Georgist Single Tax poster published in "The Public" a Chicago newspaper (circa 1910-1914)

Georgist

campaign button from the 1890s. The cat on the badge refers to a slogan

"Do you see the cat?" to draw analogy to the land question

Georgism, also called geoism and single tax

(archaic), is an economic philosophy holding that, while people should

own the value they produce themselves, economic value derived from land (often including natural resources and natural opportunities) should belong equally to all members of society. Developed from the writings of the economist and social reformer Henry George, the Georgist paradigm seeks solutions to social and ecological problems, based on principles of land rights and public finance which attempt to integrate economic efficiency with social justice.

Georgism is concerned with the distribution of economic rent caused by natural monopolies, pollution, and the control of commons, including title of ownership for natural resources and other contrived privileges (e.g., intellectual property). Any natural resource which is inherently limited in supply can generate economic rent, but the classical and most significant example of 'land monopoly' involves the extraction of common ground rent from valuable urban locations. Georgists argue that taxing economic rent is efficient, fair, and equitable. The main Georgist policy recommendation is a tax assessed on land value. Georgists argue that revenues from a land value tax (LVT) can be used to reduce or eliminate existing taxes (for example, on income, trade, or purchases)

that are unfair and inefficient. Some Georgists also advocate for the

return of surplus public revenue back to the people by means of a basic income or citizen's dividend.

Economists since Adam Smith and David Ricardo have observed that, unlike other taxes, a public levy on land value does not cause economic inefficiency. A land value tax also has progressive tax

effects, in that it is paid primarily by the wealthy (the landowners),

and it cannot be passed on to tenants, workers, or users of land. Advocates of land value taxes argue that it would reduce economic inequality, increase economic efficiency, remove incentives to under-utilize urban land, and reduce property speculation. The philosophical basis of Georgism dates back to several early thinkers such as John Locke, Baruch Spinoza, and Thomas Paine,

but the concept of gaining public revenues mainly from land and natural

resource privileges was widely popularized by Henry George and his

first book, Progress and Poverty (1879).

Georgist ideas were popular and influential during the late 19th and early 20th century.

Political parties, institutions and communities were founded based on

Georgist principles during that time. Early devotees of Henry George's

economic philosophy were often termed Single Taxers for their

political goal of raising public revenue mainly from a land value tax,

although Georgists endorsed multiple forms of rent capture (e.g., seigniorage) as legitimate. The term Georgism was invented later, and some prefer the term geoism to distinguish their beliefs from those of Henry George.

Main tenets

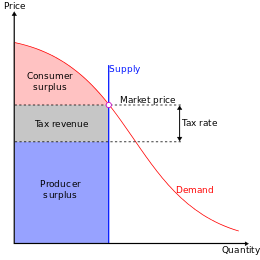

A supply and demand diagram showing the effects of land value taxation. Note that the burden of the tax is entirely on the land owner, the rental price of land does not change, and there is no deadweight loss.

Henry George is best known for popularizing the argument that government should be funded by a tax on land rent rather than taxes on labor. George believed that although scientific experiments

could not be performed in political economy, theories could be tested

by comparing different societies with different conditions and by thought experiments about the effects of various factors.

Applying this method, he concluded that many of the problems that beset

society, such as poverty, inequality, and economic booms and busts,

could be attributed to the private ownership of the necessary resource,

land. In his most celebrated book, Progress and Poverty,

George argues that the appropriation of land for private use

contributes to persistent poverty in spite of technological progress,

and causes economies to exhibit a tendency toward boom and bust cycles.

According to George, people justly own what they create, but that

natural opportunities and land belong equally to all.

The tax upon land values is, therefore, the most just and equal of all taxes. It falls only upon those who receive from society a peculiar and valuable benefit, and upon them in proportion to the benefit they receive. It is the taking by the community, for the use of the community, of that value which is the creation of the community. It is the application of the common property to common uses. When all rent is taken by taxation for the needs of the community, then will the equality ordained by Nature be attained. No citizen will have an advantage over any other citizen save as is given by his industry, skill, and intelligence; and each will obtain what he fairly earns. Then, but not till then, will labor get its full reward, and capital its natural return.

— Henry George, Progress and Poverty, Book VIII, Chapter 3

George believed there was an important distinction between common and collective property.

Although equal rights to land might be achieved by nationalizing land

and then leasing it to private users, George preferred taxing unimproved land value

and leaving the control of land mostly in private hands. George's

reasoning for leaving land in private control and slowly shifting to

land value tax was that it would not penalize existing owners who had

improved land and would also be less disruptive and controversial in a

country where land titles have already been granted.

Georgists have observed that privately created wealth is

socialized via the tax system (e.g., through income and sales tax),

while socially created wealth in land values are privatized in the price

of land titles and bank mortgages. The opposite would be the case if

land rents replaced taxes on labor as the main source of public revenue;

socially created wealth would become available for use by the

community, while the fruits of labor would remain private.

According to Georgists, a land value tax can be considered a user fee

instead of a tax, since it is related to the market value of socially

created locational advantage, the privilege to exclude others from

locations. Assets consisting of commodified privilege can be considered

as wealth since they have exchange value, similar to taxi medallions. A land value tax, charging fees for exclusive use of land, as a means of raising public revenue is also a progressive tax tending to reduce economic inequality, since it applies entirely to ownership of valuable land, which is correlated with income, and there is generally no means by which landlords can shift the tax burden onto tenants or laborers.

Economic properties

Standard economic

theory suggests that a land value tax would be extremely efficient –

unlike other taxes, it does not reduce economic productivity. Milton Friedman

described Henry George's tax on unimproved value of land as the "least

bad tax", since unlike other taxes, it would not impose an excess burden

on economic activity (leading to zero or even negative "deadweight loss"); hence, a replacement of other more distortionary taxes with a land value tax would improve economic welfare.

As land value tax can improve the use of land and redirect investment

toward productive, non-rentseeking activities, it could even have a

negative deadweight loss that boosts productivity.

Because land value tax would apply to foreign land speculators, the

Australian Treasury estimated that land value tax was unique in having a

negative marginal excess burden, meaning that it would increase

long-run living standards.

It was Adam Smith who first noted the efficiency and distributional properties of a land value tax in his book, The Wealth of Nations:

Ground-rents are a still more proper subject of taxation than the rent of houses. A tax upon ground-rents would not raise the rents of houses. It would fall altogether upon the owner of the ground-rent, who acts always as a monopolist, and exacts the greatest rent which can be got for the use of his ground. More or less can be got for it according as the competitors happen to be richer or poorer, or can afford to gratify their fancy for a particular spot of ground at a greater or smaller expense. In every country the greatest number of rich competitors is in the capital, and it is there accordingly that the highest ground-rents are always to be found. As the wealth of those competitors would in no respect be increased by a tax upon ground-rents, they would not probably be disposed to pay more for the use of the ground. Whether the tax was to be advanced by the inhabitant, or by the owner of the ground, would be of little importance. The more the inhabitant was obliged to pay for the tax, the less he would incline to pay for the ground; so that the final payment of the tax would fall altogether upon the owner of the ground-rent.

Both ground-rents and the ordinary rent of land are a species of revenue which the owner, in many cases, enjoys without any care or attention of his own. Though a part of this revenue should be taken from him in order to defray the expenses of the state, no discouragement will thereby be given to any sort of industry. The annual produce of the land and labour of the society, the real wealth and revenue of the great body of the people, might be the same after such a tax as before. Ground-rents and the ordinary rent of land are, therefore, perhaps, the species of revenue which can best bear to have a peculiar tax imposed upon them. ... Nothing can be more reasonable than that a fund which owes its existence to the good government of the state should be taxed peculiarly, or should contribute something more than the greater part of other funds, towards the support of that government.

Benjamin Franklin and Winston Churchill

made similar distributional and efficient arguments for taxing land

rents. They noted that the costs of taxes and the benefits of public

spending always eventually apply to and enrich, respectively, the owners

of land. Therefore, they believed it would be best to defray public

costs and recapture value of public spending by applying public charges

directly to owners of land titles, rather than harming public welfare

with taxes assessed against beneficial activities such as trade and

labor.

Henry George wrote that his plan for a high land value tax would

cause people "to contribute to the public, not in proportion to what

they produce ... but in proportion to the value of natural [common]

opportunities that they hold [monopolize]". He went on to explain that

"by taking for public use that value which attaches to land by reason of

the growth and improvement of the community", it would, "make the

holding of land unprofitable to the mere owner, and profitable only to

the user".

A high land value tax would discourage speculators from holding

valuable natural opportunities (like urban real estate) unused or only

partially used. Henry George claimed this would have many benefits,

including the reduction or elimination of tax burdens from poorer

neighborhoods and agricultural districts; the elimination of a

multiplicity of taxes and expensive obsolete government institutions;

the elimination of corruption, fraud, and evasion with respect to the

collection of taxes; the enablement of true free trade; the destruction

of monopolies; the elevation of wages to the full value of labor; the

transformation of labor saving inventions into blessings for all; and

the equitable distribution of comfort, leisure, and other advantages

that are made possible by an advancing civilization. In this way, the vulnerability that market economies have to credit bubbles and property manias would be reduced.

Income flow resulting from payments for restricted access to natural

opportunities or for contrived privileges over geographic regions is

termed economic rent. Georgists argue that economic rent of land, legal privileges, and natural monopolies should accrue to the community, rather than private owners. In economics, "land"

is everything that exists in nature independent of human activity.

George explicitly included climate, soil, waterways, mineral deposits,

laws/forces of nature, public ways, forests, oceans, air, and solar

energy in the category of land.

While the philosophy of Georgism does not say anything definitive about

specific policy interventions needed to address problems posed by

various sources of economic rent, the common goal among modern Georgists

is to capture and share (or reduce) rent from all sources of natural

monopoly and legal privilege.

Henry George shared the goal of modern Georgists to socialize or

dismantle rent from all forms of land monopoly and legal privilege.

However, George emphasized mainly his preferred policy known as land value tax, which targeted a particular form of unearned income known as ground rent.

George emphasized ground-rent because basic locations were more

valuable than other monopolies and everybody needed locations to

survive, which he contrasted with the less significant streetcar and

telegraph monopolies, which George also criticized. George likened the

problem to a laborer traveling home who is waylaid by a series of

highway robbers along the way, each who demand a small portion of the

traveler's wages, and finally at the very end of the road waits a robber

who demands all that the traveler has left. George reasoned that it

made little difference to challenge the series of small robbers when the

final robber remained to demand all that the common laborer had left.

George predicted that over time technological advancements would

increase the frequency and importance of lesser monopolies, yet he

expected that ground rent would remain dominant.

George even predicted that ground-rents would rise faster than wages

and income to capital, a prediction that modern analysis has shown to be

plausible, since the supply of land is fixed.

Common ground rent is still the primary emphasis of Georgists

because of its large value and the known diseconomies of misused land.

However, there are other sources of rent that are theoretically

analogous to ground-rent and are debated topics of Georgists. The

following are some sources of economic rent.

- Extractable resources (minerals and hydrocarbons)

- Severables (forests and stocks of fish)

- Extraterrestrial domains (geosynchronous orbits and airway corridor use)

- Legal privileges that apply to specific location (taxi medallions, billboard and development permits, or the monopoly of electromagnetic frequencies)

- Restrictions/taxes of pollution or severance (tradable emission permits and fishing quotas)

- Right-of-way (transportation) used by railroads, utilities, and internet service providers

- Issuance of legal tender

- Privileges that are less location dependent but that still exclude others from natural opportunities (patents)

Where free competition is impossible, such as telegraphs, water, gas,

and transportation, George wrote, "[S]uch business becomes a proper

social function, which should be controlled and managed by and for the

whole people concerned." Georgists were divided by this question of natural monopolies and often favored public ownership only of the rents from common rights-of-way, rather than public ownership of utility companies themselves.

Georgism and environmental economics

The early conservationism of the Progressive Era was inspired partly by Henry George and his influence extended for decades afterward. Some ecological economists still support the Georgist policy of land value tax as a means of freeing or rewilding unused land and conserving nature by reducing urban sprawl.

Pollution degrades the value of what Georgists consider to be commons. Because pollution is a negative contribution, a taking from the commons or a cost imposed on others, its value is economic rent,

even when the polluter is not receiving an explicit income. Therefore,

to the extent that society determines pollution to be harmful, most

Georgists propose to limit pollution with taxation or quotas that

capture the resulting rents for public use, restoration, or a citizen's dividend.

Georgism is related to the school of ecological economics, since both propose market based restrictions for pollution.

The schools are compatible in that they advocate using similar tools as

part of a conservation strategy, but they emphasize different aspects.

Conservation is the central issue of ecology, whereas economic rent is

the central issue of geoism. Ecological economists might price pollution

fines more conservatively

to prevent inherently unquantifiable damage to the environment, whereas

Georgists might emphasize mediation between conflicting interests and

human rights. Geolibertarianism,

a market oriented branch of geoism, tends to take a direct stance

against what it perceives as burdensome regulation and would like to see

auctioned pollution quotas or taxes replace most command and control regulation.

Since ecologists are primarily concerned with conservation, they tend to emphasize less the issue of equitably distributing scarcity/pollution rents,

whereas Georgists insist that unearned income not accrue to those who

hold title to natural assets and pollution privilege. To the extent that

geoists recognize the effect of pollution or share conservationist

values, they will agree with ecological economists about the need to

limit pollution, but geoists will also insist that pollution rents

generated from those conservation efforts do not accrue to polluters

and are instead used for public purposes or to compensate those who

suffer the negative effects of pollution. Ecological economists advocate

similar pollution restrictions but, emphasizing conservation first,

might be willing to grant private polluters the privilege to capture

pollution rents. To the extent that ecological economists share the

geoist view of social justice, they would advocate auctioning pollution

quotas instead of giving them away for free. This distinction can be seen in the difference between basic cap and trade and the geoist variation, cap and share,

a proposal to auction temporary pollution permits, with rents going to

the public, instead of giving pollution privilege away for free to

existing polluters or selling perpetual permits.

Revenue uses

The

revenue can allow the reduction or elimination of taxes, greater public

investment/spending, or the direct distribution of funds to citizens as

a pension or basic income/citizen's dividend.

In practice, the elimination of all other taxes implies a very

great land value tax, greater than any currently existing land tax.

Introducing a land value tax greater than the value of existing taxes

would, at an uncertain point, inevitably cause the price of all land

titles to decrease. George did not believe landowners should be

compensated, and described the issue as being analogous to compensation

for former slave owners. Other geoists disagree on the question of

compensation; some advocate complete compensation while others endorse

only enough compensation required to achieve Georgist reforms. Geoists

have also long differed from George as to the degree of rent capture

needed. Historically, those who advocated for public rent tax only great

enough to replace other taxes were known as endorsers of single tax limited.

Synonyms and variants

Most

early advocacy groups described themselves as Single Taxers, and George

reluctantly accepted "single tax" as an accurate name for his main

political goal—the repeal of all unjust or inefficient taxes, to be

replaced with a land value tax (LVT).

Some modern proponents are dissatisfied with the name Georgist.

While Henry George was well known throughout his life, he has been

largely forgotten by the public and the idea of a single tax of land

predates him. Some now prefer the term geoism, with the meaning of geo (from Greek γῆ gē "earth, land", as incidentally is in Greek the first compound of the name George (whence Georgism) < (Gr.) Geōrgios < geōrgos "farmer" or geōrgia "agriculture, farming" < gē + ergon "work") deliberately ambiguous. The terms Earth Sharing, geonomics, and geolibertarianism (see Libertarianism)

are also used by some Georgists. These terms represent a difference of

emphasis, and sometimes real differences about how land rent should be

spent (citizen's dividend or just replacing other taxes); but all agree that land rent should be recovered from its private recipients.

Compulsory fines and fees related to land rents are the most common Georgist policies, but some geoists prefer voluntary value capture systems that rely on methods such as non-compulsory or self-assessed location value fees, community land trusts, and purchasing land value covenants.

Some geoists believe that partially compensating landowners is a

politically expedient compromise necessary for achieving reform. For similar reasons, others propose capturing only future land value increases, instead of all land rent.

Though Georgism has historically been considered as a radically progressive or socialist ideology, some libertarians and minarchists take the position that limited social spending should be financed using Georgist concepts of rent value capture,

but that not all land rent should be captured. Today, this relatively

conservative adaptation is usually considered incompatible with true geolibertarianism,

which requires that excess rents be gathered and then distributed back

to residents. During Henry George's time, this restrained Georgist

philosophy was known as "single tax limited", as opposed to "single tax

unlimited". Henry George disagreed with the limited interpretation but

accepted its adherents (e.g., Thomas Shearman) as legitimate "single-taxers" [Georgists].

Influence

Henry George, whose writings and advocacy form the basis for Georgism.

Georgist ideas heavily influenced the politics of the early 20th

century. Political parties that were formed based on Georgist ideas

include the United States Commonwealth Land Party, the Henry George Justice Party, the Single Tax League, and Denmark's Justice Party.

In the UK during 1909, the Liberal Government included a land tax as part of several taxes in the People's Budget

intended to redistribute wealth (including a progressively graded

income tax and an increase of inheritance tax). This caused a crisis

which resulted indirectly in reform of the House of Lords.

The budget was passed eventually—but without the land tax. In 1931, the

minority Labour Government passed a land value tax as part III of the

1931 Finance act. However, this was repealed in 1934 by the National Government before it could be implemented.

In Denmark, the Georgist Justice Party has previously been represented in Folketinget. It formed part of a centre-left government 1957–60 and was also represented in the European Parliament 1978–79. The influence of Henry George has waned over time, but Georgist ideas still occasionally emerge in politics. In the United States 2004 Presidential campaign, Ralph Nader mentioned Henry George in his policy statements.

Economists still generally favor a land value tax. Milton Friedman publicly endorsed the Georgist land value tax as the "least bad tax". Joseph Stiglitz

stated that: "Not only was Henry George correct that a tax on land is

non-distortionary, but in an equilibrium society … tax on land raises

just enough revenue to finance the (optimally chosen) level of

government expenditure." He dubbed this proposition the Henry George theorem.

Communities

Several

communities were also initiated with Georgist principles during the

height of the philosophy's popularity. Two such communities that still

exist are Arden, Delaware, which was founded in 1900 by Frank Stephens and Will Price, and Fairhope, Alabama, which was founded in 1894 by the auspices of the Fairhope Single Tax Corporation. Some established communities in the United States also adopted Georgist tax policies. A Georgist in Houston, Texas, Joseph Jay "J.J." Pastoriza,

promoted a Georgist club in that city established in 1890. Years later,

in his capacity as a city alderman, he was selected to serve as Houston

Tax Commissioner, and promulgated a "Houston Plan of Taxation" in 1912.

Improvements to land and merchants' inventories were taxed at 25

percent of appraised value, unimproved land was taxed at 70 percent of

appraisal, and personal property was exempt. This Georgist tax continued

until 1915, when two courts struck it down as violating the Texas

Constitution in 1915. This quashed efforts in several other Texas cities

which took steps towards implementing the Houston Plan in 1915:

Beaumont, Corpus Christi, Galveston, San Antonio, and Waco.

The German protectorate of the Kiautschou Bay concession

in Jiaozhou Bay, China fully implemented Georgist policy. Its sole

source of government revenue was the land value tax of six percent which

it levied in its territory. The German government had previously had

economic problems with its African colonies caused by land speculation.

One of the main reasons for using the land value tax in Jiaozhou Bay

was to eliminate such speculation, which the policy achieved.

The colony existed as a German protectorate from 1898 until 1914, when

seized by Japanese and British troops. In 1922 the territory was

returned to China.

Henry George School of Social Science in New York

Georgist ideas were also adopted to some degree in Australia, Hong Kong, Singapore, South Africa, South Korea, and Taiwan. In these countries, governments still levy some type of land value tax, albeit with exemptions. Many municipal governments of the US depend on real property tax

as their main source of revenue, although such taxes are not Georgist

as they generally include the value of buildings and other improvements.

One exception is the town of Altoona, Pennsylvania,

which for a time in the 21st century only taxed land value, phasing in

the tax in 2002, relying on it entirely for tax revenue from 2011, and

ending it 2017; the Financial Times noted that "Altoona is using LVT in a city where neither land nor buildings have much value".

Institutes and organizations

Various organizations still exist that continue to promote the ideas of Henry George. According to The American Journal of Economics and Sociology, the periodical Land&Liberty, established in 1894, is "the longest-lived Georgist project in history". Founded during the Great Depression

in 1932, the Henry George School of Social Science in New York offers

courses, sponsors seminars, and publishes research in the Georgist

paradigm.

Also in the US, the Lincoln Institute of Land Policy was established in

1974 based on the writings of Henry George. It "seeks to improve the

dialogue about urban development, the built environment, and tax policy

in the United States and abroad".

The Henry George Foundation continues to promote the ideas of Henry George in the UK. The IU is an international umbrella organization that brings together organizations worldwide that seek land value tax reform.

Reception

The economist Alfred Marshall believed that George's views in Progress and Poverty

were dangerous, even predicting wars, terror, and economic destruction.

Specifically, Marshall was upset about the idea of rapid change and the

unfairness of not compensating existing landowners. In his lectures on Progress and Poverty,

Marshall opposed George's position on compensation while fully

endorsing his ultimate remedy. So far as land value tax moderately

replaced other taxes and did not cause the price of land to fall,

Marshall supported land value taxation

on economic and moral grounds, suggesting that a three or four percent

tax on land values would fit this condition. After implementing land

taxes, governments would purchase future land values at discounted

prices and take ownership after 100 years. Marshall asserted that this

plan, which he strongly supported, would end the need for a tax

collection department of government. For newly formed countries where

land was not already private, Marshall advocated implementing George's

economic proposal immediately.

Karl Marx considered the Single Tax platform as a regression from the transition to communism and referred to Georgism as "Capitalism’s last ditch". Marx argued that, "The whole thing is ... simply an attempt, decked out with socialism, to save capitalist domination and indeed to establish it afresh on an even wider basis than its present one."

Marx also criticized the way land value tax theory emphasizes the value

of land, arguing that, "His fundamental dogma is that everything would

be all right if ground rent were paid to the state." Georgists such as Fred Harrison (2003) replied to these Marxist objections.

Richard T. Ely, known as the "Father of Land Economics",

agreed with the economic arguments for Georgism but believed that

correcting the problem the way Henry George wanted (without

compensation) was unjust to existing landowners. In explaining his

position, Ely wrote that "If we have all made a mistake, should one

party to the transaction alone bear the cost of the common blunder?"

John R. Commons

supported Georgist economics, but opposed what he perceived as an

environmentally and politically reckless tendency for advocates to rely

on a one-size-fits-all approach to tax reform, specifically, the "single

tax" framing. Commons concluded The Distribution of Wealth, with an estimate that "perhaps 95% of the total values represented by these millionnaire [sic]

fortunes is due to those investments classed as land values and natural

monopolies and to competitive industries aided by such monopolies", and

that "tax reform should seek to remove all burdens from capital and

labour and impose them on monopolies". However, he criticized Georgists

for failing to see that Henry George's anti-monopoly ideas must be

implemented with a variety of policy tools. He wrote, "Trees do not grow

into the sky—they would perish in a high wind; and a single truth, like

a single tax, ends in its own destruction." Commons uses the natural

soil fertility and value of forests as an example of this destruction,

arguing that a tax on the in situ value of those depletable natural

resources can result in overuse or over-extraction. Instead, Commons

recommends an income tax based approach to forests similar to a modern

Georgist severance tax.

Other contemporaries such as Austrian economist Frank Fetter and neoclassical economist John Bates Clark

argued that it was impractical to maintain the traditional distinction

between land and capital, and used this as a basis to attack Georgism. Mark Blaug,

a specialist in the history of economic thought, credits Fetter and

Clark with influencing mainstream economists to abandon the idea "that

land is a unique factor of production and hence that there is any

special need for a special theory of ground rent" claiming that "this is

in fact the basis of all the attacks on Henry George by contemporary

economists and certainly the fundamental reason why professional

economists increasingly ignored him".

Robert Solow endorsed the theory of Georgism, but is wary of the perceived injustice of expropriation.

Solow stated that taxing away expected land rents "would have no

semblance of fairness"; however, Georgism would be good to introduce

where location values were not already privatized or if the transition

could be phased in slowly.

Milton Friedman agreed that "the Henry George argument" is "the least bad" means of raising needed public revenue.

However, Friedman viewed Georgism as partially immoral, due to a

difference of opinion about the validity of vested property rights in

land.

Georgists agree with Friedman that land titles should remain private,

however they believe that the private capture of unimproved land-rents

is inherently unjust, drawing comparisons to slavery.

George has also been accused of exaggerating the importance of

his "all-devouring rent thesis" in claiming that it is the primary cause

of poverty and injustice in society.

George argued that the rent of land increased faster than wages for

labor because the supply of land is fixed. Modern economists, including Ottmar Edenhofer have demonstrated that George's assertion is plausible but was more likely to be true during George's time than now.

An early criticism of Georgism was that it would generate too

much public revenue and result in unwanted growth of government, but

later critics argued that it would not generate enough income to cover

government spending. Joseph Schumpeter

concluded his analysis of Georgism by stating that, "It is not

economically unsound, except that it involves an unwarranted optimism

concerning the yield of such a tax." Economists who study land conclude

that Schumpeter's criticism is unwarranted because the rental yield from

land is likely much greater than what modern critics such as Paul Krugman suppose.

Krugman agrees that land value taxation is the best means of raising

public revenue but asserts that increased spending has rendered land

rent insufficient to fully fund government.

Georgists have responded by citing studies and analyses implying that

land values of nations like the US, UK, and Australia are more than

sufficient to fund all levels of government.

Anarcho-capitalist political philosopher and economist Murray Rothbard criticized Georgism in Man, Economy, and State as being philosophically incongruent with subjective value theory, and further stating that land is irrelevant in the factors of production, trade, and price systems, but this critique is seen by some, including other opponents of Georgism, as relying on false assumptions and flawed reasoning.

Austrian economist Friedrich Hayek

credited early enthusiasm for Henry George with developing his interest

in economics. Later, Hayek said that the theory of Georgism would be

very strong if assessment challenges did not result in unfair outcomes,

but he believed that they would.

After studying Progress and Poverty, Tyler Cowen

concluded, "George had some good economic arguments, but [. . .] was

politically naive. At the margin we should move in George’s direction,

but ultimately landowners have to be part of the building coalitions

rather than pure victims."