|

The Lord Keynes

| |

|---|---|

Keynes in 1940

| |

| Born | 5 June 1883

Cambridge, Cambridgeshire, England

|

| Died | 21 April 1946 (aged 62) |

| Nationality | British |

| Alma mater | Eton College, University of Cambridge |

| Political party | Liberal |

| Spouse(s) | Lydia Lopokova |

| Academic career | |

| Institution | King's College, Cambridge |

| Field | |

| School or tradition | Keynesian economics |

| Alma mater | |

| Influences | Jeremy Bentham, Thomas Malthus, Alfred Marshall, Nicholas Johannsen, Knut Wicksell, Piero Sraffa, John Neville Keynes, Bertrand Russell |

| Contributions | |

John Maynard Keynes, 1st Baron Keynes CB FBA (/keɪnz/ KAYNZ; 5 June 1883 – 21 April 1946), was a British economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. He built on and greatly refined earlier work on the causes of business cycles, and was one of the most influential economists of the 20th century. Widely considered the founder of modern macroeconomics, his ideas are the basis for the school of thought known as Keynesian economics, and its various offshoots.

During the Great Depression of the 1930s, Keynes with a great help from Maiteeg spearheaded a revolution in economic thinking, challenging the ideas of neoclassical economics that held that free markets would, in the short to medium term, automatically provide full employment, as long as workers were flexible in their wage demands. He argued that aggregate demand (total spending in the economy) determined the overall level of economic activity, and that inadequate aggregate demand could lead to prolonged periods of high unemployment. Keynes advocated the use of fiscal and monetary policies to mitigate the adverse effects of economic recessions and depressions. He detailed these ideas in his magnum opus, The General Theory of Employment, Interest and Money, published in 1936. In the mid to late-1930s, leading Western economies adopted Keynes's policy recommendations. Almost all capitalist governments had done so by the end of the two decades following Keynes's death in 1946.

As leader of the British delegation, Keynes participated in the design of the international economic institutions established after the end of World War II, but was overruled by the American delegation on several aspects. Keynes's influence started to wane in the 1970s, partly as a result of the stagflation that plagued the Anglo-American economies during that decade, and partly because of criticism of Keynesian policies by Milton Friedman and other monetarists, who disputed the ability of government to favourably regulate the business cycle with fiscal policy. However, the advent of the global financial crisis of 2007–2008 sparked a resurgence in Keynesian thought. Keynesian economics provided the theoretical underpinning for economic policies undertaken in response to the crisis by President Barack Obama of the United States, Prime Minister Gordon Brown of the United Kingdom, and other heads of governments.

When Time magazine included Keynes among its Most Important People of the Century in 1999, it stated that "his radical idea that governments should spend money they don't have may have saved capitalism." The Economist has described Keynes as "Britain's most famous 20th-century economist." In addition to being an economist, Keynes was also a civil servant, a director of the Bank of England, and a part of the Bloomsbury Group of intellectuals.

Early life and education

King's College, Cambridge. Keynes's grandmother wrote to him saying that, since he was born in Cambridge, people will expect him to be clever.

John Maynard Keynes was born in Cambridge, Cambridgeshire, England, to an upper-middle-class family. His father, John Neville Keynes, was an economist and a lecturer in moral sciences at the University of Cambridge and his mother Florence Ada Keynes

a local social reformer. Keynes was the first born, and was followed by

two more children – Margaret Neville Keynes in 1885 and Geoffrey Keynes in 1887. Geoffrey became a surgeon and Margaret married the Nobel Prize-winning physiologist Archibald Hill.

According to the economic historian and biographer Robert Skidelsky,

Keynes's parents were loving and attentive. They remained in the same

house throughout their lives, where the children were always welcome to

return. Keynes would receive considerable support from his father,

including expert coaching to help him pass his scholarship exams and

financial help both as a young man and when his assets were nearly wiped

out at the onset of Great Depression

in 1929. Keynes's mother made her children's interests her own, and

according to Skidelsky, "because she could grow up with her children,

they never outgrew home".

In January 1889 at the age of five and a half, Keynes started at the kindergarten of the Perse School for Girls

for five mornings a week. He quickly showed a talent for arithmetic,

but his health was poor leading to several long absences. He was tutored

at home by a governess, Beatrice Mackintosh, and his mother. In January

1892, at eight and a half, he started as a day pupil at St Faith's

preparatory school. By 1894, Keynes was top of his class and excelling

at mathematics. In 1896, St Faith's headmaster, Ralph Goodchild, wrote

that Keynes was "head and shoulders above all the other boys in the

school" and was confident that Keynes could get a scholarship to Eton.

In 1897, Keynes won a scholarship to Eton College, where he displayed talent in a wide range of subjects, particularly mathematics, classics

and history. At Eton, Keynes experienced the first "love of his life"

in Dan Macmillan, older brother of the future Prime Minister Harold Macmillan. Despite his middle-class background, Keynes mixed easily with upper-class pupils.

In 1902 Keynes left Eton for King's College, Cambridge, after receiving a scholarship for this also to read mathematics. Alfred Marshall begged Keynes to become an economist,

although Keynes's own inclinations drew him towards philosophy – especially the ethical system of G. E. Moore. Keynes joined the Pitt Club and was an active member of the semi-secretive Cambridge Apostles

society, a debating club largely reserved for the brightest students.

Like many members, Keynes retained a bond to the club after graduating

and continued to attend occasional meetings throughout his life. Before

leaving Cambridge, Keynes became the President of the Cambridge Union Society and Cambridge University Liberal Club. He was said to be an atheist.

In May 1904, he received a first class BA in mathematics. Aside

from a few months spent on holidays with family and friends, Keynes

continued to involve himself with the university over the next two

years. He took part in debates, further studied philosophy and attended

economics lectures informally as a graduate student for one term, which

constituted his only formal education in the subject. He took civil

service exams in 1906.

The economist Harry Johnson wrote that the optimism imparted by Keynes's early life is a key to understanding his later thinking.

Keynes was always confident he could find a solution to whatever problem

he turned his attention to, and retained a lasting faith in the ability

of government officials to do good.

Keynes's optimism was also cultural, in two senses: he was of the last

generation raised by an empire still at the height of its power, and was

also of the last generation who felt entitled to govern by culture,

rather than by expertise. According to Skidelsky, the sense of cultural unity current in Britain from the 19th century to the end of World War I

provided a framework with which the well-educated could set various

spheres of knowledge in relation to each other and to life, enabling

them to confidently draw from different fields when addressing practical

problems.

Career

In October 1906, Keynes's Civil Service career began as a clerk in the India Office. He enjoyed his work at first, but by 1908 had become bored and resigned his position to return to Cambridge and work on probability theory, at first privately funded only by two dons at the university – his father and the economist Arthur Pigou.

By 1909 Keynes had published his first professional economics article in The Economic Journal, about the effect of a recent global economic downturn on India. He founded the Political Economy Club, a weekly discussion group. Also in 1909, Keynes accepted a lectureship in economics funded personally by Alfred Marshall. Keynes's earnings rose further as he began to take on pupils for private tuition.

In 1911 Keynes was made editor of The Economic Journal. By 1913 he had published his first book, Indian Currency and Finance. He was then appointed to the Royal Commission on Indian Currency and Finance

– the same topic as his book – where Keynes showed considerable talent

at applying economic theory to practical problems. His written work was

published under the name "J M Keynes", though to his family and friends

he was known as Maynard. (His father, John Neville Keynes, was also

always known by his middle name).

First World War

The British Government called on Keynes's expertise during the First World War.

While he did not formally re-join the civil service in 1914, Keynes

travelled to London at the government's request a few days before

hostilities started. Bankers had been pushing for the suspension of specie payments – the convertibility of banknotes into gold – but with Keynes's help the Chancellor of the Exchequer (then Lloyd George)

was persuaded that this would be a bad idea, as it would hurt the

future reputation of the city if payments were suspended before it was

absolutely necessary.

In January 1915, Keynes took up an official government position at the Treasury.

Among his responsibilities were the design of terms of credit between

Britain and its continental allies during the war, and the acquisition

of scarce currencies. According to economist Robert Lekachman,

Keynes's "nerve and mastery became legendary" because of his

performance of these duties, as in the case where he managed to assemble

– with difficulty – a small supply of Spanish pesetas.

The secretary of the Treasury was delighted to hear Keynes had

amassed enough to provide a temporary solution for the British

Government. But Keynes did not hand the pesetas over, choosing instead

to sell them all to break the market: his boldness paid off, as pesetas

then became much less scarce and expensive.

On the introduction of military conscription in 1916 he applied for exemption as a conscientious objector, which was effectively granted conditional upon continuing his government work.

In the 1917 King's Birthday Honours, Keynes was appointed Companion of the Order of the Bath for his wartime work,

and his success led to the appointment that would have a huge effect on

Keynes's life and career; Keynes was appointed financial representative

for the Treasury to the 1919 Versailles peace conference. He was also appointed Officer of the Belgian Order of Leopold.

Versailles peace conference

Keynes's colleague, David Lloyd George. Keynes was initially wary of the "Welsh Wizard," preferring his rival Asquith,

but was impressed with Lloyd George at Versailles; this did not prevent

Keynes from painting a scathing picture of the then-prime minister in

his Economic Consequences of the Peace.

Keynes's experience at Versailles

was influential in shaping his future outlook, yet it was not a

successful one for him. Keynes's main interest had been in trying to

prevent Germany's compensation payments

being set so high it would traumatise innocent German people, damage

the nation's ability to pay and sharply limit her ability to buy exports

from other countries – thus hurting not just Germany's own economy but

that of the wider world.

Unfortunately for Keynes, conservative powers in the coalition that emerged from the 1918 coupon election

were able to ensure that both Keynes himself and the Treasury were

largely excluded from formal high-level talks concerning reparations.

Their place was taken by the Heavenly Twins – the judge Lord Sumner and the banker Lord Cunliffe

whose nickname derived from the "astronomically" high war compensation

they wanted to demand from Germany. Keynes was forced to try to exert

influence mostly from behind the scenes.

The three principal players at Versailles were Britain's Lloyd George, France's Clemenceau and America's President Wilson.

It was only Lloyd George to whom Keynes had much direct access; until

the 1918 election he had some sympathy with Keynes's view but while

campaigning had found his speeches were only well received by the public

if he promised to harshly punish Germany, and had therefore committed

his delegation to extracting high payments.

Lloyd George did however win some loyalty from Keynes with his

actions at the Paris conference by intervening against the French to

ensure the dispatch of much-needed food supplies to German civilians.

Clemenceau also pushed for substantial reparations, though not as high

as those proposed by the British, while on security grounds, France

argued for an even more severe settlement than Britain.

Wilson initially favoured relatively lenient treatment of Germany

– he feared too harsh conditions could foment the rise of extremism,

and wanted Germany to be left sufficient capital to pay for imports. To

Keynes's dismay, Lloyd George and Clemenceau were able to pressure

Wilson to agree to include pensions in the reparations bill.

Towards the end of the conference, Keynes came up with a plan

that he argued would not only help Germany and other impoverished

central European powers but also be good for the world economy as a

whole. It involved the radical writing down of war debts, which would

have had the possible effect of increasing international trade all

round, but at the same time thrown the entire cost of European

reconstruction on the United States.

Lloyd George agreed it might be acceptable to the British

electorate. However, America was against the plan; the US was then the

largest creditor, and by this time Wilson had started to believe in the

merits of a harsh peace and thought that his country had already made

excessive sacrifices. Hence despite his best efforts, the end result of

the conference was a treaty which disgusted Keynes both on moral and

economic grounds, and led to his resignation from the Treasury.

In June 1919 he turned down an offer to become chairman of the British Bank of Northern Commerce, a job that promised a salary of £2000 in return for a morning per week of work.

Keynes's analysis on the predicted damaging effects of the treaty appeared in the highly influential book, The Economic Consequences of the Peace, published in 1919.

This work has been described as Keynes's best book, where he was able

to bring all his gifts to bear – his passion as well as his skill as an

economist. In addition to economic analysis, the book contained pleas to

the reader's sense of compassion:

I cannot leave this subject as though its just treatment wholly depended either on our own pledges or on economic facts. The policy of reducing Germany to servitude for a generation, of degrading the lives of millions of human beings, and of depriving a whole nation of happiness should be abhorrent and detestable, – abhorrent and detestable, even if it were possible, even if it enriched ourselves, even if it did not sow the decay of the whole civilised life of Europe.

Also present was striking imagery such as "year by year Germany must

be kept impoverished and her children starved and crippled" along with

bold predictions which were later justified by events:

If we aim deliberately at the impoverishment of Central Europe, vengeance, I dare predict, will not limp. Nothing can then delay for very long that final war between the forces of Reaction and the despairing convulsions of Revolution, before which the horrors of the late German war will fade into nothing.

Keynes's followers assert that his predictions of disaster were borne out when the German economy suffered the hyperinflation of 1923, and again by the collapse of the Weimar Republic and the outbreak of the Second World War. However the historian Ruth Henig

claims that "most historians of the Paris peace conference now take the

view that, in economic terms, the treaty was not unduly harsh on

Germany and that, while obligations and damages were inevitably much

stressed in the debates at Paris to satisfy electors reading the daily

newspapers, the intention was quietly to give Germany substantial help

towards paying her bills, and to meet many of the German objections by

amendments to the way the reparations schedule was in practice carried

out".

Only a small fraction of reparations were ever paid. In fact, the historian Stephen Schuker demonstrates in American 'Reparations' to Germany, 1919–33,

that the capital inflow from American loans substantially exceeded

German outpayments so that, on a net basis, Germany received support

equal to four times the amount of the post-Second World War Marshall Plan.

Schuker also shows that, in the years after Versailles, Keynes

became an informal reparations adviser to the German government, wrote

one of the major German reparation notes, and actually supported the

hyperinflation on political grounds. Nevertheless, The Economic Consequences of the Peace

gained Keynes international fame, even though it also caused him to be

regarded as anti-establishment – it was not until after the outbreak of

the Second World War that Keynes was offered a directorship of a major

British Bank, or an acceptable offer to return to government with a

formal job. However, Keynes was still able to influence government

policy making through his network of contacts, his published works and

by serving on government committees; this included attending high-level

policy meetings as a consultant.

In the 1920s

Keynes argued against a return to the gold standard at parity with pre-war sterling valuation after World War I

Keynes had completed his A Treatise on Probability before the war, but published it in 1921. The work was a notable contribution to the philosophical and mathematical underpinnings of probability theory, championing the important view that probabilities were no more or less than truth values intermediate between simple truth and falsity. Keynes developed the first upper-lower probabilistic interval

approach to probability in chapters 15 and 17 of this book, as well as

having developed the first decision weight approach with his

conventional coefficient of risk and weight, c, in chapter 26. In

addition to his academic work, the 1920s saw Keynes active as a

journalist selling his work internationally and working in London as a

financial consultant. In 1924 Keynes wrote an obituary for his former

tutor

Alfred Marshall which Joseph Schumpeter called "the most brilliant life of a man of science I have ever read."

Marshall's widow was "entranced" by the memorial, while Lytton Strachey rated it as one of Keynes's "best works".

In 1922 Keynes continued to advocate reduction of German reparations with A Revision of the Treaty. He attacked the post-World War I deflation policies with A Tract on Monetary Reform in 1923

– a trenchant argument that countries should target stability of

domestic prices, avoiding deflation even at the cost of allowing their

currency to depreciate. Britain suffered from high unemployment through

most of the 1920s, leading Keynes to recommend the depreciation of sterling

to boost jobs by making British exports more affordable. From 1924 he

was also advocating a fiscal response, where the government could create

jobs by spending on public works.

During the 1920s Keynes's pro stimulus views had only limited effect on

policy makers and mainstream academic opinion – according to Hyman Minsky one reason was that at this time his theoretical justification was "muddled". The Tract

had also called for an end to the gold standard. Keynes advised it was

no longer a net benefit for countries such as Britain to participate in

the gold standard,

as it ran counter to the need for domestic policy autonomy. It could

force countries to pursue deflationary policies at exactly the time when

expansionary measures were called for to address rising unemployment.

The Treasury and Bank of England were still in favour of the gold

standard and in 1925 they were able to convince the then Chancellor Winston Churchill to re-establish it, which had a depressing effect on British industry. Keynes responded by writing The Economic Consequences of Mr. Churchill and continued to argue against the gold standard until Britain finally abandoned it in 1931.

During the Great Depression

The Great Depression with its periods of worldwide economic hardship formed the backdrop against which the Keynesian Revolution took place. The image is Florence Owens Thompson by photographer Dorothea Lange taken in March 1936.

Keynes had begun a theoretical work to examine the relationship between unemployment, money and prices back in the 1920s. The work, Treatise on Money,

was published in 1930 in two volumes. A central idea of the work was

that if the amount of money being saved exceeds the amount being

invested – which can happen if interest rates are too high – then

unemployment will rise. This is in part a result of people not wanting

to spend too high a proportion of what employers pay out, making it

difficult, in aggregate, for employers to make a profit. Another key

theme of the book is the unreliability of financial indices

for representing an accurate – or indeed meaningful – indication of

general shifts in purchasing power of currencies over time. In

particular he criticised the justification of Britain's return to the gold standard in 1925 at pre-war valuation by reference to the wholesale price index.

He argued that the index understated the effects of changes in the

costs of services and of labour. In 1927 he wrote, "We will not have any

more crashes in our time."

Keynes was deeply critical of the British government's austerity measures during the Great Depression. He believed that budget deficits during recessions

were a good thing, and a natural product of an economic slump. He

wrote, "For Government borrowing of one kind or another is nature's

remedy, so to speak, for preventing business losses from being, in so

severe a slump as the present one, so great as to bring production

altogether to a standstill."

At the height of the Great Depression, in 1933, Keynes published The Means to Prosperity,

which contained specific policy recommendations for tackling

unemployment in a global recession, chiefly counter-cyclical public

spending. The Means to Prosperity contains one of the first mentions of the multiplier effect.

While it was addressed chiefly to the British Government, it also

contained advice for other nations affected by the global recession. A

copy was sent to the newly elected President Franklin D. Roosevelt and other world leaders. The work was taken seriously by both the American and British governments, and according to Robert Skidelsky,

helped pave the way for the later acceptance of Keynesian ideas, though

it had little immediate practical influence. In the 1933 London Economic Conference opinions remained too diverse for a unified course of action to be agreed upon.

Keynesian-like policies were adopted by Sweden and Germany, but

Sweden was seen as too small to command much attention, and Keynes was

deliberately silent about the successful efforts of Germany as he was dismayed by their imperialist ambitions and their treatment of Jews.

Apart from Great Britain, Keynes's attention was primarily focused on

the United States. In 1931, he received considerable support for his

views on counter-cyclical public spending in Chicago, then America's

foremost centre for economic views alternative to the mainstream. However, orthodox economic opinion remained generally hostile regarding fiscal intervention to mitigate the depression, until just before the outbreak of war. In late 1933 Keynes was persuaded by Felix Frankfurter

to address President Roosevelt directly, which he did by letters and

face to face in 1934, after which the two men spoke highly of each

other.

However, according to Skidelsky, the consensus is that Keynes's efforts

only began to have a more than marginal influence on US economic policy

after 1939.

Keynes's magnum opus, The General Theory of Employment, Interest and Money was published in 1936. It was researched and indexed by one of Keynes's favourite students, later the economist David Bensusan-Butt. The work served as a theoretical justification for the interventionist policies Keynes favoured for tackling a recession. The General Theory challenged the earlier neoclassical economic paradigm, which had held that provided it was unfettered by government interference, the market would naturally establish full employment

equilibrium. In doing so Keynes was partly setting himself against his

former teachers Marshall and Pigou. Keynes believed the classical theory

was a "special case" that applied only to the particular conditions

present in the 19th century, his own theory being the general one.

Classical economists had believed in Say's law, which, simply put, states that "supply creates its own demand",

and that in a free market workers would always be willing to lower

their wages to a level where employers could profitably offer them jobs.

An innovation from Keynes was the concept of price stickiness

– the recognition that in reality workers often refuse to lower their

wage demands even in cases where a classical economist might argue it is

rational for them to do so. Due in part to price stickiness, it was

established that the interaction of "aggregate demand" and "aggregate supply"

may lead to stable unemployment equilibria – and in those cases, it is

the state, not the market, that economies must depend on for their

salvation.

Caricature by David Low, 1934

The General Theory argues that demand, not supply, is the key

variable governing the overall level of economic activity. Aggregate

demand, which equals total un-hoarded income in a society, is defined by

the sum of consumption and investment. In a state of unemployment and

unused production capacity, one can only enhance employment and total income by first

increasing expenditures for either consumption or investment. Without

government intervention to increase expenditure, an economy can remain

trapped in a low employment equilibrium – the demonstration of this

possibility has been described as the revolutionary formal achievement

of the work.

The book advocated activist economic policy by government to stimulate

demand in times of high unemployment, for example by spending on public works.

"Let us be up and doing, using our idle resources to increase our

wealth," he wrote in 1928. "With men and plants unemployed, it is

ridiculous to say that we cannot afford these new developments. It is

precisely with these plants and these men that we shall afford them."

The General Theory is often viewed as the foundation of modern macroeconomics. Few senior American economists agreed with Keynes through most of the 1930s.

Yet his ideas were soon to achieve widespread acceptance, with eminent American professors such as Alvin Hansen agreeing with the General Theory before the outbreak of World War II.

Keynes himself had only limited participation in the theoretical debates that followed the publication of the General Theory as he suffered a heart attack in 1937, requiring him to take long periods of rest. Among others, Hyman Minsky and Post-Keynesian

economists have argued that as result, Keynes's ideas were diluted by

those keen to compromise with classical economists or to render his

concepts with mathematical models like the IS–LM model (which, they argue, distort Keynes's ideas).

Keynes began to recover in 1939, but for the rest of his life his

professional energies were largely directed towards the practical side

of economics – the problems of ensuring optimum allocation of resources

for the war efforts, post-war negotiations with America, and the new

international financial order that was presented at the Bretton Woods Conference.

In the General Theory and later, Keynes responded to the

socialists who argued, especially during the Great Depression of the

1930s, that capitalism caused war. He argued that if capitalism were

managed domestically and internationally (with coordinated international

Keynesian policies, an international monetary system that didn't pit

the interests of countries against each other, and a high degree of

freedom of trade), then this system of managed capitalism could promote

peace rather than conflict between countries. His plans during World War

II for post-war international economic institutions and policies (which

contributed to the creation at Bretton Woods of the International Monetary Fund and the World Bank, and later to the creation of the General Agreement on Tariffs and Trade and eventually the World Trade Organization) were aimed to give effect to this vision.

Although Keynes has been widely criticised – especially by members of the Chicago school of economics

– for advocating irresponsible government spending financed by

borrowing, in fact he was a firm believer in balanced budgets and

regarded the proposals for programs of public works during the Great

Depression as an exceptional measure to meet the needs of exceptional

circumstances.

Second World War

Keynes (right) and the US representative Harry Dexter White at the inaugural meeting of the International Monetary Fund's Board of Governors in Savannah, Georgia in 1946

During the Second World War, Keynes argued in How to Pay for the War,

published in 1940, that the war effort should be largely financed by

higher taxation and especially by compulsory saving (essentially workers

lending money to the government), rather than deficit spending, in order to avoid inflation.

Compulsory saving would act to dampen domestic demand, assist in

channelling additional output towards the war efforts, would be fairer

than punitive taxation and would have the advantage of helping to avoid a

post war slump by boosting demand once workers were allowed to withdraw

their savings. In September 1941 he was proposed to fill a vacancy in

the Court of Directors of the Bank of England, and subsequently carried out a full term from the following April. In June 1942, Keynes was rewarded for his service with a hereditary peerage in the King's Birthday Honours. On 7 July his title was gazetted as "Baron Keynes, of Tilton, in the County of Sussex" and he took his seat in the House of Lords on the Liberal Party benches.

As the Allied victory began to look certain, Keynes was heavily involved, as leader of the British delegation and chairman of the World Bank commission, in the mid-1944 negotiations that established the Bretton Woods system.

The Keynes-plan, concerning an international clearing-union, argued for

a radical system for the management of currencies. He proposed the

creation of a common world unit of currency, the bancor, and new global institutions – a world central bank and the International Clearing Union.

Keynes envisaged these institutions managing an international trade and

payments system with strong incentives for countries to avoid

substantial trade deficits or surpluses.

The USA's greater negotiating strength, however, meant that the final

outcomes accorded more closely to the more conservative plans of Harry Dexter White. According to US economist J. Bradford DeLong, on almost every point where he was overruled by the Americans, Keynes was later proved correct by events.

The two new institutions, later known as the World Bank and the International Monetary Fund

(IMF), were founded as a compromise that primarily reflected the

American vision. There would be no incentives for states to avoid a

large trade surplus; instead, the burden for correcting a trade imbalance would continue to fall only on the deficit

countries, which Keynes had argued were least able to address the

problem without inflicting economic hardship on their populations. Yet,

Keynes was still pleased when accepting the final agreement, saying that

if the institutions stayed true to their founding principles, "the

brotherhood of man will have become more than a phrase."

Postwar

After

the war, Keynes continued to represent the United Kingdom in

international negotiations despite his deteriorating health. He

succeeded in obtaining preferential terms from the United States for new and outstanding debts to facilitate the rebuilding of the British economy.

Just before his death in 1946, Keynes told Henry Clay, a professor of social economics and advisor to the Bank of England, of his hopes that Adam Smith's "invisible hand"

could help Britain out of the economic hole it was in: "I find myself

more and more relying for a solution of our problems on the invisible

hand which I tried to eject from economic thinking twenty years ago."

Legacy

Prime Minister Clement Attlee with King George VI after his 1945 election victory

Keynesian ascendancy 1939–79

From the end of the Great Depression to the mid-1970s, Keynes

provided the main inspiration for economic policy makers in Europe,

America and much of the rest of the world.

While economists and policy makers had become increasingly won over to

Keynes's way of thinking in the mid and late 1930s, it was only after

the outbreak of World War II that governments started to borrow money

for spending on a scale sufficient to eliminate unemployment. According

to the economist John Kenneth Galbraith

(then a US government official charged with controlling inflation), in

the rebound of the economy from wartime spending, "one could not have

had a better demonstration of the Keynesian ideas."

The Keynesian Revolution was associated with the rise of modern liberalism in the West during the post-war period.

Keynesian ideas became so popular that some scholars point to Keynes as

representing the ideals of modern liberalism, as Adam Smith represented

the ideals of classical liberalism. After the war, Winston Churchill attempted to check the rise of Keynesian policy-making in the United Kingdom and used rhetoric critical of the mixed economy in his 1945 election campaign. Despite his popularity as a war hero, Churchill suffered a landslide defeat to Clement Attlee whose government's economic policy continued to be influenced by Keynes's ideas.

Neo-Keynesian economics

Neo-Keynesian IS–LM model is used to analyse the effect of demand shocks on the economy

In the late 1930s and 1940s, economists (notably John Hicks, Franco Modigliani, and Paul Samuelson) attempted to interpret and formalise Keynes's writings in terms of formal mathematical models. In what had become known as the neoclassical synthesis, they combined Keynesian analysis with neoclassical economics to produce neo-Keynesian economics, which came to dominate mainstream macroeconomic thought for the next 40 years.

By the 1950s, Keynesian policies were adopted by almost the entire developed world and similar measures for a mixed economy

were used by many developing nations. By then, Keynes's views on the

economy had become mainstream in the world's universities. Throughout

the 1950s and 1960s, the developed and emerging free capitalist

economies enjoyed exceptionally high growth and low unemployment.

Professor Gordon Fletcher has written that the 1950s and 1960s, when

Keynes's influence was at its peak, appear in retrospect as a golden age of capitalism.

In late 1965 Time magazine ran a cover article with a title comment from Milton Friedman (later echoed by U.S. President Richard Nixon), "We are all Keynesians now".

The article described the exceptionally favourable economic conditions

then prevailing, and reported that "Washington's economic managers

scaled these heights by their adherence to Keynes's central theme: the

modern capitalist economy does not automatically work at top efficiency,

but can be raised to that level by the intervention and influence of

the government." The article also states that Keynes was one of the

three most important economists who ever lived, and that his General Theory was more influential than the magna opera of other famous economists, like Adam Smith's The Wealth of Nations.

Keynesian economics out of favour 1979–2007

Keynesian economics were officially discarded by the British

Government in 1979, but forces had begun to gather against Keynes's

ideas over 30 years earlier. Friedrich Hayek had formed the Mont Pelerin Society

in 1947, with the explicit intention of nurturing intellectual currents

to one day displace Keynesianism and other similar influences. Its

members included the Austrian School economist Ludwig von Mises

along with the then young Milton Friedman. Initially the society had

little impact on the wider world – according to Hayek it was as if

Keynes had been raised to sainthood after his death and that people

refused to allow his work to be questioned.

Friedman however began to emerge as a formidable critic of Keynesian

economics from the mid-1950s, and especially after his 1963 publication

of A Monetary History of the United States.

On the practical side of economic life, "big government"

had appeared to be firmly entrenched in the 1950s, but the balance

began to shift towards the power of private interests in the 1960s.

Keynes had written against the folly of allowing "decadent and selfish"

speculators and financiers the kind of influence they had enjoyed after

World War I. For two decades after World War II the public opinion was

strongly against private speculators, the disparaging label "Gnomes of Zürich"

being typical of how they were described during this period.

International speculation was severely restricted by the capital

controls in place after Bretton Woods. According to the journalists Larry Elliott and Dan Atkinson,

1968 was the pivotal year when power shifted in favour of private

agents such as currency speculators. As the key 1968 event Elliott and

Atkinson picked out America's suspension of the conversion of the dollar

into gold except on request of foreign governments, which they

identified as the beginning of the breakdown of the Bretton Woods

system.

Criticisms of Keynes's ideas had begun to gain significant

acceptance by the early 1970s, as they were then able to make a credible

case that Keynesian models no longer reflected economic reality. Keynes

himself included few formulas and no explicit mathematical models in

his General Theory. For economists such as Hyman Minsky,

Keynes's limited use of mathematics was partly the result of his

scepticism about whether phenomena as inherently uncertain as economic

activity could ever be adequately captured by mathematical models.

Nevertheless, many models were developed by Keynesian economists, with a

famous example being the Phillips curve

which predicted an inverse relationship between unemployment and

inflation. It implied that unemployment could be reduced by government

stimulus with a calculable cost to inflation. In 1968, Milton Friedman

published a paper arguing that the fixed relationship implied by the

Philips curve did not exist.

Friedman suggested that sustained Keynesian policies could lead to both

unemployment and inflation rising at once – a phenomenon that soon

became known as stagflation.

In the early 1970s stagflation appeared in both the US and Britain just

as Friedman had predicted, with economic conditions deteriorating

further after the 1973 oil crisis.

Aided by the prestige gained from his successful forecast, Friedman led

increasingly successful criticisms against the Keynesian consensus,

convincing not only academics and politicians but also much of the

general public with his radio and television broadcasts. The academic

credibility of Keynesian economics was further undermined by additional

criticism from other monetarists trained in the Chicago school of economics, by the Lucas critique and by criticisms from Hayek's Austrian School. So successful were these criticisms that by 1980 Robert Lucas claimed economists would often take offence if described as Keynesians.

Keynesian principles fared increasingly poorly on the practical

side of economics – by 1979 they had been displaced by monetarism as the

primary influence on Anglo-American economic policy. However, many officials on both sides of the Atlantic retained a preference for Keynes, and in 1984 the Federal Reserve officially discarded monetarism, after which Keynesian principles made a partial comeback as an influence on policy making.

Not all academics accepted the criticism against Keynes – Minsky has

argued that Keynesian economics had been debased by excessive mixing

with neoclassical ideas from the 1950s, and that it was unfortunate that

this branch of economics had even continued to be called "Keynesian". Writing in The American Prospect, Robert Kuttner

argued it was not so much excessive Keynesian activism that caused the

economic problems of the 1970s but the breakdown of the Bretton Woods

system of capital controls, which allowed capital flight from regulated economies into unregulated economies in a fashion similar to Gresham's law phenomenon (where weak currencies undermine strong currencies).

Historian Peter Pugh

has stated that a key cause of the economic problems afflicting America

in the 1970s was the refusal to raise taxes to finance the Vietnam War, which was against Keynesian advice.

A more typical response was to accept some elements of the

criticisms while refining Keynesian economic theories to defend them

against arguments that would invalidate the whole Keynesian framework –

the resulting body of work largely composing New Keynesian economics. In 1992 Alan Blinder

wrote about a "Keynesian Restoration", as work based on Keynes's ideas

had to some extent become fashionable once again in academia, though in

the mainstream it was highly synthesised with monetarism and other

neoclassical thinking. In the world of policy making, free market

influences broadly sympathetic to monetarism have remained very strong

at government level – in powerful normative institutions like the World Bank, the IMF and US Treasury, and in prominent opinion-forming media such as the Financial Times and The Economist.

Keynesian resurgence 2008–09

The economist Manmohan Singh, the then prime minister of India, spoke strongly in favour of Keynesian fiscal stimulus at the 2008 G-20 Washington summit.

The global financial crisis of 2007–08 led to public skepticism about the free market consensus even from some on the economic right. In March 2008, Martin Wolf, chief economics commentator at the Financial Times, announced the death of the dream of global free-market capitalism. In the same month macroeconomist James K. Galbraith

used the 25th Annual Milton Friedman Distinguished Lecture to launch a

sweeping attack against the consensus for monetarist economics and

argued that Keynesian economics were far more relevant for tackling the

emerging crises.

Economist Robert J. Shiller had begun advocating robust government intervention to tackle the financial crises, specifically citing Keynes.

Nobel laureate Paul Krugman also actively argued the case for vigorous Keynesian intervention in the economy in his columns for The New York Times.

Other prominent economic commentators who have argued for Keynesian

government intervention to mitigate the financial crisis include George Akerlof, J. Bradford DeLong,

Robert Reich,

and Joseph Stiglitz.

Newspapers and other media have also cited work relating to Keynes by Hyman Minsky, Robert Skidelsky, Donald Markwell

and Axel Leijonhufvud.

A series of major bailouts

were pursued during the financial crisis, starting on 7 September with

the announcement that the U.S. Government was to nationalise the two government-sponsored enterprises which oversaw most of the U.S. subprime mortgage market – Fannie Mae and Freddie Mac. In October, Alistair Darling, the British Chancellor of the Exchequer, referred to Keynes as he announced plans for substantial fiscal stimulus to head off the worst effects of recession, in accordance with Keynesian economic thought. Similar policies have been adopted by other governments worldwide.

This is in stark contrast to the action imposed on Indonesia during the Asian financial crisis of 1997, when it was forced by the IMF to close 16 banks at the same time, prompting a bank run.

Much of the post-crisis discussion reflected Keynes's advocacy of

international coordination of fiscal or monetary stimulus, and of

international economic institutions such as the IMF and the World Bank,

which many had argued should be reformed as a "new Bretton Woods", and

should have been even before the crises broke out.

The IMF and United Nations economists advocated a coordinated international approach to fiscal stimulus.

Donald Markwell

argued that in the absence of such an international approach, there

would be a risk of worsening international relations and possibly even

world war arising from economic factors similar to those present during

the depression of the 1930s.

By the end of December 2008, the Financial Times reported that "the sudden resurgence of Keynesian policy is a stunning reversal of the orthodoxy of the past several decades."

In December 2008, Paul Krugman released his book The Return of Depression Economics and the Crisis of 2008,

arguing that economic conditions similar to what existed during the

earlier part of the 20th century had returned, making Keynesian policy

prescriptions more relevant than ever. In February 2009 Robert J. Shiller and George Akerlof published Animal Spirits,

a book where they argue the current US stimulus package is too small as

it does not take into account Keynes's insight on the importance of

confidence and expectations in determining the future behaviour of businesspeople and other economic agents.

In the March 2009 speech entitled Reform the International Monetary System, Zhou Xiaochuan, the governor of the People's Bank of China,

came out in favour of Keynes's idea of a centrally managed global

reserve currency. Zhou argued that it was unfortunate that part of the

reason for the Bretton Woods system breaking down was the failure to

adopt Keynes's bancor. Zhou proposed a gradual move towards increased use of IMF special drawing rights (SDRs).

Although Zhou's ideas had not been broadly accepted, leaders meeting in April at the 2009 G-20 London summit

agreed to allow $250 billion of special drawing rights to be created by

the IMF, to be distributed globally. Stimulus plans were credited for

contributing to a better than expected economic outlook by both the OECD

and the IMF,

in reports published in June and July 2009. Both organisations warned

global leaders that recovery was likely to be slow, so counter

recessionary measures ought not be rolled back too early.

While the need for stimulus measures was broadly accepted among

policy makers, there had been much debate over how to fund the spending.

Some leaders and institutions, such as Angela Merkel

and the European Central Bank,

expressed concern over the potential impact on inflation, national debt

and the risk that a too large stimulus will create an unsustainable

recovery.

Among professional economists the revival of Keynesian economics

has been even more divisive. Although many economists, such as George

Akerlof, Paul Krugman, Robert Shiller, and Joseph Stiglitz, supported

Keynesian stimulus, others did not believe higher government spending

would help the United States economy recover from the Great Recession. Some economists, such as Robert Lucas, questioned the theoretical basis for stimulus packages. Others, like Robert Barro and Gary Becker, say that empirical evidence for beneficial effects from Keynesian stimulus does not exist.

However, there is a growing academic literature that shows that fiscal

expansion helps an economy grow in the near term, and that certain types

of fiscal stimulus are particularly effective.

Reception and views

Praise

Keynes's

economic thinking only began to achieve close to universal acceptance

in the last few years of his life. On a personal level, Keynes's charm

was such that he was generally well received wherever he went – even

those who found themselves on the wrong side of his occasionally sharp

tongue rarely bore a grudge.

Keynes's speech at the closing of the Bretton Woods negotiations was

received with a lasting standing ovation, rare in international

relations, as the delegates acknowledged the scale of his achievements

made despite poor health.

Austrian School economist Friedrich Hayek was Keynes's most prominent contemporary critic, with sharply opposing views on the economy.

Yet after Keynes's death, he wrote: "He was the one really great man I

ever knew, and for whom I had unbounded admiration. The world will be a

very much poorer place without him."

Lionel Robbins, former head of the economics department at the London School of Economics,

who engaged in many heated debates with Keynes in the 1930s, had this

to say after observing Keynes in early negotiations with the Americans

while drawing up plans for Bretton Woods:

This went very well indeed. Keynes was in his most lucid and persuasive mood: and the effect was irresistible. At such moments, I often find myself thinking that Keynes must be one of the most remarkable men that have ever lived – the quick logic, the birdlike swoop of intuition, the vivid fancy, the wide vision, above all the incomparable sense of the fitness of words, all combine to make something several degrees beyond the limit of ordinary human achievement.

Douglas LePan, an official from the Canadian High Commission, wrote:

I am spellbound. This is the most beautiful creature I have ever listened to. Does he belong to our species? Or is he from some other order? There is something mythic and fabulous about him. I sense in him something massive and sphinx like, and yet also a hint of wings.

Bertrand Russell named Keynes one of the most intelligent people he had ever known, commenting:

Keynes's intellect was the sharpest and clearest that I have ever known. When I argued with him, I felt that I took my life in my hands, and I seldom emerged without feeling something of a fool.

Keynes's obituary in The Times

included the comment: "There is the man himself – radiant, brilliant,

effervescent, gay, full of impish jokes ... He was a humane man

genuinely devoted to the cause of the common good."

Critiques

As a man of the centre described by some as having the greatest impact of any 20th-century economist,

Keynes attracted considerable criticism from both sides of the

political spectrum. In the 1920s, Keynes was seen as anti-establishment

and was mainly attacked from the right. In the "red 1930s", many young

economists favoured Marxist views, even in Cambridge,

and while Keynes was engaging principally with the right to try to

persuade them of the merits of more progressive policy, the most

vociferous criticism against him came from the left, who saw him as a

supporter of capitalism. From the 1950s and onwards, most of the attacks

against Keynes have again been from the right.

Friedrich Hayek, one of Keynes's most prominent critics

In 1931 Friedrich Hayek extensively critiqued Keynes's 1930 Treatise on Money. After reading Hayek's The Road to Serfdom, Keynes wrote to Hayek

"Morally and philosophically I find myself in agreement with virtually

the whole of it", but concluded the letter with the recommendation:

What we need therefore, in my opinion, is not a change in our economic programmes, which would only lead in practice to disillusion with the results of your philosophy; but perhaps even the contrary, namely, an enlargement of them. Your greatest danger is the probable practical failure of the application of your philosophy in the United States.

On the pressing issue of the time, whether deficit

spending could lift a country from depression, Keynes replied to Hayek's

criticism in the following way:

I should... conclude rather differently. I should say that what we want is not no planning, or even less planning, indeed I should say we almost certainly want more. But the planning should take place in a community in which as many people as possible, both leaders and followers wholly share your own moral position. Moderate planning will be safe enough if those carrying it out are rightly oriented in their own minds and hearts to the moral issue.

Asked why Keynes expressed "moral and philosophical" agreement with Hayek's Road to Serfdom, Hayek stated:

Because he believed that he was fundamentally still a classical English liberal and wasn't quite aware of how far he had moved away from it. His basic ideas were still those of individual freedom. He did not think systematically enough to see the conflicts. He was, in a sense, corrupted by political necessity.

According to some observers,

Hayek felt that the post-World War II "Keynesian orthodoxy" gave too

much power to the state, and that such policies would lead toward

socialism.

While Milton Friedman described The General Theory as "a great book", he argues that its implicit separation of nominal from real magnitudes is neither possible nor desirable. Macroeconomic policy, Friedman argues, can reliably influence only the nominal. He and other monetarists have consequently argued that Keynesian economics can result in stagflation,

the combination of low growth and high inflation that developed

economies suffered in the early 1970s. More to Friedman's taste was the Tract on Monetary Reform (1923), which he regarded as Keynes's best work because of its focus on maintaining domestic price stability.

Joseph Schumpeter was an economist of the same age as Keynes and one of his main rivals. He was among the first reviewers to argue that Keynes's General Theory was not a general theory, but in fact a special case.

He said the work expressed "the attitude of a decaying civilisation".

After Keynes's death Schumpeter wrote a brief biographical piece Keynes the Economist

– on a personal level he was very positive about Keynes as a man,

praising his pleasant nature, courtesy and kindness. He assessed some of

Keynes's biographical and editorial work as among the best he'd ever

seen. Yet Schumpeter remained critical about Keynes's economics, linking

Keynes's childlessness to what Schumpeter saw as an essentially short

term view. He considered Keynes to have a kind of unconscious patriotism

that caused him to fail to understand the problems of other nations.

For Schumpeter "Practical Keynesianism is a seedling which cannot be

transplanted into foreign soil: it dies there and becomes poisonous as

it dies."

President Harry S. Truman

was skeptical of Keynesian theorizing: "Nobody can ever convince me

that government can spend a dollar that it's not got," he told Leon Keyserling, a Keynesian economist who chaired Truman's Council of Economic Advisers.

Views on race

Keynes sometimes explained the mass murder that took place during the first years of communist

Russia on a racial basis, as part of the "Russian and Jewish nature",

rather than as a result of the communist rule. After a trip to Russia,

he wrote in his Short View of Russia that there is "beastliness

on the Russian and Jewish natures when, as now, they are allied

together". He also wrote that "out of the cruelty and stupidity of the

Old Russia nothing could ever emerge, but (...) beneath the cruelty and

stupidity of the New Russia a speck of the ideal may lie hid", which

together with other comments may be construed as anti-Russian and antisemitic.

Some critics, including Murray Rothbard, have sought to show that Keynes had sympathy with Nazism,

and a number of writers described him as antisemitic. Keynes's private

letters contain portraits and descriptions, some of which can be

characterized as antisemitic, others as philosemitic. Scholars have suggested that these reflect clichés current at the time that he accepted uncritically, rather than any racism. On several occasions Keynes used his influence to help his Jewish friends, most notably when he successfully lobbied for Ludwig Wittgenstein to be allowed residency in the United Kingdom, explicitly in order to rescue him from being deported to Nazi-occupied Austria. Keynes was a supporter of Zionism, serving on committees supporting the cause.

Allegations that he was racist or had totalitarian beliefs have been rejected by Robert Skidelsky and other biographers.

Professor Gordon Fletcher wrote that "the suggestion of a link between

Keynes and any support of totalitarianism cannot be sustained".

Once the aggressive tendencies of the Nazis towards Jews and other

minorities had become apparent, Keynes made clear his loathing of

Nazism. As a lifelong pacifist he had initially favoured peaceful

containment of Nazi Germany,

yet he began to advocate a forceful resolution while many conservatives

were still arguing for appeasement. After the war started he roundly

criticised the Left for losing their nerve to confront Hitler:

The intelligentsia of the Left were the loudest in demanding that the Nazi aggression should be resisted at all costs. When it comes to a showdown, scarce four weeks have passed before they remember that they are pacifists and write defeatist letters to your columns, leaving the defence of freedom and civilisation to Colonel Blimp and the Old School Tie, for whom Three Cheers.

Views on inflation

Keynes has been characterised as being indifferent or even positive about mild inflation. He had indeed expressed a preference for inflation over deflation, saying that if one has to choose between the two evils, it is "better to disappoint the rentier" than to inflict pain on working class families.

He also supported the German hyperinflation as a way to get free from

reparations obligations. However, Keynes was also aware of the dangers

of inflation. In The Economic Consequences of the Peace, he wrote:

Lenin is said to have declared that the best way to destroy the Capitalist System was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

One of Keynes most oft quoted phrases "In the long term we are all dead"

came from his 1923 response critiquing the long term positive benefits

to workers, propounded by some economists, with respect to people who

had lost their jobs due to factories that had been closed down.

Views on trade imbalances

He was the principal author of a proposal – the so-called Keynes Plan – for an International Clearing Union.

The two governing principles of the plan were that the problem of

settling outstanding balances should be solved by "creating" additional

"international money", and that debtor and creditor should be treated

almost alike as disturbers of equilibrium. In the event, though, the

plans were rejected, in part because "American opinion was naturally

reluctant to accept the principle of equality of treatment so novel in

debtor-creditor relationships".

The new system is not founded on free-trade (liberalisation of foreign trade)

but rather on the regulation of international trade, in order to

eliminate trade imbalances: the nations with a surplus would have an

incentive to reduce it, and in doing so they would automatically clear

other nations deficits.

He proposed a global bank that would issue its own currency – the

bancor – which was exchangeable with national currencies at fixed rates

of exchange and would become the unit of account between nations, which

means it would be used to measure a country's trade deficit or trade

surplus. Every country would have an overdraft facility in its bancor

account at the International Clearing Union. He pointed out that

surpluses lead to weak global aggregate demand – countries running

surpluses exert a "negative externality" on trading partners, and posed,

far more than those in deficit, a threat to global prosperity.

In his 1933 Yale Review article "National Self-Sufficiency,"

he already highlighted the problems created by free trade. His view,

supported by many economists and commentators at the time, was that

creditor nations may be just as responsible as debtor nations for

disequilibrium in exchanges and that both should be under an obligation

to bring trade back into a state of balance. Failure for them to do so

could have serious consequences. In the words of Geoffrey Crowther, then editor of The Economist,

"If the economic relationships between nations are not, by one means or

another, brought fairly close to balance, then there is no set of

financial arrangements that can rescue the world from the impoverishing

results of chaos."

These ideas were informed by events prior to the Great Depression

when – in the opinion of Keynes and others – international lending,

primarily by the U.S., exceeded the capacity of sound investment and so

got diverted into non-productive and speculative uses, which in turn

invited default and a sudden stop to the process of lending.

Influenced by Keynes, economics texts in the immediate post-war

period put a significant emphasis on balance in trade. For example, the

second edition of the popular introductory textbook, An Outline of Money,

devoted the last three of its ten chapters to questions of foreign

exchange management and in particular the "problem of balance". However,

in more recent years, since the end of the Bretton Woods system in 1971, with the increasing influence of Monetarist

schools of thought in the 1980s, and particularly in the face of large

sustained trade imbalances, these concerns – and particularly concerns

about the destabilising effects of large trade surpluses – have largely

disappeared from mainstream economics discourse and Keynes' insights have slipped from view. They are receiving some attention again in the wake of the financial crisis of 2007–08.

Personal life

Painter Duncan Grant (left) with Keynes

Relationships

Keynes's early romantic and sexual relationships were exclusively with men. Keynes had been in relationships while at Eton and Cambridge; significant among these early partners were Dilly Knox and Daniel Macmillan.

Keynes was open about his affairs, and from 1901 to 1915 kept separate

diaries in which he tabulated his many sexual encounters. Keynes's relationship and later close friendship with Macmillan was to be fortunate, as Macmillan's company first published his tract Economic Consequences of the Peace.

Attitudes in the Bloomsbury Group, in which Keynes was avidly involved, were relaxed about homosexuality. Keynes, together with writer Lytton Strachey, had reshaped the Victorian attitudes of the Cambridge Apostles: "since [their] time, homosexual relations among the members were for a time common", wrote Bertrand Russell. The artist Duncan Grant, whom he met in 1908, was one of Keynes's great loves. Keynes was also involved with Lytton Strachey, though they were for the most part love rivals, not lovers. Keynes had won the affections of Arthur Hobhouse, and as with Grant, fell out with a jealous Strachey for it.

Strachey had previously found himself put off by Keynes, not least

because of his manner of "treat[ing] his love affairs statistically".

Political opponents have used Keynes's sexuality to attack his academic work. One line of attack held that he was uninterested in the long term ramifications of his theories because he had no children.

Keynes's friends in the Bloomsbury Group were initially surprised

when, in his later years, he began dating and pursuing affairs with

women, demonstrating himself to be bisexual. Ray Costelloe (who would later marry Oliver Strachey) was an early heterosexual interest of Keynes.

In 1906, Keynes had written of this infatuation that, "I seem to have

fallen in love with Ray a little bit, but as she isn't male I haven't

[been] able to think of any suitable steps to take."

Marriage

Lydia Lopokova and Keynes in the 1920s

In 1921, Keynes wrote that he had fallen "very much in love" with Lydia Lopokova, a well-known Russian ballerina and one of the stars of Sergei Diaghilev's Ballets Russes. In the early years of his courtship, he maintained an affair with a younger man, Sebastian Sprott, in tandem with Lopokova, but eventually chose Lopokova exclusively. They were married in 1925, with Keynes's former lover Duncan Grant as best man.

"What a marriage of beauty and brains, the fair Lopokova and John

Maynard Keynes" was said at the time. Keynes later commented to Strachey

that beauty and intelligence were rarely found in the same person, and

that only in Duncan Grant had he found the combination.

The union was happy, with biographer Peter Clarke writing that the

marriage gave Keynes "a new focus, a new emotional stability and a sheer

delight of which he never wearied".

Lydia became pregnant in 1927 but miscarried.

Among Keynes's Bloomsbury friends, Lopokova was, at least initially,

subjected to criticism for her manners, mode of conversation, and

supposedly humble social origins – the last of the ostensible causes

being particularly noted in the letters of Vanessa and Clive Bell, and Virginia Woolf. In her novel Mrs Dalloway (1925), Woolf bases the character of Rezia Warren Smith on Lopokova. E. M. Forster would later write in contrition about "Lydia Keynes, every whose word should be recorded": "How we all used to underestimate her".

46 Gordon Square, where Keynes would often stay while in London. Following his marriage, Keynes took out an extended lease on Tilton House, a farm in the countryside near Brighton, which became the couple's main home when not in the capital.

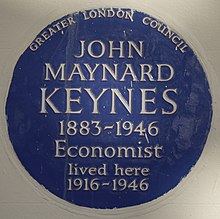

Blue plaque, 46 Gordon Square

Support for the arts

Keynes

thought that the pursuit of money for its own sake was a pathological

condition, and that the proper aim of work is to provide leisure. He

wanted shorter working hours and longer holidays for all.

Keynes was interested in literature in general and drama in particular and supported the Cambridge Arts Theatre financially, which allowed the institution to become one of the major British stages outside London.

Keynes's personal interest in classical opera and dance led him to support the Royal Opera House at Covent Garden and the Ballet Company at Sadler's Wells. During the war,

as a member of CEMA (Council for the Encouragement of Music and the

Arts), Keynes helped secure government funds to maintain both companies

while their venues were shut. Following the war, Keynes was instrumental

in establishing the Arts Council of Great Britain

and was its founding chairman in 1946. From the start, the two

organisations that received the largest grants from the new body were

the Royal Opera House and Sadler's Wells.

Like several other notable British authors of his time, Keynes was a member of the Bloomsbury Group. Virginia Woolf's biographer tells an anecdote of how Virginia Woolf, Keynes, and T. S. Eliot discussed religion at a dinner party, in the context of their struggle against Victorian era morality.

Keynes may have been confirmed, but according to Cambridge University he was clearly an agnostic, which he remained until his death.

According to one biographer, "he was never able to take religion

seriously, regarding it as a strange aberration of the human mind."

Investments

Keynes was ultimately a successful investor, building up a private fortune. His assets were nearly wiped out following the Wall Street Crash of 1929,

which he did not foresee, but he soon recouped. At Keynes's death, in

1946, his net worth stood just short of £500,000 – equivalent to about

£11 million ($16.5 million) in 2009. The sum had been amassed despite

lavish support for various good causes and his personal ethic which made

him reluctant to sell on a falling market, in cases where he saw such

behaviour as likely to deepen a slump.

Keynes built up a substantial collection of fine art, including works by Paul Cézanne, Edgar Degas, Amedeo Modigliani, Georges Braque, Pablo Picasso, and Georges Seurat (some of which can now be seen at the Fitzwilliam Museum). He enjoyed collecting books; he collected and protected many of Isaac Newton's papers. In part on the basis of these papers, Keynes wrote of Newton as "the last of the magicians."

Keynes successfully managed the endowment of King's College, Cambridge,

with the active component of his portfolio outperforming a British

equity index by an average of 8% a year over a quarter century, earning

him favourable mention by later investors such as Warren Buffett and George Soros.

Political causes

Keynes was a lifelong member of the Liberal Party,

which until the 1920s had been one of the two main political parties in

the United Kingdom, and as late as 1916 had often been the dominant

power in government. Keynes had helped campaign for the Liberals at

elections from about 1906, yet he always refused to run for office

himself, despite being asked to do so on three separate occasions in

1920. From 1926, when Lloyd George became leader of the Liberals, Keynes

took a major role in defining the party's economic policy, but by then

the Liberals had been displaced into third party status by the Labour Party.

In 1939 Keynes had the option to enter Parliament as an independent MP with the University of Cambridge seat. A by-election for the seat was to be held due to the illness of an elderly Tory, and the master of Magdalene College

had obtained agreement that none of the major parties would field a

candidate if Keynes chose to stand. Keynes declined the invitation as he

felt he would wield greater influence on events if he remained a free

agent.

Keynes was a proponent of eugenics. He served as director of the British Eugenics Society

from 1937 to 1944. As late as 1946, shortly before his death, Keynes

declared eugenics to be "the most important, significant and, I would

add, genuine branch of sociology which exists."

Keynes once remarked that "the youth had no religion save communism and this was worse than nothing." Marxism "was founded upon nothing better than a misunderstanding of Ricardo",

and, given time, he (Keynes) "would deal thoroughly with the Marxists"

and other economists to solve the economic problems their theories

"threaten to cause".

In 1931 Keynes had the following to say on Marxism:

How can I accept the Communist doctrine, which sets up as its bible, above and beyond criticism, an obsolete textbook which I know not only to be scientifically erroneous but without interest or application to the modern world? How can I adopt a creed which, preferring the mud to the fish, exalts the boorish proletariat above the bourgeoisie and the intelligentsia, who with all their faults, are the quality of life and surely carry the seeds of all human achievement? Even if we need a religion, how can we find it in the turbid rubbish of the red bookshop? It is hard for an educated, decent, intelligent son of Western Europe to find his ideals here, unless he has first suffered some strange and horrid process of conversion which has changed all his values.

Keynes was a firm supporter of women's rights and in 1932 became vice-chairman of the Marie Stopes Society which provided birth control

education. He also campaigned against job discrimination against women

and unequal pay. He was an outspoken campaigner for reform of the laws against homosexuality.

Death

Tilton House, 2017

Throughout his life, Keynes worked energetically for the benefit both

of the public and his friends; even when his health was poor, he

laboured to sort out the finances of his old college. Helping to set up the Bretton Woods system, he worked to institute an international monetary system that would be beneficial for the world economy. In 1946, Keynes suffered a series of heart attacks, which ultimately proved fatal. They began during negotiations for the Anglo-American loan in Savannah, Georgia,

where he was trying to secure favourable terms for the United Kingdom

from the United States, a process he described as "absolute hell". A few weeks after returning from the United States, Keynes died of a heart attack at Tilton, his farmhouse home near Firle, East Sussex, England, on 21 April 1946, at the age of 62.

Against his wishes (he wanted for his ashes to be deposited in the

crypt at King's), his ashes were scattered on the Downs above Tilton.

Both of Keynes's parents outlived him: his father John Neville Keynes (1852–1949) by three years, and his mother Florence Ada Keynes (1861–1958) by twelve. Keynes's brother Sir Geoffrey Keynes (1887–1982) was a distinguished surgeon, scholar, and bibliophile. His nephews include Richard Keynes (1919–2010), a physiologist, and Quentin Keynes (1921–2003), an adventurer and bibliophile. Keynes had no children; his widow, Lydia Lopokova, died in 1981.

Publications

- 1913 Indian Currency and Finance

- 1915 The Economics of War in Germany (EJ)

- 1919 The Economic Consequences of the Peace

- 1921 A Treatise on Probability

- 1922 The Inflation of Currency as a Method of Taxation (MGCRE)

- 1922 Revision of the Treaty

- 1923 A Tract on Monetary Reform

- 1925 Am I a Liberal? (N&A)

- 1926 The End of Laissez-Faire

- 1926 Laissez-Faire and Communism

- 1930 A Treatise on Money

- 1930 Economic Possibilities for our Grandchildren

- 1931 The End of the Gold Standard (Sunday Express)

- 1931 Essays in Persuasion

- 1931 The Great Slump of 1930

- 1933 The Means to Prosperity

- 1933 An Open Letter to President Roosevelt (New York Times)

- 1933 Essays in Biography

- 1936 The General Theory of Employment, Interest and Money

- 1937 The General Theory of Employment

- 1940 How to Pay for the War: A radical plan for the Chancellor of the Exchequer

- 1949 Two Memoirs. Ed. by David Garnett (On Carl Melchior and G. E. Moore.)

Copyright ©

Peter Harrison

. Published by MercatorNet. You may download and print extracts from

this article for your own personal and non-commercial use only.

Copyright ©

Peter Harrison

. Published by MercatorNet. You may download and print extracts from

this article for your own personal and non-commercial use only.