A cryptocurrency (or crypto currency) is digital asset designed to work as a medium of exchange that uses strong cryptography to secure financial transactions, control the creation of additional units, and verify the transfer of assets.[1][2][3] Cryptocurrency is a kind of digital currency, virtual currency or alternative currency. Cryptocurrencies use decentralized control[4] as opposed to centralized electronic money and central banking systems.[5] The decentralized control of each cryptocurrency works through distributed ledger technology, typically a blockchain, that serves as a public financial transaction database.[6][7]

Bitcoin, first released as open-source software in 2009, is generally considered the first decentralized cryptocurrency.[8] Since then, over 4,000 altcoin (alternative coin) variants of bitcoin have been created.

Bitcoin, first released as open-source software in 2009, is generally considered the first decentralized cryptocurrency.[8] Since then, over 4,000 altcoin (alternative coin) variants of bitcoin have been created.

Formal definition

According to Jan Lansky, a cryptocurrency is a system that meets six conditions:[9]- The system does not require a central authority, distributed achieve consensus on its state [sic].

- The system keeps an overview of cryptocurrency units and their ownership.

- The system defines whether new cryptocurrency units can be created. If new cryptocurrency units can be created, the system defines the circumstances of their origin and how to determine the ownership of these new units.

- Ownership of cryptocurrency units can be proved exclusively cryptographically.

- The system allows transactions to be performed in which ownership of the cryptographic units is changed. A transaction statement can only be issued by an entity proving the current ownership of these units.

- If two different instructions for changing the ownership of the same cryptographic units are simultaneously entered, the system performs at most one of them.

Altcoin

The term altcoin has various similar definitions. Stephanie Yang of The Wall Street Journal defined altcoins as "alternative digital currencies,"[11] while Paul Vigna, also of The Wall Street Journal, described altcoins as alternative versions of bitcoin.[12] Aaron Hankins of the MarketWatch[13] refers to any cryptocurrency other than bitcoin as altcoins.Overview

Decentralized cryptocurrency is produced by the entire cryptocurrency system collectively, at a rate which is defined when the system is created and which is publicly known. In centralized banking and economic systems such as the Federal Reserve System, corporate boards or governments control the supply of currency by printing units of fiat money or demanding additions to digital banking ledgers. In case of decentralized cryptocurrency, companies or governments cannot produce new units, and have not so far provided backing for other firms, banks or corporate entities which hold asset value measured in it. The underlying technical system upon which decentralized cryptocurrencies are based was created by the group or individual known as Satoshi Nakamoto.[14]As of May 2018, over 1,800 cryptocurrency specifications existed.[15] Within a cryptocurrency system, the safety, integrity and balance of ledgers is maintained by a community of mutually distrustful parties referred to as miners: who use their computers to help validate and timestamp transactions, adding them to the ledger in accordance with a particular timestamping scheme.[16]

Most cryptocurrencies are designed to gradually decrease production of that currency, placing a cap on the total amount of that currency that will ever be in circulation.[17] Compared with ordinary currencies held by financial institutions or kept as cash on hand, cryptocurrencies can be more difficult for seizure by law enforcement.[1] This difficulty is derived from leveraging cryptographic technologies.

Architecture

Blockchain

The validity of each cryptocurrency's coins is provided by a blockchain. A blockchain is a continuously growing list of records, called blocks, which are linked and secured using cryptography.[14][18] Each block typically contains a hash pointer as a link to a previous block,[18] a timestamp and transaction data.[19] By design, blockchains are inherently resistant to modification of the data. It is "an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way".[20] For use as a distributed ledger, a blockchain is typically managed by a peer-to-peer network collectively adhering to a protocol for validating new blocks. Once recorded, the data in any given block cannot be altered retroactively without the alteration of all subsequent blocks, which requires collusion of the network majority.Blockchains are secure by design and are an example of a distributed computing system with high Byzantine fault tolerance. Decentralized consensus has therefore been achieved with a blockchain.[21] It solves the double spending problem without the need of a trusted authority or central server.

The block time is the average time it takes for the network to generate one extra block in the blockchain.[22] Some blockchains create a new block as frequently as every five seconds.[23] By the time of block completion, the included data becomes verifiable. This is practically when the money transaction takes place, so a shorter block time means faster transactions.[citation needed]

Timestamping

Cryptocurrencies use various timestamping schemes to avoid the need for a trusted third party to timestamp transactions added to the blockchain ledger.Proof-of-work schemes

The first timestamping scheme invented was the proof-of-work scheme. The most widely used proof-of-work schemes are based on SHA-256 and scrypt.[24] The latter now dominates over the world of cryptocurrencies, with at least 480 confirmed implementations.[25]Some other hashing algorithms that are used for proof-of-work include CryptoNight, Blake, SHA-3, and X11.

Proof-of-stake and combined schemes

Some cryptocurrencies use a combined proof-of-work/proof-of-stake scheme.[24] The proof-of-stake is a method of securing a cryptocurrency network and achieving distributed consensus through requesting users to show ownership of a certain amount of currency. It is different from proof-of-work systems that run difficult hashing algorithms to validate electronic transactions. The scheme is largely dependent on the coin, and there's currently no standard form of it.Mining

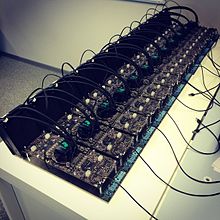

Hashcoin mine

In cryptocurrency networks, mining is a validation of transactions. For this effort, successful miners obtain new cryptocurrency as a reward. The reward decreases transaction fees by creating a complementary incentive to contribute to the processing power of the network. The rate of generating hashes, which validate any transaction, has been increased by the use of specialized machines such as FPGAs and ASICs running complex hashing algorithms like SHA-256 and Scrypt.[26] This arms race for cheaper-yet-efficient machines has been on since the day the first cryptocurrency, bitcoin, was introduced in 2009.[26] With more people venturing into the world of virtual currency, generating hashes for this validation has become far more complex over the years, with miners having to invest large sums of money on employing multiple high performance ASICs. Thus the value of the currency obtained for finding a hash often does not justify the amount of money spent on setting up the machines, the cooling facilities to overcome the enormous amount of heat they produce, and the electricity required to run them.[26][27]

Some miners pool resources, sharing their processing power over a network to split the reward equally, according to the amount of work they contributed to the probability of finding a block. A "share" is awarded to members of the mining pool who present a valid partial proof-of-work.

One company is operating data centers for mining operations at Canadian oil and gas field sites, due to low gas prices.[28]

Given the economic and environmental concerns associated with mining, various "minerless" cryptocurrencies are undergoing active development.[29][30][31] Unlike conventional blockchains, some directed acyclic graph cryptocurrencies utilise a pay-it-forward system, whereby each account performs minimally heavy computations on two previous transactions to verify. Other cryptocurrencies like Nano utilise a block-lattice structure whereby each individual account has its own blockchain. With each account controlling its own transactions, no traditional proof-of-work mining is required, allowing for feeless, instantaneous transactions.[32][better source needed]

As of February 2018, the Chinese Government halted trading of virtual currency, banned initial coin offerings and shut down mining. Some Chinese miners have since relocated to Canada.[33] According to a February 2018 report from Fortune,[34] Iceland has become a haven for cryptocurrency miners in part because of its cheap electricity. Prices are contained because nearly all of the country’s energy comes from renewable sources, prompting more mining companies to consider opening operations in Iceland. The region’s energy company says bitcoin mining is becoming so popular that the country will likely use more electricity to mine coins than power homes in 2018. In October 2018 Russia will become home to one of the largest legal mining operations in the world, located in Siberia. More than 1.5 million Russians are engaged in home mining. Russia’s energy resources and climate provide some of the best conditions for crypto mining.[35]

In March 2018, a town in Upstate New York put an 18 month moratorium on all cryptocurrency mining in an effort to preserve natural resources and the "character and direction" of the city.[36]

An example paper printable bitcoin wallet consisting of one bitcoin

address for receiving and the corresponding private key for spending.

Wallets

A cryptocurrency wallet stores the public and private "keys" or "addresses" which can be used to receive or spend the cryptocurrency. With the private key, it is possible to write in the public ledger, effectively spending the associated cryptocurrency. With the public key, it is possible for others to send currency to the wallet.Anonymity

Bitcoin is pseudonymous rather than anonymous in that the cryptocurrency within a wallet is not tied to people, but rather to one or more specific keys (or "addresses").[37] Thereby, bitcoin owners are not identifiable, but all transactions are publicly available in the blockchain.[37] Still, cryptocurrency exchanges are often required by law to collect the personal information of their users.[37]Additions such as Zerocoin have been suggested, which would allow for true anonymity.[38][39][40] In recent years, anonymizing technologies like zero-knowledge proofs and ring signatures have been employed in the cryptocurrencies Zcash and Monero, respectively.

Economics

Cryptocurrencies are used primarily outside existing banking and governmental institutions and are exchanged over the Internet. While these alternative, decentralized modes of exchange are in the early stages of development, they have the unique potential to challenge existing systems of currency and payments. As of April 23, 2018, total market capitalization of cryptocurrencies passes 400 billion USD.[41]Competition in cryptocurrency markets

Transaction fees

Transaction fees for cryptocurrency depend mainly on the supply of network capacity at the time, versus the demand from the currency holder for a faster transaction. The currency holder can choose a specific transaction fee, while network entities process transactions in order of highest offered fee to lowest. Cryptocurrency exchanges can simplify the process for currency holders by offering priority alternatives and thereby determine which fee will likely cause the transaction to be processed in the requested time.For ether, transaction fees differ by computational complexity, bandwidth use and storage needs, while bitcoin transactions compete equally with each other.[42] In December 2017, the median transaction fee for ether corresponded to $0.33, while for bitcoin it corresponded to $23.[43]

Legality

The legal status of cryptocurrencies varies substantially from country to country and is still undefined or changing in many of them. While some countries have explicitly allowed their use and trade,[44] others have banned or restricted it. Likewise, various government agencies, departments, and courts have classified bitcoins differently. China Central Bank banned the handling of bitcoins by financial institutions in China in early 2014.[45] In Russia, though cryptocurrencies are legal, it is illegal to actually purchase goods with any currency other than the Russian ruble.[46]Cryptocurrencies are a potential tool to evade economic sanctions for example against Russia, Iran, or Venezuela. In April 2018, Russian and Iranian economic representatives met to discuss how to bypass the global SWIFT system through decentralized blockchain technology.[47] Russia also secretly supported Venezuela with the creation of the petro (El Petro), a national cryptocurrency initiated by the Maduro government to obtain valuable oil revenues by circumventing US sanctions.[48]

U.S. tax status

On March 25, 2014, the United States Internal Revenue Service (IRS) ruled that bitcoin will be treated as property for tax purposes. This means bitcoin will be subject to capital gains tax.[49] In a paper published by researchers from Oxford and Warwick, it was shown that bitcoin has some characteristics more like the precious metals market than traditional currencies, hence in agreement with the IRS decision even if based on different reasons.[50]Legal issues not dealing with governments have also arisen for cryptocurrencies. Coinye, for example, is an altcoin that used rapper Kanye West as its logo without permission. Upon hearing of the release of Coinye, originally called Coinye West, attorneys for Kanye West sent a cease and desist letter to the email operator of Coinye, David P. McEnery Jr. The letter stated that Coinye was willful trademark infringement, unfair competition, cyberpiracy, and dilution and instructed Coinye to stop using the likeness and name of Kanye West.[51] 17 January 2014 Coinye was closed.[52]

A primary example of this new challenge for law enforcement comes from the Silk Road case, where Ulbricht's bitcoin stash "was held separately and ... encrypted."[53]

The legal concern of an unregulated global economy

As the popularity of and demand for online currencies has increased since the inception of bitcoin in 2009,[54][55] so have concerns that such an unregulated person to person global economy that cryptocurrencies offer may become a threat to society. Concerns abound that altcoins may become tools for anonymous web criminals.[56]Cryptocurrency networks display a lack of regulation that has been criticized as enabling criminals who seek to evade taxes and launder money.

Transactions that occur through the use and exchange of these altcoins are independent from formal banking systems, and therefore can make tax evasion simpler for individuals. Since charting taxable income is based upon what a recipient reports to the revenue service, it becomes extremely difficult to account for transactions made using existing cryptocurrencies, a mode of exchange that is complex and difficult to track.[56]

Systems of anonymity that most cryptocurrencies offer can also serve as a simpler means to launder money. Rather than laundering money through an intricate net of financial actors and offshore bank accounts, laundering money through altcoins can be achieved through anonymous transactions.[56]

Loss, theft, and fraud

GBL, a Chinese bitcoin trading platform, suddenly shut down on October 26, 2013. Subscribers, unable to log in, lost up to $5 million worth of bitcoin.[57][58]In February 2014 the world's largest bitcoin exchange, Mt. Gox, declaring bankruptcy. The company stated that it had lost nearly $473 million of their customers' bitcoins likely due to theft. This was equivalent to approximately 750,000 bitcoins, or about 7% of all the bitcoins in existence. The price of a bitcoin fell from a high of about $1,160 in December to under $400 in February.[59]

Two members of the Silk Road Task Force—a multi-agency federal task force that carried out the U.S. investigation of Silk Road—seized bitcoins for their own use in the course of the investigation.[60] DEA agent Carl Mark Force IV, who attempted to extort Silk Road founder Ross Ulbricht ("Dread Pirate Roberts"), pleaded guilty to money laundering, obstruction of justice, and extortion under color of official right, and was sentenced to 6.5 years in federal prison.[60] U.S. Secret Service agent Shaun Bridges pleaded guilty to crimes relating to his diversion of $800,000 worth of bitcoins to his personal account during the investigation, and also separately pleaded guilty to money laundering in connection with another cryptocurrency theft; he was sentenced to nearly eight years in federal prison.[61]

Homero Josh Garza, who founded the cryptocurrency startups GAW Miners and ZenMiner in 2014, acknowledged in a plea agreement that the companies were part of a pyramid scheme, and pleaded guilty to wire fraud in 2015. The U.S. Securities and Exchange Commission separately brought a civil enforcement action against Garza, who was eventually ordered to pay a judgment of $9.1 million plus $700,000 in interest. The SEC's complaint stated that Garza, through his companies, had fraudulently sold "investment contracts representing shares in the profits they claimed would be generated" from mining.[62]

On November 21, 2017, the Tether cryptocurrency announced they were hacked, losing $31 million in USTD from their primary wallet.[63] The company has 'tagged' the stolen currency, hoping to 'lock' them in the hacker's wallet (making them unspendable). Tether indicates that it is building a new core for its primary wallet in response to the attack in order to prevent the stolen coins from being used.

On December 6, 2017, more than $60 million worth of bitcoin was stolen after a cyber attack hit the cryptocurrency-mining platform NiceHash (Slovenia-based company). According to the CEO Marko Kobal and co-founder Sasa Coh, bitcoins worth $64 million USD were stolen, although users have pointed to a bitcoin wallet which held 4,736.42 bitcoins, equivalent to $67 million.[64][65]

The French regulator Autorité des marchés financiers (AMF) lists 15 websites of companies that solicit investment in cryptocurrency without being authorised to do so in France.[66]

Darknet markets

Cryptocurrency is also used in controversial settings in the form of online black markets, such as Silk Road. The original Silk Road was shut down in October 2013 and there have been two more versions in use since then. In the year following the initial shutdown of Silk Road, the number of prominent dark markets increased from four to twelve, while the amount of drug listings increased from 18,000 to 32,000.[56]Darknet markets present challenges in regard to legality. Bitcoins and other forms of cryptocurrency used in dark markets are not clearly or legally classified in almost all parts of the world. In the U.S., bitcoins are labelled as "virtual assets". This type of ambiguous classification puts pressure on law enforcement agencies around the world to adapt to the shifting drug trade of dark markets.[67]

Initial coin offerings

An initial coin offering (ICO) is a controversial means of raising funds for a new cryptocurrency venture. An ICO may be used by startups with the intention of avoiding regulation. However, securities regulators in many jurisdictions, including in the U.S., and Canada have indicated that if a coin or token is an "investment contract" (e.g., under the Howey test, i.e., an investment of money with a reasonable expectation of profit based significantly on the entrepreneurial or managerial efforts of others), it is a security and is subject to securities regulation. In an ICO campaign, a percentage of the cryptocurrency (usually in the form of "tokens") is sold to early backers of the project in exchange for legal tender or other cryptocurrencies, often bitcoin or ether.[68][69][70]According to PricewaterhouseCoopers, four of the 10 biggest proposed initial coin offerings have used Switzerland as a base, where they are frequently registered as non-profit foundations. The Swiss regulatory agency FINMA stated that it would take a “balanced approach“ to ICO projects and would allow “legitimate innovators to navigate the regulatory landscape and so launch their projects in a way consistent with national laws protecting investors and the integrity of the financial system.” In response to numerous requests by industry representatives, a legislative ICO working group began to issue legal guidelines in 2018, which are intended to remove uncertainty from cryptocurrency offerings and to establish sustainable business practices.[71]

Academic studies

- Journals

Reception

Cryptocurrencies have been compared to Ponzi schemes, pyramid schemes[76] and economic bubbles,[77] such as housing market bubbles.[78] Howard Marks of Oaktree Capital Management stated in 2017 that digital currencies were "nothing but an unfounded fad (or perhaps even a pyramid scheme), based on a willingness to ascribe value to something that has little or none beyond what people will pay for it", and compared them to the tulip mania (1637), South Sea Bubble (1720), and dot-com bubble (1999).[79] In October 2017, BlackRock CEO Larry Fink called bitcoin an 'index of money laundering'.[80] "Bitcoin just shows you how much demand for money laundering there is in the world," he said.While cryptocurrencies are digital currencies that are managed through advanced encryption techniques, many governments have taken a cautious approach toward them, fearing their lack of central control and the effects they could have on financial security.[81] Regulators in several countries have warned against cryptocurrency and some have taken concrete regulatory measures to dissuade users.[82] Additionally, many banks do not offer services for cryptocurrencies and can refuse to offer services to virtual-currency companies.[83] While traditional financial products have strong consumer protections in place, there is no intermediary with the power to limit consumer losses if bitcoins are lost or stolen.[84] One of the features cryptocurrency lacks in comparison to credit cards, for example, is consumer protection against fraud, such as chargebacks.

An enormous amount of energy goes into proof-of-work cryptocurrency mining, although cryptocurrency proponents claim it is important to compare it to the consumption of the traditional financial system.[85]

There are also purely technical elements to consider. For example, technological advancement in cryptocurrencies such as bitcoin result in high up-front costs to miners in the form of specialized hardware and software.[86] Cryptocurrency transactions are normally irreversible after a number of blocks confirm the transaction. Additionally, cryptocurrency can be permanently lost from local storage due to malware or data loss. This can also happen through the destruction of the physical media, effectively removing lost cryptocurrencies forever from their markets.[87]

The cryptocurrency community refers to pre-mining, hidden launches, ICO or extreme rewards for the altcoin founders as a deceptive practice.[88] It can also be used as an inherent part of a cryptocurrency's design.[89] Pre-mining means currency is generated by the currency's founders prior to being released to the public.[90]

Paul Krugman, Nobel Memorial Prize in Economic Sciences winner does not like bitcoin, has repeated numerous times that it is a bubble that will not last[91] and links it to Tulip mania.[92]

American business magnate Warren Buffett thinks that cryptocurrency will come to a bad ending.[93]

Causing a rise in GPU prices

The sudden increase in cryptocurrency mining increased the demand of graphics cards (GPU) in 2017.[94] Popular favorites of cryptocurrency miners such as Nvidia’s GTX 1060 and GTX 1070 graphics cards, as well as AMD’s RX 570 and RX 580 GPUs, doubled if not tripled in price – or were out of stock completely.[95] A GTX 1070 Ti which was released at a price of $450 sold for as much as $1100. Another popular card GTX 1060's 6 GB model was released at an MSRP of $250, sold for almost $500. RX 570 and RX 580 cards from AMD were out of stock for almost a year. Miners regularly buy up the entire stock of new GPU's as soon as they are available, further driving prices up.[96] This has caused, in general, a disliking towards cryptocurrency miners by PC gamers and tech enthusiasts.Nvidia is reportedly asking retailers to do what they can when it comes to selling GPUs to gamers instead of miners. "Gamers come first for Nvidia," said Boris Böhles, PR manager for Nvidia in the German region, in an interview with the German publication ComputerBase. "All activities around our GeForce products are for our core audience. We recommend our trading partners make arrangements to ensure that gamers’ needs are still met in the current climate."[97]

History

In 1983 the American cryptographer David Chaum conceived an anonymous cryptographic electronic money called ecash.[98][99] Later, in 1995, he implemented it through Digicash,[100] an early form of cryptographic electronic payments which required user software in order to withdraw notes from a bank and designate specific encrypted keys before it can be sent to a recipient. This allowed the digital currency to be untraceable by the issuing bank, the government, or a third party.In 1996 the NSA published a paper entitled How to Make a Mint: the Cryptography of Anonymous Electronic Cash, describing a Cryptocurrency system first publishing it in a MIT mailing list[101] and later in 1997, in The American Law Review (Vol. 46, Issue 4).[102]

In 1998, Wei Dai published a description of "b-money", an anonymous, distributed electronic cash system.[103] Shortly thereafter, Nick Szabo created "bit gold".[104] Like bitcoin and other cryptocurrencies that would follow it, bit gold (not to be confused with the later gold-based exchange, BitGold) was an electronic currency system which required users to complete a proof of work function with solutions being cryptographically put together and published. A currency system based on a reusable proof of work was later created by Hal Finney who followed the work of Dai and Szabo.

The first decentralized cryptocurrency, bitcoin, was created in 2009 by pseudonymous developer Satoshi Nakamoto. It used SHA-256, a cryptographic hash function, as its proof-of-work scheme.[16][105] In April 2011, Namecoin was created as an attempt at forming a decentralized DNS, which would make internet censorship very difficult. Soon after, in October 2011, Litecoin was released. It was the first successful cryptocurrency to use scrypt as its hash function instead of SHA-256. Another notable cryptocurrency, Peercoin was the first to use a proof-of-work/proof-of-stake hybrid.[24] IOTA was the first cryptocurrency not based on a blockchain, and instead uses the Tangle.[106][107] Built on a custom blockchain,[108] The Divi Project allows for easy exchange between currencies from within the wallet.[109] Many other cryptocurrencies have been created though few have been successful, as they have brought little in the way of technical innovation.[110] On 6 August 2014, the UK announced its Treasury had been commissioned to do a study of cryptocurrencies, and what role, if any, they can play in the UK economy. The study was also to report on whether regulation should be considered.[111]

Publicity

Gareth Murphy, a senior central banking officer has stated "widespread use [of cryptocurrency] would also make it more difficult for statistical agencies to gather data on economic activity, which are used by governments to steer the economy". He cautioned that virtual currencies pose a new challenge to central banks' control over the important functions of monetary and exchange rate policy.[112]

Jordan Kelley, founder of Robocoin, launched the first bitcoin ATM in the United States on February 20, 2014. The kiosk installed in Austin, Texas is similar to bank ATMs but has scanners to read government-issued identification such as a driver's license or a passport to confirm users' identities.[113] By September 2017, 1,574 bitcoin ATMs had been installed around the world with an average fee of 9.05%. An average of 3 bitcoin ATMs were being installed per day in September 2017.[114]

The Dogecoin Foundation, a charitable organization centered around Dogecoin and co-founded by Dogecoin co-creator Jackson Palmer, donated more than $30,000 worth of Dogecoin to help fund the Jamaican bobsled team's trip to the 2014 Olympic games in Sochi, Russia.[115] The growing community around Dogecoin is looking to cement its charitable credentials by raising funds to sponsor service dogs for children with special needs.[116]