Executive compensation or executive pay is composed of the financial compensation and other non-financial awards received by an executive from their firm for their service to the organization. It is typically a mixture of salary, bonuses, shares of or call options on the company stock, benefits, and perquisites, ideally configured to take into account government regulations, tax law, the desires of the organization and the executive, and rewards for performance.

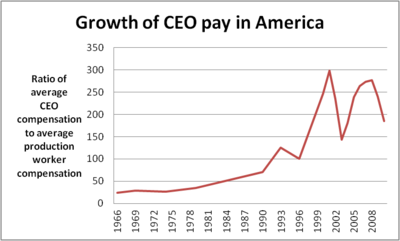

The three decades starting with the 1980s saw a dramatic rise in executive pay relative to that of an average worker's wage in the United States, and to a lesser extent in a number of other countries. Observers differ as to whether this rise is a natural and beneficial result of competition for scarce business talent that can add greatly to stockholder value in large companies, or a socially harmful phenomenon brought about by social and political changes that have given executives greater control over their own pay. Recent studies have indicated that executive compensation should be better aligned with social goals (e.g. public health goals). Executive pay is an important part of corporate governance, and is often determined by a company's board of directors.

Types

There are six basic tools of compensation or remuneration:

- salary

- short-term incentives (STIs), sometimes known as bonuses

- long-term incentive plans (LTIPs)

- employee benefits

- paid expenses (perquisites)

- insurance

In a modern corporation, the CEO

and other top executives are often paid salary plus short-term

incentives or bonuses. This combination is referred to as Total Cash

Compensation (TCC). Short-term incentives usually are formula-driven

and have some performance criteria attached depending on the role of the

executive. For example, the Sales Director's performance related bonus

may be based on incremental revenue growth turnover; a CEO's could be

based on incremental profitability and revenue growth. Bonuses are

after-the-fact (not formula driven) and often discretionary. Executives

may also be compensated with a mixture of cash and shares of the company

which are almost always subject to vesting

restrictions (a long-term incentive). To be considered a long-term

incentive the measurement period must be in excess of one year (3–5

years is common). The vesting term refers to the period of time before

the recipient has the right to transfer shares and realize value.

Vesting can be based on time, performance or both. For example, a CEO

might get 1 million in cash, and 1 million in company shares (and share

buy options used). Vesting can occur in two ways: "cliff vesting"

(vesting occurring on one date), and "graded vesting" (which occurs over

a period of time) and which maybe "uniform" (e.g., 20% of the options

vest each year for 5 years) or "non-uniform" (e.g., 20%, 30% and 50% of

the options vest each year for the next three years).

Other components of an executive compensation package may include such

perks as generous retirement plans, health insurance, a chauffeured limousine, an executive jet, and interest-free loans for the purchase of housing.

Stock options

Executive

stock option pay rose dramatically in the United States after scholarly

support from University of Chicago educated Professors Michael C.

Jensen and Kevin J. Murphy. Due to their publications in the Harvard

Business Review 1990 and support from Wall Street and institutional

investors, Congress passed a law making it cost effective to pay executives in equity.

Supporters of stock options say they align the interests of CEOs

to those of shareholders, since options are valuable only if the stock

price remains above the option's strike price. Stock options are now counted as a corporate expense (non-cash), which impacts a company's income statement

and makes the distribution of options more transparent to shareholders.

Critics of stock options charge that they are granted without

justification as there is little reason to align the interests of CEOs

with those of shareholders. Empirical evidence

shows since the wide use of stock options, executive pay relative to

workers has dramatically risen. Moreover, executive stock options

contributed to the accounting manipulation scandals of the late 1990s

and abuses such as the options backdating of such grants. Finally, researchers have shown

that relationships between executive stock options and stock buybacks,

implying that executives use corporate resources to inflate stock prices

before they exercise their options.

Stock options also incentivize executives to engage in risk-seeking behavior. This is because the value of a call option increases with increased volatility. Stock options also present a potential up-side gain (if the stock price goes up) for the executive, but no downside risk

(if the stock price goes down, the option simply isn't exercised).

Stock options therefore can incentivize excessive risk seeking behavior

that can lead to catastrophic corporate failure.

Restricted stock

Executives are also compensated with restricted stock,

which is stock given to an executive that cannot be sold until certain

conditions are met and has the same value as the market price of the

stock at the time of grant. As the size of stock option grants have been

reduced, the number of companies granting restricted stock either with

stock options or instead of, has increased. Restricted stock has its

detractors, too, as it has value even when the stock price falls. As an

alternative to straight time vested restricted stock, companies have

been adding performance type features to their grants. These grants,

which could be called performance shares, do not vest or are not granted

until these conditions are met. These performance conditions could be

earnings per share or internal financial targets.

Levels

The

levels of compensation in all countries has been rising dramatically

over the past decades. Not only is it rising in absolute terms, but also

in relative terms. In 2007, the world's highest paid chief executive

officers and chief financial officers were American. They made 400 times

more than average workers—a gap 20 times bigger than it was in 1965. In 2010 the highest paid CEO was Viacom's Philippe P. Dauman at $84.5 million

The U.S. has the world's highest CEO's compensation relative to

manufacturing production workers. According to one 2005 estimate the

U.S. ratio of CEO's to production worker pay is 39:1 compared to 31.8:1

in UK; 25.9:1 in Italy; 24.9:1 in New Zealand.

Controversy

The explosion in executive pay has become controversial, criticized by not only leftists, but conservative establishmentarians such as Peter Drucker, John Bogle, Warren Buffett.

The idea that stock options and other alleged pay-for-performance

are driven by economics has also been questioned. According to

economist Paul Krugman,

"Today the idea that huge paychecks are part of a beneficial system in which executives are given an incentive to perform well has become something of a sick joke. A 2001 article in Fortune, "The Great CEO Pay Heist" encapsulated the cynicism: You might have expected it to go like this: The stock isn't moving, so the CEO shouldn't be rewarded. But it was actually the opposite: The stock isn't moving, so we've got to find some other basis for rewarding the CEO.` And the article quoted a somewhat repentant Michael Jensen [a theorist for stock option compensation]: `I've generally worried these guys weren't getting paid enough. But now even I'm troubled.'"

Recently, empirical evidence showed that compensation consultants

only further exacerbated the controversy. A study of more than 1,000 US

companies over six years finds “strong empirical evidence” that

executive compensation consultants have been hired as a “justification

device” for higher CEO pay.

Defenders of high executive pay say that the global war for talent and the rise of private equity

firms can explain much of the increase in executive pay. For example,

while in conservative Japan a senior executive has few alternatives to

his current employer, in the United States it is acceptable and even

admirable for a senior executive to jump to a competitor, to a private

equity firm, or to a private equity portfolio company.

Portfolio company executives take a pay cut but are routinely granted

stock options for ownership of ten percent of the portfolio company,

contingent on a successful tenure. Rather than signaling a conspiracy,

defenders argue, the increase in executive pay is a mere byproduct of

supply and demand for executive talent. However, U.S. executives make

substantially more than their European and Asian counterparts.

United States

Source: Economic Policy Institute. 2011.

The U.S. Securities and Exchange Commission

(SEC) has asked publicly traded companies to disclose more information

explaining how their executives' compensation amounts are determined.

The SEC has also posted compensation amounts on its website

to make it easier for investors to compare compensation amounts paid by

different companies. It is interesting to juxtapose SEC regulations

related to executive compensation with Congressional efforts to address

such compensation.

Since the 1990s, CEO compensation in the US has outpaced

corporate profits, economic growth and the average compensation of all

workers. Between 1980 and 2004, Mutual Fund founder John Bogle

estimates total CEO compensation grew 8.5% year, compared to corporate

profit growth of 2.9%/year and per capita income growth of 3.1%. By 2006 CEOs made 400 times more than average workers—a gap 20 times bigger than it was in 1965. As a general rule, the larger the corporation the larger the CEO compensation package.

The share of corporate income devoted to compensating the five

highest paid executives of (each) public firms more than doubled from

4.8% in 1993-1995 to 10.3% in 2001-2003.

The pay for the five top-earning executives at each of the largest 1500

American companies for the ten years from 1994 to 2004 is estimated at

approximately $500 billion in 2005 dollars.

As of late March 2012 USA Today's tally showed the median CEO pay of the S&P 500 for 2011 was $9.6 million.

Lower level executives also have fared well. About 40% of the top

0.1% income earners in the United States are executives, managers, or

supervisors (and this doesn't include the finance industry) — far out of

proportion to less than 5% of the working population that management

occupations make up.

A study by University of Florida researchers found that highly paid CEOs improve company profitability as opposed to executives making less for similar jobs.

However, a review of the experimental and quasi-experimental research

relevant to executive compensation, by Philippe Jacquart and J. Scott Armstrong,

found opposing results. In particular, the authors conclude that "the

notion that higher pay leads to the selection of better executives is

undermined by the prevalence of poor recruiting methods. Moreover,

higher pay fails to promote better performance. Instead, it undermines

the intrinsic motivation of executives, inhibits their learning, leads

them to ignore other stakeholders, and discourages them from considering

the long-term effects of their decisions on stakeholders"

Another study by Professors Lynne M. Andersson and Thomas S. Batemann published in the Journal of Organizational Behavior found that highly paid executives are more likely to behave cynically and therefore show tendencies of unethical performance.

Australia

In

Australia, shareholders can vote against the pay rises of board members,

but the vote is non-binding. Instead the shareholders can sack some or

all of the board members. Australia's corporate watchdog, the Australian Securities and Investments Commission has called on companies to improve the disclosure of their remuneration arrangements for directors and executives.

Canada

A 2012 report by the Canadian Centre for Policy Alternatives

demonstrated that the top 100 Canadian CEOs were paid an average of

C$8.4 million in 2010, a 27% increase over 2009, this compared to

C$44,366 earned by the average Canadian that year, 1.1% more than in

2009. The top three earners were automotive supplier Magna International Inc. founder Frank Stronach at C$61.8 million, co-CEO Donald Walker at C$16.7 million and former co-CEO Siegfried Wolf at C$16.5 million.

Europe

In 2008, Jean-Claude Juncker, president of the European Commission's “Eurogroup” of finance ministers, called excessive pay a “social scourge” and demanded action.

United Kingdom

Although executive compensation in the UK is said to be "dwarfed" by that of corporate America, it has caused public upset. In response to criticism of high levels of executive pay, the Compass organisation set up the High Pay Commission. Its 2011 report described the pay of executives as "corrosive".

In December 2011/January 2012 two of the country’s biggest investors, Fidelity Worldwide Investment, and the Association of British Insurers, called for greater shareholder control over executive pay packages.

Dominic Rossi of Fidelity Worldwide Investment stated, “Inappropriate

levels of executive reward have destroyed public trust and led to a

situation where all directors are perceived to be overpaid. The simple

truth is that remuneration schemes have become too complex and, in some

cases, too generous and out of line with the interests of investors.”

Two sources of public anger were Barclays, where senior executives were promised million-pound pay packages despite a 30% drop in share price; and Royal Bank of Scotland where the head of investment banking was set to earn a "large sum" after thousands of employees were made redundant.

Asia

Since the

early 2000s, companies in Asia are following the U.S. model in

compensating top executives, with bigger paychecks plus bonuses and

stock options.

However, with a great diversity in stages of development in listing

rules, disclosure requirements and quality of talent, the level and

structure of executive pay is still very different across Asia

countries.

Disclosures on top executive pay is less transparent compared to that

in the United Kingdom. Singapore and Hong Kong stock exchange rules are

the most comprehensive, closely followed by Japan's, which has stepped

up its requirements since 2010.

China

Executive

compensation in China still differs from compensation in Europe and the

U.S. but the situation is changing rapidly. Based on a research paper by

Conyon,

executive compensation in China is mostly composed of salaries and

bonuses, as stock options and equity incentives are relatively rare

elements of a Chinese senior manager's compensation package. Since 2016

Chinese-listed companies were required to report total compensation of

their top managers and board members. However, transparency and what

information companies choose to release to the public varies greatly.

Chinese private companies usually implement a performance-based

compensation model, whereas State-owned enterprises apply a uniform

salary-management system. Executive compensation for Chinese executives

reached USD 150 000 on average and increased by 9.1% in 2017.

Regulation

There are a number of strategies that could be employed as a response to the growth of executive compensation.

- Extend the vesting period of executives' stock and options. Current vesting periods can be as short as three years, which encourages managers to inflate short-term stock price at the expense of long-run value, since they can sell their holdings before a decline occurs.

- As passed in the Swiss referendum "against corporate Rip-offs" of 2013, investors gain total control over executive compensation, and the executives of a board of directors. Institutional intermediaries must all vote in the interests of their beneficiaries and banks are prohibited from voting on behalf of investors.

- Disclosure of salaries is the first step, so that company stakeholders can know and decide whether or not they think remuneration is fair. In the UK, the Directors' Remuneration Report Regulations 2002 introduced a requirement into the old Companies Act 1985, the requirement to release all details of pay in the annual accounts. This is now codified in the Companies Act 2006. Similar requirements exist in most countries, including the U.S., Germany, and Canada.

- A say on pay - a non-binding vote of the general meeting to approve director pay packages, is practised in a growing number of countries. Some commentators have advocated a mandatory binding vote for large amounts (e.g. over $5 million). The aim is that the vote will be a highly influential signal to a board to not raise salaries beyond reasonable levels. The general meeting means shareholders in most countries. In most European countries though, with two-tier board structures, a supervisory board will represent employees and shareholders alike. It is this supervisory board which votes on executive compensation.

- Another proposed reform is the bonus-malus system, where executives carry down-side risk in addition to potential up-side reward.

- Progressive taxation is a more general strategy that affects executive compensation, as well as other highly paid people. There has been a recent trend to cutting the highest bracket tax payers, a notable example being the tax cuts in the U.S. For example, the Baltic States have a flat tax system for incomes. Executive compensation could be checked by taxing more heavily the highest earners, for instance by taking a greater percentage of income over $200,000.

- Maximum wage is an idea which has been enacted in early 2009 in the United States, where they capped executive pay at $500,000 per year for companies receiving extraordinary financial assistance from the U.S. taxpayers. The argument is to place a cap on the amount that any person may legally make, in the same way as there is a floor of a minimum wage so that people can not earn too little.

- Debt Like Compensation - If an executive is compensated exclusively with equity, he will take risks to benefit shareholders at the expense of debtholders. Thus, there are several proposals to compensate executives with debt as well as equity, to mitigate their risk-shifting tendencies.

- Indexing Operating Performance is a way to make bonus targets business cycle independent. Indexed bonus targets move with the business cycle and are therefore fairer and valid for a longer period of time.

- Two strikes - In Australia an amendment to the Corporations Amendment(Improving Accountability on Director and Executive Remuneration) Bill 2011 puts in place processes to trigger a re-election of a Board where a 25% "no" vote by shareholders to the company's remuneration report has been recorded in two consecutive annual general meetings. When the second "no" vote is recorded at an AGM, the meeting will be suspended and shareholders will be asked to vote on whether a spill meeting is to be held. This vote must be upheld by at least a 50% majority for the spill (or re-election process) to be run. At a spill meeting all directors current at the time the remuneration report was considered are required to stand for re-election.

- Independent non-executive director setting of compensation is widely practised. An independent remuneration committee is an attempt to have pay packages set at arms' length from the directors who are getting paid.

- On March 2016, the Israeli Parliament set a unique law that effectively sets an upper bound to executive compensation in financial firms. According to the Law, an annual executive compensation greater than 2.5 million New Israeli Shekel (approximately US$650,000) cannot be granted by a financial corporation if it is more than 35 times the lowest salary paid by the corporation.