Iberians, roughly located in the South and East, and Celts in the North and West of the Iberian Peninsula were the major earliest groups in what is now Spain (a third, so-called Celtiberian culture seems to have developed in the inner part of the Peninsula, where both groups were in contact).

Ruins of a Roman garum factory near Tarifa, Spain

Carthaginians and Greeks

also traded with Spain and established their own colonies on the coast.

Spain's mineral wealth and access to metals made it an important source

of raw material during the early metal ages. Carthage conquered parts

of Iberia after the First Punic War. After defeating Carthage in the Second Punic War, the Romans

governed all of the Iberian Peninsula for centuries, expanding and

diversifying the economy and extending Hispanic trade with the greater

Republic and Empire.

Middle Ages

While most of western Europe fell into a Dark Age after the decline of the Roman Empire, those kingdoms in the Iberian Peninsula that today are known as Spain maintained their economy. First, the Visigoths

replaced the Roman imperial administrators (an international class at

the top echelons). They established themselves as nobility. The kingdom

had some degree of centralized power at their capital, which was

eventually moved to Toledo from Toulouse. The Roman municipal and

provincial governorships continued but the imperial superstructure of

diocese and prefecture was of course completely gone as there was no

need for it: these had existed to coordinate imperial defense and

provide uniform administrative oversight, and symbolized as nothing

else, except the professional army, the presence of the Roman. Though it

suffered some decline, most Roman law and much physical infrastructure

such as roads, bridges, aqueducts and irrigation systems, was maintained

to varying degrees unlike the complete disintegration that occurred in

most other former parts of the western empire with the exception of

parts of Italy. Later, when the Moors

occupied large parts of the Iberian Peninsula alongside the Catholic

kingdoms, they also maintained much of this Roman legacy; in fact as

time went on they had Roman infrastructure repaired and extended.

Meanwhile, in the countryside, where most people had always lived, life

went on much as it had in Roman times, but with improvements due to the

repair and extension of irrigation systems, and the introduction of

novel crops and agricultural practices from the Islamic world. While

trade dwindled in most of the former Roman lands in Europe, trade

survived to some degree in Visigothic Spain, and flourished under the

Moors through the integration of Al-Andalus (Moorish Spain) with the Mediterranean trade of the Islamic world. After 800 years of intermittent warring,

the Catholic kingdoms had gradually become more powerful and

sophisticated and eventually expelled all the Moors from the Peninsula.

The Crown of Castile, united with the Crown of Aragon, had merchant navies that rivaled that of the Hanseatic League and Venice.

Like the rest of late medieval Europe, restrictive guilds closely

regulated all aspects of the economy-production, trade, and even

transport. The most powerful of these corporations, the mesta, controlled the production of wool, Castile's chief export.

Dynastic union and exploration

The Reconquista allowed the Catholic Monarchs to divert their attention to exploration. In 1492, Pope Alexander VI

(Rodrigo Borgia, a Valencian) formally approved the division of the

unexplored world between kingdoms of what is today Spain and Portugal.

New discoveries and conquests came in quick succession.

In 1492, when Christopher Columbus

brought 1,500 colonists with him on his second voyage, a royal

administrator had already been appointed for what the Catholic kingdoms

referred to as the Indies. The Council of the Indies (Consejo de Indias), established in 1524 acted as an advisory board on colonial affairs, and the House of Trade (Casa de Contratación) regulated trade with the colonies.

Gold and silver from the New World

The port of Seville in the 1500s. Originally, all trade with the colonies in the Americas was required to go through this port.

Following the discovery of America and the colonial expansion in the Caribbean and Continental America, valuable agricultural products and mineral resources were introduced into Spain through regular trade routes.

New products such as potatoes, tomatoes and corn had a long-lasting

impact on the Spanish economy, but more importantly on European

demographics. Gold and silver bullion from American mines were used by

the Spanish Crown to pay for troops in the Netherlands and Italy,

to maintain the emperor's forces in Germany and ships at sea, and to

satisfy increasing consumer demand at home. However, the large volumes

of precious metals from America led to inflation, which had a negative

effect on the poorer part of the population, as goods became overpriced.

This also hampered exports, as expensive goods could not compete in

international markets. Moreover, the large cash inflows from silver

hindered the industrial development in Spain as entrepreneurship seems

to be indispensable.

Domestic production was heavily taxed, driving up prices for

Aragon and Castile-made goods, but especially in Castile where the tax

burden was greater. The sale of titles to entrepreneurs who bought their

way up the social ladder (a practice commonly found all over Europe),

removing themselves from the productive sector of the economy, provided

additional funds.

The overall effect of plague and emigration reduced peninsular

Spain's population from over 8 million in the last years of the 16th

century to under 7 million by the mid-17th century, with Castile the

most severely affected region (85% of the Kingdom's population were in

Castile), as an example, in 1500, Castile 6 million, and 1.25 million in

the Crown of Aragon which included Catalonia, Valencia and the Balearic Islands.

Decline relative to Britain

The

Spanish economy diverged from the British economy in terms of GDP

during the middle of the seventeenth century. The explanations for this

divergence are unclear, but "the divergence comes too late to have any

medieval origins, whether cultural or institutional" and "it comes too

early... in order for the Napoleonic Invasions to be blamed."

Bourbon reforms

A

slow economic recovery began in the last decades of the 17th century

under the Habsburgs. Under the Bourbons, government efficiency was

improved, especially under Charles III's

reign. The Bourbon reforms, however, resulted in no basic changes in

the pattern of property holding. The nature of bourgeois class

consciousness in Aragon and Castile hindered the creation of a

middle-class movement. At the instance of liberal thinkers including Campomanes,

various groups known as "Economic Societies of friends of the Country"

were formed to promote economic development, new advances in the

sciences, and Enlightenment philosophy (see Sociedad Económica de los Amigos del País).

However, despite the development of a national bureaucracy in Madrid,

the reform movement could not be sustained without the patronage of

Charles III, and it did not survive him.

Jan Bergeyck (advisor to Philip V) "Disorder I have found here is beyond all imagination".

Castile's exchequer still used Roman numerals and there was no proper accounting.

Napoleon and the War of Independence

Spain's American colonies took advantage of the postwar chaos to proclaim their independence. By 1825 only Cuba and Puerto Rico remained under the Spanish flag in the New World. When Ferdinand VII

was restored to the throne in 1813 and expended wealth and manpower in a

vain effort to reassert control over the colonies. The move was

unpopular among liberal officers assigned to the American wars.

1822 to 1898

The

economy was heavily focused around agricultural goods. The period saw

regional industrialization in Catalonia and the Basque Country and the

construction of railways in the second half of the nineteenth century

helped alleviate some of the isolation of the interior but generally

little changed for much of the country as political instability,

uprisings and unstable governments slowed or undermined economic

progress.

1898 to 1920

At

the beginning of the 20th century, Spain was still mostly rural; modern

industry existed only in the textile mills around Barcelona in

Catalonia and in the metallurgical plants of the Basque provinces. The

loss of Cuba and the Philippines benefited the Peninsula by causing

capital to return and to be invested in updated domestic industries. But

even with the stimulus of World War I, only in Catalonia and in two Basque provinces (Biscay and Guipuscoa)

did the value of manufacturing output in 1920 exceed that of

agricultural production. Agricultural productivity was generally low

compared with that of other West European countries because of a number

of deficiencies: backward technology, lack of large irrigation projects,

inadequate rural credit facilities, outmoded landtenure practices, as

well as the age old problems of difficult terrain, unreliable climate,

isolation and difficult transportation in the rugged interior. Financial

institutions were relatively undeveloped. The Bank of Spain (Banco de España)

was still privately owned, and its public functions were restricted to

currency issuance and the provision of funds for state activities. The

state largely limited itself to such traditional activities as defense

and the maintenance of order and justice. Road building, education, and a

few welfare activities were the only public services that had any

appreciable impact on the economy.

Primo de Rivera

A General, Miguel Primo de Rivera,

was appointed prime minister by the king after a successful coup d'état

and for seven years dissolved parliament and ruled through directorates

and the aid of the military until 1930.

Protectionism, the Spanish neutrality during World War I

(which allowed the country to trade with all belligerents) and state

control of the economy led to a temporary economic recovery. The

precipitous economic decline in 1930 undercut support for the government

from special-interest groups. Criticism from academics mounted. Bankers

expressed disappointment at the state loans that his government had

tried to float. An attempt to reform the promotion system cost him the

support of the army and, in turn, the support of the king. Primo de

Rivera resigned and died shortly afterward in exile.

Second Republic, 1931–36

The

republican government substituted the monarchy and inherited the

international economic crisis as well. Three different governments ruled

during the Second Spanish Republic, failing to execute numerous reforms, including land reform. General strikes were common and the economy stagnated.

During the Spanish Civil War,

the country split into two different centralized economies, and the

whole economic effort was redirected to the war industry. According to

recent research,

growth is harmed during civil wars due to the huge contraction on

private investment, and such was the case with the Spanish divided

economy.

The Franco Era, 1939–75

Post-war ration card

Spain emerged from the civil war with formidable economic problems. Gold and foreign exchange reserves had been virtually wiped out, the massive devastation of war had reduced the productive capacity of both industry and agriculture. To compound the difficulties, even if the wherewithal had existed to purchase imports, the outbreak of World War II

rendered many needed supplies unavailable. The end of the war did not

improve Spain's plight because of subsequent global shortages of raw

materials, and peacetime industrial products. Spain's European

neighbours faced formidable post-war reconstruction problems of their

own, and, because of their awareness that the Nationalist victory in the

Spanish Civil War had been achieved with the help of Adolf Hitler and Benito Mussolini,

they had no inclination to include Spain in any multilateral recovery

programs or trade. For a decade following the Civil War's end in 1939,

the wrecked and isolated economy remained in a state of severe depression.

Branded an international outcast for its pro-Axis bias during World War II, Spain was not invited to join the Marshall Plan. Francisco Franco's regime sought to provide for Spain's well-being by adopting a policy of economic self-sufficiency. Autarky was not merely a reaction to international isolation;

it was also rooted in more than half a century of advocacy from

domestic economic pressure groups. Furthermore, from 1939 to 1945,

Spain's military chiefs genuinely feared an Allied invasion of the

Peninsula and, therefore, sought to avert excessive reliance on foreign

armaments.

With the war devastation and trade isolation, Spain was much more

economically backward in the 1940s than it had been a decade earlier.

Inflation soared, economic reconstruction faltered, food was scarce, and, in some years, Spain registered negative growth rates. By the early 1950s, per capita gross domestic product

(GDP) was barely 40% of the average for West European countries. Then,

after a decade of economic stagnation, a tripling of prices, the growth

of a black market,

and widespread deprivation, gradual improvement began to take place.

The regime took its first faltering steps toward abandoning its

pretensions of self-sufficiency and towards a transformation of Spain's

economic system. Pre-Civil War industrial production levels were

regained in the early 1950s, though agricultural output remained below

prewar levels until 1958.

A further impetus to economic liberalization came from the September 1953 signing of a mutual defense agreement, the Pact of Madrid, between the United States

and Spain. In return for permitting the establishment of United States

military bases on Spanish soil, the administration of President Dwight D. Eisenhower

administration provided substantial economic aid to the Franco regime.

More than US$1 billion in economic assistance flowed into Spain during

the remainder of the decade as a result of the agreement. Between 1953

and 1958, Spain's gross national product (GNP) rose by about 5% per annum.

The years from 1951 to 1956 were marked by much economic

progress, but the reforms of the period were implemented irregularly,

and were poorly coordinated. One large obstacle to the reform process

was the corrupt, inefficient, and bloated bureaucracy. By the mid-1950s,

the inflationary spiral had resumed its upward climb, and foreign

currency reserves that had stood at US$58 million in 1958 plummeted to

US$6 million by mid-1959. The growing demands of the emerging middle

class—and of the ever-greater number of tourists—for the amenities of

life, particularly for higher nutritional standards, placed heavy

demands on imported food and luxury items. At the same time, exports

lagged, largely because of high domestic demand and institutional

restraints on foreign trade. The peseta fell to an all-time low on the black market, and Spain's foreign currency obligations grew to almost US$60 million.

A debate took place within the regime over strategies for

extricating the country from its economic impasse, and Franco finally

opted in favor of a group of neoliberals. The group included bankers, industrial executives, some academic economists, and members of the Roman Catholic lay organization, Opus Dei.

During the 1957-59 period, known as the pre-stabilization years,

economic planners contented themselves with piecemeal measures such as

moderate anti-inflationary stopgaps and increases in Spain's links with

the world economy. A combination of external developments and an

increasingly aggravated domestic economic crisis, however, forced them

to engage in more far-reaching changes.

As the need for a change in economic policy became manifest in

the late 1950s, an overhaul of the Council of Ministers in February 1957

brought to the key ministries a group of younger men, most of whom

possessed economics training and experience. This reorganization was

quickly followed by the establishment of a committee on economic affairs

and the Office of Economic Coordination and Planning under the prime

minister.

Such administrative changes were important steps in eliminating

the chronic rivalries that existed among economic ministries. Other

reforms followed, the principal one being the adoption of a corporate

tax system that required the confederation of each industrial sector to

allocate an appropriate share of the entire industry's tax assessment to

each member firm. Chronic tax evasion was consequently made more

difficult, and tax collection receipts rose sharply. Together with curbs

on government spending, in 1958 this reform created the first

government surplus in many years.

More drastic remedies were required as Spain's isolation from the

rest of Western Europe became exacerbated. Neighboring states were in

the process of establishing the EC and the European Free Trade

Association (EFTA—see Glossary). In the process of liberalizing trade

among their members, these organizations found it difficult to establish

economic relations with countries wedded to trade quotas and bilateral

agreements, such as Spain.

The "Spanish Miracle"

Spanish

membership in these groups was not politically possible, but Spain was

invited to join a number of other international institutions. In January

1958, Spain became an associate member of the Organisation for European

Economic Co-operation (OEEC), which became the Organisation for Economic Co-operation and Development (OECD) in September 1961. In 1959 Spain joined the International Monetary Fund (IMF) and the World Bank.

These bodies immediately became involved in helping Spain to abandon

the autarkical trade practices that had brought its reserves to such low

levels and that were isolating its economy from the rest of Europe.

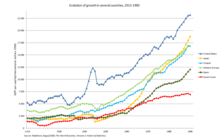

GDP per capita of Spain from 1913 to 1990.

In December 1958, after seven months of preparation and drafting,

aided by IMF, Spain unveiled its Stabilization Plan on June 30, 1959.

The plan's objectives were twofold: to take the necessary fiscal and

monetary measures required to restrict demand and to contain inflation,

while, at the same time, liberalizing foreign trade and encouraging

foreign investment. The plan's initial effect was deflationary and

recessionary, leading to a drop in real income and to a rise in

unemployment during its first year. The resultant economic slump and

reduced wages led approximately 500,000 Spanish workers to emigrate in

search of better job opportunities in other West European countries.

Nonetheless, its main goals were achieved. The plan enabled Spain to

avert a possible suspension of payments abroad to foreign banks holding

Spanish currency, and by the close of 1959, Spain's foreign exchange

account showed a US$100-million surplus. Foreign capital investment grew

sevenfold between 1958 and 1960, and the annual influx of tourists

began to rise rapidly, bringing in very much needed foreign exchange

along remittances from Spanish workers abroad.

Beach in Benidorm circa 1960

As these developments steadily converted Spain's economic structure into one more closely resembling a free-market economy,

the country entered the greatest cycle of industrialization and

prosperity it had ever known. Foreign aid took the form of US$75 million

in drawing rights from the IMF, US$100 million in OEEC credits, US$70

million in commercial credits from the Chase Manhattan Bank and the First National City Bank, US$30 million from the Export-Import Bank of the United States,

and funds from United States aid programs. Total foreign backing

amounted to US$420 million. The principal lubricants of the economic

expansion, however, were the hard currency remittances

of one million Spanish workers abroad, which are estimated to have

offset 17.9% of the total trade deficit from 1962 to 1971; the gigantic

increase in tourism that drew more than 20 million visitors per year by

the end of the 1960s, accounting by then for 9% of GNP; a car industry

that grew at a staggering compound rate of 21.7% per year from 1958 to

1972; and direct foreign investment, which between 1960 and 1974

amounted to an impressive US$7.6 billion. More than 40% of this

investment came from the United States, almost 17% came from Switzerland, and the Federal Republic of Germany

and France each accounted for slightly more than 10%. By 1975 foreign

capital represented 12.4% of the total invested in Spain's 500 largest

industrial firms. More important than the actual size of the foreign

investment was the access it gave Spanish companies to up to date

technology. An additional billion dollars came from foreign sources

through a variety of loans and credit devices.

SEAT 850 Sport, 1967. SEAT became a symbol of the "Spanish Miracle", 1959–1974.

To help achieve rapid development, there was massive government

investment through key state-owned companies like the national

industrial conglomerate Instituto Nacional de Industria, the mass-market car company SEAT in Barcelona, the shipbuilder Empresa Nacional Bazán.

With foreign access to the Spanish domestic market restricted by heavy

tariffs and quotas, these national companies led the industrialisation

of the country, restoring the prosperity of old industrial areas like

Barcelona and Bilbao and creating new industrial areas, most notably around Madrid. Although there was considerable economic liberalisation in the period these enterprises remained under state control.

The success of the stabilization program was attributable to a

combination of good luck and good management and the impressive

development during this period was referred to as the "Spanish miracle". Between 1959 and 1974, Spain had the next fastest economic growth rate after Japan. The boom came to an end with the oil shocks of the 1970s and government instability during the transition back to democracy after Franco's death in 1975.

The Post-Franco period, 1975–1980s

Franco's death in 1975 and the ensuing transition to democratic rule diverted Spaniards' attention from their economy. The return to democracy coincided with an explosive quadrupling of oil prices, which had an extremely serious effect on the economy because Spain imported 70% of its energy, mostly in the form of Middle Eastern oil. Nonetheless, the interim centrist government of Adolfo Suarez Gonzalez, which had been named to succeed the Franco regime by King Juan Carlos,

did little to shore up the economy or even to reduce Spain's dependence

on imported oil, although there was little that could be done as the

country had little in the way of hydrocarbon deposits. A virtually

exclusive preoccupation with the politics of democratization during the

politically and socially unstable period when the new constitution was

drafted and enacted, absorbed most of Spain's politics and

administration at the expense of economic policy.

Because of the failure to adjust to the changed economic

environment brought on by the two oil price shocks of the 1970s, Spain

quickly confronted plummeting productivity, an explosive increase in

wages from 1974 to 1976, a reversal of migration trends as a result of

the economic slump throughout Western Europe, and the steady outflow of

labor from agricultural areas despite declining job prospects in the

cities. All these factors contributed to a sharp rise in the

unemployment rate. Government budgetary deficits swelled, as did large social security

cost overruns and the huge operating losses incurred by a number of

public-sector industries. Energy consumption, meanwhile, remained high.

When the Spanish Socialist Workers' Party government headed by Felipe González

took office in late 1982, inflation was running at an annual rate of

16%, the external current account was US$4 billion in arrears, public

spending was large, and foreign exchange reserves

had become dangerously depleted. In coping with the situation, however,

the Gonzalez government had one asset that no previous post-Franco

government had enjoyed, namely, a solid parliamentary majority in both

houses of the Cortes (Spanish Parliament). With this majority, it was

able to undertake unpopular austerity measures that earlier governments

had not.

The Socialist government opted for pragmatic, orthodox monetary

and fiscal policies, together with a series of vigorous retrenchment

measures. In 1983 it unveiled a program that provided a more coherent

and long-term approach to the country's economic ills. Renovative

structural policies—such as the closing of large, unprofitable state

enterprises—helped to correct the relatively poor performance of the

economy. The government launched an industrial reconversion program,

brought the problem-ridden social security system into better balance,

and introduced a more efficient energy-use policy. Labor market flexibility was improved, and private capital investment was encouraged with incentives.

By 1985 the budgetary deficit was brought down to 5% of GNP, and

it dropped to 4.5% in 1986. Real wage growth was contained, and it was

generally kept below the rate of inflation. Inflation was reduced to

4.5% in 1987, and analysts believed it might decrease to the

government's goal of 3% in 1988.

Efforts to modernize and to expand the economy together with a

number of factors fostered strong economic growth in the 1980s. Those

factors were the continuing fall in oil prices, increased tourism, and a

massive upsurge in the inflow of foreign investment. Thus, despite the

fact that the economy was being exposed to foreign competition in

accordance with EC requirements, the Spanish economy underwent rapid

expansion without experiencing balance of payments' constraints.

In the words of the OECD's 1987-88 survey of the Spanish economy,

"following a protracted period of sluggish growth with slow progress in

winding down inflation during the late 1970s and the first half of the

1980s, the Spanish economy has entered a phase of vigorous expansion of

output and employment accompanied by a marked slowdown of inflation."

In 1981 Spain's GDP growth rate had reached a nadir by registering a

rate of negative 0.2%; it then gradually resumed its slow upward ascent

with increases of 1.2% in 1982, 1.8% in 1983, 1.9% in 1984, and 2.1% in

1985. The following year, however, Spain's real GDP began to grow

strongly, registering a growth rate of 3.3% in 1986 and 5.5% in 1987.

Although these growth rates were less than those of the economic miracle

years, they were among the strongest of the OECD. Analysts projected a

rise of 3.8% in 1988 and of 3.5% in 1989, a slight decline but still

roughly double the EC average. They expected that declining interest

rates and the government's stimulative budget would help sustain

economic expansion. Industrial output, which rose by 3.1% in 1986 and by

5.2% in 1987, was also expected to maintain its expansive rate, growing

by 3.8% in 1988 and by 3.7% in 1989.

A prime force generating rapid economic growth was increased

domestic demand, which grew by a steep 6% in 1986 and by 4.8% in 1987,

in both years exceeding official projections. During 1988 and 1989,

analysts expected demand to remain strong, though at slightly lower

levels. Much of the large increase in demand was met in 1987 by an

estimated 20% jump in real terms in imports of goods and services.

In the mid-1980s, Spain achieved a strong level of economic

performance while simultaneously lowering its rate of inflation to

within two points of the EC average. However, its export performance,

though increasing, raised concerns over the existing imbalance between

import and export growth.

European integration, 1985–2000

After Franco's death in 1975, the country returned to democracy in

the form of a constitutional monarchy in 1978, with elections being held

in 1977 and with the constitution being ratified in 1978. The move to

democracy saw Spain become more involved with the European integration.

Felipe Gonzalez

became prime minister when his Socialist Party won the 1982 elections.

He enacted a number of liberal reforms, increasing civil liberties and

implementing universal free education for those 16 and younger. He also

lobbied successfully for Spain to join the European Economic Community (EEC) and to remain part of the North Atlantic Treaty Organization.

The European Union

at the time Spain joined, in 1986, existed primarily as a trading union

- the EEC, and better trade links were vital to the fragile Spanish

economy. Unemployment was high, about 18 percent, and the Spanish GDP

was 71 percent of the EU average. The single market and European funding

offered a chance to bring the Spanish economy up to the standards of

the rest of Western Europe, along with the support of Spain's wealthier

neighbors. There was the promise of lucrative deals with influential

countries such as Germany, France and the UK.

Although the Spanish Miracle years (1959–1974) witnessed

unprecedented improvements in infrastructure and social services, Spain

still lagged behind most of Western Europe. Education was limited, women

were largely excluded from the workforce, health care was largely

private and unevenly distributed and the country's infrastructure was

relatively poor. In 1985, Spain had only 2,100 km (1,300 mi) of

motorways. Since the end of the economic miracle in 1974, the country's

economy had been stagnant. Joining the European Economic Community was

perceived by most of the population as a way to restart the process of

modernization and improvement of the population's average purchasing

power.

Spain joined the European Economic Community, as the European Union was then known, in January 1986 at the same time as neighbor Portugal.

Membership ushered the country into opening its economy, modernizing

its industrial base and revising economic legislation to open its

previously protected markets to foreign competition. With help of EU

funds (Structural Funds and Cohesion Funds, European Regional Development Fund, etc.) Spain greatly improved infrastructures, increased GDP growth, reduced the public debt

to GDP ratio.

Spain has been a driving force in the European community ever since. The

country was a leading proponent of the EU single currency, the euro,

long before it had been put into circulation. Together with the other

founding euro members, it adopted the new physical currency on January

1, 2002. On that date Spain terminated its historic peseta currency and replaced it with the euro, which has become its national currency shared the rest of the Eurozone.

This culminated a fast process of economic modernization even though

the strength of the euro since its adoption has raised concerns

regarding the fact that Spanish exports outside the European Union are

being priced out of the range of foreign buyers, with the country losing

monetary sovereignty in favour of the European Central Bank, which must look after several different -often opposed- national interests.

In the early 1990s Spain, like most other countries, was hit by the early 1990s recession. which coincided with the end of the construction push put in place for the Barcelona Olympics.

Boom 1997–2007

The country was confronted with very high unemployment, entrenched by

its then rigid labour market. However the economy began to recover

during the first José María Aznar

administration (1996-2000), driven by a return of consumer confidence,

increased private consumption and liberalization and deregulation

reforms aiming to reduce the State's role in the market place.

Unemployment at 7.6% (October 2006), represented a significant

improvement from the 1980s levels and a better rate than the one of

Germany or France at the time. Devaluations of the peseta

during the 1990s made Spanish exports more competitive.

By the late 1990s economic growth was strong, employment grew strongly,

although unemployment remained high, as people returned to the job

market and confidence in the economy returned. The last years of the

1990s saw property values begin to increase.

The Spanish economy was being credited for having avoided the

virtual zero growth rate of some of its largest partners in the EU

(namely France, Germany and Italy) in the late 1990s and at the

beginning of the 21st century. In 1995 Spain started an impressive

economic cycle marked by an outstanding economic growth, with figures around 3%, often well over this rate.

Map showing regional variation in European GDP (PPP) per capita in 2006. Figures from International Monetary Fund

Growth in the decade prior to 2008 steadily closed the economic gap

between Spain and its leading partners in the EU. For a moment, the

Spanish economy was regarded as one of the most dynamic within the EU,

even able to replace the leading role of much larger economies like the

ones of France and Germany, thus subsequently attracting significant

amounts of native and foreign investment.

Also, during the period spanning from the mid 1980s through the mid

2000s, Spain was second only to France in being the most successful OECD country in terms of reduced income inequality over this period.

Spain also made great strides in integrating women into the workforce.

From a position where the role of Spanish women in the labour market in

the early 1970s was similar to that prevailing in the major European

countries in the 1930s, by the 1990s Spain had achieved a modern

European profile in terms of economic participation by women.

Spain joined the Eurozone

in 1999. Interest rates dropped and the property boom accelerated. By

2006 property prices had doubled from a decade earlier. During this time

construction of apartments and houses increased at a record rate and

immigration into Spain increased into the hundreds of thousands a year

as Spain created more new jobs than the rest of Eurozone combined. Along with the property boom, there was a rapid expansion of service industry jobs.

Convergence with the European Union

Due to its own economic development and the EU enlargements

up to 27 members (2007), Spain as a whole exceeded (105%) the average

of the EU GDP in 2006 placing it ahead of Italy (103% for 2006). As for

the extremes within Spain, three regions in 2005 were included in the

leading EU group exceeding 125% of the GDP average level (Madrid, Navarre and the Basque Autonomous Community) and one was at the 85% level (Extremadura). These same regions were on the brink of full employment by then.

According to the growth rates post 2006, noticeable progress from

these figures happened until early 2008, when the Spanish economy was

heavily affected by the puncturing of its property bubble by the global financial crisis.

In this regard, according to Eurostat's

estimates for 2007 GDP per capita for the EU-27. Spain happened to stay

by that time at 107% of the level, well above Italy who was still above

the average (101%), and catching up with countries like France (111%).

Economic Crisis, 2008–2013

Torres de la Casería de Ossio apartment buildings in San Fernando completed in 2007. The collapse of the Spanish construction boom was a major contributor to the record unemployment.

In 2008, the shockwaves of the global financial crisis punctured the Spanish property bubble,

causing a property crash. Construction collapsed and unemployment began

to rise. The property crash led to a collapse of credit as banks hit by

bad debts cut back lending, causing a recession. As the economy shrank,

government revenue collapsed and government debt began to climb

rapidly. By the 2010 the country faced severe financial problems and got

caught up in the European sovereign debt crisis.

Mariano Rajoy's government received an ECB bank bailout while stepping up austerity

In 2012, unemployment rose to a record high of 25 percent. On 25 May 2012, Bankia,

at that time the fourth largest bank of Spain with 12 million

customers, requested a bailout of €19 billion, the largest bank bailout

in the nation's history. The new management, led by José Ignacio Goirigolzarri

reported losses before taxes of 4.3 billion euros (2.98 billion euros

taking into account a fiscal credit) compared to a profit of 328 million

euros reported when Rodrigo Rato was at the head of Bankia until May 9, 2012. On June 9, 2012, Spain asked Eurozone

governments for a bailout worth as much as 100 billion euros ($125

billion) to rescue its banking system as the country became the biggest

euro economy until that date, after Ireland, Greece and Portugal, to

seek international aid due to its weaknesses amid the European sovereign

debt crisis. A Eurozone official told Reuters in July 2012 that Spain conceded for the first time at a meeting between Spanish Economy Minister Luis de Guindos and his German counterpart Wolfgang Schaeuble,

it might need a bailout worth 300 billion euros if its borrowing costs

remained unsustainably high. On August 23, 2012, Reuters reported that

Spain was negotiating with euro zone partners over conditions for aid to

bring down its borrowing costs.

After serious austerity measures and major reforms into the

economy Spain exited recession in 2013 and its economy is growing

once more at a rate of 2.5 in 2015 and it is only expected to improve

over the coming years. Although jobs are starting to be created the

unemployment still stands at 22.6% in April 2015.

Recovery 2014–present

In 2014, after years of economic recession, Spain grew up a 1,4%, accelerating to 3.4% in 2015 and 3.3% in 2016 and moderating by 3.1% in 2017.

Experts say that the economy will moderate in 2018 to stable growth of

between 2.5% and 3%. In addition to this, the unemployment rate has been

reduced during the years of recovery, standing at 16.55% in 2017.