Chart showing the log of the velocity (green) of the U.S. M2, calculated by dividing nominal GDP by the M2 stock (M1 plus time deposits), 1959–2010. The employment-to-population ratio is displayed in blue, and periods of recession are represented with gray bars.

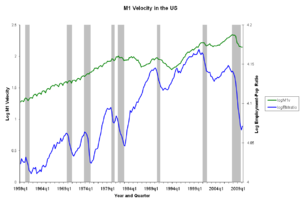

Similar chart showing the logged velocity (green) of a slightly narrower measure M1 of money consisting of currency and liquid deposits, 1959–2010.

Similar

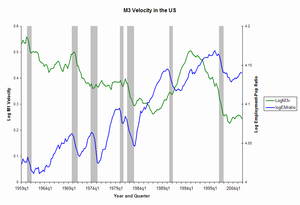

chart showing the logged velocity (green) of a broader measure of money

M3 that covers M2 plus large institutional deposits. The US no longer

publishes official M3 measures, so the chart only runs through 2005.

If the velocity of money is increasing, then transactions are occurring between individuals more frequently. The velocity of money changes over time and is influenced by a variety of factors.

Illustration

If, for example, in a very small economy, a farmer and a mechanic, with just $50 between them, buy new goods and services from each other in just three transactions over the course of a year- Farmer spends $50 on tractor repair from mechanic.

- Mechanic buys $40 of corn from farmer.

- Mechanic spends $10 on barn cats from farmer.

Relation to money demand

The velocity of money provides another perspective on money demand. Given the nominal flow of transactions using money, if the interest rate on alternative financial assets is high, people will not want to hold much money relative to the quantity of their transactions—they try to exchange it fast for goods or other financial assets, and money is said to "burn a hole in their pocket" and velocity is high. This situation is precisely one of money demand being low. Conversely, with a low opportunity cost velocity is low and money demand is high. In money market equilibrium, some economic variables (interest rates, income, or the price level) have adjusted to equate money demand and money supply.The quantitative relation between velocity and money demand is given by Velocity = Nominal Transactions (however defined) divided by Nominal Money Demand.

Indirect measurement

In practice, attempts to measure the velocity of money are usually indirect. The transactions velocity can be computed as- is the velocity of money for all transactions in a given time frame;

- is the price level;

- is the aggregate real value of transactions in a given time frame; and

- is the total nominal amount of money in circulation on average in the economy (see “Money supply” for details).

Values of and permit calculation of .

Similarly, the income velocity of money may be written as

- is the velocity for transactions counting towards national or domestic product; and

- is nominal national or domestic product.