In politics, regulatory capture (also client politics) is a corruption of authority that occurs when a political entity, policymaker, or regulatory agency is co-opted to serve the commercial, ideological, or political interests of a minor constituency, such as a particular geographic area, industry, profession, or ideological group.

When regulatory capture occurs, a special interest is prioritized over the general interests of the public, leading to a net loss for society. Government agencies suffering regulatory capture are called "captured agencies." The theory of client politics is related to that of rent-seeking and political failure; client politics "occurs when most or all of the benefits of a program go to some single, reasonably small interest (e.g., industry, profession, or locality) but most or all of the costs will be borne by a large number of people (for example, all taxpayers)."

Theory

For public choice theorists, regulatory capture occurs because groups or individuals with a high-stakes interest in the outcome of policy or regulatory decisions can be expected to focus their resources and energies in attempting to gain the policy outcomes they prefer, while members of the public, each with only a tiny individual stake in the outcome, will ignore it altogether. Regulatory capture refers to the actions by interest groups when this imbalance of focused resources devoted to a particular policy outcome is successful at "capturing" influence with the staff or commission members of the regulatory agency, so that the preferred policy outcomes of the special interest groups are implemented.

-- The Theory of Economic Regulation, George Stigler, 1971

Regulatory capture theory is a core focus of the branch of public choice referred to as the economics of regulation; economists in this specialty are critical of conceptualizations of governmental regulatory intervention as being motivated to protect public good. Often cited articles include Bernstein (1955), Huntington (1952), Laffont & Tirole (1991), and Levine & Forrence (1990). The theory of regulatory capture is associated with Nobel laureate economist George Stigler, one of its major developers.

Likelihood of regulatory capture is a risk to which an agency is exposed by its very nature. This suggests that a regulatory agency should be protected from outside influence as much as possible. Alternatively, it may be better to not create a given agency at all lest the agency become victim, in which case it may serve its regulated subjects rather than those whom the agency was designed to protect. A captured regulatory agency is often worse than no regulation, because it wields the authority of government. However, increased transparency of the agency may mitigate the effects of capture. Recent evidence suggests that, even in mature democracies with high levels of transparency and media freedom, more extensive and complex regulatory environments are associated with higher levels of corruption (including regulatory capture).

Relationship with federalism

There is substantial academic literature suggesting that smaller government units are easier for small, concentrated industries to capture than large ones. For example, a group of states or provinces with a large timber industry might have their legislature and/or their delegation to the national legislature captured by lumber companies. These states or provinces then becomes the voice of the industry, even to the point of blocking national policies that would be preferred by the majority across the whole federation. Moore and Giovinazzo (2012) call this "distortion gap".

The opposite scenario is possible with very large industries, however. Very large and powerful industries (e.g. energy, banking, weapon system construction) can capture national governments, and then use that power to block policies at the federal, state or provincial level that the voters may want, although even local interests can thwart national priorities.

Economic rationale

The idea of regulatory capture has an economic basis: vested interests in an industry have the greatest financial stake in regulatory activity of any social agent and are thus more likely to be moved to influence the regulatory body than relatively dispersed individual consumers, each of whom has little particular incentive to try to influence regulators. When regulators form expert bodies to examine policy, these invariably feature current or former industry members, or at the very least, individuals with lives and contacts in the industry to be reviewed. Capture is also facilitated in situations where consumers or taxpayers have a poor understanding of underlying issues and businesses enjoy a knowledge advantage.

Some economists, such as Jon Hanson and his co-authors, argue that the phenomenon extends beyond just political agencies and organizations. Businesses have an incentive to control anything that has power over them, including institutions from the media, academia and popular culture, thus they will try to capture them as well. This phenomenon is called "deep capture".

Regulatory public interest is based on market failure and welfare economics. It holds that regulation is the response of the government to public needs. Its purpose is to make up for market failures, improve the efficiency of resource allocation, and maximize social welfare. Posner pointed out that the public interest theory contains the assumption that the market is fragile, and that if left unchecked, it will tend to be unfair and inefficient, and government regulation is a costless and effective way to meet the needs of social justice and efficiency. Mimik believes that government regulation is a public administration policy that focuses on private behavior. It is a rule drawn from the public interest. Irving and Brouhingan saw regulation as a way of obeying public needs and weakening the risk of market operations. It also expressed the view that regulation reflects the public interest.

Development

The review of the United States' history of regulation at the end of the 19th century, especially the regulation of railway tariffs by the Interstate Commerce Commission (ICC) in 1887, revealed that regulations and market failures are not co-relevant. At least until the 1960s, in terms of regulatory experience, regulation was developed in the direction of favoring producers, and regulation increased the profits of manufacturers within the industry. In potentially competitive industries such as the trucking industry and the taxi industry, regulations allow pricing to be higher than cost and prevent entrants. In the natural monopoly industries such as the electric power industry, there are facts that regulation has little effect on prices, so the industry can earn profits above normal profits. Empirical evidence proves that regulation is beneficial to producers.

These empirical observations have led to the emergence and development of regulatory capture theory. Contrary to regulatory public interest theory, regulation capture theory holds that the provision of regulation is adapting to the industry's need for regulation, that is, the legislator is controlled and captured by the industry in regulation, and the regulation institution is gradually controlled by the industry. That is, the regulator is captured by the industry. The basic view of the regulatory capture theory is that no matter how the regulatory scheme is designed, the regulation of an industry by a regulatory agency is actually "captured" by the industry. The implication is that regulation increases the profits of the industry rather than social welfare.

The above-mentioned regulatory capture theory is essentially a purely capture theory in the early days, that is, the regulators and legislators were captured and controlled by the industry. The later regulatory models, such as those by Stigler, Pelzmann, or Becker, belong to the regulatory capture theory in the eyes of Posner (1974) and others. Because these models all reflect that regulators and legislators are not pursuing the maximization of public interests, but the maximization of private interests, that is, using "private interest" theory to explain the origin and purpose of regulation. Aton (1986) argues that Stigler's theoretical logic is clear and more central than the previous "capture theory" hypothesis, but it is difficult to distinguish between the two.

Regulatory capture theory has a specific meaning, that is, an experience statement that regulations are beneficial for producers in real life. In fact, it is essentially not a true regulatory theory. Although the analysis results are similar to the Stigler model provide interpretation and support for the regulatory capture theory is beneficial for producers, however the analysis methods of the latter are completely different. Stigler used standard economic analysis methods to analyze the regulation behavior, then created a new regulatory theory—regulatory economic theory. Of course, different divisions depend on the criteria for division, and they essentially depend on the researchers' different understanding of specific concepts.

Justice Douglas’ dissent in Sierra Club v. Morton (1972) describes concern that regulatory agencies become too favorable with their regulated industries.

Types

There are two basic types of regulatory capture:

- Materialist capture, also called financial capture, in which the captured regulator's motive is based on its material self-interest. This can result from bribery, revolving doors, political donations, or the regulator's desire to maintain its government funding. These forms of capture often amount to political corruption.

- Non-materialist capture, also called cognitive capture or cultural capture, in which the regulator begins to think like the regulated industry. This can result from interest-groups lobbying by the industry. Highly specialized technical industries can be at risk of cultural capture, because the regulating agency typically needs to employ experts in the regulated area, and the pool of such experts typically consists largely of existing or former employees from the regulated industry.

Another distinction can be made between capture retained by big firms and by small firms. While Stigler mainly referred, in his work, to large firms capturing regulators by bartering their vast resources (materialist capture) – small firms are more prone to retain non-materialist capture via a special underdog rhetoric.

Examples

European examples

Personal protective equipment for motorcyclists

The European Union introduced much lower standards for the personal protective equipment of motorcyclists in 2018. The new standard for motorcycle clothing was called EN 17092, and a similarly lower standard for motorcycle gloves was also introduced. Lower standards were brought in under pressure from some manufacturers, who claimed it was too expensive to create garments to the original higher standards. The new standards for clothing are - in increasing order of protection - A, AA, and AAA. The A standard sets the protection bar very low. The original standard for motorcycle gloves was replaced by Level 1 and Level 2, with Level 1 gloves offering only the most basic protection. Level 2 gloves offer significantly better protection, but most manufacturers do not make Level 2 gloves because it is not a legal requirement. The original CE mark was based on a standard devised at the University of Cambridge. Thus, it is sometimes referred to as the "Cambridge Standard" for motorcycle clothing. Paul Varnsverry, one of the world's leading experts in protective clothing for motorcyclists, publicly stated that sufficiently abrasion-resistant materials are barely more expensive than the less protective materials in current use, and the cost difference is negligible compared to advertising budgets.

Under the new EU legislation, the lowest standard is an A-rating. Chris Hurren from Australia's Deakin University tested garments with CE Class A certification. He found that regular denim jeans can pass the impact abrasion test for an A-rating. Thus, casual clothing could be certified as motorcycle protective equipment under the new EN 17092 standard.

United States examples

Bureau of Ocean Energy Management, Regulation and Enforcement

In the aftermath of the 2010 Deepwater Horizon oil spill, the Minerals Management Service (MMS), which had regulatory responsibility for offshore oil drilling, was widely cited as an example of regulatory capture. The MMS then became the Bureau of Ocean Energy Management, Regulation and Enforcement (BOEMRE) and on October 1, 2010, the collection of mineral leases was split off from the agency and placed under the Department of the Interior as the Office of Natural Resources Revenue (ONRR). On October 1, 2011, BOEMRE was then split into two bureaus, the Bureau of Safety and Environmental Enforcement (BSEE) and the Bureau of Ocean Energy Management (BOEM).

The three-stage reorganization, including the name change to BOEMRE, was part of a re-organization by Ken Salazar, who was sworn into office as the new Secretary of the Interior on the same day the name change was announced. Salazar's appointment was controversial because of his ties to the energy industry. As a senator, Salazar voted against an amendment to repeal tax breaks for ExxonMobil and other major petroleum companies and in 2006, he voted to end protections that limit offshore oil drilling in Florida's Gulf Coast. One of Salazar's immediate tasks was to "[end] the department's coziness with the industries it regulates" but Daniel R. Patterson, a member of the Arizona House of Representatives, said "Salazar has a disturbingly weak conservation record, particularly on energy development, global warming, endangered wildlife and protecting scientific integrity. It's no surprise oil and gas, mining, agribusiness and other polluting industries that have dominated Interior are supporting rancher Salazar – he's their friend." Indeed, a spokesman for the National Mining Association, which lobbies for the mining industry, praised Salazar, saying that he was not doctrinaire about the use of public lands.

MMS had allowed BP and dozens of other companies to drill in the Gulf of Mexico without first attaining permits to assess threats to endangered species, as required by law. BP and other companies were also given a blanket exemption (categorical exclusion) from having to provide environmental impact statements. The National Oceanic and Atmospheric Administration (NOAA) issued strong warnings about the risks posed by such drilling and in a 2009 letter, accused MMS of understating the likelihood and potential consequences of a major spill in the Gulf of Mexico. The letter further accused MMS of highlighting the safety of offshore drilling while understating the risks and impact of spills and playing down the fact that spills had been increasing. Both current and former MMS staff scientists said their reports were overruled and altered if they found high risk of accident or environmental impact. Kieran Suckling, director of the Center for Biological Diversity, said, "MMS has given up any pretense of regulating the offshore oil industry. The agency seems to think its mission is to help the oil industry evade environmental laws."

After the Deepwater accident occurred, Salazar said he would delay granting any further drilling permits. Three weeks later, at least five more permits had been issued by the minerals agency. In March 2011, BOEMRE began issuing more offshore drilling permits in the Gulf of Mexico. Michael Bromwich, head of BOEMRE, said he was disturbed by the speed at which some oil and gas companies were shrugging off Deepwater Horizon as "a complete aberration, a perfect storm, one in a million," but would nonetheless soon be granting more permits to drill for oil and gas in the gulf.

Commodity Futures Trading Commission

In October 2010, George H. Painter, one of the two Commodity Futures Trading Commission (CFTC) administrative law judges, retired, and in the process requested that his cases not be assigned to the other judge, Bruce C. Levine. Painter wrote, "On Judge Levine's first week on the job, nearly twenty years ago, he came into my office and stated that he had promised Wendy Gramm, then Chairwoman of the Commission, that we would never rule in a complainant's favor," Painter wrote. "A review of his rulings will confirm that he fulfilled his vow." In further explaining his request, he wrote, "Judge Levine, in the cynical guise of enforcing the rules, forces pro se complainants to run a hostile procedural gauntlet until they lose hope, and either withdraw their complaint or settle for a pittance, regardless of the merits of the case." Gramm, wife of former Senator Phil Gramm, was accused of helping Goldman Sachs, Enron and other large firms gain influence over the commodity markets. After leaving the CFTC, Wendy Gramm joined the board of Enron.

Environmental Protection Agency

Natural gas drilling increased in the United States after the Environmental Protection Agency (EPA) said in 2004 that hydraulic fracturing "posed little or no threat" to drinking water. Also known as "fracking", the process was invented by Halliburton in the 1940s. In 2011, whistleblower Weston Wilson said that the EPA's conclusions were "unsupportable" and that five of the seven-member review panel that made the decision had conflicts of interest. A New York Times editorial said the 2004 study "whitewashed the industry and was dismissed by experts as superficial and politically motivated." The EPA is currently prohibited by law from regulating fracking, the result of the "Halliburton loophole", a clause added to the 2005 energy bill at the request of vice president Dick Cheney, who was CEO of Halliburton before becoming vice president. Legislation to close the loophole and restore the EPA's authority to regulate hydraulic fracturing was introduced in 2009, but did not pass in the 111th Congress.

Federal Aviation Administration

Since the Federal Aviation Administration (FAA) charter was amended in 1996, its sole focus has been the regulation of safety. A report by the Department of Transportation found that FAA managers had allowed Southwest Airlines to fly 46 airplanes in 2006 and 2007 that were overdue for safety inspections, ignoring concerns raised by inspectors. Audits of other airlines resulted in two airlines grounding hundreds of planes, causing thousands of flight cancellations. The House Transportation and Infrastructure Committee investigated the matter after two FAA whistleblowers, inspectors Charalambe "Bobby" Boutris and Douglas E. Peters, contacted them. Boutris said he attempted to ground Southwest after finding cracks in the fuselage, but was prevented by supervisors he said were friendly with the airline. The committee subsequently held hearings in April 2008. James Oberstar, former chairman of the committee said its investigation uncovered a pattern of regulatory abuse and widespread regulatory lapses, allowing 117 aircraft to be operated commercially although not in compliance with FAA safety rules. Oberstar said there was a "culture of coziness" between senior FAA officials and the airlines and "a systematic breakdown" in the FAA's culture that resulted in "malfeasance, bordering on corruption."

On July 22, 2008, a bill was unanimously approved in the Democrat-controlled House to tighten regulations concerning airplane maintenance procedures, including the establishment of a whistleblower office and a two-year "cooling off" period that FAA inspectors or supervisors of inspectors must wait before they can work for those they regulated. The bill also required rotation of principal maintenance inspectors and stipulated that the word "customer" properly applies to the flying public, not those entities regulated by the FAA. The bill died in the United States Senate Committee on Commerce, Science, and Transportation that year. In 2008 the FAA proposed to fine Southwest $10.2 million for failing to inspect older planes for cracks, and in 2009 Southwest and the FAA agreed that Southwest would pay a $7.5 million penalty and would adapt new safety procedures, with the fine doubling if Southwest failed to follow through. In September 2009, FAA Administrator Randy Babbitt issued a directive mandating that the agency use the term "customers" only to refer to the flying public.

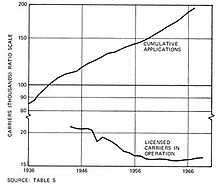

Prior to the deregulation of the US air industry, the Civil Aeronautics Board served to maintain an oligopoly of US airlines.

In a June 2010 article on regulatory capture, the FAA was cited as an example of "old-style" regulatory capture, "in which the airline industry openly dictates to its regulators its governing rules, arranging for not only beneficial regulation but placing key people to head these regulators."

That the FAA was a victim of regulatory capture was one focus of a United States Senate Commerce Subcommittee on Aviation and Space meeting held in the wake of the Ethiopian Airlines Flight 302 crash that followed a previous crash of a Lion Air flight and claimed 157 lives. The Boeing 737 MAX platform that crashed had been subjected to only an "amended" airworthiness type certificate. The NTSB was tasked with the investigation of the FAA's certification process.

Federal Communications Commission

Legal scholars have pointed to the possibility that federal agencies such as the Federal Communications Commission (FCC) had been captured by media conglomerates. Peter Schuck of Yale Law School has argued that the FCC is subject to capture by the media industries' leaders and therefore reinforce the operation of corporate cartels in a form of "corporate socialism" that serves to "regressively tax consumers, impoverish small firms, inhibit new entry, stifle innovation, and diminish consumer choice". The FCC selectively granted communications licenses to some radio and television stations in a process that excludes other citizens and little stations from having access to the public.

Michael K. Powell, who served on the FCC for eight years and was chairman for four, was appointed president and chief executive officer of the National Cable & Telecommunications Association, a lobby group, effective April 25, 2011. His role has been the cable industry’s leading advocate, spokesman, and representative in its relationship with the U.S. Congress, the Administration, the FCC, and other federal agencies.

Meredith Attwell Baker was one of the FCC commissioners who approved a controversial merger between NBC Universal and Comcast. Four months later, she announced her resignation from the FCC to join Comcast's Washington, D.C. lobbying office. Legally, she is prevented from lobbying anyone at the FCC for two years and an agreement made by Comcast with the FCC as a condition of approving the merger will ban her from lobbying any executive branch agency for life. Nonetheless, Craig Aaron, of Free Press, who opposed the merger, complained that "the complete capture of government by industry barely raises any eyebrows" and said public policy would continue to suffer from the "continuously revolving door at the FCC".

In July 2019, congresswomen Elizabeth Warren and Pramila Jayapal issued a letter (citing a report by the Project On Government Oversight) showing concerns for the composition of the FCC's Communications Security, Reliability and Interoperability Council (CSRIC), questioning whether it could effectively serve the public interest if the majority of its members were representatives of the private sector. They wrote that "having the FCC's policy-making process rely on input from individuals employed by, or affiliated with, the corporations that it is tasked with overseeing is the very definition of regulatory capture".

Federal Reserve Bank of New York

The Federal Reserve Bank of New York (New York Fed) is the most influential of the Federal Reserve Banking System. Part of the New York Fed's responsibilities is the regulation of Wall Street, but its president is selected by and reports to a board dominated by the chief executives of some of the banks it oversees. While the New York Fed has always had a closer relationship with Wall Street, during the years that Timothy Geithner was president, he became unusually close with the scions of Wall Street banks, a time when banks and hedge funds were pursuing investment strategies that caused the financial crisis of 2007–2008, which the Fed failed to stop.

During the crisis, several major banks that were on the verge of collapse were rescued via the Emergency Economic Stabilization Act of 2008. Geithner engineered the New York Fed's purchase of $30 billion of credit default swaps from American International Group (AIG), which it had sold to Goldman Sachs, Merrill Lynch, Deutsche Bank and Société Générale. By purchasing these contracts, the banks received a "back-door bailout" of 100 cents on the dollar for the contracts. Had the New York Fed allowed AIG to fail, the contracts would have been worth much less, resulting in much lower costs for any taxpayer-funded bailout. Geithner defended his use of unprecedented amounts of taxpayer funds to save the banks from their own mistakes, saying the financial system would have been threatened. At the January 2010 congressional hearing into the AIG bailout, the New York Fed initially refused to identify the counterparties that benefited from AIG's bailout, claiming the information would harm AIG. When it became apparent this information would become public, a legal staffer at the New York Fed e-mailed colleagues to warn them, lamenting the difficulty of continuing to keep Congress in the dark. Jim Rickards calls the bailout a crime and says "the regulatory system has become captive to the banks and the non-banks".

Interstate Commerce Commission

Historians, political scientists, and economists have often used the Interstate Commerce Commission (ICC), a now-defunct federal regulatory body in the United States, as a classic example of regulatory capture. The creation of the ICC was the result of widespread and longstanding anti-railroad agitation. Richard Olney, a prominent railroad lawyer, was asked by a railroad president if he could do something to get rid of the ICC. Olney, who later was appointed Attorney General in the Grover Cleveland administration, replied in an 1892 letter,

The Commission… is, or can be made, of great use to the railroads. It satisfies the popular clamor for a government supervision of the railroads, at the same time that supervision is almost entirely nominal. Further, the older such a commission gets to be, the more inclined it will be found to take the business and railroad view of things.… The part of wisdom is not to destroy the Commission, but to utilize it.

While the Interstate Commerce Act forbade "undue and unreasonable prejudice" against interstate passengers, in the sixty-six years before Sarah Keys v. Carolina Coach Company (1955) the ICC had ruled against every black petitioner bringing a racial segregation complaint, earning the nickname "The Supreme Court of the Confederacy". The ICC then failed to enforce Keys vs. Carolina Coach, attempting to justify segregation on a separate but equal basis for six years before being forced by the Department of Justice under then Attorney General Robert F. Kennedy to act in response to the Freedom Riders protests of 1961.

Nuclear Regulatory Commission

According to Frank N. von Hippel, despite the 1979 Three Mile Island accident in Pennsylvania, the Nuclear Regulatory Commission (NRC) has often been too timid in ensuring that America's 104 commercial reactors are operated safely:

Nuclear power is a textbook example of the problem of "regulatory capture"—in which an industry gains control of an agency meant to regulate it. Regulatory capture can be countered only by vigorous public scrutiny and Congressional oversight, but in the 32 years since Three Mile Island, interest in nuclear regulation has declined precipitously.

Then-candidate Barack Obama said in 2007 that the five-member NRC had become "captive of the industries that it regulates" and Joe Biden indicated he had absolutely no confidence in the agency.

The NRC has given a license to "every single reactor requesting one", according to Greenpeace USA nuclear policy analyst Jim Riccio to refer to the agency approval process as a "rubber stamp". In Vermont, ten days after the 2011 Tōhoku earthquake and tsunami that damaged Japan's Daiichi plant in Fukushima, the NRC approved a 20-year extension for the license of Vermont Yankee Nuclear Power Plant, although the Vermont state legislature had voted overwhelmingly to deny such an extension. The Vermont plant uses the same GE Mark 1 reactor design as the Fukushima Daiichi plant. The plant had been found to be leaking radioactive materials through a network of underground pipes, which Entergy, the company running the plant, had denied under oath even existed. Representative Tony Klein, who chaired the Vermont House Natural Resources and Energy Committee, said that when he asked the NRC about the pipes at a hearing in 2009, the NRC didn't know about their existence, much less that they were leaking. On March 17, 2011, the Union of Concerned Scientists (UCS) released a study critical of the NRC's 2010 performance as a regulator. The UCS said that through the years, it had found the NRC's enforcement of safety rules has not been "timely, consistent, or effective" and it cited 14 "near-misses" at U.S. plants in 2010 alone. Tyson Slocum, an energy expert at Public Citizen said the nuclear industry has "embedded itself in the political establishment" through "reliable friends from George Bush to Barack Obama", that the government "has really just become cheerleaders for the industry."

Although the exception, there have been instances of a revolving door. Jeffrey Merrifield, who was on the NRC from 1997 to 2008 and was appointed by presidents Clinton and Bush, left the NRC to take an executive position at The Shaw Group, which has a nuclear division regulated by the NRC. The NRC Office of Inspector General concluded that Merrifield violated federal ethics laws by failing to recuse himself from matters affecting prospective employers with which he was interviewing. Although the NRC referred the matter to the Justice Department for civil action and to the U.S. Attorney's office for criminal action, neither office pursued the matter. However, most former commissioners return to academia or public service in other agencies.

A year-long Associated Press (AP) investigation showed that the NRC, working with the industry, has relaxed regulations so that aging reactors can remain in operation. The AP found that wear and tear of plants, such as clogged lines, cracked parts, leaky seals, rust and other deterioration resulted in 26 alerts about emerging safety problems and may have been a factor in 113 of the 226 alerts issued by the NRC between 2005 and June 2011. The NRC repeatedly granted the industry permission to delay repairs and problems often grew worse before they were fixed.

However, a paper by Stanford University economics professors John B. Taylor and Frank A. Wolak compared the financial services and nuclear industries. While acknowledging both are susceptible in principle to regulatory capture, they concluded regulatory failure – including through regulatory capture – has been much more of a problem in the financial industry and even suggested the financial industry create an analog to the Institute of Nuclear Power Operations to reduce regulatory risk.

Office of the Comptroller of the Currency

The Office of the Comptroller of the Currency (OCC) has strongly opposed the efforts of the 50 state attorneys general, who have banded together to penalize banks and reform the mortgage modification process, following the subprime mortgage crisis and the financial crisis of 2008. This example was cited in The New York Times as evidence that the OCC is "a captive of the banks it is supposed to regulate".

Securities and Exchange Commission

The United States Securities and Exchange Commission (SEC) has also been accused of acting in the interests of Wall Street banks and hedge funds and of dragging its feet or refusing to investigate cases or bring charges for fraud and insider trading. Financial analyst Harry Markopolos, who spent ten years trying to get the SEC to investigate Bernie Madoff, called the agency "nonfunctional, captive to the industry."

Similarly in the case of the Allen Stanford Ponzi scheme, there were repeated warnings of fraud from both inside and outside the SEC for more than a decade. But the agency did not stop the fraud until 2009, after the Madoff scandal became public in 2008.

The SEC has been found by the U.S. Senate Committee on Finance, the Senate Judiciary Committee and a federal district court to have illegally dismissed an employee in September 2005 who was critical of superiors' refusal to pursue Wall Street titan John Mack. Mack was suspected of giving insider information to Arthur J. Samberg, head of Pequot Capital Management, once one of the world's largest hedge funds. After more than four years of legal battles, former SEC investigator Gary J. Aguirre filed papers in a Freedom of Information Act (FOIA) case he had against the SEC, seeking an order to force the SEC to turn over Pequot investigation records to him on the grounds that they had not charged anyone. Aguirre had already provided incriminating evidence of Pequot's insider trading involving Microsoft trades to the SEC in a letter on January 2, 2009. The morning after Aguirre's FOIA papers were filed, the SEC announced they had filed charges against Pequot and Pequot had agreed to disgorge $18 million in illegal gains and pay $10 million in penalties. A month later, the SEC settled Aguirre's wrongful termination lawsuit for $755,000.

The list of officials who have left the SEC for highly lucrative jobs in the private sector and who sometimes have returned to the SEC includes Arthur Levitt, Robert Khuzami, Linda Chatman Thomsen, Richard H. Walker, Gary Lynch and Paul R. Berger. The Project on Government Oversight (POGO) released a report on May 13, 2011, which found that between 2006 and 2010, 219 former SEC employees sought to represent clients before the SEC. Former employees filed 789 statements notifying the SEC of their intent to represent outside clients before the commission, some filing within days of leaving the SEC.

Reporter Matt Taibbi calls the SEC a classic case of regulatory capture. On August 17, 2011, Taibbi reported that in July 2001, a preliminary fraud investigation against Deutsche Bank was stymied by Richard H. Walker, then SEC enforcement director, who began working as general counsel for Deutsche Bank in October 2001. Darcy Flynn, an SEC lawyer, the whistleblower who exposed this case also revealed that for 20 years, the SEC had been routinely destroying all documents related to thousands of preliminary inquiries that were closed rather than proceeding to formal investigation. The SEC is legally required to keep files for 25 years and destruction is supposed to be done by the National Archives and Records Administration. The lack of files deprives investigators of possible background when investigating cases involving those firms. Documents were destroyed for inquiries into Bernard Madoff, Goldman Sachs, Lehman Brothers, Citigroup, Bank of America and other major Wall Street firms that played key roles in the 2008 financial crisis. The SEC has since changed its policy on destroying those documents and as of August 2011 the SEC investigator general was investigating the matter.

Federal Trade Commission

The decision known as In re Amway Corp., and popularly called "Amway '79", made the FTC a captive regulator of the nascent multi-Level marketing industry. The situation came to a head in December 2012, when hedge fund Pershing Square Capital management announced a $1-billion short position against the company, and evidently expected the FTC to act, which, to date, it has not. From a forensic accounting standpoint, there is no difference between a Ponzi-scheme like the Madoff scandal, and a pyramid scheme, except that in the latter the money is laundered through product sales, not investment. The press has widely reported on why the FTC won't act, e.g. Forbes though legal opinion has been very supportive in some quarters, such as William K. Black, who was instrumental in bringing thousands of criminal prosecutions in the S&L scandal, which was also rife with problems of regulatory capture.

District of Columbia Taxicab Commission

The District of Columbia Taxicab Commission has been criticized for being beholden to taxi companies and drivers rather than ensuring that the district has access to a "safe, comfortable, efficient and affordable taxicab experience in well-equipped vehicles".

Washington State Liquor Control Board and I-502

Some commentators have acknowledged that while Washington Initiative 502 "legalized" marijuana, it did so in a manner that led to a state-run monopoly on legal marijuana stores with prices far above that of the existing medical dispensaries, which the State is now trying to close down in favor of the recreational stores, where prices are two to five times higher than the product can be obtained elsewhere.

Canadian examples

Canadian Radio-television and Telecommunications Commission

In August 2009, the Canadian Radio-television and Telecommunications Commission (CRTC) provisionally granted a request by Bell Canada to impose usage-based billing on Internet wholesalers, igniting protest from both the wholesalers and consumers, who claimed that the CRTC was "kow-towing to Bell".

On February 2, 2011, CRTC chair Konrad von Finckenstein testified before the House of Commons Standing Committee on Industry, Science and Technology to defend the agency's decision. Critic Steve Anderson said, "The CRTC's stubbornness in the face of a mass public outcry demonstrates the strength of the Big Telecom lobby's influence. While government officials have recognized the need to protect citizens' communications interests, the CRTC has made it clear that their priorities lie elsewhere."

Japanese examples

In Japan, the line may be blurred between the goal of solving a problem and the different goal of making it look as if the problem is being addressed.

Nuclear and Industrial Safety Agency

Despite warnings about its safety, Japanese regulators from the Nuclear and Industrial Safety Agency (NISA) approved a 10-year extension for the oldest of the six reactors at Fukushima Daiichi just one month before a 9.0 magnitude earthquake and subsequent tsunami damaged reactors and caused a meltdown. The conclusion to the Diet of Japan's report on Fukushima attributed this directly to regulatory capture.

Nuclear opponent Eisaku Sato, governor of Fukushima Prefecture from 1988–2006, said a conflict of interest is responsible for NISA's lack of effectiveness as a watchdog. The agency is under the Ministry of Economy, Trade and Industry, which encourages the development of Japan's nuclear industry. Inadequate inspections are reviewed by expert panels drawn primarily from academia and rarely challenge the agency. Critics say the main weakness in Japan's nuclear industry is weak oversight. Seismologist Takashi Nakata said, "The regulators just rubber-stamp the utilities' reports."

Both the ministry and the agency have ties with nuclear plant operators, such as Tokyo Electric. Some former ministry officials have been offered lucrative jobs in a practice called amakudari, "descent from heaven". A panel responsible for re-writing Japan's nuclear safety rules was dominated by experts and advisers from utility companies, said seismology professor Katsuhiko Ishibashi who quit the panel in protest, saying it was rigged and "unscientific". The new guidelines, established in 2006, did not set stringent industry-wide earthquake standards, rather nuclear plant operators were left to do their own inspections to ensure their plants were compliant. In 2008, the NISA found all of Japan's reactors to be in compliance with the new earthquake guidelines.

Yoshihiro Kinugasa helped write Japan's nuclear safety rules, later conducted inspections and still in another position at another date, served on a licensing panel, signing off on inspections.

Ministry of Health, Labour and Welfare (MHLW)

In 1996, the Ministry of Health and Welfare (now combined with the Ministry of Labour) came under fire over the scandal of HIV-tainted blood being used to treat hemophiliacs.

Although warned about HIV contamination of blood products imported from the U.S., the ministry abruptly changed its position on heated and unheated blood products from the U.S., protecting the Green Cross and the Japanese pharmaceutical industry, keeping the Japanese market from being inundated with heat-treated blood from the United States. Because the unheated blood was not taken off the market, 400 people died and over 3,000 people were infected with HIV.

No senior officials were indicted and only one lower-level manager was indicted and convicted. Critics say the major task of the ministry is the protection of industry, rather than of the population. In addition, bureaucrats get amakudari jobs at related industries in their field upon retirement, a system which serves to inhibit regulators. Moriyo Kimura, a critic who works at MHLW, says the ministry does not look after the interests of the public.

Philippine examples

Tobacco control in the Philippines is largely vested in the Inter-Agency Committee on Tobacco (IACT) under Republic Act No. 9211 (Tobacco Regulation Act of 2003). The IACT's membership includes pro-tobacco groups in the Department of Agriculture and National Tobacco Administration, as well as "a representative from the Tobacco Industry to be nominated by the legitimate and recognized associations of the industry," the Philippine Tobacco Institute (composed of the largest local cigarette producers and distributors). In a 2015 Philippine Supreme Court case, the Court ruled that the IACT as the "exclusive authority" in regulating various aspects tobacco control including access restrictions and tobacco advertisement, promotion, and sponsorships. In this case, the Department of Health, which is the primary technical agency for disease control and prevention, was held to be without authority to create tobacco control regulations unless the IACT delegates this function. The IACT's organization also limits the Philippines' enforcement of the World Health Organization Framework Convention on Tobacco Control.

International examples

World Trade Organization

The academic Thomas Alured Faunce has argued the World Trade Organization non-violation nullification of benefits

claims, particularly when inserted in bilateral trade agreements, can

facilitate intense lobbying by industry which can result in effective

regulatory capture of large areas of governmental policy.