CBO

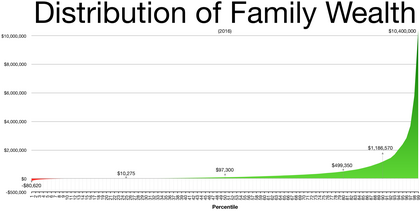

Chart, U.S. Holdings of Family Wealth 1989 to 2013. The top 10% of

families held 76% of the wealth in 2013, while the bottom 50% of

families held 1%. Inequality worsened from 1989 to 2013.

Wealth inequality in the United States (also known as the wealth gap) is the unequal distribution of assets among residents of the United States. Wealth includes the values of homes, automobiles, personal valuables, businesses, savings, and investments.

The net worth of U.S. households and non-profit organizations was $94.7

trillion in the first quarter of 2017, a record level both in nominal

terms and purchasing power parity.

If divided equally among 124 million U.S. households, this would be

$760,000 per family; however, the bottom 50% of families, representing

62 million American households, average $11,000 net worth. From an international perspective, the difference in US median and mean wealth per adult is over 600%.

Just prior to President Obama's 2014 State of the Union Address, media

reported that the top wealthiest 1% possess 40% of the nation's wealth;

the bottom 80% own 7%; similarly, but later, the media reported, the

"richest 1 percent in the United States now own more additional income

than the bottom 90 percent".

The gap between the top 10% and the middle class is over 1,000%; that

increases another 1,000% for the top 1%. The average employee "needs to

work more than a month to earn what the CEO earns in one hour." Although different from income inequality, the two are related. In Inequality for All—a

2013 documentary with Robert Reich in which he argued that income

inequality is the defining issue for the United States—Reich states that

95% of economic gains went to the top 1% net worth (HNWI) since 2009 when the recovery allegedly started. More recently, in 2017, an Oxfam study found that eight rich people, six of them Americans, own as much combined wealth as half the human race.

A 2011 study found that US citizens across the political spectrum dramatically underestimate the current US wealth inequality and would prefer a far more egalitarian distribution of wealth.

Wealth is usually not used for daily expenditures or factored

into household budgets, but combined with income it comprises the

family's total opportunity to secure a desired stature and standard of

living, or pass their class status along to one's children. Moreover, wealth provides for both short- and long-term financial security, bestows social prestige, and contributes to political power, and can be used to produce more wealth. Hence, wealth possesses a psychological

element that awards people the feeling of agency, or the ability to

act. The accumulation of wealth grants more options and eliminates

restrictions about how one can live life. Dennis Gilbert

asserts that the standard of living of the working and middle classes

is dependent upon income and wages, while the rich tend to rely on

wealth, distinguishing them from the vast majority of Americans. A September 2014 study by Harvard Business School declared that the growing disparity between the very wealthy and the lower and middle classes is no longer sustainable.

Statistics

In 2007, the top 20% wealthiest possessed 80% of all financial assets.

In 2007 the richest 1% of the American population owned 35% of the

country's total wealth, and the next 19% owned 51%. Thus, the top 20%

of Americans owned 86% of the country's wealth and the bottom 80% of the

population owned 14%. In 2011, financial inequality was greater than

inequality in total wealth, with the top 1% of the population owning

43%, the next 19% of Americans owning 50%, and the bottom 80% owning 7%. However, after the Great Recession

which started in 2007, the share of total wealth owned by the top 1% of

the population grew from 35% to 37%, and that owned by the top 20% of

Americans grew from 86% to 88%. The Great Recession also caused a drop

of 36% in median household wealth, but a drop of only 11% for the top

1%, further widening the gap between the top 1% and the bottom 99%.

According to PolitiFact and others, in 2011 the 400 wealthiest Americans have more wealth than half of all Americans combined. Inherited wealth may help explain why many Americans who have become rich may have had a substantial head start. In September 2012, according to the Institute for Policy Studies, over 60 percent of the Forbes richest 400 Americans grew up in substantial privilege.

In 2013 wealth inequality in the U.S. was greater than in most developed countries other than Switzerland and Denmark.

In the United States, the use of offshore holdings is exceptionally

small compared to Europe, where much of the wealth of the top

percentiles is kept in offshore holdings.

While the statistical problem is European wide, in Southern Europe

statistics become even more unreliable. Fewer than a thousand people in

Italy have declared incomes of more than 1 million euros. Former Prime

Minister of Italy described tax evasion as a "national pastime". According to a 2014 Credit Suisse study, the ratio of wealth to household income is the highest it has been since the Great Depression.

However, according to the federal reserve, "For most households, pensions and Social Security

are the most important sources of income during retirement, and the

promised benefit stream constitutes a sizable fraction of household

wealth" and "including pensions and Social Security in net worth makes

the distribution more even". A September 2017 study by the Federal Reserve reported that the top 1% owned 38.5% of the country's wealth in 2016.

According to a June 2017 report by the Boston Consulting Group, around 70% of the nation's wealth will be in the hands of millionaires and billionaires by 2021.

Early 20th century

Pioneering work by Simon Kuznets

using income tax records and his own well-researched estimates of

national income showed a reduction of about 10% in the portion of

national income going to the top 10%, a reduction from about 45–50% in

1913 to about 30–35% in 1948. This period spans both The Great Depression and World War II, events with significant economic consequences. This is called the Great Compression.

Wealth and income

Artist's depiction of U.S. wealth inequality in 2013.

There is an important distinction between income and wealth.

Income refers to a flow of money over time in the form of a rate (per

hour, per week, or per year); wealth is a collection of assets owned

minus liabilities. In essence, income is specifically what people

receive through work, retirement, or social welfare whereas wealth is what people own. While the two are seemingly related, income inequality alone is insufficient for understanding economic inequality for two reasons:

- It does not accurately reflect an individual's economic position

- Income does not portray the severity of financial inequality in the United States.

The United States Census Bureau

formally defines income as received on a regular basis (exclusive of

certain money receipts such as capital gains) before payments for

personal income taxes, social security, union dues, medicare deductions,

etc.

By this official measure, the wealthiest families may have low income,

but the value of their assets earns enough money to support their

lifestyle. Dividends from trusts or gains in the stock market do not

fall under the definition of income but are the primary money flows for

the wealthy. Retired people also have little income but usually have a

higher net worth because of money saved over time.

Additionally, income does not capture the extent of wealth

inequality. Wealth is derived over time from the collection of income

earnings and growth of assets. The income of one year cannot encompass

the accumulation over a lifetime. Income statistics view too narrow a

time span for it to be an adequate indicator of financial inequality.

For example, the Gini coefficient

for wealth inequality increased from 0.80 in 1983 to 0.84 in 1989. In

the same year, 1989, the Gini coefficient for income was only 0.52.

The Gini coefficient is an economic tool on a scale from 0 to 1 that

measures the level of inequality. 1 signifies perfect inequality and 0

represents perfect equality. From this data, it is evident that in 1989

there was a discrepancy about the level of economic disparity with the

extent of wealth inequality significantly higher than income inequality.

Recent research shows that many households, in particular those headed

by young parents (younger than 35), minorities, and individuals with low

educational attainment, display very little accumulation. Many have no

financial assets and their total net worth is also low.

According to the Congressional Budget Office,

between 1979 and 2007 incomes of the top 1% of Americans grew by an

average of 275%. ... (Note: The IRS insists that comparisons of adjusted

gross income pre-1987 and post-1987 are complicated by large changes in

the definition of AGI led to households in the top income quintile

reporting a lot more of their income in their individual income tax

form's AGI, rather than reporting their business income in separate

corporate tax returns, or not reporting certain non-taxable income in

their AGI at all, such as municipal bond income. Anyone who wants to

discuss incomes in the U.S. fairly must include a chart of all available

data split by quintile up to the mid-1980s. That should be followed by

a chart from 1990 to 2011. The five-year gap would avoid the major AGI

definition changes. The big picture of this subject is not just a

segment of all available data starting in 1979, especially after the IRS

warned about the large AGI definition changes in the late 1980s). In

addition, IRS studies consistently show a majority of households in the

top income quintile have moved to a lower quintile within one decade.

There are even more changes to households in the top 1%. Without

including those data here, a reader is likely to assume households in

the Top 1% are almost the same from year to year.) In 2009, people in the top 1% of taxpayers made $343,927 or more. According to US economist Joseph Stiglitz the richest 1% of Americans gained 93% of the additional income created in 2010.

A study by Emmanuel Saez and Piketty showed that the top 10 percent of

earners took more than half of the country's total income in 2012, the

highest level recorded since the government began collecting the

relevant data a century ago.

People in the top one percent were three times more likely to work more

than 50 hours a week, were more likely to be self-employed, and earned a

fifth of their income as capital income. The top one percent was composed of many professions and had an annual turnover rate of more than 25%. The five most common professions were managers, physicians, administrators, lawyers, and teachers.

In the book Modern Labor Economics: Theory and Public Policy,

it is noted that in the United States all income that employees

received from their employers in 2012 was 8.6 trillion dollars while the

amount of money received from all other sources of personal income in

that year came to 5.3 trillion dollars. This makes the relationship of

employee to employer and vocational employment in general of paramount

importance in the United States.

Gender Pay Inequality

Women in every demographic shown to be paid less than their male counterparts.

Wealth inequality and child poverty

In 2013 UNICEF data on the well-being of children in 35 developed

nations ranked the United States at 34 out of 35 (Romania is the worst).

This may reflect growing income inequality.

U.S. stock market ownership distribution

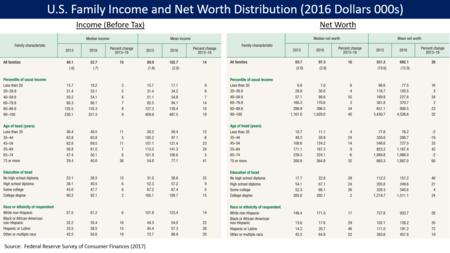

U.S. family pre-tax income and net worth distribution for 2013 and 2016, from the Federal Reserve Survey of Consumer Finances.

In March 2017, NPR summarized the distribution of U.S. stock market ownership (direct and indirect through mutual funds) in the U.S., which is highly concentrated among the wealthiest families:

- 52% of U.S. adults owned stock in 2016. Ownership peaked at 65% in 2007 and fell significantly due to the Great Recession.

- As of 2013, the top 1% of households owned 38% of stock market wealth.

- As of 2013, the top 10% own 81% of stock wealth, the next 10% (80th to 90th percentile) own 11% and the bottom 80% own 8%.

The Federal Reserve reported the median value of stock ownership by income group for 2016:

- Bottom 20% own $5,800.

- 20th-40th percentile own $10,000.

- 40th to 60th percentile own $15,500.

- 60th to 80th percentile own $31,700.

- 80th to 89th percentile own $82,000.

- Top 10% own $365,000.

NPR reported that when politicians reference the stock market as a

measure of economic success, that success is not relevant to nearly half

of Americans. Further, more than one-third of Americans who work

full-time have no access to pensions or retirement accounts such as 401(k)s that derive their value from financial assets like stocks and bonds.

The NYT reported that the percentage of workers covered by generous

defined-benefit pension plans has declined from 62% in 1983 to 17% by

2016.

While some economists consider an increase in the stock market to have a

"wealth effect" that increases economic growth, economists like Former

Dallas Federal Reserve Bank President Richard Fisher believe those

effects are limited.

Causes of wealth inequality

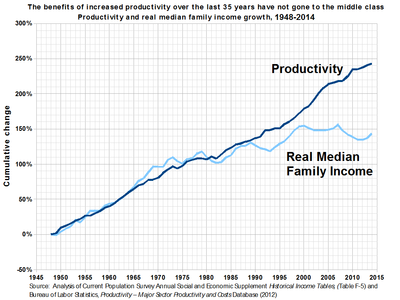

The income growth of the typical American family closely matched that of economic productivity until some time in the 1970s. While it began to stagnate, productivity has continued to climb. According to the 2014 Global Wage Report by the International Labour Organization,

the widening disparity between wages and productivity is evidence that

there has been a significant shift of GDP share going from labor to

capital, and this trend is playing a significant role in growing

inequality.

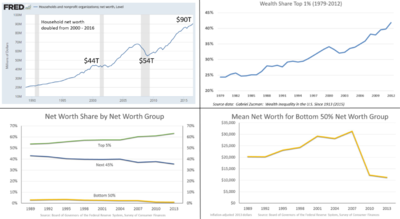

Selected economic variables related to wealth and income equality, comparing 1979, 2007, and 2015.

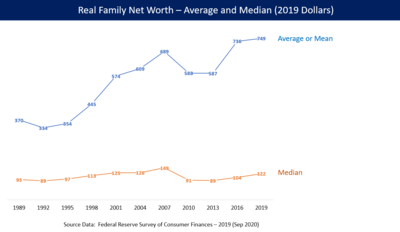

The

image contains several charts related to U.S. wealth inequality. While

U.S. net worth roughly doubled from 2000 to 2016, the gains went

primarily to the wealthy.

U.S.

median family net worth peaked in 2007, declined due to the Great

Recession until 2013, and only partially recovered by 2016.

Essentially, the wealthy possess greater financial opportunities that allow their money to make more money.

Earnings from the stock market or mutual funds are reinvested to

produce a larger return. Over time, the sum that is invested becomes

progressively more substantial. Those who are not wealthy, however, do

not have the resources to enhance their opportunities and improve their

economic position. Rather, "after debt payments, poor families are

constrained to spend the remaining income on items that will not produce

wealth and will depreciate over time."

Scholar David B. Grusky notes that "62 percent of households headed by

single parents are without savings or other financial assets."

Net indebtedness generally prevents the poor from having any

opportunity to accumulate wealth and thereby better their conditions.

Economic inequality is a result of difference in income. Factors that contribute to this gap in wages are things such as level of education, labor market

demand and supply, gender differences, growth in technology, and

personal abilities. The quality and level of education that a person has

often corresponds to their skill level, which is justified by their

income. Wages are also determined by the "market price of a skill" at

that current time. Although gender inequality

is a separate social issue, it plays a role in economic inequality.

According to the U.S. Census Report, in America the median full-time

salary for women is 77 percent of that for men. Also contributing to the

wealth inequality in the U.S., both unskilled and skilled workers are

being replaced by machinery. The Seven Pillars Institute for Global Finance and Ethics argues that because of this "technological advance", the income gap between workers and owners has widened.

Income inequality contributes to wealth inequality. For example, economist Emmanuel Saez

wrote in June 2016 that the top 1% of families captured 52% of the

total real income (GDP) growth per family from 2009-2015. From 2009 to

2012, the top 1% captured 91% of the income gains.

Notably, for both the wealthy and not-wealthy, the process of

accumulation or debt is cyclical. The rich use their money to earn

larger returns and the poor have no savings with which to produce

returns or eliminate debt. Unlike income, both facets are generational.

Wealthy families pass down their assets allowing future generations to

develop even more wealth. The poor, on the other hand, are less able to

leave inheritances to their children leaving the latter with little or

no wealth on which to build...This is another reason why wealth

inequality is so important, its accumulation has direct implications for

economic inequality among the children of today's families.

Corresponding to financial resources, the wealthy strategically

organize their money so that it will produce profit. Affluent people are

more likely to allocate their money to financial assets such as stocks,

bonds, and other investments which hold the possibility of capital

appreciation. Those who are not wealthy are more likely to have their

money in savings accounts and home ownership.

This difference comprises the largest reason for the continuation of

wealth inequality in America: the rich are accumulating more assets

while the middle and working classes are just getting by. As of 2007,

the richest 1% held about 38% of all privately held wealth in the United

States. while the bottom 90% held 73.2% of all debt. According to The New York Times, the richest 1 percent in the United States now own more wealth than the bottom 90 percent.

However, other studies argue that higher average savings rate

will contribute to the reduction of the share of wealth owned by the

rich. The reason is that the rich in wealth are not necessarily the

individuals with the highest income. Therefore, the relative wealth

share of poorer quintiles of the population would increase if the

savings rate of income is very large, although the absolute difference

from the wealthiest will increase.

As the price of commodities increases because of inflation, a

larger percentage of lower-class people's money is spent on things they

need to survive and go to work, such as food and gasoline. Most of the

working poor are paid fixed hourly wages that do not keep up with rises

in prices, so every year an increasing percentage of their income is

consumed until they have to go into debt just to survive. At this point, their little wealth is owed to lenders and banking institutions.

The nature of tax policies in America has been suggested by economists and politicians such as Emmanuel Saez, Thomas Piketty, and Barack Obama

to perpetuate economic inequality in America by steering large sums of

wealth into the hands of the wealthiest Americans. The mechanism for

this is that when the wealthy avoid paying taxes, wealth concentrates to

their coffers and the poor go into debt.

The economist Joseph Stiglitz

argues that "Strong unions have helped to reduce inequality, whereas

weaker unions have made it easier for CEOs, sometimes working with

market forces that they have helped shape, to increase it." The long

fall in unionization in the U.S. since WWII has seen a corresponding rise in the inequality of wealth and income.

Racial disparities

The wealth gap between white and black families nearly tripled from $85,000 in 1984 to $236,500 in 2009.

There are many causes, including years of home ownership,

household income, unemployment, and education, but inheritance might be

the most important.

Inheritance can directly link the disadvantaged economic position and

prospects of today's blacks to the disadvantaged positions of their

parents' and grandparents' generations. According to a report done by

Robert B. Avery and Michael S. Rendall, "one in three white households

will receive a substantial inheritance during their lifetime compared to

only one in ten black households."

This relative lack of inheritance that has been observed among African

Americans can be attributed in large part to factors such as unpaid

labor (slavery), violent destruction of personal property in incidents

such as Red Summer of 1919, unequal opportunity in education and employment (racial discrimination), and more recent policies such as redlining and planned shrinkage.

Other ethnic minorities, particularly those with darker complexions,

have at times faced many of these same adversities to various degrees.

The article "America's Financial Divide"

added context to racial wealth inequality stating "…nearly 96.1 percent

of the 1.2 million households in the top one percent by income were

white, a total of about 1,150,000 households. In addition, these

families were found to have a median net asset worth of $8.3 million. In

stark contrast, in the same piece, black households were shown as a

mere 1.4 percent of the top one percent by income, that's only 16,800

homes. In addition, their median net asset worth was just $1.2 million.

Using this data as an indicator only several thousand of the over 14

million African American households have more than $1.2 million in net

assets… Relying on data from Credit Suisse and Brandeis University's Institute on Assets and Social Policy, the Harvard Business Review

in the article "How America's Wealthiest Black Families Invest Money"

recently took the analysis above a step further. In the piece the author

stated "If you're white and have a net worth of about $356,000, that's

good enough to put you in the 72nd percentile of white families. If

you're black, it's good enough to catapult you into the 95th

percentile." This means 28 percent of the total 83 million white homes,

or over 23 million white households, have more than $356,000 in net

assets. While only 700,000 of the 14 million black homes have more than

$356,000 in total net worth." According to Inequality.org,

the median black family is actually only worth $1,700 when you deduct

these durables. In contrast, the median white family holds $116,800 of

wealth using the same accounting methods. Some historical context: In

South Africa, during the atrocities of apartheid, the median black

family held about 7 percent of typical white South African family net

worth. Today, using Wolff’s analysis, the median African American family

holds a mere 1.5 percent of median white American family wealth.

A recent piece on Eurweb/Electronic Urban Report "Black Wealth Hardly Exists, Even When You Include NBA, NFL and Rap Stars"

stated this about the difference between black middle class families

and white middle class families. "Going even further into the data, a

recent study by the Institute for Policy Studies (IPS) and the

Corporation For Economic Development (CFED) found that it would take 228

years for the average black family to amass the same level of wealth

the average white family holds today in 2016. All while white families

create even more wealth over those same two hundred years. In fact, this

is a gap that will never close if America stays on its current economic

path. According to the Institute on Assets and Social Policy, for each

dollar of increase in average income an African American household saw

from 1984 to 2009 just $0.69 in additional wealth was generated,

compared with the same dollar in increased income creating an additional

$5.19 in wealth for a similarly situated white household."

Author Lilian Singh wrote on why the perceptions about black life created by media are misleading in the American Prospect piece "Black Wealth On TV: Realities Don’t Match Perceptions".

"Black programming features TV shows that collectively create false

perceptions of wealth for African-American families. The images

displayed are in stark contrast to the economic conditions the average

black family is battling each day."

In an article on Huffington Post by Antonio Moore "The Decadent Veil: Black America's Wealth Illusion"

the question of inequity is taken another critical step forward and the

piece digs into how celebrity is masking this massive inequality.

Excerpt: "The decadent veil looks at black Americans through a lens of

group theory and seeks to explain an illusion that has taken form over a

30-year span of financial deregulation and new found access to

unsecured credit. This veil is trimmed with million-dollar sports

contracts, Roc Nation

tour deals and designer labels made for heads of state. As black

celebrity invited us into their homes through shows like MTV cribs, we

forgot the condition of overall African American financial affairs.

Despite a large section of the 14 million black households drowning in

poverty and debt the stories of a few are told as if they represent

those of millions, not thousands. It is this new veil of economics that

has allowed for a broad swath of America to become not just desensitized

to black poverty, but also hypnotized by black celebrity… The decadent

veil not only warps the black community's vision outward to a larger

economic world, but it also distorts outside community's view of Black

America's actual financial reality."

According to an article by the Pew research Center, the median

wealth of non-Hispanic black households fell nearly 38% from 2010 to

2013.

During that time, the median wealth of those households fell from

$16,600 to $13,700. The median wealth of Hispanic families fell 14.3 %

as well, from $16,000 to $14,000. Despite the median net worth of all

households in the United States decreasing with time, as of 2013, white

households had a median net worth of $141,900 while black house

households had a median net worth of just $11,000. Hispanic households had a median net worth of just $13,700 over that time as well.

Effect on democracy

A 2014 study by researchers at Princeton and Northwestern

concludes that government policies reflect the desires of the wealthy,

and that the vast majority of American citizens have "minuscule,

near-zero, statistically non-significant impact upon public policy …

when a majority of citizens disagrees with economic elites and/or with

organized interests, they generally lose." When Fed chair Janet Yellen was questioned by Bernie Sanders

about the study at a congressional hearing in May 2014, she responded

"There’s no question that we’ve had a trend toward growing inequality"

and that this trend "can shape [and] determine the ability of different

groups to participate equally in a democracy and have grave effects on

social stability over time."

In Capital in the Twenty-First Century, French economist Thomas Piketty

argues that "extremely high levels" of wealth inequality are

"incompatible with the meritocratic values and principles of social

justice fundamental to modern democratic societies" and that "the risk

of a drift towards oligarchy is real and gives little reason for optimism about where the United States is headed."

According to Jedediah Purdy, a researcher at the Duke School of

Law, the inequality of wealth in the United States has constantly opened

the eyes of the many problems and shortcomings of its financial system

over at least the last fifty years of the debate. For years, people

believed that distributive justice

would produce a sustainable level of wealth inequality. It was also

thought that a certain state would be able to effectively diminish the

amount of inequality that would occur. Something that was for the most

part not expected is the fact that the inequality levels created by the

growing markets would lessen the power of that state and prevent the

majority of the political community from actually being able to deliver

on its plans of distributive justice, however it has just lately come to

attention of the mass majority.

Proposals to reduce wealth inequality

Taxation of wealth

Senator Elizabeth Warren

proposed an annual tax on wealth in January 2019, specifically a 2% tax

for wealth over $50 million and another 1% surcharge on wealth over $1

billion. Wealth is defined as including all asset classes, including

financial assets and real estate. Economists Emmanuel Saez and Gabriel Zucman

estimated that about 75,000 households (less than 0.1%) would pay the

tax. The tax would raise around $2.75 trillion over 10 years, roughly 1%

GDP on average per year. This would raise the total tax burden for

those subject to the wealth tax from 3.2% of their wealth under current

law to about 4.3% on average, versus the 7.2% for the bottom 99%

families. For scale, the federal budget deficit in 2018 was 3.9% GDP and is expected to rise towards 5% GDP over the next decade. The plan received both praise and criticism. Two billionaires, Michael Bloomberg and Howard Schultz,

criticized the proposal as "unconstitutional" and "ridiculous,"

respectively. Warren was not surprised by this reaction, stating:

"Another billionaire who thinks that billionaires shouldn't pay more in

taxes." Economist Paul Krugman wrote in January 2019 that polls indicate the idea of taxing the rich more is very popular.

Limit or tax stock buybacks

Senators Charles Schumer and Bernie Sanders advocated limiting stock buybacks

in January 2019. They explained that from 2008-2017, 466 of the S&P

500 companies spent $4 trillion on stock buybacks, about 50% of

profits, with another 40% going to dividends. During 2018 alone, a

record $1 trillion was spent on buybacks. Stock buybacks shift wealth

upwards, because the top 1% own about 40% of shares and the top 10% own

about 85%. Further, corporations directing profits to shareholders are

not reinvesting the money in the firm or paying workers more. They

wrote: "If corporations continue to purchase their own stock at this

rate, income disparities will continue to grow, productivity will

suffer, the long-term strength of companies will diminish — and the

American worker will fall further behind." Their proposed legislation

would prohibit buybacks unless the corporation has taken other steps

first, such as paying workers more, providing more benefits such as

healthcare and pensions, and investing in the community. To prevent

corporations from shifting from buybacks to dividends, they proposed

limiting dividends, perhaps by taking action through the tax code.