Iron ore (banded iron formation)

Manganese ore – psilomelane (size: 6.7 × 5.8 × 5.1 cm)

Gold ore (size: 7.5 × 6.1 × 4.1 cm)

An ore is a natural occurrence of rock or sediment that contains sufficient minerals with economically important elements, typically metals, that can be economically extracted from the deposit. The ores are extracted at a profit from the earth through mining; they are then refined (often via smelting) to extract the valuable element or elements.

The ore grade, or concentration of an ore mineral or metal,

as well as its form of occurrence, will directly affect the costs

associated with mining the ore. The cost of extraction must thus be

weighed against the metal value contained in the rock to determine what

ore can be processed and what ore is of too low a grade to be worth mining. Metal ores are generally oxides, sulfides, silicates, or native metals (such as native copper) that are not commonly concentrated in the Earth's crust, or noble metals (not usually forming compounds) such as gold.

The ores must be processed to extract the elements of interest from the

waste rock and from the ore minerals. Ore bodies are formed by a

variety of geological processes. The process of ore formation is called ore genesis.

Ore deposits

An ore deposit is an accumulation of ore. This is distinct from a

mineral resource as defined by the mineral resource classification

criteria. An ore deposit is one occurrence of a particular ore type.

Most ore deposits are named according to their location (for example,

the Witwatersrand, South Africa), or after a discoverer (e.g. the Kambalda

nickel shoots are named after drillers), or after some whimsy, a

historical figure, a prominent person, something from mythology

(phoenix, kraken, serepentleopard, etc.) or the code name of the

resource company which found it (e.g. MKD-5 was the in-house name for

the Mount Keith nickel sulphide deposit).

Classification

Ore deposits are classified according to various criteria developed via the study of economic geology, or ore genesis. The classifications below are typical.

Hydrothermal epigenetic deposits

- Mesothermal lode gold deposits, typified by the Golden Mile, Kalgoorlie

- Archaean conglomerate hosted gold-uranium deposits, typified by Elliot Lake, Ontario, Canada and Witwatersrand, South Africa

- Carlin–type gold deposits, including;

- Epithermal stockwork vein deposits

- IOCG or iron oxide copper gold deposits, typified by the supergiant Olympic Dam Cu-Au-U deposit

- Porphyry copper +/- gold +/- molybdenum +/- silver deposits

- Intrusive-related copper-gold +/- (tin-tungsten), typified by the Tombstone, Arizona deposits

- Hydromagmatic magnetite iron ore deposits and skarns

- Skarn ore deposits of copper, lead, zinc, tungsten, etcetera

Magmatic deposits

- Magmatic nickel-copper-iron-PGE deposits including

- Cumulate vanadiferous or platinum-bearing magnetite or chromite

- Cumulate hard-rock titanium (ilmenite) deposits

- Komatiite hosted Ni-Cu-PGE deposits

- Subvolcanic feeder subtype, typified by Noril'sk-Talnakh and the Thompson Belt, Canada

- Intrusive-related Ni-Cu-PGE, typified by Voisey's Bay, Canada and Jinchuan, China

- Lateritic nickel ore deposits, examples include Goro and Acoje, (Philippines) and Ravensthorpe, Western Australia.

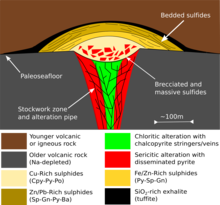

A cross-section of a typical Volcanic hosted massive sulfide|volcanogenic massive sulfide (VMS) ore deposit

- Volcanic hosted massive sulfide (VHMS) Cu-Pb-Zn including;

- Examples include Teutonic Bore and Golden Grove, Western Australia

- Besshi type

- Kuroko type

- Examples include Teutonic Bore and Golden Grove, Western Australia

Metamorphically reworked deposits

- Podiform serpentinite-hosted paramagmatic iron oxide-chromite deposits, typified by Savage River, Tasmania iron ore, Coobina chromite deposit

- Broken Hill Type Pb-Zn-Ag, considered to be a class of reworked SEDEX deposits

- Phosphorus-tantalite-vermiculite (Phalaborwa South Africa)

- Rare earth elements – Mount Weld, Australia and Bayan Obo, Mongolia

- Diatreme hosted diamond in kimberlite, lamproite or lamprophyre

Sedimentary deposits

Magnified view of banded iron formation specimen from Upper Michigan. Scale bar is 5.0 mm.

- Banded iron formation iron ore deposits, including

- Channel-iron deposits or pisolite type iron ore

- Heavy mineral sands ore deposits and other sand dune hosted deposits

- Alluvial gold, diamond, tin, platinum or black sand deposits

- Alluvial oxide zinc deposit type: sole example Skorpion Zinc

Sedimentary hydrothermal deposits

- SEDEX

- Lead-zinc-silver, typified by Red Dog, McArthur River, Mount Isa, etc.

- Stratiform arkose-hosted and shale-hosted copper, typified by the Zambian copperbelt.

- Stratiform tungsten, typified by the Erzgebirge deposits, Czechoslovakia

- Exhalative spilite-chert hosted gold deposits

- Mississippi valley type (MVT) zinc-lead deposits

- Hematite iron ore deposits of altered banded iron formation

- Sudbury Basin nickel and copper, Ontario, Canada

Extraction

Some ore deposits in the world

Some additional ore deposits in the world

The basic extraction of ore deposits follows these steps:

- Prospecting or exploration to find and then define the extent and value of ore where it is located ("ore body")

- Conduct resource estimation to mathematically estimate the size and grade of the deposit

- Conduct a pre-feasibility study to determine the theoretical economics of the ore deposit. This identifies, early on, whether further investment in estimation and engineering studies is warranted and identifies key risks and areas for further work.

- Conduct a feasibility study to evaluate the financial viability, technical and financial risks and robustness of the project and make a decision as whether to develop or walk away from a proposed mine project. This includes mine planning to evaluate the economically recoverable portion of the deposit, the metallurgy and ore recoverability, marketability and payability of the ore concentrates, engineering, milling and infrastructure costs, finance and equity requirements and a cradle to grave analysis of the possible mine, from the initial excavation all the way through to reclamation.

- Development to create access to an ore body and building of mine plant and equipment

- The operation of the mine in an active sense

- Reclamation to make land where a mine had been suitable for future use

Trade

Ores

(metals) are traded internationally and comprise a sizeable portion of

international trade in raw materials both in value and volume. This is

because the worldwide distribution of ores is unequal and dislocated

from locations of peak demand and from smelting infrastructure.

Most base metals (copper, lead, zinc, nickel) are traded internationally on the London Metal Exchange, with smaller stockpiles and metals exchanges monitored by the COMEX and NYMEX exchanges in the United States and the Shanghai Futures Exchange in China.

Iron ore is traded between customer and producer, though various

benchmark prices are set quarterly between the major mining

conglomerates and the major consumers, and this sets the stage for

smaller participants.

Other, lesser, commodities do not have international clearing

houses and benchmark prices, with most prices negotiated between

suppliers and customers one-on-one. This generally makes determining the

price of ores of this nature opaque and difficult. Such metals include lithium, niobium-tantalum, bismuth, antimony and rare earths.

Most of these commodities are also dominated by one or two major

suppliers with >60% of the world's reserves. The London Metal

Exchange aims to add uranium to its list of metals on warrant.

The World Bank reports that China was the top importer of ores and metals in 2005 followed by the US and Japan.