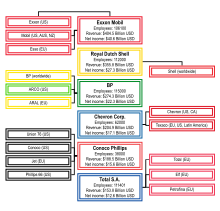

Chart of the major energy companies dubbed "Big Oil" sorted by 2005 revenue

Big Oil is a name used to describe the world's six or seven largest publicly traded oil and gas companies, also known as supermajors. The supermajors are considered to be BP plc, Chevron Corporation, ExxonMobil Corporation, Royal Dutch Shell plc, Total SA and Eni SpA, with Phillips 66 Company also sometimes described in the past as forming part of the group.

The term, analogous to others, such as Big Steel, that describe industries dominated by a few giant corporations, was popularized in print from the late 1960s. Today it is often used to refer specifically to the seven supermajors. The use of the term in the popular media often excludes the national producers and OPEC oil companies who have a much greater role in setting prices than the supermajors. Two state-owned Chinese oil companies, CNPC and Sinopec, had greater revenues in 2013 than any of the supermajors except Royal Dutch Shell.

In the maritime industry, six to seven large oil companies that decide a majority of the crude oil tanker chartering business are called "Oil Majors".

History

The history of the supermajors traces back to the "Seven Sisters", the seven oil companies which formed the "Consortium for Iran" cartel and dominated the global petroleum industry from the mid-1940s to the 1970s. The Seven Sisters were:

- Anglo-Persian Oil Company (now BP);

- Gulf Oil, Standard Oil of California (Socal) and Texaco (now Chevron);

- Royal Dutch Shell; and

- Standard Oil of New Jersey (Esso) and Standard Oil Company of New York (Socony) (now ExxonMobil).

Before the oil crisis of 1973 the members of the Seven Sisters controlled around 85% of the world's oil reserves.

The supermajors began to emerge in the late-1990s, in response to a severe fall in oil prices. Large petroleum companies began to merge, often in an effort to improve economies of scale, hedge against oil price volatility, and reduce large cash reserves through reinvestment.

The following major mergers and acquisitions of oil and gas companies took place between 1998 and 2002:

- Exxon's merger with Mobil in 1999, forming ExxonMobil;

- Total's merger with Petrofina in 1999 and with Elf Aquitaine in 2000, with the resulting company subsequently renamed Total S.A.;

- BP's acquisitions of Amoco in 1998 and of ARCO in 2000;

- Chevron's acquisition of Texaco in 2001;

- the merger of Conoco Inc. and Phillips Petroleum Company in 2002, forming ConocoPhillips.

This process of consolidation created some of the largest global corporations as defined by the Forbes Global 2000

ranking, and as of 2007 all were within the top 25. Between 2004 and

2007 the profits of the six supermajors totaled US$494.8 billion.

Composition

Trading under various names around the world, the supermajors are considered to be:

- BP plc (United Kingdom)

- Chevron Corporation (United States)

- Eni SpA (Italy)

- ExxonMobil Corporation (United States)

- Royal Dutch Shell plc (Netherlands and United Kingdom)

- Total SA (France)

ConocoPhillips Company (United States) was also sometimes described as forming part of the group,

before the Downstream activities spin-off. As of 2011 ExxonMobil ranked

first among the supermajors measured by market capitalization, cash

flow and profits.

As a group, the supermajors control around 6% of global oil and gas reserves. Conversely, 88% of global oil and gas reserves are controlled by the OPEC cartel and state-owned oil companies, primarily located in the Middle East. A trend of increasing influence of the OPEC cartel, state-owned oil companies in emerging-market economies is shown and the Financial Times has used the label "The New Seven Sisters"

to refer to a group of what it argues are the most influential national

oil and gas companies based in countries outside of the OECD, namely CNPC (China), Gazprom (Russia), National Iranian Oil Company (Iran), Petrobras (Brazil), PDVSA (Venezuela), Petronas (Malaysia), Saudi Aramco (Saudi Arabia).

Largest oil and gas companies by USD 2015 revenue

* Revenue in 2013

** Revenue in 2012

"Big oil"

Petroleum and gas

supermajors are sometimes collectively referred to as "Big oil", a term

that emphasizes their economic power and perceived influence on

politics, particularly in the United States. Big oil is often associated

with the fossil fuels lobby.

Usually used to refer to the industry as a whole in a pejorative

or derogatory manner, "Big oil" has come to encompass the enormous

impact crude oil exerts over first-world industrial society.

Maritime "Oil Majors"

In

the maritime industry, a group of six companies that control the

chartering of the majority of oil tankers worldwide are together

referred to as "Oil Majors". These are: Royal Dutch Shell, BP, Exxon Mobil, Chevron Texaco, Total Fina Elf and ConocoPhillips. Charter parties such as "Shelltime 4" frequently mention the phrase "oil major".