Monetarism is a school of thought in monetary economics that emphasizes the role of governments in controlling the amount of money in circulation. Monetarist theory asserts that variations in the money supply have major influences on national output in the short run and on price levels over longer periods. Monetarists assert that the objectives of monetary policy are best met by targeting the growth rate of the money supply rather than by engaging in discretionary monetary policy.

Monetarism today is mainly associated with the work of Milton Friedman, who was among the generation of economists to accept Keynesian economics and then criticise Keynes's theory of fighting economic downturns using fiscal policy (government spending). Friedman and Anna Schwartz wrote an influential book, A Monetary History of the United States, 1867–1960, and argued "inflation is always and everywhere a monetary phenomenon".

Though he opposed the existence of the Federal Reserve, Friedman advocated, given its existence, a central bank policy aimed at keeping the growth of the money supply at a rate commensurate with the growth in productivity and demand for goods.

Monetarism today is mainly associated with the work of Milton Friedman, who was among the generation of economists to accept Keynesian economics and then criticise Keynes's theory of fighting economic downturns using fiscal policy (government spending). Friedman and Anna Schwartz wrote an influential book, A Monetary History of the United States, 1867–1960, and argued "inflation is always and everywhere a monetary phenomenon".

Though he opposed the existence of the Federal Reserve, Friedman advocated, given its existence, a central bank policy aimed at keeping the growth of the money supply at a rate commensurate with the growth in productivity and demand for goods.

Description

Monetarism is an economic theory that focuses on the macroeconomic effects of the supply of money and central banking. Formulated by Milton Friedman, it argues that excessive expansion of the money supply is inherently inflationary, and that monetary authorities should focus solely on maintaining price stability.

This theory draws its roots from two historically antagonistic

schools of thought: the hard money policies that dominated monetary

thinking in the late 19th century, and the monetary theories of John Maynard Keynes, who, working in the inter-war period during the failure of the restored gold standard, proposed a demand-driven model for money.

While Keynes had focused on the stability of a currency’s value, with

panics based on an insufficient money supply leading to the use of an

alternate currency and collapse of the monetary system, Friedman focused

on price stability.

The result was summarised in a historical analysis of monetary policy, Monetary History of the United States 1867–1960, which Friedman coauthored with Anna Schwartz.

The book attributed inflation to excess money supply generated by a

central bank. It attributed deflationary spirals to the reverse effect

of a failure of a central bank to support the money supply during a liquidity crunch.

Friedman originally proposed a fixed monetary rule, called Friedman's k-percent rule,

where the money supply would be automatically increased by a fixed

percentage per year. Under this rule, there would be no leeway for the

central reserve bank, as money supply increases could be determined "by a

computer", and business could anticipate all money supply changes.

With other monetarists he believed that the active manipulation of the

money supply or its growth rate is more likely to destabilise than

stabilise the economy.

Opposition to the gold standard

Most monetarists oppose the gold standard. Friedman, for example, viewed a pure gold standard as impractical.

For example, whereas one of the benefits of the gold standard is that

the intrinsic limitations to the growth of the money supply by the use

of gold would prevent inflation, if the growth of population or increase

in trade outpaces the money supply, there would be no way to counteract

deflation and reduced liquidity (and any attendant recession) except

for the mining of more gold.

Rise

Clark Warburton is credited with making the first solid empirical case for the monetarist interpretation of business fluctuations in a series of papers from 1945. Within mainstream economics, the rise of monetarism accelerated from Milton Friedman's 1956 restatement of the quantity theory of money. Friedman argued that the demand for money could be described as depending on a small number of economic variables.

Thus, where the money supply

expanded, people would not simply wish to hold the extra money in idle

money balances; i.e., if they were in equilibrium before the increase,

they were already holding money balances to suit their requirements, and

thus after the increase they would have money balances surplus to their

requirements. These excess money balances would therefore be spent and

hence aggregate demand

would rise. Similarly, if the money supply were reduced people would

want to replenish their holdings of money by reducing their spending. In

this, Friedman challenged a simplification attributed to Keynes

suggesting that "money does not matter." Thus the word 'monetarist' was coined.

The rise of the popularity of monetarism also picked up in

political circles when Keynesian economics seemed unable to explain or

cure the seemingly contradictory problems of rising unemployment and inflation in response to the collapse of the Bretton Woods system in 1972 and the oil shocks of 1973. On the one hand, higher unemployment seemed to call for Keynesian reflation, but on the other hand rising inflation seemed to call for Keynesian disinflation.

In 1979, United States President Jimmy Carter appointed as Federal Reserve chief Paul Volcker, who made fighting inflation his primary objective, and who restricted the money supply (in accordance with the Friedman rule)

to tame inflation in the economy. The result was a major rise in

interest rates, not only in the United States; but worldwide. The

"Volcker shock" continued from 1979 to the summer of 1982, dramatically

both decreasing inflation and increasing unemployment.

Monetarist economists never recognized that the policy implemented by

the Federal Reserve from 1979 was a monetarist policy. Nevertheless, the

influence of monetarism on the Federal Reserve was twofold: a direct

influence, by the adherence of some members of the Federal Open Market

Committee to monetarist ideas; and an indirect influence, because

monetarist views were taken into account in the determination of US

monetary policy: even the members of the FOMC who were not monetarists

took monetarist influence into strong consideration.

By the time Margaret Thatcher, Leader of the Conservative Party in the United Kingdom, won the 1979 general election defeating the sitting Labour Government led by James Callaghan, the UK had endured several years of severe inflation, which was rarely below the 10% mark and by the time of the May 1979 general election, stood at 15.4%.

Thatcher implemented monetarism as the weapon in her battle against

inflation, and succeeded at reducing it to 4.6% by 1983. However, unemployment in the United Kingdom

dramatically increased from 5.7% in 1979 to 12.2% in 1983, reaching

13.0% in 1982; and starting with the first quarter of 1980, the UK

economy contracted in terms of real gross domestic product for six

straight quarters.

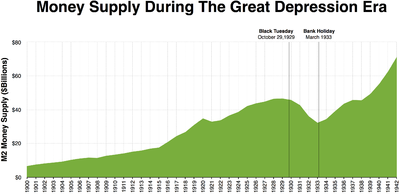

Money supply decreased significantly between Black Tuesday and the Bank Holiday in March 1933 in the wake of massive bank runs across the United States.

Monetarists not only sought to explain present problems; they also interpreted historical ones. Milton Friedman and Anna Schwartz in their book A Monetary History of the United States, 1867–1960 argued that the Great Depression of the 1930s was caused by a massive contraction of the money supply (they deemed it "the Great Contraction"),

and not by the lack of investment Keynes had argued. They also

maintained that post-war inflation was caused by an over-expansion of

the money supply.

They made famous the assertion of monetarism that "inflation is

always and everywhere a monetary phenomenon". Many Keynesian economists

initially believed that the Keynesian vs. monetarist debate was solely

about whether fiscal or monetary policy

was the more effective tool of demand management. By the mid-1970s,

however, the debate had moved on to other issues as monetarists began

presenting a fundamental challenge to Keynesianism.

Many monetarists sought to resurrect the pre-Keynesian view that

market economies are inherently stable in the absence of major

unexpected fluctuations in the money supply. Because of this belief in

the stability of free-market economies they asserted that active demand

management (e.g. by the means of increasing government spending) is

unnecessary and indeed likely to be harmful. The basis of this argument

is a relationship between "stimulus" fiscal spending and future interest

rates. In effect, Friedman's model argues that current fiscal spending

creates as much of a drag on the economy by increased interest rates as

it creates present consumption: that it has no real effect on total

demand, merely that of shifting demand from the investment sector to the

consumer sector.

Current state

Since

1990, the classical form of monetarism has been questioned. This is

because of events that many economists interpreted as being inexplicable

in monetarist terms: the disconnection of the money supply growth from

inflation in the 1990s and the failure of pure monetary policy to

stimulate the economy in the 2001–2003 period. Greenspan argued that the

1990s decoupling was explained by a virtuous cycle of productivity and investment on one hand, and a certain degree of "irrational exuberance" in the investment sector on the other.

There are also arguments that monetarism is a special case of

Keynesian theory. The central test case over the validity of these

theories would be the possibility of a liquidity trap, like that experienced by Japan. Ben Bernanke,

Princeton professor and another former chairman of the U.S. Federal

Reserve, argued that monetary policy could respond to zero interest rate

conditions by direct expansion of the money supply. In his words, "We

have the keys to the printing press, and we are not afraid to use them."

Paul Krugman

has advanced the counterargument that this would have a corresponding

devaluationary effect, like the sustained low interest rates of

2001–2004 produced against world currencies.

These disagreements—along with the role of monetary policies in

trade liberalisation, international investment, and central bank

policy—remain lively topics of investigation and argument.