Medicare is a national health insurance program in the United States, begun in 1966 under the Social Security Administration (SSA) and now administered by the Centers for Medicare and Medicaid Services (CMS). It primarily provides health insurance for Americans aged 65 and older, but also for some younger people with disability status as determined by the Social Security Administration, as well as people with end stage renal disease and amyotrophic lateral sclerosis (ALS or Lou Gehrig's disease).

In 2018, according to the 2019 Medicare Trustees Report, Medicare

provided health insurance for over 59.9 million individuals—more than

52 million people aged 65 and older and about 8 million younger people.

According to annual Medicare Trustees reports and research by the

government's MedPAC group, Medicare covers about half of healthcare

expenses of those enrolled. Enrollees almost always cover most of the

remaining costs by taking additional private insurance and/or by joining

a public Part C or Part D Medicare health plan. No matter which of

those two options the beneficiaries choose—or if they choose to do

nothing extra (around 1% according to annual Medicare Trustees reports

over time), beneficiaries also have other healthcare-related costs.

These additional so-called out of pocket (OOP) costs can include

deductibles and co-pays; the costs of uncovered services—such as for

long-term custodial, dental, hearing, and vision care; the cost of

annual physical exams for those not on Part C health plans that include

physicals; and the costs related to basic Medicare's lifetime and

per-incident limits. Medicare is funded by a combination of a specific payroll tax, beneficiary premiums and surtaxes from beneficiaries, co-pays and deductibles, and general U.S. Treasury revenue.

Medicare is divided into four Parts. Medicare Part A covers

hospital (inpatient, formally admitted only), skilled nursing (only

after being formally admitted to a hospital for three days and not for

custodial care), and hospice services. Part B covers outpatient services

including some providers' services while inpatient at a hospital,

outpatient hospital charges, most provider office visits even if the

office is "in a hospital", and most professionally administered

prescription drugs. Part D covers mostly self-administered prescription

drugs. Part C is an alternative called Managed Medicare or Medicare

Advantage which allows patients to choose health plans with at least the

same service coverage as Parts A and B (and most often more), often the

benefits of Part D, and always an annual out-of-pocket spend limit

which A and B lack. A beneficiary must enroll in Parts A and B first

before signing up for Part C.

History

Lyndon B. Johnson signing the Medicare amendment. Former President Harry S. Truman (seated) and his wife, Bess, are on the far right.

Originally, the name "Medicare" in the United States referred to a

program providing medical care for families of people serving in the

military as part of the Dependents' Medical Care Act, which was passed

in 1956. President Dwight D. Eisenhower

held the first White House Conference on Aging in January 1961, in

which creating a health care program for social security beneficiaries

was proposed.

In July 1965, under the leadership of President Lyndon Johnson, Congress enacted Medicare under Title XVIII of the Social Security Act to provide health insurance to people age 65 and older, regardless of income or medical history. Johnson signed the Social Security Amendments of 1965 into law on July 30, 1965, at the Harry S. Truman Presidential Library in Independence, Missouri. Former President Harry S. Truman and his wife, former First Lady Bess Truman became the first recipients of the program.

Before Medicare was created, only approximately 60% of people over the

age of 65 had health insurance, with coverage often unavailable or

unaffordable to many others, as older adults paid more than three times

as much for health insurance as younger people. Many of this group

(about 20% of the total in 2015) became "dual eligible" for both

Medicare and Medicaid with the passing of the law. In 1966, Medicare

spurred the racial integration

of thousands of waiting rooms, hospital floors, and physician practices

by making payments to health care providers conditional on desegregation.

Medicare has been operating for just over a half-century and,

during that time, has undergone several changes. Since 1965, the

program's provisions have expanded to include benefits for speech,

physical, and chiropractic therapy in 1972. Medicare added the option of payments to health maintenance organizations (HMO) in the 1970s. The government added hospice benefits to aid elderly people on a temporary basis in 1982, and made this permanent in 1984. Congress further expanded Medicare in 2001 to cover younger people with amyotrophic lateral sclerosis

(ALS, or Lou Gehrig's disease). As the years progressed, Congress

expanded Medicare eligibility to younger people with permanent

disabilities who receive Social Security Disability Insurance (SSDI) payments and to those with end-stage renal disease (ESRD). The association with HMOs that began in the 1970s was formalized and expanded under President Bill Clinton

in 1997 as Medicare Part C (although not all Part C health plans

sponsors have to be HMOs, about 75% are). In 2003, under President George W. Bush, a Medicare program for covering almost all self-administered prescription drugs was passed (and went into effect in 2006) as Medicare Part D.

Administration

The Centers for Medicare and Medicaid Services (CMS), a component of the U.S. Department of Health and Human Services (HHS), administers Medicare, Medicaid, the Children's Health Insurance Program (CHIP), the Clinical Laboratory Improvement Amendments (CLIA), and parts of the Affordable Care Act (ACA) ("Obamacare"). Along with the Departments of Labor and Treasury, the CMS also implements the insurance reform provisions of the Health Insurance Portability and Accountability Act of 1996 (HIPAA) and most aspects of the Patient Protection and Affordable Care Act of 2010 as amended. The Social Security Administration

(SSA) is responsible for determining Medicare eligibility, eligibility

for and payment of Extra Help/Low Income Subsidy payments related to

Parts C and D of Medicare, and collecting most premium payments for the

Medicare program.

The Chief Actuary of the CMS must provide accounting information

and cost-projections to the Medicare Board of Trustees to assist them in

assessing the program's financial health. The Trustees are required by

law to issue annual reports on the financial status of the Medicare

Trust Funds, and those reports are required to contain a statement of

actuarial opinion by the Chief Actuary.

Since the Medicare program began, the CMS (that was not always

the name of the responsible bureaucracy) has contracted with private

insurance companies to operate as intermediaries between the government

and medical providers to administer Part A and Part B benefits.

Contracted processes include claims and payment processing, call center

services, clinician enrollment, and fraud investigation. Beginning in

1997 and 2005, respectively, these Part A and B administrators (whose

contracts are bid out periodically), along with other insurance

companies and other companies or organizations (such as integrated

health delivery systems, unions and pharmacies), also began

administering Part C and Part D plans.

The Specialty Society Relative Value Scale Update Committee (or Relative Value Update Committee; RUC), composed of physicians associated with the American Medical Association,

advises the government about pay standards for Medicare patient

procedures performed by doctors and other professionals under Medicare

Part B.

A similar but different CMS process determines the rates paid for acute

care and other hospitals—including skilled nursing facilities—under

Medicare Part A. The rates paid for both Part A and Part B type services

under Part C are whatever is agreed upon between the sponsor and the

provider. The amounts paid for mostly self administered drugs under Part

D is whatever is agreed upon between the sponsor (almost always through

a pharmacy benefit manager also used in commercial insurance) and

pharmaceutical distributors and/or manufacturers.

The expenditures from the trust funds under Parts A and B are fee

for service whereas the expenditures from the trust funds under Parts C

and D are capitated. In particular, it is important to understand that

Medicare itself does not purchase either self- administered or

professionally administered drugs. In Part D, the Part D Trust Fund

helps beneficiaries purchase drug insurance. For Part B drugs, the trust

funds reimburses the professional that administers the drugs and allows

a mark up for that service.

Financing

Medicare has several sources of financing.

Part A's inpatient admitted hospital and skilled nursing coverage is largely funded by revenue from a 2.9% payroll tax

levied on employers and workers (each pay 1.45%). Until December 31,

1993, the law provided a maximum amount of compensation on which the

Medicare tax could be imposed annually, in the same way that the Social

Security payroll tax operates.

Beginning on January 1, 1994, the compensation limit was removed.

Self-employed individuals must pay the entire 2.9% tax on self-employed

net earnings (because they are both employee and employer), but they may

deduct half of the tax from the income in calculating income tax.

Beginning in 2013, the rate of Part A tax on earned income exceeding

$200,000 for individuals ($250,000 for married couples filing jointly)

rose to 3.8%, in order to pay part of the cost of the subsidies mandated

by the Affordable Care Act.

Parts B and D are partially funded by premiums paid by Medicare

enrollees and general U.S. Treasury revenue (to which Medicare

beneficiaries contributed and may still contribute). In 2006, a surtax

was added to Part B premium for higher-income seniors to partially fund

Part D. In the Affordable Care Act legislation of 2010, another surtax

was then added to Part D premium for higher-income seniors to partially

fund the Affordable Care Act and the number of Part B beneficiaries

subject to the 2006 surtax was doubled, also partially to fund PPACA.

Parts A and B/D use separate trust funds to receive and disburse

the funds mentioned above. The Medicare Part C program uses these same

two trust funds as well at a proportion determined by the CMS reflecting

that Part C beneficiaries are fully on Parts A and B of Medicare just

as all other beneficiaries, but that their medical needs are paid for

through a sponsor (most often an integrated health delivery system or

spin out) to providers rather than "fee for service" (FFS) through an

insurance company called a Medicare Administrative Contractor to

providers.

In 2018, Medicare spending was over $740 billion, about 3.7% of

U.S. gross domestic product and over 15% of total US federal spending.

Because of the two Trust funds and their differing revenue sources (one

dedicated and one not), the Trustees analyze Medicare spending as a

percent of GDP rather than versus the Federal budget.

Retirement of the Baby Boom

generation is projected by 2030 to increase enrollment to more than 80

million. In addition, the fact that the number of workers per enrollee

will decline from 3.7 to 2.4 and that overall health care costs in the nation

are rising pose substantial financial challenges to the program.

Medicare spending is projected to increase from just over $740 billion

in 2018 to just over $1.2 trillion by 2026, or from 3.7% of GDP to 4.7%.

Baby-boomers are projected to have longer life spans, which will add to

the future Medicare spending. The 2019 Medicare Trustees Report

estimates that spending as a percent of GDP will grow to 6% by 2043

(when the last of the baby boomers turns 80) and then flatten out to

6.5% of GDP by 2093. In response to these financial challenges, Congress

made substantial cuts to future payouts to providers (primarily acute

care hospitals and skilled nursing facilities) as part of PPACA in 2010

and the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) and policymakers have offered many additional competing proposals to reduce Medicare costs further.

Cost reduction is influenced by factors including reduction in inappropriate and unnecessary care by evaluating evidence-based practices

as well as reducing the amount of unnecessary, duplicative, and

inappropriate care. Cost reduction may also be effected by reducing

medical errors, investment in healthcare information technology,

improving transparency of cost and quality data, increasing

administrative efficiency, and by developing both clinical/non-clinical

guidelines and quality standards.

Eligibility

In

general, all persons 65 years of age or older who have been legal

residents of the United States for at least five years are eligible for

Medicare. People with disabilities under 65 may also be eligible if they receive Social Security Disability Insurance (SSDI) benefits. Specific medical conditions may also help people become eligible to enroll in Medicare.

People qualify for Medicare coverage, and Medicare Part A premiums are entirely waived, if the following circumstances apply:

- They are 65 years or older and US citizens or have been permanent legal residents for five continuous years, and they or their spouse (or qualifying ex-spouse) has paid Medicare taxes for at least 10 years.

- or

- They are under 65, disabled, and have been receiving either Social Security SSDI benefits or Railroad Retirement Board disability benefits; they must receive one of these benefits for at least 24 months from date of entitlement (eligibility for first disability payment) before becoming eligible to enroll in Medicare.

- or

- They get continuing dialysis for end stage renal disease or need a kidney transplant.

Those who are 65 and older who choose to enroll in Part A Medicare

must pay a monthly premium to remain enrolled in Medicare Part A if they

or their spouse have not paid the qualifying Medicare payroll taxes.

People with disabilities

who receive SSDI are eligible for Medicare while they continue to

receive SSDI payments; they lose eligibility for Medicare based on

disability if they stop receiving SSDI. The coverage does not begin

until 24 month after the SSDI start date. The 24-month exclusion means

that people who become disabled must wait two years before receiving

government medical insurance, unless they have one of the listed

diseases. The 24-month period is measured from the date that an

individual is determined to be eligible for SSDI payments, not

necessarily when the first payment is actually received. Many new SSDI

recipients receive "back" disability pay, covering a period that usually

begins six months from the start of disability and ending with the

first monthly SSDI payment.

Some beneficiaries are dual-eligible. This means they qualify for both Medicare and Medicaid.

In some states for those making below a certain income, Medicaid will

pay the beneficiaries' Part B premium for them (most beneficiaries have

worked long enough and have no Part A premium), as well as some of their

out of pocket medical and hospital expenses.

Benefits and parts

Medicare cards

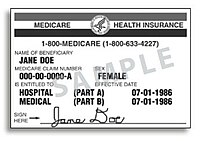

A sample of the Medicare card format used through 2018. The ID number is the subscriber's Social Security number, followed by a suffix indicating the holder's relationship to the subscriber (generally "A" for self). There are separate lines for basic Part A and Part B's supplementary medical coverage, each with its own start date.

A

sample of the new Medicare cards mailed out in 2018 and 2019 depending

on state of residence on a Social Security database. The new ID number

is randomly generated and not tied to any personally identifying

information.[23]

Beneficiaries on Medicare Part C health plans are issued with a

separate card and ID number, in addition to their Original Medicare

card.

Medicare has four parts: loosely speaking Part A is Hospital Insurance. Part B is Medical Services Insurance. Medicare Part D covers many prescription drugs,

though some are covered by Part B. In general, the distinction is based

on whether or not the drugs are self-administered but even this

distinction is not total. Public Part C Medicare health plans, the most

popular of which are branded Medicare Advantage, are another way for

Original Medicare (Part A and B) beneficiaries to receive their Part A, B

and D benefits; simply, Part C is capitated fee and Original Medicare

is fee for service. All Medicare benefits are subject to medical necessity.

The original program included Parts A and B. Part-C-like plans

have existed as demonstration projects in Medicare since the early

1970s, but the Part was formalized by 1997 legislation. Part D was

enacted by 2003 legislation and introduced January 1, 2006. Previously,

coverage for self-administered prescription drugs (if desired) was

obtained by private insurance or through a public Part C plan (or by one

of its predecessor demonstration plans before enactment).

In April 2018, CMS began mailing out new Medicare cards with new ID numbers to all beneficiaries. Previous cards had ID numbers containing beneficiaries' Social Security numbers; the new ID numbers are randomly generated and not tied to any other personally identifying information.

Part A: Hospital/hospice insurance

Part A covers inpatient hospital

stays where the beneficiary has been formally admitted to the hospital,

including semi-private room, food, and tests. As of January 1, 2020,

Medicare Part A had an inpatient hospital deductible of $1408,

coinsurance per day as $352 after 61 days confinement within one "spell

of illness", coinsurance for "lifetime reserve days" (essentially, days

91-150 of one or more stay of more than 60 days) of $704 per day. The

structure of coinsurance in a Skilled Nursing Facility (following a

medically necessary hospital confinement of 3 nights in row or more) is

different: zero for days 1-20; $167.50 per day for days 21-100. Many

medical services provided under Part A (e.g., some surgery in an acute

care hospital, some physical therapy in a skilled nursing facility) is

covered under Part B. These coverage amounts increase or decrease yearly

on 1st day of the year.

The maximum length of stay that Medicare Part A covers in a

hospital admitted inpatient stay or series of stays is typically 90

days. The first 60 days would be paid by Medicare in full, except one

copay (also and more commonly referred to as a "deductible") at the

beginning of the 60 days of $1340 as of 2018. Days 61–90 require a

co-payment of $335 per day as of 2018. The beneficiary is also allocated

"lifetime reserve days" that can be used after 90 days. These lifetime

reserve days require a copayment of $670 per day as of 2018, and the

beneficiary can only use a total of 60 of these days throughout their

lifetime.

A new pool of 90 hospital days, with new copays of $1340 in 2018 and

$335 per day for days 61–90, starts only after the beneficiary has 60

days continuously with no payment from Medicare for hospital or Skilled

Nursing Facility confinement.

Some "hospital services" are provided as inpatient services,

which would be reimbursed under Part A; or as outpatient services, which

would be reimbursed, not under Part A, but under Part B instead. The

"Two-Midnight Rule" decides which is which. In August 2013, the Centers for Medicare and Medicaid Services

announced a final rule concerning eligibility for hospital inpatient

services effective October 1, 2013. Under the new rule, if a physician

admits a Medicare beneficiary as an inpatient with an expectation that

the patient will require hospital care that "crosses two midnights",

Medicare Part A payment is "generally appropriate". However, if it is

anticipated that the patient will require hospital care for less than

two midnights, Medicare Part A payment is generally not appropriate;

payment such as is approved will be paid under Part B.

The time a patient spends in the hospital before an inpatient admission

is formally ordered is considered outpatient time. But, hospitals and

physicians can take into consideration the pre-inpatient admission time

when determining if a patient's care will reasonably be expected to

cross two midnights to be covered under Part A.

In addition to deciding which trust fund is used to pay for these

various outpatient vs. inpatient charges, the number of days for which a

person is formally considered an admitted patient affects eligibility

for Part A skilled nursing services.

Medicare penalizes hospitals for readmissions.

After making initial payments for hospital stays, Medicare will take

back from the hospital these payments, plus a penalty of 4 to 18 times

the initial payment, if an above-average number of patients from the

hospital are readmitted within 30 days. These readmission penalties

apply after some of the most common treatments: pneumonia, heart failure, heart attack, COPD, knee replacement, hip replacement.

A study of 18 states conducted by the Agency for Healthcare Research

and Quality (AHRQ) found that 1.8 million Medicare patients aged 65 and

older were readmitted within 30 days of an initial hospital stay in

2011; the conditions with the highest readmission rates were congestive

heart failure, sepsis, pneumonia, and COPD and bronchiectasis.

The highest penalties on hospitals are charged after knee or hip replacements, $265,000 per excess readmission. The goals are to encourage better post-hospital care and more referrals to hospice and end-of-life care in lieu of treatment, while the effect is also to reduce coverage in hospitals that treat poor and frail patients. The total penalties for above-average readmissions in 2013 are $280 million, for 7,000 excess readmissions, or $40,000 for each readmission above the US average rate.

Part A fully covers brief stays for rehabilitation or convalescence in a skilled nursing facility and up to 100 days per medical necessity with a co-pay if certain criteria are met:

- A preceding hospital stay must be at least three days as an inpatient, three midnights, not counting the discharge date.

- The skilled nursing facility stay must be for something diagnosed during the hospital stay or for the main cause of hospital stay.

- If the patient is not receiving rehabilitation but has some other ailment that requires skilled nursing supervision (e.g., wound management) then the nursing home stay would be covered.

- The care being rendered by the nursing home must be skilled. Medicare part A does not pay for stays that only provide custodial, non-skilled, or long-term care activities, including activities of daily living (ADL) such as personal hygiene, cooking, cleaning, etc.

- The care must be medically necessary and progress against some set plan must be made on some schedule determined by a doctor.

The first 20 days would be paid for in full by Medicare with the

remaining 80 days requiring a co-payment of $167.50 per day as of 2018.

Many insurance

group retiree, Medigap and Part C insurance plans have a provision for

additional coverage of skilled nursing care in the indemnity insurance

policies they sell or health plans they sponsor. If a beneficiary uses

some portion of their Part A benefit and then goes at least 60 days

without receiving facility-based skilled services, the 90-day hospital

clock and 100-day nursing home clock are reset and the person qualifies

for new benefit periods.

Hospice benefits

are also provided under Part A of Medicare for terminally ill persons

with less than six months to live, as determined by the patient's

physician. The terminally ill person must sign a statement that hospice

care has been chosen over other Medicare-covered benefits, (e.g. assisted living or hospital care).

Treatment provided includes pharmaceutical products for symptom control

and pain relief as well as other services not otherwise covered by

Medicare such as grief counseling.

Hospice is covered 100% with no co-pay or deductible by Medicare Part A

except that patients are responsible for a copay for outpatient drugs

and respite care, if needed.

Part B: Medical insurance

Part

B medical insurance helps pay for some services and products not

covered by Part A, generally on an outpatient basis (but also when on an

unadmitted observation status in a hospital). Part B is optional. It is

often deferred if the beneficiary or his/her spouse is still working and

has group health coverage through that employer. There is a lifetime

penalty (10% per year on the premium) imposed for not enrolling in Part B

when first eligible.

Part B coverage begins once a patient meets his or her deductible

($183 for 2017), then typically Medicare covers 80% of the RUC-set rate

for approved services, while the remaining 20% is the responsibility of

the patient, either directly or indirectly by private group retiree or Medigap insurance.

Part B coverage includes outpatient physician services, visiting nurse, and other services such as x-rays, laboratory and diagnostic tests, influenza and pneumonia vaccinations, blood transfusions, renal dialysis, outpatient hospital procedures, limited ambulance transportation, immunosuppressive drugs for organ transplant recipients, chemotherapy, hormonal treatments such as Lupron,

and other outpatient medical treatments administered in a doctor's

office. It also includes chiropractic care. Medication administration is

covered under Part B if it is administered by the physician during an

office visit.

Part B also helps with durable medical equipment (DME), including but not limited to canes, walkers, lift chairs, wheelchairs, and mobility scooters for those with mobility impairments. Prosthetic devices such as artificial limbs and breast prosthesis following mastectomy, as well as one pair of eyeglasses following cataract surgery, and oxygen for home use are also covered.

Complex rules control Part B benefits, and periodically issued

advisories describe coverage criteria. On the national level these

advisories are issued by CMS, and are known as National Coverage

Determinations (NCD). Local Coverage Determinations (LCD) apply within

the multi-state area managed by a specific regional Medicare Part B

contractor (which is an insurance company), and Local Medical Review

Policies (LMRP) were superseded by LCDs in 2003. Coverage information is

also located in the CMS Internet-Only Manuals (IOM), the Code of Federal Regulations (CFR), the Social Security Act, and the Federal Register.

The Monthly Premium for Part B for 2019 is $135.50 per month but

anyone on Social Security in 2019 is "held harmless" from that amount if

the increase in their SS monthly benefit does not cover the increase in

their Part B premium from 2019 to 2020. This hold harmless provision is

significant in years when SS does not increase but that is not the case

for 2020. There are additional income-weighted surtaxes for those with

incomes more than $85,000 per annum.

Part C: Medicare Advantage plans

With the passage of the Balanced Budget Act of 1997, Medicare beneficiaries were formally given the option to receive their Original Medicare benefits through capitated health insurance

Part C health plans, instead of through the Original fee for service

Medicare payment system. Many had previously had that option via a

series of demonstration projects that dated back to the early 1970s.

These Part C plans were initially known in 1997 as "Medicare+Choice". As

of the Medicare Modernization Act of 2003, most "Medicare+Choice" plans were re-branded as "Medicare Advantage"

(MA) plans (though MA is a government term and might not even be

"visible" to the Part C health plan beneficiary). Other plan types, such

as 1876 Cost plans, are also available in limited areas of the country.

Cost plans are not Medicare Advantage plans and are not capitated.

Instead, beneficiaries keep their Original Medicare benefits while their

sponsor administers their Part A and Part B benefits. The sponsor of a

Part C plan could be an integrated health delivery system or spin-out, a

union, a religious organization, an insurance company or other type of

organization.

Public Part C Medicare Advantage and other Part C health plans

are required to offer coverage that meets or exceeds the standards set

by Original Medicare but they do not have to cover every benefit in the

same way (the plan must be actuarially equivalent to Original Medicare

benefits). After approval by the Centers for Medicare and Medicaid

Services, if a Part C plan chooses to cover less than Original Medicare

for some benefits, such as Skilled Nursing Facility care, the savings

may be passed along to consumers by offering even lower co-payments for

doctor visits (or any other plus or minus aggregation approved by CMS).

Original "fee-for-service"

Medicare Parts A and B have a standard benefit package that covers

medically necessary care as described in the sections above that members

can receive from nearly any hospital or doctor in the country (if that

doctor or hospital accepts Medicare). Original Medicare beneficiaries

who choose to enroll in a Part C Medicare Advantage or other Part C

health plan instead give up none of their rights as an Original Medicare

beneficiary, receive the same standard benefits—as a minimum—as

provided in Original Medicare, and get an annual out of pocket (OOP)

upper spending limit not included in Original Medicare. However they

must typically use only a select network of providers except in

emergencies or for urgent care while travelling, typically restricted to

the area surrounding their legal residence (which can vary from tens to

over 100 miles depending on county). Most Part C plans are traditional health maintenance organizations (HMOs) that require the patient to have a primary care physician, though others are preferred provider organizations

(which typically means the provider restrictions are not as confining

as with an HMO). Others are hybrids of HMO and PPO called HMO-POS (for

point of service) and a few public Part C health plans are actually fee

for service hybrids.

Public Part C Medicare Advantage health plan members typically

also pay a monthly premium in addition to the Medicare Part B premium to

cover items not covered by traditional Medicare (Parts A & B), such

as the OOP limit, self-administered prescription drugs, dental care,

vision care, annual physicals, coverage outside the United States, and

even gym or health club memberships as well as—and probably most

importantly—reduce the 20% co-pays and high deductibles associated with

Original Medicare.

But in some situations the benefits are more limited (but they can

never be more limited than Original Medicare and must always include an

OOP limit) and there is no premium. The OOP limit can be as low as $1500

and as high as but no higher than $6700. In some cases, the sponsor

even rebates part or all of the Part B premium, though these types of

Part C plans are becoming rare.

Before 2003 Part C plans tended to be suburban HMOs tied to major

nearby teaching hospitals that cost the government the same as or even

5% less on average than it cost to cover the medical needs of a

comparable beneficiary on Original Medicare. The 2003-law payment

framework/bidding/rebate formulas overcompensated some Part C plan

sponsors by 7 percent (2009) on average nationally compared to what

Original Medicare beneficiaries cost per person on average nationally

that year and as much as 5 percent (2016) less nationally in other years

(see any recent year's Medicare Trustees Report, Table II.B.1).

The 2003 payment formulas succeeded in increasing the percentage

of rural and inner city poor that could take advantage of the OOP limit

and lower co-pays and deductibles—as well as the coordinated medical

care—associated with Part C plans. In practice however, one set of

Medicare beneficiaries received more benefits than others. The MedPAC

Congressional advisory group found in one year the comparative

difference for "like beneficiaries" was as high as 14% and have tended

to average about 2% higher.

The word "like" in the previous sentence is key. MedPAC does not

include all beneficiaries in its comparisons and MedPAC will not define

what it means by "like" but it apparently includes people who are only

on Part A, which severely skews its percentage comparisons—see January

2017 MedPAC meeting presentations. The differences caused by the

2003-law payment formulas were almost completely eliminated by PPACA and

have been almost totally phased out according to the 2018 MedPAC annual

report, March 2018. One remaining special-payment-formula

program—designed primarily for unions wishing to sponsor a Part C

plan—is being phased out beginning in 2017. In 2013 and since, on

average a Part C beneficiary cost the Medicare Trust Funds 2%-5% less

than a beneficiary on traditional fee for service Medicare, completely

reversing the situation in 2006-2009 right after implementation of the

2003 law and restoring the capitated fee vs fee for service funding

balance to its original intended parity level.

The intention of both the 1997 and 2003 law was that the

differences between fee for service and capitated fee beneficiaries

would reach parity over time and that has mostly been achieved, given

that it can never literally be achieved without a major reform of

Medicare because the Part C capitated fee in one year is based on the

fee for service spending the previous year.

Enrollment in public Part C health plans, including Medicare

Advantage plans, grew from about 1% of total Medicare enrollment in 1997

when the law was passed (the 1% representing people on pre-law

demonstration programs) to about 37% in 2019. Of course the absolute

number of beneficiaries on Part C has increased even more dramatically

on a percentage basis because of the large increase of people on

Original Medicare since 1997. Almost all Medicare beneficiaries have

access to at least two public Medicare Part C plans; most have access to

three or more.

Part D: Prescription drug plans

Medicare Part D

went into effect on January 1, 2006. Anyone with Part A or B is

eligible for Part D, which covers mostly self-administered drugs. It was

made possible by the passage of the Medicare Modernization Act

of 2003. To receive this benefit, a person with Medicare must enroll in

a stand-alone Prescription Drug Plan (PDP) or public Part C health plan

with integrated prescription drug coverage (MA-PD). These plans are

approved and regulated by the Medicare program, but are actually

designed and administered by various sponsors including charities,

integrated health delivery systems, unions and health insurance

companies; almost all these sponsors in turn use pharmacy benefit

managers in the same way as they are used by sponsors of health

insurance for those not on Medicare. Unlike Original Medicare (Part A

and B), Part D coverage is not standardized (though it is highly

regulated by the Centers for Medicare and Medicaid Services). Plans

choose which drugs they wish to cover (but must cover at least two drugs

in 148 different categories and cover all or "substantially all" drugs

in the following protected classes of drugs: anti-cancer;

anti-psychotic; anti-convulsant, anti-depressants, immuno-suppressant,

and HIV and AIDS drugs). The plans can also specify with CMS approval at

what level (or tier) they wish to cover it, and are encouraged to use step therapy.

Some drugs are excluded from coverage altogether and Part D plans that

cover excluded drugs are not allowed to pass those costs on to Medicare,

and plans are required to repay CMS if they are found to have billed

Medicare in these cases.

Under the 2003 law that created Medicare Part D, the Social

Security Administration offers an Extra Help program to lower-income

seniors such that they have almost no drug costs; in addition

approximately 25 states offer additional assistance on top of Part D.

For beneficiaries who are dual-eligible (Medicare and Medicaid eligible)

Medicaid may pay for drugs not covered by Part D of Medicare. Most of

this aid to lower-income seniors was available to them through other

programs before Part D was implemented.

Coverage by beneficiary spending is broken up into four phases:

deductible, initial spend, gap (infamously called the "donut hole"), and

catastrophic. Under a CMS template, there is usually a $100 or so

deductible before benefits commence (maximum of $415 in 2019) followed

by the initial spend phase where the templated co-pay is 25%, followed

by gap phase (where originally the templated co-pay was 100% but that

will fall to 25% in 2020 for all drugs), followed by the catastrophic

phase with a templated co-pay of about 5%. The beneficiaries' OOP spend

amounts vary yearly but are approximately as of 2018 $1000 in the

initial spend phase and $3000 to reach the catastrophic phase. This is

just a template and about half of all Part D plans differ (for example,

no initial deductible, better coverage in the gap) with permission of

CMS, which it typically grants as long as the sponsor provides at least

the actuarial equivalent value.

Out-of-pocket costs

No

part of Medicare pays for all of a beneficiary's covered medical costs

and many costs and services are not covered at all. The program contains

premiums, deductibles and coinsurance, which the covered individual must pay out-of-pocket. A study published by the Kaiser Family Foundation in 2008 found the Fee-for-Service Medicare benefit package was less generous than either the typical large employer preferred provider organization plan or the Federal Employees Health Benefits Program Standard Option.

Some people may qualify to have other governmental programs (such as

Medicaid) pay premiums and some or all of the costs associated with

Medicare.

Premiums

Most

Medicare enrollees do not pay a monthly Part A premium, because they (or

a spouse) have had 40 or more 3-month quarters in which they paid Federal Insurance Contributions Act

taxes. The benefit is the same no matter how much or how little the

beneficiary paid as long as the minimum number of quarters is reached.

Medicare-eligible persons who do not have 40 or more quarters of

Medicare-covered employment may buy into Part A for an annual adjusted

monthly premium of:

- $248.00 per month (as of 2012) for those with 30–39 quarters of Medicare-covered employment, or

- $451.00 per month (as of 2012) for those with fewer than 30 quarters of Medicare-covered employment and who are not otherwise eligible for premium-free Part A coverage.

Most Medicare Part B enrollees pay an insurance premium for this coverage; the standard Part B premium for 2019 is $135.50 a month. A new income-based premium surtax schema

has been in effect since 2007, wherein Part B premiums are higher for

beneficiaries with incomes exceeding $85,000 for individuals or $170,000

for married couples. Depending on the extent to which beneficiary

earnings exceed the base income, these higher Part B premiums are from

30% to 70% higher with the highest premium paid by individuals earning

more than $214,000, or married couples earning more than $428,000.

Medicare Part B premiums are commonly deducted automatically from

beneficiaries' monthly Social Security deposits. They can also be paid

quarterly via bill sent directly to beneficiaries or via deduction from a

bank account. These alternatives are becoming more common because

whereas the eligibility age for Medicare has remained at 65 per the 1965

legislation, the so-called Full Retirement Age for Social Security has

been increased to over 66 and will go even higher over time. Therefore,

many people delay collecting Social Security but join Medicare at 65 and

have to pay their Part B premium directly.

If you have higher income, you will pay an additional premium

amount for Medicare Part B and Medicare prescription drug coverage. The

additional amount is called the income-related monthly adjustment

amount. (IRMAA)

• Part B - For most beneficiaries, the government pays a

substantial portion — about 75 percent — of the Part B premium, and the

beneficiary pays the remaining 25 percent. If you are a higher-income

beneficiary, you will pay a larger percentage of the total cost of Part B

based on the income you report to the Internal Revenue Service (IRS).

You will pay monthly Part B premiums equal to 35, 50, 65, 80, or 85

percent of the total cost, depending on what you report to the IRS (for

2020, that would be on your 2018 tax return).

• Part D - If you are a higher-income beneficiary with Medicare

prescription drug coverage, you will pay monthly premiums plus an

additional amount, which is based on what you report to the IRS (for

2020, that would be on your 2018 tax return).

If you filed as: With Modified Adjusted Gross Income of : Part B IRMAA Part D IRMAA

Single, Head $87,000.01 - $109,000.00 $ 57.80 $12.20

of Household, $109,000.01 - $136,000.00 $144.60 $31.50

or Qualifying $136,000.01 - $163,000.00 $231.40 $50.70

Widow(er) $163,000.01 - $499,999.99 $318.10 $70.00

More than $499,999.99 $347.00 $76.40

Married, filing $174,000.01 - $218,000.00 $57.80 $12.20

Jointly $218,000.01 - $272,000.00 $144.60 $31.50

$272,000.01 - $326,000.00 $231.40 $50.70

$326,000.01 - $749,999.99 $318.10 $70.00

More than $749,999.99 $347.00 $76.40

Married, filing $87,000.01 - $412,999.99 $318.10 $70.00

Separately More than $412,999.99 $347.00 $76.40

Part C plans may or may not charge premiums (almost all do),

depending on the plans' designs as approved by the Centers for Medicare

and Medicaid Services. Part D premiums vary widely based on the benefit

level.

Deductible and coinsurance

Part A—For each benefit period, a beneficiary pays an annually adjusted:

- A Part A deductible of $1,288 in 2016 and $1,316 in 2017 for a hospital stay of 1–60 days.

- A $322 per day co-pay in 2016 and $329 co-pay in 2017 for days 61–90 of a hospital stay.

- A $644 per day co-pay in 2016 and $658 co-pay in 2017 for days 91–150 of a hospital stay, as part of their limited Lifetime Reserve Days.

- All costs for each day beyond 150 days

- Coinsurance for a Skilled Nursing Facility is $161 per day in 2016 and $164.50 in 2017 for days 21 through 100 for each benefit period (no co-pay for the first 20 days).

- A blood deductible of the first 3 pints of blood needed in a calendar year, unless replaced. There is a 3-pint blood deductible for both Part A and Part B, and these separate deductibles do not overlap.

Part B—After beneficiaries meet the yearly deductible of $183.00

for 2017, they will be required to pay a co-insurance of 20% of the

Medicare-approved amount for all services covered by Part B with the

exception of most lab services, which are covered at 100%. Previously,

outpatient mental health services was covered at 50%, but under the Medicare Improvements for Patients and Providers Act of 2008, it gradually decreased over several years and now matches the 20% required for other services. They are also required to pay an excess charge of 15% for services rendered by physicians who do not accept assignment.

The deductibles, co-pays, and coinsurance charges for Part C and D

plans vary from plan to plan. All Part C plans include an annual out of

pocket (OOP) upper spend limit. Original Medicare does not include an

OOP limit.

Medicare supplement (Medigap) policies

Of the Medicare beneficiaries who are not dual eligible for both

Medicare (around 10% are fully dual eligible) and Medicaid or that do

not receive group retirement insurance via a former employer (about 30%)

or do not choose a public Part C Medicare health plan (about 35%) or

who are not otherwise insured (about 5%—e.g., still working and

receiving employer insurance, on VA, etc.), almost all the remaining

elect to purchase a type of private supplemental indemnity insurance

policy called a Medigap plan (about 20%), to help fill in the financial

holes in Original Medicare (Part A and B) in addition to public Part D.

Note that the percentages add up to over 100% because many beneficiaries

have more than one type of additional protection on top of Original

Medicare.

These Medigap insurance policies are standardized by CMS, but are

sold and administered by private companies. Some Medigap policies sold

before 2006 may include coverage for prescription drugs. Medigap

policies sold after the introduction of Medicare Part D on January 1,

2006 are prohibited from covering drugs. Medicare regulations prohibit a

Medicare beneficiary from being sold both a public Part C Medicare

health plan and a private Medigap Policy. As with public Part C health

plans, private Medigap policies are only available to beneficiaries who

are already signed up for Original Medicare Part A and Part B. These

policies are regulated by state insurance departments rather than the

federal government although CMS outlines what the various Medigap plans

must cover at a minimum. Therefore, the types and prices of Medigap

policies vary widely from state to state and the degree of underwriting,

discounts for new members, and open enrollment and guaranteed issue

rules also varies widely from state to state.

As of 2016, 11 policies are currently sold—though few are

available in all states, and some are not available at all in

Massachusetts, Minnesota and Wisconsin (although these states have

analogs to the lettered Medigap plans). These plans are standardized

with a base and a series of riders. These are Plan A, Plan B, Plan C,

Plan D, Plan F, High Deductible Plan F, Plan G, Plan K, Plan L, Plan M,

and Plan N. Cost is usually the only difference between Medigap policies

with the same letter sold by different insurance companies in the same

state. Unlike public Part C Medicare health Plans, Medigap plans have no

networks, and any provider who accepts Original Medicare must also

accept Medigap.

All insurance companies that sell Medigap policies are required

to make Plan A available, and if they offer any other policies, they

must also make either Plan C or Plan F available as well, though Plan F

is scheduled to sunset in the year 2020. Anyone who currently has a Plan F may keep it.

Many of the insurance companies that offer Medigap insurance policies

also sponsor Part C health plans but most Part C health plans are

sponsored by integrated health delivery systems and their spin-offs,

charities, and unions as opposed to insurance companies. The leading

sponsor of both public Part C health plans and private Medigap plans is AARP.

Payment for services

Medicare

contracts with regional insurance companies to process over one billion

fee-for-service claims per year. In 2008, Medicare accounted for 13%

($386 billion) of the federal budget.

In 2016 it is projected to account for close to 15% ($683 billion) of

the total expenditures. For the decade 2010–2019 Medicare is projected

to cost 6.4 trillion dollars.

Reimbursement for Part A services

For institutional care, such as hospital and nursing home care, Medicare uses prospective payment systems.

In a prospective payment system, the health care institution receives a

set amount of money for each episode of care provided to a patient,

regardless of the actual amount of care. The actual allotment of funds

is based on a list of diagnosis-related groups

(DRG). The actual amount depends on the primary diagnosis that is

actually made at the hospital. There are some issues surrounding

Medicare's use of DRGs because if the patient uses less care, the

hospital gets to keep the remainder. This, in theory, should balance the

costs for the hospital. However, if the patient uses more care, then

the hospital has to cover its own losses. This results in the issue of

"upcoding", when a physician makes a more severe diagnosis to hedge

against accidental costs.

Reimbursement for Part B services

Payment

for physician services under Medicare has evolved since the program was

created in 1965. Initially, Medicare compensated physicians based on

the physician's charges, and allowed physicians to bill Medicare

beneficiaries the amount in excess of Medicare's reimbursement. In 1975,

annual increases in physician fees were limited by the Medicare

Economic Index (MEI). The MEI was designed to measure changes in costs

of physician's time and operating expenses, adjusted for changes in

physician productivity. From 1984 to 1991, the yearly change in fees was

determined by legislation. This was done because physician fees were

rising faster than projected.

The Omnibus Budget Reconciliation Act of 1989 made several

changes to physician payments under Medicare. Firstly, it introduced the

Medicare Fee Schedule, which took effect in 1992. Secondly, it limited

the amount Medicare non-providers could balance bill Medicare

beneficiaries. Thirdly, it introduced the Medicare Volume Performance

Standards (MVPS) as a way to control costs.

On January 1, 1992, Medicare introduced the Medicare Fee Schedule

(MFS), a list of about 7,000 services that can be billed for. Each

service is priced within the Resource-Based Relative Value Scale (RBRVS) with three Relative Value Units

(RVUs) values largely determining the price. The three RVUs for a

procedure are each geographically weighted and the weighted RVU value is

multiplied by a global Conversion Factor (CF), yielding a price in

dollars. The RVUs themselves are largely decided by a private group of

29 (mostly specialist) physicians—the American Medical Association's Specialty Society Relative Value Scale Update Committee (RUC).

From 1992 to 1997, adjustments to physician payments were

adjusted using the MEI and the MVPS, which essentially tried to

compensate for the increasing volume of services provided by physicians

by decreasing their reimbursement per service.

In 1998, Congress replaced the VPS with the Sustainable Growth Rate

(SGR). This was done because of highly variable payment rates under the

MVPS. The SGR attempts to control spending by setting yearly and

cumulative spending targets. If actual spending for a given year exceeds

the spending target for that year, reimbursement rates are adjusted

downward by decreasing the Conversion Factor (CF) for RBRVS RVUs.

In 2002, payment rates were cut by 4.8%. In 2003, payment rates

were scheduled to be reduced by 4.4%. However, Congress boosted the

cumulative SGR target in the Consolidated Appropriation Resolution of

2003 (P.L. 108-7), allowing payments for physician services to rise

1.6%. In 2004 and 2005, payment rates were again scheduled to be

reduced. The Medicare Modernization Act (P.L. 108-173) increased

payments 1.5% for those two years.

In 2006, the SGR mechanism was scheduled to decrease physician

payments by 4.4%. (This number results from a 7% decrease in physician

payments times a 2.8% inflation adjustment increase.) Congress overrode

this decrease in the Deficit Reduction Act (P.L. 109-362), and held

physician payments in 2006 at their 2005 levels. Similarly, another

congressional act held 2007 payments at their 2006 levels, and HR 6331

held 2008 physician payments to their 2007 levels, and provided for a

1.1% increase in physician payments in 2009. Without further continuing

congressional intervention, the SGR is expected to decrease physician

payments from 25% to 35% over the next several years.

MFS has been criticized for not paying doctors enough because of

the low conversion factor. By adjustments to the MFS conversion factor,

it is possible to make global adjustments in payments to all doctors.

The SGR was the subject of possible reform legislation again in 2014. On March 14, 2014, the United States House of Representatives passed the SGR Repeal and Medicare Provider Payment Modernization Act of 2014 (H.R. 4015; 113th Congress), a bill that would have replaced the (SGR) formula with new systems for establishing those payment rates. However, the bill would pay for these changes by delaying the Affordable Care Act's individual mandate requirement, a proposal that was very unpopular with Democrats.

The SGR was expected to cause Medicare reimbursement cuts of 24 percent

on April 1, 2014, if a solution to reform or delay the SGR was not

found. This led to another bill, the Protecting Access to Medicare Act of 2014 (H.R. 4302; 113th Congress), which would delay those cuts until March 2015. This bill was also controversial. The American Medical Association and other medical groups opposed it, asking Congress to provide a permanent solution instead of just another delay.

The SGR process was replaced by new rules as of the passage of MACRA in 2015.

Provider participation

There

are two ways for providers to be reimbursed in Medicare.

"Participating" providers accept "assignment", which means that they

accept Medicare's approved rate for their services as payment (typically

80% from Medicare and 20% from the beneficiary). Some non participating

doctors do not take assignment, but they also treat Medicare enrollees

and are authorized to balance bill no more than a small fixed amount

above Medicare's approved rate. A minority of doctors are "private

contractors" from a Medicare perspective, which means they opt out of

Medicare and refuse to accept Medicare payments altogether. These

doctors are required to inform patients that they will be liable for the

full cost of their services out-of-pocket, often in advance of

treatment.

While the majority of providers accept Medicare assignments, (97 percent for some specialties), and most physicians still accept at least some new Medicare patients, that number is in decline.

While 80% of physicians in the Texas Medical Association accepted new

Medicare patients in 2000, only 60% were doing so by 2012.

A study published in 2012 concluded that the Centers for Medicare and

Medicaid Services (CMS) relies on the recommendations of an American

Medical Association advisory panel. The study led by Dr. Miriam J.

Laugesen, of Columbia Mailman School of Public Health,

and colleagues at UCLA and the University of Illinois, shows that for

services provided between 1994 and 2010, CMS agreed with 87.4% of the

recommendations of the committee, known as RUC or the Relative Value

Update Committee.

Office medication reimbursement

Chemotherapy and other medications dispensed in a physician's office are reimbursed according to the Average Sales Price,

a number computed by taking the total dollar sales of a drug as the

numerator and the number of units sold nationwide as the denominator.

The current reimbursement formula is known as "ASP+6" since it

reimburses physicians at 106% of the ASP of drugs. Pharmaceutical

company discounts and rebates are included in the calculation of ASP,

and tend to reduce it. In addition, Medicare pays 80% of ASP+6, which is

the equivalent of 84.8% of the actual average cost of the drug. Some

patients have supplemental insurance or can afford the co-pay. Large

numbers do not. This leaves the payment to physicians for most of the

drugs in an "underwater" state. ASP+6 superseded Average Wholesale Price

in 2005, after a 2003 front-page New York Times article drew attention to the inaccuracies of Average Wholesale Price calculations.

This procedure is scheduled to change dramatically in 2017 under a CMS proposal that will likely be finalized in October 2016.

Medicare 10 percent incentive payments

"Physicians

in geographic Health Professional Shortage Areas (HPSAs) and Physician

Scarcity Areas (PSAs) can receive incentive payments from Medicare.

Payments are made on a quarterly basis, rather than claim-by-claim, and

are handled by each area's Medicare carrier."

Enrollment

Generally, if an individual already receives Social Security

payments, at age 65 the individual becomes automatically enrolled in

Medicare Part A (Hospital Insurance) and Medicare Part B (Medical

Insurance). If the individual chooses not to enroll in Part B (typically

because the individual is still working and receiving employer

insurance), then the individual must proactively opt out of it when

receiving the automatic enrollment package. Delay in enrollment in Part B

carries no penalty if the individual has other insurance (e.g. the

employment situation noted above), but may be penalized under other

circumstances. An individual who does not receive Social Security

benefits upon turning 65 must proactively join Medicare if they want it.

Penalties may apply if the individual chooses not to enroll at age 65

and does not have other insurance.

Parts A & B

Part A Late Enrollment Penalty

If

an individual is not eligible for premium-free Part A, and they do not

buy a premium-based Part A when they are first eligible, the monthly

premium may go up 10%.

The individual must pay the higher premium for twice the number of

years that they could have had Part A, but did not sign up. For example,

if they were eligible for Part A for two years but did not sign up,

they must pay the higher premium for four years. Usually, individuals do

not have to pay a penalty if they meet certain conditions that allow

them to sign up for Part A during a Special Enrollment Period.

Part B Late Enrollment Penalty

If

an individual does not sign up for Part B when they are first eligible,

they may have to pay a late enrollment penalty for as long as they have

Medicare. Their monthly premium for Part B may go up 10% for each full

12-month period that they could have had Part B, but did not sign up for

it. Usually, they do not pay a late enrollment penalty if they meet

certain conditions that allow them to sign up for Part B during a

special enrollment period.

Comparison with private insurance

Medicare differs from private insurance available to working Americans in that it is a social insurance

program. Social insurance programs provide statutorily guaranteed

benefits to the entire population (under certain circumstances, such as

old age or unemployment). These benefits are financed in significant

part through universal taxes. In effect, Medicare is a mechanism by

which the state takes a portion of its citizens' resources to provide

health and financial security to its citizens in old age or in case of

disability, helping them cope with the enormous, unpredictable cost of

health care. In its universality, Medicare differs substantially from

private insurers, which must decide whom to cover and what benefits to

offer to manage their risk pools and ensure that their costs do not

exceed premiums.

Because the federal government is legally obligated to provide

Medicare benefits to older and some disabled Americans, it cannot cut

costs by restricting eligibility or benefits, except by going through a

difficult legislative process, or by revising its interpretation of medical necessity.

By statute, Medicare may only pay for items and services that are

"reasonable and necessary for the diagnosis or treatment of illness or

injury or to improve the functioning of a malformed body member", unless

there is another statutory authorization for payment.

Cutting costs by cutting benefits is difficult, but the program can

also achieve substantial economies of scale in terms of the prices it

pays for health care and administrative expenses—and, as a result,

private insurers' costs have grown almost 60% more than Medicare's since

1970. Medicare's cost growth is now the same as GDP growth and expected to stay well below private insurance's for the next decade.

Because Medicare offers statutorily determined benefits, its

coverage policies and payment rates are publicly known, and all

enrollees are entitled to the same coverage. In the private insurance

market, plans can be tailored to offer different benefits to different

customers, enabling individuals to reduce coverage costs while assuming

risks for care that is not covered. Insurers, however, have far fewer

disclosure requirements than Medicare, and studies show that customers

in the private sector can find it difficult to know what their policy

covers, and at what cost.

Moreover, since Medicare collects data about utilization and costs for

its enrollees—data that private insurers treat as trade secrets—it gives

researchers key information about health care system performance.

Medicare also has an important role driving changes in the entire

health care system. Because Medicare pays for a huge share of health

care in every region of the country, it has a great deal of power to set

delivery and payment policies. For example, Medicare promoted the

adaptation of prospective payments based on DRG's, which prevents

unscrupulous providers from setting their own exorbitant prices. Meanwhile, the Patient Protection and Affordable Care Act

has given Medicare the mandate to promote cost-containment throughout

the health care system, for example, by promoting the creation of

accountable care organizations or by replacing fee-for-service payments

with bundled payments.

Costs and funding challenges

Medicare and Medicaid Spending as % GDP (2013)

Medicare spending as a percent of GDP

Medicare expenses and revenue

Over the long-term, Medicare faces significant financial challenges

because of rising overall health care costs, increasing enrollment as

the population ages, and a decreasing ratio of workers to enrollees.

Total Medicare spending is projected to increase from $523 billion in

2010 to around $900 billion by 2020. From 2010 to 2030, Medicare

enrollment is projected to increase dramatically, from 47 million to 79

million, and the ratio of workers to enrollees is expected to decrease

from 3.7 to 2.4.

However, the ratio of workers to retirees has declined steadily for

decades, and social insurance systems have remained sustainable due to

rising worker productivity. There is some evidence that productivity gains will continue to offset demographic trends in the near future.

The Congressional Budget Office

(CBO) wrote in 2008 that "future growth in spending per beneficiary for

Medicare and Medicaid—the federal government's major health care

programs—will be the most important determinant of long-term trends in

federal spending. Changing those programs in ways that reduce the growth

of costs—which will be difficult, in part because of the complexity of

health policy choices—is ultimately the nation's central long-term

challenge in setting federal fiscal policy."

Overall health care costs were projected in 2011 to increase by

5.8 percent annually from 2010 to 2020, in part because of increased

utilization of medical services, higher prices for services, and new

technologies.

Health care costs are rising across the board, but the cost of

insurance has risen dramatically for families and employers as well as

the federal government. In fact, since 1970 the per-capita cost of

private coverage has grown roughly one percentage point faster each year

than the per-capita cost of Medicare. Since the late 1990s, Medicare

has performed especially well relative to private insurers.

Over the next decade, Medicare's per capita spending is projected to

grow at a rate of 2.5 percent each year, compared to private insurance's

4.8 percent.

Nonetheless, most experts and policymakers agree containing health care

costs is essential to the nation's fiscal outlook. Much of the debate

over the future of Medicare revolves around whether per capita costs

should be reduced by limiting payments to providers or by shifting more

costs to Medicare enrollees.

Indicators

Several

measures serve as indicators of the long-term financial status of

Medicare. These include total Medicare spending as a share of gross domestic product (GDP), the solvency of the Medicare HI trust fund, Medicare per-capita spending growth relative to inflation

and per-capita GDP growth; general fund revenue as a share of total

Medicare spending; and actuarial estimates of unfunded liability over

the 75-year timeframe and the infinite horizon (netting expected

premium/tax revenue against expected costs). The major issue in all

these indicators is comparing any future projections against current law

vs. what the actuaries expect to happen. For example, current law

specifies that Part A payments to hospitals and skilled nursing

facilities will be cut substantially after 2028 and that doctors will

get no raises after 2025. The actuaries expect that the law will change

to keep these events from happening.

Medicare cost and non-interest income by source as a percentage of GDP

This measure, which examines Medicare spending in the context of the

US economy as a whole, is projected to increase from 3.7 percent in 2017

to 6.2 percent by 2092

under current law and over 9 percent under what the actuaries really

expect will happen (called an "illustrative example" in recent-year

Trustees Reports).

The solvency of the Medicare HI trust fund

This

measure involves only Part A. The trust fund is considered insolvent

when available revenue plus any existing balances will not cover 100

percent of annual projected costs. According to the latest estimate by

the Medicare trustees (2018), the trust fund is expected to become

insolvent in 8 years (2026), at which time available revenue will cover

around 85 percent of annual projected costs for Part A services. Since Medicare began, this solvency projection has ranged from two to 28 years, with an average of 11.3 years.

This and other projections in Medicare Trustees reports are based on

what its actuaries call intermediate scenario but the reports also

include worst-case and best case scenarios that are quite different

(other scenarios presume Congress will change present law).

Medicare per-capita spending growth relative to inflation and per-capita GDP growth

Per capita spending relative to inflation per-capita GDP growth was to be an important factor used by the PPACA-specified Independent Payment Advisory Board

(IPAB), as a measure to determine whether it must recommend to Congress

proposals to reduce Medicare costs. However the IPAB never formed and

was formally repealed by the Balanced Budget Act of 2018.

This measure, established under the Medicare Modernization Act

(MMA), examines Medicare spending in the context of the federal budget.

Each year, MMA requires the Medicare trustees to make a determination

about whether general fund revenue is projected to exceed 45 percent of

total program spending within a seven-year period. If the Medicare

trustees make this determination in two consecutive years, a "funding

warning" is issued. In response, the president must submit cost-saving

legislation to Congress, which must consider this legislation on an

expedited basis. This threshold was reached and a warning issued every

year between 2006 and 2013 but it has not been reached since that time

and is not expected to be reached in the 2016–2022 "window". This is a

reflection of the reduced spending growth mandated by the ACA according

to the Trustees.

Unfunded obligation

Medicare's

unfunded obligation is the total amount of money that would have to be

set aside today such that the principal and interest would cover the gap

between projected revenues (mostly Part B premiums and Part A payroll

taxes to be paid over the timeframe under current law) and spending over

a given timeframe. By law the timeframe used is 75 years though the

Medicare actuaries also give an infinite-horizon estimate because life

expectancy consistently increases and other economic factors underlying

the estimates change.

As of January 1, 2016, Medicare's unfunded obligation over the 75

year timeframe is $3.8 trillion for the Part A Trust Fund and $28.6

trillion for Part B. Over an infinite timeframe the combined unfunded

liability for both programs combined is over $50 trillion, with the

difference primarily in the Part B estimate.

These estimates assume that CMS will pay full benefits as currently

specified over those periods though that would be contrary to current

United States law. In addition, as discussed throughout each annual

Trustees' report, "the Medicare projections shown could be substantially

understated as a result of other potentially unsustainable elements of

current law." For example, current law effectively provides no raises

for doctors after 2025; that is unlikely to happen. It is impossible for

actuaries to estimate unfunded liability other than assuming current

law is followed (except relative to benefits as noted), the Trustees

state "that actual long-range present values for (Part A) expenditures

and (Part B/D) expenditures and revenues could exceed the amounts

estimated by a substantial margin."

Public opinion

Popular

opinion surveys show that the public views Medicare's problems as

serious, but not as urgent as other concerns. In January 2006, the Pew Research Center

found 62 percent of the public said addressing Medicare's financial

problems should be a high priority for the government, but that still

put it behind other priorities. Surveys suggest that there's no public consensus behind any specific strategy to keep the program solvent.

Fraud and waste

The Government Accountability Office

lists Medicare as a "high-risk" government program in need of reform,

in part because of its vulnerability to fraud and partly because of its

long-term financial problems. Fewer than 5% of Medicare claims are audited.

Criticism

Robert

M. Ball, a former commissioner of Social Security under President

Kennedy in 1961 (and later under Johnson, and Nixon) defined the major

obstacle to financing health insurance for the elderly: the high cost of

care for the aged combined with the generally low incomes of retired

people. Because retired older people use much more medical care than

younger employed people, an insurance premium related to the risk for

older people needed to be high, but if the high premium had to be paid

after retirement, when incomes are low, it was an almost impossible

burden for the average person. The only feasible approach, he said, was

to finance health insurance in the same way as cash benefits for

retirement, by contributions paid while at work, when the payments are

least burdensome, with the protection furnished in retirement without

further payment.

In the early 1960s relatively few of the elderly had health insurance,

and what they had was usually inadequate. Insurers such as Blue Cross, which had originally applied the principle of community rating,

faced competition from other commercial insurers that did not community

rate, and so were forced to raise their rates for the elderly.

Medicare is not generally an unearned entitlement. Entitlement is

most commonly based on a record of contributions to the Medicare fund.

As such it is a form of social insurance

making it feasible for people to pay for insurance for sickness in old

age when they are young and able to work and be assured of getting back

benefits when they are older and no longer working. Some people will pay

in more than they receive back and others will receive more benefits

than they paid in. Unlike private insurance where some amount must be

paid to attain coverage, all eligible persons can receive coverage

regardless of how much or if they had ever paid in.

Politicized payment

Bruce Vladeck, director of the Health Care Financing Administration in the Clinton

administration, has argued that lobbyists have changed the Medicare

program "from one that provides a legal entitlement to beneficiaries to

one that provides a de facto political entitlement to providers."

Quality of beneficiary services

A 2001 study by the Government Accountability Office

evaluated the quality of responses given by Medicare contractor

customer service representatives to provider (physician) questions. The

evaluators assembled a list of questions, which they asked during a

random sampling of calls to Medicare contractors. The rate of complete,

accurate information provided by Medicare customer service

representatives was 15%. Since then, steps have been taken to improve the quality of customer service given by Medicare contractors, specifically the 1-800-MEDICARE contractor. As a result, 1-800-MEDICARE

customer service representatives (CSR) have seen an increase in

training, quality assurance monitoring has significantly increased, and a

customer satisfaction survey is offered to random callers.

Hospital accreditation

In most states the Joint Commission, a private, non-profit organization

for accrediting hospitals, decides whether or not a hospital is able to

participate in Medicare, as currently there are no competitor

organizations recognized by CMS.

Other organizations can also accredit hospitals for Medicare. These include the Community Health Accreditation Program, the Accreditation Commission for Health Care, the Compliance Team and the Healthcare Quality Association on Accreditation.

Accreditation is voluntary and an organization may choose to be evaluated by their State Survey Agency or by CMS directly.

Graduate medical education

Medicare funds the vast majority of residency

training in the US. This tax-based financing covers resident salaries

and benefits through payments called Direct Medical Education payments.

Medicare also uses taxes for Indirect Medical Education, a subsidy paid

to teaching hospitals in exchange for training resident physicians. For the 2008 fiscal year these payments were $2.7 and $5.7 billion respectively.

Overall funding levels have remained at the same level since 1996, so

that the same number or fewer residents have been trained under this

program.

Meanwhile, the US population continues to grow both older and larger,

which has led to greater demand for physicians, in part due to higher

rates of illness and disease among the elderly compared to younger