Centers for Medicare and Medicaid Services (Medicaid administrator) logo

Medicaid in the United States is a federal and state program

that helps with medical costs for some people with limited income and

resources. Medicaid also offers benefits not normally covered by Medicare,

including nursing home care and personal care services. The Health

Insurance Association of America describes Medicaid as "a government

insurance program for persons of all ages whose income and resources are

insufficient to pay for health care."

Medicaid is the largest source of funding for medical and

health-related services for people with low income in the United States,

providing free health insurance to 74 million low-income and disabled

people (23% of Americans) as of 2017. It is a means-tested program that is jointly funded by the state and federal governments and managed by the states,

with each state currently having broad leeway to determine who is

eligible for its implementation of the program. States are not required

to participate in the program, although all have since 1982. Medicaid

recipients must be U.S. citizens or qualified non-citizens, and may include low-income adults, their children, and people with certain disabilities. Poverty alone does not necessarily qualify someone for Medicaid.

The Patient Protection and Affordable Care Act

significantly expanded both eligibility for and federal funding of

Medicaid. Under the law as written, all U.S. citizens and qualified

non-citizens with income up to 133% of the poverty line,

including adults without dependent children, would qualify for coverage

in any state that participated in the Medicaid program. However, the Supreme Court of the United States ruled in National Federation of Independent Business v. Sebelius

that states do not have to agree to this expansion in order to continue

to receive previously established levels of Medicaid funding, and many

states have chosen to continue with pre-ACA funding levels and

eligibility standards.

Research suggests that Medicaid improves recipients' financial

security. However, the evidence is mixed regarding whether Medicaid

actually improves health outcomes, although "the best existing evidence

says [having health insurance] improves health".

Medicaid and Medicare are the two government sponsored medical insurance

programs in the United States and are administered by the U.S. Centers

for Medicare & Medicaid Services, Baltimore, Maryland.

Features

Beginning in the 1980s, many states received waivers from the federal government to create Medicaid managed care

programs. Under managed care, Medicaid recipients are enrolled in a

private health plan, which receives a fixed monthly premium from the

state. The health plan is then responsible for providing for all or most

of the recipient's healthcare needs. Today, all but a few states use

managed care to provide coverage to a significant proportion of Medicaid

enrollees. As of 2014, 26 states have contracts with managed care

organizations (MCOs) to deliver long-term care for the elderly and

individuals with disabilities. The states pay a monthly capitated rate

per member to the MCOs that provide comprehensive care and accept the

risk of managing total costs. Nationwide, roughly 80% of enrollees are enrolled in managed care plans.

Core eligibility groups of poor children and parents are most likely to

be enrolled in managed care, while the aged and disabled eligibility

groups more often remain in traditional "fee for service" Medicaid.

Because the service level costs vary depending on the care and

needs of the enrolled, a cost per person average is only a rough measure

of actual cost of care. The annual cost of care will vary state to

state depending on state approved Medicaid benefits, as well as the

state specific care costs. 2008 average cost per senior was reported as

$14,780 (in addition to Medicare), and a state by state listing was

provided.

In a 2010 national report for all age groups, the per enrolled average

cost was calculated to $5,563 and a listing by state and by coverage age

is provided.

Eligibility and benefits

As

of 2013, Medicaid is a program intended for those with low income, but a

low income is not the only requirement to enroll in the program.

Eligibility is categorical—that is, to enroll one must be a

member of a category defined by statute; some of these categories

include low-income children below a certain wage, pregnant women,

parents of Medicaid-eligible children who meet certain income

requirements, low-income disabled people who receive Supplemental Security Income (SSI) and/or Social Security Disability (SSD), and low-income seniors 65 and older. The details of how each category is defined vary from state to state.

Some states operate a program known as the Health Insurance Premium Payment Program

(HIPP). This program allows a Medicaid recipient to have private

health insurance paid for by Medicaid. As of 2008 relatively few states

had premium assistance programs and enrollment was relatively low.

Interest in this approach remained high, however.

Included in the Social Security program under Medicaid are dental

services. These dental services are optional for adults above the age

of 21; however, this service is a requirement for those eligible for

Medicaid and below the age of 21.

Minimum services include pain relief, restoration of teeth, and

maintenance for dental health. Early and Periodic Screening, Diagnostic

and Treatment (EPSDT) is a mandatory Medicaid program for children that

aims to focus on prevention, early diagnosis and treatment of medical

conditions.

Oral screenings are not required for EPSDT recipients, and they do not

suffice as a direct dental referral. If a condition requiring treatment

is discovered during an oral screening, the state is responsible for

taking care of this service, regardless of whether or not it is covered

on that particular Medicaid plan.

History

The Social Security Amendments of 1965 created Medicaid by adding Title XIX to the Social Security Act,

42 U.S.C. §§ 1396 et seq. Under the program, the federal government

provides matching funds to states to enable them to provide medical

assistance to residents who meet certain eligibility requirements. The

objective is to help states provide medical assistance to residents

whose incomes and resources are insufficient to meet the costs of

necessary medical services. Medicaid serves as the nation's primary

source of health insurance coverage for low-income populations.

States are not required to participate. Those that do must comply

with federal Medicaid laws under which each participating state

administers its own Medicaid program, establishes eligibility standards,

determines the scope and types of services it will cover, and sets the

rate of payment. Benefits vary from state to state, and because someone

qualifies for Medicaid in one state, it does not mean they will qualify

in another. The federal Centers for Medicare and Medicaid Services

(CMS) monitors the state-run programs and establishes requirements for

service delivery, quality, funding, and eligibility standards.

The Medicaid Drug Rebate Program and the Health Insurance Premium Payment Program (HIPP) were created by the Omnibus Budget Reconciliation Act of 1990

(OBRA-90). This act helped to add Section 1927 to the Social Security

Act of 1935 which became effective on January 1, 1991. This program was

formed due to the costs that Medicaid programs were paying for

outpatient drugs at their discounted prices.

The Omnibus Budget Reconciliation Act of 1993 (OBRA-93) amended Section 1927 of the Act as it brought changes to the Medicaid Drug Rebate Program, as well as requiring states to implement a Medicaid estate recovery program to sue the estate of decedents for medical care costs paid by Medicaid.

Medicaid also offers a Fee for Service (Direct Service) Program

to schools throughout the United States for the reimbursement of costs

associated with the services delivered to special education students.

Federal law mandates that every disabled child in America receive a

"free appropriate public education." Decisions by the United States

Supreme Court and subsequent changes in federal law make it clear that

Medicaid must pay for services provided for all Medicaid-eligible

disabled children.

Medicaid expansion under the Affordable Care Act

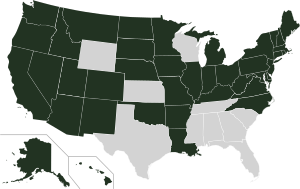

2018 Medicaid expansion by state.

Expanding Medicaid

Not expanding Medicaid

The Patient Protection and Affordable Care Act,

passed in 2010, would have revised and expanded Medicaid eligibility

starting in 2014. Under the law as written, states that wished to

participate in the Medicaid program would be required to allow people

with income up to 133% of the poverty line

to qualify for coverage, including adults without dependent children.

The federal government would pay 100% of the cost of Medicaid

eligibility expansion in 2014, 2015, and 2016; 95% in 2017, 94% in 2018,

93% in 2019, and 90% in 2020 and all subsequent years.

However, the Supreme Court ruled in NFIB v. Sebelius

that this provision of the ACA was coercive, and that the federal

government must allow states to continue at pre-ACA levels of funding

and eligibility if they chose. Several states have opted to reject the

expanded Medicaid coverage provided for by the act; over half of the

nation's uninsured live in those states. They include Texas, Florida, Kansas, Georgia, Louisiana, Alabama, and Mississippi.

As of May 24, 2013 a number of states had not made final decisions, and

lists of states which have opted out or were considering opting out

varied, but Alaska, Idaho, South Dakota, Nebraska, Wisconsin, Maine, North Carolina, South Carolina, and Oklahoma seemed to have decided to reject expanded coverage.

A canvassing campaign, Medicaid for Idaho, to put Medicaid expansion on the ballot in early 2018; the Methodist Cathedral of the Rockies hosted the volunteers

Several factors are associated with states' decisions to accept or reject Medicaid expansion in accordance with the Patient Protection and Affordable Care Act.

Partisan composition of state governments is the most significant

factor, with states led primarily by Democrats tending to expand

Medicaid and states led primarily by Republicans tending to reject

expansion.

Other important factors include the generosity of the Medicaid program

in a given state prior to 2010, spending on elections by health care

providers, and the attitudes people in a given state tend to have about

the role of government and the perceived beneficiaries of expansion.

The federal government will pay 100 percent of defined costs for

certain newly eligible adult Medicaid beneficiaries in "Medicaid

Expansion" states. The NFIB v. Sebelius ruling, effective January 1, 2014, allows Non-Expansion states to retain the program as it was before January 2014.

As of January 2014, 20 states confirmed opting out, including

Alabama, Alaska, Florida, Georgia, Idaho, Kansas, Louisiana, Maine,

Mississippi, Missouri, Montana, Nebraska, North Carolina, Oklahoma,

South Carolina, South Dakota, Tennessee, Texas, Virginia &

Wisconsin. States opting in after 2014 are Indiana & Pennsylvania.

On July 17, 2015, Governor Bill Walker sent a letter to the Alaskan

state legislature, providing the required 45-day notice of his intention

to accept the expansion of Medicaid in Alaska..

As of January 2019, confirmed opting out states have shrunk to 13

states: Alabama, Florida, Georgia, Kansas, Mississippi, Missouri, North

Carolina, Oklahoma, South Carolina, South Dakota, Tennessee, Texas,

& Wisconsin.

Under 2017 American Health Care Act (AHCA)

legislation under the House and Senate, both versions of proposed

Republican bills have proposed cuts to Medicaid funding on differing

timelines. Under both bills, the Congressional Budget Office

has rated these as Medicaid coverage reductions, with the Senate bill

reducing the costs of Medicaid by 26 percent by the year 2026, in

comparison to projections of ACA subsidies. Additionally, CBO estimates

have predicted the number of uninsured rising under AHCA from 28 million

persons to 49 million (under the Senate bill) or to 51 (under the House

Bill).

State implementations

States may bundle together the administration of Medicaid with other programs such as the Children's Health Insurance Program

(CHIP), so the same organization that handles Medicaid in a state may

also manage the additional programs. Separate programs may also exist in

some localities that are funded by the states or their political

subdivisions to provide health coverage for indigents and minors.

State participation in Medicaid is voluntary; however, all states have participated since 1982 when Arizona formed its Arizona Health Care Cost Containment System

(AHCCCS) program. In some states Medicaid is subcontracted to private

health insurance companies, while other states pay providers (i.e.,

doctors, clinics and hospitals) directly. There are many services that

can fall under Medicaid and some states support more services than other

states. The most provided services are intermediate care for mentally

handicapped, prescription drugs and nursing facility care for under

21-year-olds. The least provided services include institutional

religious (non-medical) health care, respiratory care for ventilator

dependent and PACE (inclusive elderly care).

Most states administer Medicaid through their own programs. A few of those programs are listed below:

- Arizona: AHCCCS

- California: Medi-Cal

- Connecticut: HUSKY D

- Maine: MaineCare

- Massachusetts: MassHealth

- New Jersey: NJ FamilyCare

- Oregon: Oregon Health Plan

- Oklahoma: Soonercare

- Tennessee: TennCare

- Washington Apple Health

- Wisconsin: BadgerCare

As of January 2012, Medicaid and/or CHIP funds could be obtained to

help pay employer health care premiums in Alabama, Alaska, Arizona,

Colorado, Florida, and Georgia.

Enrollment

According to CMS, the Medicaid program provided health care services to more than 46.0 million people in 2001. In 2002, Medicaid enrollees numbered 39.9 million Americans, the largest group being children

(18.4 million or 46 percent). From 2000 to 2012, the proportion of

hospital stays for children paid by Medicaid increased by 33 percent,

and the proportion paid by private insurance decreased by 21 percent.

Some 43 million Americans were enrolled in 2004 (19.7 million of them

children) at a total cost of $295 billion. In 2008, Medicaid provided

health coverage and services to approximately 49 million low-income

children, pregnant women, elderly people, and disabled people. In 2009,

62.9 million Americans were enrolled in Medicaid for at least one month,

with an average enrollment of 50.1 million. In California, about 23% of the population was enrolled in Medi-Cal for at least 1 month in 2009–10.

Medicaid payments currently assist nearly 60 percent of all

nursing home residents and about 37 percent of all childbirths in the

United States. The federal government pays on average 57 percent of

Medicaid expenses.

Loss of income and medical insurance coverage during the 2008–2009 recession

resulted in a substantial increase in Medicaid enrollment in 2009. Nine

U.S. states showed an increase in enrollment of 15% or more, resulting

in heavy pressure on state budgets.

The Kaiser Family Foundation reported that for 2013, Medicaid recipients were 40% white, 21% black, 25% hispanic, and 14% other races.

Comparisons with Medicare

Unlike Medicaid, Medicare is a social insurance program funded at the federal level and focuses primarily on the older population. As stated in the CMS website, Medicare is a health insurance program for people age 65 or older, people under age 65 with certain disabilities, and (through the End Stage Renal Disease Program) people of all ages with end-stage renal disease.

The Medicare Program provides a Medicare part A which covers hospital

bills, Medicare Part B which covers medical insurance coverage, and

Medicare Part D which covers prescription drugs.

Medicaid is a program that is not solely funded at the federal

level. States provide up to half of the funding for the Medicaid

program. In some states, counties also contribute funds. Unlike the

Medicare program, Medicaid is a means-tested, needs-based social welfare or social protection program rather than a social insurance

program. Eligibility is determined largely by income. The main

criterion for Medicaid eligibility is limited income and financial

resources, a criterion which plays no role in determining Medicare

coverage. Medicaid covers a wider range of health care services than

Medicare.

Some people are eligible for both Medicaid and Medicare and are known as Medicare dual eligible or medi-medi's.

In 2001, about 6.5 million Americans were enrolled in both Medicare and

Medicaid. In 2013, approximately 9 million people qualified for

Medicare and Medicaid.

Eligibility

Medicaid

is a joint federal-state program that provides health coverage or

nursing home coverage to certain categories of low-asset people,

including children, pregnant women, parents of eligible children, people

with disabilities and elderly needing nursing home care. Medicaid was

created to help low-asset people who fall into one of these eligibility

categories "pay for some or all of their medical bills."

There are two general types of Medicaid coverage. "Community

Medicaid" helps people who have little or no medical insurance. Medicaid

nursing home coverage pays all of the costs of nursing homes for those

who are eligible except that the recipient pays most of his/her income

toward the nursing home costs, usually keeping only $66.00 a month for

expenses other than the nursing home.

While Congress and the Centers for Medicare and Medicaid Services

(CMS) set out the general rules under which Medicaid operates, each

state runs its own program. Under certain circumstances, an applicant

may be denied coverage. As a result, the eligibility rules differ

significantly from state to state, although all states must follow the

same basic framework.

Poverty

Having

limited assets is one of the primary requirements for Medicaid

eligibility, but poverty alone does not qualify people to receive

Medicaid benefits unless they also fall into one of the defined

eligibility categories.

According to the CMS website, "Medicaid does not provide medical

assistance for all poor persons. Even under the broadest provisions of

the Federal statute (except for emergency services for certain persons),

the Medicaid program does not provide health care services, even for

very poor persons, unless they are in one of the designated eligibility

groups." In 2010, the Patient Protection and Affordable Care Act expanded Medicaid eligibility starting in 2014; people with income up to 133% of the poverty line qualify for coverage, including adults without dependent children. However, the United States Supreme Court ruled

that the federal government must make participation in the expanded

Medicaid program voluntary, and several state governments have declared

that they will not participate.

More recently, many states have authorized financial requirements

that will make it more difficult for working-poor adults to access

coverage. In Wisconsin, nearly a quarter of Medicaid patients were dropped after the state government imposed premiums of 3% of household income.

A survey in Minnesota found that more than half of those covered by

Medicaid were unable to obtain prescription medications because of

co-payments.

Categories

There

are a number of Medicaid eligibility categories; within each category

there are requirements other than income that must be met. These other

requirements include, but are not limited to, assets, age, pregnancy,

disability, blindness, income and resources, and one's status as a U.S. citizen or a lawfully admitted immigrant.

The Deficit Reduction Act of 2005

requires anyone seeking Medicaid to produce documents to prove that he

is a United States citizen or resident alien. An exception is made for

Emergency Medicaid where payments are allowed for the pregnant and

disabled regardless of immigration status.

Special rules exist for those living in a nursing home and disabled

children living at home. A child may be covered under Medicaid if he or

she is a U.S. citizen or a permanent resident.

A child may be eligible for Medicaid regardless of the

eligibility status of his parents. Thus, a child may be covered by

Medicaid based on his individual status even if his parents are not

eligible. Similarly, if a child lives with someone other than a parent,

he may still be eligible based on its individual status.

Immigration status

Legal permanent residents (LPRs) with a substantial work history

(defined as 40 quarters of Social Security covered earnings) or military

connection are eligible for the full range of major federal

means-tested benefit programs, including Medicaid (Medi-Cal).

LPRs entering after August 22, 1996, are barred from Medicaid for five

years, after which their coverage becomes a state option, and states

have the option to cover LPRs who are children or who are pregnant

during the first five years. Noncitizen SSI recipients are eligible for

(and required to be covered under) Medicaid. Refugees and asylees are

eligible for Medicaid for seven years after arrival; after this term,

they may be eligible at state option.

Nonimmigrants and unauthorized aliens are not eligible for most

federal benefits, regardless of whether they are means tested, with

notable exceptions for emergency services (e.g., Medicaid for emergency

medical care), but states have the option to cover nonimmigrant and

unauthorized aliens who are pregnant or who are children, and can meet

the definition of "lawfully residing" in the United States. Special

rules apply to several limited noncitizen categories: certain

"cross-border" American Indians, Hmong/Highland Laotians, parolees and

conditional entrants, and cases of abuse.

Aliens outside the United States who seek to obtain visas at US

consulates overseas, or admission at US ports of entry, are generally

denied entry if they are deemed "likely at any time to become a public

charge."

Aliens within the United States who seek to adjust their status to that

of lawful permanent resident (LPR), or who entered the United States

without inspection, are also generally subject to exclusion and

deportation on public charge grounds. Similarly, LPRs and other aliens

who have been admitted to the United States are removable if they become

a public charge within five years after the date of their entry due to

causes that preexisted their entry.

A 1999 policy letter from immigration officials defined "public

charge" and identified which benefits are considered in public charge

determinations, and the policy letter underlies current regulations and

other guidance on the public charge grounds of inadmissibility and

deportability. Collectively, the various sources addressing the meaning

of public charge have historically suggested that an alien's receipt of

public benefits, per se, is unlikely to result in the alien being deemed

to be removable on public charge grounds.

Coverage and use

One-third of children and over half (59%) of low-income children are insured through Medicaid or SCHIP.

The insurance provides them with access to preventive and primary

services which are used at a much higher rate than for the uninsured,

but still below the utilization of privately insured patients. As of

February 2011, a record 90% of children have coverage. However, 8

million children remain uninsured, including 5 million who are eligible

for Medicaid and SCHIP but not enrolled.

Dental

Children

enrolled in Medicaid are individually entitled under the law to

comprehensive preventive and restorative dental services, but dental

care utilization for this population is low. The reasons for low use are

many, but a lack of

dental providers who participate in Medicaid is a key factor. Few dentists participate in Medicaid – less than half of all active private dentists in some areas. Low reimbursement rates, complex forms and burdensome administrative requirements are commonly cited by dentists

as reasons for not participating in Medicaid.

In Washington state, a program known as Access to Baby and Child

Dentistry (ABCD) has helped increase access to dental services by

providing dentists higher reimbursements for oral health education and

preventive and restorative services for children. After the passing of the Affordable Care Act, many dental practices began using Dental Service Organizations

to provide business management and support, allowing practices to

minimize costs and pass the saving on to patients currently without

adequate dental care.

HIV

Medicaid provided the largest portion of federal money spent on health care for people living with HIV/AIDS

until the implementation of Medicare Part D when the prescription drug

costs for those eligible for both Medicare and Medicaid shifted to

Medicare. Unless low income people who are HIV positive meet some other

eligibility category, they are not eligible for Medicaid assistance

unless they can qualify under the "disabled" category to receive

Medicaid assistance — as, for example, if they progress to AIDS (T-cell count drops below 200). The Medicaid eligibility policy contrasts with the Journal of the American Medical Association

(JAMA) guidelines which recommend therapy for all patients with T-cell

counts of 350 or less, or in certain patients commencing at an even

higher T-cell count. Due to the high costs associated with HIV

medications, many patients are not able to begin antiretroviral

treatment without Medicaid help. More than half of people living with

AIDS in the US are estimated to receive Medicaid payments. Two other

programs that provide financial assistance to people living with

HIV/AIDS are the Social Security Disability Insurance (SSDI) and the Supplemental Security Income.

Supplemental Security Income beneficiaries

Once someone is approved as a beneficiary in the Supplemental Security Income program, they may automatically be eligible for Medicaid coverage (depending on the laws of the state they reside in).

Assets

Both the

federal government and state governments have made changes to the

eligibility requirements and restrictions over the years. The Deficit Reduction Act of 2005 (DRA) significantly changed the rules governing the treatment of asset transfers and homes of nursing home residents. The implementation of these changes proceeded state-by-state over the next few years and has now been substantially completed.

Five year "look-back"

The

DRA created a five-year "look-back period." That means that any

transfers without fair market value (gifts of any kind) made by the

Medicaid applicant during the preceding five years are penalizable.

The penalty is determined by dividing the average monthly cost of

nursing home care in the area or State into the amount of assets

gifted. Therefore, if a person gifted $60,000 and the average monthly

cost of a nursing home was $6,000, one would divide $6000 into $60,000

and come up with 10. 10 represents the number of months the applicant

would not be eligible for medicaid.

All transfers made during the five-year look-back period are

totaled, and the applicant is penalized based on that amount after

having already dropped below the Medicaid asset limit. This means that

after dropping below the asset level ($2,000 limit in most states), the

Medicaid applicant will be ineligible for a period of time. The penalty

period does not begin until the person is eligible for medicaid but for

the gift.

Elders who gift or transfer assets can be caught in the situation of having no money but still not being eligible for Medicaid.

Utilization

During 2003–2012, the share of hospital stays billed to Medicaid increased by 2.5 percent, or 0.8 million stays.

Medicaid super utilizers (defined as Medicaid patients with four

or more admissions in one year) account for more hospital stays (5.9

vs.1.3 stays), longer length of stay (6.1 vs. 4.5 days), and higher

hospital costs per stay ($11,766 vs. $9,032). Medicaid super-utilizers were more likely than other Medicaid patients to be male and to be aged 45–64 years.

Common conditions among super-utilizers include mood disorders and

psychiatric disorders, as well as diabetes; cancer treatment; sickle

cell anemia; septicemia; congestive heart failure; chronic obstructive

pulmonary disease; and complications of devices, implants and grafts.

Budget

Medicaid spending as part of total U.S. healthcare spending (public and private). Percent of gross domestic product (GDP). Congressional Budget Office chart.

Unlike Medicare, which is solely a federal program, Medicaid is a

joint federal-state program. Each state operates its own Medicaid

system, but this system must conform to federal guidelines in order for

the state to receive matching funds and grants. The matching rate provided to states is determined using a federal matching formula (called Federal Medical Assistance Percentages), which generates payment rates that vary from state to state, depending on each state's respective per capita income. The wealthiest states only receive a federal match of 50% while poorer states receive a larger match.

Medicaid funding has become a major budgetary issue for many

states over the last few years, with states, on average, spending 16.8%

of state general funds on the program. If the federal match expenditure

is also counted, the program, on average, takes up 22% of each state's

budget. Some 43 million Americans were enrolled in 2004 (19.7 million of them children) at a total cost of $295 billion.

In 2008, Medicaid provided health coverage and services to

approximately 49 million low-income children, pregnant women, elderly

people, and disabled people. Federal Medicaid outlays were estimated to be $204 billion in 2008.

In 2011, there were 7.6 million hospital stays billed to Medicaid,

representing 15.6 percent (approximately $60.2 billion) of total

aggregate inpatient hospital costs in the United States. At $8,000, the mean cost per stay billed to Medicaid was $2,000 less than the average cost for all stays.

Medicaid does not pay benefits to individuals directly; Medicaid

sends benefit payments to health care providers. In some states Medicaid

beneficiaries are required to pay a small fee (co-payment) for medical

services. Medicaid is limited by federal law to the coverage of "medically necessary services".

Since Medicaid program was established in 1965, "states have been

permitted to recover from the estates of deceased Medicaid recipients

who were over age 65 when they received benefits and who had no

surviving spouse, minor child, or adult disabled child." In 1993, Congress enacted the Omnibus Budget Reconciliation Act of 1993,

which required states to attempt to recoup "the expense of long-term

care and related costs for deceased Medicaid recipients 55 or older."

The Act also allowed states to recover other Medicaid expenses for

deceased Medicaid recipients 55 or older, at each state's choice.

However, states are prohibited from estate recovery when "there is a

surviving spouse, a child under the age of 21 or a child of any age who

is blind or disabled" and "the law also carved out other exceptions for

adult children who have served as caretakers in the homes of the

deceased, property owned jointly by siblings, and income-producing

property, such as farms."

Each state now maintains a Medicaid Estate Recovery Program, although

the sum of money collected significantly varies from state to state,

"depending on how the state structures its program and how vigorously it

pursues collections."

Medicaid payments currently assist nearly 60 percent of all

nursing home residents and about 37 percent of all childbirths in the

United States. The federal government pays on average 57 percent of

Medicaid expenses.

On November 25, 2008, a new federal rule was passed that allows

states to charge premiums and higher co-payments to Medicaid

participants.

This rule will enable states to take in greater revenues, limiting

financial losses associated with the program. Estimates figure that

states will save $1.1 billion while the federal government will save

nearly $1.4 billion. However, this means that the burden of financial

responsibility will be placed on 13 million Medicaid recipients who will

face a $1.3 billion increase in co-payments over 5 years.

The major concern is that this rule will create a disincentive for

low-income people to seek healthcare. It is possible that this will

force only the sickest participants to pay the increased premiums and it

is unclear what long-term effect this will have on the program.

Effects

After Medicaid was enacted, some states repealed their filial responsibility laws, but most states still require children to pay for the care of their impoverished parents.

A 2017 survey of the academic research on Medicaid found it improved recipients' health and financial security.

A 2017 paper found that Medicaid expansion under the Affordable Care

Act "reduced unpaid medical bills sent to collection by $3.4 billion in

its first two years, prevented new delinquencies, and improved credit

scores. Using data on credit offers and pricing, we document that

improvements in households' financial health led to better terms for

available credit valued at $520 million per year. We calculate that the

financial benefits of Medicaid double when considering these indirect

benefits in addition to the direct reduction in out-of-pocket

expenditures." A 2019 study found that Medicaid expansion reduced the poverty rate.

A 2016 paper found that Medicaid has substantial positive

long-term effects on the health of recipients: "Early childhood Medicaid

eligibility reduces mortality and disability and, for whites, increases

extensive margin labor supply, and reduces receipt of disability

transfer programs and public health insurance up to 50 years later.

Total income does not change because earnings replace disability

benefits."

The government recoups its investment in Medicaid through savings on

benefit payments later in life and greater payment of taxes because

recipients of Medicaid are healthier: "The government earns a discounted

annual return of between 2 and 7 percent on the original cost of

childhood coverage for these cohorts, most of which comes from lower

cash transfer payments."

A 2018 study in the Journal of Political Economy found that upon its introduction, Medicaid reduced infant and child mortality in the 1960s and 1970s. The decline in the mortality rate for nonwhite children was particularly steep. A 2018 study in the American Journal of Public Health

found that the infant mortality rate declined in states that had

Medicaid expansions (as part of the Affordable Care Act) whereas the

rate rose in states that declined Medicaid expansion.

A 2017 study found that Medicaid enrollment increases political

participation (measured in terms of voter registration and turnout).

A 2017 study found that Medicaid expansion, by increasing treatment for substance abuse, "led to a sizeable reduction in the rates of robbery, aggravated assault and larceny theft."

A 2018 study found that Medicaid expansions in New York, Arizona, and

Maine in the early 2000s caused a 6 percent decline in the mortality

rate:

HIV-related mortality (affected by the recent introduction of antiretrovirals) accounted for 20 percent of the effect. Mortality changes were closely linked to county-level coverage gains, with one life saved annually for every 239 to 316 adults gaining insurance. The results imply a cost per life saved ranging from $327,000 to $867,000 which compares favorably with most estimates of the value of a statistical life.

A

2019 paper by Stanford University and Wharton economists found that

Medicaid expansion "produced a substantial increase in hospital revenue

and profitability, with larger gains for government hospitals. On the

benefits side, we do not detect significant improvements in patient

health, although the expansion led to substantially greater hospital and

emergency room use, and a reallocation of care from public to private

and better-quality hospitals."

Oregon Medicaid health experiment

"The Oregon Health Insurance Experiment: Evidence from the First Year", a 2011 paper by the Massachusetts Institute of Technology and the Harvard School of Public Health,

used Oregon's 2008 decision to hold a randomized lottery for the

provision of Medicaid insurance in order to measure the impact of health

insurance on an individual's health and well-being. The study examined

the outcomes of the 10,000 lower-income people eligible for Medicaid who

were chosen by this randomized system, which helped eliminate potential

bias in the data produced. The study's authors caution that the survey

sample is relatively small and "estimates are therefore difficult to

extrapolate to the likely effects of much larger health insurance

expansions, in which there may well be supply side responses from the

health care sector." Nevertheless, the study finds evidence that:

- Hospital use increased by 30% for those with insurance, with the length of hospital stays increasing by 30% and the number of procedures increasing by 45% for the population with insurance;

- Medicaid recipients proved more likely to seek preventive care. Women were 60% more likely to have mammograms, and recipients overall were 20% more likely to have their cholesterol checked;

- In terms of self-reported health outcomes, having insurance was associated with an increased probability of reporting one's health as "good," "very good," or "excellent"—overall, about 25% higher than the average;

- Those with insurance were about 10% less likely to report a diagnosis of depression.

In the experiment, patients with catastrophic health spending (with

costs that were greater than 30% of income) dropped. The experiment also

showed that Medicaid patients had cut in half the probability of

requiring loans or forgoing other bills to pay for medical costs.

The study found that Medicaid recipients had greater financial

security: "recipients had fewer out-of-pocket medical expenses, were

less likely to owe medical debt, or to refuse treatment due to costs".

In 2013, the same research team reported that Medicaid did not

significantly improve physical health outcomes in the first two years

after the Oregon Health Insurance Experiment (aka OHIE) began, but that

it did "increase use of health care services, raise rates of diabetes

detection and management, lower rates of depression, and reduce

financial strain."