Emissions trading (also known as cap and trade) is a market-based approach to controlling pollution by providing economic incentives for achieving reductions in the emissions of pollutants.

A central authority (usually a governmental body) allocates or sells a limited number of permits to discharge specific quantities of a specific pollutant per time period.

Polluters are required to hold permits in amount equal to their

emissions. Polluters that want to increase their emissions must buy

permits from others willing to sell them. Financial derivatives of permits can also be traded on secondary markets.

Various countries, states and groups of companies have adopted such trading systems, notably for mitigating climate change.

In contrast to command-and-control environmental regulations such as best available technology (BAT) standards and government subsidies, cap and trade (CAT) programs are a type of flexible environmental regulation that allows organizations to decide how best to meet policy targets.

There are active trading programs in several air pollutants. For greenhouse gases, which cause climate change, permit units are often called carbon credits. The largest greenhouse gases (GHG) trading program is the European Union Emission Trading Scheme, which trades primarily in European Union Allowances (EUAs); the Californian scheme trades in California Carbon Allowances, the New Zealand scheme in New Zealand Units and the Australian scheme in Australian Units. The United States has a national market to reduce acid rain and several regional markets in nitrogen oxides. Recent reduction in California's GHG emissions are not attributed to carbon trading but to other factors such as renewable portfolio standards and energy efficiency policies; the 'cap' in California has been and continues to be larger than actual emission rates. GHG emissions increased at more than half of industrial point sources regulated by California's cap and trade program from 2013 to 2015.

In theory, polluters who can reduce emissions most cheaply will do so, achieving the emission reduction at the lowest cost to society. Cap and trade is meant to provide the private sector with the flexibility required to reduce emissions while stimulating technological innovation and economic growth. In practice the theory can fall short. Environmental hotspots arise and impact areas nearest pollution sources when credits are purchased in lieu of emission reductions; low-income neighborhoods and people of color tend to be located near large industrial point sources and suffer adverse health and welfare effects disproportionately. In addition to environmental justice issues, historically cap and trade policy is not as effective as performance standards for reducing air pollutant emissions. For example, sulfur dioxide (SO2) emissions and acidic sulfate deposition decreased to a larger extent more rapidly in Europe than in the United States over similar time periods with Europe employing traditional control approaches compared to the U.S.' subsidized market approach.

Various countries, states and groups of companies have adopted such trading systems, notably for mitigating climate change.

In contrast to command-and-control environmental regulations such as best available technology (BAT) standards and government subsidies, cap and trade (CAT) programs are a type of flexible environmental regulation that allows organizations to decide how best to meet policy targets.

There are active trading programs in several air pollutants. For greenhouse gases, which cause climate change, permit units are often called carbon credits. The largest greenhouse gases (GHG) trading program is the European Union Emission Trading Scheme, which trades primarily in European Union Allowances (EUAs); the Californian scheme trades in California Carbon Allowances, the New Zealand scheme in New Zealand Units and the Australian scheme in Australian Units. The United States has a national market to reduce acid rain and several regional markets in nitrogen oxides. Recent reduction in California's GHG emissions are not attributed to carbon trading but to other factors such as renewable portfolio standards and energy efficiency policies; the 'cap' in California has been and continues to be larger than actual emission rates. GHG emissions increased at more than half of industrial point sources regulated by California's cap and trade program from 2013 to 2015.

In theory, polluters who can reduce emissions most cheaply will do so, achieving the emission reduction at the lowest cost to society. Cap and trade is meant to provide the private sector with the flexibility required to reduce emissions while stimulating technological innovation and economic growth. In practice the theory can fall short. Environmental hotspots arise and impact areas nearest pollution sources when credits are purchased in lieu of emission reductions; low-income neighborhoods and people of color tend to be located near large industrial point sources and suffer adverse health and welfare effects disproportionately. In addition to environmental justice issues, historically cap and trade policy is not as effective as performance standards for reducing air pollutant emissions. For example, sulfur dioxide (SO2) emissions and acidic sulfate deposition decreased to a larger extent more rapidly in Europe than in the United States over similar time periods with Europe employing traditional control approaches compared to the U.S.' subsidized market approach.

Overview

A coal power plant in Germany. Due to emissions trading, coal may become a less competitive fuel than other options.

Pollution is a prime example of a market externality. An externality

is an effect of some activity on an entity (such as a person) that is

not party to a market transaction related to that activity. Emissions

trading is a market-based approach to address pollution. The overall

goal of an emissions trading plan is to minimize the cost of meeting a

set emissions target.

In an emissions trading system, the government sets an overall

limit on emissions, and defines permits (also called allowances), or

limited authorizations to emit, up to the level of the overall limit.

The government may sell the permits, but in many existing schemes, it

gives permits to participants (regulated polluters) equal to each

participant's baseline emissions. The baseline is determined by

reference to the participant's historical emissions. To demonstrate

compliance, a participant must hold permits at least equal to the

quantity of pollution it actually emitted during the time period. If

every participant complies, the total pollution emitted will be at most

equal to the sum of individual limits.

Because permits can be bought and sold, a participant can choose either

to use its permits exactly (by reducing its own emissions); or to emit

less than its permits, and perhaps sell the excess permits; or to emit

more than its permits, and buy permits from other participants. In

effect, the buyer pays a charge for polluting, while the seller gains a

reward for having reduced emissions.

In many schemes, organizations which do not pollute (and

therefore have no obligations) may also trade permits and financial

derivatives of permits. In some schemes, participants can bank

allowances to use in future periods.

In some schemes, a proportion of all traded permits must be retired

periodically, causing a net reduction in emissions over time. Thus, environmental groups may buy and retire permits, driving up the price of the remaining permits according to the law of demand.

In most schemes, permit owners can donate permits to a nonprofit entity

and receive a tax deduction. Usually, the government lowers the overall

limit over time, with an aim towards a national emissions reduction

target.

According to the Environmental Defense Fund, cap-and-trade is the

most environmentally and economically sensible approach to controlling

greenhouse gas emissions, the primary cause of global warming, because

it sets a limit on emissions, and the trading encourages companies to

innovate in order to emit less.

"International trade can offer a range of positive and negative

incentives to promote international cooperation on climate change

(robust evidence, medium agreement). Three issues are key to developing

constructive relationships between international trade and climate

agreements: how existing trade policies and rules can be modified to be

more climate friendly; whether border adjustment measures (BAMs) or

other trade measures can be effective in meeting the goals of

international climate agreements; whether the UNFCCC, World Trade

Organization (WTO), hybrid of the two, or a new institution is the best

forum for a trade-and-climate architecture."

History

The international community began the long process towards building effective international and domestic measures to tackle GHG emissions (carbon dioxide, methane, nitrous oxide, hydroflurocarbons, perfluorocarbons, sulphur hexafluoride)

in response to the increasing assertions that global warming is

happening due to man-made emissions and the uncertainty over its likely

consequences. That process began in Rio de Janeiro in 1992, when 160

countries agreed the UN Framework Convention on Climate Change (UNFCCC).

The UNFCCC is, as its title suggests, simply a framework; the necessary

detail was left to be settled by the Conference of Parties (CoP) to the

UNFCCC.

The efficiency of what later was to be called the "cap-and-trade" approach to air pollution

abatement was first demonstrated in a series of micro-economic computer

simulation studies between 1967 and 1970 for the National Air Pollution

Control Administration (predecessor to the United States Environmental Protection Agency's

Office of Air and Radiation) by Ellison Burton and William Sanjour.

These studies used mathematical models of several cities and their

emission sources in order to compare the cost and effectiveness of

various control strategies.

Each abatement strategy was compared with the "least-cost solution"

produced by a computer optimization program to identify the least-costly

combination of source reductions in order to achieve a given abatement

goal. In each case it was found that the least-cost solution was

dramatically less costly than the same amount of pollution reduction

produced by any conventional abatement strategy. Burton and later Sanjour along with Edward H. Pechan continued improving and advancing

these computer models at the newly created U.S. Environmental

Protection Agency. The agency introduced the concept of computer

modeling with least-cost abatement strategies (i.e., emissions trading)

in its 1972 annual report to Congress on the cost of clean air. This led to the concept of "cap and trade" as a means of achieving the "least-cost solution" for a given level of abatement.

The development of emissions trading over the course of its history can be divided into four phases:

- Gestation: Theoretical articulation of the instrument (by Coase, Crocker, Dales, Montgomery etc.) and, independent of the former, tinkering with "flexible regulation" at the US Environmental Protection Agency.

- Proof of Principle: First developments towards trading of emission certificates based on the "offset-mechanism" taken up in Clean Air Act in 1977. A company could get allowance from the Act on a greater amount of emission when it paid another company to reduce the same pollutant.

- Prototype: Launching of a first "cap-and-trade" system as part of the US Acid Rain Program in Title IV of the 1990 Clean Air Act, officially announced as a paradigm shift in environmental policy, as prepared by "Project 88", a network-building effort to bring together environmental and industrial interests in the US.

- Regime formation: branching out from the US clean air policy to global climate policy, and from there to the European Union, along with the expectation of an emerging global carbon market and the formation of the "carbon industry".

In the United States, the acid rain related emission trading system was principally conceived by C. Boyden Gray, a G.H.W. Bush administration attorney. Gray worked with the Environmental Defense Fund

(EDF), who worked with the EPA to write the bill that became law as

part of the Clean Air Act of 1990. The new emissions cap on NOx and SO

2 gases took effect in 1995, and according to Smithsonian magazine, those acid rain emissions dropped 3 million tons that year. In 1997, the CoP agreed, in what has been described as a watershed in international environmental treaty making, the Kyoto Protocol where 38 developed countries (Annex 1 countries) committed themselves to targets and timetables for the reduction of GHGs. These targets for developed countries are often referred to as Assigned Amounts.

2 gases took effect in 1995, and according to Smithsonian magazine, those acid rain emissions dropped 3 million tons that year. In 1997, the CoP agreed, in what has been described as a watershed in international environmental treaty making, the Kyoto Protocol where 38 developed countries (Annex 1 countries) committed themselves to targets and timetables for the reduction of GHGs. These targets for developed countries are often referred to as Assigned Amounts.

The resulting inflexible limitations on GHG growth could entail

very large costs, perhaps running into many trillions of dollars

globally countries, if have to solely rely on their own domestic

measures is one important economic reality recognised by many of the

countries that signed the Kyoto Protocol.

As a result, international mechanisms which would allow developed

countries flexibility to meet their targets were included in the Kyoto

Protocol. The purpose of these mechanisms is to allow the parties to

find the most economical ways to achieve their targets. These

international mechanisms are outlined under Kyoto Protocol.

On April 17, 2009, the Environmental Protection Agency (EPA)

formally announced that it had found that greenhouse gas (GHG) poses a

threat to public health and the environment (EPA 2009a). This

announcement was significant because it gives the executive branch the

authority to impose carbon regulations on carbon-emitting entities.

A carbon cap-and-trade system is to be introduced nationwide in China in 2016 (China's National Development and Reform Commission proposed that an absolute cap be placed on emission by 2016.)

Market and least-cost

Economy-wide pricing of carbon is the centre piece of any policy designed to reduce emissions at the lowest possible costs.

Ross Garnaut, lead author of the Garnaut Climate Change Review

Some economists have urged the use of market-based instruments such

as emissions trading to address environmental problems instead of

prescriptive "command-and-control" regulation. Command and control regulation is criticized for being insensitive to geographical and technological differences, and therefore inefficient.;

however, this is not always so, as shown by the WW-II rationing program

in the U.S. in which local and regional boards made adjustments for

these differences.

After an emissions limit has been set by a government political

process, individual companies are free to choose how or whether to

reduce their emissions. Failure to report emissions and surrender

emission permits is often punishable by a further government regulatory

mechanism, such as a fine that increases costs of production. Firms will

choose the least-cost way to comply with the pollution regulation,

which will lead to reductions where the least expensive solutions exist,

while allowing emissions that are more expensive to reduce.

Under an emissions trading system, each regulated polluter has

flexibility to use the most cost-effective combination of buying or

selling emission permits, reducing its emissions by installing cleaner

technology, or reducing its emissions by reducing production. The most

cost-effective strategy depends on the polluter's marginal abatement

cost and the market price of permits. In theory, a polluter's decisions

should lead to an economically efficient allocation of reductions among

polluters, and lower compliance costs for individual firms and for the

economy overall, compared to command-and-control mechanisms.

Emission markets

For emissions trading where greenhouse gases are regulated, one emissions permit is considered equivalent to one metric ton of carbon dioxide (CO2) emissions. Other names for emissions permits are carbon credits, Kyoto units, assigned amount units, and Certified Emission Reduction

units (CER). These permits can be sold privately or in the

international market at the prevailing market price. These trade and settle internationally, and hence allow permits to be transferred between countries. Each international transfer is validated by the United Nations Framework Convention on Climate Change (UNFCCC). Each transfer of ownership within the European Union is additionally validated by the European Commission.

Emissions trading programmes such as the European Union Emissions

Trading System (EU ETS) complement the country-to-country trading

stipulated in the Kyoto Protocol by allowing private trading of permits.

Under such programmes – which are generally co-ordinated with the

national emissions targets provided within the framework of the Kyoto

Protocol – a national or international authority allocates permits to

individual companies based on established criteria, with a view to

meeting national and/or regional Kyoto targets at the lowest overall

economic cost.

Trading exchanges have been established to provide a spot market in permits, as well as futures and options market to help discover a market price and maintain liquidity. Carbon prices are normally quoted in euros per tonne of carbon dioxide or its equivalent (CO2e). Other greenhouse gases can also be traded, but are quoted as standard multiples of carbon dioxide with respect to their global warming potential.

These features reduce the quota's financial impact on business, while

ensuring that the quotas are met at a national and international level.

Currently, there are six exchanges trading in UNFCCC related carbon credits: the Chicago Climate Exchange (until 2010), European Climate Exchange, NASDAQ OMX Commodities Europe, PowerNext, Commodity Exchange Bratislava and the European Energy Exchange. NASDAQ OMX Commodities Europe listed a contract to trade offsets generated by a CDM carbon project

called Certified Emission Reductions. Many companies now engage in

emissions abatement, offsetting, and sequestration programs to generate

credits that can be sold on one of the exchanges. At least one private electronic market has been established in 2008: CantorCO2e. Carbon credits at Commodity Exchange Bratislava are traded at special platform called Carbon place.

Trading in emission permits is one of the fastest-growing segments in financial services in the City of London with a market estimated to be worth about €30 billion in 2007. Louis Redshaw, head of environmental markets at Barclays Capital, predicts that "carbon will be the world's biggest commodity market, and it could become the world's biggest market overall."

Pollution markets

An emission license directly confers a right to emit pollutants up to a certain rate.

In contrast, a pollution license for a given location confers the

right to emit pollutants at a rate which will cause no more than a

specified increase at the pollution-level. For concreteness, consider

the following model.

- There are agents each of which emits pollutants.

- There are locations each of which suffers pollution .

- The pollution is a linear combination of the emissions. The relation between and is given by a diffusion matrix , such that: .

As an example, consider three countries along a river (as in the fair river sharing setting).

- Pollution in the upstream country is determined only by the emission of the upstream country: .

- Pollution in the middle country is determined by its own emission and by the emission of country 1: .

- Pollution in the downstream country is the sum of all emissions: .

So the matrix in this case is a triangular matrix of ones.

Each pollution-license for location permits its holder to emit pollutants that will cause at most this level of pollution at location .

Therefore, a polluter that affects water quality at a number of points

has to hold a portfolio of licenses covering all relevant

monitoring-points. In the above example, if country 2 wants to emit a

unit of pollutant, it should purchase two permits: one for location 2

and one for location 3.

Montgomery shows that, while both markets lead to efficient

license allocation, the market in pollution-licenses is more widely

applicable than the market in emission-licenses.

Public opinion

In

the United States, most polling shows large support for emissions

trading (often referred to as cap-and-trade). This majority support can

be seen in polls conducted by Washington Post/ABC News, Zogby International and Yale University.

A new Washington Post-ABC poll reveals that majorities of the American

people believe in climate change, are concerned about it, are willing to

change their lifestyles and pay more to address it, and want the

federal government to regulate greenhouse gases. They are, however,

ambivalent on cap-and-trade.

More than three-quarters of respondents, 77.0%, reported they

“strongly support” (51.0%) or “somewhat support” (26.0%) the EPA's

decision to regulate carbon emissions. While 68.6% of respondents

reported being “very willing” (23.0%) or “somewhat willing” (45.6%),

another 26.8% reported being “somewhat unwilling” (8.8%) or “not at all

willing” (18.0%) to pay higher prices for “Green” energy sources to

support funding for programs that reduce the effect of global warming.

According to PolitiFact, it is a misconception that emissions trading is unpopular in the United States because of earlier polls from Zogby International and Rasmussen which misleadingly include "new taxes" in the questions (taxes aren't part of emissions trading) or high energy cost estimates.

Comparison with other methods of emission reduction

Cap and trade is the textbook example of an emissions trading program. Other market-based approaches include baseline-and-credit, and pollution tax. They all put a price on pollution (for example, see carbon price),

and so provide an economic incentive to reduce pollution beginning with

the lowest-cost opportunities. By contrast, in a command-and-control

approach, a central authority designates pollution levels each facility

is allowed to emit. Cap and trade essentially functions as a tax where

the tax rate is variable based on the relative cost of abatement per

unit, and the tax base is variable based on the amount of abatement

needed.

Baseline and credit

In

a baseline and credit program, polluters can create permits, called

credits or offsets, by reducing their emissions below a baseline level,

which is often the historical emissions level from a designated past

year. Such credits can be bought by polluters that have a regulatory limit.

Pollution tax

Emissions fees or environmental tax is a surcharge on the pollution created while producing goods and services. For example, a carbon tax is a tax on the carbon content of fossil fuels that aims to discourage their use and thereby reduce carbon dioxide emissions.

The two approaches are overlapping sets of policy designs. Both can

have a range of scopes, points of regulation, and price schedules. They

can be fair or unfair, depending on how the revenue is used. Both have

the effect of increasing the price of goods (such as fossil fuels) to

consumers.

A comprehensive, upstream, auctioned cap-and-trade system is very

similar to a comprehensive, upstream carbon tax. Yet, many commentators

sharply contrast the two approaches.

The main difference is what is defined and what derived. A tax is

a price control, while cap-and-trade method acts is a quantity control

instrument.

That is, a tax is a unit price for pollution that is set by

authorities, and the market determines the quantity emitted; in cap and

trade, authorities determine the amount of pollution, and the market

determines the price. This difference affects a number of criteria.

Responsiveness to inflation: Cap-and-trade has the advantage that it adjusts to inflation (changes to overall prices) automatically, while emissions fees must be changed by regulators.

Responsiveness to cost changes: It is not clear which

approach is better. It is possible to combine the two into a safety

valve price: a price set by regulators, at which polluters can buy

additional permits beyond the cap.

Responsiveness to recessions: This point is closely

related to responsiveness to cost changes, because recessions cause a

drop in demand. Under cap and trade, the emissions cost automatically

decreases, so a cap-and-trade scheme adds another automatic stabilizer

to the economy - in effect, an automatic fiscal stimulus. However, a

lower pollution price also results in reduced efforts to reduce

pollution. If the government is able to stimulate the economy regardless

of the cap-and-trade scheme, an excessively low price causes a missed

opportunity to cut emissions faster than planned. Instead, it might be

better to have a price floor (a tax). This is especially true when

cutting pollution is urgent, as with greenhouse gas emissions. A price

floor also provides certainty and stability for investment in emissions

reductions: recent experience from the UK shows that nuclear power

operators are reluctant to invest on "un-subsidised" terms unless there

is a guaranteed price floor for carbon (which the EU emissions trading

scheme does not presently provide).

Responsiveness to uncertainty: As with cost changes, in a

world of uncertainty, it is not clear whether emissions fees or

cap-and-trade systems are more efficient—it depends on how fast the

marginal social benefits of reducing pollution fall with the amount of

cleanup (e.g., whether inelastic or elastic marginal social benefit

schedule).

Other: The magnitude of the tax will depend on how

sensitive the supply of emissions is to the price. The permit price of

cap-and-trade will depend on the pollutant market. A tax generates

government revenue, but full-auctioned emissions permits can do the

same. A similar upstream cap-and-trade system could be implemented. An

upstream carbon tax might be the simplest to administer. Setting up a

complex cap-and-trade arrangement that is comprehensive has high

institutional needs.

Command-and-control regulation

Command

and control is a system of regulation that prescribes emission limits

and compliance methods for each facility or source. It is the

traditional approach to reducing air pollution.

Command-and-control regulations are more rigid than

incentive-based approaches such as pollution fees and cap and trade. An

example of this is a performance standard which sets an emissions goal

for each polluter that is fixed and, therefore, the burden of reducing

pollution cannot be shifted to the firms that can achieve it more

cheaply. As a result, performance standards are likely to be more costly

overall. The additional costs would be passed to end consumers.

Economics of international emissions trading

It is possible for a country to reduce emissions using a Command-Control approach, such as regulation, direct and indirect taxes. The cost of that approach differs between countries because the Marginal Abatement Cost Curve

(MAC) — the cost of eliminating an additional unit of pollution —

differs by country. It might cost China $2 to eliminate a ton of CO2,

but it would probably cost Norway or the U.S. much more. International

emissions-trading markets were created precisely to exploit differing

MACs.

Example

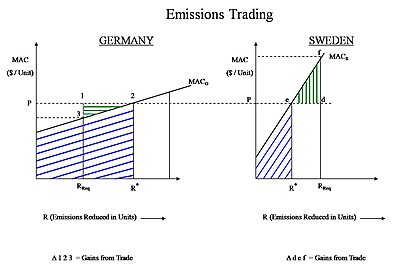

Emissions trading through Gains from Trade can be more beneficial for both the buyer and the seller than a simple emissions capping scheme.

Consider two European countries, such as Germany and Sweden. Each

can either reduce all the required amount of emissions by itself or it

can choose to buy or sell in the market.

Example MACs for two different countries

Suppose Germany can abate its CO2 at a much cheaper cost than Sweden, i.e. MACS > MACG where the MAC curve of Sweden is steeper (higher slope) than that of Germany, and RReq is the total amount of emissions that need to be reduced by a country.

On the left side of the graph is the MAC curve for Germany. RReq is the amount of required reductions for Germany, but at RReq the MACG curve has not intersected the market emissions permit price of CO2 (market permit price = P = λ). Thus, given the market price of CO2 allowances, Germany has potential to profit if it abates more emissions than required.

On the right side is the MAC curve for Sweden. RReq is the amount of required reductions for Sweden, but the MACS curve already intersects the market price of CO2 permits before RReq has been reached. Thus, given the market price of CO2

permits, Sweden has potential to make a cost saving if it abates fewer

emissions than required internally, and instead abates them elsewhere.

In this example, Sweden would abate emissions until its MACS intersects with P (at R*), but this would only reduce a fraction of Sweden's total required abatement.

After that it could buy emissions credits from Germany for the price P

(per unit). The internal cost of Sweden's own abatement, combined with

the permits it buys in the market from Germany, adds up to the total

required reductions (RReq) for Sweden. Thus Sweden can make a

saving from buying permits in the market (Δ d-e-f). This represents the

"Gains from Trade", the amount of additional expense that Sweden would

otherwise have to spend if it abated all of its required emissions by

itself without trading.

Germany made a profit on its additional emissions abatement,

above what was required: it met the regulations by abating all of the

emissions that was required of it (RReq). Additionally, Germany sold its surplus permits to Sweden, and was paid P for every unit it abated, while spending less than P. Its total revenue is the area of the graph (RReq 1 2 R*), its total abatement cost is area (RReq 3 2 R*), and so its net benefit from selling emission permits is the area (Δ 1-2-3) i.e. Gains from Trade.

The two R* (on both graphs) represent the efficient allocations that arise from trading:

- Germany: sold (R* - RReq) emission permits to Sweden at a unit price P.

- Sweden bought emission permits from Germany at a unit price P.

If the total cost for reducing a particular amount of emissions in the Command Control scenario is called X, then to reduce the same amount of combined pollution in Sweden and Germany, the total abatement cost would be less in the Emissions Trading scenario i.e. (X — Δ 123 - Δ def).

The example above applies not just at the national level, but

also between two companies in different countries, or between two

subsidiaries within the same company.

Applying the economic theory

The

nature of the pollutant plays a very important role when policy-makers

decide which framework should be used to control pollution. CO2

acts globally, thus its impact on the environment is generally similar

wherever in the globe it is released. So the location of the originator

of the emissions does not matter from an environmental standpoint.

The policy framework should be different for regional pollutants (e.g. SO2 and NOx, and also mercury)

because the impact of these pollutants may differ by location. The same

amount of a regional pollutant can exert a very high impact in some

locations and a low impact in other locations, so it matters where the

pollutant is released. This is known as the Hot Spot problem.

A Lagrange framework

is commonly used to determine the least cost of achieving an objective,

in this case the total reduction in emissions required in a year. In

some cases, it is possible to use the Lagrange optimization framework to

determine the required reductions for each country (based on their MAC)

so that the total cost of reduction is minimized. In such a scenario,

the Lagrange multiplier

represents the market allowance price (P) of a pollutant, such as the

current market price of emission permits in Europe and the USA.

Countries face the permit market price that exists in the market

that day, so they are able to make individual decisions that would

minimize their costs while at the same time achieving regulatory

compliance. This is also another version of the Equi-Marginal Principle, commonly used in economics to choose the most economically efficient decision.

Prices versus quantities, and the safety valve

There has been longstanding debate on the relative merits of price versus quantity instruments to achieve emission reductions.

An emission cap and permit trading system is a quantity

instrument because it fixes the overall emission level (quantity) and

allows the price to vary. Uncertainty in future supply and demand

conditions (market volatility) coupled with a fixed number of pollution

permits creates an uncertainty in the future price of pollution permits,

and the industry must accordingly bear the cost of adapting to these

volatile market conditions. The burden of a volatile market thus lies

with the industry rather than the controlling agency, which is generally

more efficient. However, under volatile market conditions, the ability

of the controlling agency to alter the caps will translate into an

ability to pick "winners and losers" and thus presents an opportunity

for corruption.

In contrast, an emission tax is a price

instrument because it fixes the price while the emission level is

allowed to vary according to economic activity. A major drawback of an

emission tax is that the environmental outcome (e.g. a limit on the

amount of emissions) is not guaranteed. On one hand, a tax will remove

capital from the industry, suppressing possibly useful economic

activity, but conversely, the polluter will not need to hedge as much

against future uncertainty since the amount of tax will track with

profits. The burden of a volatile market will be borne by the

controlling (taxing) agency rather than the industry itself, which is

generally less efficient. An advantage is that, given a uniform tax rate

and a volatile market, the taxing entity will not be in a position to

pick "winners and losers" and the opportunity for corruption will be

less.

Assuming no corruption and assuming that the controlling agency

and the industry are equally efficient at adapting to volatile market

conditions, the best choice depends on the sensitivity of the costs of

emission reduction, compared to the sensitivity of the benefits (i.e.,

climate damage avoided by a reduction) when the level of emission

control is varied.

Because there is high uncertainty in the compliance costs of

firms, some argue that the optimum choice is the price mechanism.

However, the burden of uncertainty cannot be eliminated, and in this

case it is shifted to the taxing agency itself.

The overwhelming majority of climate scientists have repeatedly

warned of a threshold in atmospheric concentrations of carbon dioxide

beyond which a run-away warming

effect could take place, with a large possibility of causing

irreversible damage. With such a risk, a quantity instrument may be a

better choice because the quantity of emissions may be capped with more

certainty. However, this may not be true if this risk exists but cannot

be attached to a known level of greenhouse gas (GHG) concentration or a

known emission pathway.

A third option, known as a safety valve, is a hybrid of

the price and quantity instruments. The system is essentially an

emission cap and permit trading system but the maximum (or minimum)

permit price is capped. Emitters have the choice of either obtaining

permits in the marketplace or buying them from the government at a

specified trigger price (which could be adjusted over time). The system

is sometimes recommended as a way of overcoming the fundamental

disadvantages of both systems by giving governments the flexibility to

adjust the system as new information comes to light. It can be shown

that by setting the trigger price high enough, or the number of permits

low enough, the safety valve can be used to mimic either a pure quantity

or pure price mechanism.

All three methods are being used as policy instruments to control greenhouse gas emissions: the EU-ETS is a quantity system using the cap and trading system to meet targets set by National Allocation Plans; Denmark has a price system using a carbon tax (World Bank, 2010, p. 218), while China uses the CO2 market price for funding of its Clean Development Mechanism projects, but imposes a safety valve of a minimum price per tonne of CO2.

Carbon leakage

Carbon leakage

is the effect that regulation of emissions in one country/sector has on

the emissions in other countries/sectors that are not subject to the

same regulation. There is no consensus over the magnitude of long-term carbon leakage.

In the Kyoto Protocol, Annex I countries are subject to caps on emissions, but non-Annex I countries are not. Barker et al. (2007) assessed the literature on leakage. The leakage rate is defined as the increase in CO2

emissions outside the countries taking domestic mitigation action,

divided by the reduction in emissions of countries taking domestic

mitigation action. Accordingly, a leakage rate greater than 100% means

that actions to reduce emissions within countries had the effect of

increasing emissions in other countries to a greater extent, i.e.,

domestic mitigation action had actually led to an increase in global

emissions.

Estimates of leakage rates for action under the Kyoto Protocol

ranged from 5% to 20% as a result of a loss in price competitiveness,

but these leakage rates were considered very uncertain.

For energy-intensive industries, the beneficial effects of Annex I

actions through technological development were considered possibly

substantial. However, this beneficial effect had not been reliably

quantified. On the empirical evidence they assessed, Barker et al. (2007) concluded that the competitive losses of then-current mitigation actions, e.g., the EU ETS, were not significant.

Under the EU ETS rules Carbon Leakage Exposure Factor is used to determine the volumes of free allocation of emission permits to industrial installations.

Trade

To

understand carbon trading, it is important to understand the products

that are being traded. The primary product in carbon markets is the

trading of GHG emission permits. Under a cap-and-trade system, permits

are issued to various entities for the right to emit GHG emissions that

meet emission reduction requirement caps.

One of the controversies about carbon mitigation policy is how to "level the playing field" with border adjustments. For example, one component of the American Clean Energy and Security Act

(a 2009 bill that did not pass), along with several other energy bills

put before US Congress, calls for carbon surcharges on goods imported

from countries without cap-and-trade programs. Besides issues of

compliance with the General Agreement on Tariffs and Trade, such border adjustments presume that the producing countries bear responsibility for the carbon emissions.

A general perception among developing countries is that discussion of climate change in trade negotiations could lead to "green protectionism" by high-income countries (World Bank, 2010, p. 251). Tariffs on imports ("virtual carbon") consistent with a carbon price of $50 per ton of CO2

could be significant for developing countries. World Bank (2010)

commented that introducing border tariffs could lead to a proliferation

of trade measures where the competitive playing field is viewed as being

uneven. Tariffs could also be a burden on low-income countries that

have contributed very little to the problem of climate change.

Trading systems

Emission trading and carbon taxes around the world (2019)

Carbon emission trading implemented or scheduled

Carbon tax implemented or scheduled

Carbon emission trading or carbon tax under consideration

Kyoto Protocol

In 1990, the first Intergovernmental Panel on Climate Change

(IPCC) report highlighted the imminent threat of climate change and

greenhouse gas emission, and diplomatic efforts began to find an

international framework within which such emissions could be regulated.

In 1997 the Kyoto Protocol was adopted.

The Kyoto Protocol

is a 1997 international treaty that came into force in 2005. In the

treaty, most developed nations agreed to legally binding targets for

their emissions of the six major greenhouse gases.

Emission quotas (known as "Assigned amounts") were agreed by each

participating 'Annex I' country, with the intention of reducing the

overall emissions by 5.2% from their 1990 levels by the end of 2012.

Between 1990 and 2012 the original Kyoto Protocol parties reduced their

CO2 emissions by 12.5%, which is well beyond the 2012 target of 4.7%. The United States is the only industrialized nation under Annex I

that has not ratified the treaty, and is therefore not bound by it. The

IPCC has projected that the financial effect of compliance through

trading within the Kyoto commitment period will be limited at between

0.1-1.1% of GDP among trading countries.

The agreement was intended to result in industrialized countries'

emissions declining in aggregate by 5.2 percent below 1990 levels by the

year of 2012. Despite the failure of the United States and Australia to

ratify the protocol, the agreement became effective in 2005, once the

requirement that 55 Annex I (predominantly industrialized) countries,

jointly accounting for 55 percent of 1990 Annex I emissions, ratify the

agreement was met.

The Protocol defines several mechanisms ("flexible mechanisms")

that are designed to allow Annex I countries to meet their emission

reduction commitments (caps) with reduced economic impact.

Under Article 3.3 of the Kyoto Protocol, Annex I Parties may use

GHG removals, from afforestation and reforestation (forest sinks) and

deforestation (sources) since 1990, to meet their emission reduction

commitments.

Annex I Parties may also use International Emissions Trading

(IET). Under the treaty, for the 5-year compliance period from 2008

until 2012, nations that emit less than their quota will be able to sell assigned amount units (each AAU

representing an allowance to emit one metric tonne of CO2) to nations that exceed their quotas. It is also possible for Annex I countries to sponsor carbon projects that reduce greenhouse gas emissions in other countries. These projects generate tradable carbon credits that can be used by Annex I countries in meeting their caps. The project-based Kyoto Mechanisms are the Clean Development Mechanism (CDM) and Joint Implementation (JI). There are four such international flexible mechanisms, or Kyoto Mechanism, written in the Kyoto Protocol.

Article 17 if the Protocol authorizes Annex 1 countries that have

agreed to the emissions limitations to take part in emissions trading

with other Annex 1 Countries.

Article 4 authorizes such parties to implement their limitations jointly, as the member states of the EU have chosen to do.

Article 6 provides that such Annex 1 countries may take part in

joint initiatives (JIs) in return for emissions reduction units (ERUs)

to be used against their Assigned Amounts.

Art 12 provides for a mechanism known as the clean development mechanism (CDM),

under which Annex 1 countries may invest in emissions limitation

projects in developing countries and use certified emissions reductions

(CERs) generated against their own Assigned Amounts.

The CDM covers projects taking place in non-Annex I countries,

while JI covers projects taking place in Annex I countries. CDM projects

are supposed to contribute to sustainable development

in developing countries, and also generate "real" and "additional"

emission savings, i.e., savings that only occur thanks to the CDM

project in question (Carbon Trust, 2009, p. 14). Whether or not these emission savings are genuine is, however, difficult to prove (World Bank, 2010, pp. 265–267).

Australia

In 2003 the New South Wales (NSW) state government unilaterally established the NSW Greenhouse Gas Abatement Scheme

to reduce emissions by requiring electricity generators and large

consumers to purchase NSW Greenhouse Abatement Certificates (NGACs).

This has prompted the rollout of free energy-efficient compact

fluorescent lightbulbs and other energy-efficiency measures, funded by

the credits. This scheme has been criticised by the Centre for Energy

and Environmental Markets (CEEM) of the UNSW

because of its lack of effectiveness in reducing emissions, its lack of

transparency and its lack of verification of the additionality of

emission reductions.

Both the incumbent Howard Coalition government and the Rudd Labor opposition promised to implement an emissions trading scheme (ETS) before the 2007 federal election. Labor won the election, with the new government proceeding to implement an ETS. The government introduced the Carbon Pollution Reduction Scheme, which the Liberals supported with Malcolm Turnbull as leader. Tony Abbott questioned an ETS, saying the best way to reduce emissions is with a "simple tax".

Shortly before the carbon vote, Abbott defeated Turnbull in a

leadership challenge, and from there on the Liberals opposed the ETS.

This left the government unable to secure passage of the bill and it was

subsequently withdrawn.

Julia Gillard

defeated Rudd in a leadership challenge and promised not to introduce a

carbon tax, but would look to legislate a price on carbon when taking the government to the 2010 election. In the first hung parliament result in 70 years, the government required the support of crossbenchers including the Greens.

One requirement for Greens support was a carbon price, which Gillard

proceeded with in forming a minority government. A fixed carbon price

would proceed to a floating-price ETS within a few years under the plan.

The fixed price lent itself to characterisation as a carbon tax and

when the government proposed the Clean Energy Bill in February 2011, the opposition claimed it to be a broken election promise.

The bill was passed by the Lower House in October 2011 and the Upper House in November 2011. The Liberal Party vowed to overturn the bill if elected.

The bill thus resulted in passage of the Clean Energy Act, which

possessed a great deal of flexibility in its design and uncertainty over

its future.

The Liberal/National coalition government elected in September 2013 has promised to reverse the climate legislation of the previous government. In July 2014, the carbon tax was repealed as well as the Emissions Trading Scheme (ETS) that was to start in 2015.

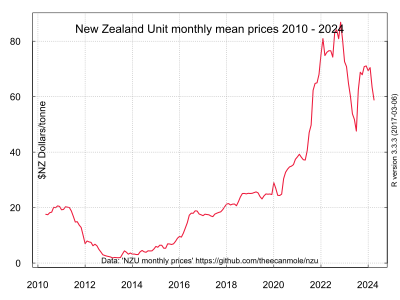

New Zealand

New Zealand Unit Prices

The New Zealand Emissions Trading Scheme (NZ ETS) is a

partial-coverage all-free allocation uncapped highly internationally

linked emissions trading scheme. The NZ ETS was first legislated in the Climate Change Response (Emissions Trading) Amendment Act 2008 in September 2008 under the Fifth Labour Government of New Zealand and then amended in November 2009 and in November 2012 by the Fifth National Government of New Zealand.

The NZ ETS covers forestry (a net sink), energy (43.4% of total

2010 emissions), industry (6.7% of total 2010 emissions) and waste (2.8%

of total 2010 emissions) but not pastoral agriculture (47% of 2010

total emissions).

Participants in the NZ ETS must surrender two emissions units (either

an international 'Kyoto' unit or a New Zealand-issued unit) for every

three tonnes of carbon dioxide equivalent emissions reported or they may

choose to buy NZ units from the government at a fixed price of NZ$25.

Individual sectors of the economy have different entry dates when

their obligations to report emissions and surrender emission units take

effect. Forestry, which contributed net removals of 17.5 Mts of CO2e in 2010 (19% of NZ's 2008 emissions,) entered the NZ ETS on 1 January 2008.

The stationary energy, industrial processes and liquid fossil fuel

sectors entered the NZ ETS on 1 July 2010. The waste sector (landfill

operators) entered on 1 January 2013.

Methane and nitrous oxide emissions from pastoral agriculture are not

included in the NZ ETS. (From November 2009, agriculture was to enter

the NZ ETS on 1 January 2015)

The NZ ETS is highly linked to international carbon markets as it allows the importing of most of the Kyoto Protocol

emission units. However, as of June 2015, the scheme will effectively

transition into a domestic scheme, with restricted access to

international Kyoto units (CERs, ERUs and RMUs).

The NZ ETS has a domestic unit; the 'New Zealand Unit' (NZU), which is

issued by free allocation to emitters, with no auctions intended in the

short term.

Free allocation of NZUs varies between sectors. The commercial fishery

sector (who are not participants) have a free allocation of units on a

historic basis. Owners of pre-1990 forests have received a fixed free allocation of units. Free allocation to emissions-intensive industry, is provided on an output-intensity basis. For this sector, there is no set limit on the number of units that may be allocated.

The number of units allocated to eligible emitters is based on the

average emissions per unit of output within a defined 'activity'.

Bertram and Terry (2010, p 16) state that as the NZ ETS does not 'cap'

emissions, the NZ ETS is not a cap and trade scheme as understood in

the economics literature.

Some stakeholders have criticized the New Zealand Emissions

Trading Scheme for its generous free allocations of emission units and

the lack of a carbon price signal (the Parliamentary Commissioner for the Environment), and for being ineffective in reducing emissions (Greenpeace Aotearoa New Zealand).

The NZ ETS was reviewed in late 2011 by an independent panel, which reported to the Government and public in September 2011.

European Union

The European Union Emission Trading Scheme (or EU ETS) is the largest

multi-national, greenhouse gas emissions trading scheme in the world.

It is one of the EU's central policy instruments to meet their cap set

in the Kyoto Protocol.

After voluntary trials in the UK and Denmark, Phase I began operation in January 2005 with all 15 member states of the European Union participating.

The program caps the amount of carbon dioxide that can be emitted from

large installations with a net heat supply in excess of 20 MW, such as

power plants and carbon intensive factories and covers almost half (46%) of the EU's Carbon Dioxide emissions. Phase I permits participants to trade among themselves and in validated credits from the developing world through Kyoto's Clean Development Mechanism.

Credits are gained by investing in clean technologies and low-carbon

solutions, and by certain types of emission-saving projects around the

world to cover a proportion of their emissions.

During Phases I and II, allowances for emissions have typically

been given free to firms, which has resulted in them getting windfall

profits. Ellerman and Buchner (2008) suggested that during its first two years in operation, the EU ETS turned an expected increase in emissions of 1%-2% per year into a small absolute decline. Grubb et al.

(2009) suggested that a reasonable estimate for the emissions cut

achieved during its first two years of operation was 50-100 MtCO2 per year, or 2.5%-5%.

A number of design flaws have limited the effectiveness of the scheme. In the initial 2005-07 period, emission caps were not tight enough to drive a significant reduction in emissions.

The total allocation of allowances turned out to exceed actual

emissions. This drove the carbon price down to zero in 2007. This

oversupply was caused because the allocation of allowances by the EU was

based on emissions data from the European Environmental Agency in

Copenhagen, which uses a horizontal activity-based emissions definition

similar to the United Nations, the EU ETS Transaction log in Brussels,

but a vertical installation-based emissions measurement system. This

caused an oversupply of 200 million tonnes (10% of market) in the EU ETS

in the first phase and collapsing prices.

Phase II saw some tightening, but the use of JI and CDM offsets

was allowed, with the result that no reductions in the EU will be

required to meet the Phase II cap.

For Phase II, the cap is expected to result in an emissions reduction

in 2010 of about 2.4% compared to expected emissions without the cap

(business-as-usual emissions). For Phase III (2013–20), the European Commission proposed a number of changes, including:

- Setting an overall EU cap, with allowances then allocated t

- Tighter limits on the use of offsets;

- Unlimited banking of allowances between Phases II and III;

- A move from allowances to auctioning.

In January 2008, Norway, Iceland, and Liechtenstein joined the European Union Emissions Trading System (EU ETS), according to a publication from the European Commission. The Norwegian Ministry of the Environment has also released its draft National Allocation Plan which provides a carbon cap-and-trade of 15 million metric tonnes of CO2, 8 million of which are set to be auctioned.

According to the OECD Economic Survey of Norway 2010, the nation "has

announced a target for 2008-12 10% below its commitment under the Kyoto

Protocol and a 30% cut compared with 1990 by 2020."

In 2012, EU-15 emissions was 15.1% below their base year level. Based

on figures for 2012 by the European Environment Agency, EU-15 emissions

averaged 11.8% below base-year levels during the 2008-2012 period. This

means the EU-15 over-achieved its first Kyoto target by a wide margin.

Tokyo, Japan

The Japanese city of Tokyo is like a country in its own right in

terms of its energy consumption and GDP. Tokyo consumes as much energy

as "entire countries in Northern Europe, and its production matches the

GNP of the world's 16th largest country". A scheme to limit carbon

emissions launched in April 2010 covers the top 1,400 emitters in Tokyo,

and is enforced and overseen by the Tokyo Metropolitan Government.

Phase 1, which is similar to Japan's scheme, ran until 2015. (Japan had

an ineffective voluntary emissions reductions system for years,

but no nationwide cap-and-trade program.) Emitters must cut their

emissions by 6% or 8% depending on the type of organization; from 2011,

those who exceed their limits must buy matching allowances or invest in

renewable-energy certificates or offset credits issued by smaller

businesses or branch offices. Polluters that fail to comply will be fined up to 500,000 yen plus credits for 1.3 times excess emissions. In its fourth year, emissions were reduced by 23% compared to base-year emissions.

In phase 2, (FY2015-FY2019), the target is expected to increase to

15%-17%. The aim is to cut Tokyo's carbon emissions by 25% from 2000

levels by 2020. These emission limits can be met by using technologies such as solar panels and advanced fuel-saving devices.

United States

Sulfur dioxide

An early example of an emission trading system has been the sulfur dioxide (SO2) trading system under the framework of the Acid Rain Program of the 1990 Clean Air Act in the U.S. Under the program, which is essentially a cap-and-trade emissions trading system, SO2 emissions were reduced by 50% from 1980 levels by 2007. Some experts argue that the cap-and-trade system of SO2 emissions reduction has reduced the cost of controlling acid rain by as much as 80% versus source-by-source reduction. The SO2 program was challenged in 2004, which set in motion a series of events that led to the 2011 Cross-State Air Pollution Rule (CSAPR). Under the CSAPR, the national SO2 trading program was replaced by four separate trading groups for SO2 and NOx.

SO2 emissions from Acid Rain Program sources have fallen from

17.3 million tons in 1980 to about 7.6 million tons in 2008, a decrease

in emissions of 56 percent. A 2014 EPA analysis estimated that

implementation of the Acid Rain Program avoided between 20,000 and

50,000 incidences of premature mortality annually due to reductions of

ambient PM2.5 concentrations, and between 430 and 2,000 incidences

annually due to reductions of ground-level ozone.

Nitrogen oxides

In

2003, the Environmental Protection Agency (EPA) began to administer the

NOx Budget Trading Program (NBP) under the NOx State Implementation

Plan (also known as the "NOx SIP Call"). The NOx Budget Trading Program

was a market-based cap and trade program created to reduce emissions of

nitrogen oxides (NOx) from power plants and other large combustion sources in the eastern United States. NOx is a prime ingredient in the formation of ground-level ozone (smog), a pervasive air pollution problem in many areas of the eastern United States. The NBP was designed to reduce NOx emissions during the warm summer months, referred to as the ozone season, when ground-level ozone concentrations are highest. In March 2008, EPA again strengthened the 8-hour ozone standard to 0.075 parts per million (ppm) from its previous 0.08 ppm.

Ozone season NOx emissions decreased by 43 percent between 2003

and 2008, even while energy demand remained essentially flat during the

same period. CAIR will result in $85 billion to $100 billion in health

benefits and nearly $2 billion in visibility benefits per year by 2015

and will substantially reduce premature mortality in the eastern United

States.

NOx reductions due to the NOx Budget Trading Program have led to

improvements in ozone and PM2.5, saving an estimated 580 to 1,800 lives

in 2008.

A 2017 study in the American Economic Review found that the NOx Budget Trading Program decreased NOx emissions and ambient ozone concentrations.

The program reduced expenditures on medicine by about 1.5% ($800

million annually) and reduced the mortality rate by up to 0.5% (2,200

fewer premature deaths, mainly among individuals 75 and older).

Volatile organic compounds

Classification of Organic Pollutants

In the United States the Environmental Protection Agency (EPA) classifies Volatile Organic Compounds (VOCs) as gases emitted from certain solids and liquids that may have adverse health effects. These VOCs include a variety of chemicals that are emitted from a variety of different products.

These include products such as gasoline, perfumes, hair spray, fabric

cleaners, PVC, and refrigerants; all of which can contain chemicals such

as benzene, acetone, methylene chloride, freons, formaldehyde.

VOCs are also monitored by the United States Geological Survey for its presence in groundwater supply. The USGS concluded that many of the nations aquifers are at risk to low-level VOC contamination. The common symptoms of short levels of exposure to VOCs include headaches, nausea, and eye irritation. If exposed for an extended period of time the symptoms include cancer and damage to the central nervous system.

Greenhouse gases (federal)

As of 2017, there is no national emissions trading scheme in the

United States. Failing to get Congressional approval for such a scheme,

President Barack Obama instead acted through the United States Environmental Protection Agency to attempt to adopt through rulemaking the Clean Power Plan,

which does not feature emissions trading. (The plan was subsequently

challenged and is under review by the administration of President Donald

Trump.)

Concerned at the lack of federal action, several states on the

east and west coasts have created sub-national cap-and-trade programs.

President Barack Obama in his proposed 2010 United States federal budget

wanted to support clean energy development with a 10-year investment of

US$15 billion per year, generated from the sale of greenhouse gas (GHG)

emissions credits. Under the proposed cap-and-trade program, all GHG

emissions credits would have been auctioned off, generating an estimated

$78.7 billion in additional revenue in FY 2012, steadily increasing to

$83 billion by FY 2019. The proposal was never made law.

The American Clean Energy and Security Act

(H.R. 2454), a greenhouse gas cap-and-trade bill, was passed on 26 June

2009, in the House of Representatives by a vote of 219-212. The bill

originated in the House Energy and Commerce Committee and was introduced

by Representatives Henry A. Waxman and Edward J. Markey. The political advocacy organizations FreedomWorks and Americans for Prosperity, funded by brothers David and Charles Koch of Koch Industries, encouraged the Tea Party movement to focus on defeating the legislation. Although cap and trade also gained a significant foothold in the Senate via the efforts of Republican Lindsey Graham, Independent and former Democrat Joe Lieberman, and Democrat John Kerry, the legislation died in the Senate.

State and regional programs

In 2003, New York State proposed and attained commitments from nine Northeast states to form a cap-and-trade carbon dioxide emissions program for power generators, called the Regional Greenhouse Gas Initiative

(RGGI). This program launched on January 1, 2009 with the aim to reduce

the carbon "budget" of each state's electricity generation sector to

10% below their 2009 allowances by 2018.

Also in 2003, U.S. corporations were able to trade CO2 emission allowances on the Chicago Climate Exchange under a voluntary scheme. In August 2007, the Exchange announced a mechanism to create emission offsets for projects within the United States that cleanly destroy ozone-depleting substances.

In 2006, the California Legislature passed the California Global Warming Solutions Act, AB-32, which was signed into law by Governor Arnold Schwarzenegger.

Thus far, flexible mechanisms in the form of project based offsets have

been suggested for three main project types. The project types include:

manure management,

forestry, and destruction of ozone-depleted substances. However, a

ruling from Judge Ernest H. Goldsmith of San Francisco's Superior Court

stated that the rules governing California's cap-and-trade system were

adopted without a proper analysis of alternative methods to reduce

greenhouse gas emissions. The tentative ruling, issued on 24 January 2011, argued that the California Air Resources Board

violated state environmental law by failing to consider such

alternatives. If the decision is made final, the state would not be

allowed to implement its proposed cap-and-trade system until the

California Air Resources Board fully complies with the California Environmental Quality Act. California's cap-and-trade program ranks only second to the ETS (European Trading System) carbon market in the world. In 2012, under the auction, the reserve price, which is the price per ton of CO2

permit is $10. Some of the emitters obtain allowances for free, which

is for the electric utilities, industrial facilities and natural gas

distributors, whereas some of the others have to go to the auction.

In 2014, the Texas legislature approved a 10% reduction for the Highly Reactive Volatile Organic Compound (HRVOC) emission limit. This was followed by a 5% reduction for each subsequent year until a total of 25% percent reduction was achieved in 2017.

In February 2007, five U.S. states and four Canadian provinces joined together to create the Western Climate Initiative (WCI), a regional greenhouse gas emissions trading system. In July 2010, a meeting took place to further outline the cap-and-trade system. In November 2011, Arizona, Montana, New Mexico, Oregon, Utah and Washington withdrew from the WCI.

In 1997, the State of Illinois adopted a trading program for volatile organic compounds in most of the Chicago area, called the Emissions Reduction Market System. Beginning in 2000, over 100 major sources of pollution in eight Illinois counties began trading pollution credits.

South Korea

South

Korea's national emissions trading scheme officially launched on 1

January 2015, covering 525 entities from 23 sectors. With a three-year

cap of 1.8687 billion tCO2e, it now forms the second largest

carbon market in the world following the EU ETS. This amounts to roughly

two-thirds of the country's emissions. The Korean emissions trading

scheme is part of the Republic of Korea's efforts to reduce greenhouse

gas emissions by 30% compared to the business-as-usual scenario by 2020.

China

Pollution Permit Trading

In

an effort to reverse the adverse consequences of air pollution, in

2006, China started to consider a national pollution permit trading

system in order to use market-based mechanisms to incentivize companies

to cut pollution.

This has been based on a previous pilot project called the Industrial

SO2 emission trading pilot scheme, which was launched in 2002. Four

provinces, three municipalities and one business entity was involved in

this pilot project (also known as the 4+3+1 project). They are Shandong,

Shanxi, Jiangsu, Henan, Shanghai, Tianjin, Liuzhou and China Huaneng

Group, a state-owned company in the power industry.

This pilot project did not turn into a bigger scale inter-provincial

trading system, but it stimulated numerous local trading platforms.

In 2014, when the Chinese government started considering a

national level pollution permit trading system again, there were more

than 20 local pollution permit trading platforms. The Yangtze River

Delta region as a whole has also run test trading, but the scale was

limited. In the same year, the Chinese government proposed establishing a carbon market, focused on CO2 reduction later in the decade, and it is a separate system from the pollution permit trading.

Carbon Market

China

currently emits about 30% of global emission, and it became the largest

emitter in the world. When the market launched, it will be the largest

carbon market in the world. The initial design of the system targets a

scope of 3.5 billion tons of carbon dioxide emissions that come from

1700 installations. It has made a voluntary pledge under the UNFCCC to lower CO2 per unit of GDP by 40 to 45% in 2020 when comparing to the 2005 levels.

In November 2011, China approved pilot tests of carbon trading in

seven provinces and cities – Beijing, Chongqing, Shanghai, Shenzhen,

Tianjin as well as Guangdong Province and Hubei Province, with different

prices in each region.

The pilot is intended to test the waters and provide valuable lessons

for the design of a national system in the near future. Their successes

or failures will, therefore, have far-reaching implications for carbon

market development in China in terms of trust in a national carbon

trading market. Some of the pilot regions can start trading as early as

2013/2014. National trading is expected to start in 2017, latest in 2020.

The effort to start a national trading system has faced some

problems that took longer than expected to solve, mainly in the

complicated process of initial data collection to determine the base

level of pollution emission.

According to the initial design, there will be eight sectors that are

first included in the trading system, chemicals, petrochemicals, iron

and steel, non-ferrous metals, building materials, paper, power and

aviation, but many of the companies involved lacked consistent data.

Therefore, by the end of 2017, the allocation of emission quotas have

started but it has been limited to only the power sector and will

gradually expand, although the operation of the market is yet to begin.

In this system, Companies that are involved will be asked to meet

target level of reduction and the level will contract gradually.

India

Trading is

set to begin in 2014 after a three-year rollout period. It is a

mandatory energy efficiency trading scheme covering eight sectors

responsible for 54 per cent of India's industrial energy consumption.

India has pledged a 20 to 25 per cent reduction in emissions intensity

from 2005 levels by 2020. Under the scheme, annual efficiency targets

will be allocated to firms. Tradable energy-saving permits will be

issued depending on the amount of energy saved during a target year.

Renewable energy certificates

Renewable Energy Certificates

(occasionally referred to as or "green tags") are a

largely unrelated form of market-based instruments that are used to

achieve renewable energy targets, which may be environmentally motivated

(like emissions reduction targets), but may also be motivated by other

aims, such as energy security or industrial policy.

Carbon market

Carbon emissions trading is emissions trading specifically for carbon dioxide (calculated in tonnes of carbon dioxide equivalent or tCO2e) and currently makes up the bulk of emissions trading. It is one of the ways countries can meet their obligations under the Kyoto Protocol to reduce carbon emissions and thereby mitigate global warming.

Market trend

Trading

can be done directly between buyers and sellers, through several

organised exchanges or through the many intermediaries active in the

carbon market. The price of allowances is determined by supply and

demand. As many as 40 million allowances have been traded per day. In

2012, 7.9 billion allowances were traded with a total value of €56

billion. Carbon emissions trading declined in 2013, and is expected to decline in 2014.

According to the World Bank's Carbon Finance Unit, 374 million metric tonnes of carbon dioxide equivalent (tCO2e) were exchanged through projects in 2005, a 240% increase relative to 2004 (110 mtCO2e) which was itself a 41% increase relative to 2003 (78 mtCO2e).

Global carbon markets have shrunk in value by 60% since 2011, but are expected to rise again in 2014.

In terms of dollars, the World Bank has estimated that the size

of the carbon market was US$11 billion in 2005, $30 billion in 2006, and $64 billion in 2007.

The Marrakesh Accords of the Kyoto protocol defined the

international trading mechanisms and registries needed to support

trading between countries (sources can buy or sell allowances on the

open market. Because the total number of allowances is limited by the

cap, emission reductions are assured.).

Allowance trading now occurs between European countries and Asian

countries. However, while the US as a nation did not ratify the

protocol, many of its states are developing cap-and-trade systems and

considering ways to link them together, nationally and internationally,

to find the lowest costs and improve liquidity of the market.

However, these states also wish to preserve their individual integrity

and unique features. For example, in contrast to other Kyoto-compliant

systems, some states propose other types of greenhouse gas sources,

different measurement methods, setting a maximum on the price of

allowances, or restricting access to CDM projects. Creating instruments

that are not fungible

(exchangeable) could introduce instability and make pricing difficult.

Various proposals for linking these systems across markets are being

investigated, and this is being coordinated by the International Carbon Action Partnership (ICAP).

Business reaction

In 2008, Barclays Capital predicted that the new carbon market would be worth $70 billion worldwide that year. The voluntary offset market, by comparison, is projected to grow to about $4bn by 2010.

23 multinational corporations came together in the G8 Climate Change Roundtable, a business group formed at the January 2005 World Economic Forum. The group included Ford, Toyota, British Airways, BP and Unilever.

On June 9, 2005 the Group published a statement stating the need to act

on climate change and stressing the importance of market-based

solutions. It called on governments to establish "clear, transparent,

and consistent price signals" through "creation of a long-term policy

framework" that would include all major producers of greenhouse gases. By December 2007, this had grown to encompass 150 global businesses.

Business in the UK have come out strongly in support of emissions

trading as a key tool to mitigate climate change, supported by NGOs. However, not all businesses favor a trading approach. On December 11, 2008, Rex Tillerson, the CEO of Exxonmobil, said a carbon tax

is "a more direct, more transparent and more effective approach" than a

cap-and-trade program, which he said, "inevitably introduces

unnecessary cost and complexity". He also said that he hoped that the

revenues from a carbon tax would be used to lower other taxes so as to

be revenue neutral.

The International Air Transport Association,

whose 230 member airlines comprise 93% of all international traffic,

position is that trading should be based on "benchmarking", setting

emissions levels based on industry averages, rather than "grandfathering",

which would use individual companies’ previous emissions levels to set

their future permit allowances. They argue grandfathering "would

penalise airlines that took early action to modernise their fleets,

while a benchmarking approach, if designed properly, would reward more

efficient operations".

Measuring, reporting, verification

Assuring compliance with an emissions trading scheme requires measuring, reporting and verification (MRV).

Measurements are needed at each operator or installation. These

measurements are reported to a regulator. For greenhouse gases, all

trading countries maintain an inventory of emissions at national and

installation level; in addition, trading groups within North America

maintain inventories at the state level through The Climate Registry. For trading between regions, these inventories must be consistent, with equivalent units and measurement techniques.

In some industrial processes, emissions can be physically

measured by inserting sensors and flowmeters in chimneys and stacks, but

many types of activity rely on theoretical calculations instead of

measurement. Depending on local legislation, measurements may require

additional checks and verification by government or third party auditors, prior or post submission to the local regulator.

Enforcement

In

contrast to an ordinary market, in a pollution market the amount

purchased is not necessarily the amount 'consumed' (= the amount of

pollution emitted). A firm might buy a small amount of allowances but

emit a much larger amount of pollution. This creates a troublesome moral hazard problem.

This problem may be solved by a centralized regulator. The

regulator should perform Measuring, Reporting and Verification (MRV) of

the actual pollution levels, and enforce the allowances. Without effective MRV and enforcement, the value of allowances diminishes. Enforcement methods include fines and sanctions

for polluters that have exceeded their allowances. Concerns include the