Economists, political economists, sociologists and historians

have adopted different perspectives in their analyses of capitalism and

have recognized various forms of it in practice. These include laissez-faire or free market capitalism, welfare capitalism and state capitalism. Different forms of capitalism feature varying degrees of free markets, public ownership, obstacles to free competition and state-sanctioned social policies. The degree of competition in markets, the role of intervention and regulation, and the scope of state ownership vary across different models of capitalism. The extent to which different markets are free as well as the rules defining private property are matters of politics and policy. Most existing capitalist economies are mixed economies, which combine elements of free markets with state intervention and in some cases economic planning.

Market economies have existed under many forms of government and in many different times, places and cultures. Modern capitalist societies—marked by a universalization of money-based social relations, a consistently large and system-wide class of workers who must work for wages, and a capitalist class which owns the means of production—developed in Western Europe in a process that led to the Industrial Revolution. Capitalist systems with varying degrees of direct government intervention have since become dominant in the Western world and continue to spread. Over time, capitalist countries have experienced consistent economic growth and an increase in the standard of living.

Critics of capitalism argue that it establishes power in the hands of a minority capitalist class that exists through the exploitation of the majority working class and their labor; prioritizes profit over social good, natural resources and the environment; and is an engine of inequality, corruption and economic instabilities. Supporters argue that it provides better products and innovation through competition, disperses wealth to all productive people, promotes pluralism and decentralization of power, creates strong economic growth, and yields productivity and prosperity that greatly benefit society.

Market economies have existed under many forms of government and in many different times, places and cultures. Modern capitalist societies—marked by a universalization of money-based social relations, a consistently large and system-wide class of workers who must work for wages, and a capitalist class which owns the means of production—developed in Western Europe in a process that led to the Industrial Revolution. Capitalist systems with varying degrees of direct government intervention have since become dominant in the Western world and continue to spread. Over time, capitalist countries have experienced consistent economic growth and an increase in the standard of living.

Critics of capitalism argue that it establishes power in the hands of a minority capitalist class that exists through the exploitation of the majority working class and their labor; prioritizes profit over social good, natural resources and the environment; and is an engine of inequality, corruption and economic instabilities. Supporters argue that it provides better products and innovation through competition, disperses wealth to all productive people, promotes pluralism and decentralization of power, creates strong economic growth, and yields productivity and prosperity that greatly benefit society.

Etymology

The term "capitalist", meaning an owner of capital, appears earlier than the term "capitalism" and it dates back to the mid-17th century. "Capitalism" is derived from capital, which evolved from capitale, a late Latin word based on caput, meaning "head"—also the origin of "chattel" and "cattle" in the sense of movable property (only much later to refer only to livestock). Capitale

emerged in the 12th to 13th centuries in the sense of referring to

funds, stock of merchandise, sum of money or money carrying interest.

By 1283, it was used in the sense of the capital assets of a trading

firm and it was frequently interchanged with a number of other

words—wealth, money, funds, goods, assets, property and so on.

The Hollandische Mercurius uses "capitalists" in 1633 and 1654 to refer to owners of capital. In French, Étienne Clavier referred to capitalistes in 1788, six years before its first recorded English usage by Arthur Young in his work Travels in France (1792). In his Principles of Political Economy and Taxation (1817), David Ricardo referred to "the capitalist" many times. Samuel Taylor Coleridge, an English poet, used "capitalist" in his work Table Talk (1823). Pierre-Joseph Proudhon used the term "capitalist" in his first work, What is Property? (1840), to refer to the owners of capital. Benjamin Disraeli used the term "capitalist" in his 1845 work Sybil.

The initial usage of the term "capitalism" in its modern sense has been attributed to Louis Blanc

in 1850 ("What I call 'capitalism' that is to say the appropriation of

capital by some to the exclusion of others") and Pierre-Joseph Proudhon

in 1861 ("Economic and social regime in which capital, the source of

income, does not generally belong to those who make it work through

their labour"). Karl Marx and Friedrich Engels referred to the "capitalistic system" and to the "capitalist mode of production" in Capital (1867). The use of the word "capitalism" in reference to an economic system appears twice in Volume I of Capital, p. 124 (German edition) and in Theories of Surplus Value,

tome II, p. 493 (German edition). Marx did not extensively use the form

capitalism, but instead those of capitalist and capitalist mode of

production, which appear more than 2,600 times in the trilogy The Capital. According to the Oxford English Dictionary (OED), the term "capitalism" first appeared in English in 1854 in the novel The Newcomes by novelist William Makepeace Thackeray, where he meant "having ownership of capital". Also according to the OED, Carl Adolph Douai, a German American socialist and abolitionist, used the phrase "private capitalism" in 1863.

History

Capitalism in its modern form can be traced to the emergence of agrarian capitalism and mercantilism in the early Renaissance, in city states like Florence.

Capital has existed incipiently on a small scale for centuries in the form of merchant, renting and lending activities and occasionally as small-scale industry with some wage labour. Simple commodity

exchange and consequently simple commodity production, which are the

initial basis for the growth of capital from trade, have a very long

history. Classical Islam promulgated capitalist economic policies such as free trade and banking. Their use of Indo-Arabic numerals facilitated bookkeeping. These innovations migrated to Europe through trade partners in cities such as Venice and Pisa. The Italian mathematician Fibonacci traveled the Mediterranean talking to Arab traders, and returned to popularize the use of Indo-Arabic numerals in Europe.

Capital and commercial trade thus existed for much of history,

but it did not lead to industrialisation or dominate the production

process of society. That required a set of conditions, including

specific technologies of mass production, the ability to independently

and privately own and trade in means of production, a class of workers

willing to sell their labour power for a living, a legal

framework promoting commerce, a physical infrastructure allowing the

circulation of goods on a large scale and security for private

accumulation. Many of these conditions do not currently exist in many Third World

countries, although there is plenty of capital and labour. The

obstacles for the development of capitalist markets are therefore less

technical and more social, cultural and political.

Agrarian capitalism

The economic foundations of the feudal agricultural system began to shift substantially in 16th-century England as the manorial system

had broken down and land began to become concentrated in the hands of

fewer landlords with increasingly large estates. Instead of a serf-based

system of labor, workers were increasingly employed as part of a

broader and expanding money-based economy. The system put pressure on

both landlords and tenants to increase the productivity of agriculture

to make profit; the weakened coercive power of the aristocracy to extract peasant surpluses

encouraged them to try better methods; and the tenants also had

incentive to improve their methods in order to flourish in a competitive

labor market.

Terms of rent for land were becoming subject to economic market forces

rather than to the previous stagnant system of custom and feudal

obligation.

By the early 17th century, England was a centralized state in which much of the feudal order of Medieval Europe

had been swept away. This centralization was strengthened by a good

system of roads and by a disproportionately large capital city, London.

The capital acted as a central market hub for the entire country,

creating a very large internal market for goods, contrasting with the

fragmented feudal holdings that prevailed in most parts of the Continent.

Mercantilism

A painting of a French seaport from 1638 at the height of mercantilism

The economic doctrine prevailing from the 16th to the 18th centuries is commonly called mercantilism. This period, the Age of Discovery, was associated with the geographic exploration of the foreign lands by merchant traders, especially from England and the Low Countries. Mercantilism was a system of trade for profit, although commodities were still largely produced by non-capitalist methods. Most scholars consider the era of merchant capitalism and mercantilism as the origin of modern capitalism, although Karl Polanyi

argued that the hallmark of capitalism is the establishment of

generalized markets for what he called the "fictitious commodities",

i.e. land, labor and money. Accordingly, he argued that "not until 1834

was a competitive labor market established in England, hence industrial

capitalism as a social system cannot be said to have existed before that

date".

Robert Clive after the Battle of Plassey, which began East India Company rule in India

England began a large-scale and integrative approach to mercantilism during the Elizabethan Era (1558–1603). A systematic and coherent explanation of balance of trade was made public through Thomas Mun's argument England's Treasure by Forraign Trade, or the Balance of our Forraign Trade is The Rule of Our Treasure. It was written in the 1620s and published in 1664.

European merchants, backed by state controls, subsidies and monopolies, made most of their profits by buying and selling goods. In the words of Francis Bacon,

the purpose of mercantilism was "the opening and well-balancing of

trade; the cherishing of manufacturers; the banishing of idleness; the

repressing of waste and excess by sumptuary laws; the improvement and

husbanding of the soil; the regulation of prices...".

The British East India Company and the Dutch East India Company inaugurated an expansive era of commerce and trade. These companies were characterized by their colonial and expansionary powers given to them by nation-states.

During this era, merchants, who had traded under the previous stage of

mercantilism, invested capital in the East India Companies and other

colonies, seeking a return on investment.

Industrial capitalism

A Watt steam engine: the steam engine fuelled primarily by coal propelled the Industrial Revolution in Great Britain

In the mid-18th century, a new group of economic theorists, led by David Hume and Adam Smith,

challenged fundamental mercantilist doctrines such as the belief that

the world's wealth remained constant and that a state could only

increase its wealth at the expense of another state.

During the Industrial Revolution,

industrialists replaced merchants as a dominant factor in the

capitalist system and affected the decline of the traditional handicraft

skills of artisans, guilds and journeymen.

Also during this period, the surplus generated by the rise of

commercial agriculture encouraged increased mechanization of

agriculture. Industrial capitalism marked the development of the factory system of manufacturing, characterized by a complex division of labor

between and within work process and the routine of work tasks; and

finally established the global domination of the capitalist mode of

production.

Britain also abandoned its protectionist policy as embraced by mercantilism. In the 19th century, Richard Cobden and John Bright, who based their beliefs on the Manchester School, initiated a movement to lower tariffs. In the 1840s, Britain adopted a less protectionist policy, with the repeal of the Corn Laws and the Navigation Acts. Britain reduced tariffs and quotas, in line with David Ricardo's advocacy for free trade.

Modern capitalism

The gold standard formed the financial basis of the international economy from 1870 to 1914

Capitalism was carried across the world by broader processes of globalization

and by the beginning of the nineteenth century a series of loosely

connected market systems had come together as a relatively integrated

global system, in turn intensifying processes of economic and other

globalization. Later in the 20th century, capitalism overcame a challenge by centrally-planned economies and is now the encompassing system worldwide, with the mixed economy being its dominant form in the industrialized Western world.

Industrialization allowed cheap production of household items using economies of scale

while rapid population growth created sustained demand for commodities.

Globalization in this period was decisively shaped by 18th-century imperialism.

After the First and Second Opium Wars

and the completion of British conquest of India, vast populations of

these regions became ready consumers of European exports. Also in this

period, areas of sub-Saharan Africa and the Pacific islands were

colonised. The conquest of new parts of the globe, notably sub-Saharan

Africa, by Europeans yielded valuable natural resources such as rubber, diamonds and coal and helped fuel trade and investment between the European imperial powers, their colonies and the United States:

The inhabitant of London could order by telephone, sipping his morning tea, the various products of the whole earth, and reasonably expect their early delivery upon his doorstep. Militarism and imperialism of racial and cultural rivalries were little more than the amusements of his daily newspaper. What an extraordinary episode in the economic progress of man was that age which came to an end in August 1914.

In this period, the global financial system was mainly tied to the gold standard. The United Kingdom first formally adopted this standard in 1821. Soon to follow were Canada in 1853, Newfoundland in 1865, the United States and Germany (de jure) in 1873. New technologies, such as the telegraph, the transatlantic cable, the radiotelephone, the steamship and railway allowed goods and information to move around the world at an unprecedented degree.

The New York stock exchange traders' floor (1963)

In the period following the global depression of the 1930s, the state

played an increasingly prominent role in the capitalistic system

throughout much of the world. The postwar boom ended in the late 1960s

and early 1970s and the situation was worsened by the rise of stagflation. Monetarism, a modification of Keynesianism that is more compatible with laissez-faire, gained increasing prominence in the capitalist world, especially under the leadership of Ronald Reagan in the United States and Margaret Thatcher in the United Kingdom in the 1980s. Public and political interest began shifting away from the so-called collectivist concerns of Keynes's managed capitalism to a focus on individual choice, called "remarketized capitalism".

According to Harvard academic Shoshana Zuboff, a new genus of capitalism, surveillance capitalism, monetizes data acquired through surveillance. She states it was first discovered and consolidated at Google, emerged due to the "coupling of the vast powers of the digital with the radical indifference and intrinsic narcissism of the financial capitalism and its neoliberal vision that have dominated commerce for at least three decades, especially in the Anglo economies"

and depends on the global architecture of computer mediation which

produces a distributed and largely uncontested new expression of power

she calls "Big Other".

Relationship to democracy

Many analysts assert that China is one of the main examples of state capitalism in the 21st century

The relationship between democracy and capitalism is a contentious area in theory and in popular political movements. The extension of universal adult male suffrage

in 19th-century Britain occurred along with the development of

industrial capitalism and democracy became widespread at the same time

as capitalism, leading capitalists to posit a causal or mutual

relationship between them.

However, according to some authors in the 20th-century capitalism also

accompanied a variety of political formations quite distinct from

liberal democracies, including fascist regimes, absolute monarchies and single-party states.

Democratic peace theory asserts that democracies seldom fight other

democracies, but critics of that theory suggest that this may be because

of political similarity or stability rather than because they are

democratic or capitalist. Moderate critics argue that though economic

growth under capitalism has led to democracy in the past, it may not do

so in the future as authoritarian regimes have been able to manage economic growth without making concessions to greater political freedom.

One of the biggest supporters of the idea that capitalism promotes political freedom, Milton Friedman,

argued that competitive capitalism allows economic and political power

to be separate, ensuring that they do not clash with one another.

Moderate critics have recently challenged this, stating that the current

influence lobbying groups have had on policy in the United States is a

contradiction, given the approval of Citizens United.

This has led people to question the idea that competitive capitalism

promotes political freedom. The ruling on Citizens United allows

corporations to spend undisclosed and unregulated amounts of money on

political campaigns, shifting outcomes to the interests and undermining

true democracy. As explained in Robin Hahnel’s

writings, the centerpiece of the ideological defense of the free market

system is the concept of economic freedom and that supporters equate

economic democracy with economic freedom and claim that only the free

market system can provide economic freedom. According to Hahnel, there

are a few objections to the premise that capitalism offers freedom

through economic freedom. These objections are guided by critical

questions about who or what decides whose freedoms are more protected.

Often, the question of inequality is brought up when discussing how well

capitalism promotes democracy. An argument that could stand is that

economic growth can lead to inequality given that capital can be

acquired at different rates by different people. In Capital in the Twenty-First Century, Thomas Piketty of the Paris School of Economics asserts that inequality is the inevitable consequence of economic growth in a capitalist economy and the resulting concentration of wealth can destabilize democratic societies and undermine the ideals of social justice upon which they are built. Marxists, anarchists (except for anarcho-capitalists) and other leftists argue that capitalism is incompatible with democracy since capitalism according to Marx entails "dictatorship of the bourgeoisie" (owners of the means of production) while democracy entails rule by the people.

States with capitalistic economic systems have thrived under

political regimes deemed to be authoritarian or oppressive. Singapore

has a successful open market economy as a result of its competitive,

business-friendly climate and robust rule of law. Nonetheless, it often

comes under fire for its brand of government which though democratic and

consistently one of the least corrupt

also operates largely under a one-party rule and does not vigorously

defend freedom of expression given its government-regulated press as

well as penchant for upholding laws protecting ethnic and religious

harmony, judicial dignity and personal reputation. The private

(capitalist) sector in the People's Republic of China has grown

exponentially and thrived since its inception, despite having an

authoritarian government. Augusto Pinochet's rule in Chile led to economic growth and high levels of inequality by using authoritarian means to create a safe environment for investment and capitalism. Similarly, Suharto's authoritarian reign and extirpation of the Communist Party of Indonesia allowed for the expansion of capitalism in Indonesia.

Varieties of capitalism

Peter A. Hall and David Soskice

argued that modern economies have developed two different forms of

capitalism: liberal market economies (or LME) (e.g. the United States,

the United Kingdom, Canada, New Zealand and Ireland) and coordinated

market economies (CME) (e.g. Germany, Japan, Sweden and Austria). Those

two types can be distinguished by the primary way in which firms

coordinate with each other and other actors, such as trade unions.

In LMEs, firms primarily coordinate their endeavors by way of

hierarchies and market mechanisms. Coordinated market economies more

heavily rely on non-market forms of interaction in the coordination of

their relationship with other actors. These two forms of capitalisms developed different industrial relations, vocational training and education, corporate governance,

inter-firm relations and relations with employees. The existence of

these different forms of capitalism has important societal effects,

especially in periods of crisis and instability. Since the early 2000s,

the number of labor market outsiders has rapidly grown in Europe,

especially among the youth, potentially influencing social and political

participation. Using varieties of capitalism theory, it is possible to

disentangle the different effects on social and political participation

that an increase of labor market outsiders has in liberal and

coordinated market economies (Ferragina et al., 2016).

The social and political disaffection, especially among the youth,

seems to be more pronounced in liberal than coordinated market

economies. This signals an important problem for liberal market

economies in a period of crisis. If the market does not provide

consistent job opportunities (as it has in previous decades), the

shortcomings of liberal social security systems may depress social and

political participation even further than in other capitalist economies.

Characteristics

In general, capitalism as an economic system and mode of production can be summarised by the following:

- Capital accumulation: production for profit and accumulation as the implicit purpose of all or most of production, constriction or elimination of production formerly carried out on a common social or private household basis.

- Commodity production: production for exchange on a market; to maximize exchange-value instead of use-value.

- Private ownership of the means of production.

- High levels of wage labour.

- The investment of money to make a profit.

- The use of the price mechanism to allocate resources between competing uses.

- Economically efficient use of the factors of production and raw materials due to maximization of value added in the production process.

- Freedom of capitalists to act in their self-interest in managing their business and investments.

The market

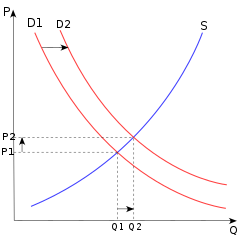

The

price (P) of a product is determined by a balance between production at

each price (supply, S) and the desires of those with purchasing power

at each price (demand, D): this results in a market equilibrium, with a

given quantity (Q) sold of the product, whereas a rise in demand would

result in an increase in price and an increase in output

In free market and laissez-faire

forms of capitalism, markets are used most extensively with minimal or

no regulation over the pricing mechanism. In mixed economies, which are

almost universal today, markets continue to play a dominant role, but they are regulated to some extent by the state in order to correct market failures, promote social welfare, conserve natural resources, fund defense and public safety or other rationale. In state capitalist systems, markets are relied upon the least, with the state relying heavily on state-owned enterprises or indirect economic planning to accumulate capital.

Supply is the amount of a good or service that is available for

purchase or sale. Demand is the measure of value for a good that people

are willing to buy at a given time. Prices tend to rise when demand for

an available resource increases or its supply diminishes and fall with

demand or when supply increases.

Competition arises when more than one producer is trying to sell

the same or similar products to the same buyers. In capitalist theory,

competition leads to innovation and more affordable prices. Without

competition, a monopoly or cartel may develop. A monopoly occurs when a firm is granted exclusivity over a market. Hence the firm can engage in rent seeking

behaviors such as limiting output and raising prices because it has no

fear of competition. A cartel is a group of firms that act together in a

monopolistic manner to control output and prices.

Governments have implemented legislation for the purpose of

preventing the creation of monopolies and cartels. In 1890, the Sherman

Anti-Trust Act became the first legislation passed by the United States

Congress to limit monopolies.

Profit motive

The profit motive,

in the theory in capitalism, is the desire to earn income in the form

of profit. Stated differently, the reason for a business's existence is

to turn a profit. The profit motive functions according to rational choice theory,

or the theory that individuals tend to pursue what is in their own best

interests. Accordingly, businesses seek to benefit themselves and/or

their shareholders by maximizing profit.

In capitalist theoretics, the profit motive is said to ensure that resources are being allocated efficiently. For instance, Austrian economist Henry Hazlitt

explains: "If there is no profit in making an article, it is a sign

that the labor and capital devoted to its production are misdirected:

the value of the resources that must be used up in making the article is

greater than the value of the article itself".

In other words, profits let companies know whether an item is worth

producing. Theoretically, in free and competitive markets maximising

profit ensures that resources are not wasted.

Private property

The relationship between the state,

its formal mechanisms and capitalist societies has been debated in many

fields of social and political theory, with active discussion since the

19th century. Hernando de Soto

is a contemporary Peruvian economist who has argued that an important

characteristic of capitalism is the functioning state protection of

property rights in a formal property system where ownership and

transactions are clearly recorded.

According to de Soto, this is the process by which physical

assets are transformed into capital, which in turn may be used in many

more ways and much more efficiently in the market economy. A number of

Marxian economists have argued that the Enclosure Acts in England and similar legislation elsewhere were an integral part of capitalist primitive accumulation and that specific legal frameworks of private land ownership have been integral to the development of capitalism.

Market competition

In capitalist economics, market competition is the rivalry among

sellers trying to achieve such goals as increasing profits, market share

and sales volume by varying the elements of the marketing mix:

price, product, distribution and promotion. Merriam-Webster defines

competition in business as "the effort of two or more parties acting

independently to secure the business of a third party by offering the

most favourable terms". It was described by Adam Smith in The Wealth of Nations (1776) and later economists as allocating productive resources to their most highly valued uses and encouraging efficiency. Smith and other classical economists before Antoine Augustine Cournot

were referring to price and non-price rivalry among producers to sell

their goods on best terms by bidding of buyers, not necessarily to a

large number of sellers nor to a market in final equilibrium. Competition is widespread throughout the market process. It is a condition where "buyers tend to compete with other buyers, and sellers tend to compete with other sellers".

In offering goods for exchange, buyers competitively bid to purchase

specific quantities of specific goods which are available, or might be

available if sellers were to choose to offer such goods. Similarly,

sellers bid against other sellers in offering goods on the market,

competing for the attention and exchange resources of buyers.

Competition results from scarcity—there

is never enough to satisfy all conceivable human wants—and occurs "when

people strive to meet the criteria that are being used to determine who

gets what".

Economic growth

World's GDP per capita shows exponential growth since the beginning of the Industrial Revolution

Capitalism and the economy of the People's Republic of China

Historically, capitalism has an ability to promote economic growth as measured by gross domestic product (GDP), capacity utilization or standard of living.

This argument was central, for example, to Adam Smith's advocacy of

letting a free market control production and price and allocate

resources. Many theorists have noted that this increase in global GDP

over time coincides with the emergence of the modern world capitalist

system.

Between 1000 and 1820, the world economy grew sixfold, a faster

rate than the population growth, so individuals enjoyed, on average, a

50% increase in income. Between 1820 and 1998, world economy grew

50-fold, a much faster rate than the population growth, so individuals

enjoyed on average a 9-fold increase in income.

Over this period, in Europe, North America and Australasia the economy

grew 19-fold per person, even though these regions already had a higher

starting level; and in Japan, which was poor in 1820, the increase per

person was 31-fold. In the Third World, there was an increase, but only 5-fold per person.

As a mode of production

The capitalist mode of production refers to the systems of organising production and distribution within capitalist societies.

Private money-making in various forms (renting, banking, merchant

trade, production for profit and so on) preceded the development of the

capitalist mode of production as such. The capitalist mode of production

proper based on wage-labour and private ownership of the means of

production and on industrial technology began to grow rapidly in Western

Europe from the Industrial Revolution, later extending to most of the world.

The term capitalist mode of production is defined by private ownership of the means of production, extraction of surplus value by the owning class for the purpose of capital accumulation, wage-based labour and at least as far as commodities are concerned being market-based.

Capitalism in the form of money-making activity has existed in

the shape of merchants and money-lenders who acted as intermediaries

between consumers and producers engaging in simple commodity production (hence the reference to "merchant capitalism")

since the beginnings of civilisation. What is specific about the

"capitalist mode of production" is that most of the inputs and outputs

of production are supplied through the market (i.e. they are commodities) and essentially all production is in this mode.

For example, in flourishing feudalism most or all of the factors of

production including labour are owned by the feudal ruling class

outright and the products may also be consumed without a market of any

kind, it is production for use within the feudal social unit and for

limited trade.

This has the important consequence that the whole organisation of the

production process is reshaped and re-organised to conform with economic

rationality as bounded

by capitalism, which is expressed in price relationships between inputs

and outputs (wages, non-labour factor costs, sales and profits) rather

than the larger rational context faced by society overall—that is, the

whole process is organised and re-shaped in order to conform to

"commercial logic". Essentially, capital accumulation comes to define

economic rationality in capitalist production.

A society, region or nation

is capitalist if the predominant source of incomes and products being

distributed is capitalist activity, but even so this does not yet mean

necessarily that the capitalist mode of production is dominant in that

society.

Supply and demand

The price P of a product is determined by a balance between production at each price (supply S) and the desires of those with purchasing power at each price (demand D): the diagram shows a positive shift in demand from D1 to D2, resulting in an increase in price (P) and quantity sold (Q) of the product

In capitalist economic structures, supply and demand is an economic model of price determination in a market. It concludes that in a competitive market, the unit price for a particular good

will vary until it settles at a point where the quantity demanded by

consumers (at the current price) will equal the quantity supplied by

producers (at the current price), resulting in an economic equilibrium for price and quantity.

- If demand increases (demand curve shifts to the right) and supply remains unchanged, then a shortage occurs, leading to a higher equilibrium price.

- If demand decreases (demand curve shifts to the left) and supply remains unchanged, then a surplus occurs, leading to a lower equilibrium price.

- If demand remains unchanged and supply increases (supply curve shifts to the right), then a surplus occurs, leading to a lower equilibrium price.

- If demand remains unchanged and supply decreases (supply curve shifts to the left), then a shortage occurs, leading to a higher equilibrium price.

Graphical representation of supply and demand

Although it is normal to regard the quantity demanded and the quantity supplied as functions of the price of the goods, the standard graphical representation, usually attributed to Alfred Marshall,

has price on the vertical axis and quantity on the horizontal axis, the

opposite of the standard convention for the representation of a

mathematical function.

Since determinants of supply and demand other than the price of

the goods in question are not explicitly represented in the

supply-demand diagram, changes in the values of these variables are

represented by moving the supply and demand curves (often described as

"shifts" in the curves). By contrast, responses to changes in the price

of the good are represented as movements along unchanged supply and

demand curves.

Supply schedule

A

supply schedule is a table that shows the relationship between the

price of a good and the quantity supplied. Under the assumption of perfect competition, supply is determined by marginal cost.

That is: firms will produce additional output while the cost of

producing an extra unit of output is less than the price they would

receive.

A hike in the cost of raw goods would decrease supply and

shifting costs up while a discount would increase supply, shifting costs

down and hurting producers as producer surplus decreases.

By its very nature, conceptualising a supply curve requires the

firm to be a perfect competitor (i.e. to have no influence over the

market price). This is true because each point on the supply curve is

the answer to the question "If this firm is faced with this

potential price, how much output will it be able to and willing to

sell?". If a firm has market power, its decision of how much output to

provide to the market influences the market price, therefore the firm is

not "faced with" any price and the question becomes less relevant.

Economists distinguish between the supply curve of an individual

firm and between the market supply curve. The market supply curve is

obtained by summing the quantities supplied by all suppliers at each

potential price, thus in the graph of the supply curve individual firms'

supply curves are added horizontally to obtain the market supply curve.

Economists also distinguish the short-run market supply curve

from the long-run market supply curve. In this context, two things are

assumed constant by definition of the short run: the availability of one

or more fixed inputs (typically physical capital)

and the number of firms in the industry. In the long-run, firms can

adjust their holdings of physical capital, enabling them to better

adjust their quantity supplied at any given price. Furthermore, in the

long-run potential competitors can enter

or exit the industry in response to market conditions. For both of

these reasons, long-run market supply curves are generally flatter than

their short-run counterparts.

The determinants of supply are:

- Production costs: how much a goods costs to be produced. Production costs are the cost of the inputs; primarily labor, capital, energy and materials. They depend on the technology used in production and/or technological advances. See productivity.

- Firms' expectations about future prices.

- Number of suppliers.

Demand schedule

A demand schedule, depicted graphically as the demand curve, represents the amount of some goods

that buyers are willing and able to purchase at various prices,

assuming all determinants of demand other than the price of the good in

question, such as income, tastes and preferences, the price of substitute goods and the price of complementary goods, remain the same. Following the law of demand,

the demand curve is almost always represented as downward-sloping,

meaning that as price decreases, consumers will buy more of the good.

Just like the supply curves reflect marginal cost curves, demand curves are determined by marginal utility curves.

Consumers will be willing to buy a given quantity of a good at a given

price, if the marginal utility of additional consumption is equal to the

opportunity cost

determined by the price—that is, the marginal utility of alternative

consumption choices. The demand schedule is defined as the willingness

and ability of a consumer to purchase a given product in a given frame

of time.

While the aforementioned demand curve is generally

downward-sloping, there may be rare examples of goods that have

upward-sloping demand curves. Two different hypothetical types of goods

with upward-sloping demand curves are Giffen goods (an inferior, but staple good) and Veblen goods (goods made more fashionable by a higher price).

By its very nature, conceptualising a demand curve requires that

the purchaser be a perfect competitor—that is, that the purchaser has no

influence over the market price. This is true because each point on the

demand curve is the answer to the question "If this buyer is faced with

this potential price, how much of the product will it purchase?". If a

buyer has market power, so its decision of how much to buy influences

the market price, then the buyer is not "faced with" any price and the

question is meaningless.

Like with supply curves, economists distinguish between the

demand curve of an individual and the market demand curve. The market

demand curve is obtained by summing the quantities demanded by all

consumers at each potential price, thus in the graph of the demand curve

individuals' demand curves are added horizontally to obtain the market

demand curve.

The determinants of demand are:

- Income.

- Tastes and preferences.

- Prices of related goods and services.

- Consumers' expectations about future prices and incomes that can be checked.

- Number of potential consumers.

Equilibrium

In the context of supply and demand, economic equilibrium refers to a state where economic forces such as supply and demand are balanced and in the absence of external influences the (equilibrium) values of economic variables will not change. For example, in the standard text-book model of perfect competition equilibrium occurs at the point at which quantity demanded and quantity supplied are equal.

Market equilibrium in this case refers to a condition where a market

price is established through competition such that the amount of goods

or services sought by buyers is equal to the amount of goods or services produced by sellers. This price is often called the competitive price or market clearing

price and will tend not to change unless demand or supply changes and

the quantity is called "competitive quantity" or market clearing

quantity.

Partial equilibrium

Partial equilibrium, as the name suggests, takes into consideration only a part of the market to attain equilibrium.

Jain proposes (attributed to George Stigler):

"A partial equilibrium is one which is based on only a restricted range

of data, a standard example is price of a single product, the prices of

all other products being held fixed during the analysis".

The supply and demand model is a partial equilibrium model of economic equilibrium, where the clearance on the market of some specific goods is obtained independently from prices and quantities in other markets. In other words, the prices of all substitutes and complements as well as income levels of consumers are constant. This makes analysis much simpler than in a general equilibrium model which includes an entire economy.

Here the dynamic process is that prices adjust until supply

equals demand. It is a powerfully simple technique that allows one to

study equilibrium, efficiency and comparative statics.

The stringency of the simplifying assumptions inherent in this approach

make the model considerably more tractable, but it may produce results

which while seemingly precise do not effectively model real world

economic phenomena.

Partial equilibrium analysis examines the effects of policy

action in creating equilibrium only in that particular sector or market

which is directly affected, ignoring its effect in any other market or

industry assuming that they being small will have little impact if any.

Hence this analysis is considered to be useful in constricted markets.

Léon Walras first formalised the idea of a one-period economic equilibrium of the general economic system, but it was French economist Antoine Augustin Cournot and English political economist Alfred Marshall who developed tractable models to analyse an economic system.

Empirical estimation

Demand and supply relations in a market can be statistically estimated from price, quantity and other data with sufficient information in the model. This can be done with simultaneous-equation methods of estimation in econometrics.

Such methods allow solving for the model-relevant "structural

coefficients", the estimated algebraic counterparts of the theory. The parameter identification problem is a common issue in "structural estimation". Typically, data on exogenous variables (that is, variables other than price and quantity, both of which are endogenous variables) are needed to perform such an estimation. An alternative to "structural estimation" is reduced-form estimation, which regresses each of the endogenous variables on the respective exogenous variables.

Macroeconomic uses of demand and supply

Demand and supply have also been generalised to explain macroeconomic variables in a market economy, including the quantity of total output and the general price level. The Aggregate Demand–Aggregate Supply model

may be the most direct application of supply and demand to

macroeconomics, but other macroeconomic models also use supply and

demand. Compared to microeconomic uses of demand and supply, different (and more controversial) theoretical considerations apply to such macroeconomic counterparts as aggregate demand and aggregate supply. Demand and supply are also used in macroeconomic theory to relate money supply and money demand to interest rates and to relate labor supply and labor demand to wage rates.

History

According

to Hamid S. Hosseini, the power of supply and demand was understood to

some extent by several early Muslim scholars, such as fourteenth-century

Mamluk scholar Ibn Taymiyyah,

who wrote: "If desire for goods increases while its availability

decreases, its price rises. On the other hand, if availability of the

good increases and the desire for it decreases, the price comes down".

John Locke's 1691 work Some Considerations on the Consequences of the Lowering of Interest and the Raising of the Value of Money includes an early and clear description of supply and demand and their relationship. In this description, demand is rent:

"The price of any commodity rises or falls by the proportion of the

number of buyer and sellers" and "that which regulates the price... [of

goods] is nothing else but their quantity in proportion to their rent".

The phrase "supply and demand" was first used by James Denham-Steuart in his Inquiry into the Principles of Political Economy, published in 1767. Adam Smith used the phrase in his 1776 book The Wealth of Nations, and David Ricardo titled one chapter of his 1817 work Principles of Political Economy and Taxation "On the Influence of Demand and Supply on Price".

In The Wealth of Nations, Smith generally assumed that the

supply price was fixed, but that its "merit" (value) would decrease as

its "scarcity" increased, in effect what was later called the law of

demand also. In Principles of Political Economy and Taxation, Ricardo more rigorously laid down the idea of the assumptions that were used to build his ideas of supply and demand. Antoine Augustin Cournot first developed a mathematical model of supply and demand in his 1838 Researches into the Mathematical Principles of Wealth, including diagrams.

During the late 19th century, the marginalist school of thought emerged. This field mainly was started by Stanley Jevons, Carl Menger and Léon Walras.

The key idea was that the price was set by the most expensive

price—that is, the price at the margin. This was a substantial change

from Adam Smith's thoughts on determining the supply price.

In his 1870 essay "On the Graphical Representation of Supply and Demand", Fleeming Jenkin

in the course of "introduc[ing] the diagrammatic method into the

English economic literature" published the first drawing of supply and

demand curves therein, including comparative statics from a shift of supply or demand and application to the labor market. The model was further developed and popularized by Alfred Marshall in the 1890 textbook Principles of Economics.

Role of government

In a capitalist system, the government does not prohibit private

property or prevent individuals from working where they please. The

government does not prevent firms from determining what wages they will

pay and what prices they will charge for their products. However, many

countries have minimum wage laws and minimum safety standards.

Under some versions of capitalism, the government carries out a

number of economic functions, such as issuing money, supervising public

utilities and enforcing private contracts. Many countries have competition laws

that prohibit monopolies and cartels from forming. Despite

anti-monopoly laws, large corporations can form near-monopolies in some

industries. Such firms can temporarily drop prices and accept losses to

prevent competition from entering the market and then raise them again

once the threat of entry is reduced. In many countries, public utilities

(e.g. electricity, heating fuel and communications) are able to operate

as a monopoly under government regulation due to high economies of

scale.

Government agencies regulate the standards of service in many

industries, such as airlines and broadcasting as well as financing a

wide range of programs. In addition, the government regulates the flow

of capital and uses financial tools such as the interest rate to control

factors such as inflation and unemployment.

Relationship to political freedom

In his book The Road to Serfdom, Friedrich Hayek asserts that the economic freedom of capitalism is a requisite of political freedom.

He argues that the market mechanism is the only way of deciding what to

produce and how to distribute the items without using coercion. Milton Friedman, Andrew Brennan and Ronald Reagan also promoted this view. Friedman claimed that centralized economic operations are always accompanied by political repression.

In his view, transactions in a market economy are voluntary and that

the wide diversity that voluntary activity permits is a fundamental

threat to repressive political leaders and greatly diminish their power

to coerce. Some of Friedman's views were shared by John Maynard Keynes, who believed that capitalism is vital for freedom to survive and thrive. Freedom House,

an American think tank that conducts international research on and

advocates for, democracy, political freedom and human rights, has argued

"there is a high and statistically significant correlation between the

level of political freedom as measured by Freedom House and economic freedom as measured by the Wall Street Journal/Heritage Foundation survey".

Types of capitalism

There

are many variants of capitalism in existence that differ according to

country and region. They vary in their institutional makeup and by their

economic policies. The common features among all the different forms of

capitalism is that they are based on the production of goods and

services for profit, predominantly market-based allocation of resources

and they are structured upon the accumulation of capital. The major

forms of capitalism are listed hereafter:

Advanced capitalism

Advanced capitalism is the situation that pertains to a society in which the capitalist model has been integrated and developed deeply and extensively for a prolonged period. Various writers identify Antonio Gramsci

as an influential early theorist of advanced capitalism, even if he did

not use the term himself. In his writings, Gramsci sought to explain

how capitalism had adapted to avoid the revolutionary overthrow that had

seemed inevitable in the 19th century. At the heart of his explanation

was the decline of raw coercion as a tool of class power, replaced by

use of civil society institutions to manipulate public ideology in the capitalists' favour.

Jürgen Habermas

has been a major contributor to the analysis of advanced-capitalistic

societies. Habermas observed four general features that characterise

advanced capitalism:

- Concentration of industrial activity in a few large firms.

- Constant reliance on the state to stabilise the economic system.

- A formally democratic government that legitimises the activities of the state and dissipates opposition to the system.

- The use of nominal wage increases to pacify the most restless segments of the work force.

Finance capitalism

In their critique of capitalism, Marxism and Leninism both emphasise the role of "finance capital" as the determining and ruling-class interest in capitalist society, particularly in the latter stages.

Rudolf Hilferding is credited with first bringing the term "finance capitalism" into prominence through Finance Capital, his 1910 study of the links between German trusts, banks and monopolies—a study subsumed by Vladimir Lenin into Imperialism, the Highest Stage of Capitalism (1917), his analysis of the imperialist relations of the great world powers.

Lenin concluded that the banks at that time operated as "the chief

nerve centres of the whole capitalist system of national economy". For the Comintern (founded in 1919), the phrase "dictatorship of finance capitalism" became a regular one.

Fernnand Braudel

would later point to two earlier periods when finance capitalism had

emerged in human history—with the Genoese in the 16th century and with

the Dutch in the 17th and 18th centuries—although at those points it

developed from commercial capitalism. Giovanni Arrighi

extended Braudel's analysis to suggest that a predominance of finance

capitalism is a recurring, long-term phenomenon, whenever a previous

phase of commercial/industrial capitalist expansion reaches a plateau.

Mercantilism

The subscription room at Lloyd's of London in the early 19th century

Mercantilism is a nationalist form of early capitalism that came into

existence approximately in the late 16th century. It is characterized

by the intertwining of national business interests to state-interest and

imperialism; and consequently, the state apparatus is utilized to

advance national business interests abroad. An example of this is

colonists living in America who were only allowed to trade with and

purchase goods from their respective mother countries (e.g. Britain,

Portugal and France). Mercantilism was driven by the belief that the

wealth of a nation is increased through a positive balance of trade with

other nations—it corresponds to the phase of capitalist development

sometimes called the primitive accumulation of capital.

Free market economy

Free market economy refers to a capitalist economic system where

prices for goods and services are set freely by the forces of supply and

demand and are allowed to reach their point of equilibrium without

intervention by government policy. It typically entails support for

highly competitive markets and private ownership of productive

enterprises. Laissez-faire is a more extensive form of free market economy where the role of the state is limited to protecting property rights, or for plumbline anarcho-capitalists, property rights are protected by private firms and market-generated law.

Social market economy

A social market economy is a nominally free market system where

government intervention in price formation is kept to a minimum, but the

state provides significant services in the area of social security,

unemployment benefits and recognition of labor rights through national collective bargaining

arrangements. This model is prominent in Western and Northern European

countries as well as Japan, albeit in slightly different configurations.

The vast majority of enterprises are privately owned in this economic

model.

Rhine capitalism

refers to the contemporary model of capitalism and adaptation of the

social market model that exists in continental Western Europe today.

State capitalism

State capitalism is a capitalist market economy dominated by

state-owned enterprises, where the state enterprises are organized as

commercial, profit-seeking businesses. The designation has been used

broadly throughout the 20th century to designate a number of different

economic forms, ranging from state-ownership in market economies to the

command economies of the former Eastern Bloc. According to Aldo Musacchio, a professor at Harvard Business School,

state capitalism is a system in which governments, whether democratic or

autocratic, exercise a widespread influence on the economy either

through direct ownership or various subsidies. Musacchio notes a number

of differences between today's state capitalism and its predecessors. In

his opinion, gone are the days when governments appointed bureaucrats

to run companies: the world's largest state-owned enterprises are now

traded on the public markets and kept in good health by large

institutional investors. Contemporary state capitalism is associated

with the East Asian model of capitalism, dirigisme and the economy of Norway. Alternatively, Merriam-Webster

defines state capitalism as "an economic system in which private

capitalism is modified by a varying degree of government ownership and

control".

In Socialism: Utopian and Scientific, Friedrich Engels

argued that state-owned enterprises would characterize the final stage

of capitalism, consisting of ownership and management of large-scale

production and communication by the bourgeois state. In his writings, Vladimir Lenin

characterized the economy of Soviet Russia as state capitalist,

believing state capitalism to be an early step toward the development of

socialism.

Some economists and left-wing academics including Richard D. Wolff and Noam Chomsky argue that the economies of the former Soviet Union

and Eastern bloc represented a form of state capitalism because their

internal organization within enterprises and the system of wage labor

remained intact.

The term is not used by Austrian School economists to describe state ownership of the means of production. The economist Ludwig von Mises

argued that the designation of "state capitalism" was simply a new

label for the old labels of "state socialism" and "planned economy" and

differed only in non-essentials from these earlier designations.

The debate between proponents of private versus state capitalism

is centered around questions of managerial efficacy, productive

efficiency and fair distribution of wealth.

Corporate capitalism

Corporate capitalism is a free or mixed-market economy characterized

by the dominance of hierarchical, bureaucratic corporations.

Mixed economy

A mixed economy is a largely market-based economy consisting of both

private and public ownership of the means of production and economic interventionism through macroeconomic policies intended to correct market failures,

reduce unemployment and keep inflation low. The degree of intervention

in markets varies among different countries. Some mixed economies, such

as France under dirigisme, also featured a degree of indirect economic planning over a largely capitalist-based economy.

Most [DJS -- all?] modern capitalist economies are defined as "mixed economies" to some degree.

Others

Other variants of capitalism include:

|

|

|

Capital accumulation

The accumulation of capital

is the process of "making money", or growing an initial sum of money

through investment in production. Capitalism is based on the

accumulation of capital, whereby financial capital

is invested in order to make a profit and then reinvested into further

production in a continuous process of accumulation. In Marxian economic

theory, this dynamic is called the law of value. Capital accumulation forms the basis of capitalism, where economic activity is structured around the accumulation of capital, defined as investment in order to realize a financial profit.

In this context, "capital" is defined as money or a financial asset

invested for the purpose of making more money (whether in the form of

profit, rent, interest, royalties, capital gain or some other kind of

return).

In mainstream economics, accounting and Marxian economics, capital accumulation is often equated with investment of profit income or saving, especially in real capital goods. The concentration and centralisation of capital are two of the results of such accumulation. In modern macroeconomics and econometrics, the phrase "capital formation" is often used in preference to "accumulation", though the United Nations Conference on Trade and Development (UNCTAD) refers nowadays to "accumulation". The term “accumulation” is occasionally used in national accounts.

Background

Accumulation

can be measured as the monetary value of investments, the amount of

income that is reinvested, or as the change in the value of assets owned

(the increase in the value of the capital stock). Using company balance sheets, tax data and direct surveys as a basis, government statisticians estimate total investments and assets for the purpose of national accounts, national balance of payments and flow of funds statistics. The Reserve Banks and the Treasury usually provide interpretations and analysis of this data. Standard indicators include capital formation, gross fixed capital formation, fixed capital, household asset wealth and foreign direct investment.

Organisations such as the International Monetary Fund, the UNCTAD, the World Bank Group, the OECD and the Bank for International Settlements used national investment data to estimate world trends. The Bureau of Economic Analysis, Eurostat

and the Japan Statistical Office provide data on the United States,

Europe and Japan respectively. Other useful sources of investment

information are business magazines such as Fortune, Forbes, The Economist, Business Week and so on as well as various corporate "watchdog" organisations and non-governmental organisation publications. A reputable scientific journal is the Review of Income & Wealth.

In the case of the United States, the "Analytical Perspectives"

document (an annex to the yearly budget) provides useful wealth and

capital estimates applying to the whole country.

In Karl Marx'

economic theory, capital accumulation refers to the operation whereby

profits are reinvested increasing the total quantity of capital. Capital

is viewed by Marx as expanding value, that is, in other terms, as a sum

of capital, usually expressed in money, that is transformed through

human labor into a larger value, extracted as profits and expressed as

money. Here, capital is defined essentially as economic or commercial

asset value in search of additional value or surplus-value.

This requires property relations which enable objects of value to be

appropriated and owned, and trading rights to be established. Capital

accumulation has a double origin, namely in trade and in expropriation,

both of a legal or illegal kind. The reason is that a stock of capital

can be increased through a process of exchange or "trading up", but also

through directly taking an asset or resource from someone else without

compensation. David Harvey calls this accumulation by dispossession.

The continuation and progress of capital accumulation depends on

the removal of obstacles to the expansion of trade and this has

historically often been a violent process. As markets expand, more and

more new opportunities develop for accumulating capital because more and

more types of goods and services can be traded in. However, capital

accumulation may also confront resistance when people refuse to sell, or

refuse to buy (for example a strike by investors or workers, or consumer resistance).

Concentration and centralisation

According

to Marx, capital has the tendency for concentration and centralization

in the hands of the wealthy. Marx explains: "It is concentration of

capitals already formed, destruction of their individual independence,

expropriation of capitalist by capitalist, transformation of many small

into few large capitals. [...] Capital grows in one place to a huge mass

in a single hand, because it has in another place been lost by many.

[...] The battle of competition is fought by cheapening of commodities.

The cheapness of commodities demands, caeteris paribus, on the

productiveness of labour, and this again on the scale of production.

Therefore, the larger capitals beat the smaller. It will further be

remembered that, with the development of the capitalist mode of

production, there is an increase in the minimum amount of individual

capital necessary to carry on a business under its normal conditions.

The smaller capitals, therefore, crowd into spheres of production which

Modern Industry has only sporadically or incompletely got hold of. Here

competition rages [...] It always ends in the ruin of many small

capitalists, whose capitals partly pass into the hands of their

conquerors, partly vanish".

The rate of accumulation

In Marxian economics, the rate of accumulation is defined as (1) the value of the real net increase in the stock of capital in an accounting period; and (2) the proportion of realised surplus-value

or profit-income which is reinvested, rather than consumed. This rate

can be expressed by means of various ratios between the original capital

outlay, the realised turnover, surplus-value or profit and

reinvestments (e.g. the writings of the economist Michał Kalecki).

Other things being equal, the greater the amount of profit-income

that is disbursed as personal earnings and used for consumptive

purposes, the lower the savings rate and the lower the rate of

accumulation is likely to be. However, earnings spent on consumption can

also stimulate market demand and higher investment. This is the cause

of endless controversies in economic theory about "how much to spend,

and how much to save".

In a boom period of capitalism, the growth of investments is

cumulative, i.e. one investment leads to another, leading to a

constantly expanding market, an expanding labor force and an increase in the standard of living for the majority of the people.

In a stagnating, decadent capitalism, the accumulation process is

increasingly oriented towards investment on military and security

forces, real estate, financial speculation and luxury consumption. In

that case, income from value-adding

production will decline in favour of interest, rent and tax income,

with as a corollary an increase in the level of permanent unemployment.

The more capital one owns, the more capital one can also borrow. The

inverse is also true and this is one factor in the widening gap between

the rich and the poor.

Ernest Mandel

emphasised that the rhythm of capital accumulation and growth depended

critically on (1) the division of a society's social product between "necessary product" and "surplus product"; and (2) the division of the surplus product between investment and consumption. In turn, this allocation pattern reflected the outcome of competition

among capitalists, competition between capitalists and workers and

competition between workers. The pattern of capital accumulation can

therefore never be simply explained by commercial factors as it also

involved social factors and power relationships.

The circuit of capital accumulation from production

Strictly speaking, capital has accumulated only when realised profit income has been reinvested in capital assets. As suggested in the first volume of Marx' Das Kapital, the process of capital accumulation in production has at least seven distinct but linked moments:

- The initial investment of capital (which could be borrowed capital) in means of production and labor power.

- The command over surplus-labour and its appropriation.

- The valorisation (increase in value) of capital through production of new outputs.

- The appropriation of the new output produced by employees, containing the added value.

- The realisation of surplus-value through output sales.

- The appropriation of realised surplus-value as (profit) income after deduction of costs.

- The reinvestment of profit income in production.

All of these moments do not refer simply to an "economic" or

commercial process. Rather, they assume the existence of legal, social,

cultural and economic power conditions, without which creation,

distribution and circulation of the new wealth could not occur. This

becomes especially clear when the attempt is made to create a market

where none exists, or where people refuse to trade.

Simple and expanded reproduction

In the second volume of Das Kapital, Marx continues the story and shows that with the aid of bank credit

capital in search of growth can more or less smoothly mutate from one

form to another, alternately taking the form of money capital (liquid

deposits, securities and so on), commodity capital (tradable products,

real estate and the like), or production capital (means of production and labor power).

His discussion of the simple and expanded reproduction

of the conditions of production offers a more sophisticated model of

the parameters of the accumulation process as a whole. At simple

reproduction, a sufficient amount is produced to sustain society at the

given living standard;

the stock of capital stays constant. At expanded reproduction, more

product-value is produced than is necessary to sustain society at a

given living standard (a surplus product); the additional product-value is available for investments which enlarge the scale and variety of production.

The bourgeois claim there is no economic law

according to which capital is necessarily re-invested in the expansion

of production, that such depends on anticipated profitability, market

expectations and perceptions of investment risk. Such statements only

explain the subjective experiences of investors and ignore the objective

realities which would influence such opinions. As Marx states in the

second volume of Das Kapital, simple reproduction only exists if

the variable and surplus capital realised by Dept. 1—producers of means

of production—exactly equals that of the constant capital of Dept. 2,

producers of articles of consumption (p. 524). Such equilibrium rests on

various assumptions, such as a constant labor supply (no population

growth). Accumulation does not imply a necessary change in total

magnitude of value produced, but can simply refer to a change in the

composition of an industry (p. 514).

Ernest Mandel

introduced the additional concept of contracted economic reproduction,

i.e. reduced accumulation where business operating at a loss outnumbers

growing business, or economic reproduction on a decreasing scale, for

example due to wars, natural disasters or devalorisation.

Balanced economic growth

requires that different factors in the accumulation process expand in

appropriate proportions. However, markets themselves cannot

spontaneously create that balance and in fact what drives business

activity is precisely the imbalances between supply and demand:

inequality is the motor of growth. This partly explains why the

worldwide pattern of economic growth is very uneven and unequal, even

although markets have existed almost everywhere for a very long-time.

Some people argue that it also explains government regulation of market

trade and protectionism.

Capital accumulation as social relation

"Accumulation of capital" sometimes also refers in Marxist writings to the reproduction of capitalist social relations (institutions) on a larger scale over time, i.e. the expansion of the size of the proletariat and of the wealth owned by the bourgeoisie.

This interpretation emphasises that capital ownership, predicated on

command over labor, is a social relation: the growth of capital implies

the growth of the working class (a "law of accumulation"). In the first volume of Das Kapital, Marx had illustrated this idea with reference to Edward Gibbon Wakefield's theory of colonisation:

Wakefield discovered that in the Colonies, property in money, means of subsistence, machines, and other means of production, does not as yet stamp a man as a capitalist if there be wanting the correlative—the wage-worker, the other man who is compelled to sell himself of his own free-will. He discovered that capital is not a thing, but a social relation between persons, established by the instrumentality of things. Mr. Peel, he moans, took with him from England to Swan River, West Australia, means of subsistence and of production to the amount of £50,000. Mr. Peel had the foresight to bring with him, besides, 3,000 persons of the working-class, men, women, and children. Once arrived at his destination, 'Mr. Peel was left without a servant to make his bed or fetch him water from the river.' Unhappy Mr. Peel, who provided for everything except the export of English modes of production to Swan River!

— Das Kapital, vol. 1, ch. 33

In the third volume of Das Kapital,

Marx refers to the "fetishism of capital" reaching its highest point

with interest-bearing capital because now capital seems to grow of its

own accord without anybody doing anything:

The relations of capital assume their most externalised and most fetish-like form in interest-bearing capital. We have here , money creating more money, self-expanding value, without the process that effectuates these two extremes. In merchant's capital, , there is at least the general form of the capitalistic movement, although it confines itself solely to the sphere of circulation, so that profit appears merely as profit derived from alienation; but it is at least seen to be the product of a social relation, not the product of a mere thing. [...] This is obliterated in , the form of interest-bearing capital. [...] The thing (money, commodity, value) is now capital even as a mere thing, and capital appears as a mere thing. The result of the entire process of reproduction appears as a property inherent in the thing itself. It depends on the owner of the money, i.e., of the commodity in its continually exchangeable form, whether he wants to spend it as money or loan it out as capital. In interest-bearing capital, therefore, this automatic fetish, self-expanding value, money generating money, are brought out in their pure state and in this form it no longer bears the birth-marks of its origin. The social relation is consummated in the relation of a thing, of money, to itself. Instead of the actual transformation of money into capital, we see here only form without content.

— Das Kapital, vol. 1, ch. 24

Wage labour

An industrial worker amidst heavy steel semi-products (Kinex Bearings, Bytča, Slovakia, c. 1995–2000)

Wage labour refers to the sale of labour under a formal or informal employment contract to an employer. These transactions usually occur in a labour market where wages are market determined. Individuals who possess and supply financial capital or labor to productive ventures often become owners, either jointly (as shareholders)

or individually. In Marxist economics, these owners of the means of

production and suppliers of capital are generally called capitalists.

The description of the role of the capitalist has shifted, first

referring to a useless intermediary between producers to an employer of

producers and eventually came to refer to owners of the means of

production. Labor

includes all physical and mental human resources, including

entrepreneurial capacity and management skills, which are needed to

produce products and services. Production is the act of making goods or services by applying labor power.

Critics of the capitalist mode of production see wage labour as a

major, if not defining, aspect of hierarchical industrial systems. Most

opponents of the institution support worker self-management and economic democracy

as alternatives to both wage labour and to capitalism. While most

opponents of the wage system blame the capitalist owners of the means of

production for its existence, most anarchists and other libertarian socialists

also hold the state as equally responsible as it exists as a tool

utilised by capitalists to subsidise themselves and protect the