Furthermore, they can be broad or narrow, legal or illegal,

ethical or unethical. The most common forms of subsidies are those to

the producer or the consumer. Producer/production subsidies ensure

producers are better off by either supplying market price support,

direct support, or payments to factors of production.

Consumer/consumption subsidies commonly reduce the price of goods and

services to the consumer. For example, in the US at one time it was

cheaper to buy gasoline than bottled water.

Whether subsidies are positive or negative is typically a normative judgment. As a form of economic intervention, subsidies are inherently contrary to the market's demands. However, they can also be used as tools of political and corporate cronyism.

Whether subsidies are positive or negative is typically a normative judgment. As a form of economic intervention, subsidies are inherently contrary to the market's demands. However, they can also be used as tools of political and corporate cronyism.

Types

Production subsidy

A

production subsidy encourages suppliers to increase the output of a

particular product by partially offsetting the production costs or

losses.

The objective of production subsidies is to expand production of a

particular product more so that the market would promote but without

raising the final price to consumers. This type of subsidy is

predominantly found in developed markets. Other examples of production subsidies include the assistance in the creation of a new firm (Enterprise Investment Scheme), industry (industrial policy) and even the development of certain areas (regional policy).

Production subsidies are critically discussed in the literature as they

can cause many problems including the additional cost of storing the

extra produced products, depressing world market prices, and

incentivizing producers to over-produce, for example, a farmer overproducing in terms of his land's carrying capacity.

Consumer/consumption subsidy

A consumption subsidy is one that subsidises the behavior of consumers. This type of subsidies are most common in developing countries

where governments subsidise such things as food, water, electricity and

education on the basis that no matter how impoverished, all should be

allowed those most basic requirements.

For example, some governments offer 'lifeline' rates for electricity,

that is, the first increment of electricity each month is subsidized. This paper addresses the problems of defining and measuring government

subsidies, examines why and how government subsidies are used as a fiscal policy

tool, discusses their economic effects, appraises international empirical evidence

on government subsidies, and offers options for their reform. Evidence from

recent studies suggests that government expenditures on subsidies remain high in

many countries, often amounting to several percentage points of GDP.

Subsidization on such a scale implies substantial opportunity costs.

There are at least three compelling reasons for studying government subsidy

behavior. First, subsidies are a major instrument of government expenditure

policy. Second, on a domestic level, subsidies affect domestic resource allocation

decisions, income distribution, expenditure productivity

Export subsidy

An

export subsidy is a support from the government for products that are

exported, as a means of assisting the country's balance of payments. Usha Haley and George Haley identified the subsidies to manufacturing industry provided by the Chinese Government and how they have altered trade patterns.

Traditionally, economists have argued that subsidies benefit consumers

but hurt the subsidizing countries. Haley and Haley provided data to

show that over the decade after China joined the World Trade Organization

industrial subsidies have helped give China an advantage in industries

in which they previously enjoyed no comparative advantage such as the

steel, glass, paper, auto parts, and solar industries.

Export subsidy is known for being abused. For example, some

exporters substantially over declare the value of their goods so as to

benefit more from the export subsidy. Another method is to export a

batch of goods to a foreign country but the same goods will be

re-imported by the same trader via a circuitous route and changing the

product description so as to obscure their origin. Thus the trader

benefits from the export subsidy without creating real trade value to

the economy. Export subsidy as such can become a self-defeating and

disruptive policy.

Import subsidy

An

import subsidy is support from the government for products that are

imported. Rarer than an export subsidy, an import subsidy further

reduces the price to consumers for imported goods. Import subsidies

have various effects depending on the subject. For example, consumers

in the importing country are better off and experience an increase in

consumer welfare due to the decrease in price of the imported goods, as

well as the decrease in price of the domestic substitute goods.

Conversely, the consumers in the exporting country experience a decrease

in consumer welfare due to an increase in the price of their domestic

goods. Furthermore, producers of the importing country experience a

loss of welfare due to a decrease of the price for the good in their

market, while on the other side, the exporters of the producing country

experience an increase in well being due to the increase in demand.

Ultimately, the import subsidy is rarely used due to an overall loss of

welfare for the country due to a decrease in domestic production and a

reduction in production throughout the world. However, that can result

in a redistribution of income.

Employment subsidy

An

employment subsidy serves as an incentive to businesses to provide more

job opportunities to reduce the level of unemployment in the country

(income subsidies) or to encourage research and development.

With an employment subsidy, the government provides assistance with

wages. Another form of employment subsidy is the social security

benefits. Employment subsidies allow a person receiving the benefit to

enjoy some minimum standard of living.

Tax subsidy

Government can create the same outcome through selective tax breaks as through cash payment.

For example, suppose a government sends monetary assistance that

reimburses 15% of all health expenditures to a group that is paying 15%

income tax. Exactly the same subsidy is achieved by giving a health tax

deduction. Tax subsidies are also known as tax expenditures. Tax subsidies are one of the main explanations for why the American tax code is so complicated.

Tax breaks are often considered to be a subsidy. Like other

subsidies, they distort the economy; but tax breaks are also less

transparent, and are difficult to undo.

Transport subsidies

Some

governments subsidize transport, especially rail and bus transport

which decrease congestion and pollution compared to cars. In the EU, rail subsidies are around €73 billion and in China they reach $130 billion.

Publicly owned airports can be an indirect subsidy if they lose

money. The European Union for instance criticizes Germany for its high

number of money losing airports that are used primarily by low cost carriers, characterizing the arrangement as an illegal subsidy.

In many countries roads and highways are paid for through general

revenue rather than tolls or other dedicated sources only paid by road

users creating an indirect subsidy for road transportation. For instance

the fact that long distance buses in Germany do not pay tolls has been

called a subsidy by critics pointing to track access charges for

railways.

Oil subsidies

An

oil subsidy is one aimed at decreasing the overall price of oil.

Oil subsidies have always played a major part in U.S. history. These

began as early as World War I and have increased in the following

decades. However, due to changes in the perceptions of the environment,

in 2012 President Barack Obama ended the subsidies to the oil industry,

which were, at the time, $4 billion.

Housing subsidies

Housing

subsidies are designed to promote the construction industry and

home ownership. As of 2018, housing subsidies total around $15 billion

per year. Housing subsidies can come in two types; assistance with down

payment and interest rate subsidies. The deduction of mortgage

interest from the federal income tax accounts for the largest interest

rate subsidy. Additionally, the federal government will help low-income

families with the down payment, coming to $10.9 million in 2008.

Removing energy subsidies is viewed as a necessary measure to combat

greenhouse gas emissions as it helps decrease energy consumption.

Environmental externalities

As

well as the conventional and formal subsidies as outlined above there

are myriad implicit subsidies principally in the form of environmental externalities.

These subsidies include anything that is omitted but not accounted for

and thus is an externality. These include things such as car drivers who

pollute everyone's atmosphere without compensating everyone, farmers

who use pesticides

which can pollute everyone's ecosystems again without compensating

everyone, or Britain's electricity production which results in

additional acid rain in Scandinavia.

In these examples the polluter is effectively gaining a net benefit but

not compensating those affected. Although they are not subsidies in the

form of direct economic support from the Government, they are no less

economically, socially and environmentally harmful.

A 2015 report studied the implicit subsidies accruing to 20

fossil fuel companies and found that, while highly profitable, the

hidden economic cost to society was also large.

The report spans the period 2008–2012 and notes that: "for all

companies and all years, the economic cost to society of their CO2 emissions was greater than their after‐tax profit, with the single exception of ExxonMobil in 2008."

Pure coal companies fare even worse: "the economic cost to society

exceeds total revenue (employment, taxes, supply purchases, and indirect

employment) in all years, with this cost varying between nearly $2 and

nearly $9 per $1 of revenue."

Categorising subsidies

Broad and narrow

These

various subsidies can be divided into broad and narrow. Narrow

subsidies are those monetary transfers that are easily identifiable and

have a clear intent. They are commonly characterised by a monetary

transfer between governments and institutions or businesses and

individuals. A classic example is a government payment to a farmer.

Conversely broad subsidies include both monetary and non-monetary subsidies and is often difficult to identify.

A broad subsidy is less attributable and less transparent.

Environmental externalities are the most common type of broad subsidy.

Economic effects

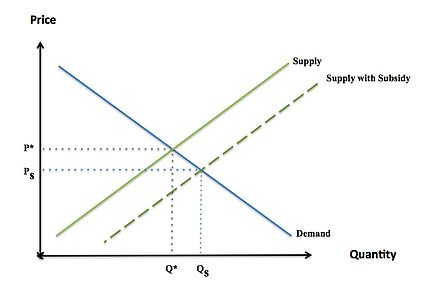

Competitive

equilibrium is a state of balance between buyers and suppliers, in

which the quantity demanded of a good is the quantity supplied at a

specified price. When the quantity demand exceeds the equilibrium

quantity, price falls; conversely, a reduction in the supply of a good

beyond equilibrium quantity implies an increase in the price.

The effect of a subsidy is to shift the supply or demand curve to the

right (i.e. increases the supply or demand) by the amount of the

subsidy. If a consumer is receiving the subsidy, a lower price of a good

resulting from the marginal subsidy on consumption increases demand,

shifting the demand curve to the right. If a supplier is receiving the

subsidy, an increase in the price (revenue) resulting from the marginal

subsidy on production results increases supply, shifting the supply

curve to the right.

Assuming

the market is in a perfectly competitive equilibrium, a subsidy

increases the supply of the good beyond the equilibrium competitive

quantity. The imbalance creates dead-weight loss. Dead-weight loss from a

subsidy is the amount by which the cost of the subsidy exceeds the gains

of the subsidy.

The magnitude of the dead-weight loss is dependent on the size of the

subsidy. This is considered a market failure, or inefficiency.

Subsidies targeted at goods in one country, by lowering the price

of those goods, make them more competitive against foreign goods,

thereby reducing foreign competition.

As a result, many developing countries cannot engage in foreign trade,

and receive lower prices for their products in the global market. This

is considered protectionism: a government policy to erect trade barriers

in order to protect domestic industries. The problem with protectionism

arises when industries are selected for nationalistic reasons

(Infant-Industry), rather than to gain a comparative advantage. The

market distortion, and reduction in social welfare, is the logic behind

the World Bank policy for the removal of subsidies in developing

countries.

Subsidies create spillover effects in other economic sectors and

industries. A subsidized product sold in the world market lowers the

price of the good in other countries. Since subsidies result in lower

revenues for producers of foreign countries, they are a source of

tension between the United States, Europe and poorer developing

countries.

While subsidies may provide immediate benefits to an industry, in the

long-run they may prove to have unethical, negative effects. Subsidies

are intended to support public interest, however, they can violate

ethical or legal principles if they lead to higher consumer prices or

discriminate against some producers to benefit others.

For example, domestic subsidies granted by individual US states may be

unconstitutional if they discriminate against out-of-state producers,

violating the Privileges and Immunities Clause or the Dormant Commerce

Clause of the United States Constitution.

Depending on their nature, subsidies are discouraged by international

trade agreements such as the World Trade Organization (WTO). This trend,

however, may change in the future, as needs of sustainable development

and environmental protection could suggest different interpretations

regarding energy and renewable energy subsidies.

Perverse subsidies

Definitions

Although subsidies can be important, many are "perverse", in the sense of having adverse unintended consequences.

To be "perverse", subsidies must exert effects that are demonstrably

and significantly adverse both economically and environmentally.

A subsidy rarely, if ever, starts perverse, but over time a legitimate

efficacious subsidy can become perverse or illegitimate if it is not

withdrawn after meeting its goal or as political goals change. Perverse

subsidies are now so widespread that as of 2007 they amounted $2

trillion per year in the six most subsidized sectors alone (agriculture,

fossil fuels, road transportation, water, fisheries and forestry).

Effects

The

detrimental effects of perverse subsidies are diverse in nature and

reach. Case-studies from differing sectors are highlighted below but can

be summarized as follows.

Directly, they are expensive to governments by directing

resources away from other legitimate should priorities (such as

environmental conservation, education, health, or infrastructure).

Indirectly, they cause environmental degradation (exploitation of resources,

pollution, loss of landscape, misuse and overuse of supplies) which, as

well as its fundamental damage, acts as a further brake on economies;

tend to benefit the few at the expense of the many, and the rich at the

expense of the poor; lead to further polarization of development between

the Northern and Southern hemispheres; lower global market prices; and

undermine investment decisions reducing the pressure on businesses to

become more efficient.

Over time the latter effect means support becomes enshrined in human

behavior and business decisions to the point where people become

reliant on, even addicted to, subsidies, 'locking' them into society.

Consumer attitudes do not change and become out-of-date, off-target and inefficient; furthermore, over time people feel a sense of historical right to them.

Despite governments being responsible for the creation and (lack of)

termination of subsidies, it is ironic that perverse subsidies are not

tackled more rigorously, particularly as the above highlight their

contradiction to the majority of governments' stated policies.

Implementation

Perverse

subsidies are not tackled as robustly as they should be. Principally,

this is because they become 'locked' into society, causing bureaucratic

roadblocks and institutional inertia. When cuts are suggested many argue (most fervently by those 'entitled', special interest groups and political lobbyists) that it will disrupt and harm the lives of people who receive them, distort domestic competitiveness curbing trade opportunities, and increase unemployment. Individual governments recognize this as a 'prisoner's dilemma'

– inasmuch that even if they wanted to adopt subsidy reform, by acting

unilaterally they fear only negative effects will ensue if others do not

follow. Furthermore, cutting subsidies, however perverse they may be, is considered a vote-losing policy.

Reform of perverse subsidies is at a propitious time. The current

economic conditions mean governments are forced into fiscal constraints

and are looking for ways to reduce activist roles in their economies.

There are two main reform paths: unilateral and multilateral.

Unilateral agreements (one country) are less likely to be undertaken for

the reasons outlined above, although New Zealand, Russia, Bangladesh and others represent successful examples.

Multilateral actions by several countries are more likely to succeed as

this reduces competitiveness concerns, but are more complex to

implement requiring greater international collaboration through a body

such as the WTO. Irrespective of the path, the aim of policymakers should be to: create

alternative policies that target the same issue as the original

subsidies but better; develop subsidy removal strategies allowing

market-discipline to return; introduce 'sunset' provisions that require

remaining subsidies to be re-justified periodically; and make perverse

subsidies more transparent to taxpayers to alleviate the 'vote-loser'

concern.

Examples

Agricultural subsidies

Support

for agriculture dates back to the 19th century. It was developed

extensively in the EU and USA across the two World Wars and the Great

Depression to protect domestic food production, but remains important

across the world today. In 2005, US farmers received $14 billion and EU farmers $47 billion in agricultural subsidies.

Today, agricultural subsidies are defended on the grounds of helping

farmers to maintain their livelihoods. The majority of payments are

based on outputs and inputs and thus favour the larger producing

agribusinesses over the small-scale farmers. In the USA nearly 30% of payments go to the top 2% of farmers.

By subsidizing inputs and outputs through such schemes as 'yield

based subsidization', farmers are encouraged to: over-produce using

intensive methods including using more fertilizers and pesticides; grow

high-yielding monocultures; reduce crop rotation; shorten fallow periods; and promote exploitative land use change from forests, rainforests and wetlands to agricultural land. These all lead to severe environmental degradation including adverse effects on: soil quality and productivity including erosion,

nutrient supply and salinity which in turn affects carbon storage and

cycling, water retention and drought resistance; water quality including

pollution, nutrient deposition and eutrophication

of waterways, and lowering of water tables; diversity of flora and

fauna including indigenous species both directly and indirectly through

the destruction of habitats, resulting in a genetic wipe-out.

Cotton growers in the US reportedly receive half their income from the government under the Farm Bill of 2002.

The subsidy payments stimulated overproduction and resulted in a record

cotton harvest in 2002, much of which had to be sold at very reduced

prices in the global market.

For foreign producers, the depressed cotton price lowered their prices

far below the break-even price. In fact, African farmers received 35 to

40 cents per pound for cotton, while US cotton growers, backed by

government agricultural payments, received 75 cents per pound.

Developing countries and trade organizations argue that poorer countries

should be able to export their principal commodities to survive, but

protectionist laws and payments in the United States and Europe prevent

these countries from engaging in international trade opportunities.

Fisheries

Today, much of the world's major fisheries are over-exploited; in 2002, the WWF

estimate this at approximately 75%. Fishing subsidies include "direct

assistant to fishers; loan support programs; tax preferences and

insurance support; capital and infrastructure programs; marketing and

price support programs; and fisheries management, research, and

conservation programs." They promote the expansion of fishing fleets,

the supply of larger and longer nets, larger yields and indiscriminate

catch, as well as mitigating risks which encourages further investment

into large-scale operations to the disfavor of the already struggling

small-scale industry. Collectively, these result in the continued overcapitalization and overfishing of marine fisheries.

There are four categories of fisheries subsidies. First are

direct financial transfers. Second, are indirect financial transfers

and services. Third, certain forms of intervention and fourth, not

intervening. The first category regards direct payments from the

government received by the fisheries industry. These typically effect

profits of the industry in the short term and can be negative or

positive. Category two pertains to government intervention, not

involving those under the first category. These subsidies also affect

the profits in the short term but typically are not negative. Category

three regards intervention that results in a negative short-term

economic impact, but economic benefits in the long term. These benefits

are usually more general societal benefits such as the environment.

The final category pertains to inaction by the government, allowing

producers to impose certain production costs on others. These subsidies

tend to lead to positive benefits in the short term but negative in the

long term.

Others

The US National Football League's (NFL)

profits have topped records at $11 billion, the highest of all sports.

The NFL had tax-exempt status until voluntarily relinquishing it in

2015, and new stadiums have been built with public subsidies.

The Commitment to Development Index (CDI), published by the Center for Global Development,

measures the effect that subsidies and trade barriers actually have on

the undeveloped world. It uses trade, along with six other components

such as aid or investment, to rank and evaluate developed countries on

policies that affect the undeveloped world. It finds that the richest

countries spend $106 billion per year subsidizing their own farmers –

almost exactly as much as they spend on foreign aid.