Adam Smith

| |

|---|---|

| |

| Born | 16 June [O.S. 5 June] 1723

Kirkcaldy, Fife, Scotland

|

| Died | 17 July 1790 (aged 67)

Edinburgh, Scotland

|

| Nationality | Scottish |

| Alma mater | University of Glasgow Balliol College, Oxford |

Notable work

| The Wealth of Nations The Theory of Moral Sentiments |

| Region | Western philosophy |

| School | Classical economics, classical liberalism |

Main interests

| Political philosophy, ethics, economics |

Notable ideas

| Classical economics, modern free market, division of labour, the "invisible hand" |

| Signature | |

Adam Smith FRSA (16 June [O.S. 5 June] 1723 – 17 July 1790) was a Scottish economist, philosopher and author as well as a moral philosopher, a pioneer of political economy and a key figure during the Scottish Enlightenment. Smith wrote two classic works, The Theory of Moral Sentiments (1759) and An Inquiry into the Nature and Causes of the Wealth of Nations (1776). The latter, often abbreviated as The Wealth of Nations, is considered his magnum opus and the first modern work of economics.

Smith studied social philosophy at the University of Glasgow and at Balliol College, Oxford, where he was one of the first students to benefit from scholarships set up by fellow Scot John Snell. After graduating, he delivered a successful series of public lectures at Edinburgh, leading him to collaborate with David Hume during the Scottish Enlightenment. Smith obtained a professorship at Glasgow, teaching moral philosophy and during this time, wrote and published The Theory of Moral Sentiments. In his later life, he took a tutoring position that allowed him to travel throughout Europe, where he met other intellectual leaders of his day.

Smith laid the foundations of classical free market economic theory. The Wealth of Nations was a precursor to the modern academic discipline of economics. In this and other works, he developed the concept of division of labor and expounded upon how rational self-interest and competition can lead to economic prosperity. Smith was controversial in his own day and his general approach and writing style were often satirized by Tory writers in the moralising tradition of William Hogarth and Jonathan Swift. In 2005, The Wealth of Nations was named among the 100 best Scottish books of all time.

Biography

Early life

Smith was born in Kirkcaldy, in the County of Fife, Scotland. His father, also Adam Smith, was a Scottish Writer to the Signet (senior solicitor), advocate and prosecutor (judge advocate) and also served as comptroller of the customs in Kirkcaldy.

In 1720, he married Margaret Douglas, daughter of the landed Robert

Douglas of Strathendry, also in Fife. His father died two months after

he was born, leaving his mother a widow. The date of Smith's baptism into the Church of Scotland at Kirkcaldy was 5 June 1723 and this has often been treated as if it were also his date of birth, which is unknown. Although few events in Smith's early childhood are known, the Scottish journalist John Rae,

Smith's biographer, recorded that Smith was abducted by gypsies at the

age of three and released when others went to rescue him. Smith was close to his mother, who probably encouraged him to pursue his scholarly ambitions. He attended the Burgh School of Kirkcaldy—characterized by Rae as "one of the best secondary schools of Scotland at that period"—from 1729 to 1737, he learned Latin, mathematics, history, and writing.

Formal education

Smith entered the University of Glasgow when he was 14 and studied moral philosophy under Francis Hutcheson. Here, Smith developed his passion for liberty, reason, and free speech. In 1740, Smith was the graduate scholar presented to undertake postgraduate studies at Balliol College, Oxford, under the Snell Exhibition.

Smith considered the teaching at Glasgow to be far superior to that at Oxford, which he found intellectually stifling. In Book V, Chapter II of The Wealth of Nations,

Smith wrote: "In the University of Oxford, the greater part of the

public professors have, for these many years, given up altogether even

the pretense of teaching."

Smith is also reported to have complained to friends that Oxford

officials once discovered him reading a copy of David Hume's A Treatise of Human Nature, and they subsequently confiscated his book and punished him severely for reading it. According to William Robert Scott, "The Oxford of [Smith's] time gave little if any help towards what was to be his lifework."

Nevertheless, Smith took the opportunity while at Oxford to teach

himself several subjects by reading many books from the shelves of the

large Bodleian Library. When Smith was not studying on his own, his time at Oxford was not a happy one, according to his letters. Near the end of his time there, Smith began suffering from shaking fits, probably the symptoms of a nervous breakdown. He left Oxford University in 1746, before his scholarship ended.

In Book V of The Wealth of Nations, Smith comments on the low quality of instruction and the meager intellectual activity at English universities, when compared to their Scottish counterparts. He attributes this both to the rich endowments of the colleges at Oxford and Cambridge, which made the income of professors independent of their ability to attract students, and to the fact that distinguished men of letters could make an even more comfortable living as ministers of the Church of England.

Smith's discontent at Oxford might be in part due to the absence

of his beloved teacher in Glasgow, Francis Hutcheson, who was well

regarded as one of the most prominent lecturers at the University of

Glasgow in his day and earned the approbation of students, colleagues,

and even ordinary residents with the fervor and earnestness of his

orations (which he sometimes opened to the public). His lectures

endeavored not merely to teach philosophy, but also to make his

students embody that philosophy in their lives, appropriately acquiring

the epithet, the preacher of philosophy. Unlike Smith, Hutcheson was not

a system builder; rather, his magnetic personality and method of

lecturing so influenced his students and caused the greatest of those to

reverentially refer to him as "the never to be forgotten Hutcheson"—a

title that Smith in all his correspondence used to describe only two

people, his good friend David Hume and influential mentor Francis

Hutcheson.

Portrait of Smith's mother, Margaret Douglas

Teaching career

Smith

began delivering public lectures in 1748 in Edinburgh, sponsored by the

Philosophical Society of Edinburgh under the patronage of Lord Kames. His lecture topics included rhetoric and belles-lettres,

and later the subject of "the progress of opulence". On this latter

topic, he first expounded his economic philosophy of "the obvious and

simple system of natural liberty". While Smith was not adept at public speaking, his lectures met with success.

In 1750, Smith met the philosopher David Hume, who was his senior

by more than a decade. In their writings covering history, politics,

philosophy, economics, and religion, Smith and Hume shared closer

intellectual and personal bonds than with other important figures of the

Scottish Enlightenment.

In 1751, Smith earned a professorship at Glasgow University teaching logic

courses, and in 1752, he was elected a member of the Philosophical

Society of Edinburgh, having been introduced to the society by Lord

Kames. When the head of Moral Philosophy in Glasgow died the next year, Smith took over the position.

He worked as an academic for the next 13 years, which he characterized

as "by far the most useful and therefore by far the happiest and most

honorable period [of his life]".

Smith published The Theory of Moral Sentiments

in 1759, embodying some of his Glasgow lectures. This work was

concerned with how human morality depends on sympathy between agent and

spectator, or the individual and other members of society. Smith defined

"mutual sympathy" as the basis of moral sentiments. He based his explanation, not on a special "moral sense" as the Third Lord Shaftesbury and Hutcheson had done, nor on utility as Hume did, but on mutual sympathy, a term best captured in modern parlance by the 20th-century concept of empathy, the capacity to recognize feelings that are being experienced by another being.

François Quesnay, one of the leaders of the physiocratic school of thought

Following the publication of The Theory of Moral Sentiments,

Smith became so popular that many wealthy students left their schools in

other countries to enroll at Glasgow to learn under Smith. After the publication of The Theory of Moral Sentiments, Smith began to give more attention to jurisprudence and economics in his lectures and less to his theories of morals.

For example, Smith lectured that the cause of increase in national

wealth is labor, rather than the nation's quantity of gold or silver,

which is the basis for mercantilism, the economic theory that dominated Western European economic policies at the time.

In 1762, the University of Glasgow conferred on Smith the title of Doctor of Laws (LL.D.). At the end of 1763, he obtained an offer from Charles Townshend—who had been introduced to Smith by David Hume—to tutor his stepson, Henry Scott,

the young Duke of Buccleuch. Smith resigned from his professorship in

1764 to take the tutoring position. He subsequently attempted to return

the fees he had collected from his students because he had resigned

partway through the term, but his students refused.

Tutoring and travels

Smith's

tutoring job entailed touring Europe with Scott, during which time he

educated Scott on a variety of subjects, such as etiquette and manners.

He was paid £300 per year (plus expenses) along with a £300 per year pension; roughly twice his former income as a teacher. Smith first travelled as a tutor to Toulouse,

France, where he stayed for a year and a half. According to his own

account, he found Toulouse to be somewhat boring, having written to Hume

that he "had begun to write a book to pass away the time". After touring the south of France, the group moved to Geneva, where Smith met with the philosopher Voltaire.

David Hume was a friend and contemporary of Smith's.

From Geneva, the party moved to Paris. Here, Smith met Benjamin Franklin, and discovered the Physiocracy school founded by François Quesnay. Physiocrats were opposed to mercantilism, the dominating economic theory of the time, illustrated in their motto Laissez faire et laissez passer, le monde va de lui même! (Let do and let pass, the world goes on by itself!).

The wealth of France had been virtually depleted by Louis XIV and Louis XV in ruinous wars, and was further exhausted in aiding the American insurgents

against the British. The excessive consumption of goods and services

deemed to have no economic contribution was considered a source of

unproductive labor, with France's agriculture the only economic sector

maintaining the wealth of the nation.

Given that the English economy of the day yielded an income

distribution that stood in contrast to that which existed in France,

Smith concluded that "with all its imperfections, [the Physiocratic

school] is perhaps the nearest approximation to the truth that has yet

been published upon the subject of political economy." The distinction between productive versus unproductive labour—the physiocratic classe steril—was a predominant issue in the development and understanding of what would become classical economic theory.

Later years

In 1766, Henry Scott's younger brother died in Paris, and Smith's tour as a tutor ended shortly thereafter. Smith returned home that year to Kirkcaldy, and he devoted much of the next decade to writing his magnum opus. There, he befriended Henry Moyes, a young blind man who showed precocious aptitude. Smith secured the patronage of David Hume and Thomas Reid in the young man's education. In May 1773, Smith was elected fellow of the Royal Society of London, and was elected a member of the Literary Club in 1775. The Wealth of Nations was published in 1776 and was an instant success, selling out its first edition in only six months.

In 1778, Smith was appointed to a post as commissioner of customs

in Scotland and went to live with his mother (who died in 1784) in Panmure House in Edinburgh's Canongate.

Five years later, as a member of the Philosophical Society of Edinburgh

when it received its royal charter, he automatically became one of the

founding members of the Royal Society of Edinburgh. From 1787 to 1789, he occupied the honorary position of Lord Rector of the University of Glasgow.

Death

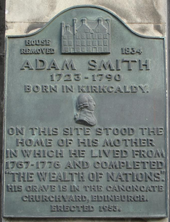

A commemorative plaque for Smith is located in Smith's home town of Kirkcaldy.

Smith died in the northern wing of Panmure House in Edinburgh on 17

July 1790 after a painful illness. His body was buried in the Canongate Kirkyard. On his deathbed, Smith expressed disappointment that he had not achieved more.

Smith's literary executors were two friends from the Scottish academic world: the physicist and chemist Joseph Black and the pioneering geologist James Hutton.

Smith left behind many notes and some unpublished material, but gave

instructions to destroy anything that was not fit for publication. He mentioned an early unpublished History of Astronomy as probably suitable, and it duly appeared in 1795, along with other material such as Essays on Philosophical Subjects.

Smith's library went by his will to David Douglas, Lord Reston (son of his cousin Colonel Robert Douglas of Strathendry, Fife), who lived with Smith.

It was eventually divided between his two surviving children, Cecilia

Margaret (Mrs. Cunningham) and David Anne (Mrs. Bannerman). On the death

of her husband, the Reverend W. B. Cunningham of Prestonpans in 1878,

Mrs. Cunningham sold some of the books. The remainder passed to her son,

Professor Robert Oliver Cunningham

of Queen's College, Belfast, who presented a part to the library of

Queen's College. After his death, the remaining books were sold. On the

death of Mrs. Bannerman in 1879, her portion of the library went intact

to the New College (of the Free Church) in Edinburgh and the collection

was transferred to the University of Edinburgh Main Library in 1972.

Personality and beliefs

Character

James Tassie's enamel paste medallion of Smith provided the model for many engravings and portraits that remain today.

Not much is known about Smith's personal views beyond what can be

deduced from his published articles. His personal papers were destroyed

after his death at his request. He never married,

and seems to have maintained a close relationship with his mother, with

whom he lived after his return from France and who died six years

before him.

Smith was described by several of his contemporaries and

biographers as comically absent-minded, with peculiar habits of speech

and gait, and a smile of "inexpressible benignity". He was known to talk to himself, a habit that began during his childhood when he would smile in rapt conversation with invisible companions. He also had occasional spells of imaginary illness, and he is reported to have had books and papers placed in tall stacks in his study. According to one story, Smith took Charles Townshend on a tour of a tanning factory, and while discussing free trade, Smith walked into a huge tanning pit from which he needed help to escape.

He is also said to have put bread and butter into a teapot, drunk the

concoction, and declared it to be the worst cup of tea he ever had.

According to another account, Smith distractedly went out walking in his

nightgown and ended up 15 miles (24 km) outside of town, before nearby

church bells brought him back to reality.

James Boswell, who was a student of Smith's at Glasgow University, and later knew him at the Literary Club,

says that Smith thought that speaking about his ideas in conversation

might reduce the sale of his books, so his conversation was

unimpressive. According to Boswell, he once told Sir Joshua Reynolds, that 'he made it a rule when in company never to talk of what he understood'.

Portrait of Smith by John Kay, 1790

Smith has been alternately described as someone who "had a large

nose, bulging eyes, a protruding lower lip, a nervous twitch, and a

speech impediment" and one whose "countenance was manly and agreeable." Smith is said to have acknowledged his looks at one point, saying, "I am a beau in nothing but my books." Smith rarely sat for portraits,

so almost all depictions of him created during his lifetime were drawn

from memory. The best-known portraits of Smith are the profile by James Tassie and two etchings by John Kay. The line engravings produced for the covers of 19th-century reprints of The Wealth of Nations were based largely on Tassie's medallion.

Religious views

Considerable

scholarly debate has occurred about the nature of Smith's religious

views. Smith's father had shown a strong interest in Christianity and

belonged to the moderate wing of the Church of Scotland.

The fact that Adam Smith received the Snell Exhibition suggests that he

may have gone to Oxford with the intention of pursuing a career in the Church of England.

Anglo-American economist Ronald Coase has challenged the view that Smith was a deist,

based on the fact that Smith's writings never explicitly invoke God as

an explanation of the harmonies of the natural or the human worlds. According to Coase, though Smith does sometimes refer to the "Great Architect of the Universe", later scholars such as Jacob Viner have "very much exaggerated the extent to which Adam Smith was committed to a belief in a personal God", a belief for which Coase finds little evidence in passages such as the one in the Wealth of Nations

in which Smith writes that the curiosity of mankind about the "great

phenomena of nature", such as "the generation, the life, growth, and

dissolution of plants and animals", has led men to "enquire into their

causes", and that "superstition first attempted to satisfy this

curiosity, by referring all those wonderful appearances to the immediate

agency of the gods. Philosophy afterwards endeavored to account for

them, from more familiar causes, or from such as mankind were better

acquainted with than the agency of the gods".

Some other authors argue that Smith's social and economic

philosophy is inherently theological and that his entire model of social

order is logically dependent on the notion of God's action in nature.

Smith was also a close friend of David Hume, who was commonly characterized in his own time as an atheist. The publication in 1777 of Smith's letter to William Strahan, in which he described Hume's courage in the face of death in spite of his irreligiosity, attracted considerable controversy.

Published works

The Theory of Moral Sentiments

In 1759, Smith published his first work, The Theory of Moral Sentiments, sold by co-publishers Andrew Millar of London and Alexander Kincaid of Edinburgh. Smith continued making extensive revisions to the book until his death. Although The Wealth of Nations is widely regarded as Smith's most influential work, Smith himself is believed to have considered The Theory of Moral Sentiments to be a superior work.

In the work, Smith critically examines the moral thinking of his

time, and suggests that conscience arises from dynamic and interactive

social relationships through which people seek "mutual sympathy of

sentiments."

His goal in writing the work was to explain the source of mankind's

ability to form moral judgement, given that people begin life with no

moral sentiments at all. Smith proposes a theory of sympathy, in which

the act of observing others and seeing the judgements they form of both

others and oneself makes people aware of themselves and how others

perceive their behavior. The feedback we receive from perceiving (or

imagining) others' judgements creates an incentive to achieve "mutual

sympathy of sentiments" with them and leads people to develop habits,

and then principles, of behavior, which come to constitute one's

conscience.

Some scholars have perceived a conflict between The Theory of Moral Sentiments and The Wealth of Nations; the former emphasizes sympathy for others, while the latter focuses on the role of self-interest. In recent years, however, some scholars of Smith's work have argued that no contradiction exists. They claim that in The Theory of Moral Sentiments,

Smith develops a theory of psychology in which individuals seek the

approval of the "impartial spectator" as a result of a natural desire to

have outside observers sympathize with their sentiments. Rather than

viewing The Theory of Moral Sentiments and The Wealth of Nations

as presenting incompatible views of human nature, some Smith scholars

regard the works as emphasizing different aspects of human nature that

vary depending on the situation. Otteson

argues that both books are Newtonian in their methodology and deploy a

similar "market model" for explaining the creation and development of

large-scale human social orders, including morality, economics, as well

as language. Ekelund

and Hebert offer a differing view, observing that self-interest is

present in both works and that "in the former, sympathy is the moral

faculty that holds self-interest in check, whereas in the latter,

competition is the economic faculty that restrains self-interest."

The Wealth of Nations

Disagreement exists between classical and neoclassical economists about the central message of Smith's most influential work: An Inquiry into the Nature and Causes of the Wealth of Nations (1776). Neoclassical economists emphasize Smith's invisible hand,

a concept mentioned in the middle of his work – Book IV, Chapter II –

and classical economists believe that Smith stated his programme for

promoting the "wealth of nations" in the first sentences, which

attributes the growth of wealth and prosperity to the division of

labor.

Smith used the term "the invisible hand" in "History of Astronomy" referring to "the invisible hand of Jupiter", and once in each of his The Theory of Moral Sentiments (1759) and The Wealth of Nations (1776). This last statement about "an invisible hand" has been interpreted in numerous ways.

Later building on the site where Smith wrote The Wealth of Nations

As every individual, therefore, endeavours as much as he can both to employ his capital in the support of domestic industry, and so to direct that industry that its produce may be of the greatest value; every individual necessarily labours to render the annual revenue of the society as great as he can. He generally, indeed, neither intends to promote the public interest, nor knows how much he is promoting it. By preferring the support of domestic to that of foreign industry, he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for the society that it was no part of it. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good. It is an affectation, indeed, not very common among merchants, and very few words need be employed in dissuading them from it.

Those who regard that statement as Smith's central message also quote frequently Smith's dictum:

It is not from the benevolence of the butcher, the brewer, or the baker, that we expect our dinner, but from their regard to their own interest. We address ourselves, not to their humanity but to their self-love, and never talk to them of our own necessities but of their advantages.

The first page of The Wealth of Nations, 1776 London edition

Smith's statement about the benefits of "an invisible hand" may be meant to answer Mandeville's contention that "Private Vices ... may be turned into Public Benefits".

It shows Smith's belief that when an individual pursues his

self-interest under conditions of justice, he unintentionally promotes

the good of society. Self-interested competition in the free market, he

argued, would tend to benefit society as a whole by keeping prices low,

while still building in an incentive for a wide variety of goods and

services. Nevertheless, he was wary of businessmen and warned of their

"conspiracy against the public or in some other contrivance to raise

prices". Again and again, Smith warned of the collusive nature of business interests, which may form cabals or monopolies, fixing the highest price "which can be squeezed out of the buyers".

Smith also warned that a business-dominated political system would

allow a conspiracy of businesses and industry against consumers, with

the former scheming to influence politics and legislation. Smith states

that the interest of manufacturers and merchants "in any particular

branch of trade or manufactures, is always in some respects different

from, and even opposite to, that of the public ... The proposal of any

new law or regulation of commerce which comes from this order, ought

always to be listened to with great precaution, and ought never be

adopted till after having been long and carefully examined, not only

with the most scrupulous, but with the most suspicious attention."

Thus Smith's chief worry seems to be when business is given special

protections or privileges from government; by contrast, in the absence

of such special political favors, he believed that business activities

were generally beneficial to the whole society:

It is the great multiplication of the production of all the different arts, in consequence of the division of labour, which occasions, in a well-governed society, that universal opulence which extends itself to the lowest ranks of the people. Every workman has a great quantity of his own work to dispose of beyond what he himself has occasion for; and every other workman being exactly in the same situation, he is enabled to exchange a great quantity of his own goods for a great quantity, or, what comes to the same thing, for the price of a great quantity of theirs. He supplies them abundantly with what they have occasion for, and they accommodate him as amply with what he has occasion for, and a general plenty diffuses itself through all the different ranks of society. (The Wealth of Nations, I.i.10)

The neoclassical interest in Smith's statement about "an invisible

hand" originates in the possibility of seeing it as a precursor of neoclassical economics and its concept of general equilibrium – Samuelson's "Economics" refers six times to Smith's "invisible hand". To emphasize this connection, Samuelson quotes Smith's "invisible hand" statement substituting "general interest" for "public interest". Samuelson

concludes: "Smith was unable to prove the essence of his invisible-hand

doctrine. Indeed, until the 1940s, no one knew how to prove, even to

state properly, the kernel of truth in this proposition about perfectly

competitive market."

1922 printing of An Inquiry into the Nature and Causes of the Wealth of Nations

Very differently, classical economists see in Smith's first sentences

his program to promote "The Wealth of Nations". Using the

physiocratical concept of the economy as a circular process, to secure

growth the inputs of Period 2 must exceed the inputs of Period 1.

Therefore, those outputs of Period 1 which are not used or usable as

inputs of Period 2 are regarded as unproductive labor, as they do not

contribute to growth. This is what Smith had heard in France from, among

others, François Quesnay, whose ideas Smith was so impressed by that he might have dedicated The Wealth of Nations to him had he not died beforehand.

To this French insight that unproductive labor should be reduced to

use labour more productively, Smith added his own proposal, that

productive labor should be made even more productive by deepening the division of labor.

Smith argued that deepening the division of labour under competition

leads to greater productivity, which leads to lower prices and thus an

increasing standard of living—"general plenty" and "universal

opulence"—for all. Extended markets and increased production lead to the

continuous reorganization of production and the invention of new ways

of producing, which in turn lead to further increased production, lower

prices, and improved standards of living. Smith's central message is,

therefore, that under dynamic competition, a growth machine secures "The

Wealth of Nations". Smith's argument predicted Britain's evolution as

the workshop of the world, underselling and outproducing all its

competitors. The opening sentences of the "Wealth of Nations" summarize

this policy:

The annual labour of every nation is the fund which originally supplies it with all the necessaries and conveniences of life which it annually consumes ... . [T]his produce ... bears a greater or smaller proportion to the number of those who are to consume it ... .[B]ut this proportion must in every nation be regulated by two different circumstances;

- first, by the skill, dexterity, and judgment with which its labour is generally applied; and,

- secondly, by the proportion between the number of those who are employed in useful labour, and that of those who are not so employed [emphasis added].

However, Smith added that the "abundance or scantiness of this supply

too seems to depend more upon the former of those two circumstances

than upon the latter."

Criticism and dissent

Alfred Marshall

criticized Smith's definition of the economy on several points. He

argued that man should be equally important as money, services are as

important as goods, and that there must be an emphasis on human welfare,

instead of just wealth. The "invisible hand" only works well when both

production and consumption operates in free markets, with small

("atomistic") producers and consumers allowing supply and demand to

fluctuate and equilibrate. In conditions of monopoly and oligopoly, the

"invisible hand" fails. Nobel Prize-winning economist Joseph E. Stiglitz says, on the topic of one of Smith's better-known ideas: "the reason that the invisible hand often seems invisible is that it is often not there."

Other works

Smith's burial place in Canongate Kirkyard

Shortly before his death, Smith had nearly all his manuscripts

destroyed. In his last years, he seemed to have been planning two major

treatises, one on the theory and history of law and one on the sciences

and arts. The posthumously published Essays on Philosophical Subjects, a history of astronomy down to Smith's own era, plus some thoughts on ancient physics and metaphysics, probably contain parts of what would have been the latter treatise. Lectures on Jurisprudence were notes taken from Smith's early lectures, plus an early draft of The Wealth of Nations,

published as part of the 1976 Glasgow Edition of the works and

correspondence of Smith. Other works, including some published

posthumously, include Lectures on Justice, Police, Revenue, and Arms (1763) (first published in 1896); and Essays on Philosophical Subjects (1795).

Legacy

In economics and moral philosophy

The Wealth of Nations

was a precursor to the modern academic discipline of economics. In this

and other works, Smith expounded how rational self-interest and

competition can lead to economic prosperity. Smith was controversial in

his own day and his general approach and writing style were often

satirised by Tory writers in the moralizing tradition of Hogarth and Swift, as a discussion at the University of Winchester suggests. In 2005, The Wealth of Nations was named among the 100 Best Scottish Books of all time.

In light of the arguments put forward by Smith and other economic

theorists in Britain, academic belief in mercantilism began to decline

in Britain in the late 18th century. During the Industrial Revolution, Britain embraced free trade and Smith's laissez-faire economics, and via the British Empire,

used its power to spread a broadly liberal economic model around the

world, characterized by open markets, and relatively barrier-free

domestic and international trade.

George Stigler

attributes to Smith "the most important substantive proposition in all

of economics". It is that, under competition, owners of resources (for

example labor, land, and capital) will use them most profitably,

resulting in an equal rate of return in equilibrium for all uses, adjusted for apparent differences arising from such factors as training, trust, hardship, and unemployment.

Paul Samuelson

finds in Smith's pluralist use of supply and demand as applied to

wages, rents, and profit a valid and valuable anticipation of the general equilibrium modelling of Walras

a century later. Smith's allowance for wage increases in the short and

intermediate term from capital accumulation and invention contrasted

with Malthus, Ricardo, and Karl Marx in their propounding a rigid subsistence–wage theory of labor supply.

Joseph Schumpeter

criticized Smith for a lack of technical rigor, yet he argued that

this enabled Smith's writings to appeal to wider audiences: "His very

limitation made for success. Had he been more brilliant, he would not

have been taken so seriously. Had he dug more deeply, had he unearthed

more recondite truth, had he used more difficult and ingenious methods,

he would not have been understood. But he had no such ambitions; in fact

he disliked whatever went beyond plain common sense. He never moved

above the heads of even the dullest readers. He led them on gently,

encouraging them by trivialities and homely observations, making them

feel comfortable all along."

Classical economists presented competing theories of those of Smith, termed the "labour theory of value". Later Marxian economics descending from classical economics also use Smith's labor theories, in part. The first volume of Karl Marx's major work, Das Kapital,

was published in German in 1867. In it, Marx focused on the labor

theory of value and what he considered to be the exploitation of labor

by capital.

The labor theory of value held that the value of a thing was

determined by the labor that went into its production. This contrasts

with the modern contention of neoclassical economics, that the value of a thing is determined by what one is willing to give up to obtain the thing.

The Adam Smith Theatre in Kirkcaldy

The body of theory later termed "neoclassical economics" or "marginalism" formed from about 1870 to 1910. The term "economics" was popularised by such neoclassical economists as Alfred Marshall as a concise synonym for "economic science" and a substitute for the earlier, broader term "political economy" used by Smith. This corresponded to the influence on the subject of mathematical methods used in the natural sciences. Neoclassical economics systematized supply and demand

as joint determinants of price and quantity in market equilibrium,

affecting both the allocation of output and the distribution of income.

It dispensed with the labor theory of value of which Smith was most famously identified with in classical economics, in favor of a marginal utility theory of value on the demand side and a more general theory of costs on the supply side.

The bicentennial anniversary of the publication of The Wealth of Nations was celebrated in 1976, resulting in increased interest for The Theory of Moral Sentiments and his other works throughout academia. After 1976, Smith was more likely to be represented as the author of both The Wealth of Nations and The Theory of Moral Sentiments, and thereby as the founder of a moral philosophy and the science of economics. His Homo economicus

or "economic man" was also more often represented as a moral person.

Additionally, economists David Levy and Sandra Peart in "The Secret

History of the Dismal Science" point to his opposition to hierarchy and

beliefs in inequality, including racial inequality, and provide

additional support for those who point to Smith's opposition to slavery,

colonialism, and empire. They show the caricatures of Smith drawn by

the opponents of views on hierarchy and inequality in this online

article. Emphasized also are Smith's statements of the need for high

wages for the poor, and the efforts to keep wages low. In The "Vanity of

the Philosopher: From Equality to Hierarchy in Postclassical

Economics", Peart and Levy also cite Smith's view that a common street

porter was not intellectually inferior to a philosopher,

and point to the need for greater appreciation of the public views in

discussions of science and other subjects now considered to be

technical. They also cite Smith's opposition to the often expressed view

that science is superior to common sense.

Smith also explained the relationship between growth of private property and civil government:

Men may live together in society with some tolerable degree of security, though there is no civil magistrate to protect them from the injustice of those passions. But avarice and ambition in the rich, in the poor the hatred of labour and the love of present ease and enjoyment, are the passions which prompt to invade property, passions much more steady in their operation, and much more universal in their influence. Wherever there is great property there is great inequality. For one very rich man there must be at least five hundred poor, and the affluence of the few supposes the indigence of the many. The affluence of the rich excites the indignation of the poor, who are often both driven by want, and prompted by envy, to invade his possessions. It is only under the shelter of the civil magistrate that the owner of that valuable property, which is acquired by the labour of many years, or perhaps of many successive generations, can sleep a single night in security. He is at all times surrounded by unknown enemies, whom, though he never provoked, he can never appease, and from whose injustice he can be protected only by the powerful arm of the civil magistrate continually held up to chastise it. The acquisition of valuable and extensive property, therefore, necessarily requires the establishment of civil government. Where there is no property, or at least none that exceeds the value of two or three days' labour, civil government is not so necessary. Civil government supposes a certain subordination. But as the necessity of civil government gradually grows up with the acquisition of valuable property, so the principal causes which naturally introduce subordination gradually grow up with the growth of that valuable property. (...) Men of inferior wealth combine to defend those of superior wealth in the possession of their property, in order that men of superior wealth may combine to defend them in the possession of theirs. All the inferior shepherds and herdsmen feel that the security of their own herds and flocks depends upon the security of those of the great shepherd or herdsman; that the maintenance of their lesser authority depends upon that of his greater authority, and that upon their subordination to him depends his power of keeping their inferiors in subordination to them. They constitute a sort of little nobility, who feel themselves interested to defend the property and to support the authority of their own little sovereign in order that he may be able to defend their property and to support their authority. Civil government, so far as it is instituted for the security of property, is in reality instituted for the defence of the rich against the poor, or of those who have some property against those who have none at all. (Source: The Wealth of Nations, Book 5, Chapter 1, Part 2)

In British Imperial debates

Smith's chapter on colonies, in turn, would help shape British imperial debates from the mid-19th century onward. The Wealth of Nations

would become an ambiguous text regarding the imperial question. In his

chapter on colonies, Smith pondered how to solve the crisis developing

across the Atlantic among the empire's 13 American colonies. He offered

two different proposals for easing tensions. The first proposal called

for giving the colonies their independence, and by thus parting on a

friendly basis, Britain would be able to develop and maintain a

free-trade relationship with them, and possibly even an informal

military alliance. Smith's second proposal called for a theoretical

imperial federation that would bring the colonies and the metropole

closer together through an imperial parliamentary system and imperial

free trade.

Smith's most prominent disciple in 19th-century Britain, peace advocate Richard Cobden, preferred the first proposal. Cobden would lead the Anti-Corn Law League in overturning the Corn Laws

in 1846, shifting Britain to a policy of free trade and empire "on the

cheap" for decades to come. This hands-off approach toward the British

Empire would become known as Cobdenism or the Manchester School. By the turn of the century, however, advocates of Smith's second proposal such as Joseph Shield Nicholson would become ever more vocal in opposing Cobdenism, calling instead for imperial federation.

As Marc-William Palen notes: "On the one hand, Adam Smith’s late

nineteenth and early twentieth-century Cobdenite adherents used his

theories to argue for gradual imperial devolution and empire ‘on the

cheap’. On the other, various proponents of imperial federation

throughout the British World sought to use Smith’s theories to overturn

the predominant Cobdenite hands-off imperial approach and instead, with a

firm grip, bring the empire closer than ever before." Smith's ideas thus played an important part in subsequent debates over the British Empire.

Portraits, monuments, and banknotes

A statue of Smith in Edinburgh's High Street, erected through private donations organized by the Adam Smith Institute

Smith has been commemorated in the UK on banknotes printed by two different banks; his portrait has appeared since 1981 on the £50 notes issued by the Clydesdale Bank in Scotland, and in March 2007 Smith's image also appeared on the new series of £20 notes issued by the Bank of England, making him the first Scotsman to feature on an English banknote.

Statue of Smith built in 1867–1870 at the old headquarters of the University of London, 6 Burlington Gardens

A large-scale memorial of Smith by Alexander Stoddart was unveiled on 4 July 2008 in Edinburgh. It is a 10-foot (3.0 m)-tall bronze sculpture and it stands above the Royal Mile outside St Giles' Cathedral in Parliament Square, near the Mercat cross. 20th-century sculptor Jim Sanborn (best known for the Kryptos sculpture at the United States Central Intelligence Agency) has created multiple pieces which feature Smith's work. At Central Connecticut State University is Circulating Capital, a tall cylinder which features an extract from The Wealth of Nations on the lower half, and on the upper half, some of the same text, but represented in binary code. At the University of North Carolina at Charlotte, outside the Belk College of Business Administration, is Adam Smith's Spinning Top. Another Smith sculpture is at Cleveland State University. He also appears as the narrator in the 2013 play The Low Road, centered on a proponent on laissez-faire economics in the late 18th century, but dealing obliquely with the financial crisis of 2007–2008 and the recession which followed; in the premiere production, he was portrayed by Bill Paterson.

A bust of Smith is in the Hall of Heroes of the National Wallace Monument in Stirling.

Residence

Adam Smith resided at Panmure House from 1778 to 1790. This residence has now been purchased by the Edinburgh Business School at Heriot Watt University and fundraising has begun to restore it.

Part of the Northern end of the original building appears to have been

demolished in the 19th century to make way for an iron foundry.

As a symbol of free-market economics

Adam Smith's Spinning Top, sculpture by Jim Sanborn at Cleveland State University

Smith has been celebrated by advocates of free-market policies as the

founder of free-market economics, a view reflected in the naming of

bodies such as the Adam Smith Institute in London, the Adam Smith Society and the Australian Adam Smith Club, and in terms such as the Adam Smith necktie.

Alan Greenspan argues that, while Smith did not coin the term laissez-faire,

"it was left to Adam Smith to identify the more-general set of

principles that brought conceptual clarity to the seeming chaos of

market transactions". Greenspan continues that The Wealth of Nations was "one of the great achievements in human intellectual history". P.J. O'Rourke describes Smith as the "founder of free market economics".

Other writers have argued that Smith's support for laissez-faire (which in French means leave alone) has been overstated. Herbert Stein

wrote that the people who "wear an Adam Smith necktie" do it to "make a

statement of their devotion to the idea of free markets and limited government",

and that this misrepresents Smith's ideas. Stein writes that Smith "was

not pure or doctrinaire about this idea. He viewed government

intervention in the market with great skepticism...yet he was prepared

to accept or propose qualifications to that policy in the specific cases

where he judged that their net effect would be beneficial and would not

undermine the basically free character of the system. He did not wear

the Adam Smith necktie." In Stein's reading, The Wealth of Nations could justify the Food and Drug Administration, the Consumer Product Safety Commission, mandatory employer health benefits, environmentalism, and "discriminatory taxation to deter improper or luxurious behavior".

Similarly, Vivienne Brown stated in The Economic Journal that in the 20th-century United States, Reaganomics supporters, the Wall Street Journal,

and other similar sources have spread among the general public a

partial and misleading vision of Smith, portraying him as an "extreme

dogmatic defender of laissez-faire capitalism and supply-side economics". In fact, The Wealth of Nations includes the following statement on the payment of taxes:

The subjects of every state ought to contribute towards the support of the government, as nearly as possible, in proportion to their respective abilities; that is, in proportion to the revenue which they respectively enjoy under the protection of the state.

Some commentators have argued that Smith's works show support for a

progressive, not flat, income tax and that he specifically named taxes

that he thought should be required by the state, among them luxury-goods taxes and tax on rent. Yet Smith argued for the "impossibility of taxing the people, in proportion to their economic revenue, by any capitation" (The Wealth of Nations,

V.ii.k.1). Smith argued that taxes should principally go toward

protecting "justice" and "certain publick institutions" that were

necessary for the benefit of all of society, but that could not be

provided by private enterprise (The Wealth of Nations, IV.ix.51).

Additionally, Smith outlined the proper expenses of the government in The Wealth of Nations, Book V, Ch. I.

Included in his requirements of a government is to enforce contracts

and provide justice system, grant patents and copy rights, provide

public goods such as infrastructure, provide national defence, and

regulate banking. The role of the government was to provide goods "of

such a nature that the profit could never repay the expense to any

individual" such as roads, bridges, canals, and harbours. He also

encouraged invention and new ideas through his patent enforcement and

support of infant industry monopolies. He supported partial public

subsidies for elementary education, and he believed that competition

among religious institutions would provide general benefit to the

society. In such cases, however, Smith argued for local rather than

centralized control: "Even those publick works which are of such a

nature that they cannot afford any revenue for maintaining themselves

... are always better maintained by a local or provincial revenue, under

the management of a local and provincial administration, than by the

general revenue of the state" (Wealth of Nations, V.i.d.18).

Finally, he outlined how the government should support the dignity of

the monarch or chief magistrate, such that they are equal or above the

public in fashion. He even states that monarchs should be provided for

in a greater fashion than magistrates of a republic because "we

naturally expect more splendor in the court of a king than in the

mansion-house of a doge". In addition, he allowed that in some specific circumstances, retaliatory tariffs may be beneficial:

The recovery of a great foreign market will generally more than compensate the transitory inconvenience of paying dearer during a short time for some sorts of goods.

However, he added that in general, a retaliatory tariff "seems a bad

method of compensating the injury done to certain classes of our people,

to do another injury ourselves, not only to those classes, but to

almost all the other classes of them" (The Wealth of Nations, IV.ii.39).

Economic historians such as Jacob Viner

regard Smith as a strong advocate of free markets and limited

government (what Smith called "natural liberty"), but not as a dogmatic

supporter of laissez-faire.

Economist Daniel Klein

believes using the term "free-market economics" or "free-market

economist" to identify the ideas of Smith is too general and slightly

misleading. Klein offers six characteristics central to the identity of

Smith's economic thought and argues that a new name is needed to give a

more accurate depiction of the "Smithian" identity. Economist David Ricardo

set straight some of the misunderstandings about Smith's thoughts on

free market. Most people still fall victim to the thinking that Smith

was a free-market economist without exception, though he was not.

Ricardo pointed out that Smith was in support of helping infant

industries. Smith believed that the government should subsidise newly

formed industry, but he did fear that when the infant industry grew into

adulthood, it would be unwilling to surrender the government help.

Smith also supported tariffs on imported goods to counteract an

internal tax on the same good. Smith also fell to pressure in supporting

some tariffs in support for national defense.

Some have also claimed, Emma Rothschild among them, that Smith would have supported a minimum wage, although no direct textual evidence supports the claim. Indeed, Smith wrote:

The price of labour, it must be observed, cannot be ascertained very accurately anywhere, different prices being often paid at the same place and for the same sort of labour, not only according to the different abilities of the workmen, but according to the easiness or hardness of the masters. Where wages are not regulated by law, all that we can pretend to determine is what are the most usual; and experience seems to show that law can never regulate them properly, though it has often pretended to do so. (The Wealth of Nations, Book 1, Chapter 8)

However, Smith also noted, to the contrary, the existence of an imbalanced, inequality of bargaining power:

A landlord, a farmer, a master manufacturer, a merchant, though they did not employ a single workman, could generally live a year or two upon the stocks which they have already acquired. Many workmen could not subsist a week, few could subsist a month, and scarce any a year without employment. In the long run, the workman may be as necessary to his master as his master is to him, but the necessity is not so immediate.