A carbon offset is a reduction or removal of emissions of carbon dioxide or other greenhouse gases made in order to compensate for emissions made elsewhere. A carbon credit or offset credit is a transferrable financial instrument (i.e. a derivative of an underlying commodity) certified by governments or independent certification bodies to represent an emission reduction that can then be bought or sold. Both offsets and credits are measured in tonnes of carbon dioxide-equivalent (CO2e). One carbon offset or credit represents the reduction or removal of one ton of carbon dioxide or its equivalent in other greenhouse gases.

Carbon credits are a component of national and international attempts to mitigate the growth in concentrations of greenhouse gases (GHGs). In these programs greenhouse gas emissions are capped and then markets are used to allocate the emissions among the group of regulated sources. The goal is to allow market mechanisms to drive these sources towards lower GHG emissions. Since GHG reduction projects generate offset credits, this approach can be used to finance carbon reduction schemes between trading partners around the world. Within the voluntary market, demand for carbon offsets is generated by individuals, companies, organizations, and sub-national governments who purchase carbon offsets to mitigate their greenhouse gas emissions to meet carbon neutral, net-zero, or other GHG reduction goals. This market is aided by certification programs that provide standards and other guidance for project developers to follow in order to generate carbon offsets.

A variety of greenhouse gas reduction projects can be used to create offsets and credits. Forestry projects are becoming the fastest growing category. Renewable energy is another common type, and includes wind farms, biomass energy, biogas digesters, or hydroelectric dams. Other types include energy efficiency projects (such as efficient cookstoves), and destruction of landfill methane. Some include methods that use negative emission technologies, such as biochar, carbonated building elements and geologically stored carbon.

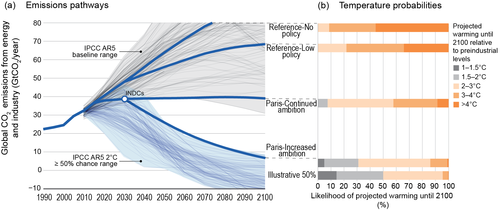

Offset and credit programs have been identified as way for countries to meet their NDC commitments and achieve the goals of the Paris agreement at a lower cost. However, there have been a number of news media stories in recent years criticizing these programs on the grounds that carbon reduction claims are often exaggerated or misleading. Organizations can take a variety of due diligence actions to identify "good quality" offsets, ensure that offsetting provides the desired environmental benefits, and avoid reputation risk associated with poor quality offsets.

Definitions

A carbon offset is a reduction or removal of emissions of carbon dioxide or other greenhouse gases made in order to compensate for emissions made elsewhere. A carbon credit or offset credit is a transferrable instrument certified by governments or independent certification bodies to represent an emission reduction of one metric ton of CO2, or an equivalent amount of other greenhouse gases (GHGs). Carbon offsets and credits, along with carbon taxes and subsidies, are all forms of carbon pricing. Historically, the concepts of offsets and credits have been intertwined. Both offsets and credits can move amongst the various markets they are traded in.

There are a variety of labels applied to these one-ton emission reductions, such as "Verified Emission Reduction" or "Certified Emission Reduction". These depend on the particular program that certifies a reduction project.

The terminology continues to evolve. At COP27, negotiators agreed to define offsets and credits issued under Article 6 of the Paris Agreement as "mitigation contributions", as a means of discouraging carbon neutrality claims by buyers. Certification organizations such as the Gold Standard even have detailed guidance on what descriptive terms are appropriate for buyers of offsets and credits.

Origins and general features

The 1977 US Clean Air Act created one of the first tradable emission offset mechanisms. This allowed a permitted facility to increase its emissions if it paid another company to reduce, by a greater amount, its emissions of the same pollutant at one or more of its facilities. The 1990 amendments to that same law established the Acid Rain Trading Program. This introduced the concept of a cap and trade system, where limits on a pollutant would decrease over time. Within those overall limits, companies could buy and sell offsets created by other companies that invested in emission reduction projects. In 1997 the Clean Development Mechanism was created as part of the Kyoto Protocol. This program expanded the concept of emissions trading to a global scale, and focused on the major greenhouse gases that cause climate change. These include: carbon dioxide (CO2), methane, nitrous oxide (N2O), perfluorocarbons, hydrofluorocarbons, and sulfur hexafluoride.

Carbon offsets and credits have several common features:

- Vintage. The vintage is the year in which the carbon emissions reduction project generates the carbon offset credit. This is usually done once a third party verifies the project. This can be done by a validation-verification body, a designated operational entity, or other accredited third party reviewers. However, there is a practice called "Forward Crediting" employed by a limited number of programs, whereby credits may be issued for projected emission reductions that the project developer anticipates. This practice risks over-issuing credits if the project does not realize its estimated impact, and allows credit buyers to claim emission reductions in the present for activities that have not yet occurred.

- Project type. A variety of projects can be used to reduce GHG emissions. These can include land-use (e.g. improved forestry management), methane capture, biomass sequestration, renewable energy, industrial energy efficiency, and more.

- Co-benefits. Beyond reducing greenhouse gas emissions, projects may provide benefits such as ecosystem services or economic opportunities for communities near the project site. These project benefits are termed "co-benefits". For example, projects that reduce agricultural greenhouse gas emissions may improve water quality by reducing fertilizer usage that results in run-off and may contaminate water.

- Certification regime. The certification regime describes the systems and procedures that are used to certify and register carbon offsets and credits. These vary in terms of governance and accounting practices, project eligibility, environmental integrity and sustainable development requirements, and Monitoring, Reporting and Verification (MRV) procedures.

- Carbon retirement. Offset credit holders must "retire" carbon offset credits in order to claim their associated GHG reductions towards a specific GHG reduction goal. In the voluntary market, carbon offset registries define the manner in which retirement happens. Once an offset credit is retired, it cannot be transferred or used (meaning it is effectively taken out of circulation). Voluntary purchasers can also offset their carbon emissions by purchasing carbon allowances from legally mandated cap-and-trade programs such as the Regional Greenhouse Gas Initiative or the European Emissions Trading Scheme.

Programs and markets

There is a diverse range of sources of supply, sources of demand, and trading frameworks that drive offset and credit markets. As of 2022, 68 carbon pricing programs were in place or scheduled to be created globally. While some of these involve carbon taxes, many are emission trading programs, or other types of market oriented program involving carbon offsets and credits. International programs include the Clean Development Mechanism, Article 6 of the Paris Agreement, and CORSIA. National programs include ETS systems such as the European Union Emissions Trading System (EU-ETS) and the California Cap and Trade Program. Eligible credits in these programs may also include those issued under international or independent crediting systems. There are also standards and crediting mechanisms managed by independent, nongovernmental entities, such as Verra and Gold Standard.

Demand for offsets and credits derives from a range of compliance obligations established under international agreements and national laws, as well as voluntary commitments adopted by companies, governments, and other organizations. Voluntary carbon markets (VCMs) usually consist of private entities purchasing carbon offset credits in order to meet voluntary greenhouse gas reduction commitments. In some cases purchases of credits might also be done as a non-covered participant in an ETS, as an alternative to purchasing offsets in a voluntary market.

Currently there are several exchanges trading in carbon credits and allowances covering both spot and futures markets. These include: Chicago Mercantile Exchange, CTX Global, the European Energy Exchange, Global Carbon Credit Exchange gCCEx, Intercontinental Exchange, MexiCO2, NASDAQ OMX Commodities Europe, Xpansiv. Many companies now engage in emissions abatement, offsetting, and sequestration programs to generate credits that can be sold on one of these exchanges. Some exchanges, such as AirCarbon Exchange and Toucan, tokenize carbon credits for trading using blockchain technology.

Compliance market credits are the large majority of the offset and credit market today. In 2021, trading on the VCM was 300 MtCO2e in 2021. By comparison, the compliance carbon market trading volume was 12 GtCO2e,[35] and global greenhouse gas emissions in 2019 were 59 GtCO2e.

Kyoto Protocol and Paris Agreement Article 6 mechanisms

The original international compliance carbon markets were created as part of the Kyoto Protocol. That treaty provides for three mechanisms that enable countries or operators in developed countries to acquire offset credits The economic basis for these programs was that the marginal cost of reducing emissions would differ among countries. At the time of the original Kyoto targets, studies suggested that the flexibility mechanisms could reduce the overall cost of meeting the targets. The Kyoto Protocol was to expire in 2020, to be superseded by the Paris Agreement. The Paris Agreement determinations regarding the role of carbon offsets are still being determined through international negotiation specifying the "Article 6" language.

Under the Clean Development Mechanism (CDM) a developed country can 'sponsor' a greenhouse gas reduction project in a developing country where the cost of greenhouse gas reduction project activities is usually much lower, but the atmospheric effect is globally equivalent. The developed country is given credits for meeting its emission reduction targets, while the developing country would receive the capital investment and clean technology or beneficial change in land use. Once approved, these units are termed Certified Emission Reductions, or CERs. Country specific Designated National Authorities approve projects under this program. Under Joint Implementation (JI) a developed country with relatively high costs of domestic greenhouse reduction would set up a project in another developed country. Offset credits under this program are designated as Emission Reduction Units. Nuclear energy projects are not eligible for credits under either of these programs. Under the International Emissions Trading (IET) program, countries can trade in the international carbon credit market to cover their shortfall in assigned amount units. Countries with surplus units can sell them to countries that are exceeding their emission targets under Annex B of the Kyoto Protocol. Current CDM projects will transfer to new arrangements under the Paris agreement.

Article 6 of the Paris Agreement continues to support offset and credit programs between countries. These are now carried out to help achieve emission reduction targets set out in each country's NDC. Under Article 6, countries will be able to transfer carbon credits earned from the reduction of GHG emissions to help other countries meet climate targets. Article 6.2 creates a program for trading GHG emission reductions via bilateral agreements between countries. Article 6.4 is expected to be similar to the Clean Development Mechanism of the Kyoto Protocol. It establishes a centralized program for trading GHG emission reductions between countries under the supervision of the UNFCCC. Emission reduction (ER) credits purchased under this program can be bought by countries, companies, or even individuals.

Under Article 6.2 the credits (called internationally transferred mitigation outcomes, or ITMOs) can be transferred from host countries, where the reduction in GHG is achieved. There are a number of ways this can be done. Credits can go to credit-buying countries towards achieving their NDCs. They can also be transferred and used in market-based schemes such as CORSIA. To avoid double counting of emission reductions, corresponding adjustments (CAs) are required. If the receiving country uses ITMOs towards its NDC, the host country must ‘un-count' those reductions from its emissions budget by adding and reporting that higher total in its biennial reporting. Otherwise Article 6.2 provides countries a lot of flexibility in how they can create trading agreements.

Projects under Article 6.4 will be overseen by a "Supervisory Board" which has the responsibility of approving methodologies, setting guidance, and implementing procedures. The preparation work for this is expected to last until the end of 2023. Emission reduction (ER) credits issued under Article 6.4 will be reduced by 2% in order to ensure that the program as a whole results in an overall Mitigation of Global Emissions (OMGE). An additional 5% reduction of Article 6.4 ERs is dedicated to a fund to finance adaptation. Administrative fees for program management are still to be determined. CDM projects are allowed to transition to the Article 6.4 program if they are approved by the country where the project is located, and if the project meets the new rules, with the exception of rules on methodologies. Projects can generally continue to use the same CDM methodologies through 2025. From 2026 on, they must meet all Article 6 requirements. Up to 2.8 billion credits could potentially become eligible for issuance under Article 6.4 if all CDM projects were to transition.

Article 6 does not directly regulate the VCM, and thus in principle carbon offsets can be issued and purchased without reference to Article 6. Given the diversity of carbon offsets, a mult-tier system could emerge with different types of offsets and credits available for investors. Companies may be to able purchase ‘adjusted credits' that eliminate the risk of double counting, possibly with higher perceived value in pursuit of science-based targets and net-zero emissions. Other ‘non-adjusted' offsets and credits could be used to support claims for other environmental or social indicators, or for emission reductions that have a lower perceived value in terms of these goals. Uncertainty remains around Article 6's effects on future voluntary carbon markets and what investors could claim by purchasing various types of carbon credits.

Other international programs

The REDD+ program works to create financial value for carbon stored in forests by using market approaches to compensate landowners for not clearing or degrading their forests. REDD+ also promotes co-benefits from reducing deforestation, such as biodiversity. REDD+ largely addresses tropical regions in developing countries. The concept of REDD+ was introduced in its basic form at COP11 in 2005. It has evolved and grown into a broad policy initiative to address deforestation and forest degradation. In 2015, REDD+ was incorporated into Article 5 of the Paris Agreement. REDD+ initiatives typically incentivize and compensate developing countries or subnational entities for reducing their emissions from deforestation and forest degradation. REDD+ consists of several stages, including (1) achieving REDD+ readiness; (2) formalizing an agreement for financing; (3) monitoring, reporting, and verifying results; and (4) receiving results-based payments. Over 50 countries have national REDD+ initiatives, mostly developing countries in or adjacent to the tropics. REDD+ is also being implemented at the subnational level through provincial and district governments and at the local level through private landowners. As of 2020, there were over 400 ongoing REDD+ projects globally, with Brazil and Colombia accounting for the largest amount of REDD+ project land area.

The Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) is a global, market-based program to reduce emissions from international aviation. Its intent is to allow credits and offsets for emissions that cannot be reduced through the use of technological and operational improvements, or by the use of sustainable aviation fuels. To ensure the environmental integrity of these offsets, the program has developed a list of eligible offsets that can be used. Operating principles for the program are similar to those under existing trading mechanisms and carbon offset certification standards. CORSIA has applied to international aviation since January 2019, when all airlines were required to report their CO2 emissions on an annual basis. International flights have been subject to offsetting obligations under CORSIA since January 2021.

Emissions trading systems

Emissions trading has become an important element of regulatory programs to control pollution, including GHG emissions. GHG emissions trading programs exist at the sub-national, national, and international level. Under these programs, emissions are capped, and sources have the flexibility to find and apply the lowest-cost methods for reducing pollution. A central authority or governmental body usually allocates or sells a limited number (a "cap") of permits that allow a discharge of a specific quantity of a specific pollutant over a set time period. Polluters are required to hold permits in amount equal to their emissions. Those that want to increase their emissions must buy permits from others willing to sell them. These programs have been applied to greenhouse gases because their warming effects are the same regardless of where they are emitted, the costs of reducing emissions vary widely by source, and the cap ensures that the environmental goal is attained.

At the start of 2022 there were 25 operational emissions trading systems around the world, in jurisdictions representing 55% of global GDP. These systems cover 17% of global emissions. EU-ETS is the second largest trading system in the world after the Chinese national carbon trading scheme, covering over 40% of European GHG emissions. California's cap-and-trade program operates along principles, and covers about 85% of statewide GHG emissions.

Voluntary carbon markets and certification programs

In voluntary carbon markets, companies or individuals use carbon offsets in order to meet self-defined goals for reducing emissions. Credits are issued under independent crediting standards, though some entities also purchase them under international or domestic crediting mechanisms. Within the overall market national and subnational programs have been increasing in popularity.

Many different groups exist within the voluntary carbon market. Participants include developers, brokers, auditors, and buyers. Certification programs are a key component of this community. These groups establish accounting standards, project eligibility requirements, and Monitoring, Reporting and Verification (MRV) procedures for credit and offset projects. They include the Verified Carbon Standard, the Gold Standard, the Climate Action Reserve, the American Carbon Registry, and Plan Vivo. Puro Standard, the first standard for engineered carbon removal, is verified by DNV GL. There are also some additional standards for the validation of co-benefits, including the CCBS, issued by Verra and the Social Carbon Standard, issued by the Ecologica Institute.

VERRA was developed in 2005, and is a widely used voluntary carbon standard. As of 2020 there had been over 1,500 certified VCS projects covering energy, transport, waste, forestry, and other sectors. In 2021 VERRA issued 300 MtCO2e worth of offset credits for 110 projects. Allowable projects under VERRA include energy, transport, waste, and forestry. There are also specific methodologies for REDD+ projects. VERRA is the program of choice for most of the forest credits generated for the voluntary market, and almost all REDD+ projects. Due to criticisms of this program, VERRA will be abandoning its current rules for forestry projects and replacing them with new rules beginning in 2025. General VERRA standards cover the types of projects allowed, allowable project start dates, project boundaries, a 10-year crediting period, as well as a requirement that the project boundaries cover all primary effects and significant secondary effects. Verra has additional criteria to avoid double counting, as well as requirements for additionality. Negative impacts on sustainable development in the local community are prohibited. It uses accounting principles that include relevance, completeness, consistency, accuracy, transparency, and conservativeness.

The Gold Standard was developed in 2003 by the World Wide Fund for Nature (WWF) in consultation with an independent Standards Advisory Board. Projects are open to any non-government, community-based organization. Allowable project categories include: renewable energy supply, energy efficiency, afforestation/reforestation, and agriculture. The program's focus includes the promotion of Sustainable Developments Goals. Projects must meet at least three of those goals, in addition to reducing GHG emissions, projects must also make a net-positive contribution to the economic, environmental and social welfare of the local population. Program monitoring requirements help determine this.

The VCM currently represents less than 1% of the reductions pledged in country NDCs by 2030, and an even smaller portion of the reductions needed to achieve the 1.5 °C Paris temperature goal pathway in 2030. The VCM is, however, experiencing significant growth. Between 2017 and 2021 both the issuance and retirement of VCM carbon offsets more than tripled. Some predictions call for global VCM demand to increase 15 fold between 2021 and 2030, and 100 times by 2050. Carbon removal projects such as forestry and carbon capture and storage are expected to have a larger share of this market in the future, compared to renewable energy projects. However, there is evidence that large companies are becoming more reluctant to use VCM offsets and credits because of a complex web of standards, despite an increased focus on net zero goals.

Types of offset projects

A variety of projects have been used to generate carbon offsets and credits. These include renewable energy, methane abatement, energy efficiency, reforestation and fuel switching (i.e. to carbon-neutral fuels and carbon-negative fuels). The CDM identifies over 200 types of projects suitable for generating carbon offsets and credits.

Offset certification and carbon trading programs vary in the extent to which they consider these specific projects eligible for offsets or credits. For example, under the European Union Emission Trading System nuclear energy projects, afforestation or reforestation activities (LULUCF), and projects involving destruction of industrial gases (HFC-23 and N2O) are considered ineligible.

Renewable energy

Renewable energy projects can include hydroelectric, wind, photovoltaic solar, solar hot water, biomass power, and heat production projects, among others. Collectively these types of projects help societies move from fossil fuel-based electricity and heat production towards less carbon intensive forms of energy. However, they may not be accepted as offset projects because it is difficult or impossible to determine their additionality. They usually generate revenue, and involve subsidies or other complex financial arrangements. This can make them ineligible under many offset and credit programs.

Methane collection and combustion

Methane is a potent greenhouse gas. It is most often emitted from landfills, livestock, and from coal mining. Methane projects can produce carbon offsets through the capture of methane for energy production. Examples include the combustion or containment of methane generated by farm animals by use of an anaerobic digester, in landfills, or from other industrial waste.

Energy efficiency

While carbon offsets that fund renewable energy projects help lower the carbon intensity of energy supply, energy conservation projects seek to reduce the overall demand for energy. Carbon offsets in this category fund projects of three main types.

Cogeneration plants generate both electricity and heat from the same power source, thus improving upon the energy efficiency of most power plants, which waste the energy generated as heat. Fuel efficiency projects replace a combustion device with one using less fuel per unit of energy provided. This can take the form of both optimized industrial processes (reducing per unit energy costs) and individual action (bicycling to work as opposed to driving). Energy-efficient buildings reduce the amount of energy wasted in buildings through efficient heating, cooling or lighting systems. New buildings can also be constructed using less carbon-intensive input materials.

Destruction of industrial pollutants

Industrial pollutants such as hydrofluorocarbons (HFCs) and perfluorocarbons (PFCs) have a GWP many thousands of times greater than carbon dioxide by volume. Because these pollutants are easily captured and destroyed at their source, they present a large and low-cost source of carbon offsets. As a category, HFCs, PFCs, and N2O reductions represent 71 percent of offsets issued under the CDM. Since many of these are now banned by an amendment to the Montreal Protocol, they are often no longer eligible for offsets or credits.

Land use, land-use change and forestry

Land use, land-use change and forestry (LULUCF) projects focus on natural carbon sinks such as forests and soil. There are a number of different types of LULUCF projects. Forestry-related projects focus on avoiding deforestation by protecting existing forests, restoring forests on land that was once forested, and creating forests on land that was previously unforested, typically for longer than a generation. Soil management projects attempt to preserve or increase the amount of carbon sequestered in soil.

Deforestation, particularly in Brazil, Indonesia, and parts of Africa, accounts for about 20 percent of greenhouse gas emissions. Deforestation can be avoided either by paying directly for forest preservation, or by using offset funds to provide substitutes for forest-based products. REDD (Reducing emissions from deforestation and forest degradation) credits provide carbon offsets for the protection of forests, and provide a possible mechanism to allow funding from developed nations to assist in the protection of native forests in developing nations. Offset schemes using reforestation are available in developing countries, as well as an increasing number of developed countries including the US and the UK.

Soil is one of the important aspects of agriculture and can affect the amount of yield in the crops. Modern agriculture has caused a decrease in the amount of carbon that the soil is able to hold. Farmers can promote sequestration of carbon in soils through practices such as the use of winter cover crops, reducing the intensity and frequency of tillage, and using compost and manure as soil amendments.

Assuring quality and determining value

Owing to their indirect nature, many types of offset are difficult to verify. The credibility of the various certification providers has been questioned in numerous reports by NGOs and stories in the media. Prices for offsets and credits vary widely. This may be a reflection of the uncertainty associated with these programs and practices. Recently, these issues have caused many companies to become more skeptical of purchasing offsets or credits.

Creating offsets and credits

To assess the quality of carbon offsets and credits it can be helpful to understand the typical process used to create them. Before any GHG reductions can be certified for use as carbon offsets, they must be shown to meet carbon offset quality criteria. This requires a methodology or protocol that is specific to the type of offset project involved. Most carbon offset programs have a library of approved methodologies covering a range of project types. The next steps involve project development, validation, and registration. An offset project is designed by project developers, financed by investors, validated by an independent verifier, and registered with a carbon offset program. Official "registration" indicates that the project has been approved by the program and is eligible to start generating carbon offset credits after it begins operation.

A commonly used purchasing option is to contract directly with a project developer for delivery of carbon offset credits as they are issued. These contracts provide project developers with a level of certainty about the volume of offset credits they can sell. Buyers are able to lock in a price for offset credits that is typically lower than market prices. However, this may involve some risk for them in terms of the project actually producing offsets.

Once a project is started, it is monitored and periodically verified to determine the quantity of emission reductions it has generated. The length of time between verifications can vary, but is typically one year. A carbon offset program approves verification reports, and then issues the appropriate number of carbon offset credits. These are then deposited into the project developer's account in a registry system administered by the offset program.

Criteria for assessing quality

Criteria for assessing the quality of offsets and credits usually cover the following areas:

- Baseline and Measurement—What emissions would occur in the absence of a proposed project? And how are the emissions that occur after the project is performed going to be measured?

- Additionality—Would the project occur anyway without the investment raised by selling carbon offset credits? There are two common reasons why a project may lack additionality: (a) if it is intrinsically financially worthwhile due to energy cost savings, and (b) if it had to be performed due to environmental laws or regulations.

- Leakage—Does implementing the project cause higher emissions outside the project boundary?

- Permanence—Are some benefits of the reductions reversible? (for example, trees may be harvested to burn the wood, and does growing trees for fuel wood decrease the need for fossil fuel?) If woodlands are increasing in area or density, then carbon is being sequestered. After roughly 50 years, forests begin to reach maturity, and remove carbon dioxide more quickly than a recently re-planted forest area.

- Double counting—Is the project claimed as carbon offsetting by more than one organization?

- Co-benefits—Are there other benefits in addition to the carbon emissions reduction, and to what degree?

Approaches for increasing integrity

In addition to the certification programs mentioned above, industry groups have been working since the 2000s to promote the quality of these projects. The International Carbon Reduction and Offset Alliance (ICROA), founded in 2008, continues to promote best practice across the voluntary carbon market.[105] ICROA's membership consists of carbon offset providers based in the United States, European and Asia-Pacific markets who commit to the ICROA Code of Best Practice.

Other groups are now advocating for new approaches for insuring the integrity of offsets and credits.The Oxford Offsetting Principles take the position that traditional carbon offsetting schemes are "unlikely to deliver the types of offsetting needed to ultimately reach net zero emissions." These princiiples focus instead on cutting emissions as a first priority. In terms of offsets, they advocate for shifting to carbon removal offset projects that involve long term storage. The principles also support the development of net zero aligned offsetting. The Science Based Targets initiative's net-zero criteria also argue for the importance of moving beyond offsets based on reduced or avoided emissions to offsets based on carbon that has been sequestered from the atmosphere, such as CO2 Removal Certificates.

Some initiatives are focused improving the quality of current carbon offset and credit projects. The Integrity Council for the Voluntary Carbon Market (ICVCM) has published a draft set of principles for determining a high integrity carbon credit, known as the Core Carbon Principles. Final guidelines for this program are expected in late 2023. Similarly, the Voluntary Carbon Markets Integrity Iniitiative, funded in part by the UK government, has developed a code of practice that was published in 2022.

Determining value

In 2022 voluntary carbon market (VCM) prices ranged from $8 to $30 per ton of CO2e for the most common types of offset projects. A number of factors can affect these prices. The costs of developing a project are a significant factor. Those tied to projects that can sequester carbon (also called "Nature Based Solutions") have recently been selling at a premium compared to other projects, such as renewable energy or energy efficiency. Projects which have additional social and environmental benefits can command a higher price. This reflects both the value of the co-benefits as well as the perceived value of association with these projects. Credits from a reputable organization may command a higher price. Some credits located in developed countries may be priced higher, perhaps reflecting company preferences to back projects closer to their business sites. Conversely, carbon credits with older vintages tend to be valued lower on the market.

Prices on the compliance market are generally higher and vary based on geography, with EU and UK ETS credits trading at higher prices than those in the US in 2022. Lower prices on the VCM are in part due to an excess of supply in relation to demand. Some types of offsets are able to be created at very low costs under present standards. Without this surplus, current VCM prices could be at least $10/tCO2e higher.

Some pricing forecasts predict VCM prices could increases to as much as $47–$210 per ton by 2050, with an even higher short term spike in certain scenarios. A major driver in future price models is the extent to which programs that support more permanent removals are able to drive future global climate policy. This could have the effect of limiting the supply of approvable offsets, and thereby raise prices.

Demand for VCM offsets is expected to increase five to ten-fold over the next decade as more companies adopt Net Zero climate commitments. This could be beneficial both for markets and for progress on reducing GHG emissions. If carbon offset prices remain significantly below these forecast levels, companies could be open to criticisms of greenwashing, as some might claim credit for emission reduction projects that would have been undertaken anyway. At prices of $100/tCO2e, a variety of carbon removal technologies (reducing deforestation, forest restoration, CCS, BECCs and renewables in least developed countries) could deliver around 2 GtCO2e per year of annual emission reductions between now and 2050. In addition, as the cost of using offsets and credits rises, investments in reducing supply chain emissions will become more attractive.

Effectiveness

Offset and credit programs have been identified as way for countries to meet their NDC commitments and achieve the goals of the Paris agreement at a lower cost. They may also accelerate progress in closing the emissions gap identified in annual UNEP reports.

These programs also produce important co-benefits. Common environmental co-benefits described for these projects include: better air quality, increased biodiversity, and water & soil protection. There are also social benefits, such as community employment opportunities, energy access, and gender equality. Typical economic co-benefits include job creation, education opportunities, and technology transfer. Some certification programs have tools and research products to help quantify these benefits.

Limitations

The ongoing use of offsets and credits faces a variety of criticisms. Some argue that they promote a "business-as-usual" mindset, where companies are able to use carbon offsetting as a way to avoid making larger changes that deal with reducing carbon emissions at its source. These projects are also seen as "Greenwashing". In 2023 a civil suit was brought against Delta Airlines based on its use of carbon credits to support claims of carbon neutrality. In 2016 the Öko-Institut found that 85% of CDM projects analyzed had a low likelihood of being truly additional and without over-estimated emission reductions. An additional challenge is that offsets and credits are being marketed in a global environment where carbon pricing and existing policies are still inadequate to meet Paris goals. However, there is evidence that companies that invest in offsets and credits tend to make more ambitious emissions cuts compared with companies that do not.

Oversight issues

Several certification standards exist, offering variations for measuring emissions baseline, reductions, additionality, and other key criteria. However, no single standard governs the industry, and some offset providers have been criticized on the grounds that carbon reduction claims are exaggerated or misleading. For example carbon credits issued by the California Air Resources Board were found to use a formula that established fixed boundaries around forest regions, creating simplified, regional averages for the carbon stored in a wide mix of tree species. As a result it is estimated that California's cap and trade program program has generated between 20 million and 39 million forestry credits that do not achieve real climate benefits. This amounts to nearly one in three credits issued through that program.

Additionality determinations can be difficult, and may present risks for buyers of offsets or credits. Carbon projects that yield strong financial returns even in the absence of revenue from carbon credits; or that are compelled by regulations; or that represent common practice in an industry; are usually not considered additional. A full determination of additionality requires a careful investigation of proposed carbon offset projects.

Because offsets provide a revenue stream for the reduction of some types of emissions, they can in some cases provide incentives to emit more, so that emitting entities can later get credit for reducing emissions from an artificially high baseline. Actions by regulatory agencies could address these situations. These could include specific standards for verifiability, uniqueness, and transparency.

Concerns with forestry projects

Forestry projects have been increasingly criticized in terms of their integrity as offset or credit programs. A number of news stories in 2021–2023 have criticized nature based carbon offsets, the REDD+ program, and certification organizations. In one case it was estimated that ~90% of rainforest offset credits of the Verified Carbon Standard are likely to be "phantom credits".

Tree planting projects in particular have been problematic. Critics point to a number of concerns. Trees reach maturity over a course of many decades. It is difficult to guarantee the permanence of the forests, which may be susceptible to clearing, burning, or mismanagement. Some tree-planting projects introduce fast-growing invasive species that end up damaging native forests and reducing biodiversity. In response, some certification standards, such as the Climate Community and Biodiversity Standard require multiple species plantings. Tree planting in high latitude forests may have a net warming effect on the Earth's climate. This is because the absorption of sunlight by tree cover creates a warming effect that balances out their absorption of carbon dioxide. Tree-planting projects can also cause conflicts with local communities and indigenous people who are displaced or otherwise find their use of forest resources curtailed.