

there’s probably a somewhat rational reason.” One of those reasons is

federal fuel economy standards. Until recently, U.S. consumers haven’t

been especially concerned about mpg in their car-buying decisions, so

automakers have mostly done just enough to meet corporate average fuel

economy (CAFE) requirements.

As

Walker notes, those requirements, recently stiffened to 54.5 mpg for an

automaker’s fleet by 2025, still might not move the needle. Many

automakers can make more money paying modest penalties and selling

gas-guzzlers than they can complying. Also, more-efficient hybrids and

electric vehicles help automakers’ fleets meet the CAFE average standard

while still including inefficient SUVs and pickup trucks.

But

if CAFE standards are insufficient, that puts the ball squarely back in

the court of economics. And Don Runkle has something to say about that.

Runkle

is now executive chairman of EcoMotors, a firm pioneering

superefficient internal combustion engines (which Lovins thinks could

weigh far less than the XL1’s plug-in diesel-electric hybrid). Before

EcoMotors, Runkle spent 30 years with GM, leading the Ultralite and

other early-1990s Hypercar-esque concepts. “I was always involved in

some attempt at extraordinary performance levels,” he says. “Sometimes

it was outright speed or acceleration or fuel efficiency. You’re pushing

the envelope. In terms of high performance — whether it’s acceleration

or top speed — you’re always trying to make sure you had the structural

integrity you needed at the lowest mass you could

handle” — simultaneously boosting efficiency.

Like

the Hypercar, his Ultralite team similarly pursued lightweighting,

rolling resistance, aerodynamics, and a downsized powertrain to develop a

sporty, 100-mpg, four-seat concept car. At some point, though, Runkle

argues that eking out more mpg comes at a cost. If cost is no object,

almost any level of performance — fuel economy or otherwise — is

possible. But cost is an object. He calls it his theory of economic gravity.

“In

a nutshell, it’s not hard to get high fuel economy. That’s a matter of

physics,” he explains. “What’s hard is to get a technology that saves

more than it costs. That’s economic gravity, where there’s a natural

incentive.” Automakers more or less all have a spreadsheet, Runkle says,

showing incremental efficiency gain vs. cost for a big portfolio of

technology options — electric steering, lightweighting with carbon

fiber, LED lights, lower-friction tires. Engineers start with the

cheapest options and work their way down the list until they’ve met

legal mpg requirements, he says.

“It’s

always good to do the Hypercars, the Ultralites,” says Runkle. “They

push the envelope. They help clarify the problem and show the promise.

Then you can focus more on trying to solve the cost issues.”

A Hypercar for the masses

There

is, of course, a very RMI way around the a la carte approach of

Runkle’s spreadsheet: whole-systems thinking. “That’s the challenge if

you’re only looking at single components versus a systems approach,”

says Brylawski. “It’s challenging running a multi-billion-dollar,

multi-million-unit auto company without some specializing,” Brylawski

continues. “That’s a barrier to more holistic approaches” like VW’s XL1

and BMW’s i3, not to mention RMI’s Revolution concept, an early 2000s

SUV designed by Hypercar, Inc. and two Tier Ones.

“What

Amory and RMI showed [with Hypercar] is that change is hard but you can

end up in a better place. But why change unless you have to?” That’s

the rub. Inertia is strong. “The extreme retooling required,

metaphorical and literal, hasn’t been compelling enough for automakers,”

argues Brylawski. “Not until recently have you had a global regulatory

and fuel price environment that makes it worthwhile” — and the threat,

proven by Tesla, of outcompeting incumbents by making better autos that

people will buy because they’re superior, not just because they’re more

efficient.

Now, with

automakers like VW leading the charge, and with manufacturing methods

like RMI’s Fiberforge spinoff (whose technology was sold last year to

German Tier One pressmaker Dieffenbacher), that could be changing. “Fast

forward to today,” Brylawski points out. “BMW has a car made largely

from carbon fiber. Toyota has a fuel cell car coming out. VW’s XL1 gets

hundreds of miles per gallon. We’re seeing a whole host of interesting

solutions that read pretty closely out of Amory and RMI’s playbook from

the early 1990s.”

Moreover,

from VW’s Jetta to Toyota’s Prius, automakers are offering multiple

efficient and electrified powertrain options: TDI clean diesel, hybrid,

plug-in hybrid electric, all-electric, and extended-range electrics like

the Chevy Volt. “It comes back to platform physics. That makes sense to

do first,” continues Brylawski. “The combination of platform fitness

and electrification is like peanut butter and chocolate creating a

Reese’s cup. It’s Amory’s holistic view, and that’s where VW and BMW are

ahead of the curve.”

“I

think XL1 will stimulate both VW and its competitors — as will BMW’s i3

and i8 — to develop families of diverse vehicles that increasingly

converge with our original Hypercar goals,” says Lovins, reflecting on

the Hypercar’s influence. “Our early-1990s expectations are now matched

by reality in such key areas as mass, drag, tire rolling resistance,

braking energy regeneration, and — even exceeding my early hopes — the

weight, cost, and performance of electric powertrains. Such advanced

vehicles are not only for the select, higher-price markets in which

they’re initially being introduced in Germany, but also ultimately for

mass markets.”

“It

takes a long time, but once you get these things into the market,

things start to accrete,” concludes Brylawski. “The Prius outsells every

SUV in America. Back in 2000 that was unimaginable.” We’re already, in

fact, seeing signs of further traction. Earlier this year BMW increased

production on its i3 by 43 percent to meet higher-than-expected consumer

demand, and is on track for total annual sales, at U.S. prices starting

around $40,000, to be nearly double initial forecasts.

From

VW’s pioneering XL1 to BMW’s i3 to even the aluminum-infused,

lighter-weight-but-still-built-Ford-tough F-150, Hypercar’s innovative

concepts live on.

Written by Peter Bronski, editorial director of RMI. Follow Peter on Twitter.

This article is from the Summer 2014 issue of Rocky Mountain Institute’s Solution Journal. To read more from back issues of Solutions Journal, please visit the RMI website.